Market Design and Trading Strategies for Community Energy Markets with Storage and Renewable Supply

Abstract

:1. Introduction

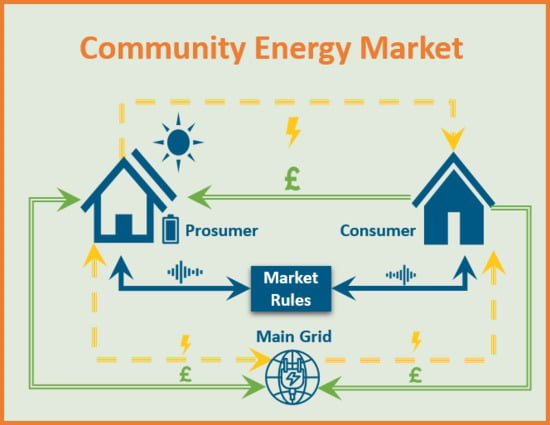

2. Related Work

3. Market Design

3.1. Two-Sided Auction

3.2. Players

3.3. Auction Rules

3.4. Clearing

| Algorithm 1 Compute Clearing Price and Volume. | |

| Input bids list , asks list | |

| Output clearing price P and trading volume V | |

| procedure ComputeClearingPriceandVolume () | |

| Require: | |

| ▹ Initialise empty list | |

| ▹ Initialise empty list | |

| for p in do | ▹ Loop over the unique set of bid prices |

| ▹ Compute the volume for price p using (3) | |

| ▹ Append price p and volume q to the bids list | |

| for p in do | ▹ Loop over the unique set of asks prices |

| ▹ Append price p and volume q to the asks list | |

| ▹ Get the bid with max volume | |

| ▹ Get the ask with max volume | |

| if then | |

| else if then | |

| else | |

| if then | |

| return Null | ▹ Return null if no trade can be done |

| return | ▹ Return the clearing price and the trading volume |

3.5. Allocation

| Algorithm 2 Envy Free Division. | |

| Input energy amount E and list of agents with their desire R | |

| Output a dictionary of agents with their shares resulting from the division | |

| procedure Divide () | |

| Require: | |

| if then return 0 for all agents | ▹ No energy to divide |

| ▹ Initialise empty dictionary for the results | |

| ▹ Sort winning agents’ desire in ascending order | |

| for a in R do | |

| return | ▹ Return agents with their shares |

3.6. Balancing

Secondary Market

| Algorithm 3 Balance Market. | |

| Input agents list , allocated demand dictionary for current round , allocated supply dictionary for the current round , minute t, current round cleared price and the community energy accounts | |

