Abstract

This study investigates the factors influencing Generation Y and Z’s satisfaction and perceived enjoyment of using E-wallet. This paper further assesses whether consumers perceived enjoyment and satisfaction with using E-wallet would significantly affect their impulsive buying behavior. PLS-SEM was conducted based on 201 valid responses from active E-wallet users collected through an online survey. The results revealed that perceived interactivity and subjective norm positively influenced perceived enjoyment and satisfaction with using E-wallet, respectively. Perceived risk had no significant impact on perceived enjoyment and satisfaction with E-wallet, whereas visual appeal positively influenced perceived enjoyment but not satisfaction. Moreover, this study found that perceived enjoyment of using an E-wallet positively affected impulse buying while satisfaction with E-wallet had no significant relationship with impulse buying. Implications and recommendations for future research are discussed in this paper.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The rapid evolution of internet access has ushered in mobile payment transactions (Melissa Teoh et al. 2020). Mobile payment systems are likely to be the most commonly used cashless payment method (Melissa Teoh et al. 2020; Cocosila and Trabelsi 2016), particularly in developing countries (Bagla and Sancheti 2018). Malaysia has launched and widely adopted E-wallet as a cashless payment method, with Touch n’Go, Boost, and GrabPay as the nation’s top three favored E-wallets (Statista 2020; Lew et al. 2020; Yan et al. 2021; Melissa Teoh et al. 2020).

E-wallet contributes to the national income, business competitiveness, and the growth of the Malaysian digital economy (Wong et al. 2020). To harness these benefits, the Malaysian government has launched the E-Tunai Rakyat initiative to stimulate E-wallet adoption among Malaysian citizens (Wong et al. 2020; Melissa Teoh et al. 2020). The E-Tunai and E-Penjana applications received positive public response, boosting E-wallet use among Malaysians (Adilla 2020; Wong et al. 2020). The COVID-19 pandemic has further encouraged consumers to adopt E-wallet as a contactless transaction method to align with social distancing measures (Wong et al. 2020; Lew et al. 2020). Notwithstanding, research is scarce on the influence of cashless payment methods during the pandemic (Aji et al. 2020; Daragmeh et al. 2021). Consumers’ lifestyles and needs change alongside changing times, urging merchants to reformulate customer services (Sedigheh et al. 2020). Thus, this has brought an opportunity for this study to examine E-wallet usage among Malaysians during the pandemic.

There is emerging research exploring mobile commerce’s impulse buying intention from the affective reaction perspective. For instance, recent studies have revealed that perceived enjoyment (affective reaction) is a vital determinant of mobile payment adoption (Triasesiarta and Rosinta 2021; Lew et al. 2020) and impulse buying intention (Zhang et al. 2020, 2021; Liu et al. 2020; Do et al. 2020; Xiang et al. 2016). Based on the general principle of affective reactions (emotions), the impact of emotions on a user’s behavioral intention has been examined and confirmed (Yuan et al. 2020). More specifically, an information system that creates pleasant sensations such as perceived enjoyment and flow states that motivate users to accept the information system (Yuan et al. 2020). Further, studies have demonstrated that users’ satisfaction (cognitive reaction) typically influenced E-wallet adoption (Phuong et al. 2020) and impulse buying behavior (Wu et al. 2020; Do et al. 2020; Zhang et al. 2020). Therefore, this study adopts satisfaction and perceived enjoyment as predictors of impulse buying behavior.

Although there is a rich literature on consumers’ impulsive buying behavior (Zheng et al. 2019; Djafarova and Bowes 2021; Xiang et al. 2016; Xu et al. 2020), relatively less research has examined the influence of cashless payment methods on impulse buying behavior. Pradhan et al. (2018) posited that consumers’ impulse control might weaken because cashless payments are considered painless compared to cash payments. Some researchers have argued that negative feelings from cash payments could counter the positive feelings evoked through impulsive purchases (Thomas et al. 2011). This study defines impulse buying as “a state of desire that is experienced upon encountering an object in the environment” (Chen and Yao 2018, p. 1254), in which the impulse buying behavior might be exhibited at any time, in any individual, depending on different circumstances (Mandolfo and Lamberti 2021; Lucas and Koff 2014). Since impulse buying is considered a transient behavior (Lucas and Koff 2014), this study measures impulse buying by asking respondents their impulse buying behavior while using an E-wallet payment system (Chen and Yao 2018).

This study examines the factors influencing consumers’ satisfaction and perceived enjoyment of using an E-wallet amid the COVID-19 pandemic that observes nascent E-wallet adoption (Wong et al. 2020). E-wallet payment platforms are imperative and adopted by both consumers and merchants to create critical mass and network externalities (Sedigheh et al. 2020). From a businesses’ perspective, impulsive buying is relevant for improving sales revenue (Miao et al. 2019). Thus, this study is guided by the following research objectives: (1) To identify the factors influencing the user’s satisfaction and perceived enjoyment of using E-wallet, (2) To examine whether the satisfaction and perceived enjoyment of using E-wallet significantly influence consumer’s impulsive buying behavior.

Literature review

The impact of electronic wallet (E-wallet) on impulse buying

An E-wallet acts as a physical wallet allowing users to reload electronic money with mobile banking services (Kasirye and Mahmudul 2021). E-wallet promotes time-saving as users do not need to constantly log on to mobile banking systems (Kasirye and Mahmudul 2021; Junadi and Sfenrianto 2015). E-wallet users can make payment transactions once it is topped with debit or credit cards (Kasirye and Mahmudul 2021).

Cashless payment has been found to influence consumers’ impulse buying behavior. An impulse purchase is defined as an unplanned purchase or making a purchasing decision on the spot (Piron 1991, p. 152). Extant research has indicated that cashless payment methods, such as credit card use, facilitated buyers’ direct purchases, and impulse purchases (Akram et al. 2017; Badgaiyan and Verma 2015). Relatedly, recent research has found that digital wallets significantly affect consumers’ impulse purchase behavior in Indonesia (Handayani and Rahyuda 2020). Similarly, E-wallet, one of Malaysia’s increasingly growing cashless payment methods (Hassan et al. 2021), compels online impulse buying behavior (Handayani and Rahyuda 2020). In light of the preceding, this study examines the consumer’s digital wallet (E-wallet) use and further investigates whether the adoption of mobile payment services would lead to impulse purchases.

Stimulus–organism–response (S–O–R) model

The Stimulus–organism–response model has been used to examine consumers’ behavior (Do et al. 2020). The stimulus is a trigger that arouses buyers to make impulse purchases (Do et al. 2020). The organism refers to the buyers’ emotional states (cognitive and affective reactions) comprising thinking processes, feelings, and perceptions (Do et al. 2020; Chan et al. 2017). Finally, the third element of the S–O–R theory is the response, which is primarily the desire to leave or enter a particular environment, i.e., avoidance or approach behavior (Bigne et al. 2020). The S–O–R model has been widely used to examine consumers’ impulsive purchasing behavior in online and offline shopping contexts (Do et al. 2020; Zheng et al. 2019; Liu et al. 2013). The S–O–R model/theory has been verified to be one of the most appropriate models to study consumer behavior, allowing researchers to interpret and bring in different app-specific predictors and examine their holistic influences on app users’ emotional states and subsequent responses (Chopdar and Balakrishnan 2020).

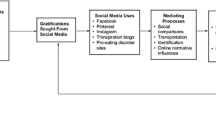

This study adopts the S–O–R model as the relationship between intrinsic stimuli, organism, and response represents the core interests of the present research. Consistent with previous studies (Patanasiri and Krairit 2018; Do et al. 2020; Zheng et al. 2019; Zhang et al. 2020), this study proposes that perceived interactivity, perceived risk, visual appeal, and subjective norm (S) can evoke perceived enjoyment and satisfaction (O) and the internal reaction will influence buyers’ impulse buying behavior (R). This research conceptually distinguishes and measures organism (O) to two different types of reactions—cognitive reaction (satisfaction) and affective reaction (perceived enjoyment).

