Abstract

This paper focuses on recent developments in motor insurance pricing in Germany, Austria and Switzerland. Through the analysis of responses to a recent comprehensive survey of industry representatives, we examine the various premium components and the processes involved in premium adaptation. New findings on the use of different tariff criteria, on the tools used for market-based and customer-specific pricing, and on the information considered for customer valuation are reported. We also address the integration of the insurance sales staff in the pricing process. With regard to premium adjustments and the introduction of new tariffs, we examine the frequency, time required and costs incurred. With this paper, we contribute to a strand of literature where little academic research has been done so far. In addition, our results entail managerial implications for improving industry practices in insurance pricing.

Similar content being viewed by others

Notes

See, for example, Eling and Luhnen (2008).

See, for example, Gesamtverband der Deutschen Versicherungswirtschaft (2012).

See, for example, Schmidt-Gallas and Lauszus (2005) and Pratt (2010).

See Hartmann et al. (2014, Figs. 47 and 48).

See, for example, Erdönmez et al. (2007, Fig. 4).

As done in Hartmann et al. (2014).

As there is an abundance of related academic papers, we focus on the main topics and some examples.

See, for example, Doherty (1981); Hoy (1982); Abraham (1985); Crocker and Snow (1986).

See, for example, Harrington and Doerpinghaus (1993); Hoy (2006); Thomas (2007); Thomas (2008).

See, for example, Finger (2001).

See, for example, Ismail and Jemain (2006).

See, for example, Baxter et al. (1980) and Stroinski and Currie (1989).

See, for example, Kelly and Nielson (2006); Brown et al. (2007); Oxera (2012).

See, for example, Oxera (2010) and Schmeiser et al. (2014).

See, for example, Wenzel and Ross (2005) and Kim et al. (2006).

See, for example, Janke (1991); Litman (2011); Boucher et al. (2013).

See, for example, Bolderdijk et al. (2011) and Greaves et al. (2013).

We focus on papers on pricing in insurance companies. In the general marketing literature, more research has been done. For a comprehensive article on the different components, see, for example, Hinterhuber (2004).

See, for example, Schlesinger and von der Schulenberg (1993) and Brockett et al. (2008).

See, for example, Smith et al. (2000); Yeo et al. (2001); Guelman and Guillén (2014).

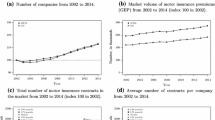

For an overview of the German, Austrian and Swiss motor insurance markets, see, for example, Hartmann et al. (2014).

It should be noted that companies acting as independent single players with independent pricing are included (e.g. the Swiss company smile.direct). We also take into consideration one respondent who completed the survey only partially.

For currency conversions, we apply the EUR/CHF exchange rate of 1.20773 as of 31 December 2012.

As the number of tariff criteria must be an integer, the empirical quantiles are calculated in the case of Question Set A. In contrast, a continuous quantile function is assumed for Question Set F (the quantile function of type 7 according to Hyndman and Fan, 1996).

See, for example, Pearson (1896).

See, for example, Miller (1986).

See, for example, Glass et al. (1972) and Miller (1986).

The McFadden R-squared and residual deviance in Table A1 show that the country and size factor can only explain a low part of the variation in the response variables. As the ordered logit regressions are only complementary in order to disentangle the country and size effects, we do not deal with this issue.

For example, gender by engine power, annual mileage and some other criteria, see Aseervatham et al. (2013).

See, for example, Meyer (2005) and Störmer and Wagner (2013).

See, for example, Meyer (2005) and Kelly and Nielson (2006).

See, for example, Statistisches Bundesamt (2014).

See, for example, McKnight and McKnight (1999); McKnight and McKnight (2003); Kelly and Nielson (2006).

See, for example, Köhne (2011).

Higher frequency in urban areas, worse consequences in rural regions; see, for example, Etgar (1975) and Sipulskyte (2012).

See Sipulskyte (2012).

See Oxera (2010).

See, for example, Litman (2011) and Boucher et al. (2013).

See Abraham (1985).

See White (1976) and Abraham (1985).