| Output updated community | |

| procedure BalanceMarket () | |

| Require: | |

| ▹ Initialise empty dictionary for consumers | |

| ▹ Initialise empty dictionary for suppliers | |

| for a in do | ▹ Do agents who have remaining allocation |

| MAXDEMAND | |

| MAXDSUPPLY | |

| if then | ▹ No enough supply to cover demand or equal |

| ▹ Suppliers sell all their supply | |

| DIVIDE(S, ) | ▹ Divide supply |

| else | |

| ▹ Consumers buy all their demand | |

| DIVIDE(D, ) | ▹ Divide demand |

| Secondary Market | |

| ▹ Initialise empty dictionary for excess demand | |

| ▹ Initialise empty dictionary for excess supply | |

| ▹ Initialise empty dictionary for flexible demand | |

| ▹ Initialise empty dictionary for flexible supply | |

| for a in do | ▹ Now compute remaining for all agents for secondary market |

| FLEXIBLEDEMAND | |

| FLEXIBLESUPPLY | |

| NET | |

| NET | |

| if then | ▹ Make sure of one way flow of energy |

| else | |

| if then | ▹ Make sure of one way flow of energy |

| else | |

| if then | ▹ Excess demand more than excess supply or equal |

| if then | ▹ Excess demand more than supply ability or equal |

| ▹ Suppliers sell all their ability | |

| DIVIDE(, ) | ▹ Divide supply ability |

| else | ▹ Supply ability is more that excess demand |

| ▹ Consumers buy all their excess demand | |

| DIVIDE(D, ) | ▹ Divide excess demand |

| else | ▹ Excess supply is more than excess demand |

| if then | |

| else if then | ▹ Excess supply more than demand ability or equal |

| ▹ Consumers buy all their ability | |

| DIVIDE(, ) | ▹ Divide all demand ability |

| else | ▹ Demand ability is more that excess supply |

| ▹ Suppliers sell all their excess supply | |

| DIVIDE(S,) | ▹ Divide excess supply |

| Grid State | |

| ▹ Initialise empty dictionary for grid import | |

| ▹ Initialise empty dictionary for grid export | |

| for a in do | ▹ Now compute what is needed from the grid |

| Update round allocated amounts | |

| Update State | |

| Exchange energy and update agents storage devices | |

| Update with | |

3.7. Accounting

| Algorithm 4 Compute Hourly Bills. | |

| Input agents list , accounts book and round T, | |

| Output updated | |

| procedure ComputeHourlyBills() | |

| Require: | |

| ▹ Initialise empty dictionary for the bills | |

| clear price for round T | |

| start of the round T , end of the hour | |

| for a in do | ▹ Loop over all agents list |

| Demand Cost | |

| Supply Income | |

| Agent Net | |

| Grid Net | |

| Grid | |

| Community Net | |

| Community | |

| Update with | |

4. Agent Trading Strategies

4.1. Energy Profile

4.2. Energy Prediction

4.3. Bidding Strategy

| Algorithm 5 Quantity Pricing. | |

| Input the estimated price for the next round , the gap between the selling and buying prices , price changing unit z quantity changing unit u, price of buying energy form the grid , price of selling energy to the grid , flexible demand quantity , flexible supply quantity | |

| Output lists of bids and asks | |

| procedure Quantity Pricing () | |

| Require: | |

| ▹ initialise bids list | |

| ▹ initialise asks list | |

| if then | |

| while do | |

| if priceSpace = 0 then | |

| ▹ append quantity and price to bids list | |

| else | |

| if then | |

| while do | |

| if then | |

| ▹ append quantity and price to asks list | |

| else | |

| return | |

5. Simulations

5.1. Data

5.2. Measures

5.3. Assumptions and Parameters

6. Results and Discussion

6.1. Perfect Predictions

6.1.1. Perfect Predictions without Storage

6.1.2. Perfect Predictions with Storage

6.2. Imperfect Predictions

6.2.1. Imperfect Predictions without Storage

6.2.2. Imperfect Predictions with Storage

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Eid, C.; Codani, P.; Perez, Y.; Reneses, J.; Hakvoort, R. Managing electric flexibility from Distributed Energy Resources: A review of incentives for market design. Renew. Sustain. Energy Rev. 2016, 64, 237–247. [Google Scholar] [CrossRef]

- Lesser, J.A.; Su, X. Design of an economically efficient feed-in tariff structure for renewable energy development. Energy Policy 2008, 36, 981–990. [Google Scholar] [CrossRef]

- Ilic, D.; Da Silva, P.G.; Karnouskos, S.; Griesemer, M. An energy market for trading electricity in smart grid neighbourhoods. In Proceedings of the 2012 6th IEEE International Conference on Digital Ecosystems and Technologies (DEST), Campione d’Italia, Italy, 18–20 June 2012; pp. 1–6. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Xiao, Y.; Wang, X.; Pinson, P.; Wang, X. A Local Energy Market for Electricity and Hydrogen. IEEE Trans. Power Syst. 2018, 33, 3898–3908. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Saad, W.; Han, Z.; Poor, H.V.; Başar, T. A Game-Theoretic Approach to Energy Trading in the Smart Grid. IEEE Trans. Smart Grid 2014, 5, 1439–1450. [Google Scholar] [CrossRef] [Green Version]

- Majumder, B.P.; Faqiry, M.N.; Das, S.; Pahwa, A. An efficient iterative double auction for energy trading in microgrids. In Proceedings of the 2014 IEEE Symposium on Computational Intelligence Applications in Smart Grid (CIASG), Orlando, FL, USA, 9–12 December 2014; pp. 1–7. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A.; Micheli, S. Socio-economic acceptability for smart grid development—A comprehensive review. J. Clean. Prod. 2016, 131, 399–409. [Google Scholar] [CrossRef]

