Abstract

Few studies have differentiated oil demand shocks from oil supply shocks in the literature that has investigated the impacts of these issues on the prices of agricultural products. This study attempts to investigate this problem by employing a structural vector autoregression (SVAR) technique on Malaysian data from January 1993 to December 2019. We found that the reactions of agricultural commodity prices to the changes in global oil prices largely depend on whether they result from oil demand shocks or oil supply shocks. Global oil demand shocks before the food price crisis (2006–2008) can explain a large share of the changes in prices of agricultural products, while after that period, their capacity to explain these changes becomes much weaker. After the food crisis period, the contribution of the oil supply shock to changes in the prices of agricultural products is higher than that of the oil demand shock. We can conclude that the role of oil supply in the economy in explaining changes in the prices of agricultural commodities is stronger after the food price crisis. This is because Malaysia’s economy, as a net oil exporter, benefits from higher oil prices resulting in higher demand for agricultural products and, consequently, higher prices for agricultural commodities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Global oil prices and exchange rates are two factors influencing almost all markets in all economies. There are also strong long-term relationships between these variables (Suliman and Abid 2020). Among all factors that may affect the agricultural sector, high crude oil prices reduce food production as food demand increases due to fast population growth in developing countries (FAO 2009).

On the other hand, energy prices affect agricultural commodities through transportation costs and agricultural inputs (chemical fertilizers and pesticides). Global oil prices influence economic sectors in different ways through direct and indirect channels. This sector could also benefit from lower global crude oil prices (Solaymani 2019). On the other hand, agricultural commodities may affect crude oil prices by producing bioenergy (Su et al. 2019). Another factor affecting agriculture commodities is the exchange rate. Since the exchange rate has an important effect on exports and imports of goods and services, it is expected to influence tradeable agricultural commodities. While the global oil prices are the most significant factor affecting agricultural productivity in the short run, the long-run determining factor is the exchange rate (Binuomote and Odeniyi 2013). Figure 1 shows that food prices and global oil prices in 2008 have increased significantly and that their relationship has changed. Therefore, all policymakers and investors need to take this new relationship into account when making decisions about the future of the agriculture sector.

The agricultural sector makes a significant contribution to the Malaysian gross domestic product by 7% in 2019. In this year, the key contributors to the agriculture value-added were palm oil (38%), other agriculture (26%), livestock, forestry and logging (21.3%), fishing (12%), and rubber (3%), respectively. In 2019, Malaysia exported about RM115.5 billion and imported about RM93.5 billion of agricultural commodities, which, respectively, increased by 0.9% and 0.2% compared to the 2018 values. Palm oil and natural rubber are the main exported crops. In 2019, palm oil production raised by 0.7 million tonnes (0.7%) compared to 2018, while natural rubber raised by 0.04 million tonnes (6%). However, paddy production decreased by 11% from 2639 thousand tonnes in 2018 to 2349 thousand tonnes in 2019 (DOSM 2021). This sector also contributes substantially to employment in Malaysia. It accounted for 10.22% of the country's total employment in 2019 at 1541 thousand people (DOSM 2021).

While Malaysia was an agricultural country based in the early 1980s and before, currently, the agricultural sector, after industry and services, is the third-largest contributor to Malaysia’s GDP (DOSM 2021). This is therefore an important sector for decision-makers in terms of economic impacts and food security. Moreover, this country is a net crude oil exporter, and due to its high dependency on crude oil revenues, changes in global oil prices affect its economy and commodity prices. Evidence showed that high global oil prices increase commodity prices in Malaysia, as a food-importing country, resulting in higher household food expenditures and lower well-being (Solaymani 2016). Fluctuations in oil prices affect the exchange rate and the prices of agricultural products in Malaysia due to changes in agricultural inputs, such as chemical fertilizers pesticides and fuel for farm machinery. It can also increase the transportation costs of exports and imports of agricultural products. Since Malaysia imports a high share of agricultural commodities, an increase in global oil prices increases the import costs of these commodities resulting in an increase in domestic prices of agricultural commodities. Another way in which world oil prices may affect the Malaysian agricultural sector is through the demand for biofuels from crops, such as palm oil, and the government supports the agricultural sector to increase agricultural products to meet food security goals. The government support and subsidies financed mainly from the oil revenues. Therefore, it is important to understand the link between agricultural commodity prices and global oil prices as they can assist producers in better understanding production costs and ultimately determine income. These findings are also important for investors to make an appropriate decision on their investment in this market and to reduce the risks they face.

Global oil price fluctuations occur due to changes in the demand side or supply side of the oil market. Accordingly, in this study, we examine the impacts of global oil demand and oil supply shocks of the oil market on agricultural commodity prices. In fact, it investigates the reactions of prices of agricultural commodities to global oil supply and oil demand shocks over two periods, before and after the food price crises in 2006–2008. Moreover, it examines how the exchange rate is affected by global oil shocks. It also decomposes the role of global oil shocks in explaining variations in the prices of agricultural commodities.

The contributions of this study, which are not considered in previous studies, are as follows. To estimate the relationship between global oil shocks and the exchange rate shock, it uses two global oil shocks, i.e., oil demand and oil supply shocks in the global oil market. This relationship is based on two periods, before the food price crisis period and after the food price crisis period in 2006–2008. Another contribution of the present study is to determine which global oil shocks affect the exchange rate. It also examines the types of shocks that explain the change in prices of agricultural products in Malaysia during the two periods. The use of a significant number of agricultural products (10 products) compared to earlier studies, which used a few products, is the final contribution of this study.

