Abstract

In this article, we provide a compelling case for demonstrating “learning-by-licensing,” and we further investigate the moderating effect of specific licensed-knowledge attributes on the innovation performance of licensee firms. This case is based on a unique dataset from the China State of Intellectual Property Office regarding technology-licensing activities and spanning the years 2000–2010. Using this dataset we make a longitudinal analysis of the lagging learning effect that transferee firms experience when they in-license technology. The empirical results from 71 Chinese electronic-industry firms reconfirm the concept of “learning-by-licensing.” Moreover, the results also indicate that both technology complexity and technology generality, which are attributes of licensed knowledge, have positive moderating effects on the relationship between technology in-licensing and the subsequent innovation performance of licensee firms. However, such a positive moderating effect was not found for the newness of technology.

Similar content being viewed by others

1 Introduction

Inward technology licensing is an important innovation strategy that many firms use to gain access to technology developed in other organizations or countries (Lall 2000; Mansfield et al. 1982). Researchers have shown the benefits of using this strategy, e.g., reducing the high costs of internal development, reaching market faster, and gaining access to the latest technology (Chatterji and Manuel 1993; Granstrand and Sjölander 1990). From the perspective of technological learning and innovation, some scholars believe that inward technology transfer may enhance a transferee firm’s knowledge accumulation and technological capabilities and improve their innovation performance (Cohen and Levinthal 1990; Huber 1991; Lin 2003). Particularly, the studies addressing technology licensing between licensors in advanced countries and licensee firms in less advanced countries have drawn considerable attention from researchers in past decades (Guan et al. 2006; Johnson 2002; Lin 2003; Tsai and Wang 2007), due to the crucial role of technology licensing for the technology-capability development of many latecomer firms’.

Researchers argue that licensing technology from advanced countries has become a catalyst for developing countries to learn and to grow their technological capabilities. Johnson (2002) further expounded upon the concept of “learning-by-licensing” and concluded that “licensing has an intuitive effect on patents…, firms are learning about a technology during the licensing period, possibly even developing new patentable technology…” (p. 175). Going beyond the macro level, Lin (2003) grounded his research at the micro (firm) level and argued that inward technology transfer may be a source of competitive advantage for firms with limited R&D resources because these firms may integrate transferred technologies into their own existing knowledge bases and innovate through a learning process. This conclusion has been supported by the follow-up studies from Guan et al. (2006). Based on these results, Tsai and Wang (2007) extended their research and revealed that inward technology licensing does not contribute much for the innovation performance of licensee firms without complementary internal R&D efforts.

Despite these contributions in the technology licensing literature, we notice that the study around learning-by-licensing from the licensee firm’s perspective remains underdeveloped. First, since Johnson (2002) introduced the “learning-by-licensing” concept, there have been several publications that intended to look into this phenomenon in detail. However, most of these studies simply examine the causal relationship between technology in-licensing activities and innovation outcomes without considering other antecedents that might matter in this process. For example, the extant literature has overlooked the impact of licensed-technology attributes like knowledge generality, complexity, and newness on the innovation performance of licensee firms. Such a gap in research is somewhat surprising, as the benefits of inward technology transfer on innovation have been emphasized in much of the literature (Chatterji 1996; Guan et al. 2006; Lin 2003; Leone and Reichstein 2012; Tsai and Wang 2007). Second, another deficiency of the extant research on technology transfer is a lack of appropriate datasets. To date, the limited research efforts on technological learning through licensing at a firm level are all based on survey data and are usually of a cross-sectional nature (i.e., Lin 2003; Guan et al. 2006). This type of study suffers, on the one hand, from assuming that the learning effect takes place immediately as technology in-licensings occur. Thus, cross-sectional studies are not able to advance our understanding of the process attributes of technological learning. On the other hand, most of these studies use either expenditure of licensing or a binary choice indicating whether technologies are imported or not as the key explanatory variable, and leaves unexamined the impact of specific characteristics of licensed knowledge on licensees’ learning and innovation. The underpinning assumption for these studies holds that licensed knowledge attributes are homogeneously influencing the transferee firms’ innovation performance.

Therefore, based on a unique dataset from China, this study intends to fill these gaps. It first provides convincing evidence to support the concept of “learning-by-licensing,” given that the extant literature has not provided a compelling case to support this concept. Then it looks into this phenomenon by investigating the influence of licensed-knowledge attributes on the innovation performance of licensee firms’. More specifically, this study aims to assess the effect of technology complexity, generality, and newness on the innovation performance of licensee firms. Our main source of data is a database established by the China State of Intellectual Property Office (SIPO), which has been filing the records of technology licensing in China since 2000. These records contain the following information: names of licensor, licensee, licensed patents, contracting number, date, and license type (exclusive or non-exclusive license). This data is thus suitable to investigate technological learning in a longitudinal fashion, particularly in a setting of technology licensing in developing countries.

The remainder of this article proceeds as follows. The next section reviews relevant literature and lists our developed hypotheses. Section three introduces the research methodology regarding data, sample selection, and variable developments. In section four we present the empirical results. Finally, a conclusion and discussion of some implications and limitations for future research is followed.

