Abstract

This paper presents new and official survey information on bank regulations in 142 countries and makes comparisons with two earlier surveys. The data do not suggest that countries have primarily reformed their bank regulations for the better over the last decade. Following Basel guidelines many countries strengthened capital regulations and official supervisory agencies, but existing evidence suggests that these reforms will not improve bank stability or efficiency. While some countries have empowered private monitoring of banks, consistent with the third pillar of Basel II, there are many exceptions and reversals along this dimension.

Similar content being viewed by others

INTRODUCTION

Is the bank-regulatory environment in countries improving and making financial systems more efficient and stable? A decade after the East Asian crisis and the ever-growing importance of developing-country-banking systems, the extent to which progress has been made in regulatory reform commands our attention for several reasons. Those concerned with the fragility of financial systems, whether from a social welfare or a narrower investor's perspective, want to know whether developing countries’ financial systems are safer now than in the 1990s, or whether they merely appear safer as a result of the recent generous inflows of foreign capital. Furthermore, those formulating financial-sector policy recommendations, including the World Bank (Bank) and the International Monetary Fund (IMF), want to know what to do next in improving the efficacy of financial systems, which presumably necessitates an understanding of what has been accomplished thus far. Indeed, in 1999 the Bank and the IMF started the Financial Sector Assessment Program to assess systematically the status of financial systems in countries and to make recommendations for reform, including in the area of bank regulation. As a result, Bank and Fund officials, among others, want to know the extent to which recommendations were adopted and whether the reforms were beneficial.

Many seem to know what has happened to bank-regulatory reforms in countries and have drawn optimistic conclusions about recent changes – perhaps though with some rethinking taking place after the turbulence in credit markets that began in the summer 2007. After all, investors in recent years have been putting their money into emerging market economies at very narrow interest rate spreads. Also, Martin Wolf commented that ‘… there have been substantial structural improvements in Asian economies, notably in the capitalization and regulation of financial systems’ (Financial Times, 23 May, 2007). Still others believe that bank regulation and supervision are now sufficiently effective to warrant more aggressive capital account liberalisation. For example, Ken Rogoff (2007) recently suggested that while IMF recommendations in the 1990s to liberalise more fully capital account transactions might have been premature, now is the time for the IMF, still searching for a new direction for itself, to resume this effort.

Yet, do we actually know what has happened to banking policies in recent years and is there any evidence regarding the consequences of the actions that have been taken? Have changes in the bank-regulatory environment enhanced the creditworthiness of developing countries? Is bank regulation so much better now that one should not expect crises to follow from greater capital account liberalisation? In addition to these important questions about the stability of financial systems, policy makers are also concerned about other features of their financial systems. Will the bank-regulatory framework prescribed by the Basel Committee on Bank Supervision increase access to financial services? Have changes in regulation contributed to financial-sector development and the allocation of capital by banks to those firms most likely to promote growth and reduce poverty? And what about the efficiency of banks, or their corporate governance, and corruption in the lending process itself? These questions regarding the recent changes in the regulatory environment and their effects represent a natural area of inquiry.

More than 10 years ago, a similar set of questions motivated us to start assembling the first cross-country database on bank regulation and supervision. Based on guidance from bank supervisors, financial economists, and our own experiences, we began putting together an extensive survey of bank regulation and supervision.Footnote 1 The original survey, Survey I, had 117 country respondents between 1998 and 2000. The first update in 2003, Survey II, characterised the regulatory situation at the end of 2002, and had 152 respondents. Survey III was posted at the Bank website in the summer of 2007 with responses from 142 countries. Survey III is special because barring a postponement in Europe on par with that in the United States; it represents the last look at the world before many countries formally begin implementing Basel II, the revised Capital Accord.

This paper is organised as follows. The next section very briefly reviews the structure of the survey and discusses some issues that arise in the responses to the three surveys. The subsequent section looks at the state of bank regulation around the world in 2006, and importantly how it has changed in the last 10 years. Then the further section turns to a first analysis of the data, asking whether the changes in bank regulation are contributing positively to financial-sector development (and thus we hope to the wider availability of financial services) and to the stability of banking systems around the world. Finally, the last section concludes with lessons for Basel II, and for countries that are grappling with a response to it.

Based on our empirical analysis of what works best in the bank regulation (BCL, 2006) and subsequent changes that have taken place since the late 1990s in the regulatory environment, we see no basis for the view that countries around the world have primarily reformed for the better. While many have followed the Basel guidelines and strengthened capital regulations and empowered supervisory agencies to a greater degree, existing evidence does not suggest that this will improve banking-system stability, enhance the efficiency of intermediation, or reduce corruption in lending. While some countries have reformed their regulations to empower private monitoring, consistent with the third pillar of Basel II, there are many exceptions and even reversals along this dimension. Moreover, many countries intensified restrictions on non-lending activities, which existing evidence suggests hurts banking-system stability, lowers bank development, and reduces the efficiency of financial intermediation.

Our tempered advice continues to be that countries will benefit from an approach to bank regulation that is grounded in what has worked in practice. In our earlier work, we found that an approach that favours private monitoring, limits moral hazard, removes activity restrictions on banks, encourages competition, including competition by foreign banks, and requires or encourages greater diversification appears to work best to foster more stable, more efficient, and less corrupt financial-sector development. Our earlier findings did not support a hurried adoption of the first two pillars of Basel II by developing countries, but rather stressed the value of first developing the legal, information, and incentive systems in which financial systems flourish to the benefit of everyone. Based on the existing evidence, we continue to believe that this approach is the most sensible one for country authorities to pursue. Critically, the data in this new survey provide the raw material for research that should help confirm, refute, or refine this private monitoring view.

