Abstract

Small-scale firms are essential contributors to employment generation and growth of many economies. In recognition of their salient role, several policy interventions have been implemented to enhance job creation functions of small-scale firms. This study examined one of these interventions, that is, promotion of small-scale firms in Sunyani municipality of Ghana by analyzing the effect of entrepreneurs, firm, and institutional characteristics on the growth of small-scale firms. A cross-sectional survey was conducted involving 200 small-scale firm operators selected through multi-stage sampling. Both descriptive and inferential analytical tools were used to analyze the data. Descriptive techniques employed included means, frequencies, and cross-tabulations. The inferential analysis included the use of multivariate multiple regression techniques that estimate a single regression model with more than one dependent variable simultaneously. The findings show three types of small-scale enterprises viz. processing (dominated by females), artisans, and service sector (dominated by males) at Sunyani municipality of Ghana. The main findings show that demographic factors (sex of operator, completion of formal education at basic school level or junior high school), institutional variables (bank investment and training services), and firm characteristics (artisan and craft industry type) conjointly and significantly influence small-scale firm performance (number of employees and sales or monthly revenue). Consequent implications for developing economies (such as Ghana) include the need for the introduction of entrepreneurship education at basic level of education in addition to the current practice where entrepreneurship education is mostly limited to tertiary institutions or undergraduate levels, and linking provision of investment services with requisite skills training and backstopping in interventions targeting small-scale firms.

Similar content being viewed by others

Introduction

The critical factors that influence small-scale business growth have extensively been explored empirically in extant literature (Coad, Segarra, & Teruel, 2016; Ilaboya & Ohiokha, 2016; Kristiansen, Furuholf, & Walid, 2003; Mohamad Radzi, Mohd Nor, & Mohezar Ali, 2017; Murphy, Trailer, & Hill, 1996; Reynolds, Camp, Bygrave, Autio, & Hay, 2001; and Storey, 1994). Wide variety of factors that potentially influence firm growth range from entrepreneur’s characteristics, firm characteristics (Abdul Wahab & Al-Damen, 2015) to issues related to the institutional localities in which the business functions (Isaga, 2018). However, findings on these factors have generally been inconclusive (Isaga, 2018) probably because operations of small businesses particularly for developing economies are complicated by variety of factors, and as a result, no extensive surveys are conducted that comprehensively explain all the variables (Braidford, Drummond, & Stone, 2017). Perhaps, it may also suggest, as we propose, that the dominant use of non-financial proxies such as customer satisfaction, corporate reputation, happiness, personal development, cultural, and social network (see Mohamad Radzi et al., 2017) to proxy firm performance or growth is fairly limited. According to Walker and Brown (2004), non-financial indicators of business growth are problematic to measure and subjective in nature. In support, Beaver (2002) claimed that non-financial indicators are best suited for firms connoted as “lift style” businesses, whose primary purpose is neither linked to growth or financial gains. In this paper, we present empirical evidence using financial proxies to measure firm growth based on the resource-based view theory (Barney, 1986; Wenerfelt 1984) to further improve understanding of antecedents of small-scale firm growth, particularly in Ghana where issues of unemployment and poverty remain top priorities among government and non-governmental organizations (Berkham, 1996).

Small-scale firms are an important source of employment and economic growth for the Ghanaian economy (Nyoike, Langat, Karani, & Lagat, 2014; Oppong, Owiredu, & Churchill, 2014). According to Ghana Statistical Service (GSS), small-scale industries (SSIs) represent the largest proportion of business establishments (92%) in the country (GSS, 2015) and employ more than 60% of the country’s labor-force (GSS, 2010). In addition, over 22% of Ghana’s Gross Domestic Product (GDP) is attributed to SSIs (GSS, 2010), hence making the sector the heart of economic policy discussions (Oppong et al., 2014). Over the past few years, Ghana’s policy toward employment creation has placed much emphasis on the informal sector (promotion of small-scale industries) and less so on the formal and private formal sector (Edusah & Antoa, 2014; Oppong et al., 2014). Since the adoption of the World Bank’s Structural Adjustment Programme in the 1980s, SSIs have become the main focus of national development for employment creation, poverty alleviation, and technological advancement (Ackah, Adjasi, & Turkso, 2012; Oppong et al., 2014). The prominence accorded to small industries was further enhanced due to its capacity to withstand foreign exchange shocks; small-scale businesses are viewed as more viable investment options than foreign exchange-dependent large-scale industries (Ackah et al., 2012).

In this empirical study, we consider small-scale firms as those with less than 30 employees (Steel & Webster, 1989) and are largely informal located in rural and peri-urban communities (Edusah and Antoa, 2014). Within this context, the understanding of critical factors that precipitate small-scale firms’ performance based on financial measures is worthwhile for various reasons. First, the use of financial proxies such as sales and employee growth is simple to document given the poor database management of SSIs in developing economies. Besides, these financial indicators are central to economic policy considerations on unemployment and poverty reduction strategies in fledgling economies such as Ghana. Second, disadvantage by insufficient capital and technical skills, examining the critical factors that influence small-scale firm growth, will generate relevant policy discussions to improve rural enterprise growth for poverty alleviation and employment creation. Furthermore, most previous studies that examine factors influencing firm growth only investigated effects of firm internal factors such as entrepreneur and firm characteristics (Abdul Wahab & Al-Damen, 2015; Coad et al., 2016; Islam, Khan, Obaidullah, & Alam, 2011; Mothibi, 2015; Nyoike et al., 2014) without consideration of external factors including institutional resources. Meanwhile, access to institutional resources such as financial and training services have been hypothesized to improve business performance. For instance, it has been demonstrated that entrepreneurs that access financial resources are able to invest in sustainable education, training of employees, and adoption of innovations to meet organizational objectives. This paper, therefore, contributes to knowledge on small-scale firm growth in developing economies by examining entrepreneur and firm characteristics as well as institutional factors that influence small business growth in Sunyani municipality of Ghana. In this study, we simultaneously use “size of employee” and “annual sales growth” as proxies for firm growth through adoption of a multivariate multiple regression that specifies two models to investigate antecedents of firm growth.