See, for example, Laurie (2011).

See, for example, Laurie (2011) and Reddy (2012).

See, for example, Progressive (2012) and Ayuso et al. (2014).

See Kim et al. (2006).

The result of the need for further development in the three areas of pricing is confirmed by the essay of Gard and Eyal (2012), who state that 75 per cent of companies are still focused on cost-based pricing. (As indicated to us by one of this study’s authors, this percentage is an estimate based on their experience in the P&C markets of Germany, France, Italy, Spain and the United Kingdom).

See, for example, Kumar (2007).

The finding of large differences is in line with the results of the survey by Earnix (2011a). In this survey, European insurance carriers were asked for the time needed to implement a new pricing strategy and the answers ranged from “less than two days” to “over three months”.

See Earnix (2011b) and Niessen (2013).

See, for example, Abraham (1985) and Vaughan and Michael (2012).

See, for example, Oxera (2013) and Schmeiser et al. (2014).

See, for example, Vaughan and Michael (2012) and Schmeiser et al. (2014).

See Störmer (2013).

Khanna and Ward (2014, p. 2); see also Vaughan and Michael (2012).

See, for example, Surminski (2014).

See also Jahn et al. (2014).

See, for example, Allianz (2013).

This report by Allianz (2013) shows an increase in the number of new vehicle registrations for Switzerland in 2012. One major reason for this increase is the strength of the Swiss franc compared with the euro (see, e.g. Simer, 2014). In 2013, the number of new vehicle registrations also declined in Switzerland (see Statista, 2014).

See Schmidt-Gallas and Lauszus (2005, p. 13).

See, for example, PWC Consumer Finance Group (2009) and Ernst & Young (2013).

See, for example, Gupta et al. (2006).

See, for example, Gupta et al. (2006) and Kumar (2007).

Jackson (1989a, 1989b, 1989c).

See, for example, Venkatesan and Kumar (2004).

See Earnix (2011b).

See, for example, Sheaf (2008) and Niessen (2013).

See, for example, Schmidt-Gallas and Lauszus (2005); Schmidt-Gallas and Lauszus (2009a); Earnix (2011b).

References

Abraham, K.S. (1985) ‘Efficiency and fairness in insurance risk classification’, Virginia Law Review 71 (3): 403–451.

Agresti, A. (2013) Categorical Data Analysis, 3rd edn, Hoboken, NJ: John Wiley & Sons.

Ajne, B. (1975) ‘A note on the multiplicative ratemaking model’, ASTIN Bulletin 8 (2): 144–153.

Allianz (2013) Inter-Connectedness is Revolutionizing Mobility Habits, Munich, Germany: Allianz SE.

Aseervatham, V., Lex, C. and Spindler, M. (2013) Pitfalls in the implementation of non-discriminatory premiums—the case of unisex tariffs in the German automobile insurance market, working paper, University of Munich, Institute for Risk Management and Insurance.

Ayuso, M., Guillén, M. and Pérez-Marín, A.M. (2014) ‘Time and distance to first accident and driving patterns of young drivers with pay-as-you-drive insurance’, Accident Analysis and Prevention 73: 125–131.

Bailey, R.A. (1963) ‘Insurance rates with minimum bias’, Proceedings of the Casualty Actuarial Society L (93): 4–11.

Bailey, R.A. and Simon, L.J. (1960) ‘Two studies in automobile insurance ratemaking’, ASTIN Bulletin 1 (4): 192–217.

Bättig, V., Burr, B., Fürnthaler, A., Schmeiser, H., Schlieker, A., Stampfli, C. and Zeier, A. (2010) Insurance in 2015—Determining the Position, New Coordinates in the German-speaking Insurance Market, St. Gallen/Zurich, Switzerland: Institute of Insurance Economics of the University of St. Gallen and Accenture.

Baxter, L.A., Coutts, S.M. and Ross, G.A.F. (1980) ‘Applications of linear models in motor insurance’, in Proceedings of the 21st International Congress of Actuaries, Zurich, pp. 11–29.