- Wiyono, D.S.; Stein, S.; Gerding, E.H. Novel Energy Exchange Models and a trading agent for community energy market. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer energy trading in a community microgrid. In Proceedings of the 2017 IEEE Power Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Pilz, M.; Al-Fagih, L. Recent Advances in Local Energy Trading in the Smart Grid Based on Game-Theoretic Approaches. IEEE Trans. Smart Grid 2019, 10, 1363–1371. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Yaagoubi, N.; Mouftah, H.T. Energy Trading in the smart grid: A game theoretic approach. In Proceedings of the 2015 IEEE International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 17–19 August 2015; pp. 1–6. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Garttner, J.; Weinhardt, C. The role of energy storage in local energy markets. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Staudt, P.; Garttner, J.; Weinhardt, C. Trading on local energy markets: A comparison of market designs and bidding strategies. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017. [Google Scholar] [CrossRef]

- Park, C.; Yong, T. Comparative review and discussion on P2P electricity trading. Energy Procedia 2017, 128, 3–9. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; De Abril, I.M.; Nowé, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014. [Google Scholar] [CrossRef]

- Vytelingum, P.; Ramchurn, S.D.; Voice, T.D.; Rogers, A.; Jennings, N.R. Trading agents for the smart electricity grid. In Proceedings of the International Joint Conference on Autonomous Agents and Multiagent Systems, AAMAS, Toronto, ON, Canada, 10–14 May 2010; Volume 2, pp. 897–904. [Google Scholar]

- Chen, K.; Lin, J.; Song, Y. Trading strategy optimization for a prosumer in continuous double auction-based peer-to-peer market: A prediction-integration model. Appl. Energy 2019, 242, 1121–1133. [Google Scholar] [CrossRef]

- Lüth, A.; Zepter, J.M.; Crespo del Granado, P.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Arghandeh, R.; Woyak, J.; Onen, A.; Jung, J.; Broadwater, R.P. Economic optimal operation of Community Energy Storage systems in competitive energy markets. Appl. Energy 2014, 135, 71–80. [Google Scholar] [CrossRef] [Green Version]

- Crespo Del Granado, P.; Wallace, S.W.; Pang, Z. The value of electricity storage in domestic homes: A smart grid perspective. Energy Syst. 2014, 5, 211–232. [Google Scholar] [CrossRef]

- Parra, D.; Gillott, M.; Norman, S.A.; Walker, G.S. Optimum community energy storage system for PV energy time-shift. Appl. Energy 2015, 137, 576–587. [Google Scholar] [CrossRef]

- Parra, D.; Norman, S.A.; Walker, G.S.; Gillott, M. Optimum community energy storage system for demand load shifting. Appl. Energy 2016, 174, 130–143. [Google Scholar] [CrossRef]

- Parra, D.; Norman, S.A.; Walker, G.S.; Gillott, M. Optimum community energy storage for renewable energy and demand load management. Appl. Energy 2017, 200, 358–369. [Google Scholar] [CrossRef]

- Sardi, J.; Mithulananthan, N.; Gallagher, M.; Hung, D.Q. Multiple community energy storage planning in distribution networks using a cost–benefit analysis. Appl. Energy 2017, 190, 453–463. [Google Scholar] [CrossRef]

- Zame, K.K.; Brehm, C.A.; Nitica, A.T.; Richard, C.L.; Schweitzer, G.D. Smart grid and energy storage: Policy recommendations. Renew. Sustain. Energy Rev. 2018, 82, 1646–1654. [Google Scholar] [CrossRef]

- Yan, X.; Lin, J.; Hu, Z.; Song, Y. P2P trading strategies in an industrial park distribution network market under regulated electricity tariff. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration, EI2 2017, Beijing, China, 26–28 November 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Nicolaisen, J.; Petrov, V.; Tesfatsion, L. Market power and efficiency in a computational electricity market with discriminatory double-auction pricing. IEEE Trans. Evol. Comput. 2001, 5, 504–523. [Google Scholar] [CrossRef] [Green Version]

