Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets

Abstract

:1. Introduction

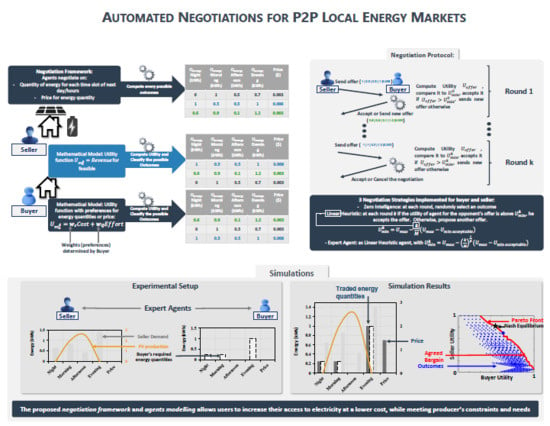

2. Automated Negotiation Framework

2.1. Negotiation Protocol

- (Pre-negotiation): First, the parties (agents) define the issues to be negotiated and the associated possible (allowed) quantities for each of them.

- An agent A determines the offer he will propose during the first round to agent B. The offer consists in the quantities of electricity for each period () and the price ().

- Agent B receives the offer; accepts it or discards it. In the first scenario, the negotiation is over. In the second, he proposes a counteroffer by determining its preferred quantities for each issue.

- Agent A can either accept it, propose a new offer (in which case we go back two steps above), or close the negotiation (no deal).

- Once the negotiation is done, the trade is validated against the physical constraints of the power exchange network, verifying that the network can support the agreed energy transfer.

- The next day, the agents commit to their energy trade.

2.2. Agent Models

2.2.1. Buyer Agent Model

2.2.2. Seller Agent Model

| Algorithm 1: Remove impossible offers from |

| Inputs: |

| Set of offers to be considered. Maximum battery capacity if no battery). Initial battery capacity at the start of the day (0 if no battery). Set of forecasted renewable energy production at each time period Ni. The maximum power of the conventional fossil fuel powered asset (0 if no conventional supply). Set of four electricity quantities that need to be self-supplied by the seller at each period Ni. |

| Initialize: |

| the space of outcomes (utility) for the considered set of offers . |

| For do. |

| . |

| For i = 1 to 4 do. |

| . |

| if then. |

| . |

| Return |

3. Agents’ Electricity Negotiation

- The agent first determines its required self-consumption () for each of the four periods, as well as the different marginal costs for electricity supply (, ).

- The seller agent also determines the forecast for its distributed energy resource (DER) production, while the buyer agent determines the values, as well as the weights and .

- The agents compute the utility function for each of the possible offers from the sets of discrete quantities and determined by the market facilitator. Thus, each agent generates the set of possible outcomes .

- The agents sort the set of possible outcomes and each determine the threshold below which it will not accept any offer. is the utility of the reserved or least package an agent can concede. Thus, any package with a utility below will be discarded.

- Negotiations begin with an agent (say agent A) initiating and sending the first offer/bid to the opponent (agent B).

- Upon receiving the offer, agent B evaluates the utility of the offer and determines if the offer is first suitable or not; that’s above or not. Depending on its strategy, agent B will either accept the offer; or refuse the offer by proposing a new offer/bid etc. within the specified deadline, until a bargain is either reached or the negotiation is closed without a deal.

3.1. Negotiation Strategies

3.1.1. “Zero Intelligence” (ZI) Strategy

3.1.2. Linear Heuristic Strategy

3.1.3. Expert Agent Strategy

3.2. Case Study

3.2.1. Buyers’ Profiles

- Buyer 1 is a consumer with equal preference for the cost of electricity, as well as the quantity of electricity he receives, provided it is close to its electricity need . Hence, .

- Buyer 2 is a consumer who prefers having the amounts of electricity given by , irrespective of price. Hence, and .

- Buyer 3 is a consumer who is most concerned with price and will adjust consumption based on the price as this buyer does not want to pay much money for its electricity consumption. Hence, .

3.2.2. Seller Profile

- Cloudy day case where the solar PV installation produces a power given by kWh, respectively.

- Sunny day case with a PV production given by: .

