Abstract

This paper examines the macroeconomic impact of regulating tuna fishing on a small island economy that relies heavily on tourism and fishing for its foreign exchange earnings. While there is scientific consensus to limit the use of drifting fish aggregating devices (dFADs) worldwide, there is no agreement on their optimal number at sea. Resolution 23/02, adopted by the Indian Ocean Tuna Commission (IOTC) in February 2023, proposed a 72-day moratorium on dFADs, but this resolution has met with resistance from many contracting parties, including developing countries. To understand the reasons for this resistance, a recursive, multi-sectoral dynamic general equilibrium model is developed for the Republic of Seychelles, a small tuna-dependent country. The model assesses the short- and medium-term macroeconomic impacts of a seasonal dFAD closure for the Indian Ocean tuna fishery. The analysis suggests that a 12% decline in canned tuna exports would result in a −8.8% deviation from the real gross domestic product trend after seven years. Such an impact would have far-reaching effects on the domestic economy, affecting all components of aggregate demand. Consequently, the economy would become more dependent on tourism, which has shown its vulnerability during the recent pandemic crisis. The study highlights the importance of considering social and economic aspects in sustainable fisheries management and provides insights into the potential consequences of dFAD regulations for small island economies.

Similar content being viewed by others

Introduction

Drifting fish aggregating devices (dFADs) are under scrutiny in the global tuna fishery because of their massive use in the oceans, their significant contribution to the growing fishing capacity of industrial purse seiners, and their negative externalities (e.g., bycatch of endangered and protected species such as pelagic sharks or loss at sea after sinking or stranding, leading to increased marine pollution and habitat degradation)1,2,3,4. Regional Fisheries Management Organizations (RFMOs) have established management plans to curb the intensive use of dFADs by implementing spatial or seasonal closures, limited deployment, and purchase of buoys per vessel, restrictions on dFAD sets, etc.5,6. However, the best intentions of dFAD management measures can also have unintended environmental or economic impacts4,5,6,7.

In February 2023, the Indian Ocean Tuna Commission (IOTC), the RFMO responsible for tuna management in the Indian Ocean, voted in favor of a resolution to create a 72-day seasonal dFAD closure from July 2024. This resolution came from a group of contracting cooperating parties (CPCs) who have experienced the adverse effects of dFADs. However, many other CPCs have objected to this resolution (in September 2023, at least eleven states had objected to this management measure: Comoros, Oman, Somalia (withdrew on March 25, 2023), Philippines, Seychelles, Kenya, European Union, France, Tanzania, Yemen (withdrew on August 8, 2023), Mauritius, Thailand, and Republic of Korea. Objecting members representing more than one-third of the 30 IOTC members, even the non-objecting members “shall not be bound by that measure” any longer (IOTC Circular 2023-51, August 8, 2023)), including developing and coastal states that are economically dependent on tuna landings from industrial purse-seine fisheries. Although the need to restrict the development of dFADs is recognized by most experts around the world, the consequences of management plans in all their dimensions are insufficiently considered7,8.

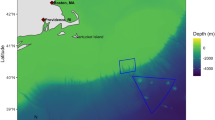

Very few scientific articles look at the socioeconomic consequences of fishery management measures, which are often limited to the sole fleets exploiting the fishery. However, beyond the catch level and landings, the whole value chain could be affected by the conservation measures and, in turn, propagate the downturn effects to the entire economy. This is why a macroeconomic approach is needed not only to determine the economic effects of a shortage on the local value chain of a small island country (the Republic of Seychelles) but also to identify the drivers and channels through which this change affects a fish-dependent economy in the long run. Using a recursive dynamic computable general equilibrium model (CGEM), the case study also highlights the interconnectedness of interests between distant water fishing nations and some coastal countries through the spillover effects affecting their economies. The present research is focused on the economic consequences of an international regulation (dFAD closure) for a small country that would lead to a sharp decline in its exports of canned tuna. According to the managers of the Seychelles-based Thai Union processing company, the closure would result in a plant shutdown of between two and six weeks, corresponding to a drop in activity between 4% and 12% (interview made on May 7, 2023). We have taken the upper bound of this range to provide a counterfactual hypothesis for the evolution of the domestic economy after the shock. This is a worst-case scenario that is unlikely to materialize, as the country and most of its partners have already objected to the resolution and are therefore not bound to it. However, the scenario illustrates the transmission of such an external shock for a small open economy and the multi-dimensional nature of conservation management measures beyond their ecological impact.

Interactions between shared stock fisheries

The literature on fisheries management policy focuses on management’s effectiveness in preventing stock depletion and overfishing9,10,11. Maintaining fish stocks within safe biological limits and achieving a maximum sustainable yield (MSY) remain the cornerstones of natural resource management. This is because the conservation of biomass and biodiversity should support all other dimensions of sustainability, including economic or social aspects such as the role of women in fisheries12. However, in most cases, management measures are designed for each individual species and stock without considering the consequences for the entire ecosystem from which the resources are extracted or the social and economic consequences that the decisions may have on coastal communities13,14.