Literature review

Business growth or success

The concept of business success has been used synonymously with business growth in management studies (Isaga, 2018; Mensah, Tribe, & Weiss, 2007). In the extant literature, no universally accepted definition of business success exists (Barkham, Gudgin, Hart, & Hanvey, 1996; Foley & Green, 1989; Mohammed et al., 2017). Success in any human endeavors has closely been associated with the achievements of goals and objectives (Ngwangwama, Ungerer, & Morrison, 2013), however, success in business studies though crucial in managerial decision-making, firms especially small and medium enterprises (SMEs) are not able to explicitly document them (Mohammed et al., 2017). For a large proportion of authors, business success has been defined in terms of firm performance (Barkham et al., 1996; Islam et al., 2011; Wang & Wang, 2012) that is often characterized by such firm’s capacity to generate acceptable outcomes and actions (Van Praag, 2003). However, according to Mohammed et al. (2017), the use of firm performance to measure success comes with complications and can be interpreted from different dimensions. In general, the debate on business success indices has been limited to two broad concepts: (i) economic (financial) and (ii) non-financial (non-pecuniary) success (Islam et al., 2011; Rahman & Ramli, 2014; Walker & Brown, 2004). Financial measures for business success or growth include return on assets, sales growth, profits, employee growth, and survival rates while non-pecuniary measures include intangible constructs such as customer satisfaction, personal development, achievement, corporate reputation, happiness, and market share (Islam et al., 2011; Masuo, Fong, Yanagida, & Cabal, 2001; Walker & Brown, 2004). In spite of the great diversity that exists in measuring business success, Hornaday (1970) claimed that continuity in business should be paramount.

According to Barkham et al. (1996), the choice for financial business success indicators is differentiated by academic disciplines. For instance, researchers within geography and economics used the number of employees as a proxy for firm performance due to the simplicity of measurements especially among SMEs whose database management is poor. Further, issues on employment levels are also key to policy makers and government administrators. On the other hand, scholars with finance background also depend on financial indices such as profits, return on assets, and sales from the firm’s account to measure business performance. Whereas these financial measures are simple to measure and easier to understand (Walker & Brown, 2004), Riquelme and Watson (2002) note that some of these accounting data cannot be reliable in measuring businesses’ performance. Meanwhile, the use of non-financial factors has been criticized to be subjective and difficult to measure and is also for businesses whose primary motive is not economic gains (Walker & Brown, 2004). In fact, Beaver (2002) contends that non-financial measures are connected with businesses termed as “lifestyle” businesses that have no motivation to grow and have no regards to financial gains.

Given this background, this study employs two financial performance indicators, that is, employee size and sales growth (see Coad et al., 2016 for example) which are important to small-scale businesses, especially, in developing countries that are deficient in accurate financial data management (Saffu, Walker, & Mazurek, 2012). The rationale to use both proxies is to allow comparison of two econometric models that have employee size and sales growth as response variables, and report on only explanatory variables that are significant in both models so as to partly offset the weakness in the financial data employed. According to Murphy et al. (1996), the choice of a firm growth indicator can influence the result of a study. That is, a specific variable may have contrasting effects on two or more performance indicators; hence, to produce results that are conclusive and definite, there is the need to adopt wider perspectives of firm success indices.

Resource-based view (RBV) theory of firm growth

The resource-based view (RBV) theory is the commonest theoretical framework used to assess factors that influence the performance of a small-scale business in the management literature (Ismail et al. 2014; Rahman & Ramli, 2014; Saffu et al., 2012). According to Ismail et al. (2014), the RBV theory was first discovered by Wernerfelt (1984) and further developed by Barnery (1986). The theory states that firms’ internal resources and capabilities generate comparative advantages (Barney, 2001). According to Barney (2001), such firms’ performance is generated from unique sets of resources which are not easily imitated and substituted. In summary, Ismail et al. (2014) contend that heterogeneity in resources owned by firms forms the basis of the RBV theory. Consequently, the RBV theory provides a useful theoretical framework to explain factors that influence performances of firms (Irwin et al., 1998; Rahman & Ramli, 2014).

Firm resources in accounting and finance literature have been defined differently. For instance, Barney (1991) extended the definition of resources by Penrose (1959) and categorizes firm’s resource into three (3) sub-groups: human, physical, and organizational capital resources. While human capital resources denote experience, training, technical know-how, relationships, and knowledge of firm managers and staff, physical capital resources also imply firm’s technology, machinery, location, and access to productive inputs. On the other hand, organizational resources refer to firms’ policies in reporting, planning, and communication and firm’s intra-relations and inter-relations with other firms and the larger society. Other authors such as Capron and Hulland (1999) and Galbreath (2005) also define resources as tangible and intangible assets that firms take ownership and control to produce the desired output in an efficient and effective manner. According to Mohamad Radzi et al. (2017), tangible assets are limited to human, physical, financial, and technological resources. However, assets including knowledge, capabilities, skills, and reputations are termed as intangible assets. Mohamad Radzi et al. (2017) argue that firms have the desire to access and control resources either in the short or long term provided the resources will offer a competitive advantage over rivalries. These firms may have disparities in the access and control of the various resources, thus generating uniqueness in the different products or services they offer. Thus, a firm’s performance is determined from effective utilization of resources and capabilities possessed in the business (Saffu et al., 2012) since such resources are required for innovations to gain and sustain competitive advantage (Mohamad Radzi et al., 2017).

The RBV theory provides a perfect contextual framework to analyze small business success especially, for developing economies where firms are confronted with inadequate access to resources and expertise (Saffu et al., 2012). Hence, the Resource-Based View theory that postulates that firms’ resources and capabilities are the main determinants of performance is adapted for this study.

In an extensive review of empirical studies on attributes associated with business success, Mohamad Radzi et al. (2017) report that the most frequently cited attributes are entrepreneurial competencies which include skills, entrepreneur educational levels, experience, expertise (know-how), and personal goals. In the least developed economies, some of these entrepreneurial competencies such as business skills, expertise, and educational levels are low. As results, specialized institutional bodies are established to bridge the skills and knowledge gap expected of entrepreneurs. Other relevant factors that influence business success include access to financial resources and services from financial institutions (Mohamad Radzi et al., 2017; Murphy et al., 1996).

Besides firms’ access to resources, entrepreneur demographics and firm characteristics (Cragg & King, 1988; Duh, 2003; Rutherford & Oswald, 2000) are also key determinants of small-scale business success. Demographic characteristics such as gender, age, education, and industry experience are basic fundamentals to determine business success (Islam et al., 2011). According to Abdul Wahab and Al-Damen (2015), entrepreneurs required specific characteristics for performance and these factors reflect the competency of the entrepreneur to success. From the perspective of firm characteristics, length of time in operation, type of industry, and ownership are important factors that affect the performance of small-scale businesses (Smallbone et al., 1995; Westhead 1995). Based on the above reviewed, we proposed to categorize the factors that influenced small-scale businesses in Ghana into three (3) sub-groups: demographic characteristics (age, gender, and education), firm characteristics (length of time in operation, type of sector, and business ownership type), and institutional factors (access to financial services and resources, access to technical trainings, and business advisory services).