Although studies have argued that the organism factors (affective states), such as enjoyment and flow, are transient and changeable during goal execution (Yuan et al. 2020), they can also be highly salient depending on the intensity through its retrieval from memory (Song et al. 2011). In addition, researchers have opined that affective states (emotions) are enduring feeling states that are comparatively steady (Kim 2017; Zhang et al. 2020). On the other hand, affective states are more intense and situational-specific (Kim 2017; Zhang et al. 2020). Liu et al. (2016) defined organism as a user’s temporarily unaware experience when participating in specific social commerce activities, comprising certain emotional states such as flow and enjoyment. Their study indicated that the transient effect could influence the individuals’ final responses. In this regard, this study posits that a transient affective state (perceived enjoyment) will affect impulsive buying behavior. This study adopts perceived enjoyment, which measures the user’s enjoyment of the E-wallet experience. Accordingly, the present work examines the impact of perceived risk, perceived interactivity, visual appeal, subjective norm on the buyer’s perceived enjoyment, and satisfaction with using E-wallet. Further, this study also investigates the influence of perceived enjoyment and satisfaction on impulsive buying behavior. Table 1 summarizes the definition of each construct, while Fig. 1 illustrates the proposed research framework of this study.

Relationship between E-wallet apps experience, satisfaction, and enjoyment

Perceived interactivity

Perceived interactivity is defined as “the ability of users to change the form and content of a mediated environment in real-time” (Do et al. 2020, p. 3). Studies have indicated that perceived interactivity (i.e., responsiveness, personalization, etc.) positively influenced users’ attitudes toward a mobile application (Yoon 2016; Krishanan et al. 2017). Likewise, perceived interactivity was significant in determining young Malaysian consumers’ attitudes concerning mobile payment transactions (Krishanan et al. 2017; Yan et al. 2021). Moghavvemi et al. (2021) conducted a longitudinal study by interviewing Malaysian consumers who have adopted E-wallet. The researchers found that perceived interactivity (responsiveness of the E-wallet systems) was the primary concern in E-wallet adoption insofar as the payment processing time could be shortened to increase the payment counter’s overall efficiency. In the virtual shopping context, interaction is essential in determining consumers’ behavior (Lin and Lo 2015; Xiang et al. 2016; Akram et al. 2017). For instance, an easy-navigable interface allows consumers to interact with the system with minimal mental effort, while a system’s interface that is challenging to navigate may frustrate the consumers as it requires more mental effort to accomplish the intended task (Lin and Lo 2015).

The literature has also demonstrated perceived interactivity as a significant determinant of users’ satisfaction with using a system (Do et al. 2020; Moghavvemi et al. 2021). In addition, stronger perceptions of interactivity with a system will contribute to user satisfaction (Song and Zinkhan 2008). Perceived interactivity is considered a vital antecedent to the enjoyment of using an interactive system or service (Jang and Park 2019). Previous empirical studies have also confirmed the significant relationship between interactivity and enjoyment (Vorderer et al. 2003; Jung 2014). Moreover, Jang and Park (2019) found that users’ perceived interactivity of virtual reality games was positively associated with perceived enjoyment of the games. Prior studies have also indicated that the perceived interactivity of mobile platforms had a robust effect on consumers’ enjoyment of using mobile-augmented reality apps (Do et al. 2020). Resonating with Do et al. (2020), this study considers perceived interactivity as a stimulus in examining users’ satisfaction and perceived enjoyment of using an E-wallet. Thus, this study hypothesizes that:

H1

Perceived interactivity has a positive effect on satisfaction with using an E-wallet.

H2

Perceived interactivity has a positive effect on perceived enjoyment of using an E-wallet.

Perceived risk

Perceived risk is defined as “a consumer’s belief about uncertain adverse outcomes from an online transaction” (Kim et al. 2008, p. 546; Wu et al. 2020, p. 2). In the online shopping environment, app users are considerably concerned about risk issues associated with the apps’ security for payment transactions (Hsiao 2020; Sarkar and Khare 2017; Nizam et al. 2019). Perceived risk has been examined in cashless payment transactions, particularly its effect on mobile wallet adoption (Amoroso and Magnier-Watanabe 2012; Karjaluoto et al. 2018). Despite the ubiquity and convenience of mobile payment (Nizam et al. 2019; Yan et al. 2021), security and privacy issues challenge mobile payment transactions (Madan and Yadav 2018; Aji et al. 2020; Kasirye and Mahmudul 2021). However, a recent study suggests that security factors may not significantly influence users’ behavioral intention to use E-wallet, particularly in the Malaysian context (Abdullah et al. 2020).

Although perceived risk has been widely examined in the online shopping context, the effect of perceived risk on impulse purchases is less clear (Wu et al. 2020; Chen et al. 2019a, b). Moreover, studies on perceived risk concerning E-wallet remain scarce (Chopdar and Sivakumar 2018). Notwithstanding, recent research has noted that perceived risk (security issue) plays a significant role in influencing Malaysian E-wallet adoption (Moghavvemi et al. 2021; Nizam et al. 2019). Hence, this study proposes a novel research model integrating perceived risk in the impulse purchase context through satisfaction and perceived enjoyment of using E-wallet by examining the role of consumers’ perceived risk in shaping their E-wallet usage in Malaysian. Cohering with Patanasiri and Krairit (2018)’s study, this study assigns perceived risk as a stimulus in examining E-wallet usage behavior.

Wu et al. (2020) reported that lower perceived risk was associated with enhanced confidence and consumers’ satisfaction with online financial services, thereby indicating a negative relationship between perceived risk and satisfaction. Moreover, research has found that perceived privacy risk negatively affects social networking site users’ enjoyment (Ernst 2014). Users’ perceived enjoyment may decrease due to suffering a loss in pursuit of a desired outcome that makes up perceived risk (Tseng and Kuo 2014). Thus, this study hypothesizes that:

H3

Perceived risk is negatively associated with satisfaction with using an E-wallet.

H4

Perceived risk is negatively associated with perceived enjoyment of using an E-wallet.

Visual appeal

Visual appeal is “the exhibition of fonts and other visual elements such as graphics that enhance the overall presentation of a system” (Parboteeah et al. 2009, p. 62). In the pre-purchase and pre-usage stages, visual appeal is a significant predictor in motivating buyers to browse and facilitates effective information searching (Zheng et al. 2019), thereby enhancing behavioral intention (Lee and Kacen 2008). In addition, studies have found that esthetic factor (visual appeal) is the vital determinant that users most appreciate in mobile applications (Zheng et al. 2019; Okazaki and Mendez 2013). In a similar vein, Lazard et al. (2016) reported that the esthetic factor was an influential determinant of system use.

“Stimuli (e.g., situational factors), … have a demonstrable and systematic effect on current behavior” (Zheng et al. 2019, p. 152). Therefore, this study regards visual appeal as a stimulus influencing consumers’ affective and cognitive reactions (Zheng et al. 2019; Liu et al. 2013). Implicatively, the visual appeal of an information system or online platform will affect user satisfaction with the systems (Ramírez-Correa et al. 2018). Further, visual appeal in contents and layouts evokes positive emotions and, thus, induces impulse purchases (Liu et al. 2013), especially among young consumers (Djafarova and Bowes 2021). Supporting this premise, Anubhav and Anuja (2020) noted that visual appeal reflected the degree of buyer satisfaction with smartphone intelligent voice assistants. Thus, this study proposes that visual appeal can influence Malaysian impulse buying behavior through perceived enjoyment and satisfaction with E-wallet.

Xiang et al. (2016) confirmed that the online store’s graphic display (visual appeal) could enhance consumers’ virtual haptic experience, subsequently facilitating consumers to experience strong positive feelings (perceived enjoyment). Furthermore, prior research has indicated that consumers would gain more emotional recognition due to the vivid pictures of online products (Huang 2016). Similarly, a recent study demonstrated that visual appeal positively influences consumers’ perceived enjoyment of using mobile commerce (Zhang et al. 2020). An element-rich platform or interface significantly improves the user’s emotional experience, ultimately infusing a sense of excitement and pleasance into the shopping experience (Zhang et al. 2020). Thus, this paper hypothesizes that:

H5

Visual appeal positively influences the satisfaction with using an E-wallet.

H6

Visual appeal positively influences the perceived enjoyment of using an E-wallet.

