Abstract

The major purposes of this study are two fold. First, we investigate whether or not the dilutive effect from stock options on the denominator of earnings per share is associated with the incurrence of stock repurchases. We use the FASB dilution and the economic dilution as the direct dilution measures and examine their relationship with stock repurchase decision. Second, we explore which of the extant measures of stock options can better explain the incurrence of stock repurchases. Six extant measures of stock options from previous studies are used: (1) the FASB's treasury-stock EPS dilution method, (2) the economic dilution measure based on Core, Guay and Kothari (2002), (3) the number of employee stock option exercises, (4) the number of stock option grants, (5) the number of total stock options outstanding, and (6) the number of exercisable stock options.

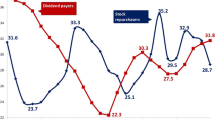

Using a pooled cross-sectional sample from 1996–2000, we find a positive association between the likelihood of stock repurchases and the FASB dilution as well as the economic dilution in EPS, respectively. Thereby providing support for the undo-dilution hypothesis. The highest incremental explanatory power is found when we add the number of stock options exercisable to the baseline model. However, further analysis does not support the option-funding hypothesis suggested by Kahle (2002). We provide two explanations for why exercisable stock options better explain the stock repurchase decision.

Similar content being viewed by others

References

Aboody, D., M. Barth and R. Kasznik, “SFAS No. 123 Stock-Based Compensation Expense and Equity Market Values.” The Accounting Review 79, 251–276 (2004).

Bagwell, L. S., “Share Repurchase and Takeover Deterrence.” RAND Journal of Economics 27, 72–88 (1991).

Bagwell, L.S. and J. B. Shoven, “Share Repurchases and Acquisitions: An Analysis of which Firms Participate.” In A. G. Auerbach (Ed.). Corporate Takeovers: Causes and Consequences. Chicago, IL: University of Chicago Press, 191–213 1988.

Barth, M. E. and R. Kasznik, “Share Repurchases and Intangible Assets.” Journal of Accounting and Economics 28, 211–241 (1999).

Bartov, E., “Open-Market Stock Repurchases as Signals for Earnings and Risk Changes.” Journal of Accounting and Economics 14, 275–294 (1991).

Bens, D. A., V. Nagar and M. H. F. Wong, “Real Investment Implications of Employee Stock Option Exercises.” Journal of Accounting Research 40, 359–393 (2002).

Bens, D. A., V. Nagar, D. J. Skinner and M. H. F. Wong, “Employee Stock Options, EPS Dilution, and Stock Repurchases.” Journal of Accounting and Economics 36, 51–91 (2003).

Black, F. and M. Scholes, “The Pricing of Options and Corporate Liabilities.” Journal of Political Economy 81, 637–654 (1973).

Brav, A., J. R. Graham, C. R. Harvey and R. Michaely, Payout Policy in the 21st Century. Unpublished working paper, 2003.

Comment, R. and G. Jarrell, “The Relative Signaling Power of Dutch-Auction and Fixed Price Self-Tender Offers and Open Market Share Repurchases.” Journal of Finance 46, 1243–1271 (1991).

Core, J. and W. Guay, “Estimating the Value of Stock Option Portfolios and Their Sensitivities to Price and Volatility.” Journal of Accounting Research 40, 613–630 (2002).

Core, J., W. Guay and S. P. Kothari, “The Economic Dilution of Employee Stock Options: Diluted EPS for Valuation and Financial Reporting.” The Accounting Review 77, 627–652 (2002).

Dittmar, A. K., “Why do Firms Repurchase Stock?” Journal of Business 73, 331–355 (2000).

Financial Accounting Standards Board (FASB), Statement of Financial Accounting Standards No.123: Accounting for Stock-based Compensation. FASB, Norwalk, CT (1995).

Financial Accounting Standards Board (FASB), Earnings per Share. Statement of Financial Accounting Standards No. 128. Norwalk, CT: FASB, 1997.

Fenn, G. W. and N. Liang, “Corporate Payout Policy and Managerial Stock Incentives.” Journal of Financial Economics 60, 45–72 (2001).

Guay, W., “Discussion of: Real Investment Implications of Employee Stock Option Exercises.” Journal of Accounting Research 40, 395–406 (2002).

Hovakimian, A., T. Opler and S. Titman, “The Debt-Equity Choice.” Journal of Financial and Quantitative Analysis 36, 1–24 (2001).

Huson, M. R., T. W. Scott and H. A. Wier, “Earnings dilution and the Explanatory Power of Earnings for Returns. The Accounting Review 76, 589–612 (2001).

Jagannathan, M., C. P. Stephens and M. S. Weisbach, “Financial Flexibility and the Choice Between Dividends and Stock Repurchases.” Journal of Financial Economics 57, 355–384 (2000).

Jensen, M., “Agency Costs of Free-Cash-Flow, Corporate Finance, and Takeovers.” American Economic Review 76, 323–329 (1986).

Jolls, C., “Stock Repurchases and Incentive Compensation.” NBER working paper 6467 (1998).

Kahle, K. M., “When a Buyback Isn't a Buyback: Open Market Repurchases and Employee Options.” Journal of Financial Economics 63, 235–261 (2002).

Klassen, K. J. and R. Sivakumar, “Stock Repurchases Associated With Stock Options do Represent Dollars Out of Shareholders' Wallets.” Unpublished working paper. University of Waterloo 2001.

Lambert, R. A., W. Lanen and D. Larcker, “Executive Stock Option Plans and Corporate Dividend Policy.” Journal of Financial and Quantitative Analysis 24, 409–425 (1989).

Liang, J. N. and S.A. Sharpe, “Shares Repurchases and Employee Stock Options and Their Implications for S&P 500 Share Retirements and Expected Returns.” Unpublished working paper. Division of Research and Statistics, Federal Reserve Board, 2000.

Maddala, G. S. Introduction to Econometrics. 2 edition, N.Y.: MacMillan, 1992.

Neill, J. D. and G. M. Pfeiffer, “The Effect of Potentially Dilutive Securities on P/Es.” Financial Analysts Journal, 58–64 (1999).

Ofer, A. and A. V. Thakor, “A Theory of Stock Price Responses to Alternative Corporate Cash Disbursement Methods: Stock Repurchases and Dividends.” Journal of Finance 42, 365–394 (1987).

Scholes, M. S. and M. A. Wolfson, Taxes and Business Strategy: A Planning Approach. Englewood Cliffs NJ: Prentice-Hall, 1992.

Stephens, C. P. and M. S. Weisbach, “Actual Share Reacquisition's in Open-Market Repurchase Programs.” Journal of Finance 53, 313–334 (1998).

Vermaelen, T., “A Common Stock Repurchases and Market Signaling: An Empirical Dissertation.” Journal of Financial Economics (June), 139–183 (1981).

Weisbenner, S. J., “Corporate Share Repurchase in the 1990s: What Role do Stock Options Play?” FEDS Working Paper, No. 2000-29 2000.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lee, CH., Alam, P. Stock Option Measures and the Stock Repurchase Decision. Review of Quantitative Finance and Accounting 23, 329–352 (2004). https://doi.org/10.1023/B:REQU.0000049320.04188.a7

Issue Date:

DOI: https://doi.org/10.1023/B:REQU.0000049320.04188.a7