Abstract

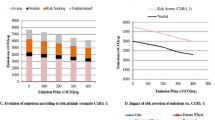

Even if there exists an extensive literature on the modeling of farmers’ behavior under risk, actual measurements of the quantitative impact of risk aversion on input use are rare. In this article, we use simulations to quantify the impact of risk aversion on the optimal quantity of input and farmers’ welfare when production risk depends on how much of the input is used. The assumptions made on the technology and form of farmers’ risk preferences were chosen such that they are fairly representative of crop farming conditions in the USA and Western Europe. In our benchmark scenario featuring a traditional expected utility model, we find that less than 4% of the optimal pesticide expenditure is driven by risk aversion and that risk induces a decrease in welfare that varies from −1.5 to −3.0% for individuals with moderate to normal risk aversion. We find a stronger impact of risk aversion on quantities of input used when farmers’ risk preferences are modeled under the cumulative prospect theory framework. When the reference point is set at the median or maximum profit, and for some levels of the parameters that describe behavior toward losses, the quantity of input used that is driven by risk preferences represents up to 19% of the pesticide expenditure.

Similar content being viewed by others

Data Availability

Data and R codes are available.

Code Availability

We provide the code (in the form of R-Markdown documents) allowing anyone to either reproduce the results or extend the analysis to a wider range of parameters.

Notes

Some empirical evidence of pesticides reducing production risk were found in Di Falco and Chavas [22] using data from durum wheat farms in Sicily (Italy) and in Koundouri et al. [32] on a panel of Finnish crop farms but Serra et al. [57] and Serra et al. [58], in a study of 596 farms from Kansas, found pesticides to be risk-increasing inputs. This discrepancy in findings may be explained by the effect of inputs varying depending on whether crop growth conditions are good or bad [59] and/or by the use of different types of indicators of pesticide application [8].

The author does not indicate how the cost of risk compares to the expected profit and certainty equivalent.

In these articles, technology parameters and the parameters representing farmers’ risk preferences (often a risk aversion coefficient) were estimated within a unique model made of simultaneous equations, in most cases under the assumption that farmers face production risk only. Separate identification of the technology and risk preferences in such models was later called into question by Lence [60] and Just and Just [61].

In line with the assumption of narrow bracketing [62], we assume pesticide decisions are made in isolation from other decisions made on the farm. Among the determinants of narrow bracketing are two factors that are relevant for pesticide use: farmers face cognitive resource scarcity and use heuristics (treatment planning) that increase the probability of narrow bracketing in pesticide use. We are aware of only one study pointing to narrow bracketing by farmers in their choice of inputs. Using an investment game to experimentally elicit risk preferences, Verschoor et al. [63] show that risk preferences in the lab significantly explain fertilizer use of Ugandan crop farmers, but not the decision to grow cash crops or the degree of market participation. They suggest that this result can be explained by narrow bracketing in fertilizer use, a decision made in isolation and similar to the decision in the experimental investment game.

For calibration of the production function and in order to determine plausible ranges for pesticide use and prices, we relied on observational data from farms producing cereals in northeastern France. The major crops produced on these farms were wheat, barley, and rapeseed. We used annual data on winter wheat over the period 1993–2010 (see Appendix A1). For additional information on these data, see also Carpentier and Letort [64], Femenia and Letort [45], and Koutchadé et al. [65].

Expenditure is often the only information that is available to researchers, in particular for those using data from the (European) Farm Accountancy Data Network. However, and as will be discussed in Sect. 5.3., more refined indicators of pesticide use are recommended when available [8].

Yields can only be positive or null so the generated yield is set at zero when realizations of the random shock produce a negative yield.

Empirical estimates of the relative risk aversion coefficient vary on a wide range and estimated coefficients around 6 are not uncommon (e.g., [30, 31, 38], cf. Appendix A3).

The empirical analysis has been made using R. Programs are available in the supplementary material.