THE 2006 SURVEY

The Survey of Bank Regulation and Supervision Around the World assembles and makes available a database to permit international comparisons of various features of the bank-regulatory environment. Current and previous surveys and responses are on the Bank website and the earlier surveys, responses, and indices are available on a CD in BCL (2006).Footnote 2 Most questions could be answered ‘Yes/No’, although in many cases we requested that in case of doubt the authorities attach governing regulations or laws. Some of the questions in the latest version explicitly or implicitly refer to Basel II, such as those enquiring as to the plans for the implementation of Basel II, and if so then the variant of the first pillar to be adopted. Similarly, some of the questions relating to capital, provisioning, and supervision have been modified to keep abreast of current thinking and emerging practice in these areas.

Before turning to the data, an obvious question concerns the accuracy of the responses. The survey was sent to the principal contacts in each country of the Basel Committee on Bank Supervision. Even though these contacts should know the regulatory environment, the survey's scope is such that for any country a number of people usually are involved in its completion, and some or all of the members of this group might change over time, raising the issue of differences in the interpretation of questions over time (in addition to changes in the wording noted above). In order to attain the greatest possible consistency over time, we adopted several approaches: going back to authorities for clarification, where there were notable changes, as well as posting the survey responses on the web, so that the data could be challenged and inconsistencies resolved.

We also searched for instances in which there was a reversal in a country's response to a question across the different surveys, for example, if a component of an index rose from Surveys I to II and then declined from Surveys II to III, or vice versa. Such a change could, though need not, be due to an error in reporting, or possibly a difference in interpretation due to a change in the person or persons replying on behalf of the regulatory agency. With the exception of some of the components of the index on the overall restrictiveness of bank activities, where mostly small reversals occurred in about 20% of the cases, few reversals were seen in the other components. The full results of this analysis are reported in the working paper version of this paper. Again, these reversals are not necessarily an indication of errors, particularly for those questions that require a simple yes or no answer. However, these cases might merit further checking.

Another way to insure accuracy is through the publication of the results. Surveys I and II have been posted since 2000 and 2004, respectively, so one would assume that authorities, especially after prompting from the Bank, would have reported errors by now. Yet, each survey had only a handful of countries questioning an individual response, notwithstanding that each survey has been posted for a number of years. Survey III was just posted in July 2007.

To summarise, despite investing significant effort in cleaning the data, we did not always receive clear responses from the authorities and are concerned that they suffer from survey fatigue. We therefore recommend ongoing efforts to clean (and update) the data. It might also be noted that some countries chose not to respond to any surveys, not to respond to some surveys but to others, and not to answer some questions but others, which raises the question as to whether this was a strategic decision or simply survey fatigue.

We will not go into detail about the specific contents of the survey here given the earlier explanations provided in BCL (2006, 2004, 2001). The latest survey continues to group the survey questions and responses into the same 12 sections as previously, namely,

-

Entry into banking,

-

Ownership,

-

Capital,

-

Activities,

-

External auditing requirements,

-

Internal management/organisational requirements,

-

Liquidity and diversification requirements,

-

Depositor (savings) protection schemes,

-

Provisioning requirements,

-

Accounting/information disclosure requirements,

-

Discipline/problem institutions/exit, and

-

Supervision.

Also, as is evident in the survey, the majority of questions are structured to be in a yes/no format, or otherwise require a precise, often quantitative response. Experience suggests that simple and precise questions increase the response rate and reduce the potential for mis-interpretation.

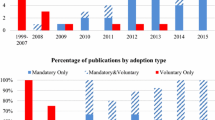

With the third survey, we now have data spanning almost a decade, as the first responses to the initial survey were recorded in 1998. As Survey I was the initial launch of the survey, and as internet penetration in a number of developing countries was still on the increase, many of the responses came in gradually during 1998–1999, but a number of them were received in 2000 as well. The second survey (Survey II) was conducted in early 2003, assessing the state of regulation as of the end of 2002. Survey III, the latest update, sought a characterisation of the environment as of the end of 2005. However, it took considerable time to clean the data, which involved going back to country authorities for clarifications, and process it for presentation on the Bank website. Thus, the data from Survey III were only available in early July of2007 and it is perhaps accurate to interpret the responses as describing the situation in 2006.

The survey consists of a large number of questions. Survey I was composed of about 180 questions. We substantially expanded Survey II to 275 questions. Changes to the current survey were more limited, with most changes aimed at achieving greater clarity and precision, and others made in anticipation of Basel II, so that Survey III has a bit over 300 questions.