In tropical tuna fisheries where mobile stocks are shared, interactions initially occur at different age classes between surface and deep-sea fishing gears (e.g., purse-seine and longline)15. For example, purse-seine fleets using dFADs and pole-and-line fleets target juveniles of yellowfin tuna (Thunnus albacares), while longline vessels catch more adults of the same species. Harry Campbell15 estimated what an optimal allocation of yellowfin catches among the three gears (purse-seine, longline, and pole-and-line) might look like. He relied on an earlier estimate of catch interactions between 1978 and 1989, which indicated that a 1% decline of catch per unit effort (CPUE) in the purse-seine fishery corresponded to a 1.68% increase in CPUE in the longline fishery eighteen months later. However, he preferred to use a more conservative response of a 1% increase in longline catches for every 1% decrease in purse-seine yellowfin catches15. Nevertheless, it remains difficult to demonstrate a clear causal relationship between the catch dynamics of yellowfin tuna and bigeye tuna (T. obesus), which have been fished in the Indian Ocean since the 1950s, despite the enormous expansion of purse-seine fisheries since the early 1980s16,17. More recently, Ovando et al.7 studied the bigeye tuna fishery in the West Central Pacific Ocean (WCPO) and attempted to estimate the social cost of bigeye tuna conservation in terms of forgone catches of skipjack tuna (Katsuwonus pelamis) with dFADs. The authors estimated that the MSY of bigeye tuna can only be achieved at the cost of withdrawing three-quarters of the effort on dFADs, which would simultaneously reduce the catch of small bigeye tuna and yellowfin tuna, but also of skipjack. In such a case, the net welfare result would lead to a loss of USD 1.2 billion and would primarily affect the Pacific Small Island Developing States (SIDS), while only Japanese sashimi consumers would benefit7. They concluded that only a limited dFAD removal (~15%) would bring social benefits that exceed costs.

Ecological consequences of fisheries management policies

The consequences of tuna management policies also have other ecological impacts, such as increased bycatch. Drifting FADs used by purse-seiners are known to increase bycatch compared to free school fishing. Watson et al.18 have identified closure areas in the Eastern Pacific Ocean where bycatch of silky sharks (Carcharhinus falciformis) could be reduced by a third, while catches of target tuna species would only be reduced by 12%. However, it sometimes happens that the management of single a species has undesirable consequences for bycatch. For instance, implementing a total allowable catch for yellowfin tuna in the Indian Ocean (IOTC Res. 2016-01) has fostered the use of dFADs in the northern division to avoid large yellowfin tuna, which are harvested on free schools. This has dramatically increased the number of silky sharks accidentally caught with dFADs, at considerable social cost4. It is not easy to find a balanced compromise between the conservation of target stocks and the ecological impact of management decisions. However, most experts agree that dFAD fishing produces detrimental effects on marine ecosystems and should therefore be limited1,3,5,6,19.

Economic effects of dFAD management on SIDS

The economic consequences of dFAD management can also be severe for contracting parties. In the WCPO, SIDS would be the first losers from a substantial reduction in dFADs. The Vessel Day Scheme allows small island countries to sell effort rights in their EEZ (access fees) to the vessels of distant water fishing nations (DWFN)10,20. This system would become less profitable, and the value of the VDS license could decline significantly if dFADs were prohibited or severely restricted7. Recall that fishing access fees represent more than 50% of government revenue for Tuvalu, 70% for Kiribati, and more than 80% for Tokelau21. In the coming decades, climate change will reduce and spatially redistribute tuna biomass, eliminating a significant portion of this revenue for a number of Pacific SIDS (Ibid.) and also for territories located in the Indian Ocean22.

Tuna-dependent economies will not be the only ones to suffer from a seasonal closure of dFAD fishing every year. Purse-seine fleets around the world are increasingly dependent on dFADs because they use larger vessels, supply boats to support them, and use sophisticated electronic equipment such as echo-sounders to detect fish biomass under dFADs, etc.5,6,7,8. It has been estimated that a six-month dFAD closure in the Atlantic and Indian Oceans would reduce the catch by 600 to 1800 tons per boat per year, i.e., 12% to 37% less catch, depending on the season and conditions under which this dFAD restriction measure is implemented23. In the WCPO, the economic loss would amount to 15% of the vessel’s revenue, i.e., on average, USD −250,000 per fishing trip24. The economic prosperity of small developing states relies often on the fish landed by these industrial fleets.

The economic development of small island territories is based on many port activities and fish-related jobs such as stevedores, fuel suppliers, shipping agencies, fishing equipment manufacturers, warehousing agents, sea transporters, fish processors, seafood traders, etc.25. Tourism and fishing are often the two economic pillars of SIDS, providing them with important foreign exchange earnings and enabling them to secure their imports of other commodities and services26,27. However, such specialization increases their vulnerability to external shocks, and diversifying their activities would enhance the conditions for endogenous growth28. Because of this specialization, it is of great interest to evaluate the economic contribution of the fishing industry to local economies based on its direct and indirect effects27.