Risk-loving farmers decrease their use of pesticides if pesticides are risk decreasing. When the relative risk aversion coefficient is set at -1, the optimal input use is 5 EUR lower than in the risk-neutral case and the risk premium is negative in this case and equal to 16 EUR. With a relative risk aversion coefficient of -2, the negative risk premium reaches 31 EUR (there was a positive risk premium of 34 EUR under risk aversion with a relative risk aversion coefficient of + 2). We observe the same phenomenon (impact of same magnitude and opposite sign) also for relative risk aversion coefficients equal to -3 and -4.

Historical data for the price of wheat (in EUR) are publicly available here: https://www.indexmundi.com/commodities/?commodity=wheat&months=180¤cy=eur

These variations in pesticide use in response to price changes would correspond to price elasticities of demand for pesticide varying between −0.7 and −1.2, which is in the lower end of the distribution of elasticity estimates measured in the literature [66].

Using data from French cereal crop farmers, Femenia and Letort [45] found that a 35% pesticide tax would induce a 25% reduction in pesticide use. The tax rate that is necessary to induce a 25% reduction in pesticide use is slightly higher in their case but we believe it is partly driven, among other differences in the modelling framework, by their assumption of a higher output price. In their simulations they set the price of wheat at 171 EUR per ton (against 110 EUR per ton in our case).

When rare catastrophic weather events occur and damage the crops very badly, farmers usually benefit from specific disaster funds that help compensate for losses. Hence farmers in Europe do not really have any incentive to manage the risk of (catastrophic) crop damage and losses.

There is rare theoretical guidance for the choice of the reference point and the need to make assumptions on where such a reference point is seen as one of the major weaknesses of CPT Barberis [44].

We also ran one scenario featuring Tversky and Kahneman (12)’s parameters except for loss aversion being set at 3.50. The optimal input use with the reference point being set at 0, the median profit, and the maximum profit is 270 EUR, 279 EUR, and 279 EUR, respectively. This scenario is not shown in Tables 4 and 5 due to space constraints.

A few countries have adopted pesticide taxation, the most commonly cited being Sweden and Denmark. Sweden applies a tax to each kilogram of active substance (EUR 3.64/kg in 2016) while Denmark applies a pesticide tax that is differentiated by the pesticides’ category (insecticides, herbicides, fungicides, and growth regulators). For greater information on pesticide taxation schemes, we refer readers to Böcker and Finger (67) and Finger et al. (68).

When rare catastrophic weather events occur and damage the crops very badly, farmers usually benefit from specific disaster funds that help compensate for losses. Hence farmers in Europe do not really have any incentive to manage the risk of (catastrophic) crop damage and losses.

References

Feder, G. (1979). Pesticides, information, and pest management under uncertainty. American Journal of Agricultural Economics, 61(1), 97–103.

Just, R. E., & Pope, R. D. (1978). Stochastic representation of production functions and econometric implications. Journal of Econometrics, 7(1), 67–86.

Lichtenberg, E., & Zilberman, D. (1986). The econometrics of damage control: why specification matters. American Journal of Agricultural Economics, 68(2), 261–273.

Chavas, J.P. (2019a). Role of risk and uncertainty in agriculture in Cramer, G.L. (Ed.), Paudel, K.P. (Ed.), Schmitz, A. (Ed.), Chapter 32, The Routledge Handbook of Agricultural Economics. London: Routledge.

Iyer, P., Bozzola, M., Hirsch, S., Meraner, M., & Finger, R. (2020). Measuring farmer risk preferences in Europe: a systematic review. Journal of Agricultural Economics, 71(1), 3–26.

Carpentier, A. (1995). La Gestion du Risque Phytosanitaire par les Agriculteurs dans les Systèmes de Production Intensive : Une Approche Econométrique. Ecole des Hautes Etudes en Sciences Sociales, France: Thèse de Doctorat. In French.

Pannell, D. J. (1995). Optimal herbicide strategies for weed control under risk aversion. Review of Agricultural Economics, 17(3), 337–350.

