Abstract

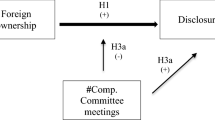

This paper uses new and unique bank-level data to investigate whether board governance determines executives’ remuneration and if the pay-governance relationship changes across bank ownership groups in India. The findings based on dynamic pay model estimated using two-step system GMM approach reveal that (i) past pay levels hold significant predicting power for the future level of executives’ pay, (ii) executive remuneration is significantly responsive to forward-looking market-based profitability measures, and (iii) individual board attributes play a significant role in pay setting in the Indian banking industry. Frequent board meetings and a more significant proportion of female directors on board moderate the executive remuneration packages. The results further infer that the board’s monitoring abilities considerably differ across ownership groups, with boards play a more prominent role in private banks, while boards of public sector banks lack adequate autonomy to determine executives’ pay. The results validate the “managerial power” approach, suggesting that any weaknesses in governance structure (especially in private banks) may inhibit bank boards from effectively performing their monitoring functions in optimal pay fixation.

Similar content being viewed by others

Data Availability

Not applicable.

Code Availability

Not applicable.

Notes

This is defined in the annual reports of banks, as per the Department of Economic Affairs (Banking Division) notification F.No. 20/1/2005-BOI dated 9th March, 2007, Ministry of Finance, Government of India.

Note here that the insignificant coefficient on Durbin-Wu Hausman test confirms the exogeneity of lagged performance measures in the pay-performance relationship (see Table 13 in Appendix A).

Windmeijer (2005) showed that corrected estimates of variance provide more accurate and robust results and approximates the finite sample variance.

These results are not reported for the sake of brevity and can be available upon request.

The authors would like to acknowledge the anonymous referee for this valuable suggestion.

References

Adams, R.B., and D. Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94 (2): 291–309.

Al Farooque, O., W. Buachoom, and N. Hoang. 2019. Interactive effects of executive compensation, firm performance and corporate governance: Evidence from an Asian market. Asia Pacific Journal of Management 36 (4): 1111–1164.

Almazan, A., and J. Suarez. 2003. Entrenchment and severance pay in optimal governance structures. Journal of Finance 58 (2): 519–548.

Andres, P.D., and E. Vallelado. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking and Finance 32 (12): 2570–2580.

Andrieș, A.M., B. Căpraru, and S. Nistor. 2018. Corporate governance and efficiency in banking: Evidence from emerging economies. Applied Economics 50 (34–35): 3812–3832.

Arellano, M., and S. Bond. 1991. Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Review of Economic Studies 58 (2): 277–297.

Arellano, M., and O. Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68 (1): 29–51.

Ayadi, N., and Y. Boujèlbène. 2013. The influence of the board of directors on the executive compensation in the banking industry. Global Business and Management Research 5 (2/3): 83–90.

Baker, G., M. Gibbs, and B. Holmstrom. 1994. The wage policy of a firm. The Quarterly Journal of Economics 109 (4): 921–955.

Bebchuk, L., and J. Fried. 2004. Pay Without Performance. Cambridge, MA: Harvard University Press.

Bebchuk, L.A., J.M. Fried, and D.I. Walker. 2002. Managerial power and rent extraction in the design of executive compensation. University of Chicago Law Review 69 (3): 751–846.

Bebchuk, L.A., A. Cohen, and H. Spamann. 2010. The wages of failure: executive compensation at Bear Stearns and Lehman 2000–2008. Yale Journal on Regulation 27 (C): 257–282.

Benkraiem, R., A. Hamrouni, F. Lakhal, and N. Toumi. 2017. Board independence, gender diversity and CEO compensation. Corporate Governance: The International Journal of Business in Society 17 (5): 845–860.

Bhatia, M., and R. Gulati. 2020. Does board effectiveness matter for bank performance? evidence from India. International Journal of Comparative Management 3 (1–2): 9–52.

