Abstract

This paper investigates empirically the effect of tax reform on fiscal space in developing countries. The analysis has used an unbalanced panel dataset comprising 99 developing countries (of which 37 Least developed countries—LDCs) over the period 1980–2015. It has shown empirical evidence that tax reform is associated with greater fiscal space in developing countries, with this positive impact being particularly higher for LDCs than for the set of other countries in the full sample. Furthermore, the higher the degree of openness to international trade, the greater is the positive effect of tax reform on fiscal space. In light of the importance of securing greater fiscal space to finance development needs, policymakers in developing countries should pursue their tax reform in the context of greater trade openness, notably with the assistance of both bilateral partners (developed countries) and relevant international institutions.

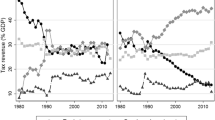

(Source: Authors)

(Source: Authors)

Similar content being viewed by others

Notes

Further information on criteria used on the choice of countries included in this category could be obtained online at http://unohrlls.org/about-ldcs/.

We recognize that the use of the fiscal space indicator based on the De Facto Tax Base averaged over 4-year period for robustness check analysis might seem ad-hoc. However, the use of this alternative measure of fiscal space helps check the robustness of the results based on the "FSPACE5" indicator, in the absence of another reliable measure of the extent of tax transition reform.

References

Adedeji, O., Ahokpossi, C., Battiati, C., & Farid, M. (2016). A probabilistic approach to fiscal space and prudent debt level: Application to low-income developing countries. IMF Working Paper, WP/16/163, Washington, D.C.

Ağca, S., & Celasun, O. (2012). Sovereign debt and corporate borrowing costs in emerging markets. Journal of International Economics,88(1), 198–208.

Aizenman, J. & Jinjarak, Y. (2010). De facto Fiscal Space and fiscal stimulus: Definition and assessment. NBER Working Paper No. 16539, Cambridge, MA.

Aizenman, J., Jinjarak, Y., Nguyen, K. H. T., & Park, D. (2019). Fiscal space and government-spending and tax-rate cyclicality patterns: A cross-country comparison, 1960-2016. Journal of Macroeconomics,60, 229–252.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics,68(1), 29–51.

Auerbach, A. J. (1996). Measuring the impact of tax reform. National Tax Journal,49(4), 665–673.

Balamatsias, P. (2017). Democracy and taxation. Economics Discussion Papers, No 2017-100, Kiel Institute for the World Economy. http://www.economicsejournal.org/economics/discussionpapers/2017-100. Accessed 22 Nov 2017.

Barro, R., & Furman, J. (2018). Macroeconomic Effects of the 2017 Tax Reform. Brookings Papers on Economic Activity, Spring 2018.

Barroy, H., Kutzin, J., Tandon, A., Kurowski, C., Lie, G., Borowitz, M., et al. (2018). Assessing Fiscal space for health in the SDG era: a different story. Health Systems & Reform,4(1), 4–7.

Baunsgaard, T., & Keen, M. (2010). Tax revenue and (or?) trade liberalization. Journal of Public Economics,94(9–10), 563–577.

Benno, T. (2003). To Evade or not to evade: That is the question. Journal of Socio-Economics,3, 283–302.

Bird, R. M., & Martinez-Vazquez, J. (2008). Tax effort in developing countries and high-income countries: The impact of corruption, voice and accountability. Economic Analysis and Policy,38(1), 55–71.

Blanchard, O., Chouraqui, J-C, Hagemann, R., & Sartor, N. (1990). The sustainability of fiscal policy: New answers to an old questions. OECD Economic Studies, No. 15, Autumn, Paris.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics,87, 115–143.

Bohn, H. (1998). The behavior of US public debt and deficits. Quarterly Journal of Economics,113(3), 949–963.

Bohn, H. (2008). The sustainability of fiscal policy in the United States. In R. Neck & J.-E. Sturm (Eds.), Sustainability of public debt (pp. 15–49). Cambridge: MIT Press.