Möhring, N., Bozzola, M., Hirsch, S., & Finger, R. (2020a). Are pesticides risk decreasing? The relevance of pesticide indicator choice in empirical analysis. Agricultural Economics, https://doi.org/10.1111/agec.12563, published online.

Pannell, D. J. (1991). Pests and pesticides, risk and risk aversion. Agricultural Economics, 5(4), 361–383.

Pannell, D. J. (2006). Flat earth economics: the far-reaching consequences of flat payoff functions in economic decision making. Review of Agricultural Economics, 28(4), 553–566.

Pannell, D. J., Malcolm, B., & Kingwell, R. S. (2000). Are we risking too much? Perspectives on risk in farm modelling. Agricultural Economics, 23(1), 69–78.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Babcock, B. A. (2015). Using cumulative prospect theory to explain anomalous crop insurance coverage choice. American Journal of Agricultural Economics, 97(5), 1371–1384.

Bocquého, G., Jacquet, F., & Reynaud, A. (2014). Expected utility or prospect theory maximisers? assessing farmers’ risk behaviour from field-experiment data. European Review of Agricultural Economics, 41(1), 135–172.

Bougherara, D., Gassmann, X., Piet, L., & Reynaud, A. (2017). Structural estimation of farmers’ risk and ambiguity preferences: a field experiment. European Review of Agricultural Economics, 44(5), 782–808.

Chavas, J. P. (2019b). Adverse shocks in agriculture: the assessment and management of downside risk. Journal of Agricultural Economics, 70(3), 731–748.

Just, R. E., Calvin, L., & Quiggin, J. (1999). Adverse selection in crop insurance: actuarial and asymmetric information incentives. American Journal of Agricultural Economics, 81(4), 834–849.

Goodwin, B. K., Vandeveer, M. L., & Deal, J. L. (2004). An empirical analysis of acreage effects of participation in the federal crop insurance program. American Journal of Agricultural Economics, 86(4), 1058–1077.

Smith, V. H., & Goodwin, B. K. (1996). Crop insurance, moral hazard, and agricultural chemical use. American Journal of Agricultural Economics, 78(2), 428–438.

Weber, J. G., Key, N., & O’Donoghue, E. (2016). Does federal crop insurance make environmental externalities from agriculture worse? Journal of the Association of Environmental and Resource Economists, 3(3), 707–742.

Just, R. E., & Pope, R. D. (1979). Production function estimation and related risk considerations. American Journal of Agricultural Economics, 61(2), 277–284.

Di Falco, S., & Chavas, J. P. (2006). Crop genetic diversity, farm productivity and the management of environmental risk in rainfed agriculture. European Review of Agricultural Economics, 33(3), 289–314.

Antle, J. M. (1983). Testing the stochastic structure of production: a flexible moment-based approach. Journal of Business & Economic Statistics, 1(3), 192–201.

Bontems, P., & Thomas, A. (2000). Information value and risk premium in agricultural production: the case of split nitrogen application for corn. American Journal of Agricultural Economics, 82(1), 59–70.

Quiggin, J., Karagiannis, G., & Stanton, J. (1993). Crop insurance and crop production: an empirical study of moral hazard and adverse selection. Australian Journal of Agricultural Economics, 37(2), 95–113.

Goodwin, B. K., & Smith, V. H. (2003). An ex post evaluation of the conservation reserve, federal crop insurance, and other government programs: program participation and soil erosion. Journal of Agricultural and Resource Economics, 28(2), 201–216.

Wu, J. (1999). Crop insurance, acreage decisions, and nonpoint-source pollution. American Journal of Agricultural Economics, 81(2), 305–320.

Möhring, N., Dalhaus, T., Enjolras, G., & Finger, R. (2020). Crop insurance and pesticide use in European agriculture. Agricultural Systems, 184, 102902.

Love, H. A., & Buccola, S. T. (1991). Joint risk preference-technology estimation with a primal system. American Journal of Agricultural Economics, 73(3), 765–774.