Human capital theory

Compared with the RBV, the human capital theory deals directly with resource endowment of the entrepreneur which concerns his/her knowledge and capacities for efficient business performance (Martin, McNally, & Kay, 2013; Oyedele et al., 2014; Yaacob, Mahmood, Zin, & Puteh, 2014). Hence, the theory postulates that small businesses’ chance of survival and performance depend on the knowledge and experience of the entrepreneur (Dimov & Shepherd, 2005; Martin et al., 2013). According to Oyedele et al. (2014), entrepreneurs with low human capital can be improved through training since the theory deals with knowledge and capacities. As a result, improved human capital development through entrepreneurship education and training has attracted significant importance among governments around the globe (Martin et al., 2013). In their operational definition of human capital, Dimov and Shepherd (2005) classified human capital into (i) level of education and experience (age) termed as general human capital and (ii) industry-specific human capital (employment experience, leadership experience, and self-employed). Human capital variables including years of education, experience (measured in terms of age), leadership experience, and self-employment have been used in empirical studies to analyze the impact of human capital on business success. For instance, Dimov and Shepherd (2005) reported a positive relationship between education and experience, and small-scale business performance.

Conceptual framework and hypothesis

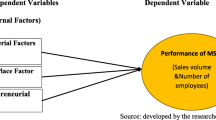

Based on the RBV and human capital theories, the framework in Fig. 1 is proposed for this study. The framework also includes other important attributes which are consistent or complemented the RBV theory in examining factors that influence business success. Three categories of independent factors (entrepreneur factors, institutional- and firm-related factors) are hypothesized to influence two dependent variables as noted in the framework. The firm performance is the dependent variable and is measured by two financial performance indicators (employee growth and sales growth) as adopted by Coad et al. (2016).

Entrepreneur characteristics

Various empirical studies have established a strong relationship between entrepreneurs’ demographic characteristics such as age, gender, and education, and firm performance (Islam et al., 2011; Kolvereid, 1996; Kristiansen et al., 2003; Mazzarol, Volery, Doss, & Thein, 1999; Reynolds et al., 2001). Entrepreneurs’ demographic characteristics have an impact on entrepreneurial intention and endeavor (Reynolds et al., 2001), personal qualities and traits, and entrepreneurial orientation (Islam et al., 2011) for business success. For instance, Reynolds et al. (2001) report that entrepreneurs with older ages from 25 to 45 years have higher entrepreneurial endeavors and hence are most successful than younger counterparts. Similarly, Harada (2003) and Littunen and Virtanen (2006) observe that older firm managers are endowed with rich business experience and might have gone through different phases of business challenges compared with younger entrepreneurs. Prior empirical studies have shown a positive relationship between age and business success (Kristiansen et al., 2003). It is therefore important to acknowledge that older entrepreneurs have higher-performing businesses than younger ones.

Similarly, Mazzarol et al. (1996) report that male entrepreneurs are more successful in businesses than female counterparts. A key reason attributed to female entrepreneurs’ underperformance is due to lower entrepreneurial intentions compared with male counterparts. For instance, McPherson (1992) argues that in developing countries, female entrepreneurs invest little to expand their business operation because funds generated are used to cater for household livelihood needs and security. Furthermore, socio-cultural factors such as marital status (Robinson & Sexton, 1994), responsibility of childcare (Presser & Baldwin, 1980), and growth orientation (Morris et al., 2006) and other economic constraints including access to financial resources (Yetim, 2008) and low educational background (Brush et al., 2003) further limit female entrepreneurs’ business growth. Hence, various studies (Gebreyesus, 2007 and Liedholm, 2001) have reported higher business growth in male-owned businesses compared with female counterparts.

Formal education has also been documented to influence entrepreneurial intention and business success (Sinha, 1996). According to Sinha (1996), education of entrepreneurs breeds entrepreneurial effectiveness since such operators have a better understanding to deal with difficult situations intuitively. The business landscape of small-scale industries is evolving faster, and this requires the collection and processing of complex information to succeed. Thus, firm entrepreneurs with higher education tend to adopt more innovative practices compared with other counterparts with no or little formal education. Studies for small-scale businesses (Barringer, Jones, & Neubaum, 2005; Cooper, Folta, Gimeno-Gascon, & Woo, 1992; Kim et al., 2006; Watson, Stewart, & BarNir, 2003; Yusuf, 1997) suggest a positive relationship between small-scale business growth and education. In a study for sub-Saharan Africa, Ramachandran and Shah (1999) establish a strong correlation between entrepreneurs with secondary and university educational, and business growth. Similarly, Jones (2004) reports that firm managers with higher education at the tertiary levels increase the formation of new products, are innovative, and easily adopt high technologies for successful businesses. Following these reviews, the study postulates the following:

-

H1: Entrepreneur’s age is positively related to small-scale business growth in Sunyani municipality.

-

H2: Entrepreneur’s educational background is positively related to small-scale business growth in Sunyani municipality.

-

H3: Male entrepreneurs compared with female counterparts have higher small-scale business growth in Sunyani municipality.

Institutional resources

The strategic relevance of institutional resources such as access to financial services (McMahon, 2001; Mohamad Radzi et al., 2017) and technical trainings (Carter et al., 2002; Goodale, 1989; Kitching and Blackburn, 2002) are well documented as critical factors that could improve business performance. Financial services including bank payment and investment (credit and savings) services influence technological adoption for successful firm development. However, access to these services from formal financial institutions in rural Africa is limited or non-existing (AGI, 2013). According to the Association of Ghana Industries (AGI) (2013), the main bane of small-scale growth in Ghana is deeply linked to the lack of adequate capital from formal financial institutions. For small enterprises to sustain competitive advantage and growth, adequate financial resources are demanded for sustainable investment in education and training of employees as well as the initiation of any innovation process (Dyer et al., 2014). Empirically, McMahon (2001) report a positive and significant relationship between small enterprise growth and access to sufficient financial resources.

Entrepreneurs of small businesses often have comparatively limited formal education and business skills (Goodale, 1989) for organizational performance. Such small firms, therefore, compensate these shortfalls through continuous training on the job and apprenticeship programs. This is so, because, the small-scale business environment is dynamic with new challenges and opportunities that require that firm managers and employees acquire new skills for successful operations (Goodale, 1989). As a result, strategic business training becomes a pre-requisite to acquiring new competencies for the attainment of organizational objectives. (Gakure, R. W: Factors affecting job creating and low job creating firms owned by women. Unpublished) Small enterprises normally compete on their technical know-how and use the knowledge to gain competitive advantage since they are financially handicapped to spend on labor, land, technology, and capital (Mohamad Radzi et al., 2017). Based on the foregoing, the study hypothesized that:

-

H4: Firms’ access to banking payment service is positively related to small-scale business growth in Sunyani municipality.

-

H5: Firms’ access to investment services (credit and savings) is positively related to small-scale business growth in Sunyani municipality.

-

H6: Firms’ access to technical training is positively related to small-scale business growth in Sunyani municipality.