Bichsel, F. and Straub, E. (1970) ‘Erfahrungstarifierung in der Kollektivkrankenversicherung’, unpublished manuscript.

Bolderdijk, J.W., Knockaert, J., Steg, E.M. and Verhoef, E.T. (2011) ‘Effects of pay-as-you-drive vehicle insurance on young drivers’ speed choice: Results of a Dutch field experiment’, Accident Analysis and Prevention 43 (3): 1181–1186.

Boucher, J.-P., Pérez-Marín, A.M. and Santolino, M. (2013) ‘Pay-as-you-drive insurance: The effect of the kilometers on the risk of accident’, Anales del Instituto de Actuarios Españoles 19: 135–154.

Brat, E., Corradi, D., Eyal, O., Hoying, T. and Sasaki, Y. (2013) ‘Telematics: The test for insurers’, bcg.perspectives.

Brockett, P.L., Golden, L.L., Guillén, M., Nielsen, J.P., Parner, J. and Pérez-Marín, A.M. (2008) ‘Survival analysis of a household portfolio of insurance policies: How much time do you have to stop total customer defection’, The Journal of Risk and Insurance 75 (3): 713–737.

Brown, R.L., Charters, D., Gunz, S. and Haddow, N. (2007) ‘Colliding interests: Age as an automobile insurance rating variable: Equitable rate-making or unfair discrimination?’ Journal of Business Ethics 72 (2): 103–114.

Bruneteau, F., Hallauer, T., Noël, M. and Tusa, S. (2013) Usage-Based Insurance, Global Study, Catch up with the Telematics Revolution, Brussels, Belgium: Ptolemus Consulting Group.

Bühlmann, H. (1967) ‘Experience rating and credibility’, ASTIN Bulletin 4 (3): 199–207.

Bühlmann, H. and Straub, E. (1970) ‘Glaubwürdigkeit für Schadensätze’, Mitteilungen der schweizerischen Vereinigung der Versicherungsmathematiker 70: 111–133.

Crocker, K.J. and Snow, A. (1986) ‘The efficiency effects of categorical discrimination in the insurance industry’, Journal of Political Economy 94 (2): 321–344.

Dannenburg, D. (1994) ‘Some results on the estimation of the credibility factor in the classical Bühlmann model’, Insurance: Mathematics and Economics 14 (1): 39–50.

De Vylder, F. and Goovaerts, M.J. (1992) ‘Estimation of the heterogeneity parameter in the Bühlmann–Straub credibility theory model’, Insurance: Mathematics and Economics 10 (4): 233–238.

Doherty, N. (1981) ‘Is rate classification profitable’, The Journal of Risk and Insurance 48 (2): 286–295.

Dolan, R.D. and Simon, H. (1996) Power Pricing: How Managing Price Transforms the Bottom Line, New York: The Free Press.

Donkers, B., Verhoef, P.C. and de Jong, M.G. (2007) ‘Modeling CLV: A test of competing models in the insurance industry’, Quantitative Marketing and Economics 5 (2): 163–190.

Earnix (2011a) European General Insurance Pricing Survey, n.p.

Earnix (2011b) The New Insurance Pricing Process: 6 Keys to Success, n.p.

Eling, M. and Luhnen, M. (2008) ‘Understanding price competition in the German motor insurance market’, Zeitschrift für die gesamte Versicherungswissenschaft 97 (1): 37–50.

Erdönmez, M., Gerber, M. and Nützenadel, C. (2007) Pricing-Strategien in der Motorfahrzeug-Versicherung, St. Gallen/Dübendorf, Switzerland: Institute of Insurance Economics of the University of St. Gallen and Solution Providers.

Ernst & Young (2012) Voice of the Customer: Time for Insurers to Rethink their Relationships, Global Consumer Insurance Survey 2012, Europe, London, UK: Ernst & Young.

Ernst & Young (2013) The Journey toward Greater Customer Centricity, New York: Ernst & Young.

Etgar, M. (1975) ‘Unfair price discrimination in P-L insurance and the reliance on loss ratios’, The Journal of Risk and Insurance 42 (4): 615–624.