The organization of this study is as follows. The next section reviews the literature on the impacts of oil price and exchange rate on agricultural commodities. Section “Data and Methodology” explains the data and the methodology. Section “Results and Discussion” evaluates the estimated results of the structural VAR model. Finally, Sect. “Discussion” ends the paper with a conclusion and some suggestions.

Literature Review

The increase in agricultural commodity prices in recent decade has increased concerns about the negative effects of high food prices on food security and has increased attention to studies that investigate key drivers of changes in agricultural commodity prices. The main drivers of fluctuations in agricultural commodity prices are global oil price changes, exchange rate changes, climate change, and, at the domestic level, government policies and supports in the agricultural sector.

Some studies have separated the effects of global oil price changes into the supply side shock and the demand side shock (Yasmeen et al. 2019). Demand side shocks, which are most important, occur due to increases in population growth and household income, dollar depreciation, and an increase in biofuel production such as ethanol (Wang et al. 2018; Lima et al. 2019). Garcia et al. (2020) showed that the COVID-19 pandemic negatively affected international crude oil demand and reduced prices. The rise in biofuel production is responsible for the rise in the prices of agricultural commodities (Paris 2018). But the main drivers of supply-side shocks are the rise in global oil prices and the increase in the agricultural commodity prices due to drought and climate change (Hochman et al. 2014).

Since the first global rise in oil prices in early 1970, the importance of the impact of changes in oil prices on economic sectors and commodity prices has been considered widely and many studies have investigated this relationship through different methodologies. Pal and Mitra (2018) by using a cross-correlation assessment found a positive interdependency between the crude oil prices and global food prices. Similarly, other studies showed that the association between global oil price rises and prices of agricultural commodities is significant and positive (Meyer et al. 2018; Fasanya et al. 2019; Judit et al. 2017). But, Zmami and Ben-Salha (2019) using the ARDL model highlighted that global food prices are only affected by positive long-run oil price shocks. The bounds test for cointegration shows that the price of crude oil has an asymmetrical impact on the food price variation in the long run (Wong and Shamsudin 2017). The impact of downside changes in crude oil prices on Chinese commodity prices is greater than upside changes (Meng et al. 2020). Zafeiriou et al. (2018) using the ARDL cointegration approach revealed that crude oil prices influence by those agricultural products that are used to produce bio-energies like ethanol. Gokmenoglu et al. (2020) also using cointegration and causality analysis investigated the response of Nigerian agricultural commodities to changes in global oil prices. Mokni and Youssef (2020) argued that the impact of delayed global crude oil prices on agricultural commodity prices is less than the immediate changes. Yip et al. (2020) using the VAR model found that the stability of the impact of oil price changes on agricultural commodities depends on the high and low volatility of oil prices. Harri et al. (2009) also using the cointegration method suggested that the prices of corn, cotton, and soybeans, except wheat, are related to changes in oil prices. Some studies also found two-way causality link between global oil prices and agricultural commodity prices (Sun et al. 2021; Hung 2021). We can conclude that the direction and magnitude of the impact of global oil price changes on agricultural commodity prices depends on the country and the duration of the impacts.

Regarding the impacts of exchange rates, Kiatmanaroch and Sriboonchitta (2014) using the GARCH model demonstrated the importance of exchange rates in managing the interactions between the price of palm oil and the price of crude oil. Financial crises also can change the impact of the exchange rate on commodity prices. Using the GARCH model, Siami-Namini (2019) suggested that crude oil volatility leads to the exchange rate volatility that leads to changes in agricultural commodity prices. Higher oil prices also lead to higher exchange rates in oil-exporting countries and lower currency value in oil-importing countries (Abed et al. 2016; Mensah, et al. 2017; Nandelenga and Simpasa 2020). For example, Fowowe (2014) reported that oil price rises lead to exchange rate depreciation in South Africa. Butt et al. (2020), using Engle-Granger and threshold cointegration methods, found a bidirectional relationship between the prices of two major Malaysian agricultural commodities (i.e., palm oil and rubber) and the exchange rate in the long and short run.

In analyzing time-series data, Ahmid (2020) suggested that global oil prices and exchange rates positively affect the prices of corn, barley, wheat, oats, and rye. However, other studies found an insignificant long-run association between global oil prices and the exchange rates (Adam et al. 2018). Therefore, the link between the exchange rate, global oil demand change, and prices of agricultural commodities depends on the type of oil-exporter and oil-importer country and the existence of the global financial crisis. Subsidy removal policies, which increase the prices of goods and services, also decrease food availability and access to food in Malaysia (Solaymani et al. 2019). Another factor that affects agricultural commodity prices is climate change which harms food availability and access to food and reduces household welfare. Many studies have shown that while the agriculture sector benefits from high commodity prices, improvements in agricultural productivity are expected to reduce the adverse impacts of rising food prices on Malaysian food security and poverty (Solaymani 2017). Therefore, government policies and support can significantly improve agriculture productivity and provide adaptation policies against climate change.

We can conclude from the above literature that the most important methods used in the literature are Granger causality and ARDL. The GARCH and VAR models have also been used widely in the literature. However, there are a few studies that have used structural VAR analysis to investigate the impacts of the global oil price shock on agricultural commodities. Analyzing two global oil shocks, i.e., oil demand shock and oil supply shock, is also rare in the literature. In addition, the evaluation of the relationships between agricultural commodity prices and oil price shocks in two periods was not considered only in a few studies. Furthermore, this study applies a decomposition analysis to verify the robustness of the structural VAR model of the study. To improve and make a significant contribution to the literature, this study addresses these gaps.