Economy-wide assessment of fisheries management effects

Typically, economists develop input-output or general equilibrium models to calculate the multiplier effects of the fishing industry on the rest of the economy29. Input-output (IO) approaches have long been applied more generally to fisheries and marine sectors30. Matrix calculus is used to describe the chain of cascading effects that a product or an industry may have on the whole economy (or several in the case of multiregional IO models) through the industrial linkages between suppliers responding to a shift in final demand. Computable general equilibrium models (CGEM) “are based on the theory of general equilibrium, which relies on the main concepts of market clearing and neoclassical micro-economic optimization behavior of rational and homogeneous economic agents”29. Beyond the domestic industry response in output quantity after a demand shift, the CGEM approach introduces a degree of price flexibility31. In real terms, the shock will not fully translate into a proportional impact on the output of national industries. Still, it may also be reflected in lower prices for some commodities and thus mitigate the overall impact on the domestic economy32. The IO and CGEM frameworks offer enough flexibility to establish links to the natural resources and the environment on which economic development is based. Such conceptual developments linking macroeconomic models and fish population dynamics have been proposed in the fisheries literature in the past, either to emphasize the feedback loops between the ecosystem and the economic system33,34 or more often to estimate the economic contribution of commercial or recreational fisheries to the domestic economy35. Our approach is related to this second strand of research but provides an original dynamic CGE approach to account for the sequential effects following an initial shock. Instead of accurately predicting a real shock, such as a seasonal closure of fishery, a possible long-term trend29 is provided for a small island country that would be affected by a fishery management rule that is beyond its control.

The next section presents the results with the deviation of a few selected aggregate variables from their reference levels after the foreign trade shock. The results are discussed in another section to disentangle the multiplier effects of this external shock on the domestic economy of the Seychelles. In a final section, more details are given about the macroeconomic model and its assumptions based on the CGEM literature and an original social accounting matrix tailored for the purpose of this study.

Results

Seychelles as example of a tuna-dependent economy

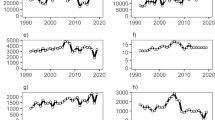

Seychelles has a structural trade deficit that has increased from SCR 7.7 billion in 2015 to SCR 11.8 billion in 2022 (NBS 2023), with significant consequences for the economy and the public sector. The government’s overall balance was at equilibrium or even slightly positive between 2015 and 2019. Nevertheless, it fell sharply into deficit during the COVID-19 pandemic (SCR −3.9 billion in 2020 and SCR −1.5 billion in 2021), as tourism revenues plummeted before recovering in 2022 and 2023 (Central Bank of Seychelles, www.cbs.sc). Tuna products, which on average account for almost 90% of all merchandise exports, have supported the domestic economy during this difficult period, with exports of canned fish actually increasing by 40% in volume terms (20% in nominal terms) between 2019 and 2022 (Fig. 1). This dynamics demonstrates the key role played by the tuna industry for the domestic economy, accounting directly and indirectly for 8% of domestic GDP at basic prices27.

Elaborated from NBS Merchandise trade bulletin, www.nbs.gov.sc.

Effects of a temporal closure scenario

Assuming a worst-case scenario with a significant drop in production and exports following a seasonal closure of tuna fishing for three months (third quarter), we analyze the consequences of this closure for this small open economy. In this context, our simulation cuts the nominal value of fish product exports by 12% in the first year and keeps it constant at this new level in subsequent years, as though the dFAD moratorium was extended from year to year with the same consequences for the country’s tuna landings.

The overall impact of a decline in fish exports would lead, among other things, to a fall in real GDP and growing debt (Fig. 2). Demand for fish by foreign consumers is an essential component of aggregate demand and accounts for 19% of the GDP. The contraction of fish landings and exports will therefore directly affect the GDP by a few points in the first years following the dFAD management decision (−0.1% compared to the reference level of the first year, then −1.5% in the second year, −3.7% in the third year, etc., Table 1). As this industry uses several domestic and foreign inputs and provides jobs for locals and foreigners (Indian Ocean Tuna Ltd the tuna canning plant of Seychelles, belonging 60% to the Thai Union Group and 40% to the state of Seychelles, employs nearly 2000 people, of whom one-third are Seychellois, and two-thirds are foreign workers.), the cascading effects on the economy could be significant, affecting government tax revenue and increasing public debt by more than 4% compared to the reference level after seven years (Fig. 2). The households’ income would also fall proportionately, thus depressing the domestic consumption. Interestingly, all components of the aggregate demand (private consumption, private and public Investment, government spending, and exports) exhibit a similar decreasing pattern, accelerated after the shock (Table 1). It mainly shows the great dependence of the domestic economy on the export performance of this small country. As soon as the main driver of the economy weakens, all other components of demand adjust to the new level of disposable income.