- Lamparter, S.; Becher, S.; Fischer, J.G. An Agent-based Market Platform for Smart Grids. In Proceedings of the 9th International Conference on Autonomous Agents and Multiagent Systems: Industry Track, Toronto, ON, Canada, 10–14 May 2010; pp. 1689–1696. [Google Scholar]

- Friedman, D. The double auction market institution: A survey. In The Double Auction Market: Institutions, Theories, and Evidence; Routledge: Abingdon-on-Thames, UK, 1993; Chapter 1; pp. 3–26. [Google Scholar]

- Niu, J.; Parsons, S. Maximizing matching in double-sided auctions. arXiv 2013, arXiv:1304.3135. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Market framework for local energy trading: A review of potential designs and market clearing approaches. IET Gener. Transm. Distrib. 2018, 12, 5899–5908. [Google Scholar] [CrossRef] [Green Version]

- Brams, S.J.; Taylor, A.D. An Envy-Free Cake Division Protocol. Am. Math. Mon. 1995, 102, 9–18. [Google Scholar] [CrossRef]

- McKenna, E.; Thomson, M. High-resolution stochastic integrated thermal–electrical domestic demand model. Appl. Energy 2016, 165, 445–461. [Google Scholar] [CrossRef] [Green Version]

- OFGEM. Feed-In Tariff (FIT) Rates; OFGEM: London, UK, 2019.

- OFGEM. Retail Market Indicators; OFGEM: London, UK, 2019.

| Paramter | Value | Unit | Description |

|---|---|---|---|

| M | 29 | days | Length of the simulation |

| 1 | penny | Strategy price gap | |

| u | 1 | kWh | Strategy increment quantity |

| z | 0.5 | penny | Strategy price changing rate |

| y | 0.25 | penny | Strategy distance from the grid prices |

| 8.3 | pence | Buy price from the grid | |

| 3.41 | pence | Sell price to the grid |

| Prosumer Ratio | Aggregate Max PV Power | |||

|---|---|---|---|---|

| 20% | 20 | 1.51 | 50.05 | 50.05 |

| 40% | 50 | 21.51 | 101.51 | 101.51 |

| 60% | 85 | 18.54 | 102.82 | 102.82 |

| 80% | 125 | 18.38 | 87.54 | 87.54 |

| 100% | 185 | 14.80 | 61.71 | 61.71 |

| Ratio of Prosumers with Storage | Storage Capacity (kWh) | Storage Power (kW) | + | Aggregate Demand Savings From Storage Only | ||||

