Abstract

The government organizations grant incentives to promote green product consumption, improve green product quality, boost remanufacturing activities, etc. through various policies. The objective of this study is to highlight pros and cons of two incentive policies, namely (1) incentive on manufacturer’s R&D investment and (2) direct incentive to consumer based on greening level of the product on the optimal pricing and investment decisions in improving used product return and greening level decisions in a closed-loop supply chain (CLSC). Optimal decisions are derived under manufacturer and retailer-Stackelberg games, and results are compared to explore characteristics of optimal decisions, consumer surplus, and environmental improvement under two marketing strategies of a manufacturer. It is found that the greening level and used product return rate in a CLSC are always higher under retailer-Stackelberg game. If the manufacturer sets a target for greening level, the CLSC members may receive higher profits if consumer receives incentive because of higher consumer surplus. However, environmental improvement may be lower. If the manufacturer sets a product return goal, then CLSC members may compromise with consumer surplus or environmental improvement for receiving higher profits. In the presence of direct incentive to consumers, CLSC members can trade with product at lower greening level for higher profits. Moreover, investment in improving used product return is always less compared to the investment in improving greening level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Due to environmental awareness, government regulations, and economical benefits of product remanufacturing/recycling, closed-loop supply chain (CLSC) management emerges as one of the leading research interests from marketing and supply chain management researchers (Savaskan et al. 2004; Jayaraman 2006; Kumar and Putnam 2008; Yuan and Gao 2010; Chen and Chang 2012; Hong et al. 2013; Huang et al. 2013; De Giovanni and Zaccour 2014; Gao et al. 2016; Tighazoui et al. 2019). In a CLSC, products move from the manufacturer to the consumers in forward supply chain, while the reverse supply chain involves the movement of used products from consumers for remanufacturing. Manufacturers employ different measures such as raw material selection during product development, reconstruction of process for recycling, employees training, and consumer awareness programme, provide monetary reward or exchange offer, etc., for remanufacturing. For example, Xerox corporation is using advanced technologies to produce waste-free products and collects millions of cartridges for remanufacturing or reuse. The initiatives not only ensure monetary benefit over $127 million, but also help the company to save over 115 million pounds of greenhouse gasses.Footnote 1 In 2016, Hewlett-Packard launched recycling initiatives to collect hardware in collaboration with Best Buy stores and recycled 3200 tonnes plastic resin to develop product such as HP ENVY Photo 6200, 7100, and 7800 printers.Footnote 2 Apple designed their global supply chain facilities by clean energy and archived the goal “100% renewable is 100% doable.”Footnote 3 Government organizations also encourage remanufacturing activities by providing incentives under various policies. One can identify different forms of incentive which are implemented in different countries. For example, the Florida Department of Environmental Protection, a leading agency for environmental management, encourages remanufacturing through different policies such as Recycling Loan Program, Household Hazardous Waste Grants, and Innovative Recycling/ Waste Reduction Grants.Footnote 4 The government of UK announced a businesses support programme of £4 million to encourage “circular economy” approaches to improve recycling processes, innovations that encourage people to change behavior and reduce plastic waste.Footnote 5 The government of New Zealand provided support through “Waste Minimization Fund” to encourage resource efficiency, reuse, recovery, and recycling and reduce waste to landfill.Footnote 6 Government of India introduced “UJALA programme”Footnote 7 and provided incentive up to 50% of unit cost of 20W LED and 40% of BEE 5-star rated energy-efficient fans directly to consumers. The government estimated that the initiative can annually save 79 million tonnes of CO2 gas emission. Iino and Lim (2010) reported that the government of Japan introduced “Eco Car Subsidy Policy” to encourage the replacement of aged vehicles with better environmental performance standards on popular car model and provided tax incentive up to 10% of the vehicle’s price. The evidence of government incentives can also be obtained in different market segments such as energy-efficient home appliances (Yu et al. 2018), energy-efficient lighting (Harder and Beard 2016), and electric or hybrid plug-in vehicles in several countries (Yang et al. 2016). However, the effects of different government incentive polices on the optimal decisions of a CLSC are not explored explicitly. In addition, if manufacturers have options, it is necessary to explore the characteristics of optimal decisions by considering various marketing goals or operational barriers. Therefore, this study conducts a comparative analysis for the selection of optimal incentive policy in the perspective of remanufacturing and environmental sustainability.

In the literature, researchers made continuous efforts to explore optimal pricing and investment decision in improving greening level and encouraging used product return for remanufacturing in different scenarios (Govindan et al. 2015). However, based on our knowledge, no analytical study in CLSC setting was made to investigate characteristics of optimal decisions under joint influence of marketing or operational strategies of manufacturer in the presence of government incentive policies. We analyze the effects of two incentive policies: government incentive on total R&D investment (Policy T) and direct consumer incentives (Policy C). The main objective of our study is to find the answers of the following questions:

which policy will assure maximum profits for the CLSC members?

what are the impacts of two incentive policies on greening level (GL) of the product and used product return rate?

how do incentive policies affect the consumer surplus (CS) and environmental improvement (EI)?

and, if the manufacturer has a marketing goal or faces issues related to implementation of green technology, does the preference of the manufacturer change according to power structure of CLSC members?

To find answers to the above questions, this study considers two game structures and two incentive policies. Our analysis leads to the following main results: irrespective of whether the manufacturer is receiving incentives from the government, GL and return rate are always higher in retailer-Stackelberg (RS) game. In a pragmatic scenario, the objective of CLSC members may not be concurrent with the government. The profits of each CLSC member increase with government incentive, but GL may not. If the manufacturer bounds to set target for GL, each member of CLSC receives higher profits under incentive Policy C. Used product return rate and CS are also higher under this policy. When the manufacturer sets a remanufacturing goal, under the manufacturer Stackelberg (MS) game, the retailer receives uniform profits under both incentive policies. CLSC members may prefer incentive Policy C, which can lead to inferior outcomes in perspective of GL and EI.

Literature review

This study is largely concerned with governments incentive and game structure in CLSC, and the literature on price- and GL-sensitive demand. In the following paragraphs, we discuss two important topics in the literature to highlight the motivation and importance of this study.

CLSC management is one of the great interests in both business and academic research due to growing consumer awareness on environmental issues and regulations. It is difficult to ignore the influence of government organizations in CLSC. Government regulatory agencies not only set the rules for trading/remanufacturing goods and regulate environmental impact such as emissions, and waste disposal, but encourage remanufacturing by providing incentives also. However, the literature is scanty on government’s incentive policy in CLSC. Mitra and Webster (2008) explored the effect of government subsidies on the retail price competition between new and remanufactured products. The authors found that the profits earned by the manufacturer through the remanufacturing activity reduce significantly as the amount of government incentive increases. Ma et al. (2013) studied the impact of government consumption subsidy on a dual-channel CLSC. The authors found that the bricks mortar retailer always receives higher profits under the government subsidy, whereas benefits of e-retailer largely depend on system parameters. Wang et al. (2014) conducted an empirical investigation to compare the effect of government incentive on R&D investment and production quantity in the context of Chinese recycling and remanufacturing industry. Through simulation experiment, the authors found that the production subsidy could control the quantity of remanufactured products and keep the stability of remanufacturing industry. Heydari et al. (2017) studied the impact of tax exemptions or subsidies on a two-echelon CLSC and found that the government intervention can increase the number of remanufactured products. Shu et al. (2017) compared optimal pricing and remanufacturing decision under the government’s tax rebate policy and remanufacturing incentive. The authors found that trade-in subsidy always stimulates remanufacturing. Jena et al. (2018) studied a CLSC consist with two manufacturers and a common retailer and found that return rate of used product and the individual profit of participating member increases with the government incentive. However, the above-cited literature did not consider the impact of investment decisions by correlating marketing goals or explore the effects of different incentive policies on EI in different game structures.