Data and Methodology

Description of Data

This study explores the impact of global oil shocks on prices of agricultural products over the 27 years from January 1993 to December 2019. This study uses the monthly Brent oil price data, because this oil price is the main benchmark for global oil prices, and nominal prices of ten major agricultural commodities (Bananas, coconuts, cocoa, eggs, papayas, palm oil, rice, rubber, tomatoes, watermelon). The U.S. Consumer Price Index (CPI) is used to obtain the real values of crude oil prices and the Malaysia’s CPI is used to capture the real value of agricultural commodity prices. The Consumer Price Index data are collected from the World Bank indicators. Brent crude oil prices obtained from the Energy Information Administration (EIA) and the prices of agriculture commodities are collected from the Food and Agriculture Organization (FAO). As shown in Fig. 1, the relationship between prices of agricultural products and global crude oil prices changed substantially after May 2006. This is also evident in some studies like Ciaian and Kancs (2011) and Baumeister and Kilian (2014). Accordingly, this study divides the whole sample into two subsamples, i.e., from January 1993 to April 2006 as before the food price crisis period, and from May 2006 to December 2019 as in and after the food price crisis period.

Table 1 summarizes the descriptive statistics of the variables under consideration. The coefficient of variation demonstrates that the price of crude oil followed by rubber price has the greatest variation both before and after the food price crisis, which is consistent with the fluctuations in the crude oil prices in recent decades. The mean prices of all agricultural products in the second period are higher than those of the first period. Regarding the volatility in the prices of agricultural commodities, it seems that the prices of rubber, palm oil, cocoa, coconut, and watermelon are more unstable than those of bananas, tomatoes, eggs, and papaya. This can be related to the fact that Malaysia is the top producer and exporter of palm oil and rubber and the majority of other agricultural products are consumed locally. This table also shows the typical characteristics of financial data, since the coefficients of kurtosis are positive and the coefficients of skewness, except for tomatoes, are negative for before the food price crisis period.

For the period prior to the food price crisis, the null hypothesis of the Jarque and Bera statistics is rejected and series are not distributed normally. This means that price changes for all agricultural products have tail distribution. This is supported by not zero skewness and excessive positive kurtosis. However, the value of this statistic for two commodity prices is not significant, demonstrating that for before and after food price crisis periods, commodity prices have less tail distribution. In the structural VAR context, this study further decomposes global oil price variations into oil demand shock and oil supply shock. For the oil supply shock, we used monthly data on world oil production gathered from the Energy Information Administration of the United States Department of Energy. For the oil demand shock, we used the methodology introduced by Kilian (2009) and Hamilton (2009).

Table 2 represents the simultaneous correlation coefficients of the logarithmic form of variables. While the correlation coefficients do not suggest causality, they show that all agricultural commodity prices (except rubber) are linearly correlated. Therefore, if a shock happens in a market, it probably affects other markets. Prices of all agricultural commodities, except rubber, have a strong positive correlation to crude oil prices. This is due to the direct and indirect impacts of global crude oil prices on agricultural commodity prices.

Stationary Test

Table 3 reports the results of stationary tests according to Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and KPSS (Kwiatkowski–Phillips–Schmidt–Shin) methods. The null hypothesis in the ADF and PP tests is that the series is non-stationary, whereas in the KPSS test is stationary. The outcomes of the three stationary tests recommend that all variables are not stationary at their level, except for tomatoes and rice, but after the first differentiation they have been stationary and integrated of the first order, I(1).

These stationary tests do not reveal structural breaks in the series under consideration. If structural breaks exist in a time series, the stationarity tests without structural breaks will be misleading. For this reason, we use a unit root test suggested by Kim and Perron (2009) that allows us to perform a break under both the null hypothesis and in the opposite hypothesis. If the test statistics were rejected, show that series are stationary in trend. Kim and Perron (2009) recommend two models for conducting stationary tests. Their first model permits a structural break in the trend and the second model permits a structural break in the intercept and trend.

Table 4 provides the results of the Kim and Perron (2009) test. It can be seen that for the majority of time series the null hypothesis of stationarity is not rejected for both models because their t-statistics are lower than the critical values. The exceptions here are for the t-statistic of oil supply and oil demand, that the null hypothesis is rejected at a significant level of 10%. In general, the stationarity tests with structural breaks also show that the time series are stationary, consistent with the outcomes based on previous stationary tests (ADF, PP, and KPSS).

Cointegration Test

To explore the cointegration relationship between each variable and both global oil demand and oil supply shocks, we employed the Johansen cointegration test (Table 5). As it can be seen, none of the trace and the maximum eigenvalue statistics show the existence of a cointegration relationship among the variables, except for egg and rice prices.

Since the Johansen test does not show evidence of structural breaks in series, we further perform the cointegration relationships among the variables using Gregory and Hansen’s cointegration test, which is a residual-based test. This test provides three statistics ADF*, Zt*, and Zα*. We check these statistics for the existence of structural break in intercept (level shift) (Model IN), of a structural break in level shift with a time trend (Model IN/T), and structural breaks in both intercept and slope (Model IN/S) (Table 6).

Table 6 reports the results of the Gregory and Hansen cointegration test. The results show that the null hypothesis of no cointegration relationships of the majority of variables is failed to be rejected. This is consistent with the results of Johansen trace and maximum eigenvalue tests. The lack of cointegration shows that the VAR technique is fitting and superior to the vector error correction (VEC) model based on short-run forecast variance (Hoffman and Rasche 1996; Engle and Yoo 1987). Then, we will use the VAR model to identify the combined dynamics between oil shocks and the prices of agricultural products.