Although the responses to individual questions are of interest in their own right, especially for authorities who want to compare particular features of their own banking systems with those in other countries, it is difficult to extract broad lessons from so many responses. Yet, policy makers want to know the general direction in which to proceed with reforms (eg, whether to emphasise bank activity restrictions, capital requirements, bank supervision, or private monitoring) to improve banking systems. Consequently, this group will appreciate a greater degree of grouping and aggregation (and thus quantification) of the responses, as will empirical researchers bound by degrees of freedom (and a need for quantifiable variables). So, we follow our earlier practice (BCL, 2006, 2004, 2001) and aggregate the data into broader indices, the principal ones being: overall restrictions (on bank activities), entry requirements, official supervisory powers, private monitoring, and capital regulation. As in the past, we stress that there is no unique grouping or aggregation (or even quantification), and we encourage researchers to experiment with their own groupings.Footnote 3

BANK REGULATION AND SUPERVISION AROUND THE WORLD: WHAT THE DATA SAY

With three surveys over almost a decade, one can ask to what extent have there been changes in the regulatory environment in countries around the world. As Survey III is just becoming available, analysis of these changes understandably is in an early stage, and we hope that with the data available on the web, more people will investigate the impact of variations in bank regulation on various outcomes. Also, in principle this analysis can be done for all of the individual questions and countries that are available over the surveys. Here, we restrict our attention to the major indices described in the previous section and developed in BCL (2006).

Figure 1 shows the changes in overall restrictiveness of bank activities from Surveys I to III. As a change in a positive direction indicates a move towards greater restrictiveness, it appears as though restrictions on what banks can do are on the increase. We highlight in black three large, high-income countries, namely Japan, the United Kingdom, and the United States, as well as seven countries whose banking crises for different reasons were the focus of attention in the 1990s: Argentina, Indonesia, Korea, Malaysia, Mexico, the Philippines, and Russia. The contrast between two crisis countries is of interest. In particular, Mexico responded to the 1994 crisis by easing restrictions on banks, while Argentina saw tightened restrictions and policies that led foreign banks to withdraw. Most other crisis countries also moved in the direction of greater restrictions. The United States moved in the opposite direction reflects the dismantling of the Glass–Steagall barriers separating commercial banking, investment banking, and insurance.

Change in the index of overall restrictions on bank activities from Surveys I to III. Notes: The index of overall restrictions on bank activities measures the degree to which banks face regulatory restrictions on their activities in (a) securities markets, (b) insurance, (c) real-estate, and (d) owning shares in non-financial firms. For each of these four sub-categories, the value ranges from 0 to 4, where 4 indicates the most restrictive regulations on this sub-category of bank activity. Thus, the index of overall restrictions can potentially range from 0 to 16. The figure indicates the change in this index from Surveys I to III, where positive numbers indicate an increase in restrictions on bank activities

Domestic bank entry requirements mostly remained unchanged, although there was some tightening in crisis countries, as well as in the US case. Note that this index essentially counts the number of requirements for a banking license: (1) draft by-laws, (2) intended organisational chart, (3) financial projections for first 3 years, (4) financial information on main potential shareholders, (5) background/experience of future directors, (6) background/experience of future managers, (7) sources of funds to be used to capitalise the new bank, and (8) market differentiation intended for the new bank. Thus, this index is a proxy for the hurdles that entrants have to overcome to get a license. However, the absence of changes does not necessarily imply that the banking sector was not undergoing significant change, as foreign entry was expanding sharply in a number of countries.

We also collected information on the percentage of assets in majority-owned foreign banks, and here the changes have been dramatic. In the aftermath of their crises, foreign presence rose significantly in Mexico, Korea, and Indonesia, barely changed in Malaysia, the Philippines, and Russia, and fell significantly in Argentina. Some countries rely on foreign entities either to take over insolvent banks and/or to expand their intermediation activities while insolvent banks are restructured, downsized or closed, similar to the way Texas first permitted banks from outside its state to take over its banking system during the crisis in the 1980s. Others, such as Argentina, foisted such a large share of the costs of the crisis on already present foreign banks that some left and some potential entrants surely stayed away.

Figures 2, 3, and 4 show the changes in the indices measuring the three pillars of Basel II, namely capital regulation, official supervisory power, and private monitoring, respectively. Interestingly, those countries easing capital requirements are only slightly less numerous than those moving in the opposite direction. Once again, Argentina stands out, with the weakening in its capital requirements having been part of the effort to ease regulation in advance of the crisis, with Korea and Japan making similar moves but in the aftermath of their crises. Argentina did not change its official supervisory power, although it should be noted that any weakening in the exercise of these powers is not measured here. There is a more noticeable balance of countries moving to strengthen official supervision, or at least provide supervisors with more explicit power, notably in Korea, Mexico, Malaysia, and to some degree in Russia. Unfortunately, as we will return to below, an increase in supervisory power was not found to be helpful in bank development, performance, and stability in our earlier work (BCL, 2006), particularly in countries with a weak institutional environment, and actually was associated with increased corruption in the lending process.Footnote 4 Interestingly, the UK authorities moved in the opposite direction, and have established a working group, whose report is due shortly, to address concerns about excessive regulation and supervision.

Change in the index of bank capital regulations from Surveys I to III. Notes: The index of bank capital regulations includes information on (1) the extent of regulatory requirements regarding the amount of capital banks must hold and (2) the stringency of regulations on the source of funds that count as regulatory capital can include assets other than cash or government securities, borrowed funds, and whether the regulatory/supervisory authorities verify the sources of capital. Large values indicate more stringent capital regulations. The maximum possible value is 9, while the minimum possible value is 0. The figure indicates the change in the index of bank capital regulations from Surveys I to III, where positive numbers indicate an increase in restrictions on bank capital