|---|---|---|---|---|---|---|---|---|

| 0% | 0 | 0 | 21.51 | 101.51 | 101.51 | 203.02 | 50% | |

| 20% | 3 | 3 | 17.70 | 95.71 | 141.10 | 236.81 | 60% | 18.66 |

| 40% | 3 | 3 | 15.13 | 82.65 | 170.18 | 252.83 | 67% | 39.66 |

| 60% | 3 | 3 | 13.64 | 68.63 | 190.65 | 259.28 | 74% | 61.32 |

| 80% | 3 | 3 | 10.77 | 48.64 | 214.18 | 262.82 | 81% | 82.94 |

| 100% | 3 | 3 | 9.10 | 39.00 | 225.78 | 264.78 | 85% | 102.73 |

| 20% | 5 | 5 | 18.32 | 100.43 | 149.25 | 249.68 | 60% | 22.43 |

| 40% | 5 | 5 | 14.24 | 78.55 | 190.64 | 269.19 | 71% | 47.35 |

| 60% | 5 | 5 | 11.19 | 52.04 | 221.85 | 273.89 | 81% | 74.48 |

| 80% | 5 | 5 | 10.27 | 27.30 | 237.68 | 264.98 | 90% | 101.82 |

| 100% | 5 | 5 | 7.07 | 23.00 | 244.41 | 267.41 | 91% | 125.41 |

| 20% | 10 | 5 | 13.04 | 111.32 | 174.30 | 285.62 | 61% | 25.17 |

| 40% | 10 | 5 | 8.54 | 69.53 | 232.86 | 302.39 | 77% | 52.79 |

| 60% | 10 | 5 | 8.77 | 31.95 | 252.88 | 284.83 | 89% | 84.96 |

| 80% | 10 | 5 | 10.40 | 15.89 | 241.31 | 257.20 | 94% | 117.50 |

| 100% | 10 | 5 | 5.54 | 15.62 | 251.00 | 266.62 | 94% | 144.44 |

| Prosumer Ratio | ||||||

|---|---|---|---|---|---|---|

| 20% | −39.11 | −30.47 | 38.36 | 40.70 | 21.12 | 27.42 |

| 40% | −88.60 | −58.81 | 37.94 | 55.78 | 54.97 | 66.92 |

| 60% | −95.30 | −60.42 | 27.83 | 50.69 | 63.97 | 75.98 |

| 80% | −86.25 | −49.51 | 12.17 | 38.31 | 58.29 | 68.88 |

| 100% | −74.05 | −38.48 | −4.26 | 21.91 | 38.83 | 48.23 |

| Storage Ratio | Capacity (kWh) | Power (kW) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 0% | 0 | 0 | −88.60 | −58.81 | 37.94 | 55.78 | 54.97 | 66.92 | 54% |

| 20% | 3 | 3 | −98.55 | −62.05 | 24.17 | 52.94 | 96.05 | 103.78 | 66% |

| 40% | 3 | 3 | −94.90 | −60.05 | 20.89 | 50.85 | 123.77 | 128.66 | 72% |

| 60% | 3 | 3 | −84.77 | −48.50 | 14.22 | 47.15 | 151.31 | 154.65 | 77% |

| 80% | 3 | 3 | −66.78 | −26.85 | −1.49 | 37.15 | 187.65 | 188.94 | 84% |

| 100% | 3 | 3 | −55.13 | −14.45 | −5.59 | 34.68 | 211.92 | 212.33 | 86% |

| 20% | 5 | 5 | −102.72 | −63.27 | 27.10 | 57.81 | 99.19 | 107.93 | 65% |

| 40% | 5 | 5 | −101.75 | −59.59 | 10.38 | 47.13 | 142.06 | 147.46 | 76% |

| 60% | 5 | 5 | −90.71 | −45.83 | −4.69 | 37.27 | 178.73 | 181.65 | 83% |

| 80% | 5 | 5 | −71.47 | −21.66 | −28.10 | 21.31 | 218.65 | 219.06 | 91% |

| 100% | 5 | 5 | −59.52 | −8.42 | −31.54 | 19.47 | 241.28 | 241.38 | 93% |

| 20% | 10 | 5 | −123.84 | −76.54 | 33.65 | 68.33 | 108.44 | 121.07 | 64% |

| 40% | 10 | 5 | −120.92 | −68.30 | −2.65 | 43.67 | 170.85 | 177.16 | 80% |

| 60% | 10 | 5 | −101.32 | −47.18 | −30.85 | 21.70 | 213.13 | 214.73 | 91% |

| 80% | 10 | 5 | −73.88 | −18.71 | −44.61 | 10.39 | 227.04 | 227.22 | 96% |

| 100% | 10 | 5 | −63.52 | −8.30 | −44.00 | 11.13 | 249.15 | 249.24 | 96% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alabdullatif, A.M.; Gerding, E.H.; Perez-Diaz, A. Market Design and Trading Strategies for Community Energy Markets with Storage and Renewable Supply. Energies 2020, 13, 972. https://doi.org/10.3390/en13040972

Alabdullatif AM, Gerding EH, Perez-Diaz A. Market Design and Trading Strategies for Community Energy Markets with Storage and Renewable Supply. Energies. 2020; 13(4):972. https://doi.org/10.3390/en13040972

Chicago/Turabian StyleAlabdullatif, Abdullah M., Enrico H. Gerding, and Alvaro Perez-Diaz. 2020. "Market Design and Trading Strategies for Community Energy Markets with Storage and Renewable Supply" Energies 13, no. 4: 972. https://doi.org/10.3390/en13040972