4. Experimental Results

4.1. Negotiation Framework Implementation

4.2. Negotiation Strategies Comparison

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- UN Sustainable Development Goal 7. Ensure Access to Affordable, Reliable, Sustainable and Modern Energy. Available online: https://www.un.org/sustainabledevelopment/energy/ (accessed on 30 September 2019).

- International Energy Agency; International Renewable Energy Agency; United Nations; World Bank Group; World Health Organization. Tracking SDG 7: The Energy Progress Report 2019; Washington, DC, USA, 2019; Available online: https://trackingsdg7.esmap.org/downloads (accessed on 20 June 2019).

- Etukudor, C.; Abdulkareem, A.; Ayo, O. The Daunting Challenges of the Nigerian Electricity Supply Industry. J. Energy Technol. Policy 2015, 5, 25–32. [Google Scholar]

- Mahapatra, S.; Dasappa, S. Rural electrification: Optimising the choice between decentralised renewable energy sources and grid extension. Energy Sustain. Dev. 2012, 16, 146–154. [Google Scholar] [CrossRef]

- Berizzi, A.; Delfanti, M.; Falabretti, D.; Mandelli, S.; Merlo, M. Electrification Processes in Developing Countries: Grid Expansion, Microgrids, and Regulatory Framework. Proc. IEEE 2019, 107, 1–14. [Google Scholar] [CrossRef]

- Kothari, D.P. Energy problems facing the third world. In Proceedings of the 2009 Australasian Universities Power Engineering Conference, Adelaide, Australia, 27–30 September 2009; pp. 1–12. [Google Scholar]

- Nigerian Bulletin. Nigeria is Second Largest Market for Generator-Driven Economy in Africa. Available online: https://www.nigerianbulletin.com/threads/nigeria-is-second-largest-market-for-generator-driven-economy-in-africa.216809/ (accessed on 31 July 2018).

- Nwafor, P. Nigeria spends $5bn on generators annually. Available online: https://www.vanguardngr.com/2017/07/nigeria-spends-5bn-generators-annually/ (accessed on 31 July 2018).

- Ibhadode, O.; Tenebe, I.T.; Emenike, P.C.; Adesina, O.S.; Okougha, A.F.; Aitanke, F.O. Assessment of noise-levels of generator-sets in seven cities of South-Southern Nigeria. Afr. J. Sci. Technol. Innov. Dev. 2018, 10, 125–135. [Google Scholar] [CrossRef]

- Oguntoke, O.; Adeyemi, A. Degradation of urban environment and human health by emissions from fossil-fuel combusting electricity generators in Abeokuta metropolis, Nigeria. Indoor Built Environ. 2017, 26, 538–550. [Google Scholar] [CrossRef]

- ThisDay Editorial. Death from generator fumes. Available online: https://www.thisdaylive.com/index.php/2019/07/26/death-from-generator-fumes-2/ (accessed on 10 December 2019).

- Anyagafu, V.S. Nigeria records over 10,000 deaths through ‘generator’ fumes. Available online: https://www.vanguardngr.com/2014/08/nigeria-records-10000-deaths-generator-fumes/ (accessed on 10 December 2019).

- Lysen, E.H. Pico Solar PV Systems for Remote Homes; International Energy Agency: Paris, France, 2013; IEA-PVPS T9-12: 2012. [Google Scholar]

- Maher, P.; Smith, N.P.A.; Williams, A.A. Assessment of pico hydro as an option for off-grid electrification in Kenya. Renew. Energy 2003, 28, 1357–1369. [Google Scholar] [CrossRef]

- Kamalapur, G.D.; Udaykumar, R.Y. Rural electrification in India and feasibility of Photovoltaic Solar Home Systems. Int. J. Electr. Power Energy Syst. 2011, 33, 594–599. [Google Scholar] [CrossRef]

- Lemaire, X. Off-grid electrification with solar home systems: The experience of a fee-for-service concession in South Africa. Energy Sustain. Dev. 2011, 15, 277–283. [Google Scholar] [CrossRef]

- Chaurey, A.; Kandpal, T.C. A techno-economic comparison of rural electrification based on solar home systems and PV microgrids. Energy Policy 2010, 38, 3118–3129. [Google Scholar] [CrossRef]

