Abstract

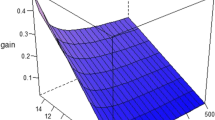

It is well established that house prices are dynamic. It is also axiomatic that location influences such selling prices, motivating our objective of incorporating spatial information in explaining the evolution of house prices over time. In this paper, we propose a rich class of spatio-temporal models under which each property is point referenced and its associated selling price modeled through a collection of temporally indexed spatial processes. Such modeling includes and extends all house price index models currently in the literature, and furthermore permits distinction between the effects of time and location. We study single family residential sales in two distinct submarkets of a metropolitan area and further categorize the data into single- and multiple-transaction observations. We find the spatial component is very important in explaining house price. Moreover, the relative homogeneity of homes within the submarket and the frequency with which homes sell affects the pattern of variation across space and time. Differences between single and repeat sale data are evident. The methodology is applicable to more general capital asset pricing when location is anticipated to be influential.

Similar content being viewed by others

References

Archer, W. R., D. H. Gatzlaff, and D. C. Ling. (1996). "Measuring the Importance of Location in House Price Appreciation," Journal of Urban Economics 40, 334-353.

Bailey, M. J., R. F. Muth, and H. O. Nourse. (1963). "A Regression Method for Real Estate Price Index Construction," Journal of the American Statistical Association 58, 933-942.

Basu, S., and T. G. Thibodeau. (1998). "Analysis of Spatial Correlation in House Prices," Journal of Real Estate Finance and Economics 17, 61-85.

Can, A. (1990). "The Measurement of Neighborhood Dynamics in Urban Housing Prices," Economic Geography 66(3), 254-272.

Can, A., and I. Megbolugbe. (1997). "Spatial Dependence and House Price Index Construction," Journal of Real Estate Finance and Economics 14, 203-222.

Case, B., and J. M. Quigley. (1991). "The Dynamics of Real Estate Prices," The Review of Economics and Statistics 73(3), 50-58.

Case, K. E., and R. J. Shiller. (1989). "The Efficiency of the Market for Single Family Homes," American Economic Review 79, 125-137.

Clapp, J. M., C. Giaccotto, and D. Tirtiroglu. (1991). "Repeat Sales Methodology for Price Trend Estimation," Journal of the American Real Estate and Urban Economics Association 19, 270-285.

Court, A. T. (1939). the Dynamics of Automobile Demand. New York: General Motors.

Cox, D. R., and D. Oakes. (1984). Analysis of Survival Data. New York: Chapman and Hall.

Cressie, N. (1993). Statistics for Spatial Data. New York: John Wiley and Sons.

Dubin, R. A. (1988). "Estimation of Regression Coefficients in the Presence of Spatial Autocorrelated Error Terms," Review of Economics and Statistics 70, 466-474.

Dubin, R. A. (1992). "Spatial Autocorrelation and Neighborhood Quality," Regional Science and Urban Economics 22, 433-452.

Dubin, R. A., and C.-H. Sung. (1990). "Specification of hedonic Regressions: Non-nested Tests on Measures of Neighborhood Quality," Journal of Urban Economics 27, 97-110.

Ecker, M. D., and A. E. Gelfand. (2003). "Spatial Modeling and Prediction under Stationary Non-Geometric Range Anisotropy," Environmental and Ecological Statistics 10, 165-178.

Gatzlaff, D. H., and D. R. Haurin. (1997). "Sample Selection Bias and Repeat-Sales Index Estimates," The Journal of Real Estate Finance and Economics 14(1/2), 33-50.

Gelfand, A. E., and S. K. Ghosh. (1998). "Model Choice: A Minimum Posterior Predictive Loss Approach," Biometrika 85, 1-11.

Gelfand, A. E., S. K. Ghosh, J. R. Knight, and C. F. Sirmans. (1998). "Spatio-Temporal Modeling of Residential Sales Data," Journal of Business and Economic Statistics 16, 312-321.

Gelfand, A. E., and A. M. F. Smith. (1990). "Sampling Based Approaches to Calculating Marginal Densities," Journal of the American Statistical Association 85, 398-409.

Goetzmann, W. N., and M. Spiegel. (1997). "A Spatial Model of Housing Returns and Neighborhood Substitutability," Journal of the Real Estate Finance and Economics 14, 11-32.

Goodman, A. C. (1978). "Hedonic Prices, Price Indices, and Housing Markets," Journal of Urban Economics 5(4), 471-484.

Hill, R. C., J. R. Knight, and C. F. Sirmans. (1997). "Estimating Capital Asset Price Indexes," The Review of Economics and Statistics 79, 226-233.

Hill, R. C., C. F. Sirmans, and J. R. Knight. (1999). "A Random Walk Down Main Street," Regional Science and Urban Economics 29, 89-103.

Knight, J. R., J. Dombrow, and C. F. Sirmans. (1995). "A Varying Parameters Approach to Constructing House Price Indexes," Real Estate Economics 23(2), 87-105.

Li, M., and H. J. Brown. (1980). "Micro-neighborhood Externalities and Hedonic Housing Prices," Land Economics 56, 125-141.

Pace, R. K., R. Barry, J. M. Clapp, and M. Rodriguez. (1998). "Spatiotemporal Autoregressive Models of Neighborhood Effects," The Journal of Real Estate Finance and Economics 17(1), 15-33.

Pace, R. K., and O. W. Gilley. (1998). "Generalizing OLS and the Grid Estimator," Real Estate Economics 26(2), 331-347.

Quigley, J. M. (1995). "A Simple Hybrid Model for Estimating Real Estate Indexes," Journal of Housing Economics 4, 1-12.

Ridker, R. G., and J. A. Henning. (1967). "The Determinants of Property Values with Special Reference to Air Pollution," The Review of Economics and Statistics 49(2), 246-257.

Rosen, S. (1974). "Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition," The Journal of Political Economy 82(1), 34-55.

Shiller, R. J. (1993). "Measuring Asset Values for Cash Settlement in Derivative Markets: Hedonic Repeated Measures Indices and Perpetual Futures," The Journal of Finance 98(3), 911-931.

Thibodeau, T. G. (1989). "Housing Price Indexes from the 1974-83 SMSA Annual Housing Surveys," Journal of the American Real Estate and Urban Economics Association 17(1), 100-117.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Gelfand, A.E., Ecker, M.D., Knight, J.R. et al. The Dynamics of Location in Home Price. The Journal of Real Estate Finance and Economics 29, 149–166 (2004). https://doi.org/10.1023/B:REAL.0000035308.15346.0a

Issue Date:

DOI: https://doi.org/10.1023/B:REAL.0000035308.15346.0a