Botev, J., Fournier, J., & Mourougane, A. (2016). A Re-assessment of Fiscal Space in OECD countries. OECD Economics Department Working Papers, No. 1352, OECD Publishing, Paris. http://dx.doi.org/10.1787/fec60e1b-en.

Bray, J. R., & Curtis, J. T. (1957). An ordination of the upland forest communities of Southern Wisconsin. Ecological Monographies,27, 325–349.

Brun, J.-F., Chambas, G., Combes, J.-L., Dulbecco, P., Gastambide, A., Guerineau, S., & Rota Graziosi, G. (2006). Fiscal space in developing countries. Concept Paper. New York: UNDP, Bureau for Development Policy, Poverty Group.

Brun, J. F., Chambas, G., & Mansour, M. (2015). Tax effort of developing countries: An alternative measure. In M. Boussichas & P. Guillaumont (Eds.), Financing sustainable development addressing vulnerabilities. Paris: FERDI, Economica.

Cagé, J., & Gadenne, L. (2018). Tax revenues and the fiscal cost of trade liberalization, 1792–2006, 1792–2006. Explorations in Economic History,70, 1–24.

Cheng, H.W.J., & Pitterle, I. (2018). Towards a more comprehensive assessment of fiscal space. DESA Working Paper No. 153, ST/ESA/2018/DWP/153. United Nations Department of Economic & Social Affairs, New York.

Christiansen, L., Schindler, M., & Tressel, T. (2013). Growth and structural reforms: A new assessment. Journal of International Economics,89(2), 347–356.

Clements, B., Dybczak, K., Gaspar, V., Gupta, S., & Soto, M. (2015). The Fiscal Consequences of Shrinking Populations. IMF Staff Discussion Note, SDN/15/21. International Monetary Fund, Wsshington, D.C.

Crivelli, E. (2016). Trade liberalization and tax revenue in transition: an empirical analysis of the replacement strategy. Eurasian Economic Review, 6, 1–25.

Crivelli, E. and Gupta, S. (2014). Resource blessing, revenue curse? Domestic revenue effort in resource-rich countries. European Journal of Political Economy, 35, 88–101.

Cyan, M., Martinez-Vazquez, J., & Vulovic, V. (2013). Measuring tax effort: Does the estimation approach matter and should effort be linked to expenditure goals?. International Center for Public Policy Working Paper 13-08

De Benedictis, L., & Tajoli, L. (2007). Economic integration and similarity in trade structures. Empirica,34, 117–137.

De Benedictis, L., & Tajoli, L. (2008). Similarity in trade structures, integration and catching-up. Economics of Transition.,16(2), 165–182.

Development Committee. (2006). Fiscal Policy for Growth and Development—An Interim Report. Paper presented at the Development Committee Meeting, Washington D.C.

Easterly, William. (2002). How Did heavily indebted poor countries become heavily indebted? Reviewing two decades of debt relief. World Development,30(10), 1677–1696.

Eisl, A. (2017). Explaining Variation in Public Debt: A Quantitative Analysis of the Effects of Governance. MaxPo Discussion Paper 17/1. Max Planck Sciences Po Center on Coping with Instability in Market Societies Sciences Po, France.

Escolano, J. (2010). A Practical guide to public debt dynamics, fiscal sustainability, and cyclical adjustment of budgetary aggregates. Technical notes and manuals No. 2010/2. Washington: International Monetary Fund.

Finger, J. M., & Kreinin, M. E. (1979). A measure of “export similarity” and its possible uses. Economic Journal,89(356), 905–912.

Fournier, J.M., & Fall, F. (2015). Limits to Government Debt Sustainability”, OECD Economics Department Working Papers, No. 1229, OECD Publishing, Paris. http://dx.doi.org/10.1787/5jrxv0fctk7j-en.

Frenkel, J. A., & Razin, A. (1999). International effects of tax reforms. The Economic Journal,99(395), 38–58.