Saha, A., Shumway, C. R., & Talpaz, H. (1994). Joint estimation of risk preference structure and technology using expo-power utility. American Journal of Agricultural Economics, 76(2), 173–184.

Chavas, J. P., & Holt, M. T. (1996). Economic behavior under uncertainty: a joint analysis of risk preferences and technology. Review of Economics and Statistics, 78, 329–335.

Koundouri, P., Laukkanen, M., Myyrä, S., & Nauges, C. (2009). The effects of EU agricultural policy changes on farmers’ risk attitudes. European Review of Agricultural Economics, 36(1), 53–77.

Carpentier, A., & Weaver, R. D. (1997). Damage control productivity: why econometrics matters. American Journal of Agricultural Economics, 79(1), 47–61.

Skevas, T., Oude Lansink, A. G. J. M., & Stefanou, S. E. (2013). Designing the emerging EU pesticide policy: a literature review. NJAS - Wageningen Journal of Life Sciences, 64–65, 95–103.

Chavas, J.P. (2004). Risk analysis in theory and practice. Elsevier, First Edition.

Gollier, C. (2004). The economics of risk and time. Cambridge, MA: The MIT Press.

Anderson, J.R., and Dillon, J.L. (1992). Risk analysis in dryland farming systems. farming systems management series no. 2, Food and Agriculture Organization of the United Nations (FAO). FAO, Rome.

Sckokai, P., & Moro, D. (2006). Modeling the reforms of the common agricultural policy for arable crops under uncertainty. American Journal of Agricultural Economics, 88(1), 43–56.

Hennessy, D. A. (1998). The production effects of agricultural income support policies under uncertainty. American Journal of Agricultural Economics, 80(1), 46–57.

Möhring, N., Gaba, S., & Finger, R. (2019). Quantity based indicators fail to identify extreme pesticide risks. Science of The Total Environment, 646, 503–523.

Chavas, J.P., & Nauges, C. (2020). Uncertainty, learning and technology adoption in agriculture. Applied Economic Perspectives and Policy 42(1) Special Issue: Adoption of Agricultural Innovations: 42–53.

Köszegi, B., & Rabin, M. (2007). Reference-dependent risk attitudes. American Economic Review, 97(4), 1047–1073.

Di Falco, S., & Chavas, J. P. (2009). On crop biodiversity, risk exposure, and food security in the highlands of Ethiopia. American Journal of Agricultural Economics, 91(3), 599–611.

Barberis, N. C. (2013). Thirty years of prospect theory in economics: a review and assessment. Journal of Economic Perspectives, 27(1), 173–196.

Femenia, F., & Letort, E. (2016). How to significantly reduce pesticides use: an empirical evaluation of the impacts of pesticides taxation associated with a change in cropping practice. Ecological Economics, 125, 27–37.

Gardebroek, C., Chavez, M. D., & Oude Lansink, A. (2010). Analysing production technology and risk in organic and conventional dutch arable farming using panel data. Journal of Agricultural Economics, 61(1), 60–75.

Isik, M., & Khanna, M. (2003). Stochastic technology, risk preferences, and adoption of site-specific technologies. American Journal of Agricultural Economics, 85(2), 305–317.

Lence, S. H. (2000). Using consumption and asset return data to estimate farmers’ time preferences and risk attitudes. American Journal of Agricultural Economics, 82(4), 934–947.

Pope, R. D., LaFrance, J. T., & Just, R. E. (2011). Agricultural arbitrage and risk preferences. Journal of Econometrics, 162(1), 35–43.

Tanaka, T., Camerer, C. F., & Nguyen, Q. (2010). Risk and time preferences: linking experimental and household survey data from Vietnam. American Economic Review, 100(1), 557–571.

Nguyen, Q., & Leung, P. (2010). How nurture can shape preferences: an experimental study on risk preferences of Vietnamese fishers. Environment and Development Economics, 15(5), 609–631.

Harrison, G., Humphrey, S. J., & Verschoor, A. (2010). Choice under uncertainty: evidence from Ethiopia. India and Uganda. The Economic Journal, 120(543), 80–104.