Change in the index of official supervisory powers from Surveys I to III. Notes: The official supervisory index measures the degree to which the country's commercial bank supervisory agency has the authority to take specific actions. It is composed of information on many features of official supervision: (1) Does the supervisory agency have the right to meet with external auditors about banks? (2) Are auditors required to communicate directly to the supervisory agency about elicit activities, fraud, or insider abuse? (3) Can supervisors take legal action against external auditors for negligence? (4) Can the supervisory authority force a bank to change its internal organisational structure? (5) Are off-balance sheet items disclosed to supervisors? (6) Can the supervisory agency order the bank's directors or management to constitute provisions to cover actual or potential losses? (7) Can the supervisory agency suspend the directors’ decision to distribute (a) dividends, (b) bonuses, and (c) management fees? (8) Can the supervisory agency supersede the rights of bank shareholders and declare a bank insolvent? (9) Can the supervisory agency suspend some or all ownership rights? (10) Can the supervisory agency (a) supersede shareholder rights, (b) remove and replace management, and (c) remove and replace directors? The official supervisory index has a maximum value of 14 and a minimum value of 0, where larger numbers indicate greater power. The figure indicates the change in the index of official supervisory power from Surveys I to III, where positive numbers indicate an increase in official supervisory power

Change in the index of private monitoring from Surveys I to III. Notes: The private monitoring index measures the degree to which regulations empower, facilitate, and encourage the private sector to monitor banks. It is composed of information on whether (1) bank directors and officials are legally liable for the accuracy of information disclosed to the public, (2) whether banks must publish consolidated accounts, (3) whether banks must be audited by certified international auditors, (4) whether 100% of the largest 10 banks are rated by international rating agencies, (5) whether off-balance sheet items are disclosed to the public, (6) whether banks must disclose their risk management procedures to the public, (7) whether accrued, though unpaid interest/principal, enter the income statement while the loan is still non-performing, (8) whether subordinated debt is allowable as part of capital, and (9) whether there is no explicit deposit insurance system and no insurance was paid the last time a bank failed. The private monitoring index has a maximum value of 9 and a minimum value of 0, where larger numbers indicate greater regulatory empowerment of private monitoring of banks. The figure indicates the change in the index of private monitoring from Surveys I to III, where positive numbers indicate an increase in private monitoring power

Private monitoring, a proxy for the third pillar of Basel II, has been found to be positively linked with a number of desirable outcomes in the banking sector, and appears generally to be on the rise in a number of countries, with Mexico once again in the lead. Only a few countries, notably including the United Kingdom, Malaysia, and Korea, have seen a decline in their score on this index.

As with all of these changes, we examined the changes in the individual components of the indices to identify which factors account for the variations in the indices. Thus in the UK case, private monitoring weakened slightly because of the change to an affirmative in the response to the question, ‘Does accrued, though unpaid interest/principal enter the income statement while the loan is still non-performing?’. Here, the rationale is that allowing accrued but unpaid interest for a non-performing loan makes it more difficult for market participants to perceive the underlying health of a bank. Readers are welcome to investigate the sources of other changes with these tables, using the data on the Bank's website, noted above.

We will now turn our attention to a more systematic extension of our earlier research to gauge the impact of the aforementioned changes in the regulatory environment on the development of the banking sector, its fragility, and other outcomes of interest.

BANK REGULATION AND SUPERVISION AROUND THE WORLD: WHAT THE DATA MEAN

How reforms affect banking systems: Overview

How have reforms to bank regulations and supervisory practices affected national banking systems? In countries that changed their regulatory policies, have these reforms reduced banking-system fragility and boosted banking-system development? Have these policy changes enhanced the efficiency of intermediation and moderated corruption in the lending process? Answers to these questions will help some countries adjust their reforms and will help other countries avoid mistakes and select more appropriate reform strategies.

Given the available data, we conduct some illustrative simulations to assess the potentially impact of bank-regulatory reforms over the last decade on national banking systems. In the first step, we estimate the relationships between bank regulations and banking-system fragility, development, efficiency, and corruption in lending. These estimates are based on Survey I and analyses in BCL (2006). In the second step, we use the estimate coefficient from the first step to compute the impact of regulatory reforms between Surveys I and III on banking-system fragility, development, efficiency, and corruption. We make these computations for each country and describe this simulation strategy in greater detail below.Footnote 5

Baseline regressions

Table 1 presents estimates of the relationships between various bank regulations and banking-system fragility, development, efficiency, and corruption. As BCL (2006) explain these estimation processes in great detail, we provide a very brief synopsis of that description.Footnote 6

First, consider banking-system fragility, which we measure as a dummy variable that equals 1 if the country experienced a systemic crisis during the period 1988–1999, and 0 if it did not. While inherently arbitrary, we join Demirgüç-Kunt et al. (2008), among others, and classify a systemic crisis as one where (1) emergency measures were taken to assist the banking system (such as bank holidays, deposit freezes, blanket guarantees to depositors, or other bank creditors), (2) large-scale nationalisations took place, (3) non-performing assets reached at least 10% of total assets at the peak of the crisis, or (4) the cost of the rescue operations was at least 2% of GDP. We conduct a logit estimation based on key regulatory variables. As many studies find that macroeconomic instability induces banking-sector distress, we also include the average inflation rate during the 5 years prior to the crisis in countries that experienced a banking crisis. In countries that did not, we include the average inflation rate during the 5 years prior to the survey of bank regulatory and supervisory indicators (1993–1997).