Ghosh, A. R., Kim, J. I., Mendoza, E. G., Ostry, J. D., & Qureshi, M. S. (2013). Fiscal fatigue, fiscal space and debt sustainability in advanced economies. Economic Journal,123(566), 4–30.

Gnangnon, S. K. (2018). Export product concentration and De Facto Fiscal Space: Does openness to international trade matter? Global Economy Journal, De Gruyter,18(1), 1–12.

Gnangnon, S. K. (2019a). Fiscal space for trade: How could the international trade community help? Journal of International Commerce, Economics and Policy,10(01), 1950001.

Gnangnon, S. K. (2019b). De Facto Fiscal Space in Donor-countries and their aid supply: To what extent is trade-related aid supply affected? South Asian Journal of Macroeconomics and Public Finance,8(1), 1–25.

Gnangnon, S. K., & Brun, J. F. (2017). Impact of export upgrading on tax revenue in developing and high-income countries. Oxford Development Studies,45(4), 542–561.

Gnangnon, S. K., & Brun, J. F. (2018a). Is the impact of development aid on government revenue sustainable? An empirical assessment. The Quarterly Review of Economics and Finance,67, 311–325.

Gnangnon, S. K., & Brun, J. F. (2018b). Impact of bridging the Internet gap on public revenue mobilization. Information Economics and Policy.,4(C), 23–33.

Grilli, Vittorio, Masciandaro, Donato, Tabellini, Guido, Malinvaud, Edmond, & Pagano, Marco. (1991). Political and monetary institutions and public financial policies in the industrial countries. Economic Policy,6(13), 341–392.

Haley, A. J. (2018). Fiscal Space: What Is It? Who Has It? When to Use It? Centre for International Governance Innovation (CIGI) Paper No. 181, Canada.

Harris, E. (2013). Financing social protection floors: Considerations of fiscal space. International Social Security Review,66(3–4), 111–143.

Heller, P. (2005). Understanding Fiscal Space. IMF Policy Discussion Paper No. PDP/05/4. International Monetary Fund, Washington, DC.

Aizenman J. & Jinjarak, Y. (2011). The Fiscal Stimulus of 2009-10: Trade Openness, Fiscal Space and Exchange Rate Adjustment, NBER Working Paper 17427.

Keen, M., & Simone, A. (2004). Tax policy in developing countries: some lessons from the 1990s and some challenges ahead (pp. 302–352). Helping countries develop: The role of fiscal policy.

Khattry, B., & Rao, J. M. (2002). Fiscal faux pas?: an analysis of the revenue implications of trade liberalization. World Development,30(8), 1431–1444.

Langford, B., & Ohlenburg, T. (2016). Tax revenue potential and effort: an empirical investigation, Working Paper S-43202-UGA-1. International Growth Centre, United Kingdom.

Le, T.M., Moreno-Dodson, B., & Bayraktar, N. (2012). Tax capacity and tax effort extended cross-country analysis from 1994 to 2009. World Bank Policy Research Working Paper 6252, Washington, D.C.

Mario, M. (2013). Budgeting for fiscal space and government performance beyond the great recession. OECD Journal on Budgeting,13(2), 9–47.

Marshall, M. G., & Jaggers, K. (2009). Polity IV project country reports, CIDUM. College Park: University of Maryland.

Michaelis, J., & Birk, A. (2006). Employment- and growth effects of tax reforms. Economic Modelling,23(6), 909–925.

Morrissey, O., Von Haldenwang, C., Von Schiller, A., Ivanyna, M., & Bordon, I. (2016). Tax revenue performance and vulnerability in developing countries. The Journal of Development Studies,52, 1–15.

Naito, T. (2017). An asymmetric Melitz model of trade and growth. Economics Letters,158, 80–83.

Nashashibi, K., & Bazoni, S. (1994). Exchange rate policies and fiscal performance in sub-Saharan Africa. IMF Staff Papers,41(1), 76–122.