Methodology

This study estimates the impact of crude oil price shocks and real exchange rates on some agricultural commodity prices. Many studies have investigated these issues in recent years. For example, Mokni and Youssef (2020) investigated the impact of West Texas Intermediate prices on prices of agricultural commodities such as soybean, corn, sugar, rice, wheat, and cotton using the ARMA-GARCH methodology. Yip et al. (2020) by employing the partially Integrated Vector Autoregressive model investigated the impact of world crude oil prices on corn, soybean, and wheat prices. Harri et al. (2009) used the cointegration method to investigate the effect of crude oil prices and the prices of corn, cotton, soybeans, and wheat. Wang et al. (2014) also used an SVAR model to analyze the relationship between Brent prices and prices of some agricultural commodities.

In this study, the structural vector autoregression model (SVAR) is used to estimate the effects of global oil supply and demand shocks on the prices of agricultural commodities in Malaysia. The main advantage of the SVAR model over the original VAR model is that, unlike the VAR model, where structural shocks are implicitly identified, the SVAR model explicitly has economic theories to implement constraints (Fahimifard 2020). Furthermore, the SVAR model can clearly examine the effect of the various dimensions of global oil shocks on the prices of agricultural products. To do this, it is necessary to calculate the impulse response function. This criterion makes it possible to determine the duration of the shock effect and its maximum effect after occurrence (Chatziantoniou et al. 2013).

In this paper, the structural VAR model is applied based on the vector time series Zt, Zt = (ΔGOD, ΔGOS, ΔACP)′. Where GOD shows the global crude oil demand, GOS reveals the global crude oil supply, and ACP denotes the agricultural commodity prices. The structural form of VAR model is as follows (Kilian 2011):

where j is the lag length, which is selected according to the Schwarz information criterion (SIC). ε represents the vector of structural errors that are serially and mutually cointegrated. Zt is a 3 × 1 vector of system endogenous variables as follows:

where GOD refers to the variation in global oil prices caused by shocks on the demand side of the world oil market, which shows changes in global economic activities. This was derived from the methodology introduced by Kilian (2009) and Hamilton (2009). GOS indicates changes in global oil prices due to shocks on the supply side of the global oil market, which is obtained by the use of global production of crude oil. This variable cannot be explained by GOD. ACP refers to the shock on agricultural commodity prices, which cannot be explained by GOD and GOS. In addition, we also add the real effective exchange rate (REXR) to this model to evaluate the impact of this variable on the prices of major agricultural products in Malaysia.

If we assume that et represents the errors of the reduced VAR, so that \({{e}_{\text{t}}={A}_{\text{t}}^{-1}\varepsilon }_{\text{t}}\). Structural errors are derived on \({A}_{\text{t}}^{-1}\) with short-run constraints. This model considers a block recursive structure based on the simultaneous relationship between the reduced errors and the corresponding structural errors. The main relationship established between reduced form errors (\({e}_{\text{t}}\)) and structural form errors (\({\varepsilon }_{\text{t}}\)) in the SVAR model is as follows:

where \({{e}_{\text{t}}={A}_{\text{t}}^{-1}\varepsilon }_{\text{t}}\) and \(AE({{e}_{\text{t}}\cdot {e}_{\text{t}}^{^{\prime}})A=C}_{k}\). Ck is diagonal matrix with k dimensions (in our case k = 3 denotes the number of variables selected within the vector).

In this study, we consider only short-run constraints on current relations between selected variables and do not consider any long-run constraints. Thus, on a long-run basis, all the variables are permitted to respond to all shocks. It also considers three global shocks to structural errors, namely oil demand shocks, oil supply shocks, and shocks in the prices of agricultural products. In this study, we execute the recursive structure of short-run constraints. Consequently, the representation of matrix A−1 is supposed to be as follows:

Results and Discussion

Reactions of Global Oil Prices to Shocks

Before assessing the effect of oil shocks on the price evolution of agricultural commodities, the study first looks at the reaction of each oil shock to another oil shock because this is useful in understanding the dynamics of oil shocks.

The general reactions of changes in global oil prices to structural shocks of one standard deviation are plotted in Fig. 2. The impulse response functions take a 95% confidence intervals. The bands of confidence are achieved from 5000 Monte Carlo simulations. The reactions of the world oil prices to the positive oil supply shocks can be seen as positive and insignificant. In a net oil-exporting country like Malaysia, this is partly due to the fact that a rise in oil production in one region may offset in other regions because of low global prices of crude oil in recent years. Another reasonable description is the decline in global oil production in recent years due to excess supply in the world crude oil market. Accordingly, major oil producers like Saudi Arabia and major oil organizations like OPEC decided to decline the supply and production of oil (November 2016–April 2017, September–December 2017, December 2018–May 2019) to boost global crude oil prices on world markets. But this shock did not significantly affect global oil prices as confirmed by Kilian (2008).

Global oil prices respond positively and significantly to positive oil demand shocks at the 5% level. It is significant from the first months of the imposition of the shock and thereafter. With regard to the insignificant effects of the oil supply shock, we can observe that the main contributor to oil price fluctuations is the oil demand shock, not the oil supply shock. This finding is consistent with the results of the study conducted by Wang et al. (2013).

Reaction of Prices of Agricultural Commodities to Global Oil Shocks

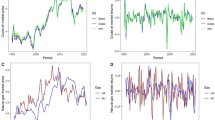

This section examines the impact of both oil demand and oil supply shocks on the prices of agricultural products by investigating the reactions of agricultural commodity prices to these structural oil shocks. These reactions are provided in Figs. 3 and 4. Figure 3 illustrates the reactions of the prices of agricultural products to structural shocks in oil demand before and after the food price crises. It is obvious that reactions to oil demand shocks are significant or marginally significant for the majority of agricultural products in the short and long term.