One key finding on fragility from equation 1 is that regulatory restrictions on banking activities (Activity restrictions) increase the probability of a banking crisis. Many argue that restricting banks from engaging in non-lending services, such as securities market activities, underwriting insurance, owning non-financial firms, or participating in real estate transactions, will reduce bank risk taking and therefore increase banking-system stability. We find no support for this claim. Rather, we find that restricting bank activities increases bank fragility. Fewer regulatory restrictions may increase the franchise value of banks and thereby augment incentives for more prudent behaviour. Or, banks that engage in a broad array of activities may find it easier to diversify income streams and thereby become more resilient to shocks, with positive implications for banking-system stability.

The second key finding on fragility involves the diversification index, which includes information on whether there are regulatory guidelines concerning loan diversification and the absence of restrictions on making loans abroad. Diversification is negatively associated with the likelihood of a crisis but diversification guidelines have less of a stabilising effect in bigger economies, as measured by the logarithm of GNP. The inflection point is quite high; diversification guidelines have significant stabilising effects in all but the nine largest countries.

Second, consider bank corruption, which is measured by asking firms whether corruption of bank officials is an obstacle to firm growth. These data are obtained from the Bank's World Business Environment Survey, and the details are described in greater detail in Beck et al. (2006). In particular, a value of 1 signifies that corruption is an obstacle, while a value of 0 means that firms responded that corruption of bank officials is not an obstacle. The survey covers 2,259 firms across 37 countries in our sample. The firm-level regression in equation 2 of Table 1 controls for many firm-level characteristics besides the national bank regulation indices. These data allow us to test conflicting theoretical predictions regarding the impact of specific bank supervisory strategies on the extent to which corruption of bank officials impedes the efficient allocation of bank credit. The public interest view holds that a powerful supervisory agency that directly monitors and disciplines banks can enhance the corporate governance of banks, reduce corruption in bank lending, and thereby boost the efficiency with which banks intermediate society's savings. In contrast, the private interest view argues that politicians and supervisors may induce banks to divert the flow of credit to politically connected firms, or banks may ‘capture’ supervisors and induce them to act in the best interests of banks rather than in the best interests of society. This theory suggests that strengthening official supervisory power – in the absence of political and legal institutions that induce politicians and regulators to act in the best interests of society – may actually reduce the integrity of bank lending with adverse implications on the efficiency of credit allocation.

As shown in Table 1, equation 2, there are two key findings concerning corruption and bank regulation. First, the results contradict the public interest view, which predicts that powerful supervisory agencies will reduce market failures, with positive implications for the integrity of bank–firm relations. Rather, we observe that official supervisory power never enters the bank corruption regressions with a positive and significant coefficient.

Second, the results are broadly consistent with the private interest view. The positive coefficient on official supervisory power is consistent with concerns that governments with powerful supervisors further their own interests by inducing banks to lend to politically connected firms, so that strengthening official supervision accommodates increased corruption in bank lending. Beck et al. (2006) showed that sound political and legal systems reduce the pernicious effects of official supervisory power, but they never found that empowering official supervisors significantly reduces corruption in lending. Furthermore, Table 1 shows that private monitoring enters negatively and significantly, which further supports the private interest view of bank regulation. Firms in countries with stronger private monitoring tend to have less of a need for corrupt ties to obtain bank loans. This is consistent with the assertion that laws that enhance private monitoring will improve corporate governance of banks with positive implications for the integrity of bank–firm relations.

Next, we consider bank development, which is measured as the ratio of bank credit to private firms as a share of GDP in 2001. Although bank development is an imperfect indicator of banking-system performance, past research shows that this specific bank-development variable is a good predictor of long-run economic growth (Levine, 2005). In equation 3, we also control for the legal origin of each country since Beck et al. (2003) showed that legal origin helps explain cross-country differences in bank development.Footnote 7

In terms of bank development, there are two major results reported in Table 1. First and foremost, policies that strengthen the rights of private-sector monitors of banks are associated with higher levels of bank development. Our results on strengthening private-sector monitoring of banks emphasise the importance of regulations that make it easier for private investors to acquire reliable information about banks and exert discipline over banks. This finding underscores Basel II's third pillar. Second, regulatory restrictions on bank activities retard bank development. The results do not support the view that financial conglomerates impede governance and hurt the operation of the financial system. These findings are more consistent with the existence of economies of scope in the provision of financial services; though see Laeven and Levine (2007), who find no evidence of economies of scope in banks that diversify their activities beyond lending.

Finally, consider banking-system efficiency, which we measure as (i) the net interest income margin relative to total assets and (ii) overhead costs relative to total assets for a large cross-section of banks in each country. High net interest margins can signal inefficient intermediation and greater market power that allow banks to charge high margins. High overhead costs can signal unwarranted managerial perquisites and market power that contradict the notions of sound governance of banks and efficient intermediation. To identify the independent relationship between these bank efficiency measures and bank regulations, we control for an array of bank-specific traits, including the bank's market share, its size, the liquidity of its assets, bank equity, and the proportion of income that the bank receives in non-interest bearing assets.

The results shown in Table 1, equations 4 and 5, again advertise the benefits of regulations that empower private-sector monitoring of banks. These regressions use a cross-section of 1,362 banks across 68 countries. The bank-level data are averaged over the period 1995–1999. We average over a few years to reduce the potential impact of business-cycle fluctuations on these measures of bank efficiency, but obtain similar results hold when using data from 1999 only. Private monitoring is associated with greater bank efficiency, as measured by lower levels of net interest margin and overhead costs. These findings, and those in Demirgüç-Kunt et al. (2004), suggest bank regulatory and supervisory policies that foster private-sector monitoring enhance bank efficiency.

