The WHO recommends consumption of at least 400 g of fruit and vegetables daily as part of a healthy diet(1). In addition to fruit and vegetables being a rich source of minerals and vitamins, evidence has shown that consumption reduces the risk of CVD(Reference Dauchet, Amouyel and Hercberg2) and certain types of cancer, and can prevent weight gain and thus reduce the risk of obesity(3). In Fiji, however, 85 % of 25–64 year olds consume fewer than 5 servings of fruit and vegetables daily and the prevalence of non-communicable disease (NCD) is high(4). This is associated with a global nutrition transition of human diets(Reference Popkin, Adair and Ng5), fuelled by industrialization and globalization, that has seen energy become cheaper and nutrients more expensive(Reference Miller, Yusuf and Chow6).

Many strategies have been recommended to improve fruit and vegetable consumption, fiscal policy interventions being one of them. A systematic review of the literature has shown food taxes and subsidies ‘have the potential to contribute to healthy consumption patterns at the population level’(Reference Thow, Jan and Leeder7). The WHO has called on countries to consider such economic tools to incentivize healthier food options(8) and recently the EAT–Lancet Commission has provided five recommendations for how a sustainable food system transformation could be achieved(Reference Willett, Rockström and Loken9). Evidence suggests that subsidies for fresh fruit and vegetables that reduce price by at least 10 % increase consumption(8,Reference Eyles, Mhurchu and Nghiem10) .

As part of the Pacific Obesity Prevention in Communities (OPIC) project in Fiji in 2009, the Pacific Research Centre for the Prevention of Obesity and NCDs (C-POND) at Fiji National University brought policy makers and stakeholders from various organizations together to identify twenty-two food-related policy recommendations that were considered to be feasible and cost-effective to address poor diets in the country(Reference Snowdon, Lawrence and Shultz11). At the time, strengthening food control systems was a priority in the minds of Pacific governments because of changes in the cost and availability of food due to the 2008 global financial crisis. Leaders endorsed a food security framework at a Regional Food Summit in Vanuatu in 2010. In Fiji, food-related policy recommendations were championed initially by C-POND and ultimately by the National Food and Nutrition Centre and the Public Health Division of the Ministry of Health and Medical Sciences (MoHMS) with the support of the Minister for Health. In response, and through the Fiji Revenue and Customs Authority, the Fijian Government increased the import fiscal duty on palm oil from 15 to 32 %(Reference Coriakula, Moodie and Waqa12) and on monosodium glutamate from 5 to 32 %. Two of the policy recommendations focused on decreasing fruit and vegetable import duties(Reference Mavoa, Waqa and Moodie13); in particular, reducing import duty on all vegetables to 0 % (except when an item is in season locally) and reducing import duty on all fruit to 0 %. These policies, in a slightly modified form, were endorsed during the 2012(14) and 2013(15) budget announcements with the specific purpose of helping address Fiji’s NCD crisis(Reference Latu, Moodie and Coriakula16).

Until 2016, budget planning took place towards the end of the calendar year with the Government budget for the following year being released in November. The process of developing the next budget included a consultation with all government departments and an open call for budget submissions. Tariffs (both fiscal and excise) are reviewed annually as part of budget deliberations. Fiji’s import tariff structure consists of four bands (0, 5, 15 and 32 %). Also, almost all goods and services in Fiji are subject to a value-added tax which was lowered from 15 to 9 % in January 2016. The present case study describes the development of fruit and vegetable fiscal policies and the impact they have had on import volumes. This is important for informing future policy-making processes and determining policy effectiveness.

Methods

Study design

A case study methodology was utilized to conduct an in-depth analysis of the policy process and the impact of the lower import duties on fruit and vegetables summarized in Table 1. We aimed to identify factors facilitating or hindering the progression of the policy from the formulation stage to endorsement by Cabinet. We evaluated the impact of the policy by describing volumes of imported fruit and vegetables before and after policy implementation.

Table 1 Tariffs and value-added tax on fruit and vegetables imported to Fiji from 2010 to 2014 (data from Fiji Revenue and Customs Authority)

* Lettuce, tomatoes and carrots.