- Raman, P.; Murali, J.; Sakthivadivel, D.; Vigneswaran, V.S. Opportunities and challenges in setting up solar photo voltaic based micro grids for electrification in rural areas of India. Renew. Sustain. Energy Rev. 2012, 16, 3320–3325. [Google Scholar] [CrossRef]

- International Energy Agency; International Renewable Energy Agency; United Nations; World Bank Group; World Health Organization. Tracking SDG7: The Energy Progress Report 2018; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- GSES. Oversized PV Arrays and battery days of autonomy in stand-alone power systems. In Design, Technical Articles, Technology; Global Sustainable Energy Solutions: BOTANY NSW, Australia, 2019. [Google Scholar]

- Fairley, P. Swarm Electrification Powers Villages in Bangladesh. IEEE Spectr. 2018, 55. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Park, C.; Yong, T. Comparative review and discussion on P2P electricity trading. Energy Procedia 2017, 128, 3–9. [Google Scholar] [CrossRef]

- Jogunola, O.; Ikpehai, A.; Anoh, K.; Adebisi, B.; Hammoudeh, M.; Son, S.-Y.; Harris, G. State-of-the-art and prospects for peer-to-peer transaction-based energy system. Energies 2017, 10, 2106. [Google Scholar] [CrossRef] [Green Version]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer energy trading in a community microgrid. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; pp. 1–5. [Google Scholar]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D. Blockchains: Crypto-control your own energy supply. Nature 2017, 548, 158. [Google Scholar] [CrossRef] [Green Version]

- Jogunola, O.; Adebisi, B.; Anoh, K.; Ikpehai, A.; Hammoudeh, M.; Harris, G.; Gacanin, H. Distributed adaptive primal algorithm for P2P-ETS over unreliable communication links. Energies 2018, 11, 2331. [Google Scholar] [CrossRef] [Green Version]

- Kahrobaee, S.; Rajabzadeh, R.A.; Soh, L.-K.; Asgarpoor, S. Multiagent study of smart grid customers with neighborhood electricity trading. Electr. Power Syst. Res. 2014, 111, 123–132. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Enerchain P2P Trading Project. European Energy Trading Firms Test Peer-to-Peer Trading Over Blockchain; Enerchain P2P Trading Project: Hamburg, Germany, 2017. [Google Scholar]

- Ilic, D.; Da Silva, P.G.; Karnouskos, S.; Griesemer, M. An energy market for trading electricity in smart grid neighbourhoods. In Proceedings of the 2012 6th IEEE International Conference on Digital Ecosystems and Technologies (DEST), Campione d’Italia, Italy, 18–20 June 2012; pp. 1–6. [Google Scholar]

- Pouttu, A.; Haapola, J.; Ahokangas, P.; Xu, Y.; Kopsakangas-Savolainen, M.; Porras, E.; Matamoros, J.; Kalalas, C.; Alonso-Zarate, J.; Gallego, F.D.; et al. P2P model for distributed energy trading, grid control and ICT for local smart grids. In Proceedings of the 2017 European Conference on Networks and Communications (EuCNC), Oulu, Finland, 12–15 June 2017; pp. 1–6. [Google Scholar]

- Mengelkamp, E.; Staudt, P.; Garttner, J.; Weinhardt, C. Trading on local energy markets: A comparison of market designs and bidding strategies. In Proceedings of the 14th International Conference on the European Energy Market, EEM, Dresden, Germany, 6–9 June 2017. [Google Scholar]

- Narayanan, A.; Haapaniemi, J.; Kaipia, T.; Partanen, J. Economic impacts of power-based tariffs on peer-to-peer electricity exchange in community microgrids. In Proceedings of the International Conference on the European Energy Market, EEM, Lodz, Poland, 27–29 June 2018. [Google Scholar]

- Alam, M.R.; St-Hilaire, M.; Kunz, T. An optimal P2P energy trading model for smart homes in the smart grid. Energy Effic. 2017. [Google Scholar] [CrossRef]

