Abstract

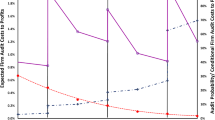

In this paper we address the role of theveil of ignorance on work incentives andtax rates in a two-person real effortexperiment. We find that effort levelsdecrease with a rise in tax rates. Taxrevenues peak at intermediate tax rates of50% to 65%, supporting the existence of aLaffer curve in taxation. Tax authoritiesdo not exploit their power to tax in full,which is compatible both with revenuemaximizing but also fair behavior. Behindthe veil of ignorance, subjects care morefor efficiency and restrict the power totax more than in case their position(taxpayer or tax authority) is fixed inadvance.

Similar content being viewed by others

References

Alm, J., Jackson, B.R. and McKee, M. (1992). Institutional uncertainty and taxpayer compliance. American Economic Review 82: 1018-1026.

Alm, J., Jackson, B.R. and McKee, M. (1993). Fiscal exchange, collective decision institutions, and tax compliance. Journal of Economic Behavior and Organization 22: 285-303.

Alm, J., McClelland, G.H. and Schulze, W.D. (1999). Changing the social norm of tax compliance by voting. Kyklos 52: 141-172.

Andreoni, J., Erard, B. and Feinstein, J. (1998). Tax compliance. Journal of Economic Literature 36: 818-860.

Becsi, Z. (2000). The shifty Laffer curve. Federal Reserve Bank of Atlanta Economic Review 85: 53-64.

Bolton, G.E. and Ockenfels, A. (2000). ERC: A theory of equity, reciprocity and competition. American Economic Review 90: 166-193.

Bosman, R. and Winden, F., van (2002). Emotional hazard in a power-to-take game experiment. Economic Journal 112: 147-169.

Bosman, R., Sutter, M. and Winden, F., van (2000). Emotional hazard and real effort in a power-to-take game: An experimental study. Tinbergen Institute - Discussion Paper TI 2000 - 106/1. University of Amsterdam.

Brennan, G. and Buchanan, J.M. (1977). Towards a tax constitution for Leviathan. Journal of Public Economics 8: 255-274.

Brennan, G. and Buchanan, J.M. (1980). The power to tax. Analytical foundations of a fiscal constitution. Cambridge MA: Cambridge University Press.

Buchanan, J.M. (1975). A contractarian paradigm for applying economic theory. American Economic Review, Papers and Proceedings 65: 225-230.

Buchanan, J.M. (1977). Freedom in constitutional contract. Perspectives of a political economist. College Station/London: Texas A&M University Press.

Buchanan, J.M. (1987). Constitutional economics. In: Newman, P. et al. (Eds.), The new palgrave. A dictionary of economics, Vol. 1, 585-588. London: MacMillan.

Buchanan, J.M. and Tullock, G. (1962). The calculus of consent. Logical foundations of constitutional democracy. Ann Arbor: University of Michigan Press.

Canto, V.A., Joines, D.H. and Laffer, A.B. (1983). Foundations of supply-side economics: Theory and evidence. New York: Academic Press.

Charness, G. and Rabin, M. (2000). Social preferences: Some simple tests and a new model. Mimeo. University of California at Berkeley.

Eichenberger, R. and Oberholzer-Gee, F. (1999). Intrinsisch motivierte Fairne ß: Experimente und Realität. In: M. Held and H.G. Nutzinger (Eds.), Institutionen prägen Menschen: Bausteine zu einer allgemeinen Institutionenökonomik, 148-170. Frankfurt aM.: Campus Verlag.

Fahr R. and Irlenbusch, B. (2000). Fairness as a constraint on trust in reciprocity: Earned property rights in a reciprocal exchange experiment. Economics Letters 66: 275-282.

Fehr, E. and Schmidt, K. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics 114: 817-868.

Feld, L.P. and Tyran, J.-R. (2001). Beyond intrinsic motivations of voters: An experimental analysis of tax evasion. Mimeo, University of St. Gallen.

Fullerton, D. (1982). On the possibility of an inverse relationship between tax rates and government revenues. Journal of Public Economics 19: 3-22.

Güth, W., Schmidt, C. and Sutter, M. (2002). Fairness in the mail and opportunism in the internet: A newspaper experiment on ultimatum bargaining. German Economic Review, forthcoming.

Güth, W., Schmittberger, R. and Schwarze, B. (1982). An experimental analysis of ultimatum bargaining. Journal of Economic Behavior and Organization 3: 367-388.

Hennig-Schmidt, H. (1999). Bargaining in a video experiment. Determinants of boundedly rational behavior. Lecture notes in economics and mathematical systems Vol. 467. Berlin: Springer Verlag.

Hoffman, E. (1997). Public choice experiments. In: D.C. Mueller (Ed.), Perspectives on public choice: A handbook, 415-426. Cambridge: Cambridge University Press.

Hoffman, E. and Spitzer, M.L. (1985). Entitlements, rights, and fairness: An experimental examination of subjects' concepts of distributive justice. Journal of Legal Studies 14: 259-297.

Kirchgässner, G. (1994). Constitutional economics and its relevance for the evolution of rules. Kyklos 47: 321-339.

Lindsey, L.B. (1985). Estimating the revenue maximizing top personal tax rate. NBER Working Paper No. 1761.

Loewenstein, G. (2000). Emotions in economic theory and economic behavior. American Economic Review, Papers and Proceedings 90: 426-432.

Pommerehne, W.W. and Weck-Hannemann, H. (1996). Tax rates, tax administration and income tax evasion in Switzerland. Public Choice 88: 161-170.

Rawls, J. (1971). A theory of justice. Cambridge MA: Harvard University Press.

Siegel, S. and Castellan, N.J. (1988). Nonparametric statistics for the behavioral sciences. McGraw-Hill. New York. 2nd edition.

Sillamaa, M.A. (1999). How work effort responds to wage taxation: An experimental test of a zero top marginal tax rate. Journal of Public Economics 73: 125-134.

Stuart, C.E. (1981). Swedish tax rates, labor supply, and tax revenues. Journal of Political Economy 89: 1020-1038.

Sutter, M., Kocher, M., Bosman, R. and Winden, F., van (2002). The role of gender and gender pairing in bargaining: A power-to-take experiment. Mimeo. University of Amsterdam, University of Innsbruck.

Swenson, C.W. (1988). Taxpayer behavior in response to taxation. An experimental analysis. Journal of Accounting and Public Policy 7: 1-28.

Walster, W., Berscheid, E. and Walster, G.W. (1973). New directions in equity research. Journal of Personality and Social Psychology 25: 151-176.

Winden, F., van and Bosman, R. (1996). Experimental research in public economics. Ökonomie und Gesellschaft 13: 52-87.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Sutter, M., Weck-Hannemann, H. Taxation and the Veil of Ignorance – A Real Effort Experiment on the Laffer Curve. Public Choice 115, 217–240 (2003). https://doi.org/10.1023/A:1022873709156

Issue Date:

DOI: https://doi.org/10.1023/A:1022873709156