Distinct effects between industries

However, not all sectors are hit to the same extent. The most striking decline is observed in real fish exports, with a negative deviation of 9.4% from the reference levels in the first year after the shock. This effect intensifies in subsequent periods, reaching up to −33.2% after seven years (Tables 1 and s2 in SM), as if the local supply chain has been disrupted impeding any output recovery. This fall would only have a weak impact on the first economic pillar of the domestic economy, i.e., the tourism industry, which would respond positively after the shock (+0.5% and +0.1% for the first two years, respectively) and would only decline by −1% and −3% in the following years. The two opposite trends show the separate dynamics of the two industries, whose drivers are independent of each other. A look at the sectoral contributions to GDP reinforces this result: all sectors are equally affected seven years after the exogenous shock of lower fish exports (−9% compared to the reference levels), except for a few industries (Table s3 in SM). The fishing industry bears a more significant impact than others, experiencing a decline of over −19% after seven years. Simultaneously, the manufacturing industry is also severely affected by the shock, with a reduction of −18%. It is important to remember that energy operators belong to the manufacturing sector supplying the highly fuel-consuming fishing activity36, as well as other companies producing various inputs necessary for fishing at sea (electrical and electronic equipment, ice, salt, fishing gear, food, etc.). At the end of the period following the shock, sectoral GDP in all other industries falls between 9 and 10%, except the tourism industry, whose activity is less severely hit (−6% only after 6 years).

Discussion

Conservation and management measures are intended to replenish fish stocks and, in the event of recovery, increase future catches and landings, as several successful examples have shown in the past37,38. They can also have unintended effects on other ecological components or on social and economic aspects4,39,40. The IOTC adopted a resolution in February 2023 that provides for a seasonal dFAD closure from July 1 to September 11, 2024 (IOTC Res. 23-02). Several contracting parties have objected to this resolution because they considered that this measure was not scientifically justified in all its consequences (For a list of arguments underpinning the objections, see the nine IOTC Circulars (2023-11, 2023-12, 2023-14, 2023-18, 2023-19, 2023-20, 2023-26, 2023-28, 2023-35, 2023-48, 2023-49, 2023-51) downloadable on the IOTC website (https://iotc.org/documents/circulars).). This is why analyzing the effects such a measure may have on small tuna-dependent economies seems important.

We have set up a counterfactual hypothesis based on a worst-case scenario in which the tuna cannery in the Seychelles would be closed for six weeks every year from 2019, resulting in a 12% drop in fish exports, which account for the bulk of the country’s foreign sales. This case is unrealistic as the Republic of Seychelles has already objected to the IOTC Resolution 2023-02 and is evading its implementation in the country as per the RFMO’s rules. Secondly, most trading partners that land and export fish to the country have also objected and can supply the local cannery with frozen tuna. The analysis is nevertheless interesting to understand the consequences of a sudden disruption of fish production and the channels through which a small open economy could be affected41.

In particular, the external impact could be somehow comparable to a strong effect of the El Niño Southern Oscillation (ENSO). This event brought local tuna landings to a halt during the second quarter of 1998, resulting in a 34% decrease in the production value of fisheries and fish processing industries. Consequently, this translated into a −5% change in real GDP22. The recent COVID-19 pandemic was another good example of what could trigger such an external shock. The number of foreign visitors had fallen by 70% in 2020, resulting in an 11% decrease in the GDP27,32.

What is observed in the present case is a twin deficit in public and foreign trade accounts. Several explanations and pass-through effects can be put forward. We summarize the overall effect in the following chart (Fig. 3):

Notes: j stands for sectors or products, EX = export, IM = import, QS = aggregate supply, DD = aggregate demand, VA = value-added, IC = intermediate consumption, ID = input demand, KD = capital demand, LD = labor demand, YHsal = household’s salary income, YHcap = household’s capital income, YF = firms’ revenue, C = consumption, INV = investment, G = government, RoW = Rest of world, IT = indirect taxes, IMT = import taxes, EXP = export price, IMP = import price, CP = composite price, PVA = price of VA, PIC = price of intermediate consumption, W = wage, R = interest rate, S = savings. Links represent income or expenditure. Dashed flows represent transfers (taxes, savings, social transfers, grants, remittances, etc.).

The first is based on a Keynesian loop related to the loss of capital (KD→YF+YHcap →C + INV→DD→QS→VA→KD in Fig. 3). The fishing industry is capital-intensive, with capital income representing 92% of the primary income in the case of the Seychelles. Consequently, the capital market (and thus investment and savings) collapsed after the shock, affecting almost all industries. The marginal rate of substitution becomes smaller than the marginal rate of transformation, resulting in a lower relative price of fish compared to other goods and services. Domestic consumption does not respond to this decreasing price by consuming more fish because this specific output (canned tuna), which is produced in very large quantities (~50,000 tons per year, see Fig. 1), is almost exclusively destined for the export market. Labor-intensive activities do not benefit from the new situation because the public sector is also hit, reducing social transfers and public investment. Only a few industries can take advantage of the lower interest rates, like the financial and real estate sectors, but this is far from offsetting the loss of the seafood industry, in which the country specializes. The whole economy is therefore depressed by the decline of household consumption.