- Moret, F.; Pinson, P. Energy Collectives: A Community and Fairness Based Approach to Future Electricity Markets. IEEE Trans. Power Syst. 2019, 34, 3994–4004. [Google Scholar] [CrossRef] [Green Version]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-based approach to peer-to-peer electricity markets with product differentiation. IEEE Trans. Power Syst. 2018, 34, 994–1004. [Google Scholar] [CrossRef] [Green Version]

- Costantini, S.; Tocchio, A.; Tsintza, P. A heuristic approach to P2P negotiation. In Computational Logic in Multi-Agent Systems: 8th International Workshop, CLIMA VIII, Porto, Portugal, 10–11 September 2007: Revised Selected and Invited Papers; Sadri, F., Ed.; Springer: Berlin/Heidelberg, Germany, 2008; Volume 5056, pp. 177–192. [Google Scholar]

- Jonker, C.; Robu, V.; Treur, J. An agent architecture for multi-attribute negotiation using incomplete preference information. Auton. Agents Multi-Agent Syst. 2007, 15, 221–252. [Google Scholar] [CrossRef] [Green Version]

- Weinhardt, C.; Block, C.; Collins, J.; Ketter, W. A Multi-Agent Energy Trading Competition. In ERIM Report Series: Report in management; ERIM is the Joint Research Institute of the Rotterdam School of Management, Erasmus University and the Erasmus School of Economics (ESE) at Erasmus University Rotterdam; Erasmus Research Institute of Management (ERIM): Rotterdam, The Netherlands, 2009; Volume ERS-2009-054-LIS, p. 25. [Google Scholar]

- Capodieci, N.; Cabri, G.; Pagani, G.A.; Aiello, M. Adaptive game-based agent negotiation in deregulated energy markets. In Proceedings of the 2012 International Conference on Collaboration Technologies and Systems (CTS), Denver, CO, USA, 21–25 May 2012; pp. 300–307. [Google Scholar]

- Morstyn, T.; Teytelboym, A.; Mcculloch, M.D. Bilateral Contract Networks for Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2019, 10, 2026–2035. [Google Scholar] [CrossRef]

- Moret, F.; Baroche, T.; Pinson, P.; Sorin, E. Negotiation algorithms for peer-to-peer electricity markets: Computational properties. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 11–15 June 2018. [Google Scholar]

- Spasova, B.; Kawamoto, D.; Takefuji, Y. Evaluation of the Effects of Bidding Strategy with Customized Pricing on the Individual Prosumer in a Local Energy Market. Adv. Sci. Technol. Eng. Syst. J. 2019, 44, 366–379. [Google Scholar] [CrossRef]

- Amato, A.; Aversa, R.; Di Martino, B.; Scialdone, M.; Venticinque, S.; Hallsteinsen, S.; Horn, G. Software Agents for Collaborating Smart Solar-Powered Micro-Grids. In Lecture Notes in Information Systems and Organisation; Caporarello, L., Di Martino, B., Martinez, M., Eds.; Springer: Cham, Switzerland, 2014; Volume 7. [Google Scholar]

- Abdella, J.; Shuaib, K. Peer to peer distributed energy trading in smart grids: A survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Alam, M.; Gerding, E.H.; Rogers, A.; Ramchurn, S.D. A scalable, decentralized multi-issue negotiation protocol for energy exchange. In Proceedings of the International Joint Conference on Artificial Intelligence (IJCAI), Buenos Aires, Argentina, 25 July–1 August 2015. [Google Scholar]

- Chakraborty, S.; Baarslag, T.; Kaisers, M. Energy Contract Settlements through Automated Negotiation in Residential Cooperatives. arXiv 2018, arXiv:1807.10978. [Google Scholar]

- Rubinstein, A. Perfect Equilibrium in a Bargaining Model. Econom. J. Econom. Soc. 1982, 50, 97–109. [Google Scholar] [CrossRef] [Green Version]

- Faratin, P.; Sierra, C.; Jennings, N.R. Negotiation decision functions for autonomous agents. Robot. Auton. Syst. 1998, 24, 159–182. [Google Scholar] [CrossRef] [Green Version]

- Bhatia, M.; Angelou, N. Beyond Connections: Energy Access Redefined; World Bank: Washington, DC, USA, 2015; Available online: https://openknowledge.worldbank.org/handle/10986/24368 (accessed on 20 July 2018).