Black, B.S., A.G. De Carvalho, and J.O. Sampaio. 2014. The evolution of corporate governance in Brazil. Emerging Markets Review 20 (C): 176–195.

Blundell, R., and S. Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87 (1): 115–143.

Borisova, G., J.M. Salas, and A. Zagorchev. 2019. CEO compensation and government ownership. Corporate Governance: An International Review 27 (2): 120–143.

Boschen, J.F., and K.J. Smith. 1995. You can pay me now and you can pay me later: The dynamic response of executive compensation to firm performance. Journal of Business 68 (4): 577–608.

Byrd, J., E.S. Cooperman, and G.A. Wolfe. 2010. Director tenure and the compensation of bank CEOs. Managerial Finance 36 (2): 86–102.

Cambini, C., R. Rondi, and S. De Masi. 2015. Incentive compensation in energy firms: Does regulation matter? Corporate Governance: An International Review 23 (C): 378–395.

Chhaochharia, V., and Y. Grinstein. 2009. CEO compensation and board structure. The Journal of Finance 64 (1): 231–261.

CMIE. 2019. ProwessIQ—A Database by the Centre for Monitoring Indian Economy. Mumbai, India. Available at: ProwessIQ (cmie.com)

Conger, J., D. Finegold, and E. Lawler III. 1998. Appraising boardroom performance. Harvard Business Review 76 (1): 136–148.

Conheady, B., P. McIlkenny, K.K. Opong, and I. Pignatel. 2015. Board effectiveness and firm performance of Canadian listed firms. British Accounting Review 47 (3): 290–303.

Conyon, M.J., and L. He. 2011. Executive compensation and corporate governance in China. Journal of Corporate Finance 17 (4): 1158–1175.

Conyon, M.J., and L. He. 2012. CEO compensation and corporate governance in China. Corporate Governance: An International Review 20 (6): 575–592.

Conyon, M.J., and K.J. Murphy. 2000. The prince and the pauper? CEO pay in the United States and United Kingdom. The Economic Journal 110 (467): F640–F671.

Conyon, M.J., and S.I. Peck. 1998. Board control, remuneration committees, and top management compensation. Academy of Management Journal 41 (2): 146–157.

Conyon, M., P. Gregg, and S. Machin. 1995. Taking care of business: Executive compensation in the United Kingdom. The Economic Journal 105 (430): 704–714.

Core, J.E., R.W. Holthausen, and D.F. Larcker. 1999. Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics 51 (3): 371–406.

Daily, C.M., D.R. Dalton, and A.A. Cannella. 2003. Corporate governance: Decades of dialogue and data. Academy of Management Review 28 (3): 371–382.

Doucouliagos, H., J. Haman, and S. Askary. 2007. Directors’ remuneration and performance in Australian banking. Corporate Governance: An International Review 15 (6): 1363–1383.

Elmagrhi, M.H., C.G. Ntim, Y. Wang, H.A. Abdou, and A.M. Zalata. 2020. Corporate governance disclosure index–executive pay nexus: The moderating effect of governance mechanisms. European Management Review 17 (1): 121–152.

Fama, E.F., and M.C. Jensen. 1983. Separation of ownership and control. The Journal of Law and Economics 26 (2): 301–325.

Farber, H.S., and R. Gibbons. 1996. Learning and wage dynamics. The Quarterly Journal of Economics 111 (4): 1007–1047.

Flannery, M.J., and K.W. Hankins. 2013. Estimating dynamic panel models in corporate finance. Journal of Corporate Finance 19 (C): 1–19.

Garen, J.E. 1994. Executive compensation and principal-agent theory. Journal of Political Economy 102 (6): 1175–1199.

Gibbons, R., and M. Waldman. 1999. A theory of wage and promotion dynamics inside firms. The Quarterly Journal of Economics 114 (4): 1321–1358.

Government of India. 1970. The Nationalised Banks (Management and Miscellaneous Provisions) Scheme. Section 3(ii), p. 57, Gazette of India, India.