The second channel through which the economy is affected lies in the Leontief multiplier effects (QS→IC→ID→QS in Fig. 3). The intermediate demand for inputs by the seafood industry has dramatically decreased after the shock, in particular the demand for self-consumed inputs such as frozen tuna landed by Seychelles-flagged (domestic inputs) vessels or foreign-flagged vessels (imported inputs), but also transportation and storage, food products (oil, salt), rubber and plastics used for fishing nets or packaging, marine diesel, stevedoring services, electronic equipment, etc. The spillover effects of this central activity are usually very important for such specialized small island economies21,29,42. The spillover effects spread throughout the economy, cascading from industry to industry and from year to year in our recursive multisector dynamic system.

A meta-analysis of economic multipliers in the marine sector lato sensu (including freight, shipbuilding, marine renewable energy, aquaculture, tourism, etc.) estimated an average output multiplier of 1.82. This suggests that every US dollar generated by the marine sector would result in an additional 82 cents increase in domestic output across the rest of the economy30. In the Seychelles’ case, the fish industry’s output multiplier was estimated to be slightly higher (1.99)27. The fish industry’s supplier, which has been mainly affected by the decreasing production of canned tuna, was the ‘Transportation and storage’ sector. This latter sector nonetheless creates wealth within the domestic economy by consuming many intermediate and primary inputs, such as the refined oil produced by the local petroleum company from imported crude oil. We can therefore understand why the trade balance is deeply modified after the external shock, not only on the export side but also through imported goods and services.

The third transmission channel of the shock is naturally passing through foreign trade and investment, thereby creating a twin deficit in the country (EX-IM→RoW→IT + IMT→G + INV →DD→ EX-IM in Fig. 3). The fishing industry imports a third of its inputs but exports 96% of its output. After a shock that affects exports of fishery products, the trade balance becomes strongly negative, leading to financing needs that cannot be met by domestic savings, increasing the public deficit. The government incurs a loss of tax income, inflating its current deficit and debt stock. Remember that the state holds 40% of the shares of the local canning company (Indian Ocean Ltd), which is owned by Thai Union Group, a foreign investor, for the remaining shares. Because of the decreasing activity of the cannery during the dFAD closure season, the government receives fewer royalties and corporate income tax revenue. However, indirect taxes only have a weak impact on the public budget, as the tax rates on value-added or import duties for fishery input products are virtually zero. On the other hand, the loss of duties on the shrinking import flows of energy products can be more harmful to the government. Consequently, the state has a less active supporting role through its spending (consumption + public investment) or money transfers to private institutions (firms and households). With the current account balance drifting towards a larger deficit for the country, the financing capacity of foreigners could rise and trickle down to the domestic economy through grants, aid, loans, or foreign investment. However, the latter variables are considered fixed in the model and cannot supplement the weakening domestic demand.

Conclusive remarks and limitations of the study

In this article, we have examined the macroeconomic consequences of an international fisheries management measure for a small open economy. The recent IOTC decision on a 72-day closure of the dFAD fishery for the Indian Ocean purse-seine fishery could lead to a shortage of fish supply for tuna-dependent areas and affect other activities and institutions through a chain of cascading effects. Using a dynamic general equilibrium model applied to the case of Seychelles, we examined the spillover effects of a 12% decline in fish exports for this country.

We show that this shock to foreign demand affects all industries and institutions in this small open economy that specializes in tourism and fishing. The shock wave spreads rapidly to the domestic demand for all goods and services through the decline in capital income. The IMF’s projected growth trend of 3–4% is undermined by a deviation of nearly 9% after seven years, resulting in a change in GDP of −5% or −6%, with the impact compounding over time if other factors remain equal, i.e., in the absence of countervailing economic policies or international support. All the drivers of aggregate demand are affected (household consumption, investment, government spending, etc.), starting with the most important one (exports), so that the entire domestic economy depends on foreign visitors and tourist activities, increasing its vulnerability to a new shock such as a pandemic or an international crisis. The overall effect on the domestic economy is comparable to a strong ENSO event, as shown in the past (1998) for this small island territory.

Several limitations of the study can be put forward. The first one concerns the hypothetical case itself, which is not likely to happen since one-third of the IOTC members have objected, thus canceling the dFAD management measure. The shock is therefore certainly overestimated because a re-allocation of the fishing effort to free school fishing or substitutes of raw material inputs for the tuna cannery may occur if the measure is implemented. A second one lies in the lack of recent data to build an updated version of the social accounting matrix. However, what matters is the deviation trend after the shock, rather than the accuracy of the outcome itself. In future research, more comprehensive analysis should be undertaken to assess the effects of dFAD management at the overall scale of the Indian Ocean tuna fishery. This analysis should involve all fleets and all CPCs, with the aim of establishing a fair and sustainable agreement.