2 Theory and hypotheses

Technology licenses are contractual agreements that grant permission to organizations to use a particular piece of patent-protected knowledge held by another organization (Chawla 2007). A license agreement typically involves two parties: the licensor who supplies the technology and the licensee who gets permission to use this technology. Studies on technology licenses proliferated in the 1970s as the innovation strategy of firms increasingly shifted to open innovation (Chesbrough 2003; Teece 1977). Focusing on the inside-out flow, this phenomenon is often addressed from the licensor’s perspective (Laursen et al. 2010). Research from this point of view sought to address licensing-process questions, such as why firms need to license out their technologies and the relative benefits and risks, how to choose licensee partners, and how to write an optimal license agreement in order to maximize the revenues of the licensors (Fosfuri 2006; Lichtenthaler and Ernst 2009; Ziedonis 2007).

In contrast to the considerable research efforts spent on the licensor point of view, few publications devoted space to research from the licensee firm’s perspective. From these research efforts, researchers have identified a set of conditions—including a firm’s previous licensing experience, relative costs and benefits, awareness of licensing opportunities, and the firm’s internal new product development and R&D capabilities—upon which firms may differ in terms of their propensities to license-in technologies (Chatterji and Manuel 1993; Atuahene-Gima 1993). In addition, some other scholars also have shown some benefits that licensee companies could obtain from licensing activities, e.g., the tactical benefits of licensee firms from inward technology licensing-ins (Laursen et al. 2010). Likewise, Katrak (1997) states that the recipient’s absorptive capabilities and in-licensings have a sequential relationship in Indian electrical and electronic industries. Chesbrough (2003) argues that by licensing external knowledge, firms get access to technologies that will help to fill in gaps, prevail over blind spots, complement firms’ internal capabilities, and eventually enhance their developments over time. He also emphasizes that both the buying and selling perspectives are necessary to improve intellectual property management.

Departing from these contributions, some scholars have extended the research setting by positioning their studies in developing countries and have theorized that technology in-licensings might be for licensee firms a very important inroad for technological learning (Johnson 2002; Lin 2003; Pitkethly 2001; Tsai and Wang 2007). For instance, Pitkethly (2001) claims that patent licensing might be a learning opportunity for licensees. Johnson (2002) proposes the concept of “learning-by-licensing” and argues that inward licensings can also be perceived as a way to foster technological learning. Lin (2003) states that technology in-licensing can act as an important source of competitive advantage, and technology transfer should be recognized as a learning process. Tsai and Wang (2007) document that a licensee may accumulate its technological knowledge and strengthen its technological capabilities from the search and use of external technology while firms invest internal R&D activities at the same time. Following this stream of study, we present three different aspects of licensing effects that accelerate licensee firms’ learning and innovation.

First of all, a firm (licensee) gets permission to access and use another organization’s knowledge through a technology license agreement. The licensee firm integrates parts of a licensor’s knowledge base into its own knowledge base. As a consequence, the licensee firm enlarges their knowledge base, which in turn brings in economies of scale and scope in new knowledge creation (Fleming 2001). This is in line with the argument that the knowledge creation process is a recombinant process that brings different knowledge elements together to come up with new inventions (Ahuja and Katila 2001; Fleming 2001). The larger the knowledge base, the higher the possibility that a firm can generate new knowledge.

Second, besides covering the transfer of explicit knowledge, technology license agreements also cover the transfer of tacit knowledge from a licensor to a licensee (Horwitz 2007). Technology licensing is not a one-time trade in the technology market. A license agreement builds up the inter-firm connectivity, which acts as a vehicle to convey tacit knowledge from a licensor firm to a licensee firm (Hagedoorn 1993). In order to help licensees practice the licensed technology, a large set of information must be transferred to the licensee. This information may be incorporated in patents or proprietary know-how information (Chatterji and Manuel 1993; Horwitz 2007). Such know-how information includes some present and future non-patentable inventions (relating to improvements of licensed technology), trade secrets, technical data, testing results, regulatory submissions, methods of manufacture, specifications, techniques, procedures, or other proprietary or non-proprietary information relating to or useful in the development of the manufacture, use, or sale of the licensed product. Also, licensing linkages represent areas of training, demonstration, and regular meetings for the licensee. This kind of interaction would be beneficial for a licensee’s learning capability.

Third, technology licenses stimulate licensee firms’ R&D efforts in terms of the necessary effort to make the technology work properly, as well as the deliberate efforts to learn, such as reverse engineering, imitation, and improvement (Arora and Gambardella 1994). Licensing technology leads a licensee firm to undertake further technological expenditure to install, learn, absorb, assimilate, and develop the inward licensing technology. Such R&D efforts will focus on lab-testing, quality control, hiring new scientists and engineers, adapting to local demands, etc. These R&D efforts reinforce the licensee’s technological capability and have a large potential to convert them into innovation output (Lee and Lim 2001). Based on the above argument, therefore, we hypothesize:

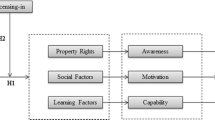

Hypothesis 1

The more the licensing activities of a licensee firm, the higher its subsequent innovative performance.