Gulati, R., R. Kattumuri, and S. Kumar. 2020. A non-parametric index of corporate governance in the banking industry: an application to Indian data. Socio-Economic Planning Sciences 70: 100702.

Hallock, K.F. 1997. Reciprocally interlocking boards of directors and executive compensation. Journal of Financial and Quantitative Analysis 32 (3): 331–344.

Hermalin, B.E., and M.S. Weisbach. 2003. Board of directors as an endogenously determined institution: A survey of the economic literature. Economic Policy Review 9 (1): 7–26.

Holmstrom, B. 1999. Managerial incentive problems: A dynamic perspective. Review of Economic Studies 66 (1): 169–182.

Jensen, M.C. 1993. The modern industrial revolution, exit, the failure of internal control systems. Journal of Finance 48 (3): 831–880.

Kirkpatrick, G. 2009. The corporate governance lessons from the financial crisis. Financial Market Trends 1 (96): 1–30.

Lambert, R.A. 1983. Long-term contracts and moral hazard. The Bell Journal of Economics 14 (2): 441–452.

Lee, S.P., and M. Isa. 2015. Directors’ remuneration, governance and performance: The case of Malaysian banks. Managerial Finance 41 (1): 26–44.

Lipton, M., and J.W. Lorsch. 1992. A modest proposal for improved corporate governance. The Business Lawyer 48 (1): 59–77.

Luo, Y. 2015. CEO power, ownership structure and pay performance in Chinese banking. Journal of Economics and Business 82 (C): 3–16.

Main, B.G., and J. Johnston. 1993. Remuneration committees and corporate governance. Accounting and Business Research 23 (sup1): 351–362.

Main, B.G., A. Bruce, and T. Buck. 1996. Total board remuneration and company performance. The Economic Journal 106 (439): 1627–1644.

Marques, L.B., and Oppers, S.E. 2014. Risk-taking by banks: the role of governance and executive pay. In: Risk taking, liquidity, and shadow banking–curing excess while promoting growth (pp. 105–142), IMF Global Financial Stability Report.

Méndez, C.F., S. Pathan, and R.A. García. 2015. Monitoring capabilities of busy and overlap directors: evidence from Australia. Pacific-Basin Finance Journal 35 (C): 444–469.

Ministry of Corporate Affairs. 2013. The Companies Act 2013. New Delhi: Government of India; 2013. Available at: http://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf.

Mishra, C.S., and J.F. Nielsen. 2000. Board independence and compensation policies in large bank holding companies. Financial Management 29 (3): 51–69.

Murphy, K.J. 1985. Corporate performance pay and managerial remuneration: An empirical analysis. Journal of Accounting and Economics 7 (1–3): 11–42.

Murphy, K. 1999. Executive compensation. In Handbook of labor economics, vol. 3B, ed. O. Ashenfelter and D. Card, 2485–2563. Amsterdam: Elsevier.

Nam, S.W., and I.C. Nam. 2004. Corporate governance in Asia: Recent evidence from Indonesia, Republic of Korea, Malaysia, and Thailand. Asian Development Bank Institute. Available at: https://www.adb.org/sites/default/files/publication/159384/adbi-corp-gov-asia.pdf

Nickell, S. 1981. Biases in dynamic models with fixed effects. Econometrica 49 (6): 1417–1426.

NSE. 2019. Indian Boards—a database by the NSE Infobase. Mumbai. Available at: https://www.nseinfobase.com/single-product.aspx.

Ntim, C.G., S. Lindop, K.A. Osei, and D.A. Thomas. 2015. Executive compensation, corporate governance and corporate performance: A simultaneous equation approach. Managerial and Decision Economics 36 (2): 67–96.

Olaniyi, C.O., and O.B. Obembe. 2017. Determinants of CEO pay: Empirical evidence from Nigerian quoted banks. International Journal of Business Performance Management 18 (3): 327–349.