A large body of the literature has dealt with CLSC models under different game structures in absence of government incentive. Hong et al. (2013) developed Stackelberg game models to investigate a CLSC composed of a manufacturer and an independent retailer, or a manufacturer, a retailer, and a third party with price and advertisement-level-dependent demand. The authors found that the cooperative advertisement fails to coordinate the CLSC. Wei et al. (2015) studied a CLSC model with symmetric and asymmetric information structures and used game theory in order to investigate how the manufacturer and retailer make their individual pricing decisions and return rate. Guo and Gao (2015) studied the optimal recycling production strategy in a CLSC by considering constant demand. The authors assumed the recycling rate, buyback, and remanufacturing cost as exponential distribution functions. Taleizadeh et al. (2016) studied the influence of two-part tariff on a dual-channel CLSC. The authors found that the supply chain member could receive higher profit if the manufacturer invests in both marketing effort and advertising itself. Gao et al. (2016) explored the characteristics of a CLSC under different power structures on the optimal decisions and performance of overall supply chain. Saha et al. (2016) explored the characteristics of a CLSC under reward-driven remanufacturing policy. The authors found that the consumers receive maximum reward if the manufacturer directly collects the product. Modak et al. (2016) discussed collusion behavior in a CLSC with a manufacturer and duopolies retailers and employed cost sharing contract mechanism for coordination. Genc and De (2017) developed a two-period MS game model for a CLSC in which the return rate of the product is a function of both price and quality and consumers look for most possible gain from their returns. Taleizadeh et al. (2018) investigated pricing, product quality, and used product return rate decisions of the manufacturer, retailer, and third party under dual recycling. Alamdar et al. (2018) investigated pricing, product return, and sales effort decisions in a three-level CLSC under fuzzy environment. The authors proved that collaboration between CLSC members improves the profits of each member.

In this study, we explore the behavior of optimal decisions of a CLSC under price- and GL-sensitive demand. The increase in consumer awareness toward environmental issues, it is necessary to determine optimal GL. Perhaps, Ghosh and Shah (2012) introduced first analytical model under price- and GL-sensitive demand. The authors employed cost and revenue-sharing contract in the perspective of achieving supply chain coordination. In a similar study, Ghosh and Shah (2015) showed that the manufacturer can able to produce products with a higher GL if the retailer offers a R&D-cost-sharing contract. Swami and Shah (2013) extended the study and showed that the two-part tariff contract between the supply chain members could reduce channel conflict. Li et al. (2016) analyzed dual-channel green supply chain where the manufacturers produce eco-friendly products in both centralized and decentralized frameworks. The authors showed that the manufacturer’s decision to open a direct channel is directly related to GL of the product. Basiri and Heydari (2017) added another important dimension as sales effort and formulated an analytical model to study the impact of substitutable green products. The authors showed that the manufacturer could always trade with the product at superior GL under the cooperative environment. Song and Gao (2018) introduced two contract mechanisms and proved that a retailer-led revenue-sharing contract always improves profits of each participating member, but the retailer always receives less amount of profit under a bargaining revenue-sharing contract. Dey et al. (2018) also proved that the manufacturer decision to produce development or marginal-cost sensitive green product is highly correlated with the retailer inventory carrying decision. In this direction, the recent work of Li et al. (2016), Dai et al. (2017), Yang and Xiao (2017), Ghosh et al. (2018), Patra (2018), Dey and Saha (2018), Jamali and Rasti-Barzoki (2018) and Nielsen et al. (2019a) is worth mentioning. However, in a CLSC, the manufacturer needs to invest both in R&D to improve GL and marketing effort to encourage recycling. Therefore, it is necessary to explore the nature of investment patterns of a manufacturer under a CLSC.

Problem description

We consider a bilateral monopoly in a CLSC with a single retailer and a single manufacturer under MS and RS games. The manufacturer produces a green product and sells through an independent retailer. We consider two types of incentive policies and two game structures and consequently analyze six different scenarios. We represent scenarios by ij, where \(i=M, R\) represents the MS (M) and RS (R) games and \(j=T, C, N\) represents inventive on total R&D investment (T), direct incentive to consumer (C), and benchmark no-incentive case (N). The manufacturer directly collects the used product from consumers. The following assumptions are made to formulate analytical models:

- 1.

The market demand faced by the retailer is linearly dependent on the retail price (p) and GL (\(\theta\)). Similar to Yang and Xiao (2017), Song and Gao (2018) and Dey and Saha (2018), the functional from of market demand is assumed as \(D = a-b p+\beta \theta\), where a, b, and \(\beta\) represent market potential, price, and GL sensitivity of consumers, respectively. Green innovation cost is considered as \(\lambda \theta ^2\) to ensure that a higher investment is needed to produce products at higher GL. Furthermore, notice that this assumption is common in the literature, such as in Ghosh and Shah 2015; Li et al. 2016; Dey et al. 2018; Nielsen et al. 2019b.

- 2.

The unit manufacturing and remanufacturing costs are considered as \(c_m\) and \(c_r\), respectively. All the return products have same manufacturing cost, and unit manufacturing cost is higher than remanufacturing cost, i.e., \(c_r< c_m\) (Savaskan et al. 2004; Taleizadeh et al. 2018). The total investment of collection \(CL(\tau , \alpha )\) for the manufacturer is considered as \(CL(\tau , \alpha ) =\alpha \tau D + \kappa \tau ^2\), where \(\kappa >0\) and \(\alpha >0\), respectively, represent the scaling parameter (Savaskan et al. 2004; Jena et al. 2018). Therefore, the consumer receives \(\$\alpha\) per unit from the manufacturer by returning the product and \(\tau , 0\le \tau \le 1\) represents the used product return rate.

- 3.

A fraction \(\delta\) of remanufactured products converts into same quality to the new product and sold as new one (Gao et al. 2016; Taleizadeh et al. 2018). Similar to the works in Saha et al. (2016), Alamdar et al. (2018), Sinayi and Rasti-Barzoki (2018), and Taleizadeh et al. (2019), the effect of logistics costs in forward and reverse supply chain between manufacturer to customers is also normalized to zero to improve the clarity of the analytical findings. The manufacturer sells the rest of the products in secondary market with a price of \(w_s\). The CLSC decisions are taken in a single-period setting (Guo et al. 2018). The manufacturer is responsible for the used product collection in remanufacturing. The real examples of the model are televisions and digital cameras of Samsung, fashion accessories brand like H&M, Zara, etc. (Martin 2019).