Nerlich, C., & Reuter, W. (2013). The design of national fiscal frameworks and their budgetary impact. ECB Working Paper Series 1588, 1–30

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica,49(6), 1417–1426.

Oatley, T. (2010). Political Institutions and Foreign Debt in the Developing World”. International Studies Quarterly,54(1), 175–195.

Olson, M. (1993). Dictatorship, Democracy, and Development. The American Political Science Review,87(3), 567–576.

Ostry, J., Ghosh, A.R., Kim, J.I., and Qureshi, M. (2010). Fiscal space. IMF Staff Position Note SPN/10/11. Washington, DC: International Monetary Fund.

Park, S. (2012). Quantifying impact of aging population on fiscal space. IMF Working Paper No. 12/164, Fiscal Affairs Department, IMF, Washington.

Roodman, D. M. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economic and Statistics,71(1), 135–158.

Roy, R., Heuty, A., & Letouzé, E. (2006). Fiscal space for public investment: Towards a human development approach. Paper prepared for the G24-Meeting in Singapore, September 2006. New York: UNDP.

Roy, R., Heuty A., & Letouzé, E. (2007). Fiscal space for what? Analytical issues from a human development perspective. Paper prepared for the G20-Workshop on Fiscal Policy, June–July 2007, UNDP, New York.

Saxegaard, M. (2014). Safe debt and uncertainty in emerging markets: An application to South Africa. IMF Working Paper No. 14/231 (Washington: International Monetary Fund)

Schick, A. (2009). Budgeting for Fiscal Space. OECD Journal on Budgeting. Vol. 9, No. 2. http://www.oecd.org/gov/budgetingandpublicexpenditures/45361746.pdf.

Tanzi V (1977) Inflation, lags in collection, and the real value of tax revenue. Staff Papers, 26, 154-67, International Monetary Fund, Washington D.C.

Tanzi, V., & Zee, H. H. (2000). Tax policy for emerging markets: Developing countries. National Tax Journal, 299–322.

Ter-Minassian, T., Hughes, R., & Hajdenberg, A. (2008). Creating Sustainable Fiscal Space for Infrastructure: The Case of Tanzania. IMF Working Paper, WP/08/256, Washington, DC.

Thomas, A., & J.P. Treviño (2013) Resource Dependence and Fiscal Effort in Sub-Saharan Africa. IMF Working Paper, WP/13/188, Washington D.C.

Torgler, B. (2003). Tax morale and institutions. Journal of Economic Psychology,30(2), 228–245.

Torgler, B., Schneider, F., & Macintyre, A. (2011). Shadow economy, voice and accountability and corruption. Handbook on the shadow economic, 469.

Yeyati, E. L., Panizza, U., & Stein, E. (2007). The cyclical nature of North-South FDI flows. Journal of International Money and Finance,26, 104–130.

Yohou, D.H. (2015). In Search of Fiscal Space in Africa: The Role of the Quality of Government Spending. CERDI, Série Études Et Documents, no 27, Clermont-Ferrand, France.

Yohou, H. D., and Goujon, M. (2017). Reassessing tax effort in developing countries: A proposal of a vulnerability-adjusted tax effort index (VATEI). Working Paper no 186, Fondation pour les Etudes et de Recherches sur le Développement International (FERDI).

Acknowledgments

The Authors would like to express their gratitude to the anonymous Reviewers for their useful comments on this article. The latter represents the personal opinions of individual staff members of the WTO and is not meant to represent the position or opinions of the WTO or its Members, nor the official position of any staff members. Any errors or omissions are the fault of the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

See Table 5.

Appendix 2

See Table 6.

Appendix 3

See Table 7.

Appendix 4

See Table 8.

Rights and permissions

About this article

Cite this article

Gnangnon, S.K., Brun, JF. Tax reform and fiscal space in developing countries. Eurasian Econ Rev 10, 237–265 (2020). https://doi.org/10.1007/s40822-019-00135-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-019-00135-z