Nguyen, Q. (2011). Does nurture matter: theory and experimental investigation on the effect of working environment on risk and time preferences. Journal of Risk and Uncertainty, 43(3), 245–270.

Liu, E. M., & Huang, J. (2013). Risk preferences and pesticides use by cotton farmers in China. Journal of Development Economics, 103, 202–215.

Liebenehm, S., & Waibel, H. (2014). Simultaneous estimation of risk and time preferences among small-scale cattle farmers in West Africa. American Journal of Agricultural Economics, 96(5), 1420–1438.

Prelec, D. (1998). The probability weighting function. Econometrica, 66(3), 497–527.

Serra, T., Zilberman, D., Goodwin, B. K., & Featherstone, A. (2006). Effects of decoupling on the mean and variability of output. European Review of Agricultural Economics, 33(3), 269–288.

Serra, T., Zilberman, D., & Gil, J. M. (2008). Farms’ technical inefficiencies in the presence of government programs. The Australian Journal of Agricultural and Resource Economics, 52(1), 57–76.

Horowitz, J. K., & Lichtenberg, E. (1994). Risk-reducing and risk-increasing effects of pesticides. Journal of Agricultural Economics, 45(1), 82–89.

Lence, S. H. (2009). Joint estimation of risk preferences and technology: flexible utility or futility? American Journal of Agricultural Economics, 91(3), 581–598.

Just, R. E., & Just, D. R. (2011). Global identification of risk preferences with revealed preference data. Journal of Econometrics, 162(1), 6–17.

Read, D., Loewenstein, G., & Rabin, M. (1999). Choice bracketing. Journal of Risk and Uncertainty, 19(1), 171–197.

Verschoor, A., D’Exelle, B., & Perez-Viana, B. (2016). Lab and life: does risky choice behaviour observed in experiments reflect that in the real world? Journal of Economic Behavior & Organization, 128, 134–148.

Carpentier, A., & Letort, E. (2011). Accounting for heterogeneity in multicrop micro-econometric models: implications for variable input demand modeling. American Journal of Agricultural Economics, 94(1), 209–224.

Koutchadé, O. P., Carpentier, A., & Femenia, F. (2018). Modeling heterogeneous farm responses to European Union biofuel support with a random parameter multicrop model. American Journal of Agricultural Economics, 100(2), 434–455.

Böcker, T., & Finger, R. (2017). A meta-analysis on the elasticity of demand for pesticides. Journal of Agricultural Economics, 68(2), 518–533.

Böcker, T., and Finger, R. (2016). European pesticide tax schemes in comparison: an analysis of experiences and developments. Sustainability 8, 378; doi:https://doi.org/10.3390/su8040378

Finger, R., Möhring, N., Dalhaus, T., & Böcker, T. (2017). Revisiting pesticide taxation schemes. Ecological Economics, 134, 263–266.

Funding

The study is financially supported by the project “Facilitate public Action to exit from peSTicides (FAST)” as part of the French Priority Research Programme “Growing and Protecting Crops Differently of the French National Research Agency (ANR) and the French National Research Agency (ANR) under the Investments for the Future (Investissements d’Avenir) program, grant ANR-17-EURE-0010.

Author information

Authors and Affiliations

Contributions

We certify that the three authors have contributed equally to the work presented in this article.

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1

1.1 Description of the Crop Data from France Used for Calibration of the Production Function

We use data from crop farms from the Meuse département (a small administrative region in northeastern France). Our sample is a rotating panel which covers years from 1993 to 2010. The major crops produced on these farms are wheat, barley, and rapeseed. In the following, we focus on winter wheat, which was grown on 1,144 farms on our sample over the entire period (with the number of observations per year varying from 255 to 687 farms). We focus on a single-output single-input function, and we choose pesticides as the major input of the production of winter wheat. Information on input use is crop-specific and is measured in real monetary terms (expenditure). Below are two graphs featuring smoothed regressions of wheat yield on pesticides expenditure:

As expected, the relationship is increasing and concave. We try and fit a Just-Pope function on these data. The best fit was obtained with the following function: \(y = 16 \times {x^{0.28}} + 30 \times {x^{ - 0.20}} \times \varepsilon\), which we approximate with \(y = 15 \times {x^{0.30}} + 30 \times {x^{ - 0.20}} \times \varepsilon\) in our simulation exercise. The price of wheat is set at 110€/t, which corresponds to the median on our sample over the entire period.