Methods

The model presented in this paper builds on interesting contributions in dynamic general equilibrium modeling, like those of refs. 31,33,43,44. However, it differs from some of these models’ treatment of expectations since households and firms are myopic in their decision-making. Our model is thus a recursive dynamic general equilibrium that can then be viewed as a sequence of successive static general equilibria linked by adjusting the level of capital and labor stocks. The Seychelles is treated as a small open economy that takes world prices as given. The whole structure and equations of the model are described in ref. 32. The assumptions about the reference case are specified in Table s1 (SM) to avoid a tedious presentation in the core of the text. Four types of economic agents are considered: firms, households, the government, and the rest of the world. The model considers the linkages between firms, households, and the government in the domestic economy and the economy’s linkages with the rest of the world, considering resource constraints. The main economic agents in the model respond to changes in relative prices. The model considers the presence of taxes levied by the government on transactions of goods and services and primary factor incomes. It also considers the government’s ability to invest in public infrastructure, which affects the productivity of private primary factors.

The model assumes an exogenous growth rate for the labor force in the economy. In the reference situation, the model provides projections for various sectoral and macroeconomic variables based on IMF projections for real GDP growth rates and the values of exports of goods (Table s1 in SM) (https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/SYC). Based on the growth rate of the labor force and the evolution of physical capital, the model determines the underlying growth rates of total factor productivity, which are consistent with GDP growth rates.

The calibration of the model is based on the 2019 social accounting matrix (SAM) of the Seychelles, built using the coefficients of the 2014 SUT and 2019’s actual levels for aggregate variables from the national accounts, balance of payments, and government financial operations statistics32. The Seychelles Industrial Classification of 23 industries and 35 products was aggregated into nine sectors (Agriculture, Fish industry, Manufacturing, Utilities, Construction, Finance and real estate, Tourism, Information, and communications, and Other services. The 23 industries and 35 products are included in the model; aggregation into nine sectors is done only for the presentation of the model results.) to simplify the presentation of results. The ‘fish industry’ group encompasses fishing and fish processing activities.

Firms

In each industry, production requires a combination of labor, capital, and intermediate inputs. The production technology features constant returns to scale and provides managers with various options for substituting inputs in response to changes in relative prices. The productivity of private primary factors is influenced by the government’s public capital stock. Firms pay taxes and invest in physical capital, which increases their capital stock.

The optimal level of inputs is determined by a cost minimization rule and the Shephard lemma. Since firms are not endowed with intertemporal behavior in the model, the level of investment is determined ad hoc based on the rental rate of capital and the price of capital goods. Gross output is transformed into goods using a fixed-proportion rule, and the same good produced by different industries is aggregated using a CES function. The representative firm receives transfers from the government and retains a fixed share of the return on capital for saving.

Households

Households have preferences for leisure and for domestically produced and imported goods. Over time, their total time endowment grows at the same rate as the constant growth rate of the population. They allocate their time between labor and leisure and derive their income from the returns to labor and physical capital, transfers received from the government, and net transfers from the rest of the world. They pay income taxes to the government and other taxes, such as sales taxes on goods, levied by the government.

In each period, the representative household maximizes its utility, subject to a budget constraint, to determine the optimal level of labor supply and consumption of goods. A two-level nested utility function is used to represent the preferences of representative households, where utility is a logarithmic function of total consumption and leisure at the top level and total consumption is a CES function of various goods at the second level. A two-step optimization process is used to solve the representative household problem. At the optimum, an increase in the relative price of a good reduces relative quantity demanded.

The government

The government consumes goods and invests in public capital, increasing the productivity of private factors. It finances its expenditures through taxes and bond issuance. Government spending includes consumption and public investment spending, transfers to households and firms, and interest payments on government debt. A fixed proportion rule is used to allocate the total expenditure of each category among the various commodities. The government’s total outlays minus its total revenue represents its balance. When this is negative, the government finances the deficit through bonds purchased by domestic households and non-residents. The government pays interest on its outstanding debt to domestic and foreign residents. Government spending on capital goods increases the public capital stock and affects the productivity of private primary factors such as private capital and labor. Public investment affects the economy both on the traditional demand side through the demand for capital goods and on the supply side through its impact on the productivity of private factors.

Relations with the rest of the world

The domestic economy relates to the rest of the world through exports, imports, transfers to households and the government, and net capital inflows to finance investment. On the supply side, total production of each good in the domestic economy is sold or exported. A constant elasticity of transformation (CET) function is used to capture the transformation of the composite into sales in both markets. A revenue maximization rule is used to determine the optimal level of sales in each market.

On the demand side, domestic agents’ total demand for each commodity includes demand from households, the government, firms for intermediate uses, and investment by the private sector and the government. Investment demand by sector of destination is a different concept from investment demand, which we discussed earlier. Total investment by sector of destination is a composite of investment demand by sector of origin. A Cobb-Douglas aggregator combines investment by sector of origin to form total investment demand by sector of destination. A cost-minimization rule is used to determine the composition of the composite and its dual price. The aggregate demand for each good is a composite of domestically produced goods and imports. A CES aggregator captures the imperfect substitutability between the goods of the two origins.