Firm characteristics

Characteristics of small enterprises including ownership type, firm age, and sector of firm could influence the business success (Islam et al., 2014; Mothibi, 2015; Smallbone et al. 1995). Mothibi (2015) reports a significant positive relationship between firm age and business success. Arrow (1962); Chang, Gomes, and Schorfheide (2002); and Sorensen and Stuart (2000) observe that older firms may benefit from past business experiences and therefore have a higher degree of sustainable growth and performance than younger counterparts. In support, Islam et al. (2014) state that small businesses’ length in operation may be synonymous with a learning curve which presupposes that older firms will have a higher probability of learning from their experiences to succeed.

With respective to firm ownership type, Westhead et al. (1995) report that firms that are owned by more than one individual such as a partnership or diverse shareholders are more likely to sustain business growth and performance than one ownership or sole proprietorships. From the dimension of sector (enterprise) type, Liedholm and Chuta (1975) find that the type of enterprise tends to have a significant effect on its performance. The study argues that the capital and investment requirements, as well as customer-based small-scale businesses, are different, hence making profitability levels dissimilar for different types of industries. In Ghana, small businesses such as the processing sector that depend on agriculture for its primary resource are mostly not sustainable and have a higher tendency of low growth compared with other sectors because agricultural production in the country is seasonal (Edusah, 2014). Based on the above arguments, the study posited that:

-

H7: The age of the firm is positively related to small enterprise growth in the Sunyani municipality.

-

H8: Enterprises in agro-based processing are negatively related to business growth compared with other enterprise sectors in the Sunyani municipality.

-

H9: Enterprises with more than one owner is positively related to business growth compared with sole proprietorships in the Sunyani municipality.

Materials and methods

Study area

The Sunyani East municipality is one of the 27 administrative districts in the Brong Ahafo region of Ghana and also serves as the regional capital of the subzone. The municipality is located between latitude 7° 20′ N and 7° 33′ N and longitude 2° 20′ W and 2° 33′ W. Sunyani East is strategically located between four districts: Tano North to the east, Asutifi North to the south, Sunyani West to the northern, and Dormaa districts to the west (Fig. 2). The municipality covers a geographical landmass of 506.7 km2 representing 2.1% of the total land area in Ghana. The 2010 population and housing census suggest that the total population in the municipality is 123,224 representing 5.3% of the regional population. Across sex category, females are dominant (50.1%) compared with males’ counterparts (49.9%) (Ghana Statistical Service, 2012).

Map of Ghana showing the study location and site. Source: Government of Ghana (www.sunyanieast.ghanadistricts.gov.gh)

Even though the Sunyani East serves as the administrative capital of Brong Ahafo region, the municipality has an agrarian economy with a large rural population. The agro-ecological characteristics of the municipality exhibit the moist semi-deciduous forest vegetation zone. The rainfall pattern is bi-modal in nature with the major season spanning from March to September and the minor season between October and December. The annual mean rainfall is 88.99 cm with relative humidity between 75 and 80% during rainy seasons and from 70 to 80% in the dry seasons. The average yearly temperature ranges from 23 to 33 °C, the highest observed in March and April while the lowest is recorded in August (MoFA, 2018).

The seasonal nature of agriculture, unreliable rainfall patterns, and the imminent threat of climate change in the municipality has served as a catalyst for rural dwellers to seek for alternative livelihoods in non-farm activities as a way of diversifying income for livelihood security and insurance. Official statistics show that 45.9% of the populates are crop farmers, while 14.7% are employed in the industry sector mainly carpentry, bricks and block laying, food processing, timber-related activities, construction works, among others. Additional 9% are employed in the service sector (government, hairdressers, seamstresses, communication, tourism, etc.), and 10% engaged in other sectors such as commerce, mining, head porting, and transportation. Currently, the municipality is undergoing massive rural industrialization as a mean of economic diversification to end poverty and create jobs for the teeming unemployed youth. The initiative has resulted in increased activities of rural small-scale industries (RSSIs) in the municipality.

Research design and data collection process

The mix quantitative and qualitative research approach was employed to carry out the study. Using both techniques improve the validity and reliability of the data collected. A structured questionnaire was used to collect quantitative data on respondent’s demographic, social, and cultural characteristics; business-related data and information; and access to enabling business institutions in the study area. On the other hand, qualitative data collection methods such as key informant interview and focus group discussions were conducted to assess respondents’ perceptions and opinions on challenges affecting business establishment, access to training programs, skills, and competencies in small-scale business management.

The study uses cross-sectional data collected in October 2016. A structured questionnaire was developed and pre-tested before actual data collection. The aim of the pre-testing was to examine the practicality and appropriateness of the instrument in answering the research questions of the study. Further, it was an opportunity to revise and include questions which might previously be not considered. Ten (10) small-scale business operators were chosen through simple random selection in two (2) communities under the municipality for the survey instrument pre-testing. The data collected was analyzed, and the findings were used to examine the strength and weakness of the questionnaire.

A two-stage sampling technique was adopted to sample 200 operators of small-scale operators. Stage one includes selecting 10 communities (Atronie, Asukwaa, Kotokrom, Nkrankese, Yawhimakrom, Adantia, Atuahenekrom, Nwawansua, Benu, Nkwanta, and Nkurosu II) from a sample frame of communities located within the municipality. At stage two, simple random selection was also applied to select individual operators from a sample frame sourced from the government municipal local authority. An equal proportion of 20 operators per community totaling 200 operators was adopted for fair representation.

Measurement of variables

The variables used as proxies to measure financial service access and participation in training/skills improvement programs are based on literature and adapted to fit the context of this study. Access to bank payment service was assessed using five items on a 3-point Likert scale. The items include frequency of cash withdrawals, payment of clients through banks, use of ATMs for withdrawals, cell phone banking, and change checks or vouchers into cash. Four items measuring access to investment services were also adopted and measured on a 3-point Likert scale. The items measure the credit capacity and risk-bearing ability of firms to receive credit facilities from formal banking institutions. These items assessed the levels of firms’ ownership of current account with money; savings account with money; business investments in insurance, stocks, and bonds at bank; and receivable of loan facility for business. Meanwhile, six items were used to assess the extent to which firms are receiving training/skill improvement from governmental agencies such as business advisory services for firm performance and growth. The items assessed the levels of awareness of support programs and training from business advisory services; training received in business planning, marketing, and information services; accounting and financial services; entrepreneurship-related activities (new markets, products, and services); and human resource services. The remaining explanatory variables are explained in the next section under the econometric methodology.