- 4.

The impact of two government incentive policies is analyzed. In Policy T, the manufacturer receives incentives from the government on the total R&D investment (Nam 2012; Liu and Xia 2018). Therefore, the contribution from the government is \(\gamma \lambda \theta ^2\), (\(0< \gamma < 1\)). For example, in Japan, Ministry of Environment approves 5 billion yen in 2019 as subsidy for the manufacturer to cover 33 to 50% of their equipment price to produce products with biodegradable bioplastics (https://bioplasticsnews.com/2018/08/27/japan-government-bioplastics/ ). Through Technology & Quality Upgradation Support scheme for MSMEs (TEQUP), government of India provides subsidy upto 25% of the project cost for implementation of energy-efficient technology (www.standupmitra.in/Home/Subsidy SchemesForAll). In Policy C, the government provides incentives directly to consumer based on the GL of the product. If the government provides subsidy \(\rho _0+\rho \theta\), then the price paid by the consumer to the retailer will be \(p-(\rho _0+\rho \theta )\). The similar incentive policy is studied by the researches (Chu et al. 2018; Sinayi and Rasti-Barzoki 2018) in the existing literature if \(\rho =0\). However, green purchasing decision and amount of incentives depend on GL of the product (Mannberg et al. 2014; Houde and Aldy 2014). For example, government of China offered a per unit fixed amount of ¥31,500 for purchasing of plug-in hybrid electric vehicles with electric range of 50 km or more. The subsidy amount increased ¥54,000, ¥45,000, and ¥31,500 for the vehicles with battery capacity range of 250 km or higher, 150–250 km, and 80–150 km, respectively (www.evpartner.com/news/27/detail-13412.html). Similar evidence also reported by Zheng et al. (2018), where government of China implemented incremental incentive policy to consumers in various provinces. Therefore, it is necessary to explore characteristics of optimal decisions if the amount of incentive varies with GL.

- 5.

The Stackelberg game approach is employed to derive the optimum decisions. Under MS and RS games, the decision sequence is defined as follows:

- Step 1:

In MS game, the manufacturer decides \(w_m^j\), \(\theta _m^j\), and \(\tau _m^j\). In RS game, the retailer decides profit margin \(m_r^j = p_r^j - w_r^j\);

- Step 2:

In MS game, the retailer decides retail price \(p_m^j\). In RS game, the manufacturer decides \(w_r^j\), \(\theta _r^j\), and \(\tau _r^j\).

According to the backward solution, anticipating the follower’s response, the Stackelberg leader optimizes his/her own decision variables (Taleizadeh et al. 2019).

- Step 1:

The following notations are used for developing models under different scenarios:

\(w_i^j\) | Unit wholesale price (decision variable) |

\(p_i^j\) | Unit retail price (decision variable) |

\(\tau _i^j\) | Return rate of used products from the customer (decision variable) |

\(\theta _i^j\) | Level of green innovation (decision variable) |

\(\pi _{mi}^{j}\) | Profit of the manufacturer |

\(\pi _{ri}^{j}\) | Profit of the retailer |

\(Q_i^j\) | Sales volume |

Model

In this section, we present the profit structures for CLSC members and explore characteristics of optimal decisions.

Optimal decisions under incentive Policy T

The manufacturer produces the green product at a manufacturing cost of \(c_m\) and sells the product with GL \(\theta _m^T\) to the retailer at a wholesale price \(w_m^{T}\). The retailer sells it to the customers at a price of \(p_m^{T}\). The manufacturer collects used product from the consumers by paying \(\alpha\) per unit. Only a portion \(\delta\) has same quality with the new one with GL \(\theta _m^T\), and the remaining portion are sold in the secondary market with a price of \(w_s\). The profit functions for the retailer and manufacturer in Scenario MT are obtained as follows:

In MS game, the manufacturer first decides GL (\(\theta _m^T\)), return rate (\(\tau _m^T\)), and wholesale price (\(w_m^{T}\)); then, the retailer sets retail price (\(p_m^{T}\)). However, under RS game the retailer sets retail price (\(p_r^{T}\)) first, and then, the manufacturer decides GL (\(\theta _r^T\)), return rate (\(\tau _r^T\)), and wholesale price (\(w_r^{T}\)). The following two propositions represent the optimal decisions in Scenarios MT and RT, respectively.

Proposition 1

Under MS game, optimal decisions in Policy Tare obtained as follows:

where \(\Delta _1 = b (1 - \gamma ) \lambda (8 \kappa - b M^2) - \beta ^2 \kappa\)and\(M=(c_m \delta + w_s (1 - \delta ) -c_r - \alpha )\).

Proof

Please see “Appendix 1.” \(\square\)

Proposition 2

Under RS game, optimal decisions in Policy T are obtained as follows:

where \(\Delta _2 = b (1 - \gamma ) \lambda (4 \kappa - b M^2) - \beta ^2 \kappa\)

Proof

Please see “Appendix 2.”

Optimal solutions exist under Scenarios MT and RT if \(\Delta _l>0\), \(l=1,2\), which implies \(4 \kappa > b M^2\). Substituting \(\gamma =0\) in Equations (1) and (2), one can find the profit functions for the Scenarios MN or RN, where government does not provide any incentives. We present the optimal decisions under two game structures in “Appendix 3,” because the expressions are similar to Propositions 1 and 2, respectively. Government incentives encourage the manufacturer to produce product with a higher GL and promote recycling because \(\frac{\partial \theta _m^T}{\partial \gamma }= \frac{(a - b c_m)(8 \kappa -b M^2)b \beta \lambda \kappa }{{\Delta _1}^2}>0\), \(\frac{\partial \tau _m^{T}}{\partial \gamma }= \frac{(a - b c_m) b M \beta ^2 \lambda \kappa }{{\Delta _1}^2}>0\), \(\frac{\partial \theta _r^T}{\partial \gamma }= \frac{(a - b c_m)(4\kappa -b M^2)b \beta \lambda \kappa }{2{\Delta _2}^2}>0\), and \(\frac{\partial \tau _r^{T}}{\partial \gamma }=\frac{(a - b c_m) b M \beta ^2 \lambda \kappa }{2{\Delta _2}^2}>0\), respectively. Under the influence of government incentive, the manufacturer has more flexibility to invest in improving GL and accelerating used return rate. Results justify the fact. We propose the following theorem to explore behavior of optimal decisions under two game structures. \(\square\)

Theorem 1

Under incentive Policy T,

-

(1)

the GL of the product is higher in RS game

-

(2)

the return rate is higher in RS game

-

(3)

consumers need to pay more in MS game compared to RS game if \(\lambda > \frac{\beta ^2}{2 b (1 - \gamma )}\)

-

(4)

the manufacturer and retailer receive higher profits under their respective leadership.