Finger, R.J. (2001) ‘Risk Classification’, in Casualty Actuarial Society (ed.) Foundations of Casualty Actuarial Science, 4th edn Arlington, VA: Casualty Actuarial Society, pp. 287–342.

Gard, J.-C. and Eyal, O. (2012) ‘The six steps to pricing power in insurance’, bcg.perspectives.

Gesamtverband der Deutschen Versicherungswirtschaft (2012) The German Insurance Industry, 2012 Yearbook, Berlin, Germany: Gesamtverband der Deutschen Versicherungswirtschaft.

Glass, G.V., Peckham, P.D. and Sanders, J.R. (1972) ‘Consequences of failure to meet assumptions underlying the fixed effects analyses of variance and covariance’, Review of Educational Research 42 (3): 237–288.

Greaves, S., Fifer, S. and Ellison, R. (2013) ‘Exploring behavioral responses of motorists to risk-based charging mechanisms’, Transportation Research Record: Journal of the Transportation Research Board 2386 (1): 52–61.

Guelman, L. and Guillén, M. (2014) ‘A causal inference approach to measure price elasticity in automobile insurance’, Expert Systems with Applications 41 (2): 387–396.

Guelman, L., Guillén, M. and Pérez-Marín, A.M. (2014) ‘A survey of personalized treatment models for pricing strategies in insurance’, Insurance: Mathematics and Economics 58: 68–76.

Guillén, M., Nielsen, J.P. and Pérez-Marín, A.M. (2008) ‘The need to monitor customer loyalty and business risk in the european insurance industry’, The Geneva Papers on Risk and Insurance—Issues and Practice 33 (2): 207–218.

Gupta, S., Hanssens, D., Hardie, B., Kahn, W., Kumar, V., Lin, N., Ravishanker, N. and Sriram, S. (2006) ‘Modeling customer lifetime value’, Journal of Service Research 9 (2): 139–155.

Harrington, S.E. and Doerpinghaus, H.I. (1993) ‘The economics and politics of automobile insurance rate classification’, The Journal of Risk and Insurance 60 (1): 59–84.

Hartmann, M., Laas, D., Nützenadel, C., Schmeiser, H. and Wagner, J. (2014) Pricing-Strategien in der KfZ-Versicherung, St. Gallen/Dübendorf, Switzerland: Institute of Insurance Economics of the University of St. Gallen and Solution Providers Switzerland.

Hinterhuber, A. (2004) ‘Towards value-based pricing—an integrative framework for decision making’, Industrial Marketing Management 33 (8): 765–778.

Hoy, M. (1982) ‘Categorizing risks in the insurance industry’, The Quarterly Journal of Economics 97 (2): 321–336.

Hoy, M. (2006) ‘Risk classification and social welfare’, The Geneva Papers on Risk and Insurance—Issues and Practice 31 (2): 245–269.

Hyndman, R.J. and Fan, Y. (1996) ‘Sample quantiles in statistical packages’, The American Statistician 50 (4): 361–365.

Ismail, N. and Jemain, A.A. (2006) ‘A comparison of risk classification methods for claim severity data’, Journal of Modern Applied Statistical Methods 5 (2): 513–528.

Jackson, D. (1989a) ‘Determining a customer’s lifetime value, part 1’, Direct Marketing 51 (11): 60–62/123.

Jackson, D. (1989b) ‘Determining a customer’s lifetime value, part 2’, Direct Marketing 52 (1): 24–32.

Jackson, D. (1989c) ‘Determining a customer’s lifetime value, part 3’, Direct Marketing 52 (4): 28/30.

Jahn, H.C., Heyen, M. and Wälder, J. (2014) ‘Sein oder nicht sein—die Zukunft der Kfz-Versicherung’, PWC Insurance Monitor 3.

Janke, M.A. (1991) ‘Accidents, annual mileage and the exaggeration of risk’, Accident Analysis and Prevention 23 (2–3): 183–188.

Jubraj, P., Moneta, A. and Summerhayes, V. (2014) Insurance Telematics: A Game-changing Opportunity for the Industry, Accenture’s Series The Digital Insurer.