Turning our attention to the knowledge attributes of licensed technology, many accept the view that technological knowledge is heterogeneous with respect to its characteristics. Early work from Arrow (1962) conceptualized the characteristics of knowledge into different categories such as indivisibility, appropriability, tradability, and expandability. The modules of technological knowledge are today seen to differ also in terms of generality, complexity, codification, articulation, and newness (Contractor and Ra 2002; Cowan and Foray 2000). Knowledge attributes have been widely discussed in knowledge and innovation management literature, particularly in the literature about the choice of alliance governance that is in favor of technology transfer (i.e., Contractor and Ra 2002; Simonin 1999). Despite these contributions, the important relationship between transferred knowledge attributes and innovation performance of licensee firms is still insufficiently addressed. We argue that the different attributes of knowledge present different opportunities and resource requirements for licensee firms to absorb, assimilate, and integrate technologies and to eventually innovate. In other words, they act as the important moderating factors between the technology in-licensings and subsequent innovation performance of licensee firms. Since licensed technologies in our study are all protected by certain patents, this means they have already been codified and clearly articulated. We thus focus on those attributes that are prominently featured in the theoretical literature. The specific attributes are complexity, generality, and newness of licensed technologies. We develop three hypotheses regarding these three attributes as follows.

First, we discuss the licensed-knowledge attribute of complexity. There are various definitions of technological complexity in the literature (i.e., Simonin 1999; Singh 1997). For instance, Singh (1997: 340) defines a complex technology as “an applied system whose components have multiple interactions and constitute a non-decomposable whole.” Similarly, scholars agree that technological complexity refers to the extent to which knowledge is derived from the combination of a variety of knowledge streams. That is, a complex technology involves a merging of several diverse disciplines or a great number of interdependencies. Highly complex knowledge is often the result of combining tacit knowledge and routines that are deeply embedded in the technology source firm’s social context and value creation process (Reed and DeFillippi 1990). Therefore, a complex technology is difficult to transfer to and difficult to integrate for licensee firms (Kogut and Zander 1993). However, complex technologies could also be a crucial catalyst for licensee firms to learn because a complex technology contains a rich stream of knowledge elements that might enable firms to make recombination with their existing technologies and pursue a greater production of new knowledge creation (Yayavaram and Ahuja 2008). Moreover, complex technologies are more difficult to be imitated and “invented around” by competitors, so they may help firms to build and sustain competitive advantages in turn. Therefore, the following hypothesis is proposed:

Hypothesis 2

The relationship of inward technology licensing of a licensee firm and its subsequent innovation performance is moderated by knowledge complexity. The greater the complexity of licensed technology, the greater the positive effect of technology licensing on subsequent innovation performance.

Second, we move on to the attribute of knowledge generality. Knowledge generality refers to the extent to which knowledge required to develop a product can be applied to develop another product (Bresnahan and Trajtenberg 1995). It is closely related to the concept of “general purpose technologies” (GPTs), which are characterized by their potential pervasive use in a broad array of industries and their technological dynamism (Aghion and Howitt 1998; Helpman and Trajtenberg 1998; Hornstein and Krusell 1996). Bresnahan and Trajtenberg (1995) suggest that most GPTs take the bulk of “enabling technologies,” aiming at opening up new opportunities rather than providing complete and final solutions. The licensee firms could combine them with other knowledge bases for more inventions. Moreover, these technologies are subject to continuous technical advances after they are first introduced. This would also provide licensee firms great opportunities to learn with sustained performance improvements in their in-licensed technologies. Taken together, we develop the following hypothesis:

Hypothesis 3

The relationship of inward technology licensing of a licensee firm and its subsequent innovation performance is moderated by knowledge generality. The greater the generality of licensed technology, the greater the positive effect of technology licensing on subsequent innovation performance.

Finally, we turn to the attribute of knowledge newness, which refers to the age of licensed knowledge. With a licensing agreement, a firm obtains the rights to use another firm’s patents or technology. However, in many cases, as scholars mentioned, technology is not embodied in codified descriptions alone. There is a great deal of uncodified information that is vital for making the technology transfer well (Teece 1977). From a licensor’s perspective, as the technology’s age increases, there is more knowledge, expertise, and skill in relation to the transferred technology, and more employees master the unmodified knowledge of transferred technology. Thus, mature technologies in combination with sufficient extant research, experience, and industry practices make it easier for licensees to assimilate in-licensed technologies because of the increasing possibility of acquiring technological support. This is consistent with the argument of Mytelka and Smith (2002) that transferred technologies can be best used only if they are complemented by many available elements. Therefore, if the licensed technology is older, the recipients are more likely to learn and to innovate based on it. So we hypothesize:

Hypothesis 4

The relationship of inward technology licensing of a licensee firm to its subsequent innovation performance is moderated by knowledge newness. The less new the licensed technology, the greater is the positive effect of technology licensing on subsequent innovation performance.

3 Methods

3.1 Data and sample

This study takes China as the research context where, as many scholars have reported, technology outsourcing is the dominant mode of learning and innovation strategy for firms. It fits well with the purpose of this study. For example, according to Liu’s (2005) survey, almost 90 % of firms’ R&D expenditures were spent on technology markets, of which 70 % was paid to technology licensors in 2001. Given this background, we wanted to find an unexplored, unique dataset with the detailed identity of licenses that may benefit our study. In fact, the State Intellectual Property Office of China (SIPO) is in charge of recording licensing agreements in order to monitor the development of licensing activity and provide evidence for firms involved in IPR litigation issues. Recorded agreements include both domestic and international licensing activities. Each record contains information on the licensor, licensee, and licensed patent names, as well as the contracting date and patent number information. More specifically, records reveal who licenses what patents to whom in a particular year. The SIPO has recorded and published this information since 2000. So far, the records from 2000 to 2010 have been made available for the public. In total, there are 17,835 license agreements that cover 40,623 patents (with 3,968 unique patents), and they involve 7,758 licensors (including 3,917 individuals) and 7,046 licensees (including 62 individuals).