Proof

The following inequalities ensure the proof:

The theorem is proved. \(\square\)

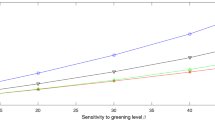

The graphical representations of GL, return rate, and retail price are presented in Fig. 1a–c. The following parameter values are used: \(a = 300\), \(b = 0.5\), \(c_m = \$50\), \(\lambda = 1\), \(c_r = \$20\), \(w_s = \$5\), \(\alpha = \$10\), \(\delta = 0.6\), \(\rho _0 =\$30\), \(\kappa = 800\), \(\beta \in (0.2, 0.4)\), \(\gamma \in (0, 0.5)\), and \(\rho \in (0, 0.15)\).

Note that GL, return rate, and retail price increase with GL sensitivity (\(\beta\)) of consumers and incentive rate (\(\gamma\)). If \(\gamma\) increases, then the manufacturer can invest more to improve GL and used product return. It is expected that CLSC members can receive higher profits under their own leadership. The above results justify the facts. Investment flexibility can allow product and process innovation that helps to improve overall CLSC performance and generate competitive advantages. Recently, Vozza (2018) reported that an estimated 68 million Americans considered - personal, social, and environmental aspect during point of purchase. Consequently, powerful retailers always want to trade with higher-quality products and meet the quality dimensions to maintain reputation. Therefore, the manufacturer may be obligated to produce greener products under RS game. Return rate of used product is higher under RS game. Indeed, retailers have better understanding the importance of personalization and consumer’s buying decisions due to their interaction opportunity. In many emerging sector like food chain, electronic accessories, retailers have emerged as the dominant players in many parts of the world through marketing contracts exercise. Therefore, retailer-dominated CLSC is beneficial in perspective of product quality and remanufacturing.

Optimal decisions under incentive Policy C

In this policy, the consumer directly receives the incentive form the government. The profit functions for the retailer and manufacturer in Scenario MC are obtained as follows:

If \(\rho =0\), consumers receive fixed amount of incentive whatever the GL of the product (Sinayi and Rasti-Barzoki 2018). However, the amount of incentive may proportional with GL of the product such as Energy Star products which directly influence purchase behavior of consumer. The following two propositions represent the optimal decisions in Scenarios MC and RC, respectively.

Proposition 3

Under MS game, optimal decisions in Policy C are obtained as follows:

where \(\Delta _3 = b \lambda (8 \kappa - b M^2) - (\beta + b \rho )^2 \kappa\).

Proposition 4

Under RS game, optimal decisions in Policy C are obtained as follows:

where\(\Delta _4 = b \lambda (4 \kappa - b M^2) - (\beta + b \rho )^2 \kappa\).

Optimal solutions exist under Scenarios MC and RC if \(\Delta _l>0\), \(l=3,4\). Derivations of optimal decisions in Scenarios MC and RC are similar to Scenarios MT and RT, respectively. Therefore, we omitted the proofs. Government incentives encourage the manufacturer to produce product with a higher GL and invest more to collect used products because \(\frac{\partial \theta _m^C}{\partial \rho }=\frac{(a - b (c_m - \rho _0))(8 b \kappa \lambda +\kappa (\beta + b\rho )^2 -b^2 M^2 \lambda )b \kappa }{{\Delta _3}^2}>0\), \(\frac{\partial \theta _r^C}{\partial \rho }=\frac{(a - b (c_m - \rho _0))(\kappa (4 b \lambda + (\beta + b\rho )^2 )-b^2 M^2 \lambda ) b \kappa }{2{\Delta _4}^2} > 0\), \(\frac{\partial \tau _m^{C}}{\partial \rho }= \frac{2 (a - b (c_m - \rho _0))(\beta + b\rho ) b^2 M \kappa \lambda }{{\Delta _3}^2}>0\), and \(\frac{\partial \tau _r^{C}}{\partial \rho }= \frac{(a - b (c_m - \rho _0)) (\beta + b\rho ) b^2 M \kappa \lambda }{{\Delta _4}^2}>0\), respectively. Therefore, consumers always receive products with a higher GL compared to no-incentive policy. Moreover, it stimulates recycling activity also. Additionally, CLSC members can sell more products under RS game. Theorem 2 analyzes the optimal decisions in two game structures under incentive Policy C.

Theorem 2

Under incentive Policy C,

-

(1)

the GL of the product is higher in RS game

-

(2)

the return rate is higher in RS game

-

(3)

consumers need to pay more in MS game compared to RS game if \(\lambda > \frac{ (\beta + b\rho )^2}{2 b }\)

-

(4)

the manufacturer and retailer receive higher profits under their respective leadership.

Proof

The following inequalities ensure the proof:

The theorem is proved. \(\square\)

The graphical representations of GL, return rate and retail price are presented in Fig. 2a–c under incentive Policy C. The parameter values remain unchanged.

It is intuitive that the investment opportunity for the manufacturer in producing green products or collecting used product will increase with government incentive \(\rho\), and above figures also demonstrate the facts. Theorems 1 and 2 demonstrate that the manufacturer needs to produce product with higher GL under RS game irrespective of incentive type. Although consumers may need to pay mare under MS game, it does not ensure to receive products with higher GL. Government incentives encourage the manufacturer to improve product quality and accelerate remanufacturing activities. This increases the overall quantity demanded. The nature of GL and used product return rate under both incentive policies support the fact. Next, we discuss the nature of optimal decisions under influence of marketing and operational targets of a manufacturer.

Managerial insights and discussion

First, we determine the \({{ CS^k=\frac{1}{2}(\hat{p_k}-{p_k}^{*}){q_k}^{*}}}\)(k= MT, MC, RT, and RC) to measure the outcome of incentive in the perspective product consumption (Xie 2016; Hong and Guo 2018), where \(\hat{p_k}\), \({p_k}^{*}\), and \({q_k}^{*}\), represent the retail price at which no consumer will purchase the green product, optimal retail price, and sales volume in Scenario k, respectively. On simplification, the values of \(CS^k\) are, respectively, obtained as follows:

Similarly, we compute \(EI^k=(\hat{\theta _k}-{\theta _k}^{*}){Q_k}^{*}\), where \(\hat{\theta _k}\), \({\theta _k}^{*}\), and \({Q_k}^{*}\) represent the GL in presence of incentive, GL in the absence of incentive, and the optimal sales volume under the influence of government incentive (Hong and Guo 2018). The values of \(EI^k\) are obtained as follows:

There are numerous issues that may discourage remanufacturing activities such as availability of robust remanufacturing technology, the perception of consumers about remanufactured products, the compatibility issues related to the replacement parts, processing cost, and time (Atasu et al. 2013). On contrary, the manufacturers sometime face substantial barrier related to high cost of environmental technologies associated with new product manufacturing or product upgradation and used product remanufacturing, lack of perception in implementing complex environmental management system, highly price-sensitive consumers, etc. (Jabbour et al. 2016). Therefore, a comparative analysis is necessary by considering operational perspectives of the manufacturer.

Theorem 3

Irrespective of incentive type, if the manufacturer wants to keep GL unchanged under MS game, then:

-

(1)

the manufacturer always receives higher profits in incentive Policy C, and the retailer receives higher profits in incentive Policy C if \(\gamma > \frac{b \rho }{\beta + b \rho }\),

-

(2)

the return rate is higher under incentive Policy C if \(\gamma > \frac{b \rho }{\beta + b \rho }\),

-

(3)

the CS satisfies \(CS^{MC}> CS^{MT}\) if \(\gamma > \frac{b \rho }{\beta + b \rho }\),

-

(4)

the EI satisfies \(EI^{MC} < EI^{MT}\) if \(\gamma \in (\frac{b \rho }{\beta + b \rho }, \frac{b ((a - b c_m) \rho + (\beta + b \rho )\rho _0)}{(a-b (c_m - \rho _0))(\beta + b \rho )})\).