Jung, J. (1968) ‘On automobile insurance ratemaking’, ASTIN Bulletin 5 (1): 41–48.

Kaishev, V.K., Nielsen, J.P. and Thuring, F. (2013) ‘Optimal customer selection for cross-selling of financial services products’, Expert Systems with Applications 40 (5): 1748–1757.

Kelly, M. and Nielson, N. (2006) ‘Age as a variable in insurance pricing and risk classification’, The Geneva Papers on Risk and Insurance—Issues and Practice 31 (2): 212–232.

Kendall, M.G. (1938) ‘A new measure of rank correlation’, Biometrika 30 (1/2): 81–93.

Kendall, M.G. (1948) Rank Correlation Methods, London, UK: Griffin.

Khanna, A. and Ward, P. (2014) Time to Get Streetwise: Unlocking Value-based Pricing in Personal Lines Insurance, L.E.K. Consulting, Executive Insights XVI/22.

Kim, B.-D. and Kim, S.-O. (1999) ‘Measuring upselling potential of life insurance customers: Application of a stochastic frontier model’, Journal of Interactive Marketing 13 (4): 2–9.

Kim, H.S., Kim, H.J. and Son, B. (2006) ‘Factors associated with automobile accidents and survival’, Accident Analysis and Prevention 38 (5): 981–987.

Klauer, S.G., Dingus, T.A., Neale, V.L., Sudweeks, J.D. and Ramsey, D.J. (2009) Comparing Real-world Behaviors of Drivers with High versus Low Rates of Crashes and Near-crashes, Report No. DOT HS 811 091, National Highway Traffic Safety Administration.

Köhne, T. (2011) ‘Zur Preissituation im deutschen Kfz-Versicherungsmarkt, Studie im Auftrag der Direct Line Versicherung AG’, from www.blog.directline.de/wp-content/uploads/Studie-Zur-Preissituation-im-deutschen-Kfz-Versicherungsmarkt.pdf, accessed 26 August 2014.

Kumar, V. (2007) ‘Customer lifetime value—the path to profitability’, Foundations and Trends in Marketing 2 (1): 1–96.

Laurie, A. (2011) ‘Telematics: The new auto insurance’, Towers Watson Emphasis 2011 (1): 20–25.

Litman, T. (2011) Distance-based Vehicle Insurance, Feasibility, Costs and Benefits, Technical Report, Victoria Transport Policy Institute.

McKnight, J.A. and McKnight, S.A. (1999) ‘Multivariate analysis of age-related driver ability and performance deficits’, Accident Analysis and Prevention 31 (5): 445–454.

McKnight, J.A. and McKnight, S.A. (2003) ‘Young novice drivers: Careless or clueless?’ Accident Analysis and Prevention 35 (6): 921–925.

Meyer, U. (2005) Final Report for the Project Car Insurance Tariffs, Part III, Motor Liability Insurance in Europe, Comparative Study of the Economic-statistical Situation.

Mildenhall, S. (1999) ‘A systematic relationship between minimum bias and generalized linear models’, Proceedings of the Casualty Actuarial Society LXXXVI (164): 393–487.

Miller, R.G.J. (1986) Beyond ANOVA, Basics of Applied Statistics, New York: John Wiley & Sons.

Naujoks, H., Lubig, D. and Bernert, A. (2012) Was Versicherungskunden wirklich wollen, Munich, Germany: Bain & Company.

Nelder, J.A. and Verrall, R.J. (1997) ‘Credibility theory and generalized linear models’, ASTIN Bulletin 27 (1): 71–82.

Niessen, G. (2013) ‘Tarifierung in den Nicht-Lebens-Sparten—Welche Informationen benötigt das Management’, in J. Strobel (ed.) Rechnungsgrundlagen und Prämien in der Personen- und Schadenversicherung—Aktuelle Ansätze, Möglichkeiten und Grenzen, Cologne, Germany: Institut für Versicherungswesen (IVW), pp. 20–43.

Ohlsson, E. (2008) ‘Combining generalized linear models and credibility models in practice’, Scandinavian Actuarial Journal 2008 (4): 301–314.