† Leeks, capsicums, cauliflowers and celery.

‡ Oranges, mandarins and pineapples.

§ Apples, pears and grapes.

Data collection

Participants

Permanent Secretaries (Directors) of each government Ministry were contacted to select and approve relevant officers involved in the development and implementation of changes to the fruit and vegetable duties. Managers of supermarkets were contacted requesting their identification and approval of staff to be interviewed. A plain language statement detailing the study was attached for further information. Once approval was given, participants were sought through a purposive sampling process and asked for their informed written consent. We invited a total of sixteen participants from three government Departments (MoHMS, Fiji Revenue and Customs Authority, and the National Food and Nutrition Centre, prior to the Centre becoming part of MoHMS) and five supermarkets.

Government policy makers were interviewed for approximately 40 min on the process of policy development and the barriers and facilitators to getting the duty changes endorsed and implemented. We also sought supermarket participants’ perspective regarding the impact of the changes on supermarket availability and consumer purchasing behaviours. The interview guide was based on a case study conducted on previous food policies in the Pacific(Reference Thow, Swinburn and Colagiuri17). Interviews were conducted in English and transcribed and validated by a second researcher before analysis. Document reviews, which included government gazettes, media news reports and policy documents, were conducted to validate and supplement information collected from key informant interviews.

Import volumes

Publically available import volume data and prices of food products were collected from the Fiji Bureau of Statistics, for the period 2010–2014. For vegetables, we collected data on imported vegetables not grown in Fiji (leeks, red capsicums, cauliflowers (grown seasonally), celery and separately for carrots). For fruit, only data on imports of oranges and mandarins were collected as a 15 % import duty on lemons remained unchanged over the study period and other imported fruit (apples, pears and grapes) already had import duties of only 5 %.

Data analysis

Transcripts were coded and categorized into themes identified as part of a broader analysis of food policy implementation in Fiji(Reference Latu, Moodie and Coriakula16), namely the nature of the policy, leadership and collaboration. For the present case study our specific purpose was identifying barriers and facilitators of changes to duties on imported fruit and vegetables. We also identified themes arising from participants’ perspectives on the impact of the tax on consumption behaviour. Annual import volumes were presented as bar charts for the 5-year period from 2010 to 2014.

Results

Tariff changes on vegetables and fruit

In 2011, the Fijian Government imposed a 10 % excise on all imported vegetables (Table 1). Following receipt of the call from the Ministry of Finance for budget submissions for the following year, a meeting was called by the Minister of Health to consider what requests should be submitted by the Ministry in response to this call. Policy briefs from the OPIC project were reviewed during the meeting including one on changing the import duties on fruit and vegetables(Reference Latu, Moodie and Coriakula16). In 2012, the MoHMS lodged a submission that all tariffs on imported vegetables be removed. This submission, along with those from other sectors, was reviewed by the budget committee (Fiji Revenue and Customs Authority and Ministry of Finance officials) and submitted to Cabinet.

Cabinet did not respond in full to the MoHMS submission. While the fiscal duty was decreased on imported vegetables not grown in Fiji from 32 to 5 %, it remained unchanged for imported vegetables also grown in Fiji. Also, the excise duty remained and value-added tax increased on all products by 2·5 %. Overall, for imported vegetables also grown in Fiji (lettuce and tomatoes), there was a 13·5 % increase in tax between 2010 and 2012 and for imported vegetables not grown in Fiji, there was a 14·5 % decrease. The excise duty was completely removed from imported vegetables in 2013, leading to a 10 % decrease in duty rates on all imported vegetables between 2012 and 2014. The tax on imported fruit also grown in Fiji decreased by 7·5 % between 2010 and 2012 but increased on imported fruit not grown in Fiji by 2·5 %. There were no changes in the tariffs on imported fruit between 2012 and 2014.

Factors influencing the policy-making process

We completed fourteen interviews with eleven government representatives including two NCD officers and three supermarket representatives. Two supermarkets did not respond to our follow-ups. Themed barriers and facilitators to policy making are described below.