Appendix 2

2.1 Review of Technology Parameters: Elasticities of Mean Output and Output Variance to Input Use

We report below estimates from the literature of the elasticity of mean output and output variance to input use, for studies that have estimated production functions and measured output in physical quantities. All these estimates are for arable farms producing crops.

Article | Country and inputs | Elasticity of mean output | Elasticity of output variance |

|---|---|---|---|

Just and Pope [21] | Country: USA Input: fertilizers | 0.3‐0.4 | 0.1‐0.2 |

Gardebroek et al. [46] | Country: Netherlands Input: herbicides and pesticides | 0.23 (for conventional farms) | 0.21 (but not statistically significant) |

Koundouri et al. [32] | Country: Finland Inputs: fertilizers and plant protection | 0.50 for plant protection 0.77 for fertilizers | −0.05 for plant protection −0.02 for fertilizers |

Femenia and Letort [45] | Country: France Inputs: fertilizers and pesticides | 0.1 for both fertilizers and pesticides | - |

Appendix 3

3.1 Review of Relative Risk Aversion Parameters Derived from Expected Utility Models

Authors | Sample | Coefficient of relative risk aversion |

|---|---|---|

Bontems and Thomas [24] | Corn plots from US Midwest 1990–1992 | 3.7 |

Chavas and Holt [31] | US aggregate corn and soybean acreage decisions 1954–1985 | [1.4–6.8] |

Isik and Khanna [47] | Field-level data (99 fields) from Illinois (USA) 1993–1994 | 1.5 |

Lence [48] | US aggregate data 1934–1994 | [1.1–2.5] |

Love and Buccola [29] | Farm data on corn and soybean production, Iowa (USA) | [2.4–18.8] |

Pope et al. [49] | State-level data on net returns and acreages, 8 US states | 0.4 |

Saha et al. [30] | Farm-level data for wheat farms in Kansas (USA), 1979–1982 | [3.8–5.4] |