Simulation mechanics

The simulation mechanics for the bank development and efficiency regressions are straightforward. These are simple linear regressions from the estimated relationships in Table 1:

where Y is either bank development, the net interest margin, or overhead costs; X is the matrix of explanatory variables from Survey I listed in Table 1 for each regression; α and β are the estimated parameters shown in Table 1.

Differencing the above equation yields

where ΔX is the change in the explanatory variables between Surveys I and III. Specifically, it is the value in Survey III minus the value in Survey I. This equation then provides the forecasted or simulated change in Y (bank development, the net interest margin, or overhead costs) resulting from reforms to the regulatory system between Surveys I and III, based on the estimated relationships from Survey I reported in Table 1. We assume that the non-regulatory variables remain fixed and therefore only focus on estimating the effects of the change in regulatory policies on the banking system. We performed the simulations of regulatory reforms for each country in the survey that was (i) included in Table 1 regressions and (ii) has complete data for Survey III.

The simulation mechanics are bit more involved for the logit regressions because this is a non-linear estimator. In our case, P equals the probability that the country suffers a systemic crisis (or the probability that a firm responds that corrupt bank officials are an impediment to its growth). Then, in Table 1, we estimate the following equation:

In order to compute the estimated changes in the probability of a crisis resulting from a change in a particular index x k within the full matrix of explanatory variables X, we cannot simply use the estimated β k for that particular index. The coefficients from the logit model have to be rescaled in order to illustrate the marginal effect on the probability of a crisis. This rescaling must account for the initial conditions for each country. In order to compute country-specific marginal effects on a particular regulatory variable x k , therefore, we apply the standard formula for each country in the sample:

The ratio on the right-hand side of the equation is a country-specific scale effect. For this scale effect, we use the initial reported valued from Survey I. Thus, we are assessing the estimated impact on the probability of a crisis from changes in regulatory policies from Surveys I to III based on the initial conditions defined by Survey I. The country-specific marginal effects for the change in a particular index, x k , are then obtained by multiplying this scale factor with the estimated logit coefficient, β k . In this manner, we present the estimated changes in the probability of a crisis in each country from the change in each regulatory index from Surveys I to III.

There are many serious caveats associated with these simulations. First, we are assuming that the equation defining the relationship between the dependent variables and the regressors has not changed across the different sampling periods. Second, we are assuming that the only change in each simulation reported below is that one of the regulatory variables changes, and that the observed changes in the regulatory variables are measured without error. Third, we are assuming that the estimated relations between regulations and various banking-sector outcomes have not changed over the last decade, that is, the estimated coefficients, the β's, have not changed. Fourth, in the non-linear regressions involving crises and corruption in lending, we are also assuming that changes in the non-bank-regulatory variables do not materially affect the computed marginal impact of regulatory changes on the outcome measures. Fifth, these simulations do not assess dynamics. Changes in bank regulations will affect bank development, corruption in lending, bank efficiency, and banking-system stability over time, not instantaneously. We do not account for this. Given these assumptions, the estimated standard error of simulated forecast for each country is simply [(ΔX i )2 × σ2(β)+σ2(ɛ)]1/2, where ΔX i is the change in the regulatory indicator in country i, σ(β) is the estimate standard error on the parameter β, and σ(ɛ) is the standard error of the residual from the initial equation. This accounts for the uncertainty of parameter estimate and the estimated model.Footnote 8 In the simulations that follow, only the 10 countries with the biggest regulatory changes in each simulation have an estimated change in the dependent variable that is more than a standard deviation away from the null hypothesis of no change.

In sum, these simulations are at best an illustrative first evaluation of the data. They do not provide tight inferences about the impact of regulatory changes on the banking system. Future research will need to directly analyse the impact of these regulatory changes using panel procedures that relax the assumptions discussed above.

How reforms affect banking systems: Illustrative simulations

Given changes in bank regulations around the world over the last decade, this sub-section provides estimates of the impact of these changes on national banking systems. For each country, we illustrate the impact of changes in relevant regulatory indices on (1) banking-system fragility, (2) corruption in lending, (3) bank development, and (4) banking-system efficiency. By ‘relevant regulatory indexes’, we refer to regulatory indices that enter statistically significantly in Table 1. We present the simulation results for each of these indices for every county in the sample. We emphasise that these simulations are subject to the many qualifications regarding the underlying estimates presented in Table 1 that are discussed in detail in our book (BCL, 2006). It is difficult to overstress these qualifications. Yet, given all of these qualifications, we use the systematic, consistent estimates provided in Table 1 to illustrate the potential impact of recent regulatory changes on national banking systems. Also, to continue our narrative on 10 particular countries, we focus the discussion on Argentina, France, Indonesia, Japan, Korea, Malaysia, the Philippines, Russia, the United Kingdom, and the United States, even though other countries have frequently undertaken the biggest regulatory reforms, which will be illustrated in the figures. Finally, for each regulatory index and for each country, we show which individual regulations changed by documenting changes question-by-question. Thus, readers can readily identify which individual regulatory reforms produce the changes in the indices that we use when conducting the simulations.