Owen, A.L., and J. Temesvary. 2019. CEO compensation, pay inequality, and the gender diversity of bank board of directors. Finance Research Letters 30 (C): 276–279.

Patel, U. 2018. Preventive vigilance—The key tool of good governance at public sector institutions. Speech presented at the Central Vigilance Commission. New Delhi. Available at: https://rbidocs.rbi.org.in/rdocs/Speeches/PDFs/CVCD1939C8177BE443E587735B76A030BF37.PDF.

Reserve Bank of India. 2012. Guidelines on Compensation of Whole Time Directors/Chief Executive Officers/Risk takers and Control Function staff, etc. Mumbai. Available at: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=6938andMode=0.

Reserve Bank of India. 2014. Report of the Committee to Review Governance of Boards of Banks in India (Chairman: P.J. Nayak). Mumbai. Available at: https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/BCF090514FR.pdf.

Reserve Bank of India. 2019. Revised Guidelines on Compensation of Whole Time Directors/Chief Executive Officers/Material Risk Takers and Control Function staff. Mumbai. Available at: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11720andMode=0.

Reserve Bank of India. 2019a. Statistical table relating to Banks in India: 2005–2019. Mumbai. Available at: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications.

Roodman, D. 2009a. How to do xtabond2: An introduction to difference and system GMM in stata. Stata Journal 9 (1): 86–136.

Roodman, D. 2009b. A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71 (1): 135–158.

Ross, S.A. 1973. The economic theory of agency: The principal’s problem. The American Economic Review 63 (2): 134–139.

SANSCO. 2019. Report junction. Mumbai: Researchbytes Corporate Services Pvt. Ltd. Available at: https://www.reportjunction.com/.

Słomka-Gołębiowska, A., and P. Urbanek. 2016. Corporate boards, large blockholders and executive compensation in banks: evidence from Poland. Emerging Markets Review 28 (C): 203–220.

Shiyyab, F., C. Girardone, and I. Zakaria. 2014. Pay for no performance? Executive pay and performance in EU banks. In: Paper presented at European Financial Management Association (EFMA) Annual Meetings, Rome, Italy.

Shleifer, A., and R.W. Vishny. 1997. A survey of corporate governance. Journal of Finance 520 (2): 737–783.

Sykes, A. 2002. Overcoming poor value executive remuneration: Resolving the manifest conflicts of interest. Corporate Governance: An International Review 10 (4): 256–260.

Tarchouna, A., B. Jarraya, and A. Bouri. 2017. How to explain non-performing loans by many corporate governance variables simultaneously? A corporate governance index is built to US commercial banks. Research in International Business and Finance 42 (C): 645–657.

Tosi, H.L., S. Werner, J.P. Katz, and L.R. Gomez-Mejia. 2000. How much does performance matter? A meta-analysis of CEO pay studies. Journal of Management 26 (2): 301–339.

Van Essen, M., P.P. Heugens, J. Otten, and J. Van Oosterhout. 2012. An institution-based view of executive compensation: A multilevel meta-analytic test. Journal of International Business Studies 43 (4): 396–423.

Wang, C. 1997. Incentives, CEO compensation, and shareholder wealth in a dynamic agency model. Journal of Economic Theory 76 (1): 72–105.

Williamson, O.E. 1985. The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press.

Windmeijer, F. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126 (1): 25–51.

Zagorchev, A., and L. Gao. 2015. Corporate governance and performance of financial institutions. Journal of Economics and Business 82 (C): 17–41.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gulati, R., Bhatia, M. & Duppati, G. Do Boards Govern Executive Remuneration in Indian Banks? An Econometric Exploration. J. Quant. Econ. 20, 211–255 (2022). https://doi.org/10.1007/s40953-021-00282-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-021-00282-8

Keywords

- Executive remuneration

- Board governance

- Dynamic panel models

- Two-step system GMM

- Agency theory

- Managerial power theory

- Indian banks