Figure 4 illustrates that how agricultural commodity prices response to oil supply shocks. In general, before the food price crisis, the impacts of oil supply shocks on the majority of prices of agricultural products are insignificant. However, after the food price crisis, the impact of oil supply shocks on the majority of agricultural commodity prices is significant, particularly after the first month following the shock.

The responses of exchange rates to global oil shocks before and after the food price crises are shown in Fig. 5. We can see that before the crisis, the reactions of real exchange rates to oil demand fluctuations are not significant. During this period, the impact of the oil supply shock on real exchange rates is negative and statistically significant for all months following the shock. During and after the food price crisis, the impact of the oil demand shock on real exchange rates is positive and significant, particularly two months after the shock. During this period, the real exchange rate responds negatively and significantly to the oil supply shock, particularly in the first three months after the shock.

Figure 6 represents the price responses of Malaysia’s major agricultural commodities—palm oil, rice, and rubber—to real exchange rate shocks before and after food price crises. Before the crisis period, palm oil responded positively and significantly to real exchange rates. Rice prices also respond positively and significantly to real exchange rates only in the first six months after the shock. Similarly, rubber prices respond positively to global oil demand shock only during the first four months after the shock. After the food price crisis, the impact of real exchange rates on rubber prices is significant only for three months after the shock. But, it has an adverse and significant impact on palm oil prices only during the first month after the shock.

To measure the share of the two oil shocks in changes in the prices of agricultural products, this study uses the method of predicting the decomposition of the error variance. Table 7 reports the findings of the variance decomposition method to predict errors in market returns of agricultural products over the projection periods of one month (short run) and three years (long run), respectively. It is obvious that before and after the food price crises, the share of oil demand and oil supply shocks is larger in the long run than in the short run. The oil demand shock can explain a very large share of the price changes in agricultural products before the food price crisis, but the supply shock can explain much of the price changes in agricultural products after the food price crisis.

Discussion

Global variation in oil prices affects both demand and supply in the agricultural sector (Fig. 7). Both shocks influence agricultural commodity prices. On the supply side, the fluctuation in global oil prices, which shift the supply curve of agricultural commodities to the left, directly and indirectly, affects agriculture products in two ways. The first way is through changes in transport costs. This means that as global crude oil prices increase, transport fuel prices increase which consequently increase the costs of transporting agricultural products from the production area to the sales markets and final consumers. The second channel is through agricultural inputs, such as pesticides, fertilizers, fuels used in farm machinery, etc. In other words, as global oil prices increase, the prices of agricultural inputs increase, resulting in higher agricultural commodity prices. These channels increase the production costs of agricultural commodities and shift the supply curve of these commodities to the left (Fig. 7a). On the demand side, the demand for agricultural commodities will influence due to more demand for biofuels. High global oil prices and environmental concerns stimulate more use of energy crops and shift the demand for agricultural commodities to the right (Fig. 7b). This increases demand for biofuels such as corn and soybean, as suitable and alternative fuels for fossil fuels. The increase in these crops increases not only the prices of these crops, but also the prices of other crops because of land scarcity in the cultivation of other crops.

Results of the oil demand shock show that the majority of agricultural products react to this type of shock significantly or marginally significant in the short and long term. These reactions occur both before and after the food price crises. This is because the oil demand shock, or demand for oil products, had a significant impact on changes in global oil prices. It is worth noting that the impact of oil demand shocks on the prices of agricultural products is greater and statistically more significant, which confirms the results of previous studies such as Ciaian and Kancs (2011) and Baumeister and Kilian (2014). Wang et al. (2018) argued that economic development is one of the drivers of world-wide high food prices.

It should be noted that the effects of oil demand shock are different both before and after the food price crisis. For example, the price reactions of the majority of agricultural products were heightened after the crisis period. In particular, after the food price crisis, the reactions to the positive oil demand shocks are positive and significant for eight out of the ten products under consideration. These findings are in line with results from other studies that found positive and significant relationship between oil demand shocks and prices of agricultural commodities such as Meyer et al. (2018), Fasanya et al. (2019), and Judit et al. (2017). The impact of the oil demand shock on the change in prices of egg, cocoa, papaya, rubber, and tomato is between 2 and 4 months and for palm oil and rice is about 6 months. Palm oil, the main source of biofuels in Malaysia, responds to the oil demand shock positively or negatively, consistent with the finding of the study conducted by Hochman et al. (2014) for ethanol. Paris (2018) also showed that greater demand for biofuels leads to higher agricultural commodity prices. Before the food price crisis, the reactions of the change in prices of five out of ten agricultural products are significant, but they are almost the same as the period after the crisis. For instance, the effects of the oil demand shock on changes in the prices of cocoa and palm oil are significant for more than two months following the shock. The prices of rice and rubber response positively and significantly to oil demand shocks, which ended one month following the shock. Moreover, we can see that after the crisis, the response scales have become larger. These results demonstrate that after the food price crisis, the importance of Malaysian economic activities in explaining the changes in agricultural commodity prices becomes stronger. This is because Malaysia, as a net exporter of crude oil, benefits from high global oil prices and its economic activities, mainly the industrial sector experiences significant growth. Wang et al. (2013) showed that in oil-exporting countries, high oil prices enhance market co-movement. However, the findings may be reversed in oil-importing countries (Wang et al. 2014). Therefore, increases in the production of economic activities increase the demand for agricultural products, leading to higher prices for agricultural products. Thus, after the food price crisis, Malaysia’s economic growth can stimulate the prices of agricultural products more strongly than before the food price crisis. The prices of coconut, rice, and watermelon response positively and significantly for at least 5 months. This is because this type of shock significantly affects economic activities resulting in an increase in demand for agricultural products and, therefore, higher prices for agricultural products.

