Abstract

In the light of the unconventional monetary policies implemented by most large central banks around the world, there is an intense debate about the potential impact on the prices of capital assets. Particularly in Germany, skepticism about the sustainability of the current policy by the European Central Bank is wide spread and concerns about the emergence of a speculative price bubble in the housing market are increasing. The present study analyzes a comprehensive data set covering 127 large German cities from 1990 through 2013, using tests for speculative bubbles, both at a national and city level. Furthermore, we apply two new testing approaches: panel-data and principal components versions of explosive root tests. We find evidence for explosive price increases in many cities. However, it is only in select urban housing markets that prices decouple from their fundamental values. There is no evidence for speculative price movements nationally.

Similar content being viewed by others

Notes

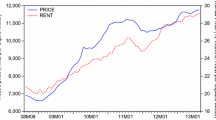

The ca rates are the initial yield of real estate investments. They are defined as the annual rental income divided by the per square meter price of the apartment. We calculated them based on the first principal components of the 127 German cities, as introduced in Sect. 4.2. The implicit risk premia are calculated as the spread between the cap rates and the yield of German 10-year treasury bonds.

In a nutshell, the value of a real option describes investors willingness to pay to have the options to modify an existing building lot. In the land context, for example, undeveloped land contains a premium for the option to develop the site in the future, while this premium is lost in cases of already developed sites (for an overview, see Reuer and Tong (2007)).

For more details, see Hampe and Wenzel (2011).

All the computations in this paper are carried out using the codes written by the authors in the statistical programming language R (R Core Team 2013). These codes are available upon request.

Test results are available on request.

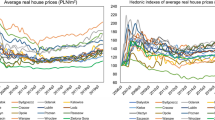

The share of variance accounted for by the first principal component ranges from roughly 45 to 70% for newly built apartments and approximately one-third to two-thirds for second-hand apartments.

EONIA stands for the Euro OverNight Index Average, which is a weighted average of all overnight unsecured lending transactions in the interbank market in euros. It was used because, unlike the Bank of Israel, the European Central Bank does not have a 1-year interest rate.

The time series cover the period between January 1999 and December 2015 and were taken from the Deutsche Bundesbank database .

References

Abranham J, Hendershott P (1996) Bubbles in metropolitan housing market. J Hous Res 7(2):191–207

Abreu D, Brunnermeier MK (2003) Bubbles and crashes. Econometrica 71(1):173–204

Agnello L, Schuknecht L (2011) Booms and busts in housing markets: determinants and implications. J Hous Econ 20(3):171–190

Allen F, Gorton G (1993) Churning bubbles. Rev Econ Stud 60(4):813–836

an de Meulen P, Micheli M (2013) Droht eine Immobilienpreisblase in Deutschland? Wirtschaftsdienst 93(8):539–544

Anundsen AK, Gerdrup K, Hansen F, Kragh-Sørensen K (2016) Bubbles and crises: the role of house prices and credit. J Appl Econom 31(7):1291–1311

Belke A, Wiedmann M (2005) Boom or bubble in the us real estate market. Intereconomics 40(5):273–284

Blanchard OJ, Watson MW (1982) Bubbles, rational expectations and financial markets. In: Wachtel P (ed) Crises in the economic and financial structure: bubbles, bursts, and shocks. D.C.Heath and Company, Lexington

Brunnermeier MK (2008) Bubbles. In: Durlauf SN, Blume LE (eds) The New Palgrave dictionary of economics, vol 2, 2nd edn. Palgrave MacMillan, Basingstoke

Brunnermeier MK, Oehmke M (2012) Bubbles, financial crises, and systemic risk. NBER Working Papers 18398, National Bureau of Economic Research, Inc. https://ideas.repec.org/p/nbr/nberwo/18398.html

Bundesinstitut für Bau-, Stadt- und Raumforschung (2011) Renaissance der Großstädte — eine Zwischenbilanz. BBSR-Berichte KOMPAKT 9/2011

Campbell SD, Davis MA, Gallin J, Martin RF (2009) What moves housing markets: a variance decomposition of the rent-price ratio. J Urb Econ 66(2):90–102. https://ideas.repec.org/a/eee/juecon/v66y2009i2p90-102.html

Case KE, Shiller RJ (2003) Is there a bubble in the housing market? Brook Pap Econ Act 2:299–362

Caspi I (2016) Testing for a housing bubble at the national and regional level: the case of Israel. Empir Econ 51(2):483–516

Chen X, Funke M (2013) Renewed momentum in the German housing market: boom or bubble? CESifo Working Paper (No. 4287)

Clapp JM, Eichholtz P, Lindenthal T (2013) Real option value over a housing market cycle. Reg Sci Urb Econ 43(6):862–874

Clark SP, Coggin TD (2011) Was there a us house price bubble? An econometric analysis using national and regional panel data. Q Rev Econ Finance 51(2):189–200

Deutsche Bundesbank (2013) Monatsbericht Oktober 2013

Dombret A, Braun R, Rottke NB, Oertel CY, Mense A, Schumacher J (2013) Miet- und immobilienpreissteigerungen: droht eine immobilienblase? Ifo Schnelldienst 66(02):03–20