Meanwhile, we focus on the Chinese indigenous firms in China’s most innovative industry, electronics, as the empirical setting of this study. The electronics industry in China has witnessed a rapid two-digit output growth rate since the 1990s, and now it has become the most innovative industry in the country (Altenburg et al. 2008). We thus selected our sample firms from all Chinese indigenous firms that were engaged in technology licensing from licensors in the US from 2000 to 2005 and traced the identities of these sample firms to ensure they were still active by the end of 2010. We controlled for the origin of the technology source in order to reduce the bias, since licensed technologies from different patent offices have different filing requirements, such as the different rules of patent citations between the European Patent Office (EPO) and the US. Patent and Trade Office (USPTO) patents. For our study sample, we used 71 firms who licensed-in technologies from the US from 2000 to 2005.

3.2 Measurements

3.2.1 Dependent variable

3.2.1.1 Innovation performance

Innovation performance can be measured in various ways, such as R&D expenditure, the number of new products, and patents (Ahuja and Katila 2001). In line with prior studies, in this paper we use the cumulative number of patents applied for by a focal firm within the 5 years after the year of licensing (Dushnitsky and Lenox 2005; Katila and Ahuja 2002). Note that we do not use granted patents, partly because the Chinese Patent Office publishes patent data within several months after application, while an application may not be granted for several years. If we use data based on the granted patents, we would lose a lot of observations in our sample.

3.2.2 Independent variables

3.2.2.1 License experience

Technology licensing is often directed to the licensing of patent rights (Horwitz 2007). Thus, for this variable we count the total number of patents covered by a license agreement between the Chinese firms and their US counterparts in each year.

3.2.2.2 Technological complexity

In prior studies, technological complexity was operationalized as the average number of unique technical subclasses of the patents, or the number of forward and backward citations (Carayannopoulos and Auster 2010; Cloodt et al. 2006; Sorenson et al. 2006). Following these studies we operationalize technological complexity as the average number of backward citations that all the US patents received in a firm’s license agreements in a particular year.

3.2.2.3 Technological generality

In literature, the generality of technology has been widely measured by either the generality index developed by Hall et al. (2001) or by the claims appearing in the front page of each patent (Lanjouw and Schankerman 2004; Lerner 1994). The number of claims is argued as a direct measure of generality since the claims are attributions of a potential area of applications of the technology. In line with this argument, in this study we use the average number of claims of all the licensed US patents to measure this variable.

3.2.2.4 Knowledge newness

For this variable, this study operationalizes the average years of backward citation lags of all patents covered under a firm’s license agreements each year. Backward-citation lags measure the average time difference between the year of application of citing patents and that of the cited patents. This measure calculates the extent to which a firm’s licensed patent portfolio is in a mature technological field (Hall et al. 2001).

3.2.3 Controls

We also control for several potential factors that probably have impacts on the Chinese licensee firms’ innovation performance. These controls are measured at the licensed knowledge level, firm level, and the macro level. At the knowledge level, we control for the average number of patent classes (following three digital patent classes of the USPTO classification system) from all licensed patent portfolios in a firm’s yearly licenses (Technology classes). At the firm level, we control for firm size, ownership, absorptive capacity, firm age, and collaboration with university (co-university). Firm size is measured by the number of employees on staff in the licensing year (using a natural logarithm form). A dummy variable is used to capture the ownership; when a firm belongs to the state, we denote this variable as “1.” Otherwise, we use a “0.” Absorptive capability is measured as the number of patents applied by a licensee firm 5 years prior to the licensing year. Firm age is measured as the number of years that elapse between a licensee’s year of establishment and the year when the licensing agreement was established. Collaboration with a university is measured as a dummy variable; when a licensee firm has any co-patenting activities with universities within the 5 years before its technology in-licensings, we denote “1” as its value. Otherwise it receives a value of “0.” For licensee firms’ external macro condition, we control for the province patent stock as the number of patent applications per 10,000 residents of the province where licensee firms reside. In the same vein, we control for firms’ product market situations (market competition), which is measured as the number of firms who licensed-in the same technologies from the same licensor within the current year and the two subsequent years. Finally, owing to the rapid transition of the Chinese market and economic environment, we also need to control for any other unobservable variances pertaining to a particular year, which may affect firms’ patenting activities. Thus, dummy years (2000–2005) were added, using the year 2000 as the omitted reference category.

3.3 Analytical procedure

Since the dependent variable is a count variable, a Poisson regression method would normally be suitable for this study. However, this works only if the variance is equal to the mean. Otherwise, a negative binomial model is more appropriate for an over-dispersion situation. In the case of our study, the data has demonstrated significant evidence of over-dispersion, as the variances mostly exceed the relative means (see Table 1). We thus use a negative binomial regression to conduct the statistical analysis. This estimation technique is common in studies on innovation management where patent counts are used as a dependent variable. To control for firm heterogeneity, we used the generalized estimating equations (GEE) regression method, which accounts for autocorrelation—due to repeated yearly measurements of the same firms—by estimating the correlation structure of the error terms (Liang and Zeger 1986) resulting from, for instance, some firms licensing more than one time during our observation period. Moreover, to control for any overdispersion in the data, we report results with robust standard errors. We also include a province dummy to control for potential clustering effects, for instance, some licensee firms from some provinces might demonstrate certain innovation behaviors more than the others. If that is the case, it will lead to the error terms not being independent. Prior work has shown that the “exchangeable” matrix option that we use is more appropriate than fixed- or random-effects models (Hilbe 2011). The empirical analysis is executed in stata11.0 by using the “xtgee” command.