Data analysis

Both descriptive and inferential analytical tools were used to analyze the data. Descriptive techniques such as means, standard deviation, frequencies, and cross-tabulations were used to describe the data. Analysis of variance (ANOVA) was also used to compare the means of continuous variables among the industry types. In order to analyze the effect of socio-economic and institutional factors on firm growth, we used the multivariate multiple regression techniques that estimate a single regression model with more than one dependent variable simultaneously:

where ui is the error that captures other variations, which are not captured by the explanatory variables captured in the model. The dependent variables are annual employee growth size (PrEmpli) and sales rate (PrSalesi). Employee growth is measured in terms of the number of full-time and part-time employees also known as labor of the firm. Annual sales growth is determined from the firms’ revenue made within the year. Other explanatory variables are described in Table 1.

Results and discussions

Descriptive analysis

The descriptive analysis shows that out of the 200 rural small-scale firms surveyed, 46% are into agro-processing and 37% are within the artisanal industry while 17% are from the service industry (Table 2). The majority of the respondents are females (51.5%) compared with male counterparts (48.5%). Across the industry, female entrepreneurs dominate the processing sector while males preoccupy the artisan industry which is consistent with national reports (GSS, 2010). The high illiteracy rate of 43.5% uneducated entrepreneurs and 43.5% with only basic education has a negative implication for business growth because entrepreneurs will face constraints in accessing information, credit, and technologies for business development. The illiteracy statistics are similar to the national figure of 33.0% reported by Edusah and Antoa (2014).

The mean age of operators, 35.64 years, depicts a youthful and active population in the management of SSIs in the study area. The finding agrees with observations made by Anheier and Seibel (1987) and Edusah and Antoa (2014) in the Central region of Ghana. Across industries, the mean difference is significant suggesting an aging population (37.8 years) for small-scale business operators in the processing industry. Similarly, the data suggests a higher monthly sale (261.5) for processing industry compare with artisans (149.34) and service industry entrepreneurs (141.5) at 1% significance level. The average employee size is 2.4 whiles age of the firms is 5.75 years. No significant difference exists among the three sectors for employee size and firm age.

Validity and reliability test

The Cronbach’s alpha coefficients are above 0.6 which suggest that the institutional constructs are internally stable and reliable for further analysis. Besides, the significant Keiser-Meyer-Olkin (0.815) and Bartlett’s test of sphericity of 1467.3 confirms the data on the institutional variables are valid for the data analysis (Table 3).

Econometric results

The appropriateness of the multivariate multiple regression to the data was evaluated in terms of the multivariate criterion that indicates if both equations, taken together, are statistically significant. The result reveals that specification of the overall model is statistically significant, irrespective of the type of the multivariate criteria used as indicated by the significant levels (1%) of the F ratios from the Wilk’s lambda (0.277), Lawley-Hotelling trace (2.193), Pillai’s trace (0.840), and Roy’s largest rot (1.981) coefficients. Similarly, the multivariate tests for each of the predictor variables are statistically significant, irrespective of the test used, and were, therefore, included in the analysis. The predictive power of the multivariate regression model for each of the response variable was also assessed in terms of the fraction of variance explained. The R-squares, 0.6 and 0.57, imply that 60% and 57% of the variance in sale growth and employee growth respectively are explained by entrepreneurs’ demographics and institutional and firm characteristics. The F-statistics, 21.79 for sale growth and 18.78 for employee growth models significant at 1% level, justifies the application of multivariate regression model to the data. The Doornik Hansen chi-square value of 2021.46 significant at 1% denotes that residuals of the data are normally distributed and the variance inflation factor (VIF) is at acceptable levels with tolerance levels above 0.1 suggesting the absence of multicollinearity among the predictor variables. Therefore, the significant effects of the predictor variables on the two response variables were evaluated (Table 4). The results depict that effects of demographic factors (sex of operator, completion of formal education at JHS level), institutional variables (bank investment and training services), and firm characteristics (industry type) conjointly influence small-scale business performance. Besides industry type, the coefficients of the remaining factors that significantly influence business performance are consistent with a priori expectations.

The study uses the RBV and human capital theoretical framework to examine the precursors of business performance. Specifically, this study contributes to the literature by investigating data on rural small-scale firms in Sunyani municipality of Ghana. Six variables based on the RBV theory were found to be consistent with extant literature on factors influencing SSIs performance.

The importance of demographic characteristics reflects the competencies entrepreneurs required to succeed in business management. This finding is congruent with previous studies (Harada, 2003; Islam et al., 2011; Littunen & Virtanen, 2006; Unger et al., 2009a). For instance, Islam et al. (2014) in a study for Bangladesh found that entrepreneurs’ demographic factors such as age, gender, and education greatly influenced small-scale business success. Similarly, Mothibi (2015) also reported that entrepreneur’s education and age were significant determinants of business success in Kenya. Given that most small businesses’ operators have lower formal education and are constraint by technical training, strong entrepreneurial characteristics such as education and age are important in determining the success of the firm. The business landscape of small-scale firms is evolving faster, and this requires the collection and processing of complex information to succeed. Thus, firm operators with higher education tend to adopt more innovative practices for success (Barringer et al., 2005; Cooper et al., 1992; Kim, Aldrich, & Keister, 2006; Watson et al., 2003; Yusuf, 1997). Besides, older firm operators might be endowed with rich business experience and might have gone through different faces of business challenges to overcome obstacles in firm operations (Harada, 2003; Littunen & Virtanen, 2006).

The result of this study also indicates that institutional characteristics mainly access to investment services and technical training significantly influence small-scale business performance. In support of this finding, Martin et al. (2013) observed a strong positive relationship between entrepreneurs’ access to training and business success. In a related study, Yaacob et al. (2014) in Malaysia also reported a significant positive relationship between graduate entrepreneurs’ access to technical training and survival of businesses. Business skill acquisition and continuous training are important antecedents of business growth. For small businesses in the informal sector, formal education of operators is low (Goodale, 1989); hence, entrepreneurs acquire skills and improve business competencies through access to technical training to achieve organizational objectives. From the result of the study, it appears that firm operators with limited business skills can compensate the shortfall with continuous training on the job, especially in rural areas for success. Meanwhile, access to investment resources from financial institutions directly influences technology adoption for successful firm development in this dynamic business environment. However, the main bane of small-scale business growth in rural Africa is attributed to insufficient capital from formal financial institutions. Therefore, access to investment options that provide credit and savings opportunities is necessary to help many small businesses respond to the rapidly changing business environment to be successful (McMaon, 2001).

Substantial empirical studies have highlighted the significance of firm characteristics in influencing business performance (Islam et al., 2014; Mothibi, 2015; Smallbone et al., 1995). However, the result of this study only found the type of industry sector to significantly influence business performance. Consistent with this finding, Mothibi (2015) reported that firm characteristics such as firm type are a crucial determinant of small-scale business performance in Kenya. On the contrary, Islam et al. (2014) found no significant relationship between firm-specific characteristics and performance in the study for Bangladesh. In this study, it appears that businesses in the processing industry mainly agro-processing tend to be more successful than the artisans and service industries. This finding is contrary to a prior expectation which suggests that processing industries that use agricultural raw materials are unsustainable because agricultural production, especially for developing countries, is risky and variable (Edusah, 2011). Probably, the reason that accounts for this finding might be related to the improved agricultural growth in 2016 when the study was conducted compared to other periods.