Subjective norm

Subjective norm refers to “an individual's perceived social pressure from the surrounding environment regarding whether or not to perform a behavior, and two major sources of pressure are interpersonal influence and media influence” (Liu et al. 2019, p. 1107). Friends, peers, and family can exert normative influence and exchange information upon the user’s continuance intention to use the social media (Liu et al. 2019; Hsieh et al. 2008). Zheng et al. (2019) observe that subjective norms associated with interpersonal influence and media influence (Liu et al. 2019; Kim 2011) act as a stimulus strongly affecting individuals’ buying behavior, especially in a collectivist country. Indeed, Malaysia represents a collectivist culture (Tafarodia and Alyson 2001; Bochner 1994; Lew et al. 2020). Additionally, young consumers can more easily be influenced by the closest people to use mobile payment services in online transactions (Triasesiarta and Rosinta 2021). Thus, this study adopts subjective norms in examining the usage behavior of E-wallet.

Due to social pressure, interpersonal and mass media’s positive recommendations often predict users’ satisfaction with systems or services. (Liu et al. 2019). Research has shown that subjective norms positively influence users’ perceived enjoyment of mobile video calling (Zhou and Feng 2017). The study also demonstrated that subjective norms emerged as a weak significant antecedent of perceived enjoyment in adopting mobile video calling. The present research proposes that subjective norms can influence buyers’ impulse purchasing behavior through their satisfaction and perceived enjoyment of using E-wallet, thereby postulating that:

H7

Subjective norm is positively related to satisfaction with using an E-wallet.

H8

Subjective norm is positively related to perceived enjoyment of using an E-wallet.

Relationship between satisfaction, perceived enjoyment, and impulse buying

Satisfaction

Satisfaction is defined as “the psychological or emotional state resulting from a cognitive assessment of the gap between the expectations and the actual performance of an information system” (Natarajan et al. 2018, p. 83). Satisfaction is measured based on how successful the collaboration between specific information systems and the end-users is, indicating the extent to which the system users believe the systems have fulfilled their expected needs (Hussein et al. 2021). When the users are satisfied with the user experiences, they will remain interested and continue to use the mobile payment system (Chen et al. 2019a, b). Satisfaction has been categorized as cognitive reactions under organism within the S–O–R model/theory (Chan et al. 2017). Cognitive reactions involve mental processes and effort while responding to the stimuli, specifically, impulse purchase triggers within the impulse purchase context (Chan et al. 2017). Individuals’ satisfaction could be evaluated with a thorough cognitive assessment, indicating their satisfaction level based on prior user experience or earlier decisions to use an information system (Natarajan et al. 2018).

The literature has long recognized customer satisfaction as one of the most reliable and significant factors in triggering impulse purchases (Bressolles et al. 2007; Wu et al. 2020). Satisfaction motivates approach behaviors, increasing retail sales revenue (Bressolles et al. 2007). Nevertheless, Do et al. (2020) argued that the influence of consumer satisfaction on impulse purchasing has yet to be thoroughly clear. Congruent with Bressolles et al. (2007)’s viewpoint, this study notes that relatively less research has examined the relationship between satisfaction with a specific system and impulsive buying behavior. Satisfaction with a system is associated with the degree to which a user experiences a positive feeling while online shopping on e-commerce websites (Bressolles et al. 2007). Their study demonstrated that consumers tended to experience online impulse buying impulses when satisfied with online shopping websites. Similarly, Do et al. (2020) found a significant relationship between satisfaction with mobile-augmented reality apps and impulse buying in the tourism field. Following Bressolles et al. (2007)’s findings, this study proposes that satisfaction with an E-wallet can compel impulse purchase behavior. More formally, this study hypothesizes that:

H9

Satisfaction with using an E-wallet has a positive influence on impulse buying.

Perceived enjoyment

Perceived enjoyment is defined as “the extent to which the activity of using the computer is perceived to be enjoyable in its own right, apart from any performance consequences that may be anticipated” (Zhou and Feng 2017, p. 3). Perceived enjoyment is a form of hedonic motivation (Chan et al. 2017; Lew et al. 2020; Rouibah et al. 2021), comprising emotional states such as entertainment, fun, and enjoyment (Lew et al. 2020). Per the S–O–R model/theory, perceived enjoyment has been categorized as affective reactions under organism (Chan et al. 2017). When individuals indulge in impulse buying behavior, their affective reactions (positive and negative emotional responses) will appear to either motivate or avoid their impulse purchase urges (Chan et al. 2017; Sihombing et al. 2020; Verhagen and Dolen 2011). While cognitive reactions (e.g., satisfaction) require beliefs, thoughts, and perceptions when interacting with the impulse purchase triggers (Chan et al. 2017), perceived enjoyment focuses on individuals’ hedonic motivation in which they have to indicate whether they are having fun or pleasure when using E-wallet (Lew et al. 2020). Comparable with prior studies (Ashfaq et al. 2019; Hsiao et al. 2016; Rouibah et al. 2021; Do et al. 2020; Hussein et al. 2021), this research adopts both satisfaction (cognitive reaction) and perceived enjoyment (affective reaction) of using mobile payment system such as an E-wallet.

Beatty and Ferrell (1998) argued that individuals inclined to make impulse purchases tend to spend less cognitive effort forming purchasing decisions because of emotional interests in products. Consumers’ mood depends on the feeling before purchasing transactions (Floh and Madlberger 2013). When individuals enjoy interacting with an online shopping platform, they tend to have higher impulsive buying behavior, resulting in unplanned purchases (Sihombing et al. 2020). Xiang et al. (2016) reported that consumers made impulse purchases decision because they were influenced by their perceived enjoyment when using the social commerce platforms (Xiang et al. 2016). Do et al. (2020) found that users who experienced greater enjoyment in adopting mobile-augmented reality apps exhibited impulse purchasing behavior. In light of these findings, this study hypothesizes that the E-wallet’s perceived enjoyment as a positive affective reaction can compel unplanned purchases. Hence, this study hypothesizes that:

H10

Perceived enjoyment of using an E-wallet has a positive influence on impulse buying.

Methodology

Sample and data collection procedure

This study targeted Malaysian Generation Y and Z respondents, born from 1978 to 1994 (Lim et al. 2015; Ali et al. 2019) and from 1995 to 2010, respectively (Ahmed et al. 2020; Nielsen 2019). The Malaysian government has provided incentives for adopting E-wallet to young Malaysians (Ministry of Finance Malaysia 2020). Malaysian Gen Zers acquire spending power (Nielsen 2019; Ahmed et al. 2020) and are the keenest E-wallet users compared to other generational cohorts (Oppotus 2020). Moreover, E-wallet adoption is prevalent among technology-savvy users comprising Malaysian Generation Y and Z (Izwan 2021; Rohiman 2020). Because some E-wallet applications restrict certain features and promotions for users below 18 years old (Touch’ n Go eWallet 2020), this study targeted e-wallet users between 18 and 44 years old (i.e., born between the years 1977 and 2003) as respondents.

This study adopted a cross-sectional approach utilizing an online survey for primary data collection (Shukla 2008). Recent reports confirmed that Malaysian internet users in age ‘20s, ‘30s, and ‘40s widely adopt and share online content on social media (MCMC 2020). Thus, the online survey link was posted on social media (Facebook, Instagram, etc.) to facilitate data collection. A non-probability purposive sampling technique was adopted in the current study. Purposive sampling requires participants to meet some characteristics or criteria that the researcher seeks to study to enhance the accuracy of results (Sarstedt et al. 2017). The filtering questions were (1) asking respondents whether having at least one registered E-wallet account and (2) ever conducted a transaction using E-wallet within the past 12 months (Lew et al. 2020). Only respondents who answered “Yes” for both questions were requested to answer the survey.

Construct measurements and data analysis methods

As shown in Table 3, all construct measurements were adapted from previous literature, with minor modifications made to ensure contextual consistency. An expert review was done to ensure the survey’s content validity, and the modifications were made accordingly. Partial Least Squares Structural Equation Modeling (PLS-SEM) analysis was conducted using Smart PLS. A structural equation modeling (SEM) technique was utilized because it efficiently predicts how well a set of constructs predicts a dependent variable (Hair et al. 2014). This study was proposed to examine users’ behaviors on E-wallet applications and how these factors influence consumers’ impulsive buying behavior. Thus, PLS-SEM was deemed appropriate for this study compared to covariance-based SEM (concentrates less on explained variance, R2).

Results

Data examination

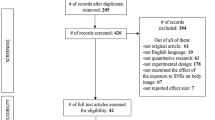

This study used Google form for data collection. The parameters were programed to prohibit participants from overlooking or omitting questions; thus, there were no missing values in the data. One response associated with not utilizing an E-wallet for purchasing transactions was omitted. This study framework is a multivariate model with more than one independent variable. Mahalanobis distance (d2) values were identified to assess the multivariate outliers. The critical value of d2 for four independent variables is 18.47 (p < 0.001) (Tabachnick and Fidell, 2013). The current research framework’s d2 maximum value is 22.65, which exceeds the critical value. Thus, there were four cases with d2 above the critical value; hence, they were removed.