4 Results

Table 1 summarizes the descriptive statistics and the correlations of all variables in the empirical analysis, except for the dummy variables. With two exceptions, the independent variables reflecting the hypothesized effects are not highly correlated among themselves or with the controls. The first exception is the correlation between complexity and generality (0.57), and the second one is the correlation between firm size and newness (−0.51). To ensure that these higher correlations do not compromise our analyses, we conducted a multicolinearity test, which showed that all the variance inflation factor (vif) scores are below 3.73, which is lower than the critical point 10 (Belsley 1980).

Table 2 presents the results for all the models using a GEE negative binominal regression analysis. Variables were entered step by step in six models. Model 1 is the base model with all the control variables. Firm size, absorptive capacity, market competition, and collaboration with university show significantly positive effects, and technology classes show a significantly negative effect on innovation performance; these significant effects remain consistent in all the models in Table 2, while other control variables do not show significant effects.

Our central independent variable, license experience, and the three aspects of knowledge attributes were entered in Model 2. Further, we constructed three interaction terms by multiplying the value for license experience with knowledge complexity, knowledge generality, and knowledge newness, respectively. To reduce or eliminate potential bias resulting from multicolinearity—because the interaction terms are usually correlated with their original values—we first standardized the value of these independent variables before we formed interaction terms. These interaction terms were introduced separately in Models 3–5. Finally, in Model 6 we employ the full model, including all the interaction terms to test our hypotheses.

Hypothesis 1 predicts that there is a positive relationship between technology in-licensing by a Chinese firm and its subsequent innovation performance. The coefficient of license experience in Model 6 is positive and significant at the 1 %-level (β = 1.306, p = 0.00), and this positive effect remains consistently significant in all the relevant models in Table 2. Thus, it provides support for Hypothesis 1. Next, in Hypothesis 2, we expect that the relationship between technology in-licensing and the innovation performance of a licensee firm is positively moderated by the knowledge complexity of the licensed technology. To test the moderating effect of technology complexity, we introduced the interaction term of license experience and complexity in Model 3 and Model 6 (the full model), where the coefficients of LE*Complexity in both models are positive and significant at the 10 %-level (β = 0.150, p = 0.09). Thus, Hypothesis 2 is supported. Similarly, in Hypothesis 3 we predicted that the relationship between technology in-licensing and subsequent innovation performance of a licensee firm is positively moderated by knowledge generality of the licensed technology. The coefficients of LE*Generality in Model 4 and Model 6 are also positive and significant at the 5 %-level (β = 0.236, p = 0.03). Thus, Hypothesis 3 is supported as well. Finally, the coefficients of the interaction term of newness and license experience in Model 5 and Model 6 are not significant. This indicates that Hypothesis 4 is not supported. That is, the newness of licensed knowledge does not have a significant moderating effect on the innovation performance of Chinese licensee firms’.

Among the control variables, those of firm size, absorptive capacity, market competition, and collaboration with universities show positive and significant effects on innovation performance. First, large firms normally have more resources to invest in technological learning and innovation, thus they perform better than smaller firms in innovation. This finding thus is in line with the Schumpeterian perspective of innovation. Second, firms with a strong absorptive capacity often have a greater ability to integrate external technology into their existing technology base, and to generate a positive effect on innovation performance. Similarly, if a technology is extensively used by multiple competitive firms, a strong competitive pressure is created among the competing firms. In such a way, these firms are more likely to “escape the competition” by exploring novel opportunities (Aghion et al. 2005; Li and Vanhaverbeke 2009). Moreover, we also observed that collaboration with universities is able to strengthen firms’ innovation performance. Other control variables show either non-significant or inconsistent effects on Chinese licensee firms.

In addition, it is worth noting that although we found significant relationships between some independent variables with the dependent variable, any interpretation of our results toward causality should be treated with caution. In social science studies, causal inferences regarding the relationship between two concepts may be drawn only if four conditions are met (Cook and Campbell 1979; Kenny 1979). That is, the research should (1) demonstrate that the cause variable precedes the outcome variable in time, (2) show a significant statistical relation between the presumed cause and outcome, (3) exclude possible alternative explanations (i.e., ensure nonspuriousness), and (4) provide a theoretical interpretation of the relationship(s) under study. Among these four conditions, it is certainly not possible for us to theoretically ensure nonspuriousness, meaning a relationship between two variables is not due to variation in a third variable. For instance, both in-licensing and innovation performance of a firm may increase due to the improved financial performance of a firm in a particular period; in such a case, a causal relationship should not be inferred from the positive association between in-licensing and innovation performance.