Implications and conclusion

The performances of small-scale firms in terms of growth and sustainability are affected by both firm internal and external factors. This study considers firm internal factors such as entrepreneurs’ and firms’ characteristics as well as external factors (institutional) based on the RBV and human capital theories to make empirical and practical contributions toward explaining critical factors that affect small-scale business performance. The study, therefore, contributes to existing entrepreneurship literature by explaining critical antecedents of small-scale firm performance in developing economies, particularly Ghana.

Given that previous findings on business success factors are inconclusive, the current study concludes that these may be attributed to the over-reliance on measuring business performance from a non-financial perspective, which is often subjective and may not be an actual indicative of business success. Thus, the study evidences that the usage of more than one financial indicator to proxy small-scale performance offers a possible solution that also eliminates the weakness of using financial data especially in developing economies, thereby contributing to the measurement of small business performance. Past studies on small-scale success factors that consider financial indicators examined the effect of either only internal or external factors on small business performance. This study improves this body of knowledge by simultaneously examining the effects of these two factors on business performance in the Ghanaian context which has relatively received low research attention. The study is, therefore, a valuable addition to the limited studies on small-scale business performance in Ghana. Indeed, the ultimate contribution from the study shows that both internal (i.e., firm and entrepreneur characteristics) and external (i.e., institutional characteristics) characteristics are important contributors to business performance.

The study also presents several practical implications. First, the findings from the study suggest that the effect of basic educational level on firm growth was conjointly significant, but high school and undergraduate levels were conjointly insignificant. This finding adds to earlier studies that report on the relationship between higher education (i.e., undergraduate levels or higher levels) innovative practices and firm growth. This finding has implications for the introduction of entrepreneurship education at the basic level of education, thus the need to lay a firm foundation of entrepreneurship from basic school level rather than the current situation where entrepreneurship education is mostly limited to tertiary or undergraduate levels. Second, the study also shows that provision of investment services and training programs are not only interconnected but are crucial to small-scale performance. Small-scale entrepreneurs in Ghana and other developing countries have a low educational background and insufficient capital to expand business operations. The implication is that there is the need for linkage between provision of investment services targeting small-scale firms with requisite skills training, technical backstopping, and finances for business performance. For instance, the Government of Ghana through the Ministry of Business Development (MBD) and National Board for Small-Scale Industries (NBSSI) should establish and make visible more rural business advisory and investment services to improve small-scale entrepreneurs’ business skills and competencies. Further, the significant influence of gender on business performance calls for gender mainstreaming in the promotion of small-scale businesses. Therefore, programs designed for small-scale entrepreneurs should be disaggregated based on female and male entrepreneur for maximum impact.

Availability of data and materials

The datasets used and or analyzed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- AGI:

-

Association of Ghana Industries

- ANOVA:

-

Analysis of variance

- ATM:

-

Automated teller machine

- GDP:

-

Gross Domestic Product

- GSS:

-

Ghana Statistical Service

- JHS:

-

Junior high school

- RBV:

-

Resource-based view

- RSSIs:

-

Rural small-scale industries

- SHS:

-

Senior high school

- SMEs:

-

Small and medium enterprises

- SSIs:

-

Small-scale industries

References

Abdul Wahab, M. H., & Al-Damen, R. A. (2015). The impact of entrepreneurs’ characteristics on small business success at medical instruments supplies organizational in Jordan. International Journal of Business and Social Science, 6(8), 164–175.

Ackah, C., Adjasi, C., & Turkso, F. (2012). Scoping study on the evolution of industry in Ghana. Working paper no. 18. African Growth Initiatives, African Development Bank Group and United Nations University.

Anheier, H.K. and Seibel, H.D. (1987) Small-Scale Industries and Economic Development in Ghana: Business Behavior and Strategies in Informal Sector Economies. Breitenbach, Saarbrücken.

Arrow, K. J. (1962). The economic implications of learning by doing. Review of Economic Studies, 29, 155–173.

Association of Ghana Industries, (AGI) (2013). Difficulty in Accessing Credit Restrict the Growth of Small Businesses in Ghana. Available at http://businessandfinancehub.com.

Barkham, R., Gudgin, G., Hart, M., & Hanvey, E. (1996). The determinants of small firm growth — an inter-regional study in the UK (pp. 1986–1990). London: Jessica Kingsley.

Barney, J. (2001). Is the resource-based ‘view’ a useful perspective for strategic management research? Yes. Academic of Management Review, 2(1), 41–56.

Barringer, B. R., Jones, F. F., & Neubaum, D. O. (2005). A quantitative content analysis of the characteristics of rapid-growth firms and their founders. Journal of Business Venturing, 20(5), 663–687. https://doi.org/10.1016/j.jbusvent.2004.03.004.

Beaver, H. W. (2002). Perspectives on recent capital market research. The Accounting Review, 77(2), 453–474. https://doi.org/10.2308/accr.2002.77.2.453.

Birger Wernerfelt, (1984) A resource-based view of the firm. Strategic Management Journal 5 (2):171–180.

Braidford, P., Drummond, I., & Stone, I. (2017). The impact of personal attitude on the growth ambitions of small business owners. Journal of Small Business and Enterprise Development, 24(4), 850–862.

Brush, C. G., Edelman, L. F., & Manolova, T. (2002). The impact of resources on small firm internationalization. Journal of Small Business Strategy, Vol. 13 No.1, pp. 1–17.

Capron, L., & Hulland, J. (1999). Redeployment of brands, sales forces, and general marketing management expertise following horizontal acquisitions: a resource-based view. Journal of Marketing, 63(4), 41–54.

Carter, S., Ennis, S., Lowe, A., Tagg, S., Tzokas, N., Webb, J., and Andriopoulous, C., (2000). “Barriers to survival and growth in U.K small-firms”. Report to the. Federation of small Businesses available @ http:www.marketing.strath.ac.uk.

Chang, Y., Gomes, J. F., & Schorfheide, F. (2002). Learning-by-doing as a propagation mechanism. American Economic Review, 92, 1498–1520.

Coad, A., Segarra, A., & Teruel, M. (2016). Innovation and firm growth: does firm age play a role? Research Policy, 45, 387–400.

Cooper, A. C., Folta, F., Gimeno-Gascon, F. J., & Woo, C. Y. (1992). Entrepreneurs, process of founding, and new firm performance. In D. Sexton & J. Kassandra (Eds.), The state of the art in entrepreneurship. Boston: PWS Kent Publishing Co..

