Abstract

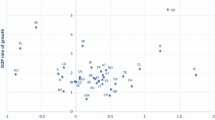

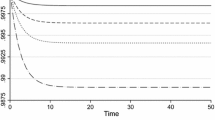

This paper characterizes optimal fiscal policy in an endogenous growth model whose policy implications are consistent with the relationship between two stylized facts observed in a majority of OECD economies, namely the growth in the ratios of both government consumption to public investment and of direct to indirect taxation from 1970 to 2004. Assuming a continuation in the upward trend for the public consumption to output ratio consistent with that observed for this variable between 1970 and 2004 for most developed economies, we find that the optimal tax system becomes more intensive in income taxation relative to consumption taxation, and that public disbursements become less intensive in public investment, which is consistent with the co-evolution of these ratios over the last 40 years.

Similar content being viewed by others

References

Ai C, Cassou SP (1995) A normative analysis of public capital. Appl Econ 27: 1201–1209

Aschauer DA (1989) Is public expenditure productive?. J Monet Econ 23: 177–200

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Political Econ 98(5): S103–S125

Barro RJ, Sala-i-Martín X (1992) Public finance in models of economic growth. Rev Econ Stud 89: 645–661

Benabou R (1996) Inequality and growth. In: Bernanke BS, Ritemberg J (eds) NBER Macroeconomic Annual 11. MIT Press, Cambridge

Burgess R, Stern N (1993) Taxation and development. J Econ Lit 31: 762–830

Caballé J (1998) Growth effects of taxation under altruism and low elasticity of intertemporal substitution. Econ J 108: 92–104

Caballe J, Santos M (1993) On Endogenous growth with physical and human capital. J Political Econ 101(6): 1042–1067

Cassou SP, Lansing KJ (1998) Optimal fiscal policy, public capital and the productivity slowdown. J Econ Dyn Control 22: 911–935

Chamley C (2001) Capital income taxation, wealth distribution and borrowing constraints. J Public Econ 79: 55–69

Chen BL (2006) Economic growth with an optimal public spending composition. Oxf Econ Pap 58: 123–136

Cooley TF, Prescott EC (1995) Economic growth and business cycle. In: Cooley TF (eds) Frontiers of business cycle research. Princeton University Press, Princeton

de Hek PA (2006) On taxation in a two-sector endogenous growth model with endogenous labor supply. J Econ Dyn Control 30: 655–685

Devarajan S, Swaroop V, Zou H (1996) The composition of public expenditure and economic growth. J Monet Econ 37(3): 313–344

Domeij D, Heathcote J (2004) On the distributional effects of reducing capital taxes. Int Econ Rev 45(2): 523–554

Fisher WH, Turnovsky SJ (1998) Public investment, congestion and private capital accumulation. Econ J 108: 399–413

Futagami K, Morita Y, Shibata A (1993) Dynamic analysis of an endogenous growth model with public capital. Scand J Econ 95(4): 607–625

Glomm G, Ravikumar B (1994) Public investment in infrastructure in a simple growth model. J Econ Dyn Control 18: 1173–1187

Glomm G, Ravikumar B (1999) Competitive equilibrium and public investment plans. J Econ Dyn Control 23: 1207–1224

Gómez MA (2007) Optimal tax structure in a two-sector models of endogenous growth. J Macroecon 29: 305–325

Jones LE, Manuelli RE (1990) A convex model of equilibrium growth: theory and policy implications. J Political Econ 98(5): 1008–1038

Jones LE, Manuelli RE (1992) Finite lifetimes and growth. J Econ Theory 58: 171–197

Jones LE, Manuelli RE, Rossi PE (1993) Optimal taxation in models of endogenous growth. J Political Econ 101(3): 485–517

King RG, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Political Econ 98(1): s126–s151

King RG, Plosser CI, Rebelo S (1988) Production, growth and business cycles I: the basic neoclassical model. J Monet Econ 21: 195–232

Kneller R, Bleaney MF, Gemmell N (1999) Fiscal policy and growth: evidence from OECD countries. J Public Econ 74: 171–190

Lynde C, Richmond J (1992) The role of public capital in production. Rev Econ Stat 74: 37–44

Lucas RE Jr (1990) Supply-side economics: an analytical review. Oxf Econ Pap 42: 293–316

Lucas RE Jr, Stokey NL (1983) Optimal fiscal and monetary policy in an economy without capital. J Monet Econ 12(1): 55–93

Ljungqvist L, Sargent TJ (2000) Recursive macroeconomic theory. MIT Press, Cambridge

Marrero GA (2005) An active public investment rule and the downsizing experience in the US: 1960–2000. Top Macroecon 5(1): Article 9

Marrero GA (2008) Revisiting the optimal stationary public investment policy in endogenous growth economies. Macroecon Dyn 12(2): 172–194

Marrero GA, Novales A (2005) Growth and welfare: distorting versus non-distorting taxes. J Macroecon 27: 403–433

Marrero GA, Novales A (2007) Income taxes, public investment and welfare in a growing economy. J Econ Dyn Control 31(10): 3348–3369

Munnell A (1990) How does public infrastructure affect regional performance? N Engl Econ Rev Sept./Oct: 11–32

Ramsey FP (1927) A contribution to the theory of taxation. Econ J 37: 47–61

Romer PM (1986) Increasing returns and long-run growth. J Political Econ 94(5): 1002–1037

Turnovsky SJ (1996) Optimal tax and expenditure policies in a growing economy. J Public Econ 60: 21–44

Turnovsky SJ (1997) Public and private capital in an endogenously growing economy. Macroecon Dyn 1(3): 615–639

Turnovsky SJ (2000) Fiscal policy, elastic labor supply and endogenous growth. J Monet Econ 45: 185–210

Turnovsky SJ (2004) The transitional dynamics of fiscal policy: long-run capital accumulation and growth. J Money Credit Bank 36(5): 883–910

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Marrero, G.A. Tax-mix, public spending composition and growth. J Econ 99, 29–51 (2010). https://doi.org/10.1007/s00712-009-0094-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-009-0094-7