Proof

See “Appendix 5.” \(\square\)

Theorem 4

Irrespective of incentive type, if the manufacturer wants to keep GL unchanged under RS game, then:

-

(1)

both the manufacturer and retailer receive higher profits in incentive Policy C,

-

(2)

the return rate is greater under incentive Policy C if \(\gamma > \frac{b \rho }{\beta + b \rho }\),

-

(3)

the CS satisfies \(CS^{RC}> CS^{RT}\) if \(\gamma > \frac{b \rho }{\beta + b \rho }\),

-

(4)

the EI satisfies \(EI^{RC} < EI^{RT}\) if \(\gamma \in \left( \frac{b \rho }{\beta + b \rho }, \frac{b ((a - b c_m) \rho + (\beta + b \rho )\rho _0)}{(a - b (c_m - \rho _0))(\beta + b \rho )}\right)\).

Proof

See “Appendix 6.” \(\square\)

In producing, marketing, and recycling green products, financial and operational obstacles as well as consumer’s sensitivity to green products may incite the manufacturer to fix GL. Theorems 3 and 4 demonstrate that if \(\gamma > \frac{b \rho }{\beta + b \rho }\), then CLSC members receive higher profits under Policy C. Additionally, if the manufacturers select this policy, then it will lead to higher CS. Game structures are unable to make any impact on the optimal selection for the manufacturer. However, preferences of the CLSC members are identical under RS game. Overall, if the government organizations directly stimulants consumers, then it will generate higher profits for the CLSC members but not EI. However, if \(\gamma > \phi =\frac{b ((a - b c_m)\rho + (\beta + b \rho )\rho _0)}{(a - b (c_m - \rho _0))(\beta + b \rho )}\) and the manufacturer selects incentive Policy C, then CLSC members not only receive higher profits but represent themselves as an ambassador of sustainability. If \(\gamma \ngtr \phi\), then the manufacturer should select incentive Policy T. Therefore, our findings indicate that under this circumstance the manufacturer needs to estimate parameter values delicately for selecting incentive scheme. Graphical representations of profits of CLSC members, return rate, EI, and CS under MS and RS games are presented in supplementary file for numerical justification.

Customer recognition is one of the key factors influencing demand of remanufacturing products. Additionally, the manufacturer needs to integrate clean technology related to recycling, overcome legislation restriction, hire specialized labor, install facility for remanufacture, etc. Therefore, the manufacturing may face operational barrier if the volume of return product is too high (Govindan et al. 2016; Wei et al. 2015). Similarly, if the manufacturer is not efficient enough in encouraging consumers to participate in recycling activities, then also the remanufacturing activities are not profitable. Consequently, we determine the characteristics of optimal decision when the manufacturer decides to set a goal on return rate.

Theorem 5

Irrespective of incentive type, if the return rate of used products remains uniform under MS game, then:

-

(1)

the manufacturer receives higher profits in incentive Policy C, whereas the profits for the retailer remain equal,

-

(2)

GL is higher in incentive Policy T,

-

(3)

the CSs remain identical in both the incentive policies,

-

(4)

the EI satisfies \(EI^{MC} < EI^{MT}\).

Proof

See “Appendix 7.” \(\square\)

Theorem 6

Irrespective of incentive type, if the return rate of used products remains uniform under RS game, then:

-

(1)

both the manufacturer and retailer receive higher profits in incentive Policy C,

-

(2)

GL is higher in incentive Policy T,

-

(3)

the CSs remain identical in both the incentive policies,

-

(4)

the environmental improvement satisfies \(EI^{RC} < EI^{RT}\).

Proof

See “Appendix 8.” \(\square\)

Theorems 5 and 6 demonstrate that whatever the values of parameters, CLSC members always receive higher profits in Policy C. It is noteworthy to mention that the GL of the product is always less under that policy. Although CS remains uniform, incentive Policy T can assure higher EI. Consequently, profit-seeking motive of manufacturer can allure both the manufacturer and retailer to deviate from sustainability goals. Graphical representations of profits of CLSC members, GL, EI, and CS are presented under MS and RS game in supplementary document. If the manufacturer faces some operations and financial bottleneck, then goals of government and CLSC members may not be concurrent. Incentive may improve profits not GL or EI. Consequently, a strict regulatory measure is necessary along with incentive to cultivate an expectation of desirable outcomes. This study also ravels that the internal dynamics of power structure in a CLSC is a critical factor. A powerful retailer can impede the manufacturer to trade with products at lower GL.

Note that the ratios of the investment in used product collection with total R&D investment for the manufacturer (\(RI_i^j, i= M, R\)) under incentive Policy T in both MS and RS games are uniform, and the corresponding ratios are \(RI_i^T=\frac{CL_m^T}{(1 - \gamma )\lambda {\theta _m^T}^2}= \frac{CL_r^T}{(1 - \gamma )\lambda {\theta _r^T}^2}= \frac{b^2 (1 - \gamma ) (M + 2\alpha )M \lambda }{\beta ^2 \kappa }\). Similarly, one can verify that the ratios of the investment in used collection with total R&D investment for the manufacturer in Scenarios MC and RC are uniform, and the corresponding ratio is \(RI_i^C=\frac{CL_m^C}{\lambda {\theta _m^C}^2}= \frac{CL_r^C}{\lambda {\theta _r^C}^2}= \frac{b^2 ( M + 2\alpha )M \lambda }{\kappa (\beta + b \rho )^2}\). Therefore, the ratios are independent from market potential (a) or constant part of incentive (\(\rho _0\)) received by consumers from the government. One can observe that consumers’ sensitivity with GL (\(\beta\)) and investment efficiency of the manufacturer in improving return rate (\(\kappa\)) are inversely proportional with investment ratio. Results suggest that the consumer sensitivity with GL discourages the manufacturer in investing return rate. The results make sense, if the consumers are sensitive with GL, then the manufacturer can improve demand of the product directly by higher investment in R&D. The graphical representations of ratios of investment without and with consideration of targets of the manufacturer are presented in Fig. 3a and b.

Above figures suggest that the ratios of investment change significantly if the manufacturer sets targets. The ratio is minimum if the manufacturer sets a target on GL. In this circumstance, the investment in improving return rate becomes small. Overall, if the manufacturer does not set any target, then the ratio is maximum and marketing goal is a key factor in investment decision. Therefore, results are sensible.

Similarly, we compute total investment (\({TI_i}^j\)) for the manufacturer in R&D and used product collection rate under both policies and the following results are obtained:

The graphical representations of total amount of investments are presented in Fig. 4a and b.