Equilibrium and dynamics

The model assumes that all economic agents respect their budget constraints and that market equilibrium is achieved through price adjustment. The wage rate adjusts to clear the labor market, and the price of each domestically produced good adjusts to supply and demand. Capital is industry-specific, and investment flows move between industries in response to differences in rates of return. There is a macroeconomic equilibrium between savings and investment in which total investment must be financed by total savings, i.e., the sum of foreign and domestic savings. To avoid an unsustainable level of debt, the model incorporates a closure rule in which the ratio of foreign savings to current GDP follows an exogenous path each period. The model is closed by adjusting in each period the saving rates of households to achieve equilibrium between savings and investment. The evolution of the labor force, private and public capital, and public debt drives the model’s dynamics.

Data availability

The Social Accounting Matrix data supporting this study are available from the corresponding author upon request.

References

Hanich, Q., Davis, R., Holmes, G., Amidjogbe, E. R. & Campbell, B. Drifting fish aggregating devices (FADs): deploying, soaking and setting—when is a FAD ‘Fishing’? Int. J. Mar. Coast. Law 34, 731–754 (2019).

Gomez, G., Farquhar, S., Bell, H., Laschever, E. & Hall, S. The IUU nature of FADs: implications for tuna management and markets. Coast. Manag. 48, 534–558 (2020).

Churchill, R. Just a harmless fishing FAD—or does the use of FADs contravene international marine pollution law? Ocean Dev. Int. Law 52, 169–192 (2021).

Tolotti, M., Guillotreau, P., Forget, F., Capello, M. & Dagorn, L. Unintended effects of single-species fisheries management. Environ. Dev. Sustain 25, 1–24 (2022).

Davies, T. K., Mees, C. C. & Milner-Gulland, E. J. The past, present and future use of drifting fish aggregating devices (FADs) in the Indian Ocean. Mar. Policy 45, 163–170 (2014).

Song, L. & Shen, H. An integrated scheme for the management of drifting fish aggregating devices in tuna purse seine fisheries. Fish. Manag. Ecol. https://doi.org/10.1111/fme.12600 (2022).

Ovando, D., Libecap, G. D., Millage, K. D. & Thomas, L. Coasean approaches to address overfishing: Bigeye tuna conservation in the Western and Central Pacific Ocean. Mar. Resour. Econ. 36, 91–109 (2021).

Capello, M., Merino, G., Tolotti, M., Murua, H. & Dagorn, L. Developing a science-based framework for the management of drifting Fish Aggregating Devices. Mar. Policy 153, 105657 (2023).

Allen, R., Joseph, J. A. & Squires, D. Conservation and Management of Transnational Tuna Fisheries (John Wiley & Sons, 2010).

Yeeting, A. D., Bush, S. R., Ram-Bidesi, V. & Bailey, M. Implications of new economic policy instruments for tuna management in the Western and Central Pacific. Mar. Policy 63, 45–52 (2016).

Wiedenmann, J., Wilberg, M., Sylvia, A. & Miller, T. An evaluation of acceptable biological catch (ABC) harvest control rules designed to limit overfishing. Can. J. Fish. Aquat. Sci. 74, 1028–1040 (2017).

Barclay, K. M., Satapornvanit, A. N., Syddall, V. M. & Williams, M. J. Tuna is women’s business too: Applying a gender lens to four cases in the Western and Central Pacific. Fish. Fish. 23, 584–600 (2022).

Pikitch, E. K. et al. Ecosystem-based fishery management. Science 305, 346–347 (2004).

Hornborg, S. et al. Ecosystem-based fisheries management requires broader performance indicators for the human dimension. Mar. Policy 108, 103639 (2019).

Campbell, H. Investing in yellowfin tuna, the economics of conservation. Mar. Policy 18, 19–28 (1994).

Okamoto, H. & Miyabe, N. Updated standardized CPUE of Bigeye Caught by the Japanese Longline Fishery in the Indian Ocean, and Stock Assessment by Production Model (eds Anganuzzi et al.) Vol. 1996, 225–231 (1996).

Nishida, T. Influence of purse-seine fisheries on longline fisheries for yellowfin tuna (Thunnus albacares) in the western Indian Ocean. In IOTC Proceedings, 6th Expert Consultation on Indian Ocean Tunas Vol. 9, 258–263 (1996).

Watson, J. T., Essington, T. E., LENNERT‐CODY, C. E. & Hall, M. A. Trade‐offs in the design of fishery closures: management of silky shark bycatch in the Eastern Pacific Ocean tuna fishery. Conserv. Biol. 23, 626–635 (2009).

Lennert-Cody, C. E., Moreno, G., Restrepo, V., Román, M. H. & Maunder, M. N. Recent purse-seine FAD fishing strategies in the eastern Pacific Ocean: what is the appropriate number of FADs at sea? ICES J. Mar. Sci. 75, 1748–1757 (2018).

Havice, E. The structure of tuna access agreements in the Western and Central Pacific Ocean: Lessons for Vessel Day Scheme planning. Mar. Policy 34, 979–987 (2010).

Bell, J. D. et al. Pathways to sustaining tuna-Pacific Island economies during climate change. Nat. Sustain. 4, 900–910 (2021).

Robinson, J. et al. Impacts of climate variability on the tuna economy of Seychelles. Clim. Res. 43, 149–162 (2010).