This study utilized a five-point Likert scale by giving respondents to rate their agreement and disagreement for each survey item. Hair et al. (2014) suggested that a straight-lining response with all 1 s, 3 s, and 5 s should be discarded. Based on a thorough check of the 213 datasets, a total of seven datasets with all 3 s and 5 s were omitted. Hence, a final sample of 201 responses was used in the final study. This resulted in a 94.4% response rate that surpasses the minimum sample size of 174 obtained from G*Power with an effect size of 0.15, a significance level of 0.5, and a power of 0.99 (Singh 2006).

While performing PLS-SEM, the data are not necessary to be normally distributed (Hair et al. 2017). However, the extremely non-normal data will generate issues while evaluating the significance of the parameters and inflates standard errors obtained from bootstrapping (Hair et al. 2017). Hence, Hair et al. (2017) recommended that researchers examine the skewness and kurtosis. A general guideline for skewness and kurtosis should be between − 3 to + 3 and − 10 to + 10, respectively (Brown 2006). Results revealed that skewness and kurtosis for all latent constructs in this study ranged between − 0.401 to − 0.180 and − 0.769 to 1.886, respectively, fall within the criteria of normality of the data.

Common method bias

Harman’s single factor was determined to detect common method bias (CMB) because the independent variables’ and dependent variables’ data were gathered from the same respondents. Unrotated principal component factor analysis accounted for 20.48% of the variance in data which is less than 50%, indicating that the dataset does not suffer from CMB (Podsakoff et al. 2003).

Respondent demographics

Among the 201 respondents, the percentage of males was 34.8%, and females were 65.2%. The majority of the participants were from the age group of 18 to 26. The majority of the respondents were students (61.7%). More than half of the respondents (64.7%) had a monthly salary of RM 2000 and below. These percentages correspond to the previous percentages for occupations whereby most of the group were students.

The results revealed that 61.7% of the respondents have just begun to use E-wallet in the past one to 2 years. 72.6% of the respondents have used E-wallet to perform transactions six to ten times within the last 12 months. Moreover, the top three digital wallets chosen by the respondents were Touch n’Go e-wallet (N = 159), followed by Shopee Pay (N = 113), and Grab Pay (N = 62). The respondents were most commonly using E-wallet to pay for food and beverage (N = 170), convenience stores (N = 127), groceries (N = 126), etc. There are several reasons been indicated by the respondents regarding the purpose of using E-wallets. As tabulated in Table 2, more than 80% of the respondents use E-wallets for purchasing food and beverage. More than 60% of the respondents indicated that they use E-wallets on groceries and convenience stores. Besides, the respondents use E-wallet to pay for food delivery, bill payment, transportation, petrol, and mobile reload. More than 10% of respondents use E-wallet to pay for gaming and movie tickets. Few respondents use E-wallet to pay for online shopping (N = 9), hotel booking (N = 3), instant transfer (N = 3), health services (N = 3), and rentals (N = 2). Only one respondent reported that he uses E-wallets for any purchasing transaction of less than RM150. The detailed demographic information of respondents is shown in Table 2.

Measurement model

To measure convergent validity, AVE values should fulfill the minimum threshold of 0.50, indicating each construct should account for at least 50% of the assigned indicators’ variance (Hair et al. 2017). Most indicators are highly loaded on each construct and are significant, which are above 0.5 except II3 (0.461). Since the outer loading of II3 falls within 0.40 to 0.70, it was retained to assess further (Hair et al. 2017). The values of composite reliability (CR) and average variance extracted (AVE) were examined and analyzed on the impact of the indicator deletion (Hair et al. 2017). The AVE of the subjective norm was 0.458, not fulfilling the minimum threshold of 0.5 before the deletion of items. Thus, the item with lower loading (II3) was removed to achieve the threshold of 0.5 (Hair et al. 2017). Subsequently, the AVE and CR of all variables were fulfilled the minimum threshold of 0.5 and 0.7, respectively (Table 3).

In sum, all the squared roots of AVEs (bold diagonal values) are higher than the correlations with other constructs (Fornell and Larcker 1981), as shown in Table 4. As shown in Table 4, the heterotrait–monotrait ratio of correlations (HTMT) are below the threshold of 0.85 (Henseler et al. 2015). Both Fornell–Larcker criterion and HTMT results provided sufficient evidence of discriminant validity for all variables (Table 5).

Variance inflation factor (VIF) values of at five or above indicate potential collinearity problems (Hair et al. 2011). The current study results found that all constructs’ inner VIF ranged from 1.057 to 1.349, which are lower than 5. Hence, based on the collinearity assessment results, collinearities between the variables are not an issue in the current research framework.

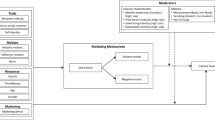

Structural model

The data analysis results support all the hypotheses except H3, H4, H5, and H9, as shown in Fig. 2. H1 and H2 were supported, indicating PI had significant relationship with SA (β = 0.386; p < 0.001) and PE (β = 0.182; p < 0.01). PR had no significant relationship with SA (β = − 0.119; p > 0.05) and PE (β = − 0.025; p > 0.05), thus, rejecting H3 and H4, respectively.

VA (β = 0.089; p > 0.05) had not significant relationship with SA, hence, rejecting H5. However, VA (β = 0.322; p < 0.001) significantly influenced PE, thus supporting H6. SN had positively influenced SA (β = 0.110; p < 0.05) and PE (β = 0.171; p < 0.01), thus, supporting H7 and H8, respectively. SA (β = 0.122; p > 0.05) had no significant relationship with IB, thus rejecting H9. H10 was supported, indicating that PE (β = 0.192; p < 0.01) had a positive and significant relationship with IB.

The R2 (coefficient of determination) was determined to assess the predictive accuracy of the dependent variables. Overall, the model interprets 24.4% of PE, 21.4% of SA, and 7.6% of IB, as depicted in Fig. 2. The R2 values of 0.244 and 0.214 were above the threshold of 0.13 as suggested by Cohen (1988), which denoted a moderate predictive power. R2 values of 0.076 represent weak predictive power (Cohen 1988).

Discussion

This study examines the E-wallet impact on impulse buying among Malaysian Gen-Y and Gen-Z through the S–O–R model/theory lens. The data showed that perceived interactivity positively influenced users’ satisfaction with E-wallets; and had the strongest direct effect in predicting users’ satisfaction with E-wallets compared to other predictors. This observation is compatible with prior findings indicating that perceived interactivity enhanced satisfaction (Meyliana et al. 2020; Cheng 2020; Li et al. 2020). Implicatively, prospective users may be more concerned with fulfilling their information needs such as responsiveness, accessibility, and convenience while using an E-wallet, which subsequently enhances their satisfaction with using the application. Moreover, this study indicated that perceived interactivity elevated perceived enjoyment with E-wallet, which aligns with similar findings (Jang and Park 2019; Coursaris and Sung 2012).

In the context of this study, the influence of perceived risk on perceived enjoyment was not significant, contravening prior works (Lang 2018; Claus-Peter and Alexander 2016). Relatedly, this study found that perceived risk had no significant direct influence on E-wallet satisfaction, thereby contradicting previous findings (Ofori et al. 2016; Tandon et al. 2017). It could be asserted that users may have some risk concerns regarding identity or information theft when using digital wallets (Leong et al. 2019). Research has shown that risk barriers impacted intention to use mobile commerce in Malaysia (Moorthy et al. 2017). Likewise, risk significantly predicts mobile wallet resistance among Malaysian users (Leong et al. 2019). Bagla and Sancheti (2018) noted that from the digital wallet service provider perspective, lack of trust, particularly perceived risk issues, is the most challenging task to be overcome (Bagla and Sancheti 2018).

This study revealed that visual appeal had no significant impact on E-wallet satisfaction, contradicting recent findings (Ting 2018). On the other hand, visual appeal was positively related to the E-wallet perceived enjoyment. Likewise, Sihombing et al. (2020) and Zhang et al. (2020) reported that visual appeal significantly predicted perceived enjoyment. Thus, the visually pleasing design could enhance the overall app interface’s presentation, which arouses users’ gratification and positive feelings when engaging with E-wallets (Ku and Chen 2019).