Banking crises

Figure 5 presents the estimated changes in the probability of a crisis for each country resulting from the change in regulatory restrictions on bank activities from Survey I (1997) to Survey III (2007). In presenting the simulations, we use terms such as ‘increased fragility’ or ‘enhanced stability’ to describe increases or decreases, respectively, in the estimated probability of a systemic banking-system crisis in a particular country. Crucially, we examine the impact of a country's changing bank regulations on the probability of a systemic crisis in that country. We do not examine contagion. Nor do we aggregate regulatory changes across individual countries and weight the resultant fragility effects by the financial importance of each country to derive an estimate of a world financial system crisis. These are valuable extensions.

By intensifying regulatory restrictions on bank activities, many countries increased banking-system fragility according to our simulations. The simulations suggest that Argentina, Korea, and Russia imposed additional restrictions on bank activities and these reforms will increase the probability of a systemic crisis by between 20% and 40%. Other countries relaxed restrictions on bank activities, allowing banks to diversify income flows with positive effects on banking-system stability. According to our estimates, Mexico's reduction in regulatory impediments to banks engaging in non-lending services will have a large stabilising effect on Mexico's banking system. On a much smaller level, Japan, the UK, and the United States also reduced activity restrictions, with corresponding boosts to stability.

Corruption in lending

Figures 6 and 7 present the simulation results of changes in official supervisory power and private monitoring on corruption in lending based on equation (2) in Table 1. As discussed above, regulations that empower official supervisors are associated with greater corruption in lending, except in countries with exceptionally high levels of democratic political institutions, while private monitoring reduces corruption in lending by inducing a more transparent banking environment. The simulations provide some stark warnings and encouragement regarding reforms during the last decade.

The simulations suggest that some countries increased the likelihood of corruption of bank officials by increasing official supervisory power and by reducing private monitoring. In particular, Malaysia increased the probability that corrupt bank officials will act as a barrier to firm growth by boosting the power and discretion of official supervisors. Moreover, Malaysia also enacted regulations that reduced private monitoring, which – according to our simulations – will further intensify corruption in lending in these two economies. Taken together, the simulations suggest that the probability that a firm will view the corruption of bank officials as an impediment to firm growth will rise by almost 10% in Malaysia.

In turn, other countries reduced the likelihood of corruption in lending by adjusting bank regulations to facilitate private monitoring of banks, including Mexico. Mexico is an interesting case. It enacted regulations that both enhanced private monitoring and boosted official supervisory power. According to our estimates, these should exert countervailing effects on corruption in lending within Mexico. Taken together, the simulations suggest that the probability that a firm will view the corruption of bank officials as an impediment to firm growth will fall by about 2% in Mexico. Furthermore, based on information not included in the survey, the strengthening of democratic institutions over the last decade provides some support for the view that the harmful effects of strengthening official supervisory power will be mitigated, so that the beneficial effects of stronger private monitoring will be even more dominating in Mexico.

Bank development

Two regulatory indices dominate the relationship with overall banking-system development: activity restrictions and private monitoring. Mexico both reformed to boost private monitoring and reformed to reduce activity restrictions. Based on our simulations, these reforms should reinforce each other and boost banking-system development substantially in Mexico. The combined effects are potentially huge. While subject to ample qualifications, the simulations suggest that banking development in Mexico could rise by as much as 50% of GDP due to these two regulatory changes, from an admittedly low level. Korea and Malaysia lie at the other extreme because they made regulatory changes that tend to weaken private monitoring, while also imposing greater restrictions on the activities of banks. According to our estimates, these bank-regulatory reforms will lower banking-system development in Korea and Malaysia by about 15% of GDP. There are also more mixed, nuanced country cases. The strengthening of private monitoring in Indonesia, Russia, and Argentina will tend to boost bank development. However, these countries also increased regulatory restrictions on banks, which our estimates suggest will counteract the beneficial effects of boosting private monitoring. On net, we forecast little change in bank development in these economies.

Bank efficiency

Finally, we also conducted simulations based on two indictors of bank efficiency. The first measures the net interest margin as a fraction of total interest earning assets and the second measures overhead costs as share of total assets. Since the private monitoring index is the only regulatory indicator that significantly enters both the net interest margin and overhead cost regressions, we only discuss the results on the private monitoring index.

Mexico, Indonesia, Japan, and Argentina reformed their policies in ways that are likely to enhance banking-system efficiency. In contrast, Korea, Malaysia, and the United Kingdom changed regulations in a manner that is likely to reduce private monitoring, with adverse effects on bank efficiency. For example, the simulations suggest that interest margins are likely to fall by over one percentage point in Mexico, and rise by over one-half of a percentage point in Korea.

CONCLUSIONS

Over the last 10 years, many countries have substantially reformed components of their bank-regulatory regimes. Based on our analyses of the pros and cons of a wide range of bank regulations (BCL, 2006), there is no reason for believing that countries around the world have primarily reformed for the better. While many have followed the Basel guidelines and strengthened capital regulations and empowered supervisory agencies, existing evidence does not suggest that this will improve banking-system stability, enhance the efficiency of intermediation, or reduce corruption in lending. While some countries have reformed their regulations to empower private monitoring, consistent with the third pillar of Basel II, there are many exceptions and reversals along this dimension. Furthermore, many countries intensified restrictions on the non-lending activities, which existing evidence suggests hurts banking-system stability, lowers bank development, and reduces the efficiency of financial intermediation. Indeed, our simulations advertise the case in two countries. Korea empowered official supervision, reduced private monitoring regulations, and imposed greater restrictions on the non-lending activities of banks after its crisis. Mexico, while also strengthening official supervisory power, substantively increased regulations that enhance private monitoring and reduced restrictions on bank activities. While many other factors change in a country and many institutional characteristics shape the efficacy of bank regulations, our initial and preliminary estimates suggest greater optimism about Mexico's reforms than Korea's. In sum, our examination of the latest data on bank regulation around the world does not provide a uniformly positive view of recent reforms.