Sckokai and Moro [38] | Farm-level data from Italy, 1993–1999 | [0–5.5] |

Appendix 4

4.1 Sensitivity of the Optimal Input Use to the Mean Function

Appendix 5

5.1 Sensitivity of Input Use and Risk Premium to Levels of Relative Risk Aversion and Parameters of the Risk Function

Risk neutrality | Risk aversion | |||||

|---|---|---|---|---|---|---|

Risk function | rr = 0 | rr = 1 | rr = 2 | rr = 3 | rr = 4 | |

Risk-decreasing input | ||||||

\(g(x) = 20{x^{ - 0.1}}\) | Input use (EUR) | 264 | 266 | 268 | 270 | 272 |

Self-insurance (%) | 0.0 | 0.8 | 1.5 | 2.2 | 2.9 | |

RP* (EUR) | 0 | 7 | 15 | 22 | 30 | |

\(\Delta\) CE (%) | - | −0.6 | −1.3 | −2.0 | −2.6 | |

\(g(x) = 40{x^{ - 0.1}}\) | Input use (EUR) | 264 | 273 | 283 | 295 | 309 |

Self-insurance (%) | 0.0 | 3.3 | 6.7 | 10.5 | 14.6 | |

RP* (EUR) | 0 | 30 | 63 | 100 | 142 | |

\(\Delta\) CE (%) | - | −2.7 | −5.7 | −9.0 | −12.7 | |

\(g(x) = 30{x^{ - 0.1}}\) | Input use (EUR) | 264 | 268 | 273 | 279 | 285 |

(Benchmark) | Self-insurance (%) | 0.0 | 1.5 | 3.3 | 5.4 | 7.4 |

RP* (EUR) | 0 | 17 | 34 | 52 | 71 | |

\(\Delta\) CE (%) | - | −1.5 | −3.0 | −4.6 | −6.3 | |

\(g(x) = 30{x^{ - 0.2}}\) | Input use (EUR) | 264 | 267 | 270 | 273 | 276 |

Self-insurance (%) | 0.0 | 1.1 | 2.2 | 3.3 | 4.3 | |

RP* (EUR) | 0 | 5 | 11 | 16 | 21 | |

\(\Delta\) CE (%) | - | −0.5 | −1.0 | −1.4 | −1.9 | |

Risk-increasing input | ||||||

\(g(x) = 10{x^{0.1}}\) | Input use (EUR) | 264 | 259 | 253 | 247 | 241 |

Self-insurance (%) | 0.0 | −1.9 | −4.3 | −6.9 | −9.5 | |

RP* (EUR) | 0 | 17 | 35 | 54 | 73 | |

\(\Delta\) CE (%) | - | −1.5 | −3.1 | −4.8 | −6.6 | |

\(g(x) = 15{x^{0.1}}\) | Input use (EUR) | 264 | 251 | 234 | 213 | 187 |

Self-insurance (%) | 0.0 | −5.2 | −12.8 | −23.9 | −41.2 | |

RP* (EUR) | 0 | 41 | 87 | 142 | 207 | |

\(\Delta\) CE (%) | - | −3.6 | −7.8 | −12.8 | −18.7 | |

Appendix 6

6.1 Sensitivity to Initial Wealth

Risk neutrality | Risk aversion | |||||

|---|---|---|---|---|---|---|

Initial wealth | rr = 0 | rr = 1 | rr = 2 | rr = 3 | rr = 4 | |

500 EUR | Input use (EUR) | 264 | 268 | 273 | 279 | 285 |

(benchmark) | Self-insurance (%) | 0.0 | 1.5 | 3.3 | 5.4 | 7.4 |

RP* (EUR) | 0 | 17 | 34 | 52 | 71 | |

\(\Delta\) CE (%) | - | −1.5 | −3.0 | −4.6 | −6.3 | |

1000 EUR | Input use (EUR) | 264 | 267 | 270 | 273 | 277 |

Self-insurance (%) | 0.0 | 1.1 | 2.2 | 3.3 | 4.7 | |

RP* (EUR) | 0 | 11 | 23 | 34 | 46 | |

\(\Delta\) CE (%) | - | −0.7 | −1.4 | −2.1 | −2.8 | |

1500 EUR | Input use (EUR) | 264 | 266 | 268 | 271 | 273 |

Self-insurance (%) | 0.0 | 0.8 | 1.5 | 2.6 | 3.3 | |

RP* (EUR) | 0 | 8 | 17 | 26 | 34 | |

\(\Delta\) CE (%) | - | −0.4 | −0.8 | −1.2 | −1.6 | |

5000 EUR | Input use (EUR) | 264 | 264 | 265 | 266 | 267 |

Self-insurance (%) | 0.0 | 0 | 0.4 | 0.8 | 1.1 | |

RP* (EUR) | 0 | 3 | 6 | 10 | 13 | |

\(\Delta\) CE (%) | − | −0.1 | −0.1 | −0.2 | −0.2 | |

Appendix 7

7.1 Review of Parameters Derived from CPT Models

Authors, sample | Specification | Parameter estimates |

|---|---|---|

Tversky and Kahneman [12] 25 Students | CRRA utility function No preference reversal \({\alpha }^{+}={\alpha }^{-}=\alpha\) Loss aversion \(\lambda\) KT probability weighting function \({\gamma }^{+}\ne {\gamma }^{-}\) | \(\widehat{\alpha }=\widehat{{\alpha }^{+}}=\widehat{{\alpha }^{-}}=0.88\) (Farmers are risk averse) \(\widehat{\lambda }\approx 2.25\) (Farmers are loss averse) \(\widehat{{\gamma }^{+}}\approx 0.61;\widehat{{\gamma }^{-}}\approx 0.69\) (Less probability distortion in losses than in gains) |