Nature of the policy

Policy makers’ awareness of the NCD epidemic was high in Fiji and because the proposed duty changes were directed at reducing NCD, participants noted that this facilitated endorsement:

‘Fruit and vegetables have been advertised sufficiently enough as healthy … the Ministry of Health have been going on and on about the consumption of fruit and vegetables … I think a lot of people could see the value in reducing the import tax on fruit and vegetables and specifically when our local fruit and vegetables are seasonal.’ (Policy maker 1, male)

This was further supported by an official on the receiving end of budget submissions:

‘We were also invited to some of their workshops and public conferences where they did mention the need to know that … [NCD] are a national issue that all departments should come together and fight, and I think that’s why it was well supported.’ (Policy maker 2, male)

It was also noted that the policy did not conflict with local production and therefore that opposition was minimal.

Leadership

Officials from Revenue and Customs considered MoHMS leadership to be sufficiently motivating that Government was willing to forego revenue to ‘ensure that healthy food was accessible, [and as] cheap as possible’. Leadership at a regional level was also identified as important, with the tourism industry backing calls from the Pacific Food Summit convened in Vanuatu in 2010 to ‘go local’(Reference Snowdon, Lawrence and Shultz11). However, they also recognized that reducing import duties would help meet tourist demand for vegetables:

‘We got a lot of support from the hoteliers, the tourism industry … in 2009 or 10 there was a food security conference in Vanuatu and everybody was still warm with that idea that we should produce local and eat local and fresh food and we should move away from canned stuff. So what we did we worked on that and said “hey listen we need to be able to go local” but at the same time the hoteliers said “hey listen we can’t produce enough broccoli and cauliflower and tomatoes locally so our prices are going up and Fiji needs to remain competitive” so we got this added advantage from the tourism sector.’ (Policy maker 3, male)

Collaboration

A collaboration between C-POND and the MoHMS was responsible for the background research and draft policy documents that preceded the duty changes. The quality of the research and documents was considered by one participant to have provided strong justification for the changes during the budget deliberation phase:

‘They were already written up and ready to go with a strong justification included that was clearly kind of well laid out … because my only discussion about it was with [Senior Official]. He was certainly very happy and so were the others who were in that meeting about the fact that it was already written up and with a clear justification and it was kind of well thought through. So that was why he was willing to take them forward and they were in line with the general strategy of the government at that time.’ (Academic, female)

Changes in import volumes of vegetables and fruit

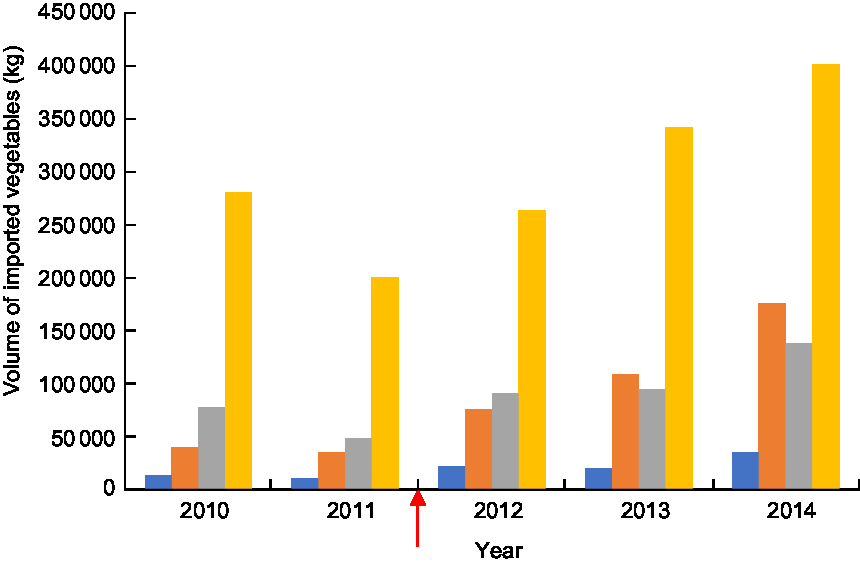

Figure 1 shows import volumes of leeks, capsicums, cauliflowers and celery (vegetables not also grown in Fiji) each year from 2010 to 2014. The red arrow indicates the timing of the reduction in fiscal duty from 32 to 5 % in November 2011 which was followed by a reduction of excise tax from 10 to 0 % in November 2012. Imports of these vegetables showed a decline from 2010 to 2011 but increases from 2012 to 2014, especially for celery.

