Abstract

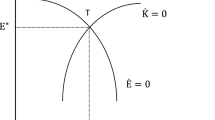

The paper examines the effects of an environmental tax reform in a small open economy with decentralised wage bargaining, monopolistically competitive firms and equilibrium unemployment. There is a tradable and a non-tradable sector and all firms use labour as well as an imported polluting factor of production (“energy”). A key result is that a tax on energy, recycled to reduce the payroll tax, reduces unemployment if there is a tradable sector wage premium. However, even if energy taxes may boost employment, welfare will not necessarily improve. Numerical simulations suggest that energy taxes in general provide an environmental dividend but also reduce real GDP.

Similar content being viewed by others

References

Bovenberg, L., and F. van der Ploeg. (1996). “Optimal Taxation, Public Goods and Environmental Policy with Involuntary Unemployment.” Journal of Public Economics 62, 59-83.

Bovenberg, L., and F. van der Ploeg. (1998). “Tax Reform, Structural Unemployment and the Environment.” Scandinavian Journal of Economics 100, 593-610.

Brunello, G. (1996). “Labour Market Institutions and the Double Dividend Hypothesis.” In C. Carraro and D. Siniscalco (eds.), Environmental Fiscal Reform and Unemployment. Kluwer Academic Publishers.

Carraro, C., M. Galeotti, and M. Gallo. (1996). “Environmental Taxation and Unemployment: Some Evidence on the ‘Double Dividend Hypothesis’ in Europe.” Journal of Public Economics 62, 141-181.

Goulder, L. (1995). “Environmental Taxation and the Double Dividend: A Reader' Guide.” International Tax and Public Finance 2, 157-183.

Gruber, J. (1997). “The Incidence of Payroll Taxation: Evidence from Chile.” Journal of Labor Economics 15, 72-101.

Hamermesh, D. (1993). Labor Demand. Princeton University Press.

Holmlund, B. (1997). “Macroeconomic Implications of Cash Limits in the Public Sector.” Economica 64, 49-62.

Jackman, R., R. Layard, and S. Nickell. (1996). “Combatting Unemployment: Is Flexibility Enough?” Discussion Paper No. 293. Centre for Economic Performance, London School of Economics.

Johnson, G., and R. Layard. (1986). “The Natural Rate of Unemployment: Explanation and Policy.” In O. Ashenfelter and R. Layard (eds.), Handbook of Labor Economics, vol. 2. North-Holland.

Kolm, A-S. (1998). “Differentiated Payroll Taxes, Unemployment and Welfare.” Journal of Public Economics 70, 255-271.

Koskela, E., R. Schöb, and H.-W. Sinn. (1998). “Pollution, Factor Taxation and Unemployment.” International Tax and Public Finance 5, 379-396.

Layard, R., S. Nickell, and R. Jackman. (1991). Unemployment: Macroeconomic Performance and the Labour Market. Oxford University Press.

Nielsen, S. B., L. H. Pedersen, and P. B. Sørensen. (1995). “Environmental Policy, Pollution, Unemployment and Endogenous Growth.” International Tax and Public Finance 2, 185-205.

Pissarides, C. (1990). Equilibrium Unemployment Theory. Basil Blackwell.

Pissarides, C. (1998). “The Impact of Employment Tax Cuts on Unemployment and Wages: The Role of Unemployment Benefits and Tax Structure.” European Economic Review 42, 155-183.

Strand, J. (1998). “Pollution Taxation and Revenue Recycling under Monopoly Unions.” Scandinavian Journal of Economics 100, 765-780.

Tyrväinen, T. (1995). “RealWage Resistance and Unemployment.” The OECD Jobs Study,Working Paper Series No 10, OECD.

Rights and permissions

About this article

Cite this article

Holmlund, B., Kolm, AS. Environmental Tax Reform in a Small Open Economy With Structural Unemployment. International Tax and Public Finance 7, 315–333 (2000). https://doi.org/10.1023/A:1008757830467

Issue Date:

DOI: https://doi.org/10.1023/A:1008757830467