The oil supply shock also affects agricultural commodity prices, particularly after the food price crisis. Before the food price crisis, the impacts of oil supply shocks on the majority of prices of agricultural products are insignificant. For example, the prices of coconut, cocoa, palm oil, and tomato response negatively and significantly to this shock. However, after the food price crisis, the impact of oil supply shocks on the majority of agricultural commodity prices is significant, particularly after the first month following the shock. These findings are consistent with the findings of the study conducted by Wang et al. (2014) which showed that the oil supply shock explains very small portions of changes in agricultural commodity prices.

On the responses of exchange rates to global oil shocks, results show that before the crisis, the reactions of real exchange rates to oil demand fluctuations are not significant. During this period, the impact of the oil supply shock on real exchange rates is negative and statistically significant for all months following the shock. Ji et al. (2020) showed that the oil supply shock results in a stronger depreciation impact in oil-exporting countries. In and after the food price crisis, the impact of the oil demand shock on real exchange rates is positive and significant, particularly two months after the shock. This is because an increase in global oil demand because of exogenous oil price shocks by the deterioration of the United States’ terms of trade leads to dollar weakness, which consequently increases the value of the Malaysian currency. During this period, the real exchange rate responds negatively and significantly to the oil supply shock, particularly in the first three months after the shock. This shows that these types of shocks after the food price crisis have been effective due to changes in the behavior of Malaysia’s economic activities and their demand for oil products. This, therefore, increased the supply of crude oil to the economy. But, Forhad and Alam (2021) noted that oil supply and demand shocks do not significantly impact the exchange rate.

Furthermore, before the crisis period, palm oil responded positively and significantly to real exchange rates. This is consistent with the results of the study conducted by Siami-Namini (2019). Rice prices also respond positively and significantly to real exchange rates only in the first six months after the shock. Similarly, rubber prices respond positively to global oil demand shock only during the first four months after the shock. After the food price crisis, the impact of real exchange rates on rubber prices is significant only for three months after the shock. But, it has an adverse and significant impact on palm oil prices only in the first month after the shock. Kiatmanaroch and Sriboonchitta (2014) highlighted the importance of exchange rates in managing the interactions between the price of palm oil and the price of crude oil. Therefore, after the food price crisis, global oil shocks have an insignificant or a weak impact on the prices of agricultural products through real exchange rates.

The results on the predicting the decomposition of the error variance show that before and after the food price crises, the share of oil demand and oil supply shocks is larger in the long run than in the short run. The oil demand shock can explain a very large share of the price changes in agricultural products before the food price crisis, but the supply shock can explain much of the price changes in agricultural products after the food price crisis. This is due to the short-run effects of the oil supply shock on variations in the prices of agricultural commodities, as plotted in Fig. 2, and the reasonably weak effects of real exchange rates on agricultural commodity prices after the crisis period as plotted in Fig. 6. It should be noted that the explanatory impact of the oil supply shock is bigger than that of the oil demand shock after the crisis period.

Conclusion and Recommendations

In this study, we investigated the impacts of global oil shocks on the prices of agricultural products during two periods, before and after the food price crises in 2006–2008. We decompose global oil shocks into two components: the global oil demand shock and the global oil supply shock. For this purpose, it used the structural vector autoregressive (SVAR) model based on the monthly data of global economic activity as a proxy for the oil demand shock, global crude oil production as a proxy for the oil supply shock and local prices of 10 agricultural commodities in Malaysia. The monthly data range from January 1993 to December 2019.

The results show that global oil prices respond positively and significantly to global oil demand shock that have occurred due to changes in demand for world crude oil by economic activities. However, they do not respond significantly to oil supply shocks. The oil demand shock positively and significantly affects the majority of agricultural commodity prices before and after the food price crises. These kinds of shocks come from the demand side of the crude oil market, which shows the important role of economic activities in explaining the variations in agricultural commodity prices, particularly before the food price crisis. This is because increased economic activities increase the demand for agricultural products and their prices. Cocoa, palm oil, and rubber prices were significantly affected by the global oil shocks before and after the food price crises. This shock affected palm oil prices negatively about 7 months before and after the food price crisis, while rubber influenced between 2 and 3 months. The impact of the oil demand shock after the food price crisis on the rice prices is positive and about 6 months. However, as Malaysia is a net exporter of crude oil, higher global prices for crude oil motivate this country to supply and export more crude oil. This obtains more revenues for the government, which can invest more in the economy. Accordingly, economic activities experience more growth, leading to increases in demand for agricultural commodities and their prices. Therefore, oil demand suck can explain the high share of changes in agricultural prices before the food price crisis in the long run. The role of global crude oil supply in explaining the variation in agricultural commodity prices has increased over time. For example, the majority of agricultural commodity prices do not respond to this type of shock before the food price crisis, while seven out of ten products respond significantly to this shock after the food price crisis.

Furthermore, real exchange rate responses to the global oil shocks. Its response to the global oil demand shock was not significant, while it has a negative and significant respond to oil supply shock before the food price crisis. But, after the food price crisis, the reaction of real exchange rates to oil demand shocks is positive and significant, but after the first month following the shock. However, this variable has a negative and significant response to oil supply shock only in the first two months following the shock. This indicates that after the food price crisis, not only changes in global oil demand can affect agricultural commodity prices, but also the role of other factors such as real exchange rates and global oil supply has improved.