This study found that subjective norm had a significant and positive relationship with E-wallet satisfaction. This finding demonstrates the vital role of an individual’s family, friends, colleagues, peers, and influencers in boosting E-wallet usage and satisfaction. This study’s findings support some research (Phonthanukitithaworn and Sellitto 2017) while countering others (Yuda et al. 2020). Furthermore, this study demonstrated that interpersonal and media influence positively influenced E-wallet users’ perceived enjoyment, which conforms with Liu et al.’s (2021) finding discovering a positive relationship between subjective norms and perceived enjoyment.

The data showed that satisfaction with E-wallet had no significant influence on impulse buying, which is discordant with recent research (Gogoi 2017). Implicatively, satisfaction with using an E-wallet would not compel the users to make impulse purchases. Cognition refers to how individuals analyze information (Youn and Faber 2000; Husnain and Akhtar 2016). Satisfaction is a type of cognitive reaction (Chan et al. 2017) in which consumers judge whether the product or service provided a pleasurable level related to consumers’ fulfillment response (Martínez Caro and Martínez García 2007). When individuals are rational, they will be less subjective in evaluating their needs and allocate more energy to the targeted things. In light of this, they are more likely to have planned than impulse purchases (Zhang et al. 2020). Contrary to previous findings, this study posits that individuals’ satisfaction, a type of rational reaction, may not influence their impulse buying behavior.

The current study found that perceived enjoyment was a significant antecedent in predicting E-wallet users’ impulse purchases. In other words, E-wallet users feel that the application’s actual process is enjoyable, fun, and pleasant—and this perceived experience induces unplanned purchase desires. This observation concords with empirical studies revealing that perceived enjoyment significantly influenced impulsive buying intention (Zhang et al. 2020; Hasima et al. 2020). Relatedly, prior research has found that positive emotion encourages individuals to generously reward themselves (Zhang et al. 2020) and makes them feel they have more freedom to act (Heilman et al. 2002). Table 6 summarizes the research findings in relation to previous studies.

Practical implications

This study offers some implications for E-wallet system designers and Malaysian merchants. The data demonstrated that perceived interactivity positively correlates with satisfaction and perceived enjoyment of using E-wallet. Thus, it is recommended that E-wallet system designers assure the compatibility between E-wallet’s features and users’ requirements as well as develop interactivity-based mechanisms (e.g., useful instruments such as real-time purchasing transactions), which contributes to user value and satisfaction (Cheng 2020). This study recommends personalized marketing to highlight fast accessibility and responsiveness speed to promote E-wallet.

This study indicated that subjective norm positively correlates with E-wallet satisfaction and perceived enjoyment. Although system designers and merchants will not alter an individual’s mind and personal network, they can promote E-wallet benefits among users, family, and friends through social media. Encouragement from family members and peers can produce a strong word-of-mouth effect in promoting E-wallet. In addition, social media influencers, key opinion leaders, and media celebrities can endorse E-wallet adoption; this establishes and enhances the parasocial interaction between apps users and endorsers. These parasocial connections can boost perceived enjoyment and, thus, encourage impulsive purchase (Xiang et al. 2016; Zafar et al. 2020).

System designers should emphasize proper visual elements, including background color, layouts, and images, as visual appeal positively impacts the E-wallet’s perceived enjoyment. Users’ positive emotional response (perceived enjoyment) elicited through E-wallet’s visual appeal promotes impulse purchase intention. In this regard, E-wallet companies can acquire user feedback to design E-wallet with a visually appealing interface.

Finally, this study verified the relationship between perceived enjoyment and impulse buying. Findings demonstrated that E-wallet users perceive the actual process of using E-wallet as pleasant, enjoyable, and fun, which subsequently induces impulse purchase intents. Therefore, this study accentuates the importance of E-wallet users’ enjoyment experience for enhancing impulse purchases. Accordingly, designers and developers should minimize the tediousness of using the E-wallet during payment transactions and incorporate instant cashback to evoke a sense of enjoyment, gratification, and pleasance in users.

Limitations and recommendations

This section highlights limitations and recommendations for future work. First, this study was limited to Gen-Y and Gen-Z respondents; hence, future research can compare different age groups, as E-wallet perceptions vary across diverse generation profiles. This study identified and investigated several factors influencing consumers’ perceived enjoyment and satisfaction associated with impulse purchase behavior. Future research examining impulse buying intentions should extend to other extrinsic factors such as cashback and convenience. Last but not least, the use of non-random sampling in this study cannot generalize to the whole population (Zikmund and Babin 2010). Therefore, future studies may apply a probability sampling technique to include E-wallet users from different ethnicities, especially since Malaysia is multicultural.

Conclusion

Malaysia has widely adopted mobile payment systems, including E-wallets. Thus, it is essential to determine the predictors of the end user’s experience (satisfaction and perceived enjoyment) and develop a strategy to cultivate a pleasant E-wallet experience. While considerable research has been conducted regarding the antecedents to using and adopting mobile payment, there is limited study determining whether users’ experience with E-wallet will impact spending behaviors. This study contributes insights into this stream by examining whether cognitive reaction (satisfaction) and affective reaction (perceived enjoyment) will lead to impulse purchase in Malaysia. To this end, the present work validated the relationship between perceived enjoyment and impulse buying, albeit it did not confirm the relationship between satisfaction and impulse buying. Conclusively, perceived enjoyment, an emotional response, significantly influenced online impulse buying. Contrary to the previous research findings, this study indicates that satisfaction, categorized as a rational reaction, may not impact impulse buying. Finally, the observation that perceived enjoyment with E-wallet could encourage consumers to make unplanned purchases is beneficial for buyers to enhance awareness and understanding regarding impulse purchase intents. Consumers should make mindful purchases instead of impulse purchases to avoid unnecessary expenses.

References

Abdullah, N., F. Redzuan, and N.A. Daud. 2020. E-wallet: Factors influencing user acceptance towards cashless society in Malaysia among public universities. Indonesian Journal of Electrical Engineering and Computer Science 20 (1): 67–74.

Adilla, F. 2020. Expert: Penjana covers many groups. Retrieved from New Straits Times https://www.nst.com.my/news/nation/2020/06/598375/expert-penjana-covers-many-groups

Ahmed, R.I., N. Bang, J. Chen, T.C. Melewar, and M. Bahtiar. 2020. Brand engagement in self-concept (BESC), value consciousness and brand loyalty: a study of generation Z consumers in Malaysia. Young Consumers 22: 1–19.

Aji, H.M., I. Berakon, and M. Md Husin. 2020. COVID-19 and e-wallet usage intention: A multigroup analysis between Indonesia and Malaysia. Cogent Business & Management 7 (1): 1–17.

Akram, U., H. Peng, M. Khan, T. Yasir, M. Khalid, and A. Wasim. 2017. How website quality affects online impulse buying: Moderating effects of sales promotion and credit card use. Asia Pacific Journal of Marketing and Logistics 30 (1): 235–256.

Ali, S., M.M. Imtiaz, and T. Mutsumi. 2019. Using SERVQUAL to determine Generation Y’s satisfaction towards hoteling industry in Malaysia. Journal of Tourism Futures 5 (1): 62–74.

Amoroso, D.L., and R. Magnier-Watanabe. 2012. Building a research model for mobile wallet consumer adoption: The case of mobile Suica in Japan. Journal of Theoretical and Applied Electronic Commerce Research 7 (1): 94–110.

Anubhav, M., and S. Anuja. 2020. Psychological determinants of consumer’s usage, satisfaction, and word-of-mouth recommendations toward smart voice assistants. FIP Advances in Information and Communication Technology. https://doi.org/10.1007/978-3-030-64849-7_24.

Ashfaq, M., J. Yun, A. Waheed, M.S. Khan, and M. Farrukh. (2019). Customers’ Expectation, Satisfaction, and Repurchase Intention of Used Products Online: Empirical Evidence From China. SAGE Open 9 (2): 1–14.

Badgaiyan, A., and A. Verma. 2015. Does urge to buy impulsively differ from impulsive buying behaviour? Assessing the impact of situational factors. Journal of Retailing and Consumer Services 22 (1): 145–157.

