Abstract

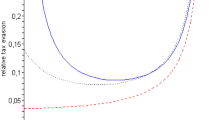

This paper shows that unit taxation can be welfare superior to ad valorem taxation in asymmetric and differentiated oligopolies if the goods are sufficiently differentiated, the cost variance is sufficiently large and the ad valorem tax rate is sufficiently high. Moreover, this result holds under either Cournot competition or Bertrand competition.

Similar content being viewed by others

References

Anderson S, de Palma A, Kreider B (2001a) Tax incidence in differentiated product oligopoly. J Public Econ 81: 173–192

Anderson S, de Palma A, Kreider B (2001b) The efficiency of indirect taxes under imperfect competition. J Public Econ 81: 231–251

Blackorby C, Murty S (2007) Unit versus ad valorem taxes: monopoly in general equilibrium. J Public Econ 91: 817–822

Cournot A (1838) Researches into the mathematical principles of the theory of wealth. English translation by Nathaniel Bacon. Macmillan, New York

Delipalla S, Keen M (1992) The comparison between ad valorem and specific taxation under imperfect competition. J Public Econ 49: 351–367

Denicolo V, Matteuzzi M (2000) Specific and ad valorem taxation in asymmetric Cournot oligopolies. Int Tax Public Finance 7: 335–342

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10: 20–32

Dixit A, Stiglitz J (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67: 297–308

Farrell J, Shapiro C (1990) Horizontal mergers: an equilibrium analysis. Am Econ Rev 80: 107–126

Grazzini L (2006) A note on ad valorem and per unit taxation in an oligopoly model. J Econ 89: 59–74

Hamilton S (1999) The comparative efficiency of ad valorem and specific taxes under monopoly and monopsony. Econ Lett 63: 235–238

Heubeck S, Smythe D, Zhao J (2006) A note on the welfare effects of horizontal mergers in asymmetric linear oligopolies. Ann Econ Finance 1: 29–47

Kamien M, Tauman Y (2003) Patent licensing: the inside story. Manchester Sch 70: 7–15

Kay J, Keen M (1983) How should commodities be taxed? Market structure, product heterogeneity and the optimal structure of commodity taxes. Eur Econ Rev 23: 339–358

Keen M (1998) The balance between specific and ad valorem taxation. Fiscal Stud 19: 1–37

Lahiri S, Ono Y (2004) Trade and industrial policy under international oligopoly. Cambridge University Press, Cambridge

Liu L, Saving T (2005) Market substitution and the Pareto dominance of ad valorem taxation. South Econ J 72: 463–481

Schröder P (2004) The comparison between ad valorem and unit taxes under monopolistic competition. J Econ 83: 281–292

Skeath S, Trandel G (1994) A Pareto comparison of ad valorem and unit taxes in noncooperative environments. J Public Econ 53: 53–71

Suits D, Musgrave R (1953) Ad valorem and unit taxes compared. Q J Econ 67: 598–604

Wicksell K (1896) Taxation in the monopoly case, translation from the original. In: Musgrave R, Shoup C (eds) Readings in the economics of taxation. Irwin, Homewood

Zhao J, Howe E (2007) Inverse matrices and merger incentives from Bertrand competition, Working Paper, University of Saskatchewan

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, X.H., Zhao, J. On the efficiency of indirect taxes in differentiated oligopolies with asymmetric costs. J Econ 96, 223–239 (2009). https://doi.org/10.1007/s00712-008-0046-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-008-0046-7