Tanaka et al. [50] 181 Villagers, Vietnam | CRRA utility function No preference reversal \({\alpha }^{+}={\alpha }^{-}=\alpha\) Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=0.60\) \(\widehat{\lambda }=3.47\) \(\widehat{\gamma }=0.74\) |

Nguyen and Leung [51] 103 Fishermen, Vietnam | CRRA utility function No preference reversal α+ = α− Loss aversion λ Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=0.62\) \(\widehat{\lambda }=2.63\) \(\widehat{\gamma }=0.75\) |

Harrison et al. [52] 531 Villagers, Ethiopia, India and Uganda | CRRA utility function No loss aversion (gains only) KT probability weighting function γ | \(\widehat{\alpha }=0.54\) \(\widehat{\gamma }=1.38\) |

CRRA utility function No loss aversion (gains only in the experiment) Prelec probability weighting function \(\gamma\) (and additional scale parameter \(\eta\)) | \(\widehat{\alpha }=0.50\) \(\widehat{\gamma }=0.96\) \(\widehat{\eta }=1.20\) | |

Nguyen [53] 181 Fishermen, Vietnam | CRRA utility function No preference reversal α+ = α− = α Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=1.01\) \(\widehat{\lambda }=3.26\) \(\widehat{\gamma }=0.96\) |

Liu and Huang [54] 320 Cotton farmers, China | CRRA utility function No preference reversal α+ = α− = α Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=0.52\) \(\widehat{\lambda }=3.47\) \(\widehat{\gamma }=0.69\) |

Bocquého et al. [14] Farmers, France | CRRA utility function No preference reversal α+ = α− = α Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=0.28\) \(\widehat{\lambda }=2.28\) \(\widehat{\gamma }=0.66\) |

Liebenehm and Waibel [55] 211 Cattle farmers, Mali and Burkina Faso | CRRA utility function No preference reversal α+ = α− = α Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}={\gamma }^{-}=\gamma\) | \(\widehat{\alpha }=0.11\) \(\widehat{\lambda }=1.35\) \(\widehat{\gamma }=0.13\) |

Bougherara et al. [15] 197 Crop farmers, France | CRRA utility function No preference reversal α+ = α− = α Loss aversion \(\lambda\) KT probability weighting function \({\gamma }^{+}\ne {\gamma }^{-}\) | \(\widehat{\alpha }=0.61\) \(\widehat{\lambda }=1.37\) \(\widehat{{\gamma }^{+}}=0.79;{\gamma }^{-}=0.84\) |

CRRA utility function No preference reversal \({\alpha }^{+}={\alpha }^{-}=\alpha\) Loss aversion \(\lambda\) Prelec probability weighting function \({\gamma }^{+}\ne {\gamma }^{-}\) | \(\widehat{\alpha }=0.63\) \(\widehat{\lambda }=1.38\) \(\widehat{{\gamma }^{+}}=0.81;\widehat{{\gamma }^{-}}=0.89\) | |

CRRA utility function Preference reversal \({\alpha }^{+}\ne {\alpha }^{-}\) No loss aversion KT probability weighting function \({\gamma }^{+}\ne {\gamma }^{-}\) | \(\widehat{{\alpha }^{+}}=0.60;\widehat{{\alpha }^{-}}=0.66\) \(\widehat{{\gamma }^{+}}=0.79;\widehat{{\gamma }^{-}}=0.84\) |

Rights and permissions

About this article

Cite this article

Bontemps, C., Bougherara, D. & Nauges, C. Do Risk Preferences Really Matter? The Case of Pesticide Use in Agriculture. Environ Model Assess 26, 609–630 (2021). https://doi.org/10.1007/s10666-021-09756-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-021-09756-8