Cragg, P. B., & King, M. (1988). Organizational characteristics and small firms’ performance revisited. Entrepreneurship Theory and Practice, 13(2), 49–64.

Dimov, D. P., & Shepherd, D. A. (2005). Human capital theory and venture capital firms: exploring “home runs” and “strike outs”. Journal of Business Venturing, 20(1), 1–21. https://doi.org/10.1016/j.jbusvent.2003.12.007.

Dyer, W.G., Nenque, E., & Hill, E.J. (2014). Toward a theory of family capital and entrepreneurship: Antecedents and outcomes. Journal of Small Business. Management, 52(2), 266–285. https://doi.org/10.1111/jsbm.12097.

Edusah, S. E. (2011). Management and growth paradox of rural small-scale industrial sector in Ghana. Journal of Science and Technology, 31(2), 57–67.

Edusah, S. E., & Antoa, E. (2014). The socio-economic contribution of rural small-scale industries in Ghana. Journal of Economics and Sustainable Development, 5(2), 161–172.

Foley, P., & Green, H. (1989). Small business success. London: Paul Chapman Publishing.

Galbreath, J. (2005). Which resources matter the most to firm success? An exploratory study of resource-based theory. Technovation, 25(9), 979–987. https://doi.org/10.1016/j.technovation.2004.02.008.

Gebreeyesus, M. (2007). Growth of Micro-Enterprises: Emprical evidence from Ethiopia. Ethiopia Development Research Institute (EDRI). Available at https://www.researchgate.net/publication/228457234_Growth_of_Micro-Enterprises_Empirical_evidence_from_Ethiopia.

Ghana Statistical Service, (2010). 2010 Population and Housing Census, national Analytical Report: Ghana Statistical Service.

Ghana Statistical Service, (2012). 2010 Population and Housing Census, BrongAhafo Regional Analytical Report.

Ghana Statistical Service, (2015). 2010 Population and Housing Census, national Analytical Report: Ghana Statistical Service.

Goodale, B. D. (1994). Education and Training for the Informal Sector, Education, Research Paper No 11. Department for International Development, UK.

Nobuyuki Harada, (2003) Who succeeds as an entrepreneur? An analysis of the post-entry performance of new firms in Japan. Japan and the World Economy 15 (2):211–222.

Hornaday, J. A. (1970). The nature of the entrepreneur. Personnel Psychology, 23(1), 47–54. https://doi.org/10.1111/j.1744-6570.1970.tb01634.x.

Ilaboya, J. O., & Ohiokha, I. F. (2016). Firm age, size and profitability dynamics: a test of learning by doing and structural inertia hypotheses. Business and Management Research, 5(1), 29–39.

Isaga, N. (2018). The relationship of personality to cognitive characteristics and SME performance in Tanzania. Journal of Small Business and Enterprise Development, 25(4), 667–686.

Islam, M. A., Khan, M. A., Obaidullah, A. Z. M., & Alam, M. S. (2011). Effect of entrepreneur and firm characteristics on the business success of small and medium enterprises (SMEs) in Bangladesh. International Journal of Business and Management, 6(3), 289–299.

Ismail, W. N., Mokhtar, M. Z., & Ali, A. R. (2014). Do IT helps SMEs gain better performance: A conceptual analysis on RBV. International Journal of Management and Sustainability 3, (5), 307–320.

Janice Jones, (2004) Training and Development, and Business Growth: A Study of Australian Manufacturing Small–Medium Sized Enterprises. Asia Pacific Journal of Human Resources 42, (1):96–121.

Jay B. Barney, (1986) Strategic Factor Markets: Expectations, Luck, and Business Strategy. Management Science 32 (10):1231–1241.

John G. Irwin, James J. Hoffman, Bruce T. Lamont, (1998) The effect of the acquisition of technological innovations on organizational performance: A resourcebased view. Journal of Engineering and Technology Management 15, (1):25–54.

Kim, K.S., Knotts, T.L., & Jones, S.C. (2008). Characterizing viability of small manufacturing enterprises (SME) in the market. Expert Systems with Applications. 34(1), 128–134. https://doi.org/10.1016/j.eswa.2006.08.009.

Kitching J, Blackburn R, 2002’ the nature of training and motivation to train in small firms ‘ small business research Centre, Kingston university, Kingston upon Thames, surrey.

Kolvereid, L. (1996). Organizational employment versus self-employment: reasons for career intentions. Entrepreneurship Theory and Practice, 20(3), 23–31.

Kristiansen, S., Furuholf, B., & Walid, F. (2003). Internet café entrepreneurs: Pioneers in information dissemination in Idonesia. The International Journal of Entrepreneurship and Innovation, 4(4), 251-263.

Liedholm, C., & Chuta, E. (1975). The economics of rural and urban small-scale industries in Sierra Leone. Michigan: Michigan State University.

Liedholm, Carl. (2001) “Small Firm Dynamics: Evidence from Africa and Latin America”. World Bank Institute.

Littunen, H., & Virtanen, M. (2006). Differentiating growing ventures from non-growth firms. International Journal of Entrepreneurship and Management, 2(1), 93–109 Springer.

Martin, C. B., McNally, J. J., & Kay, M. J. (2013). Examining the formation of human capital in entrepreneurship: a meta-analysis of entrepreneurship education outcomes. Journal of Business Venturing, 28(2), 211–224.

Masuo, D., Fong, G., Yanagida, J., & Cabal, C. (2001). Factors associated with business and family success: a comparison of single manager and dual manager family business households. Journal of Family and Economic Issues, 22(1), 55–73.

Mazzarol, T., Volery, T., Doss, N., & Thein, V. (1999). Factors influencing small business start-ups. International Journal of Entrepreneurial Behavior and Research, 5(2), 48–63.

McPherson, M. A. (1992). Growth and survival of small Southern African firms. In PhD Dissertation. East Lansing: Michigan State University.

Mensah, J. V., Tribe, M., & Weiss, J. (2007). The small-scale manufacturing sector in Ghana: a source of dynamism or of subsistence income? Journal of International Development, 19, 253–273.

MoFA (2018). Ministry of Food and Agriculture, Suniyani Municipality. Available at Mofa.gov.gh/site/?page_id=137. Accessed 23 Feb 2018.

Mojca Duh, (2011) Family enterprises as an important factor of economic development: The case of slovenia. Journal of Enterprising Culture 11, (02):111–130.

Mohamad Radzi, K., Mohd Nor, M. N., & Mohezar Ali, S. (2017). The impact of internal factors on small business success: a case of small enterprises under the FELDA scheme. Asian Academy of Management Journal, 22(1), 27–55. https://doi.org/10.21315/aamj2017.22.1.2.