Fig. 1 Import volume (kg) of vegetables not grown in Fiji (![]() , leeks;

, leeks; ![]() , capsicums;

, capsicums;![]() , cauliflowers;

, cauliflowers; ![]() , celery), 2010–2014.

, celery), 2010–2014. ![]() shows the timing of the reduction in fiscal duty

shows the timing of the reduction in fiscal duty

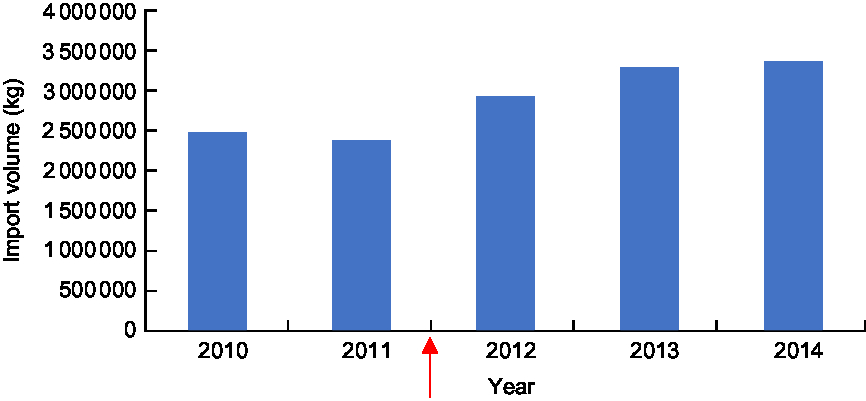

To illustrate the impact of the duty changes on vegetables also grown in Fiji, Fig. 2 shows changes in imports of carrots from 2010 to 2014. This group of vegetables experienced an overall increase in tax of 2·5 % over the period. Import volumes of carrots increased but did not appear to increase as much as volumes of vegetables not grown in Fiji.

Fig. 2 Import volume (kg) of carrots to Fiji, 2010–2014. ![]() shows the timing of the reduction in fiscal duty

shows the timing of the reduction in fiscal duty

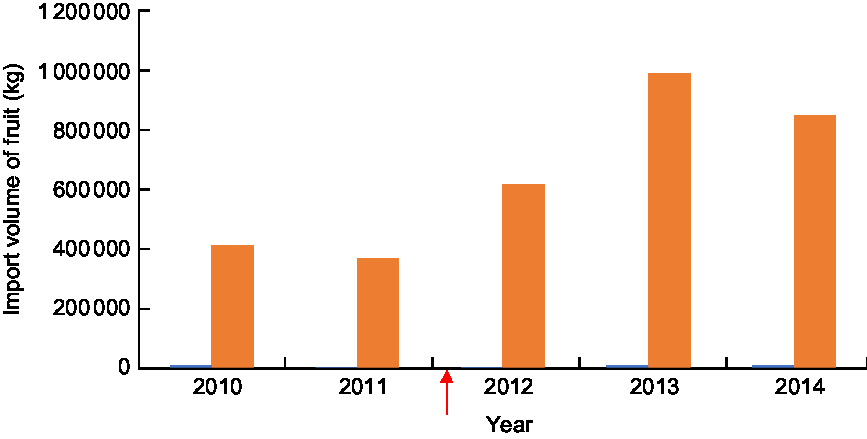

Oranges and mandarins experienced a 10 % decrease in fiscal duty in 2011 countered slightly by a 2·5 % increase in value-added tax. Figure 3 shows that import volumes of oranges and mandarins to Fiji declined from 2010 to 2011, increased substantially between 2012 and 2013 and dropped off slightly in 2014.

Fig. 3 Import volume (kg) of oranges (![]() ) and mandarins (

) and mandarins (![]() ) to Fiji, 2010–2014.