Oxera (2010) The use of gender in insurance pricing, ABI Research Paper No. 24, Association of British Insurers.

Oxera (2012) Why the Use of Age and Disability Matters to Consumers and Insurers, Oxford, UK: Oxera.

Oxera (2013) Equality in Insurance Pricing: The Effect of the Gender Ban, Oxera Agenda April 2013: Oxera.

Paefgen, J., Fleisch, E., Ackermann, L., Staake, T., Best, J. and Egli, L. (2013a) Telematics strategy for automobile insurers, I-Lab Whitepaper.

Paefgen, J., Staake, T. and Thiesse, F. (2013b) ‘Evaluation and aggregation of pay-as-you-drive insurance rate factors: A classification analysis approach’, Decision Support Systems 56: 192–201.

Pearson, K. (1896) ‘Mathematical contributions to the theory of evolution. III. Regression, heredity, and panmixia’, Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences 187: 253–318.

Pratt, K. (2010) ‘Pricing’, The Journal of the Chartered Insurance Institute 2010 (February/March): 19–21.

Progressive (2012) Linking Driving Behavior to Automobile Accidents and Insurance Rates, An Analysis of Five Billion Miles Driven, Progressive Snapshot ® Report.

PWC Consumer Finance Group (2009) Customer Segmentation: How to Harness its Profit-building Power, Melbourne, Australia: PricewaterhouseCoopers.

Reddy, A.S. (2012) The New Auto Insurance Ecosystem: Telematics, Mobility and the Connected Car, Cognizant Reports.

Ryals, L.J. and Knox, S. (2005) ‘Measuring risk-adjusted customer lifetime value and its impact on relationship marketing strategies and shareholder value’, European Journal of Marketing 39 (5/6): 456–472.

Schlesinger, H. and von der Schulenberg, J.M. (1993) ‘Consumer information and decisions to switch insurers’, The Journal of Risk and Insurance 60 (4): 591–615.

Schmeiser, H., Störmer, T. and Wagner, J. (2014) ‘Unisex insurance pricing: Consumers’ perception and market implications’, The Geneva Papers on Risk and Insurance—Issues and Practice 39 (2): 322–350.

Schmidt-Gallas, D. and Beeck, V. (2009) Das Pricing deutscher Versicherer im internationalen Vergleich, Frankfurt am Main, Germany: Simon Kucher & Partners.

Schmidt-Gallas, D., Beeck, V. and Paluch, M. (2010) ‘Neue Rabattsysteme für eine konsistente Positionierung und mehr Ertrag’, Transfer Werbeforschung & Praxis 56 (4): 49–52.

Schmidt-Gallas, D. and Lauszus, D. (2005) Mehr Markt: Die Pricing-Prozesse der Versicherer müssen besser werden, Ergebnisse der Branchenbefragung 2005 und Empfehlungen für das Management, Bonn, Germany: Simon Kucher & Partners.

Schmidt-Gallas, D. and Lauszus, D. (2009a) Die Wertschöpfung im Vertrieb steigern, Bonn, Germany: Simon Kucher & Partners.

Schmidt-Gallas, D. and Lauszus, D. (2009b) Pricing-Exzellenz durch schlagkräftige Organisationen, Bonn, Germany: Simon Kucher & Partners.

Sheaf, S. (2008) Insurance: Rate Monitoring Systems. The Actuary (online article), from www.theactuary.com/, accessed 12 September 2014.

Simer, A. (2014) Schweiz—Kfz-Industrie und Kfz-Teile, Bonn, Germany.

Sipulskyte, R. (2012) ‘Development of a Motor Vehicle Classification Scheme for a New Zealand Based Insurance Company ’, in New Zealand Society of Actuaries Conference 2012, Waitangi, New Zealand, 18–21 November 2012.

Sison, C.P. and Glaz, J. (1995) ‘Simultaneous confidence intervals and sample size determination for multinomial proportions’, Journal of the American Statistical Association 90 (429): 366–369.