Figure 4a and b also justify the real practice, a manufacturer needs to change investment pattern according to marketing goals. If the manufacturer sets a target on GL, then total investment under that circumstance is maximum in Policy C. Direct monetary benefits can stimulate cognitive control of the psychology behind consumers purchase decisions in a preparatory manner. The potential effect in demand can increase a manufacturer’s decision to invest in R&D and used product collection. The results demonstrate the fact. The above figures also demonstrate that total investment is minimum in Policy T if the manufacturer does not set any marketing goal. Overall, if consumers are highly sensitive with green products, then investment in R&D to improve GL is better investment strategy for the manufacturer. Next, we analyze the behavior of total amount of government incentive (\({GI_i}^j\)) received by the manufacturer under incentive Policy C and Policy T in two game structures. On simplification, the following expressions are obtained:

The graphical representations of total amount of government incentives are presented in Fig. 5a and b.

One can observe that the marketing or operational goal of the manufacturer directly affects the total amount of incentive, and the amount is maximum if the manufacturer sets a target on GL. Figure 5a is consistent with the findings of Theorems 3 and 4. The GL is higher in incentive Policy C, where the manufacturer receives maximum support. However, the supports are relatively low without any targets in Policy T. The total amount of incentive is less in Policy T and in the absence of any target. Moreover, the nature of incentive is correlated with game structures and consumer sensitivity with GL. One can observe that the total amount of incentive is less in RS game in Policy T compared to Policy C when the manufacturer sets target on used product collection. However, the reverse trend is observed in MS game. Therefore, the total amount of investment related to green manufacturing and used product return is highly sensitive with the manufacturer’s strategic intentions. Recently, Chu et al. (2018) conducted an empirical study to investigate the effects of environmental concern versus different government incentive policies on the consumers adaptation of environment-friendly cars (EFCs) in the USA, Germany, Japan, Korea, and China. The authors found that government incentives appear somewhat ineffective in encouraging the adoption of EFCs for four countries, but it makes a significant impact in China. This study also reveals that environmental concern of consumers and the manufacturer’s intention are the keys for the desired outcomes of an incentive program. By comparing outcomes under two incentive policies, we found that an appropriate selection and implementation are crucial to achieve sustainability goal if the government or the manufacturer has limited budget.

Summary and concluding remarks

This study investigates the interaction between two CLSCs members under price- and GL-sensitive demand. Optimal decisions along with CS and EI are compared under two government incentive policies in perspective of obtaining a decision support framework for green manufacturing and recycling. The following outcomes are of managerial significance. Irrespective of the incentive schemes, the GL and return rate are always greater under RS game. Consumers need to pay more under MS game. Therefore, a shift of market dynamics can excite the manufacturer to produce greener products. Characteristics of CLSC are commonly explored under MS game; consequently, it is necessary to compare CLSC decisions under different game structures to obtain impeccable knowledge about manufacturing and recycling practices. If the manufacturer has options for selecting incentive scheme, then operational and marketing goals play a critical role for the outcomes. If the manufacturer sets uniform GL and selects incentive Policy C or T based on system parameters, CLSC members can receive higher profits under both policies due to higher CS, product return, and EI. However, if the manufacturer sets used product return goal, then it initiates an awful situation. Whatever the parameter values, the manufacturer receives higher profits under incentive Policy C, but GL and EI are always less compared to incentive Policy T. Although CS or profit of the retailer remains invariant, there is a possibility that the CLSC member can compromise their sustainability goals to receive higher profits. It is found that the ratios of investment are also sensitive to the manufacturer’s intention. The manufacturer needs to reduce amount of investment significantly in encouraging recycling activities, if the consumers sensitivity is high with green products. Therefore, it is necessary to explore the properties of CLSC under budgetary constraints. Overall, the objective of CLSC members and government organization may not be concurrent. Consequently, incentive policies should be implemented under regulation to obtain a desirable outcome in the perspective of green manufacturing and recycling.

We consider a simple CLSC structure, which can be extended in several directions. For example, one cannot ignore the presence of third party to collect used products. Consequently, we need to explore the nature of optimal decision by comparing three different modes of collection i.e., manufacturer, retailer, and third-party collection mode (Saha et al. 2016). We assume that consumer cannot identify the difference between the new and remanufactured products. However, consumers often value the remanufactured product less than the new product (Ferrer and Swaminathan 2010). We restrict our analysis under single-period formulation; therefore, one can extend this analysis under two-period formulation (De Giovanni and Zaccour 2014). The model can be formulated as a mixed-integer programming problem to consider the effect of logistic cost, transportation vehicle type and their capacity, investment budget, capacity of facility, etc. (Ghezavati and Beigi 2016; Shishebori and Babadi 2018; Rezaee et al. 2017), to obtain influence of government incentive empirically in a CLSC network, because those costs make significant impact on overall CLSC performance. We consider and compare results under two incentive policies; one can analyze incentives on remanufacturing activities or the manufacturer’s target on the volume of recycled products. Meanwhile, future research should also explore the coordination contract design, such as revenue sharing and cost sharing, and explore comparative outcomes.

Notes

References

Alamdar SF, Rabbani M, Heydari J (2018) Pricing, collection, and effort decisions with coordination contracts in a fuzzy, three-level closed-loop supply chain. Expert Syst Appl 104:261–276

Atasu A, Toktay LB, Van Wassenhove LN (2013) How collection cost structure drives a manufacturer’s reverse channel choice. Prod Oper Manag 22:1089–1102

Basiri Z, Heydari J (2017) A mathematical model for green supply chain coordination with substitutable products. J Clean Prod 145:232–249

Chen JM, Chang CI (2012) The co-opetitive strategy of a closed-loop supply chain with remanufacturing. Transp Res Part E Logist Transp Rev 48(2):387–400

Chu W, Baumann C, Hamin H, Hoadley S (2018) Adoption of environment-friendly cars: direct vis-a-vis mediated effects of government incentives and consumers’ environmental concern across global car markets. J Glob Market 31(4):282–291

Dai R, Zhang J, Tang W (2017) Cartelization or cost-sharing? comparison of cooperation modes in a green supply chain. J Clean Prod 156:159–173

De Giovanni P, Zaccour G (2014) A two-period game of a closed-loop supply chain. Eur J Oper Res 232(1):22–40

Dey K, Roy S, Saha S (2018) The impact of strategic inventory and procurement strategies on green product design in a two-period supply chain. Int J Prod Res. https://doi.org/10.1080/00207543.2018.1511071

Dey K, Saha S (2018) Influence of procurement decisions in two-period green supply chain. J Clean Prod 190:388–402

Ferrer G, Swaminathan JM (2010) Managing new and differentiated remanufactured products. Eur J Oper Res 203(2):370–379

Gao J, Han H, Hou L, Wang H (2016) Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J Clean Prod 112:2043–2057

Genc TS, Giovanni De (2017) Trade-in and save: a two-period closed-loop supply chain game with price and technology dependent returns. Int J Prod Econ 183:514–527

Ghezavati VR, Beigi M (2016) Solving a bi-objective mathematical model for location-routing problem with time windows in multi-echelon reverse logistics using metaheuristic procedure. J Ind Eng Int 12:469–83