Morris, Michael H., Nola N. Miyasaki, Craig E. Watters, and Susan M. Coombes (2006). The Dilemma of Growth: Understanding Venture Size Choices of Women Entrepreneurs, Journal of Small Business Management vol. 44, no. 2, pp. 221–244.

Mothibi, G (2015). The effects of entrepreneurial and firm characteristics on performance of small and medium enterprises in Pretoria. International journal of economics, commerce and management united kingdom, 3(3), 1–8.

Murphy, G. B., Trailer, J. W., & Hill, R. C. (1996). Measuring performance in entrepreneurship research. Journal of Business Research, 36, 15–23.

Ngwangwama, M. M., Ungerer, M., & Morrison, J. (2013). An exploratory study of key success factors for business success of companies in the Namibian tertiary industry. International Journal of Innovations in Business, 2(6), 604–629.

Nyoike, E. W., Langat, L. C., Karani, L. M., & Lagat, A. C. (2014). Factors influencing the growth of small-scale resturants in Nakuru Municipality-Kenya. Journal of Business and Management, 16(3), 62–74.

Oppong, M., Owiredu, A., & Churchill, R. Q. (2014). Micro and small scale enterprises development in Ghana. European Journal of Accounting Auditing and Finance Research, 2(6), 84–97.

Oyedele M. O., Oluseyi O., Olalekan A., Kabuoh M., and Elemo G. N. (2014) On Entrepreneurial Success of Small and Medium Enterprises (SMEs): A Conceptual and Theoretical Framework Journal of Economics and Sustainable Development ISSN 2222–1700 (Paper) ISSN 2222–2855 (Online) Vol. 5, No. 16, 2014.

Penrose, E. T. (1959). The theory of the growth of the firm. Oxford: Blackwell.

Presser, H. B. and W. Baldwin. (1980). Child Care as a Constraint on Employment: Prevalence, Correlates, and Bearings on the Work and Fertility Nexus. Amercian. Journal of Sociology 85:1202–1213.

Rahman, N. A., & Ramli, A. (2014). Entrepreneurship management, competitive advantage and firm performances in the craft industry: concepts and framework. Procedia-Social and Behavioral Sciences, 145, 129–137.

Ramachandran, V., & Shah, M. K. (1999). Entrepreneurship and firm performance in Sub-Saharan Africa (English). Africa Region findings; No. 146. Washington, DC: World Bank http://documents.worldbank.org/curated/en/205701467990360948/Entrepreneurship-and-firm-performance-in-Sub-Saharan-Africa.

Reynolds, P. D., Camp, S. M., Bygrave, W. D., Autio, E., & Hay, M. (2001). Global entrepreneurship monitor. 2001 executive report. Kansas: Kauffman Foundation.

Richard G. P. Mcmahon, (2016) Growth and Performance of Manufacturing SMEs: The Influence of Financial Management Characteristics. International Small Business Journal: Researching Entrepreneurship 19, (3):10–28.

Robinson, Peter B. & Sexton, Edwin A., (1994). "The effect of education and experience on self-employment success," Journal of Business Venturing, Elsevier, vol. 9(2), pages 141–156.

Rutherford, M., & Oswald, S. (2000). Antecedents of small business performance. New England Journal of Entrepreneurship, 3(2), 1–22.

Saffu, K., Walker, J. H., & Mazurek, M. (2012). Perceived strategic value and e-Commerce adoption among SMEs in Slovakia. Journal of Internet Commerce, 11, 1–23.

Sinha, T. N. (1996). Human factors in entrepreneurship effectiveness. The Journal of Entrepreneurship, 5(1), 23–39. https://doi.org/10.1177/097135579600500102.

Smallbone, D., Leigh, R. & North, D. (1995) The characteristics and strategies of high growth SMEs. International Journal of Entrepreneurial Behaviour and Research, 1(3), 44–62.

Sorensen, J. B., & Stuart, T. E. (2000). Aging, obsolescence, and organizational innovation. Administrative Science Quarterly, 45, 81–112.

Steel, W. F., & Webster, L. M. (1989). Building the role of SMEs; lessons learned from credit programmes. The Courie.

Storey, D. J. (1994). Understanding the small business sector. London: Routledge.

Unger, J. M., Rauch, A., Frese, M., & Rosenbusch, N. (2009a). Human capital and entrepreneurial success: A meta-analytical review. Journal of Business Venturing 26, (3) 341–358. https://doi.org/10.1016/j.jbusvent.2009.09.004.

Van Praag, C. M. (2003). Business survival and success of young small business owners. Small Business Economics, 21(1), 1–17. https://doi.org/10.1023/A:1024453200297.

Walker, E., & Brown, A. (2004). What success factors are important to small business owners. International Small Business Journal, 22(6), 577–594.

Wang, Z., & Wang, N. (2012). Knowledge sharing, innovation and firm performance. Expert Systems with Applications, 39(10), 8899–8908. https://doi.org/10.1016/j.eswa.2012.02.017.

Watson, W., Stewart, W. H., & BarNir, A. (2003). The effects of human capital, organizational demography, and interpersonal processes on venture partner perceptions of firm profit and growth. Journal of Business Venturing, 18, 145–164. https://doi.org/10.1016/S0883-9026(01)00082-9.

Westhead, P. (1995). Survival and employment growth contrasts between types of owner- managed high technology firms. Entrepreneurship Theory & Practice, 20 (1), 5–28.

Yaacob, N. M., Mahmood, R., Zin, M. S., & Puteh, M. (2014). Factors affecting the performance of small business start-ups under Tunas Mekar Programme. In Proceedings of the ASEAN Entreprenuership conference Available at https://link.springer.com/book/10.1007/978-981-10-0036-2. Accessed 12 July 2019.

Yusuf, A. (1997). An empirical investigation of the organisation life cycle model for small business development and survival in the South Pacific. Journal of Enterprising Culture, 5(4), 423–445. https://doi.org/10.1142/S0218495897000247.

Acknowledgements

We wish to thank the following persons: Messrs.’ Cornelius Joojo Cobbina, Samuel Koomson and Michael Kodom for their support and help in the production of this study and manuscript.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

BKCE conceived of the study, participated in its design, carried out the data collection, and participated in the sequence alignment and drafting of the manuscript. FA participated in the design and coordinated the study, helped performed the statistical analysis, and participated in the alignment and drafting of the manuscript. KA participated in its design, helped performed the statistical analysis, and helped draft the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Essel, B.K.C., Adams, F. & Amankwah, K. Effect of entrepreneur, firm, and institutional characteristics on small-scale firm performance in Ghana. J Glob Entrepr Res 9, 55 (2019). https://doi.org/10.1186/s40497-019-0178-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40497-019-0178-y