Smith, K.A., Willis, R.J. and Brooks, M. (2000) ‘An analysis of customer retention and insurance claim patterns using data mining: A case study’, The Journal of the Operational Research Society 51 (5): 532–541.

Statista (2014) Anzahl der Neuzulassungen von Kraftfahrzeugen in der Schweiz in den Jahren 2005 bis 2013 nach Fahrzeuggruppe (Online chart), from www.de.statista.com/, accessed 19 September 2014.

Statistisches Bundesamt (2014) Verkehr: Verkehrsunfälle 2013, Wiesbaden, Germany: Statistisches Bundesamt.

Störmer, T. (2013) Optimizing insurance pricing by incorporating consumers’ perceptions of risk classification, working papers on risk management and insurance no. 140, University of St. Gallen, Institute of Insurance Economics.

Störmer, T. and Wagner, J. (2013) A comparison of insurers’ usage and consumers’ perception of price differentiation factors, working papers on risk management and insurance no. 139, University of St. Gallen, Institute of Insurance Economics.

Stroinski, K.J. and Currie, I.D. (1989) ‘Selection of variables for automobile insurance rating’, Insurance: Mathematics and Economics 8 (1): 35–46.

Sundt, B. (1988) ‘Credibility estimators with geometric weights’, Insurance: Mathematics and Economics 7 (2): 113–122.

Surminski, M. (2014) ‘Gibt es ein Geschäftsmodell für Telematik-Tarife in Deutschland?’ Zeitschrift für Versicherungswesen 2014 (6): 163–164.

Thomas, G.R. (2007) ‘Some novel perspectives on risk classification’, The Geneva Papers on Risk and Insurance—Issues and Practice 32 (1): 105–132.

Thomas, G.R. (2008) ‘Loss coverage as a public policy objective for risk classification schemes’, The Journal of Risk and Insurance 75 (4): 997–1018.

Thuring, F., Nielsen, J., Guillén, M. and Bolancé, C. (2012) ‘Selecting prospects for cross-selling financial products using multivariate credibility’, Expert Systems with Applications 39 (10): 8809–8816.

Vaughan, D. and Michael, L. (2012) ‘Why rate differentiation is important: equal may not be fair’, Towers Watson Emphasis 2012 (2): 2–5.

Venkatesan, R. and Kumar, V. (2004) ‘A customer lifetime value framework for customer selection and resource allocation strategy’, Journal of Marketing 68 (4): 106–125.

Verhoef, P.C. and Donkers, B. (2001) ‘Predicting customer potential value an application in the insurance industry’, Decision Support Systems 32 (2): 189–199.

Wedekind, K. (2012) ‘Profitable und unprofitable Kunden klassifizieren, Implementierung eines Kundenwert-managements im Versicherungsunternehmen’, Versicherungswirtschaft 2012 (23): 1726–1727.

Wenzel, T.P. and Ross, M. (2005) ‘The effects of vehicle model and driver behavior on risk’, Accident Analysis and Prevention 37 (3): 479–494.

White, S.B. (1976) ‘On the use of annual vehicle miles of travel estimates from vehicle owners’, Accident Analysis and Prevention 8 (4): 257–261.

Yeo, A.I., Smith, K.A., Willis, R.J. and Brooks, M. (2001) ‘Modeling the effect of premium changes on motor insurance customer retention rates using neural networks’, in V.N. Alexandrov, B.A. Dongarra, R.S. Juliano, R.S. Renner and C.J.K. Tan (eds) Computational Science—ICCS 2001. International Conference, San Francisco, CA, USA, May 28–30, 2001, Proceedings, Part II, Berlin, Germany: Springer Verlag, pp. 390–399.

Young, V.R. and De Vylder, E.F. (2000) ‘Credibility in favor of unlucky insureds’, North American Actuarial Journal 4 (1): 107–113.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Laas, D., Schmeiser, H. & Wagner, J. Empirical Findings on Motor Insurance Pricing in Germany, Austria and Switzerland. Geneva Pap Risk Insur Issues Pract 41, 398–431 (2016). https://doi.org/10.1057/gpp.2015.30

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/gpp.2015.30