Abstract

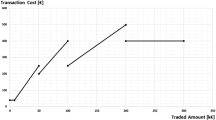

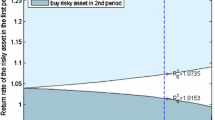

This paper addresses itself to a portfolio optimization problem under nonconvex transaction costs and minimal transaction unit constraints. Associated with portfolio construction is a fee for purchasing assets. Unit transaction fee is larger when the amount of transaction is smaller. Hence the transaction cost is usually a concave function up to certain point. When the amount of transaction increases, the unit price of assets increases due to illiquidity/market impact effects. Hence the transaction cost becomes convex beyond certain bound. Therefore, the net expected return becomes a general d.c. function (difference of two convex functions). We will propose a branch-and-bound algorithm for the resulting d.c. maximization problem subject to a constraint on the level of risk measured in terms of the absolute deviation of the rate of return of a portfolio. Also, we will show that the minimal transaction unit constraints can be incorporated without excessively increasing the amount of computation.

Similar content being viewed by others

References

Chvátal, V., Linear Programming, Freeman and Co., 1983.

Elton, J.E. and Gruber, M.J., Modern Portfolio Theory and Investment Analysis (Fourth edition), John Wiley & Sons, New York, 1991.

Falk, J.E. and Soland, R.M., An Algorithm for Separable Nonconvex Programming Problems, Management Science, 15 (1969) 550–569.

Konno, H., Suzuki T. and Kobayashi, D., A Branch and Bound Algorithm for Solving Mean-Risk-Skewness Model, Optimization Methods and Software, 10 (1998) 297–317.

Konno, H. and Suzuki, K., A Mean Variance Skewness Portfolio Optimaization Model, J. of the Operation Research Society of Japan 38 (1995) 173–187.

Konno, H., Thach, P.T and Tuy, H., Optimization on Low Rank Nonconvex Structures, Kluwer Academic Publishers, 1997.

Konno, H. and Yamazaki, H., Mean Absolute Deviation Portfolio Optimization Model and Its Application to Tokyo Stock Market, Management Science 37 (1991) 519–531.

Konno, H. and Wijayanayake, A., Mean-Absolute Deviation Portfolio Optimization Model under Transaction Costs, J. of the Operation Research Society of Japan 42 (1999) 422–435.

Konno, H. and Wijayanayake, A., Portfolio Optimization Problems under Concave Transaction Costs and Minimal Transaction Unit Constraints, Mathematical Programming 89 (2001) 233–250.

Luenberger D.G., Linear and Nonlinear Programming (Second edition), Addison-Wesley Publishers, Reading, MA, 1984.

Markowitz, H.M., Portfolio Selection: Efficient Diversification of Investments (Second edition), John Wiley & Sons, New York, 1991.

Mulvey, J.M., Incorporating Transaction Costs in Models for Asset Allocation, in Financial Optimization (W. Ziemba et al., eds.), Cambridge University Press, New York, (1993) pp. 243–259.

Ogryczak, W. and Ruszczynski, A., From Stochastic Dominance to Mean-Risk Model, European J. of Operational Research 116 (1999) 33–50.

Perold, A.F., Large Scale Portfolio Optimization, Management Science 30 (1984) 1143–1160.

Phong, T.Q., An, L.T.H. and Tao, P.D., Decomposition Branch and Bound Method for Globally Solving Linearly Constrained Indefinite Quadratic Minimization Problems, Operations Research Letters 17 (1995) 215–220.

Tuy, H., Convex Analysis and Global Optimization, Kluwer Academic Publishers, Dordrecht, 1998.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Konno, H., Wijayanayake, A. Portfolio optimization under D.C. transaction costs and minimal transaction unit constraints. Journal of Global Optimization 22, 137–154 (2002). https://doi.org/10.1023/A:1013850928936

Issue Date:

DOI: https://doi.org/10.1023/A:1013850928936