Bagla, R.K., and V. Sancheti. 2018. Gaps in customer satisfaction with digital wallets: Challenge for sustainability. Journal of Management Development 37 (6): 442–451.

Beatty, S., and E. Ferrell. 1998. Impulse buying: Modeling its precursors. Journal of Retailing 74 (2): 161–167.

Bigne, E., K. Chatzipanagiotou, and C. Ruiz. 2020. Pictorial content, sequence of conflicting online reviews and consumer decision-making: The stimulus–organism–response model revisited. Journal of Business Research 115: 403–416.

Bochner, S. 1994. Cross-cultural differences in the self-concept: A test of Hofstede’s individualism/collectivism distinction. Journal of Cross-Cultural Psychology 25: 273–283.

Bressolles, G., F. Durrieu, and M. Giraud. 2007. The impact of electronic service quality’s dimensions on customer satisfactionand buying impulse. Journal of Consumer Behavior 6 (1): 37–56.

Brown, T.A. 2006. Confirmatory factor analysis for applied research. New York: Guilford Press.

Chan, T.K., C.M. Cheung, and Z.W. Lee. 2017. The state of online impulse-buying research: A literature analysis. Information Management 54 (2): 204–217.

Chen, C.C., and J.Y. Yao. (2018). What drives impulse buying behaviors in a mobile auction? The perspective of the Stimulus-Organism-Response model. Telematics and Informatics 35: 1249–1262.

Chen, S.C., K.C. Chung, and M.Y. Tsai. 2019a. How to Achieve Sustainable Development of Mobile Payment through Customer Satisfaction—The SOR Model. Sustainability 11 (6314): 1–16.

Chen, Q., Y. Feng, L. Liu, and X. Tian. 2019b. Understanding consumers’ reactance of online personalized advertising: A new scheme of rational choice from a perspective of negative effects. International Journal of Information Management 44: 53–64.

Cheng, Y.M. 2020. Students’ satisfaction and continuance intention of the cloud-based e-learning system: Roles of interactivity and course quality factors. Education + Training. https://doi.org/10.1108/ET-10-2019-0245.

Chopdar, P.K., and V.J. Sivakumar. 2018. Understanding continuance usage of mobile shopping applications in India: the role of espoused cultural values and perceived risk. Behaviour & Information Technology 38: 1–23.

Chopdar, P.K., and J. Balakrishnan. 2020. Consumers response towards mobile commerce applications: S-O–R approach. International Journal of Information Management 53: 102106.

Claus-Peter, H.E., and W.E. Alexander. 2016. The influence of privacy risk on smartwatch. Twenty-second Americas Conference on Information Systems, San Diego.

Cocosila, M., and H. Trabelsi. 2016. An integrated value-risk investigation of contactless mobile payments adoption. Electronic Commerce Research & Applications 20: 159–170.

Cohen, J. 1988. Statistical power analysis for the behavioral science, 2nd ed. Hillsdale, NJ: Lawrence Erlbaum Associates.

Coursaris, C.K., and J. Sung. 2012. Antecedents and consequents of a mobile websites interactivity. New Media & Society 14: 1128–1146.

Daragmeh, A., J. Sági, and Z. Zéman. 2021. Continuous intention to use E-wallet in the context of the COVID-19 pandemic: Integrating the Health Belief Model (HBM) and Technology Continuous Theory (TCT). Journal of Open Innovation: Technology, Market, and Complexity 7 (132): 1–23.

Djafarova, E., and T. Bowes. 2021. Instagram made Me buy it": Generation Z impulse purchases in fashion industry. Journal of Retailing and Consumer Services. 59: 102345.

Do, H.N., W. Shih, and Q.A. Ha. 2020. Effects of mobile augmented reality apps on impulse buying behavior: An investigation in the tourism field. Heliyon 6 (8): e04667.

Ernst, C.P. 2014. Risk Hurts Fun: The Influence of Perceived Privacy Risk on Social Network Site Usage. Twentieth Americas Conference on Information Systems, Savannah.

Floh, A., and M. Madlberger. 2013. The role of atmospheric cues in online-impulse buying behavior. Electronic Commerce Research and Applications 12 (1): 45–439.

Fornell, C., and D.F. Larckers. 1981. Evaluating strcutural equation models with unobservable variables and measurement error. Journal of Marketing Research 18 (1): 39–50.

Gogoi, B.J. 2017. Effect of store design on perceived crowding and impulse buying behavior. International Review of Management and Marketing 7 (2): 180–186.

Hair, J.F., G.T. Hult, C.M. Ringle, and M. Sarstedt. 2017. A primer on partial least squares structural equation modeling (PLS-SEM), 2nd ed. London: SAGE Publications Inc.

Hair, J.J., G.M. Hufit, C.M. Ringle, and M. Sarstedt. 2014. A primer on partial least squares structural equation modelling (PLS-SEM). London: SAGE Publications Inc.

Hair, J.F., C.M. Ringle, and M. Sarstedt. (2011). PLS-SEM: Indeed a Silver Bullet. Journal of Marketing Theory and Practice 19 (2): 139–152.

Handayani, N.S., and K. Rahyuda. 2020. Website quality affects online impulse buying behavior (OIBB): Moderating effects of sales promotion and digital wallet use (A Study on Tokopedia E-Commerce). SSRG International Journal of Economics and Management Studies 7 (12): 16–24.

Hasima, M.A., S. Hassan, M.F. Ishak, and A.A. Razak. 2020. Factors influencing Gen-Y in Malaysia to purchase impulsively: A mediating effect of perceived enjoyment. International Journal of Innovation, Creativity and Change 11 (5): 385–396.

Hassan, M.A., Z. Shukur, and M.K. Hasan. 2021. Electronic wallet payment system in Malaysia. Data Analytics and Management 54: 711–736.

Heilman, C.M., K. Nakamoto, and A. Rao. 2002. Pleasant surprises: Consumer response to unexpected in-store coupons. Journal of Marketing Research 39 (2): 242–252.

Henseler, J., C.M. Ringle, and M. Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43: 115–135.

Hsiao, C., L.J. Chang, and K. Tang. (2016). Exploring the influential factors in continuance usage of mobile social Apps: Satisfaction, habit, and customer value perspectives. Telematics and Informatics 33 (2): 342–355.

Hsiao, M.-H. 2020. Influence of interpersonal competence on behavioral intention in social commerce through customer-perceived value. Journal of Marketing Analytics 9 (1): 44–55.

Hsieh, J.J., A. Rai, and M. Keil. 2008. Understanding digital inequality: Comparing continued use behavioral models of the socio-economically advantaged and disadvantaged. MIS Quarterly 32 (1): 97–126.

Huang, L.T. 2016. Flow and social capital theory in online impulse buying. Journal of Business Research 69 (6): 2277–2283.

Hussein, R.S., H. Mohamed, and A. Kais. 2021. Antecedents of level of social media use: Exploring the mediating effect of usefulness, attitude and satisfaction. Journal of Marketing Communications. https://doi.org/10.1080/13527266.2021.1936125.

Husnain, M., and M.W. Akhtar. 2016. Impact of branding on impulse buying behavior: Evidence from FMCG’s sector Pakistan. International Journal of Business Administration 7 (1): 59–68.

Izwan, I. 2021. E-wallet use in Malaysia growing. Retrieved from News Straits Time: https://www.nst.com.my/opinion/columnists/2021/04/683345/e-wallet-use-malaysia-growing

Jang, Y.J., and E. Park. 2019. An adoption model for virtual reality games: The roles of presence and enjoyment. Telematics and Informatics. 42: 101239.

Junadi, S., and Sfenrianto. 2015. A model of factors influencing consumer’s intention to use e-payment system in Indonesia. Procedia Computer Science 59: 214–220.

Jung, H.J. 2014. Ubiquitous learning: Determinants impacting learners’ satisfaction and performance with smartphones. Language Learning Technology 18: 97–119.

Karjaluoto, H., A.A. Shaikh, H. Saarijärvi, and S. Saraniemi. 2018. How perceived value drives the use of mobile financial services apps. International Journal of Information Management. 47: 252–261.

Kasirye, F., and H.M. Mahmudul. 2021. The effects of e-wallet among various types of users in Malaysia: A comparative study. 3rd Kuala Lumpur International Conference on Education, Economics and Technology (KLICEET2021). Kuala Lumpur, Malaysia: Asian Scholars Network.