The impact of real exchange rates on palm oil, rice, and rubber prices is significant only before the food price crisis. However, real exchange rates have little or no impact on palm oil, rice, and rubber prices after the food price crisis. The decomposition of changes in agricultural commodity prices shows that the oil demand shock can explain the change in agricultural commodity prices more effectively than the oil supply shock before the food price crisis. However, the role of the oil supply shock in explaining the variation in agricultural commodity prices is greater than the oil demand shock after the food price crisis. These findings support the results of the structural VAR model. Finally, the results revealed a positive and significant relationship between positive oil shocks and the production of the main renewable energy source in Malaysia, i.e., palm oil.

In terms of sustainability, the high use of fossil fuels increased environmental concerns about higher GHG emissions and related problems. Furthermore, fluctuations in the prices of these fuels have raised concerns about their negative impacts on overall economy and on the prices of agricultural commodities. These phenomena shift attention to the use of alternative and clean energy sources. This has resulted in the shift in government support, research and investment to new technologies that are safe, clean, and sustainable, which, in the future, will lead to sustainable development for every country.

We suggest that agricultural and food policymakers pay more attention to the analyses that explain the dynamics of variations in agricultural commodity prices. They must demonstrate that the rise in food prices is due to the increase in global activities or other external factors. The results showed that some agricultural commodities are neutral to global oil price shocks, such as eggs, papaya, and almost bananas. Investors and speculators can use these commodities for portfolio diversification and hedging purposes. Therefore, agricultural policies aimed at mitigating price volatility for these commodities must be different from other agricultural commodities that depend on energy prices. On the other hand, due to reliance on global energy prices, the agricultural sector can take advantage of this issue by protecting those products that are significantly influenced by high energy prices. Moreover, as energy prices affect the real exchange rate and, consequently, some agricultural products, agricultural policymakers need to pay more attention to mitigation policies such as high storage of food products, increasing tariffs on food exports and so on.

Data Availability

The sources of all data are mentioned in the main text.

References

Abed ER, Amor TH, Nouira R, Rault C (2016) Asymmetric effect and dynamic relationships between oil prices shocks and exchange rate volatility: Evidence from some selected MENA countries. Top Middle East Afr Econ 18(2):1–25

Adam P, Rosnawintang, Saidi LO, Tondi L, Sani LOA (2018) The causal relationship between crude oil price, exchange rate and rice price. Int J Energy Econ Policy 8(1):90–94

Ahmid A (2020) The Impact of oil price and exchange rate on agricultural commodity prices: evidence from Turkey. GSI J Ser B 3(1):1–15. https://doi.org/10.5281/zenodo.4030139

Baumeister C, Kilian L (2014) Do oil price increases cause higher food prices? Econ Policy 29(80):691–747

Binuomote SO, Odeniyi KA (2013) Effect of crude oil price on agricultural productivity in Nigeria (1981–2010). Int J Appl Agric Apic Res 9(1–2):131–139

Butt S, Ramakrishnan S, Loganathan N et al (2020) Evaluating the exchange rate and commodity price nexus in Malaysia: evidence from the threshold cointegration approach. Financ Innov. https://doi.org/10.1186/s40854-020-00181-6

Chatziantoniou I, Duffy D, Filis G (2013) Stock market response to monetary and fiscal policy shocks: multi-country evidence. Econ Model 30:454–769

Ciaian P, Kancs A (2011) Interdependencies in the energy-bioenergy-food price systems: a cointegration analysis. Resour Energy Econom 33:326–348

Department of Statistics Malaysia (DOSM) (2021) Statistics by theme: agriculture. Department of Statistics Malaysia, Putrajaya

Engle RF, Yoo BS (1987) Forecasting and testing in cointegrated system. J Econ 35:143–159

Fahimifard SM (2020) Studying the effect of economic sanctions on Iran’s Environmental Indexes (SVAR Approach). J Econ Model 5(3):93–119

Fasanya IO, Odudu TF, Adekoya O (2019) Oil and agricultural commodity prices in Nigeria: new evidence from asymmetry and structural breaks. Int J Energy Sect Manage 13(2):377–401. https://doi.org/10.1108/IJESM-07-2018-0004

Food and Agriculture Organization (FAO) (2009) The state of agricultural commodity markets high food prices and the food crisis—experiences and lessons learned. FAO, Rome, Italy. http://www.fao.org/3/i0854e/i0854e.pdf

Forhad MAR, Alam MR (2021) Impact of oil demand and supply shocks on the exchange rates of selected Southeast Asian countries. Glob Finance J. https://doi.org/10.1016/j.gfj.2021.100637

Fowowe B (2014) Modelling the oil price–exchange rate nexus for South Africa. Int Econ 140:36–48

Garcia LE, Illig A, Schindler I (2020) Understanding oil cycle dynamics to design the future economy. Biophys Econ Sustain 5:15. https://doi.org/10.1007/s41247-020-00081-4

Gokmenoglu KK, Güngör H, Bekun FV (2020) Revisiting the linkage between oil and agricultural commodity prices: panel evidence from an Agrarian state. Int J Econ Finance. https://doi.org/10.1002/ijfe.2083

Hamilton J (2009) Causes and consequences of the oil shock of 2007–08. Technical report, National Bureau of Economic Research

Harri A, Nalley L, Hudson D (2009) The Relationship between oil, exchange rates, and commodity prices. J Agric Appl Econ 41(2):501–510

Hochman G, Rajagopal D, Timilsina G, Zilberman D (2014) Quantifying the causes of the global food commodity price crisis. Biomass Bioenergy 68:106–114

Hoffman DL, Rasche RH (1996) Assessing forecast performance in a cointegrated system. J Appl Econ 11:495–517