Dreger C, Kholodilin KA (2013) An early warning system to predict speculative house price bubbles. Econ Open Access Open Asses E J https://doi.org/10.5018/economics-ejournal.ja.2013-8

Duca JV, Muellbauer J, Murphy A (2010) Housing markets and the financial crisis of 2007–2009: lessons for the future. J Financ Stab 6(4, Sp. Iss. SI):203–217

Empirica AG (2014) empirica-Blasenindex II/2014

Fernández-Kranz D, Hon MT (2006) A cross-section analysis of the income elasticity of housing demand in Spain: is there a real estate bubble? J Real Estate Finance Econ 32(4):449–470

Georgi S, Barkow P (2010) Wohnimmobilien-Indizes: Vergleich Deutschland—Großbritannien. Zentraler Immobilien Ausschuss e.V., Berlin

Glaeser EL, Nathanson C (2014) Housing bubbles. NBER Working Paper No. w20426

Goodman AC, Thibodeau T (2008) Where are the speculative bubbles in US housing markets? J Hous Econ 17(2):117–137

Gordon MJ (1959) Dividends, earnings, and stock prices. Rev Econ Stat 41(2):99–105

Haas H, Henger R, Voigtländer M (2013) Reale Nachfrage oder bloße Spekulation: ist der deutsche Wohnimmobilienmarkt überhitzt?. Technical report, IW policy paper

Hampe S, Wenzel F (2011) BulwienGesa-Immobilienindex 1975–2010. Technical report, BulwienGesa AG

Harding D, Pagan A (2002) Dissecting the cycle: a methodological investigation. J Monet Econ 49(2):365–381

Henger R, Pomogajko K, Voigtländer M (2012) Gibt es eine spekulative Blase am deutschen Wohnimmobilienmarkt. Hg v Institut der deutschen Wirtschaft Köln. IW-Trends–Vierteljahresschrift zur empirischen Wirtschaftsforschung 39(3):3–16

Himmelberg C, Mayer C, Sinai T (2005) Assessing high house prices: bubbles, fundamentals, and misperceptions. NBER Working Paper Series 11643

Hoffmann J, Kurz C (2002) Rent indices for housing in West Germany 1985 to 1998. Working Paper Series 116, European Central Bank

Hoffmann J, Lorenz A (2006) Real estate price indices in Germany: past, present and future. In: OECD-IMF workshop “Real Estate Price Indexes”, Paris, 6–7 Nov

Homm U, Breitung J (2012) Testing for speculative bubbles in stock markets: a comparison of alternative methods. J Financ Econom 10(1):198–231

Hwang M, Quigley JM (2006) Economic fundamentals in local housing markets: evidence from U.S. metropolitan regions. J Reg Sci 46(3):425–453

IMF (2014) Germany—selected issues. IMF country report 14/217

Jordà Ò, Schularick MH, Taylor AM (2014) Betting the house. Technical report. Paper presented at the NBER international seminar on macroeconomics

Kajuth F, Knetsch TA, Pinkwart N (2013) Assessing house prices in Germany: evidence from an estimated stock-flow model using regional data. Discussion paper Deutsche Bundesbank 46/2013

Kholodilin KA (2017) Wanderungen in die Metropolen Deutschlands. Der Landkreis 1/2:44–47

Kholodilin KA, Ulbricht D (2015) Urban house prices: a tale of 48 cities. Econ Open Access Open Assess E J https://doi.org/10.5018/economics-ejournal.ja.2015-28

Kivedal BK (2013) Testing for rational bubbles in the US housing market. J Macroecon 38:369–381

Kofner S (2014) The German housing system: fundamentally resilient? J Hous Built Environ 29(2):255–275

Krainer J (2001) A theory of liquidity in residential real estate markets. J Urb Econ 49(1):32–53

McCarthy J, Peach RW (2004) Are home prices the next bubble? FRBNY Econ Policy Rev 10(3):1–17

Michelsen C, Weiß D (2010) What happened to the East German housing market? A historical perspective on the role of public funding. Post Communist Econ 22(3):387–409

Miller E (1977) Risk, uncertainty, and divergence of opinion. J Finance 32(4):1151–1168

Phillips PC, Wu Y, Yu J (2011) Explosive behavior in the 1990s NASDAQ: when did exuberance escalate asset values? Int Econ Rev 52(1):201–226

R Core Team (2013) R: a language and environment for statistical computing. R Foundation for Statistical Computing, Vienna

Reichert AK (1990) The impact of interest rates, income, and employment upon regional housing prices. J Real Estate Finance Econ 3(4):373–391

Reuer JJ, Tong TW (2007) Real options theory. Elsevier, Amsterdam

Shleifer A, Vishny R (1997) The limits of arbitrage. J Finance 52(1):35–55

Smith MH, Smith G (2006) Bubble, bubble, where’s the housing bubble? Brook Pap Econ Act 1:1–67

Tirole J (1985) Asset bubbles and overlapping generations. Econometrica 53(5):1071–1100

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kholodilin, K.A., Michelsen, C. & Ulbricht, D. Speculative price bubbles in urban housing markets. Empir Econ 55, 1957–1983 (2018). https://doi.org/10.1007/s00181-017-1347-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1347-x