However, although an absolute causal relationship cannot be drawn, two specific elements in our research design to a great extent are believed to enhance the analytical power of our results with regard to demonstrating the significant association between the independent and dependent variables. First, we used a longitudinal dataset to discover the links among various variables instead of using a cross-sectional design. A longitudinal study is based on repeated measurements of the same respondents and variables. It could make causality more plausible compared to the “snap-shot assessment” in cross-sectional research, with which we cannot determine the temporal order of the research variables (Taris 2000). Moreover, a longitudinal design helps researchers to explore the strength, direction, and magnitude of the cross-lagged relations (i.e., relations across time) between the variables of interest (Kessler and Greenberg 1981; Menard 2002; Taris 2000). Thus, it could be used to study how and why a relation between variables exists in relation to aspects of stability and change across time (Nesselroade and Baltes 1979). Finally, our regression models are designed in a way that incorporates the lagging effect from in-licensing. This sequential design of time-lag between independent variable and dependent variable also suggests temporal direction of potential causal relationships. In this respect, a longitudinal dataset, combined with a time-lag design in our study, enables us to be more confident in interpreting the significant relationships between variables of interest.

5 Conclusion and discussions

This study advances the understanding of technology licensing in two ways. First, we provide a compelling case for the concept of “learning-by-licensing.” In light of growing managerial and academic interests in understanding technology-licensing phenomenon, this article starts by focusing on the concept of “learning-by-licensing.” According to this concept, firms learn about a technology during the licensing period, and along the way facilitate the development of new knowledge. Given the interesting implications of “learning-by-licensing” for research and practice, substantial attentions have been paid to the inquiry into this concept. However, most prior studies were based on survey data and resulted in contradictory conclusions. Thus, the evidence is rather weak at best for the argument that firms in developing countries could learn from their previously in-licensed technology. In line with this stream of research, we provided a compelling case using this longitudinal study that supports the concept of “learning-by-licensing” by using a unique license database containing information on licensing activities of Chinese firms in the electronics industry.

Second, we set aside the assumption widely held in prior research that many licensed-knowledge attributes homogeneously affect all licensee firms. In this study, we take into account the impacts of licensed knowledge attributes on the subsequent innovation performance of licensee firms. Although an absolute causality cannot be drawn, we still found that the technology licensing-in is significantly positively associated with licensee firms’ technological performance. And such a positive relationship is even amplified when the complexity and generality of in-licensed technology increases. However, knowledge newness does not influence the innovation performance of licensee firms.

Furthermore, practitioners such as technology recipients and policy makers could benefit from this study. For technology recipients, the implications of these findings are threefold. First, our findings show that there is a positive correlation between the complexity of licensed knowledge and a licensee’s innovation performance. It suggests that licensees are likely to improve innovation performance by licensing-in complex technology. However, complex technology is difficult to absorb in terms of the resource requirements and accumulated knowledge reservoir to assimilate and integrate the complex technology. Thus in practice, licensees and prospective licensees are urged to evaluate their own resource endowments (e.g., human resources, technological capability) and assess whether they are able to absorb the complex technology and eventually benefit from in-licensing it. Second, our findings also suggest that at a high level of knowledge generality, the potential for technological learning and further innovation is higher in pursuing gradual advance within the technology field or transforming it into a wide variety of technology areas for new inventions by the licensees. Yet the ability to apply the in-licensed generable technology to other technical and product areas is largely dependent not only on the absorptive capacity of the licensee firm itself, but also on the accessibility and quality of complementary external resources. In this sense, the prospective licensees are urged to build up complementary and proprietary innovation competence and establish their networks with complementary industries and firms to better utilize the in-licensed generable technology. And lastly, the findings show that knowledge newness doesn’t show significant effects on the innovation performance of a licensee. It explains that exclusively licensing-in the latest technologies will not guarantee superb innovation performance.

Very importantly, the correlations demonstrated in our findings must be interpreted and understood as a process of dynamic interactions. That means from a Chinese innovative firm’s perspective, the more innovative it is (i.e., having many technical inventions), the more relevant it is for the firm to decide whether to further develop these technologies into marketable products or commercialize them on the idea/technology market. Either way, it is imperative to in-source new and complementary technological elements, in combination with the focal technology, to create, add, or complete a unique value for a marketable product or a utilizable technology input. Thus, it is critical to have a strategic assessment on the excludability of the environment in which potential competing companies can be precluded from effectively developing the focal technology, as well as the availability and quality of complementary resources (Gans and Stern 2003). In this sense, it becomes useful to understand that complex technology tends to enjoy a higher level of excludability, and generable technology sources tend to have a higher possibility of finding complementary knowledge. To conclude, our findings also suggest two specific aspects of technology that innovation firms need to consider when they design their strategies for technology commercialization.

Our strong empirical results also offer some implications for the policy makers in the host developing countries where technology recipients are located. We found that if Chinese firms take on more inward technology licensing, they are more likely to achieve better subsequent innovation performance. Such a positive relationship is even more evident if the licensed technologies are complex and generally applicable. Therefore, policy design should focus on how to mitigate the risks and reduce the costs pertaining to licensee firms with regard to absorbing and learning from complex and generable technologies. This can be achieved by facilitating the positive learning effect through establishing systems and mechanisms that provide easy access to complementary resources and reduce the transaction cost of knowledge exchanging. In other words, the results of our study may help policy makers identify new areas of “weakness in the system of innovation” (Carlsson 1994; Bozeman 2000) and design policies accordingly. To be more concrete, national science and technology policy can be oriented in favor of more collaboration between industry and university (Audretsch and Link 2012; Wright et al. 2008) and more service-oriented technology intermediaries (Li-Ying 2012).

Despite its contributions, our study also has some limitations. First, we use patent information to measure a firm’s innovation performance as many scholars have done. Future research is encouraged to use other types of measures that count for the product-market aspect of innovation and learning process. The second limitation is that we only focus on the technology transferred from the US to Chinese firms in the electronics industry. Therefore, to what extent these findings could be generalized for firms (both licensees and licensors) in other countries and in other industries is up for testing in other research settings. Future research could consider addressing these limitations to advance our understanding of technological learning through licensing by firms in developing countries.