Escalle, L. et al. Forecasted consequences of simulated FAD moratoria in the Atlantic and Indian Oceans on catches and bycatches. ICES J. Mar. Sci. 74, 780–792 (2017).

Holmes, G., Hanich, Q. & Soboil, M. Economic benefits of FAD set limits throughout the supply chain. Mar. Policy 103, 1–8 (2019).

Bell, J. D. et al. Realising the food security benefits of canned fish for Pacific Island countries. Mar. Policy 100, 183–191 (2019).

Pratt, S. The economic impact of tourism in SIDS. Ann. Tour. Res. 52, 148–160 (2015).

Guillotreau, P., Antoine, S., Bistoquet, K., Chassot, E. & Rassool, K. How fisheries can support a small island economy in pandemic times, the Seychelles case. Aquat. Living Resour. 36, 24 (2023).

Bell, J. D. et al. Diversifying the use of tuna to improve food security and public health in Pacific Island countries and territories. Mar. Policy 51, 584–591 (2015).

Akbari, N., Failler, P., Pan, H., Drakeford, B. & Forse, A. The impact of fisheries on the economy: a systematic review on the application of general equilibrium and input–output methods. Sustainability 15, 6089 (2023).

Jacobsen, K. I., Lester, S. E. & Halpern, B. S. A global synthesis of the economic multiplier effects of marine sectors. Mar. Policy 44, 273–278 (2014).

Dissou, Y. Dynamic effects in Senegal of the regional trade agreement among UEMOA countries. Rev. Int. Econ. 10, 177–199 (2002).

AfDB. Economic Impacts of COVID-19 and Policy Options in the Seychelles 97. https://www.afdb.org/en/documents/economic-impacts-covid-19-and-policy-options-seychelles (African Development Bank Group, 2021).

Jin, D., Hoagland, P. & Dalton, T. M. Linking economic and ecological models for a marine ecosystem. Ecol. Econ. 46, 367–385 (2003).

Cordier, M., Uehara, T., Weih, J. & Hamaide, B. An input-output economic model integrated within a system dynamics ecological model: feedback loop methodology applied to fish nursery restoration. Ecol. Econ. 140, 46–57 (2017).

Waters, E. C., Seung, C. K., Hartley, M. L. & Dalton, M. G. Measuring the multiregional economic contribution of an Alaska fishing fleet with linkages to international markets. Mar. Policy 50, 238–248 (2014).

Basurko, O. C. et al. Fuel consumption of free-swimming school versus FAD strategies in tropical tuna purse seine fishing. Fish. Res. 245, 106139 (2022).

Fromentin, J. M., Bonhommeau, S., Arrizabalaga, H. & Kell, L. T. The spectre of uncertainty in management of exploited fish stocks: The illustrative case of Atlantic bluefin tuna. Mar. Policy 47, 8–14 (2014).

Hilborn, R. et al. Effective fisheries management instrumental in improving fish stock status. Proc. Natl Acad. Sci. USA 117, 2218–2224 (2020).

Knapp, R. A., Corn, P. S. & Schindler, D. E. The introduction of non-native fish into wilderness lakes: good intentions, conflicting mandates, and unintended consequences. Ecosystems 4, 275–278 (2001).

Abbott, J. K. & Haynie, A. C. What are we protecting? Fisher behavior and the unintended consequences of spatial closures as a fishery management tool. Ecol. Appl. 22, 762–777 (2012).

Guillotreau, P., Campling, L. & Robinson, J. Vulnerability of small island fishery economies to climate and institutional changes. Curr. Opin. Environ. Sustain. 4, 287–291 (2012).

Gephart, J. A., Deutsch, L., Pace, M. L., Troell, M. & Seekell, D. A. Shocks to fish production: Identification, trends, and consequences. Glob. Environ. Change 42, 24–32 (2017).

Dissou, Y. & Didic, S. Public Infrastructure and Economic Growth. Working paper, Department of Economics, University of Ottawa (2011).

Lofgren, H. & Robinson, S. Public Expenditures, Growth, and Poverty: Lessons from Developing Countries, Chapter 6, 184–224 (IFPRI & The John Hopkins University Press, 2008).

Acknowledgements

The authors are grateful to France Filière Pêche (FFP) which has funded the MANFAD project on which this research is carried out. The authors also thank the National Bureau of Statistics of Seychelles, the Ministry of Fisheries and Blue Economy, the Seychelles Fishing Authority and the Central Bank of Seychelles for collecting and sharing their data.

Author information

Authors and Affiliations

Contributions

P.G. has contributed to the data collection, analysis, and writing; Y.D. has contributed to the design of the model, data collection and processing, analysis of results, and writing; S.A., M.C., F.S., A.T. and L.D. have contributed to the analysis of results, writing and editing process.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Guillotreau, P., Dissou, Y., Antoine, S. et al. Macroeconomic impact of an international fishery regulation on a small island country. npj Ocean Sustain 3, 18 (2024). https://doi.org/10.1038/s44183-024-00054-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s44183-024-00054-w