Kim, B. 2011. Understanding antecedents of continuance intention in social-networking services. Cyberpsychology, Behavior, and Social Networking 14 (4): 199–205.

Kim, B. 2017. Understanding key antecedents of user loyalty toward mobile messenger applications: An integrative view of emotions and the dedication-constraint model. International Journal of Human-Computer Interaction 33 (12): 1–17.

Kim, D.J., D.L. Ferrin, and H.R. Rao. 2008. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems 44 (2): 544–564.

Krishanan, D., L.T. Kevin Low, and K. Siti. 2017. Moderating effects of agw & education on consumers' perceived interactivity & intention to use mobile banking in Malaysia: A structural equation modeling approach. Proceeding of International Conference on Humanities, Language, Culture & Business, (pp. 39–52). Penang, Malaysia.

Ku, E.C., and C.D. Chen. 2019. Flying on the clouds: How mobile applications enhance impulsive buying of low cost carriers. Service Business 14 (1): 23–45.

Lang, C.M. 2018. Perceived risks and enjoyment of access-based consumption: Identifying barriers and motivations to fashion renting. Fashion and Textiles 5 (23): 1–18.

Lazard, A., I. Watkins, M.S. Mackert, B. Xie, K. Stephens, and H. Shalev. 2016. Design simplicity influences patient portal use: The role of aesthetic evaluations for technology acceptance. Journal of the American Medical Informatics Association 23 (e1): E157–E161.

Lee, J.A., and J.J. Kacen. 2008. Cultural influences on consumer satisfaction with impulse and planned purchase decisions. Journal of Business Research 61 (3): 265–272.

Leong, L.Y., T.S. Hew, K.B. Ooi, and J. Wei. 2019. Predicting mobile wallet resistance: A two-staged structural equation modeling-artificial neural network approach. International Journal of Information Management. 51: 102047.

Li, Y., H. Wang, X. Zeng, S. Yang, and J. Wei. (2020). Effects of interactivity on continuance intention of government microblogging services: an implication on mobile social media. International Journal of Mobile Communications 18 (4).

Lew, S., G.W. Tan, X.M. Loh, J.J. Hew, and K.B. Ooi. 2020. The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technology in Society 63: 101430.

Lim, Y.S., A. Omar, and T. Ramayah. 2015. Online purchase: A study of generation Y in Malaysia. International Journal of Business and Management 10 (6): 1–7.

Lin, S.W., and L.Y. Lo. 2015. Evoking online consumer impulse buying through virtual layout schemes. Behaviour & Information Technology 35 (1): 38–56.

Liu, H., H. Chu, Q. Huang, and X. Chen. 2016. Enhancing the flow experience of consumers in China through interpersonal interaction in social commerce. Computers in Human Behavior 58: 306–314.

Liu, Q., Z. Shao, J. Tang, and W. Fan. 2019. Examining the influential factors for continued social media use. Industrial Management & Data Systems 119 (5): 1104–1207.

Liu, Y., Q. Li, T. Edu, L. Jozsa, and I.C. Negricea. 2020. Mobile shopping platform characteristics as consumer behavior determinants. Asia Pacific Journal of Marketing and Logistics 32 (7): 1565–1587.

Liu, Y.Q., Y. Gan, Y. Song, and J. Liu. 2021. What influences the perceived trust of a voice-enabled smart home system: An empirical study. Sensors 21 (6): 2037.

Liu, Y., H.X. Li, and F. Hu. 2013. Website attributes in urging online impulse purchase: An empirical investigation on consumer perceptions. Decision Support Systems 55 (3): 829–837.

Lucas, M., and E. Koff. 2014. The role of impulsivity and of self-perceived attractiveness in impulse buying in women. Personality and Individual Differences 56: 111–115.

Madan, K., and R. Yadav. 2018. Understanding and predicting antecedents of mobile shopping adoption. Asia Pacific Journal of Marketing and Logistics 30 (1): 139–162.

Mandolfo, M., and L. Lamberti. 2021. Past, present, and future of impulse buying research methods: A systematic literature review. Frontiers in Psychology 12: 1.

Martínez Caro, L., and J.A. Martínez García. 2007. Cognitive–affective model of consumer satisfaction. An exploratory study within the framework of a sporting event. Journal of Business Research 60 (2): 108–114.

MCMC. 2020. Internet Users Survey 2020. Retrieved from Malaysian Communications and Multimedia Commission: https://www.mcmc.gov.my/skmmgovmy/media/General/pdf/IUS-2020-Report.pdf

Melissa Teoh, T.T., C.Y. Hoo, and T.H. Lee. 2020. E-wallet adoption: A case in Malaysia. International Journal of Research in Commerce and Management Studies 2 (2): 216–223.

Meyliana, A.N.H., S. Bruno, K.B. Eko, and M.P. Nurul. 2020. The impact of parasocial interaction toward prospective students’ intention to enrol in a university and share information through electronic word-of-mouth. International Journal of Business Innovation and Research 21 (2): 176–197.

Miao, M., T. Jalees, S. Qabool, and S.I. Zaman. 2019. The effects of personality, culture and store stimuli on impulsive buying behavior. Asia Pacific Journal of Marketing and Logistics 32 (1): 188–204.

Ministry of Finance Malaysia. (2020). Budget 2021. Malaysia. Retrieved from https://www.treasury.gov.my/pdf/speech/budget-2021-touchpoints-en.pdf

Moghavvemi, S., X.M. Tan, S.W. Phoong, and S.Y. Phoong. 2021. Drivers and barriers of mobile payment adoption: Malaysian merchants’ perspective. Journal of Retailing and Consumer Services 59: 102364.

Moorthy, K., S.L. Ching, W.F. Yeong, M.Y. Chan, K.Y. Elaine Chong, S.Y. Kwa, and K.W. Lee. 2017. Barriers of mobile commerce adoption intention: Perceptions of generation X in Malaysia. Journal of Theoretical and Applied Electronic Commerce Research 12 (2): 37–53.

Natarajan, T., S.A. Balasubramanian, and D.L. Kasilingam. 2018. The moderating role of device type and age of users on the intention to use mobile shopping applications. Technology in Society 53: 79–90.

Nielsen. 2019. Understanding Malaysia's Gen Z... and How to reach them. Nielsen Insights. https://www.nielsen.com/my/en/insights/article/2019/understanding-malaysias-gen-z/

Nizam, F., H.J. Hwang, N. Valaei. 2019. Measuring the effectiveness of E-wallet in Malaysia. Big Data, Cloud Computing, Data Science & Engineering, Studies in Computational Intelligence, Yonago, Japan, pp. 59–69.

Ofori, K.S., O. Larbi-Siaw, E. Fianu, R.E. Gladjah, and E.O. Boateng. 2016. Factors influencing the continuance use of mobile social media: The effect of privacy concerns. Journal of Cyber Security 4: 105–124.

Okazaki, S., and F. Mendez. 2013. Exploring convenience in mobile commerce: Moderating effects of gender. Computers in Human Behavior 29 (3): 1234–1242.

Oppotus. 2020. E-Wallet usage in Malaysia 2020: Thriving in lockdown. Retrieved from Oppotus: https://www.oppotus.com/e-wallet-usage-in-malaysia-2020/

Parboteeah, D., J. Valacich, and J. Wells. 2009. The influence of website characteristics on a consumer’s urge to buy impulsively. Information Systems Research 20 (1): 60–78.

Patanasiri, A., and D. Krairit. 2018. A comparative study of consumers’ purchase intention on different internet platforms. Mobile Networks and Applications 24: 1–15.

Phonthanukitithaworn, C., and C. Sellitto. 2017. Facebook as a second screen: An influence on sport consumer satisfaction and behavioral intention. Telematics and Informatics 34 (8): 1477–1487.

Phuong, N.N., L.T. Luan, V.V. Dong, and N.L. Khanh. 2020. Examining customers’ continuance intentions towards E-wallet usage: The emergence of mobile payment acceptance in Vietnam. Journal of Asian Finance, Economics and Business 7 (9): 505–516.

Piron, F. 1991. Defining impulse purchasing. Advances in Consumer Research 18 (1): 509–514.

Podsakoff, P.M., S.B. MacKenzie, and J.Y. Lee. 2003. Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology 88 (5): 879–903.

Pradhan, D., D. Israel, and A.K. Jena. 2018. Materialism and compulsive buying behaviour: The role of consumer credit card use and impulse buying. Asia Pacific Journal of Marketing and Logistics. 30: 1239–1258.

