Abstract

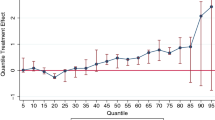

This paper reexamines the permanent income hypothesis (PIH) in the frequency domain. In contrast to some time domain tests, our frequency domain approach provides an explicit and natural test ofboth the permanentand transitory implications of the PIH for jointly nonstationary consumption and income data. Using a simple theoretical model, we demonstrate that the PIH implies the marginal propensity to consume (MPC) out of zero frequency income is unity. The PIHalso implies that the theoretical MPC out of transitory (or high frequency) income is smaller than the long-run MPC. These theoretical restrictions are natural implications of Friedman's hypothesis that agents consume out of permanent or low frequency income and (dis)save out of transitory or high frequency income.

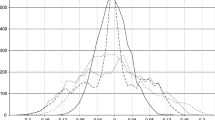

We test this full set of restrictions directly using spectral regression techniques. Under our set of assumptions, the derived disposable income process is shown to have a unit root and to be cointegrated with consumption. We therefore employ a systems spectral regression procedure that accommodates stochastic trends in the consumption and income series as well as the joint dependence in these series. In view of the relatively recent development of these systems spectral estimators, we also conduct Monte Carlo simulations across both low and high frequencies to assess properties of the estimator relative to established single equation techniques. New empirical estimates of the consumption function and tests of the PIH based on systems spectral regression methods are reported for U.S. aggregate consumption and income data over the period 1948–1993. The empirical results provide some evidence for the theoretical implications of the PIH.

Similar content being viewed by others

References

Brillinger D (1981) Time series: Data analysis and theory. San Francisco Holden Day

Campbell J (1987) Does saving anticipate declining labor income? An alternative test of the permanent income hypothesis. Econometrica 55 (6):1249–73

Cochrane J, Sbordone A (1988) Multivariate estimates of the permanent components of GNP and stock prices. Journal of Economic Dynamics and Control 12:255–96

Engle R (1974) Band spectrum regression. International Economic Review 15 (1):1–11

Engle R, Granger C (1987) Co-integration and error correction: Representation, estimation, and testing. Econometrica 55:251–76

Flavin M (1981) The adjustment of consumption to changing expectations about future income. Journal of Political Economy 89:974–1009

Hannan E (1963) Regression for time series. In: Rosenblatt M (ed) Time Series Analysis, New York Wiley

Hannan E (1970) Multiple time series. New York Wiley

Ouliaris S, Park J, Phillips PCB (1988) Testing for a unit root in the presence of a maintained trend. Advances in Econometrics and Modelling, Raj (ed) Holland D Reidel Publishing Co

Park JY, Choi B (1988) A new approach to testing for a unit root. Cornell University working paper # 23

Phillips PCB (1987) Time series regression with unit roots. Econometrica 55 (2):277–302

Phillips PCB (1991) Spectral regression for co-integrated time series. In: Barnett W, Powell J, Tauchen G (eds) Nonparametric and Semiparametric Methods in Economics and Statistics. Cambridge University Press

Phillips PCB, Loretan M (1991) Estimating long run economic equilibria. Review of Economic Studies 59:407–436

Quah D (1990) Permanent and transitory movements in labor income: An explanation for ‘excess smooothness’ in consumption. Journal of Political Economy 98:449–75

Raj B, Siklos PL (1988) The role of fiscal policy in the St. Louis model: Nonparametric estimates for a small open economy. Empirical Economics 13:169–86

Said S, Dickey D (1984) Testing for unit roots in autoregressive-moving average models of unknown order. Biometrika 71:599–607

Sargan JD (1989) Lectures on advanced econometric theory. Desai M (ed) Oxford Basil Blackwell

Sargent T (1987) Macroeconomic theory. New York Academic Press 362–79

Stock J (1988) A reexamination of Friedman's consumption puzzle. Journal of Business and Economic Statistics 6:401–7

Author information

Authors and Affiliations

Additional information

We wish to thank Steve Durlauf, Rob Engle, Vance Martin, Chuck Whiteman, participants at the Sixth World Econometric Congress, the NBER Group on Common Elements of Economic Fluctuations, and two anonymous referees for helpful comments on an earlier version of this paper.

Rights and permissions

About this article

Cite this article

Corbae, D., Ouliaris, S. & Phillips, P.C.B. A reexamination of the consumption function using frequency domain regressions. Empirical Economics 19, 595–609 (1994). https://doi.org/10.1007/BF01205817

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01205817