While our preliminary examination of the data challenges the confident proclamations of many observers about improvements in bank regulation and supervision, the qualifications associated with these results must be prominently and repeatedly explicated. We do not relate changes in bank regulations to changes in outcomes. Thus, we do not run any regressions of changes in bank fragility, development, efficiency, or corruption on changes in bank regulations. We leave that to future research. Rather, in this paper, we first document the responses in Survey III and illustrate changes in bank regulations that have taken place over the last decade. Then, based on our early estimates from Survey I, we simulate how changes in bank regulations may influence various outcomes. In sum, the conclusion of this paper is where the analytics begin. Given these new data on banking-system reforms, researchers must assess the direct impact of these reforms on national banking systems to be more confident about which regulatory changes are for the better and which for the worse.

Notes

As in Barth, Caprino and Levine (2006), hereinafter BCL, we sometimes use the term regulation generically to apply to banking-sector policies and compliance mechanisms, while at other times to discuss particular, specific regulations or special aspects of supervision.

See BCL (2006) for the description of the indices, and the caveat on their arbitrary nature. For example, we include the Certified Audit Required variable, which measures whether an external audit by a licensed or certified auditor is required of banks, in the index of private monitoring. Yet, in the countries in which this is a requirement imposed by supervisors, one could instead include this variable in an index of supervision.

This is based on a survey of bank borrowers on the extent to which they had to pay a bribe to get a bank loan. As in this effort we controlled for economy-wide corruption, it is not the case that our results reflect countries stepping up supervision in response to greater corruption.

One difference between the estimates reported in this paper and our earlier work is that here we now use indices based on the summation of the individual questions, rather than computing the principal component of the individual questions underlying the indices. We do this because it makes it much more transparent to see how changes in an individual question changed the index, and hence the estimated probability of a systemic banking crisis. Also, ideally, we would examine how changes in regulatory reforms affect banking-system fragility, development, efficiency, and corruption. This would involve first computing changes in bank regulations for each country, which we documented above in the subsequent section. Second, we would need to compute changes in banking system fragility, development, efficiency, and corruption from 1999 (Survey I) to 2007 (Survey III). Unfortunately, these data are not yet available. Thus, an examination of how changes in banking regulation affect changes in banking-system characteristics will have to wait until these data are constructed.

Owing to poor response quality in Survey III on question 8.3.1, we made a small adjustment to the private monitoring index for conducting the baseline regressions based on Survey I. We do not include 8.3.1 in the private monitoring index for Table 1 regressions below based on the Survey I indices. This has little effect on the estimated results.

The OLS estimate is used in the simulations below, although the instrumental variable results produce similar findings.

The estimated standard error of the simulated forecast is a bit more complex when using the logit estimator because it is non-linearity.

References

Barth, J, Caprio, G and Levine, R . 2001: The regulation and supervision of banks around the world: A new database. In: Litan, R and Herring, R (eds). Brookings-Wharton Papers on Financial Services. Brookings Institution Press: Washington, D.C., pp. 183–240.

Barth, J, Caprio, G and Levine, R . 2004: Bank regulation and supervision: What works best. Journal of Financial Intermediation 12 (April): 205–248.

Barth, J, Caprio, G and Levine, R . 2006: Rethinking Bank Regulation: Till Angels Govern. Cambridge University Press: New York.

Beck, T, Demirgüç-Kunt, A and Levine, R . 2003: Law, endowments, and finance. Journal of Financial Economics 70: 137–181.

Beck, T, Demirgüç-Kunt, A and Levine, R . 2006: Bank supervision and corruption in lending. Journal of Monetary Economics 53: 2131–2163.

Demirgüç-Kunt, A, Detragiache, E and Gupta, P . 2008: Inside the crisis: An empirical analysis of banking systems in distress. Journal of International Money and Finance, forthcoming.

Demirgüç-Kunt, A, Laeven, L and Levine, R . 2004: Regulations, market structure, institutions, and the cost of financial intermediation. Journal of Money, Credit and Banking 36: 593–622.

Laeven, L and Levine, R . 2007: Is there a diversification discount in financial conglomerates? Journal of Financial Economics 85: 331–367.

Levine, R . 2005: Finance and growth: Theory and evidence. In: Aghion, P. and Durlauf, S. (eds). Handbook of Economic Growth, Vol. 1, North-Holland Elsevier Publishers: Amsterdam, pp. 865–934.

Rogoff, K . 2007: The way forward for global financial policy. Project Syndicate, April 13 2007, http://www.project_syndicate.org/commentary/rogoff29.

Acknowledgements

We thank Martin Goetz and Tomislav Ladika for outstanding research assistance and Triphon Phumiwasana for helpful suggestions. We received very helpful comments from Thorsten Beck, Paul Wachtel, and participants at the 13th Dubrovnik Economic Conference, sponsored by the Croatian National Bank, as well as from an anonymous referee.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Barth, J., Caprio, G. & Levine, R. Bank Regulations are Changing: For Better or Worse?. Comp Econ Stud 50, 537–563 (2008). https://doi.org/10.1057/ces.2008.33

Published:

Issue Date:

DOI: https://doi.org/10.1057/ces.2008.33