) to Fiji, 2010–2014. ![]() shows the timing of the reduction in fiscal duty

shows the timing of the reduction in fiscal duty

Stakeholder perspectives on the impact of the duty changes

Perceptions of supermarket managers and NCD officials as to the impact of the duty changes on retail price and consumer purchasing behaviours were mixed. One reported an initial impact on retail prices but other outside influences such as exchange rates and the weather and seasonality were also influences on retail price:

‘And coming onto fruit and vegetables, in vegetables, yes, we did see some impact initially but there are [other] factors [affecting] prices in the market and customer decisions are based on that … Consumption of celery has definitely risen but the thing again … the weather factor, the currency, [meant the duty reduction was] quite short lived, it didn’t have a long impact. These things are weather based so you didn’t get the fully reduced price. Like some time for three to six months you have lower prices and the quality was really good and then when the crop is out you see the prices going up … That [is] what has happen[ed] in this year also, prices are really high and another factor to it is that US dollar is very strong now.’ (Supermarket manager, 1)

Another supermarket did not see any drop in prices:

‘I didn’t see any gradual drop for the prices from our suppliers thereby resulting in no changes likely. The price were almost the same unit and obviously consumption for few things went down … I see a change in buying pattern but still a lot needs to be done. In terms of pricing I don’t see any changes in prices.’ (Supermarket owner 2)

Another supermarket representative commented on the fact that the majority of shoppers who bought fruit and vegetables at that particular supermarket were from a small segment of the population who prioritized health over cost. Therefore, fruit and vegetables were frequently purchased regardless of the price:

‘The customers we get here, we almost can’t keep up … so over here people tend to go for quality they don’t mind paying a bit extra for quality.’ (Supermarket owner 3)

An NCD official noted that fruit and vegetable consumption was low across the country as evidenced by the 2011 NCD STEPS survey(4):

‘[The] 2011 survey is telling me they’re not [buying more fruit and vegetables]. The consumption, where we want it to reach, is not there – it’s still very low the consumption of fruit and vegetables.’ (Policy maker, male)

There was an opinion that price was just a ‘facilitating factor’ to encourage the consumption of fruit and vegetables but that consumption is ultimately influenced by sociocultural behavior. One NCD official commented, ‘traditionally, it’s not the practice’ – referring to the traditional Fijian diet and the lack of consumption of certain imported fruit and vegetables such as those in Fig. 1 in the usual family menu. This is further supported by the Fiji National Nutrition Survey in 2004 which listed only onions and cabbage as imported vegetables most frequently eaten by Fijians, stating that the ‘status of fruit within the traditional food hierarchy … is not as important as other foods’(18).

Discussion

The process of policy development for the fruit and vegetable duty changes was rapid and straightforward, facilitated by a collaboration that provided a well-researched and clearly justified policy document, a policy that met the needs of multiple sectors and leadership from the Ministry of Health. Import volumes of measured fruit and vegetables have increased since the duty changes were implemented.

These observations are consistent with those of a study in Canada which found that strategic positioning, internal and external partnerships and knowledge translation contributed to food policy endorsement(Reference Wegener, Raine and Hanning19). In Fiji’s case, policy makers took advantage of the strategic position of the Minister for Health to move the duty changes through faster than they would normally have. They also used existing taxation mechanisms instead of new policy measures, minimizing barriers to implementation. The MoHMS partnership with C-POND facilitated the preparation of well-researched policy documents that were easily translatable across and outside government sectors.

Modelling studies predict that tax reductions and/or subsidies on fruit and vegetables will increase consumption and improve health outcomes(Reference Thow, Downs and Jan20–Reference Holm, Laursen and Koch22), particularly where prices are reduced by at least 10 %(8,Reference Willett, Rockström and Loken9) . Across the four years from 2010 to 2014, the tax on vegetables dropped by more than 10 % only for vegetables not also grown in Fiji (−24·5 %) while the tax on fruit also grown in Fiji dropped by 7·5 %. Feedback from supermarkets suggests that these reductions may not have been passed on to consumers. That said, import volumes, particularly of vegetables not also grown in Fiji and oranges and mandarins, did increase over this period. It is important to note however that there is not a direct correlation between fruit and vegetable import volume and consumption patterns. Fruit and vegetable importation in Fiji is influenced by tourism. In 2012, there were 660 590 tourist arrivals in Fiji (compared with a population of 873 596) and the number of tourist arrivals per year increased by about 150 000 between 2010 and 2016 compared with a population increase of approximately 6600 per year(23). Hoteliers have to maintain a steady supply of fruit and vegetables and rely on imported products for this(Reference Martyn24,Reference McComb and Cooper25) . The Department of Agriculture has noted that hotels create a year-round demand for non-traditional vegetables such as carrots, tomatoes and broccoli(Reference Veit26). Also, because local suppliers cannot meet the tourist demand, locally grown vegetables are often overlooked by the tourist market, even when they are cheaper(Reference Martyn24). It is likely, therefore, that the lower duties may have increased the supply of fruit and vegetables for tourists but Fijians may not have benefited.