References

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Aghion, P., & Howitt, P. (1998). On the macroeconomic effects of major technological change. In E. Helpman (Ed.), General purpose technologies and economic growth (pp. 121–144). Cambridge, MA: MIT Press.

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strategic Management Journal, 22(3), 197–220.

Altenburg, T., Schmitz, H., & Stamm, A. (2008). Breakthrough China’s and India’s transition from production to innovation. World Development, 36(2), 325–344.

Arora, A., & Gambardella, A. (1994). The changing technology of technological change: General and abstract knowledge and the division of innovative labor. Research Policy, 23(5), 523–532.

Arrow, K. J. (1962). Studies in applied probability and management science. Stanford, CA: Stanford University Press.

Atuahene-Gima, K. (1993). Determinants of inward technology licensing intentions: An empirical analysis of Australian engineering firms. Journal of Product Innovation Management, 10(3), 230–240.

Audretsch, D. B., & Link, A. N. (2012). Entrepreneurship and innovation: Public policy frameworks. The Journal of Technology Transfer, 37(1), 1–17.

Belsley, D. A. (1980). On the efficient computation of the nonlinear full-information maximum-likelihood estimator. Journal of Econometrics, 14(2), 203–225.

Bozeman, B. (2000). Technology transfer and public policy: A review of research and theory. Research Policy, 29, 627–655.

Bresnahan, T. F., & Trajtenberg, M. (1995). General purpose technologies ‘engines of growth’? Journal of Econometrics, 65(1), 83–108.

Carayannopoulos, S., & Auster, E. R. (2010). External knowledge sourcing in biotechnology through acquisition versus alliance: A KBV approach. Research Policy, 39(2), 254–267.

Carlsson, B. (1994). Technological systems and economic performance. In M. Dodgson & R. Rothwell (Eds.), The handbook of industrial innovation (pp. 13–24). Cheltenham: Edward Elgar.

Chatterji, D. (1996). Accessing external sources of technology. Research Technology Management, 39(2), 48–56.

Chatterji, D., & Manuel, T. A. (1993). Benefiting from external sources of technology. Research Technology Management, 36(6), 21–27.

Chawla, H. S. (2007). Managing intellectual property rights for better transfer and commercialization of agricultural technologies. Journal of Intellectual Property Rights, 12(5), 330–340.

Chesbrough, H. W. (2003). Open innovation: The new imperative for creating and profiting from technology. Boston, MA: Harvard Business School Press.

Cloodt, M., Hagedoorn, J., & Van Kranenburg, H. (2006). Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Research Policy, 35(5), 642–654.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Contractor, F. J., & Ra, W. (2002). How knowledge attributes influence alliance governance choices: A theory development note. Journal of International Management, 8(1), 11–27.

Cook, T. D., & Campbell, D. T. (1979). Quasi-experimentation: Design and analysis for field settings. Boston: Houghton Mifflin.

Cowan, R., & Foray, D. (2000). The economics of codification and the diffusion of knowledge. Industrial and Corporate Change, 6, 595–622.

Dushnitsky, G., & Lenox, M. J. (2005). When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates. Research Policy, 34(5), 615–639.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Fosfuri, A. (2006). The licensing dilemma: Understanding the determinants of the rate of technology licensing. Strategic Management Journal, 27(12), 1141–1158.

Gans, J. S., & Stern, S. (2003). The product market and the market for ‘ideas’: Commercialization strategies for technology entrepreneurs. Research Policy, 32(2), 333–350.

Granstrand, O., & Sjölander, S. (1990). The acquisition of technology and small firms by large firms. Journal of Economic Behavior & Organization, 13(3), 367–386.

Guan, J. C., Mok, C. K., Yam, R. C. M., Chin, K. S., & Pun, K. F. (2006). Technology transfer and innovation performance: Evidence from Chinese firms. Technological Forecasting and Social Change, 73(6), 666–678.

Hagedoorn, J. (1993). Understanding the rationale of strategic technology partnering: Inter-organizational modes of cooperation and sectoral differences. Strategic Management Journal, 14, 371–385.

Hall, B. H., Jaffe, A., & Trajtenberg, M. (2001). The NBER patent citations data file: Lessons, insights, and methodological tools. In A. Jaffe & M. Trajtenberg (Eds.), Patents, citations, and innovations (pp. 172–187). Cambridge, MA: The MIT Press.

Helpman, E., & Trajtenberg, M. (1998). A time to sow and a time to reap: Growth based on general purpose technologies. In E. Helpman (Ed.), General purpose technologies and economic growth (pp. 55–83). Cambridge, MA: The MIT Press.

Hilbe, J. M. (2011). Negative binomial regression (2nd ed.). Cambridge: Cambridge University Press.

Hornstein, A., & Krusell, P. (1996). Can technology improvements cause productivity slowdowns? Nber Macroeconomic Annual, 11, 209–259.

Horwitz, E. (2007). Patent and technology licensing. Computer & Internet Lawyer, 24(10), 28–40.

Huber, G. P. (1991). Organizational learning: The contributing processes and the literatures. Organization Science, 2(1), 88–115.