Hung NT (2021) Oil prices and agricultural commodity markets: evidence from pre and during COVID-19 outbreak. Resour Policy 73:102236

Ji Q, Shahzad SJH, Bouri E, Suleman MT (2020) Dynamic structural impacts of oil shocks on exchange rates: lessons to learn. Economic Structures 9:20. https://doi.org/10.1186/s40008-020-00194-5

Judit O, Péter L, Péter B, Mónika HR, József P (2017) The role of biofuels in food commodity prices volatility and land use. J Compet 9(4):81–93

Kiatmanaroch T, Sriboonchitta S (2014) Relationship between exchange rates, palm oil prices, and crude oil prices: a vine copula based GARCH approach. In: Huynh VN, Kreinovich V, Sriboonchitta S (eds) Modeling dependence in econometrics. Advances in intelligent systems and Computing, vol 251. Springer, Cham. https://doi.org/10.1007/978-3-319-03395-2_25

Kilian L (2008) Exogenous oil supply shocks: how big are they and how much do they matter for the U.S. economy? Rev Econ Stat 90:216–240

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069

Kim D, Perron P (2009) Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. J Econom 148:1–13

Lima CRA, de Melo GR, Stosic B, Stosic T (2019) Cross-correlations between Brazilian biofuel and food market: ethanol versus sugar. Physica A 513:687–693

Meng J, Nie H, Mo B, Jiang Y (2020) Risk spillover effects from global crude oil market to China’s commodity sectors. Energy 202:117208

Mensah L, Obi P, Bokpin G (2017) Cointegration test of oil price and us dollar exchange rates for some oil dependent economies. Res Int Bus Finance 42:304–311

Meyer DF, Sanusi KA, Hassan A (2018) Analysis of the asymmetric impacts of oil prices on food prices in oil-exporting developing countries. J Int Stud 11(3):82–94

Mokni K, Youssef M (2020) Empirical analysis of the cross-interdependence between crude oil and agricultural commodity markets. Rev Financ Econ 38(4):635–654

Nandelenga MW, Simpasa A (2020) Oil price and exchange rate dependence in selected countries, Working Paper Series No 334, African Development Bank, Abidjan, Côte d’Ivoire

Pal D, Mitra SK (2018) Interdependence between crude oil and world food prices: a detrended cross correlation analysis. Physica A 492:1032–1044

Paris A (2018) On the link between oil and agricultural commodity prices: do biofuels matter? Int Econ 155:48–60

Siami-Namini S (2019) Volatility transmission among oil price, exchange rate and agricultural commodities prices. Appl Econ Finance 6(4):41–61

Solaymani S (2016) Welfare and change in consumption structure. In: Schultz C (ed) Poverty: global perspectives, challenges and issues of the 21st century. Nova Science Publisher Inc, New York

Solaymani S (2017) Agriculture and poverty responses to high agricultural commodity prices. Agric Res 6:195–206

Solaymani S (2019) Social and economic aspects of the recent fall in global oil prices. Int J Energy Sect Manage 13(2):258–276. https://doi.org/10.1108/IJESM-06-2017-0006

Solaymani S, Aghamohammadi E, Falahati A, Sharafi S, Kari F (2019) Food security and socio-economic aspects of agricultural input subsidies. Rev Soc Econ 77(3):271–296. https://doi.org/10.1080/00346764.2019.1596298

Su WC, Wang X-Q, Tao R, Lobon O-R (2019) Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 172:691–701

Suliman THM, Abid M (2020) The impacts of oil price on exchange rates: evidence from Saudi Arabia. Energy Explor Exploit 38(5):2037–2058

Sun Y, Mirza N, Qadeer A, Hsueh H-P (2021) Connectedness between oil and agricultural commodity prices during tranquil and volatile period. Is crude oil a victim indeed? Resour Policy 72:102131

Wang Y, Wu C, Yang L (2013) Oil price shocks and stock market activities: evidence from oil-importing and oil-exporting countries. J Comp Econ 41:1220–1239

Wang Y, Wu C, Yang L (2014) Oil price shocks and agricultural commodity prices. Energy Econ 44:22–35

Wang L, Duan W, Qu D, Wang S (2018) What matters for global food price volatility? Empir Econ 54:1549–1572

Wong KKS, Shamsudin MN (2017) Impact of crude oil price, exchange rates and real GDP on Malaysia’s food price fluctuations: symmetric or asymmetric? Int J Econ Manage 11(1):259–275

Yasmeen H, Wang Y, Zameer H, Solangi YA (2019) Does oil price volatility influence real sector growth? Empirical evidence from Pakistan. Energy Rep 5:688–703

Yip PS, Brooks R, Do HX, Nguyen DK (2020) Dynamic volatility spillover effects between oil and agricultural products. Int Rev Finance Anal 69:101465

Zafeiriou E, Arabatzis G, Karanikola P, Tampakis S, Tsiantikoudis S (2018) Agricultural commodities and crude oil prices: an empirical investigation of their relationship. Sustainability 10:1199. https://doi.org/10.3390/su10041199

Zmami M, Ben-Salha O (2019) Does oil price drive world food prices? Evidence from linear and nonlinear ARDL modeling. Economies 7(1):12. https://doi.org/10.3390/economies7010012

Author information

Authors and Affiliations

Contributions

SS contributed toward estimation, writing, data collection, interpretation, and analyzing, revising.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest..

Ethical approval

Not applicable.

Consent for Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Solaymani, S. Global Energy Price Volatility and Agricultural Commodity Prices in Malaysia. Biophys Econ Sust 7, 11 (2022). https://doi.org/10.1007/s41247-022-00105-1

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-022-00105-1