Finally, even if some of the observed increase in fruit and vegetable import volumes is explained by Fijian, rather than tourist consumption, it may only be affluent Fijians who have increased consumption. Consistent with the observations of one of the supermarket representatives interviewed here, studies show that consumption of fruit and vegetables tends to occur in higher-income households(Reference Farrell, Negin and Awoke27,Reference Tiffin and Salois28) . Data from the 2015 National Nutrition Survey will shed some light on fruit and vegetable consumption patterns of the population but these data are yet to be released.

Strengths and limitations

The major strength of the present case study was the candid insights obtained from policy makers and key stakeholders regarding actual fiscal policy changes, as well as the opportunity to capture policy makers’ and supermarket representatives’ perspectives on the impact of the duty changes and compare this with import data. Finally, our case study provides a rare opportunity to track a food-related fiscal policy from inception to implementation.

There were also limitations including the small number of stakeholders interviewed. While implementation of this policy involved only a small number of stakeholders, there were some who refused to be interviewed or could not be contacted because they were no longer in the organization. Other policy case studies in the Pacific have also had small numbers of participants(Reference Thow, Swinburn and Colagiuri17,Reference Thow, Quested and Juventin29) . The other main limitation is the lack of population consumption data to determine impact. While import data available suggest an increase in consumption of fruit and vegetables, we do not know if consumption by the Fijian population has increased. There were government initiatives over this time to promote the production and consumption of local foods (e.g. the theme of the 2012 Hibiscus Festival was overcoming NCD) but availability and affordability were perceived as important barriers so these initiatives may not have had an impact on demand(Reference Morgan, Vatucawaqa and Snowdon30). Collecting retail prices from supermarkets pre- and post-tax implementation was beyond the scope of the study. We did look for data on local production of fresh fruit and vegetables; however, this information was scarce.

Conclusion

The present case study has demonstrated that governments can use fiscal policy to meet the needs of a range of sectors including health, agriculture and tourism. The policy was well formulated, well understood, expertly handled and consequently had smooth passage through the endorsement process. The resulting reductions in import duties appear to have contributed to increases in volumes of vegetables and fruit imported to Fiji but it is not clear if this has increased population consumption. This information helps policy makers in facilitating the development of similar policy interventions – more specifically in Pacific settings with similar cultural and social contexts. We recommend the development of monitoring tools for measuring the impact of such food-related fiscal policies on health.

Acknowledgements

Acknowledgements: The study team acknowledges the time and commitment of the participants who contributed to this case study. Financial support: This work was supported by the National Health and Medical Research Council (NHMRC), Australia (grant number APP1041020). The NHMRC had no role in the design, analysis or writing of this article. All authors except W.S. are researchers within the NHMRC Centre of Research Excellence in Obesity Policy and Food Systems. Conflict of interest: None. Authorship: C.B., W.S. and M.M. designed the study and formulated the research question. G.W. facilitated data collection and C.L. and J.C. collected and analysed the data. All authors contributed to writing the article and approved the final version. Ethics of human subject participation: This study was conducted according to the guidelines laid down in the Declaration of Helsinki. All procedures involving human subjects were approved by the the Fiji National Research Ethics Review Committee (2014.63.MC) and Deakin University Human Research Ethics Committee, Australia (HEAG-H 169_2014). Informed written consent was obtained from all participants and organizations.