Abstract

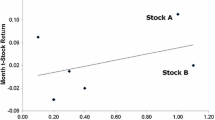

Anomalies based on forecast properties (dispersion and error), size, book-to-market ratio and momentum are evaluated during the period 1992–2001 for a sample of US stocks using an annual buy-and-hold strategy. The forecast property, book-to-market and momentum anomalies all clearly persist during the sample period, while the size anomaly disappears. Although the book-to-market anomaly is the most powerful in magnitude, the forecast property anomalies are the most consistent in year-by-year performance. Combining the forecast property anomalies with either the momentum or book-to-market anomalies results in spectacular return performance. Overall, investors should consider taking advantage of the forecast property anomalies when selecting their stock holdings.

Similar content being viewed by others

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

J Ciccone, S. Forecast dispersion and error versus size, book-to-market ratio and momentum: A comparison of anomalies from 1992 to 2001. J Asset Manag 3, 333–344 (2003). https://doi.org/10.1057/palgrave.jam.2240087

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jam.2240087