Johnson, D. K. N. (2002). ‘Learning-by-licensing’: R&D and technology licensing in Brazilian invention. Economics of Innovation & New Technology, 11(3), 163–177.

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45(6), 1183–1194.

Katrak, H. (1997). Developing countries’ imports of technology, in-house technological capabilities and efforts: An analysis of the Indian experience. Journal of Development Economics, 53(1), 67–83.

Kenny, D. (1979). Correlation and causality. New York: Wiley.

Kessler, R. C., & Greenberg, D. F. (1981). Linear panel analysis: Models of quantitative change. New York: Academic Press.

Kogut, B., & Zander, U. (1993). Knowledge of the firm and the evolutionary theory of the multinational corporation. Journal of International Business Studies, 24(4), 625–645.

Lall, S. (2000). Technological change and industrialization in the Asian newly industrializing economies: Achievements and challenges. In L. Kim & R. R. Nelson (Eds.), Technology, learning, and innovation: Experiences of newly industrializing economies (pp. 240–261). Cambridge: Cambridge University Press.

Lanjouw, J. O., & Schankerman, M. (2004). Patent quality and research productivity: Measuring innovation with multiple indicators. Economic Journal, 114(495), 441–465.

Laursen, K., Leone, M. I., & Torrisi, S. (2010). Technological exploration through licensing: New insights from the licensee’s point of view. Industrial & Corporate Change, 19(3), 871–897.

Lee, K., & Lim, C. (2001). Technological regimes, catching-up and leapfrogging: Findings from the Korean industries. Research Policy, 30(3), 459–483.

Leone, M. I., & Reichstein, T. (2012). Licensing-in fosters rapid invention! The effect of the grant-back clause and technological unfamiliarity. Strategic Management Journal. doi:10.1002/smj.1950.

Lerner, J. (1994). The importance of patent scope: An empirical analysis. Rand Journal of Economics, 25, 319–333.

Li, Y., & Vanhaverbeke, W. (2009). The relationships between foreign competition, absorptive capacity and pioneering innovation: An empirical investigation in Canada. International Journal of Innovation Management, 13(1), 105–137.

Liang, K.-Y., & Zeger, S. L. (1986). Longitudinal data analysis using generalized linear models. Biometrika, 73(1), 13–22.

Lichtenthaler, U., & Ernst, H. (2009). Technology licensing strategies: The interaction of process and content characteristics. Strategic Organization, 7(2), 183–221.

Lin, B.-W. (2003). Technology transfer as technological learning: A source of competitive advantage for firms with limited R&D resources. R&D Management, 33(3), 327–341.

Liu, X. (2005). China’s development model: An alternative strategy for technological catch-up. Working paper. Hitotsubashi.

Li-Ying, J. (2012). What do we need from intermediaries for technology transfer to China? A European firm perspective. Prometheus: Critical Studies in Innovation. doi:10.1080/08109028.2012.661553.

Mansfield, E., Romeo, A., Schwartz, M., Teece, D., Wagner, S., & Brach, P. (1982). Technology transfer, productivity, and economic policy. New York: Norton.

Menard, S. (2002). Longitudinal research. London: Sage Publications.

Mytelka, L. K., & Smith, K. (2002). Policy learning and innovation theory: An interactive and co-evolving process. Research Policy, 31(8–9), 1467–1479.

Nesselroade, J. R., & Baltes, P. B. (Eds.). (1979). Longitudinal research in the study of behavior and development. New York: Academic Press.

Pitkethly, R. H. (2001). Intellectual property strategy in Japanese and UK companies: Patent licensing decisions and learning opportunities. Research Policy, 30(3), 425–442.

Reed, R., & DeFillippi, R. J. (1990). Causal Ambiguity, barriers to imitation, and sustainable competitive advantage. Academy of Management Review, 15(1), 88–102.

Simonin, B. L. (1999). Ambiguity and the process of knowledge transfer in strategic alliances. Strategic Management Journal, 20(7), 595–623.

Singh, K. (1997). The impact of technological complexity and interfirm cooperation on business survival. Academy of Management Journal, 40(2), 339–367.

Sorenson, O., Rivkin, J. W., & Fleming, L. (2006). Complexity, networks and knowledge flow. Research Policy, 35(7), 994–1017.

Taris, T. W. (2000). A primer in longitudinal data analysis. Londen: Sage.

Teece, D. J. (1977). Technology transfer by multinational firms: The resource cost of transferring technological know-how. Economic Journal, 87(346), 242–261.

Tsai, K.-H., & Wang, J.-C. (2007). Inward technology licensing and firm performance: A longitudinal study. R&D Management, 37(2), 151–160.

Wright, M., Clarysseb, B., Lockett, A., & Knockaert, M. (2008). Mid-range universities’ linkages with industry: Knowledge types and the role of intermediaries. Research Policy, 37(8), 1205–1223.

Yayavaram, S., & Ahuja, G. (2008). Decomposability in knowledge structures and its impact on the usefulness of inventions and knowledge-base malleability. Administrative Science Quarterly, 53(2), 333–362.

Ziedonis, A. A. (2007). Real options in technology licensing. Management Science, 53(10), 1618–1633.

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Wang, Y., Zhou, Z. & Li-Ying, J. The impact of licensed-knowledge attributes on the innovation performance of licensee firms: evidence from the Chinese electronic industry. J Technol Transf 38, 699–715 (2013). https://doi.org/10.1007/s10961-012-9260-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-012-9260-0