Ramírez-Correa, P.E., F.J. Rondán-Cataluña, and J. Arenas-Gaitán. 2018. Student information system satisfaction in higher education: the role of visual aesthetics. Kybernetes. https://doi.org/10.1108/K-08-2017-0297.

Rohiman, H. 2020. E-wallet gaining traction in Malaysia. Retrieved from News Straits Times: https://www.nst.com.my/opinion/columnists/2020/07/605958/e-wallet-gaining-traction-malaysia

Rouibah, K., N. Al-Qirim, and Y.J. Hwang. 2021. The determinants of eWoM in social commerce: The role of perceived value, perceived enjoyment, trust, risks, and satisfaction. Journal of Global Information Management 29 (3): 75–102.

Sarkar, S., and A. Khare. 2017. Moderating effect of price perception on factors affecting attitude towards online shopping. Journal of Marketing Analytics 5: 68–80.

Sarstedt, M., P. Bengart, A.M. Shaltoni, and S. Lehmann. 2017. The use of sampling methods in advertising research: A gap between theory and practice. International Journal of Advertising the Review of Marketing Communications 37 (4): 650–663.

Sedigheh, M., X.M. Tan, S.W. Phoong, and S.Y. Phoong. 2020. Drivers and barriers of mobile payment adoption: Malaysian merchants’ perspective. Journal of Retailing and Consumer Services 59: 1–12.

Shukla, P. 2008. Essentials of marketing research. Paurav Shukla & Ventus Publishing Aps. Retrieved from http://web.ftvs.cuni.cz/hendl/metodologie/marketing-research-an-introduction.pdf

Sihombing, E.S., I. Budi, and Q. Munajat. 2020. Factors affecting the urge of impulsive buying on social commerce Instagram. International Journal of Internet Marketing and Advertising 14 (3): 236–257.

Singh, Y.K. 2006. Fundamental of research methodology and statistics. New Delhi: New Age International (P) Ltd.

Song, J.H., and G.M. Zinkhan. 2008. Determinants of perceived web site interactivity. Journal of Marketing 72 (2): 99–113.

Song, P.J., W.B. Chen, C. Zhang, and L.H. Huang. 2011. Understanding the role of intrinsic motivations in information technology usage habit: Evidence from instant messenger and search engine. International Journal of Organisational Design and Engineering 1 (3): 163–183.

Statista, R.I. 2020. Major e-payment services used among respondents in Malaysia in 2020. Retrieved from Statista: https://www.statista.com/statistics/1106239/malaysia-leading-e-payment-services/

Tabachnick, B.G., and L.S. Fidell. 2013. Using multivariate statistics, 6th ed. Pearson: Pearson Education Inc.

Tafarodia, R.W., and J.S. Alyson. 2001. ndividualism–collectivism and depressive sensitivity to life events: The case of Malaysian sojourners. International Journal of Intercultural Relations 25: 73–88.

Tandon, U., R. Kiran, and A.N. Sah. 2017. The influence of website functionality, drivers and perceived risk on customer satisfaction in online shopping: An emerging economy case. Information Systems and e-Business Management 16 (1): 57–91.

Thomas, M., K.K. Desai, and S. Seenivasan. 2011. How credit card payments increase unhealthy food purchases: Visceral regulation of vices. Journal of Consumer Research 38 (1): 126–139.

Ting, C. 2018. Mobile commerce website success: Antecedents of consumer satisfaction and purchase intention. Journal of Internet Commerce 17 (3): 1–27.

Touch' n Go eWallet. 2020. Touch' n Go eWallet Official Facebook Account. Retrieved from Facebook: https://www.facebook.com/touchngoewallet/posts/is-there-a-minimum-age-for-opening-a-touchngo-ewallet-account/883846852106686/

Triasesiarta, N., and R.P. Rosinta. 2021. Factors influencing the adoption of mobile payment method among generation Z: The extended UTAUT approach. Journal of Accounting, and Economics 4 (1): 14–28.

Tseng, S.Y., and A.M. Kuo. 2014. Investigating the effects of information quality and perceived risk on information adoption on travel websites. 2014 IEEE International Conference on Management of Innovation and Technology, (pp. 205–210). Taiwan.

Verhagen, T., and W.V. Dolen. 2011. The influence of online store beliefs on consumer online impulse buying. Information & Management 48: 320–327.

Vorderer, P., T.Hartmann, and C. Klimmt. 2003. Explaining the enjoyment of playing video games: the role of competition. Proceedings of the second international conference on Entertainment computing (pp. 1–9). Carnegie Mellon University.

Wong, C.Y., I.K. Mohamed, and M. Pakir. 2020. Understanding the factors influences users continuous intention towards E-wallet in Malaysia: Identifying the gap. Research in Management of Technology and Business 1 (1): 312–325.

Wu, I.L., M.L. Chiu, and K.W. Chen. 2020. Defining the determinants of online impulse buying through a shopping process of integrating perceived risk, expectation-confirmation model, and flow theory issues. International Journal of Information Management 52: 102099.

Xiang, L., X. Zheng, M.K. Lee, and D. Zhao. 2016. Exploring consumers’ impulse buying behavior on social commerce platform: The role of parasocial interaction. International Journal of Information Management 36: 333–347.

Xu, H., K.Z. Zhang, and S.J. Zhao. 2020. A dual systems model of online impulse buying. Industrial Management & Data System. https://doi.org/10.1108/IMDS-04-2019-0214.

Yan, L.Y., G.W. Tan, X.M. Loh, J.J. Hew, and K.B. Ooi. 2021. QR code and mobile payment: The disruptive forces in retail. Journal of Retailing and Consumer Services 58: 102300.

Yoon, H.Y. 2016. User acceptance of mobile library applications in academic libraries: An application of the technology acceptance model. The Journal of Academic Librarianship 42 (6): 687–693.

Youn, S., and R.J. Faber. 2000. Impulse buying: Its relation to personality traits and cues. Advances in Consumer Research 27 (1): 179–185.

Yuan, S.B., L. Liu, B.D. Su, and H. Zhang. 2020. Determining the antecedents of mobile payment loyalty: Cognitive and affective perspectives. Electronic Commerce Research and Applications 41: 100971.

Yuda, B.I., M. Gede, T. Rakhmawati, S. Sumaedi, T. Widianti, M. Yarmen, and N.J. Astrini. 2020. Public transport users' WOM: An integration model of the theory of planned behavior, customer satisfaction theory, and personal norm theory. World Conference on Transport Research - WCTR 2019, 48, pp. 3365–3379. Mumbai.

Zafar, A.U., J. Qiu, and M. Shahzad. 2020. Do digital celebrities’ relationships and social climate matter? Impulse buying in f-commerce. Internet Research. https://doi.org/10.1108/INTR-04-2019-0142.

Zhang, L., Z. Shao, X.T. Li, and Y.Q. Feng. 2021. Gamification and online impulse buying: The moderating effect of gender and age. International Journal of Information Management. https://doi.org/10.1016/j.ijinfomgt.2020.102267.

Zhang, W., X.M. Leng, and S.Y. Liu. 2020. Research on mobile impulse purchase intention in the perspective of system users during COVID-19. Personal and Ubiquitous Computing. https://doi.org/10.1007/s00779-020-01460-w.

Zheng, X.B., J.Q. Men, F. Yang, and X.Y. Gong. 2019. Understanding impulse buying in mobile commerce: An investigation into hedonic and utilitarian browsing. International Journal of Information Management 48: 151–160.

Zhou, R., and C. Feng. 2017. Difference between leisure and work contexts: The roles of perceived enjoyment and perceived usefulness in predicting mobile video calling use acceptance. Frontiers in Psychology. https://doi.org/10.3389/fpsyg.2017.00350.

Zikmund, W., and B. Babin. 2010. Essentials of marketing research. Boston: South-Western Cengage Learning

Acknowledgements

This work was supported by Ministry of Higher Education Malaysia under the Fundamental Research Grant Scheme (Grant No. FRGS/1/2020/SS0/MMU/02/4).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lee, Y.Y., Gan, C.L. & Liew, T.W. Do E-wallets trigger impulse purchases? An analysis of Malaysian Gen-Y and Gen-Z consumers. J Market Anal 11, 244–261 (2023). https://doi.org/10.1057/s41270-022-00164-9

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41270-022-00164-9