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135:568–583

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Ghosh D, Swami S, Shah J (2018) Product greening and pricing strategies of firms under green sensitive consumer demand and environmental regulations. Ann Oper Res. https://doi.org/10.1007/s10479-018-2903-2

Govindan K, Shankar KM, Kannan D (2016) Application of fuzzy analytic network process for barrier evaluation in automotive parts remanufacturing towards cleaner production e a study in an Indian scenario. J Clean Prod 114:199–213

Govindan K, Soleimani H, Kannan D (2015) Reverse logistics and closed-loop supply chain: a comprehensive review to explore the future. Eur J Oper Res 240(3):603–626

Guo J, Gao Y (2015) Optimal strategies for manufacturing/remanufacturing system with the consideration of recycled products. Comput Ind Eng 89:226–234

Guo J, He L, Gen M (2018) Optimal strategies for the closed-loop supply chain with the consideration of supply disruption and subsidy policy. Comput Ind Eng. https://doi.org/10.1016/j.cie.2018.10.029

Harder A, Beard E (2016) Energy efficient lighting. www.ncsl.org/research/energy/energy-efficient-lighting.aspx

Heydari J, Govindan K, Jafari A (2017) Reverse and closed loop supply chain coordination by considering government role. Transp Res Part D Transp Environ 52:379–398

Hong Z, Guo X (2018) Green product supply chain contracts considering environmental responsibilities. Omega. https://doi.org/10.1016/j.omega.2018.02.010

Hong X, Wang Z, Wang D, Zhang H (2013) Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. Int J Adv Manuf Technol 68:1851–1865

Houde S, Aldy JE (2014) Belt and suspenders and more: the incremental impact of energy efficiency subsidies in the presence of existing policy instruments. https://heep.hks.harvard.edu/

Huang M, Song M, Lee L, Ching WK (2013) Analysis for strategy of closed-loop supply chain with dual recycling channel. Int J Prod Econ 144:510–520

Iino F, Lim A (2010) Developing Asias competitive advantage in green products: Learning from the Japanese experience. ADBI Working Paper 228. Tokyo: Asian Development Bank Institute. www.adbi.org/workingpaper/2010/07/09/3934.asia.advantage.green.prod.japan.experience/

Jabbour JC, Jabbour A, Govindan K, Freitas T, Soubihia D, Kannan D, Latan H (2016) Barriers to the adoption of green operational practices at Brazilian companies: effects on green and operational performance. Int J Prod Res 54(10):3042–3058

Jamali MB, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043

Jayaraman V (2006) Production planning for closed-loop supply chains with product recovery and reuse: an analytical approach. Int J Prod Res 44(5):981–998

Jena SK, Sarmah SP, Padhi SS (2018) Impact of government incentive on price competition of closed-loop supply chain systems. INFOR: Inf Syst Oper Res 56(2):192–224

Kumar S, Putnam V (2008) Cradle to cradle: reverse logistics strategies and opportunities across three industry sectors. Int J Prod Econ 115(2):305–315

Li B, Zhu M, Jiang Y, Li Z (2016) Pricing policies of a competitive dual-channel green supply chain. J Clean Prod 112:2029–2042

Liu C, Xia G (2018) Research on the dynamic interrelationship among R&D investment, technological innovation and economic growth in China. Sustainability 10(11):4260

Lu J (2017) Comparing U.S. and Chinese electric vehicle policies. Environmental and Energy Study Institute. www.eesi.org/articles/view/comparing-u.s.-and-chinese-electric-vehicle-policies

Ma WM, Zhao Z, Ke H (2013) Dual-channel closed-loop supply chain with government consumption-subsidy. Eur J Oper Res 226:221–227

Mannberg A, Jansson J, Pettersson T, Brnnlund R, Lindgren U (2014) Do tax incentives affect households’ adoption of ‘green’ cars? A panel study of the Stockholm congestion tax. Energy Policy. 74:286–299

Martin E (2019) 14 companies that recycle their own products. www.goodhousekeeping.com/uk/consumer-advice/consumer-rights/a25915660/brands-that-recycle-products/. Accessed 6 Sept 2019

Mitra S, Webster S (2008) Competition in remanufacturing and the effects of government subsidies. Int J Prod Econ 111:287–298

Modak NM, Panda S, Sana SS (2016) Two-echelon supply chain coordination among manufacturer and duopolies retailers with recycling facility. Int J Adv Manuf Technol 87:1531–1546

Nam CW (2012) Corporate tax incentives for R&D investment in OECD countries. Int Econ J 26(1):69–84

Nielsen I, Majumder S, Saha S (2019a) Exploring the intervention of intermediary in a green supply chain. J Clean Prod 233:1525–1544

Nielsen I, Majumder S, Sana SS, Saha S (2019b) Comparative analysis of government incentives and game structures on single and two-period green supply chain. J Clean Prod 235(20):1371–1398

Patra P (2018) Distribution of profit in a smart phone supply chain under Green sensitive consumer demand. J Clean Prod 192:608–620

Rezaee MJ, Yousefi S, Hayati J (2017) A multi-objective model for closed-loop supply chain optimization and efficient supplier selection in a competitive environment considering quantity discount policy. J Ind Eng Int 13:199–213

Saha S, Sarmah SP, Moon I (2016) Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int J Prod Res 54(5):1503–1517

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manage Sci 50(2):239–252

Shishebori D, Babadi AY (2018) Designing a capacitated multi-configuration logistics network under disturbances and parameter uncertainty: a real-world case of a drug supply chain. J Ind Eng Int 14:65–85

Shu T, Peng Z, Chen S, Wang S, Lai KK, Yang H (2017) Government Subsidy for remanufacturing or carbon tax rebate: which is better for firms and a low-carbon economy. Sustainability 9:156. https://doi.org/10.3390/su9010156

Sinayi M, Rasti-Barzoki M (2018) A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J Clean Prod 196(2018):1443–1458

Song H, Gao X (2018) Green supply chain game model and analysis under revenue-sharing contract. J Clean Prod 170:183–192

Swami S, Shah J (2013) Channel coordination in green supply chain management. J Oper Res Soc 64:336–351

Taleizadeh AA, Alizadeh-Basban N, Niaki ATA (2019) A closed-loop supply chain considering carbon reduction, quality improvement effort, and return policy under two remanufacturing scenarios. J Clean Prod 232:1230–1250

Taleizadeh AA, Sane-Zerang E, Choi TM (2016) The effect of marketing effort on dual-channel closed-loop supply chain systems. IEEE Trans Syst Man Cybern Syst 99:1–12

Taleizadeh AA, Moshtagh MS, Moon I (2018) Pricing, product quality, and collection optimization in a decentralized closed-loop supply chain with different channel structures: game theoretical approach. J Clean Prod 189:406–431

Tighazoui A, Turki S, Sauvey C (2019) Optimal design of a manufacturing-remanufacturing-transport system within a reverse logistics chain. Int J Adv Manuf Technol 101(5–8):1773–1791

Vozza S (2018) Sustainability in retail: what it looks like and why it matters for your business. www.shopify.com/retail/sustainability-in-retail-what-it-looks-like-and-why-it-matters

