Abstract

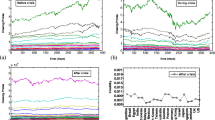

We analyzed cross-correlations between price fluctuations of global financial indices (20 daily stock indices over the world) and local indices (daily indices of 200 companies in the Korean stock market) by using random matrix theory (RMT). We compared eigenvalues and components of the largest and the second largest eigenvectors of the cross-correlation matrix before, during, and after the global financial the crisis in the year 2008. We find that the majority of its eigenvalues fall within the RMT bounds [λ −, λ +], where λ − and λ + are the lower and the upper bounds of the eigenvalues of random correlation matrices. The components of the eigenvectors for the largest positive eigenvalues indicate the identical financial market mode dominating the global and local indices. On the other hand, the components of the eigenvector corresponding to the second largest eigenvalue are positive and negative values alternatively. The components before the crisis change sign during the crisis, and those during the crisis change sign after the crisis. The largest inverse participation ratio (IPR) corresponding to the smallest eigenvector is higher after the crisis than during any other periods in the global and local indices. During the global financial the crisis, the correlations among the global indices and among the local stock indices are perturbed significantly. However, the correlations between indices quickly recover the trends before the crisis.

Similar content being viewed by others

References

R. N. Mantegna and H. E. Stanely, An introduction to Econophysics (Cambridge University Press, Cambridge, 2000).

J. P. Bouchaud and M. Potters, Theory of Financial Risk (Cambridge University Press, Cambridge, 2000).

D. Challet and Y. C. Zhang, Physica A 246, 407 (1997).

T. Lux and M. Marchesi, Nature 397, 498 (1999).

P. Stauffer, P. M. C De Oliveria and A. T. Bernardes, Int. J. Theor. Appl. Finance. 2, 83 (1999).

V. M. Eguiluz and M. G. Zimmermann, Phys. Rev. Lett. 85, 5659 (2000).

S. Kumar and N. Deo, Phys. Rev. E 86, 026101 (2012).

M. L. Mehta, Random Matrices (Academic Press, Boston, 1991).

T. Guhr, A. Müller-Groeling and H. A. Weidenmüller, Phys. Rep. 299, 190 (1998)

F. J. Dyson and M. L. Mehta, J. Math. Phys. 4, 701 (1963).

F. J. Dyson, J. Math. Phys. 3, 140 (1962).

M. L. Mehta and F. J. Dyson, J. Math. Phys. 4, 713 (1963).

T. A. Brody, J. Flores, J. B. French, P. A. Mello, A. Pandey and S. S. M. Wong, Rev. Mod. Phys. 53, 385 (1981).

R. K. Pan and S. Sinha, Phys. Rev. E 76, 046116 (2007); L. Sandoval, Jr. and I. D. P Franca, Physica A 391, 187 (2012).

D.-M. Song, M. Tumminello, W.-X. Zhou and R. N. Mantegna, Phys. Rev. E 84, 026108 (2011).

T. H. Baker, P. J. Forrester and P. A. Pearce, J. Phys. A 31, 6087 (1998).

A. Edelman, SIAM J. Matrix Anal. Appl. 9, 543 (1998).

A. M. Sengupta and P. P. Mitra, Phys. Rev. E 60, 3389 (1999).

L. Laloux, P. Cizeau, J.-P. Bouchaud and M. Potters, Phys. Rev. Lett. 83, 1467 (1999).

V. Plerou, P. Gopikrishnan, B. Rosenow, L. A. N. Amaral and H. E. Stanley, Phys. Rev. Lett. 83, 1471 (1999).

V. Plerou, P. Gopikrishnan, B. Rosenow, L. A. N. Amaral, T. Guhr and H. E. Staneley, Phys. Rev. E 65, 066126 (2002).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nobi, A., Maeng, S.E., Ha, G.G. et al. Random matrix theory and cross-correlations in global financial indices and local stock market indices. Journal of the Korean Physical Society 62, 569–574 (2013). https://doi.org/10.3938/jkps.62.569

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.3938/jkps.62.569