- Raiffa, H. The Art and Science of Negotiation; Harvard University: Cambridge, MA, USA, 1982. [Google Scholar]

- European Parliament; Council of the European Union. Directive (EU) 2019/994 of the European Parliament and of the Council on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU; 2019. Available online: https://eur-lex.europa.eu/eli/dir/2019/944/oj?eliuri=eli:dir:2019:944:oj (accessed on 21 January 2020).

- Ivanova, V.; Griffa, A.; Elks, S. The Policy and Regulatory Context for New Local Energy Markets; Energy Systems Catapult: BHX, UK, 2019. [Google Scholar]

- Kalathil, D.; Wu, C.; Poolla, K.; Varaiya, P. The Sharing Economy for the Electricity Storage. IEEE Trans. Smart Grid 2019, 10, 556–567. [Google Scholar] [CrossRef]

- Henriquez-Auba, R.; Pauli, P.; Kalathil, D.; Callaway, D.S.; Poolla, K. The Sharing Economy for Residential Solar Generation. In Proceedings of the 2018 IEEE Conference on Decision and Control (CDC), Miami Beach, FL, USA, 17–19 December 2018; pp. 7322–7329. [Google Scholar]

- van Soest, H. Peer-to-peer electricity trading: A review of the legal context. Compet. Regul. Netw. Ind. 2018, 19, 180–199. [Google Scholar] [CrossRef]

- Smarter Together. Report on Collective Self-Consumption of Photovoltaic. 2016. Available online: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5adb475db&appId=PPGMS (accessed on 21 January 2020).

- Polymeneas, E.; Tai, H.; Wagne, A. Less carbon means more flexibility: Recognizing the rise of new resources in the electricity mix. In Electric Pwer and Natural Gas; Mckinsey & Company: Hoboken, NJ, USA, 2018. [Google Scholar]

- OFGEM. Future Supply Market Arrangements-Response to Our Call for Evidence; Markets, Office of Gas and Electricity Markets: London, UK, 2018.

- FERC. FERC Approves First Compliance Filings on Landmark Storage Rule; Federal Energy Regulatory Commission (FERC): Washington, DC, USA, 2019.

- OFGEM. Targeted Charging Review: Decision and Impact Assessment; Office of Gas Electricity Markets, Ed.; Office of Gas Electricity Markets: London, UK, 2019.

| Multi-Tier Matrix for Measuring Access to Household Electricity Supply | ||||||

|---|---|---|---|---|---|---|

| Consumption Description | Tier 1 | Tier 2 | Tier 3 | Tier 4 | Tier 5 | |

| Peak Capacity | Power capacity ratings (W) | Min 3 W | Min 50 W | Min 200 W | Min 800 W | Min 2 kW |

| Daily Energy consumption (Wh) | Min 12 Wh | Min 200 Wh | Min 1 kWh | Min 3.43 kWh | Min 8.2 kWh | |

| Or Services | Lighting of 1000 lumen-h/day | Electric lights, air circulation, TV, and phone charging are possible | ||||

| Duration | Hours per day | Min 4 h | Min 4 h | Min 8 h | Min 16 h | Min 23 h |

| Hours per evening | Min 1 h | Min 2 h | Min 3 h | Min 4 h | Min 4 h | |

| Computation of Utility Matrix | Negotiation | |

|---|---|---|

| CPU Time (s) | 4.1 | 0.7 |

| Memory (MB) | 18 | 12 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Etukudor, C.; Couraud, B.; Robu, V.; Früh, W.-G.; Flynn, D.; Okereke, C. Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets. Energies 2020, 13, 920. https://doi.org/10.3390/en13040920

Etukudor C, Couraud B, Robu V, Früh W-G, Flynn D, Okereke C. Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets. Energies. 2020; 13(4):920. https://doi.org/10.3390/en13040920

Chicago/Turabian StyleEtukudor, Christie, Benoit Couraud, Valentin Robu, Wolf-Gerrit Früh, David Flynn, and Chinonso Okereke. 2020. "Automated Negotiation for Peer-to-Peer Electricity Trading in Local Energy Markets" Energies 13, no. 4: 920. https://doi.org/10.3390/en13040920