Wang Y, Chang X, Chen Z, Zhong Y, Fan T (2014) Impact of subsidy policies on recycling and remanufacturing using system dynamics methodology: a case of auto parts in China. J Clean Prod 74:161–171

Wang W, Ding J, Sun H (2018) Reward-penalty mechanism for a two-period closed-loop supply Chain. J Clean Prod 203:898–917

Wei S, Cheng D, Sundin E, Tang O (2015) Motives and barriers of the remanufacturing industry in China. J Clean Prod 94:340–351

Xie G (2016) Cooperative strategies for sustainability in a decentralized supply chain with competing suppliers. J Clean Prod 113:807–821

Yang D, Xiao T (2017) Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J Clean Prod 149:1174–1187

Yang Z, Slowik P, Lutsey N, Searle S (2016) Principles for effective electric vehicle incentive design. https://theicct.org/sites/default/files/publications/ICCT_IZEV-incentives-comp_201606.pdf

Yuan KF, Gao Y (2010) Inventory decision-making models for a closed-loop supply chain system. Int J Prod Res 48(20):6155–6187

Yu JJ, Tang CS, Shen M (2018) Improving consumer welfare and manufacturer profit via government subsidy programs: subsidizing consumers or manufacturers? Manuf Serv Oper Manag 20(4):752–766

Zheng X, Lin H, Liu Z, Li D, Llopis-Albert C, Zeng S (2018) Manufacturing decisions and government subsidies for electric vehicles in china: a maximal social welfare perspective. Sustainability. 10:672. https://doi.org/10.3390/su10030672

Acknowledgements

The authors deeply appreciate the valuable comments of four anonymous reviewers and the Associate Editor to improve this study significantly.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Optimal decision in Scenario MT

The optimal solution for the retailer’s optimization problem is obtained by solving \(\frac{\partial \pi _{rm}^T}{\partial p_m^T}= a - b (2 p_m^T - w_m^T) + \beta \theta _m^T=0\). On simplification, \(p_m^T=\frac{a + b w_m^{T} + \beta \theta _m^T}{2 b}\). The profit function for the retailer is concave as \(\frac{\partial ^2 \pi _{rm}^T}{\partial {p_m^T}^2}=-2b<0\). Substituting the optimal response in Equation (2), the profit function for the manufacture is obtained as follows:

We solve the following first-order conditions simultaneously to obtain optimal decision:

After solving, optimal decision are obtained as presented in Proposition 1.

We compute Hessian matrix (\(H^{T}\)) for the manufacturer profit function as follows:

Values of principal minors of above Hessian matrix are \(H_1^{T}=-b<0\); \(H_2^{T}= \frac{b(8 \kappa - b M^2)}{4}>0\); and \(H_3^{T}= -\frac{b(1 - \gamma )\lambda (8\kappa - b M^2)- \beta ^2 \kappa }{2}<0\), respectively, where \(M= c_m \delta + w_s (1 - \delta ) -c_r - \alpha\). Therefore, profit function for the manufacturer is also concave if \(\Delta _1 = b (1 - \gamma ) \lambda (8 \kappa - b M^2) - \beta ^2 \kappa >0\).

Appendix 2: Optimal decision in Scenario RT

The optimal decision for the manufacturer’s optimization problem is obtained by solving following equation simultaneously:

After solving, the following solution is obtained:

\(w_r^{T}= \frac{(2 \kappa - b M^2) (2 (a + b (c_m - m_r^T)) (1 - \gamma ) \lambda -c_m \beta ^2 )-b c_m M^2 (\beta ^2 - 2 b (1 - \gamma ) \lambda )}{2(b (1 - \gamma ) (4 \kappa - b M^2 ) \lambda - \beta ^2 \kappa )}\); \(\tau _r^T= \frac{b (a - b (c_m + m_r^{T})) M (1 - \gamma ) \lambda }{ b (1 - \gamma ) (4 \kappa - b M^2 ) \lambda -\beta ^2 \kappa }\); and \(\theta _r^T= \frac{(a - b (c_m + m_r^{T})) \beta \kappa }{ b (1 - \gamma ) (4 \kappa - b M^2 ) \lambda -\beta ^2 \kappa }\)

We compute Hessian matrix (\(H^{T}\)) the retailers’s optimization problem is obtained as follows:

The corresponding values of principal minors are \(H_1^{T}=-2b<0\); \(H_2^{T}= b(4 \kappa - b M^2) >0\); and \(H_3^{T}= 2(b(1 - \gamma )\lambda (4\kappa - b M^2)-\beta ^2 \kappa )\), respectively. Therefore, profit function for the manufacturer is concave if \(\Delta _2 = b(1 - \gamma )\lambda (4\kappa - b M^2)-\beta ^2 \kappa >0\).

Substituting the optimal response, the profit function for the retailer is obtained as \(\pi _{rr}^{T}(m_r^{T})=\frac{2 b m_r^{T} (a - b (c_m + m_r^{T})) (1 - \gamma ) \kappa \lambda }{ b (1 - \gamma ) (4 \kappa - b M^2 ) \lambda -\beta ^2 \kappa }\). Therefore, one needs to solve \(\frac{\partial \pi _r^T}{\partial m_r^{T}}=\frac{2 b (a - b (c_m + 2 m_r^{T})) (1 - \gamma ) \kappa \lambda }{ b (1 - \gamma ) (4 \kappa - b M^2 ) \lambda -\beta ^2 \kappa } =0\) to obtain optimal decision. On simplification, we obtain \(m_r^{T}= \frac{a - b c_m}{2 b}\). The profit function for the retailer is concave as \(\frac{\partial ^2 \pi _r^T}{\partial {m_r^{T}}^2}= -\frac{4 b^2 (1 - \gamma ) \kappa \lambda }{ \Delta _2}<0\). By using backward substitution, we obtain the optimal decision as presented in Proposition 2.

Appendix 3: Optimal decisions in the absence of government incentive

Proposition C.1

Optimal decision in Scenario MN is obtained as follows:

where \(\Delta _5 = b \lambda (8 \kappa - b M^2) - \beta ^2 \kappa\).

Proposition C.2

Optimal decision in Scenario RN is obtained as follows:

where\(\Delta _6 = b \lambda (4 \kappa - b M^2) - \beta ^2 \kappa\).

Appendix 4: Profit differences with and without incentive

The following inequalities ensure that the profits of CLSC member are always higher in the presence of incentives:

Above inequalities ensure the proof.

Appendix 5: Proof of Theorem 3

The optimal GLs in Scenarios MT and MC are \(\theta _m^T = \frac{(a - b c_m) \beta \kappa }{\Delta _1}\) and \(\theta _m^{C} = \frac{(a - b (c_m - \rho _0))(\beta + b \rho ) \kappa }{\Delta _3}\), respectively. Therefore, GLs are equal if \(\lambda =\frac{((a - b c_m )\rho - \beta \rho _0)(\beta + b\rho ) \beta \kappa }{((a - b c_m) (\beta \gamma - b \rho (1 - \gamma )) - b(\beta + b\rho )(1 - \gamma ) \rho _0)(8 \kappa -b M^2)} (=\lambda _1, say)\). Now, the difference between profits of CLSC members, return rate, CS and EI between Scenarios MT and MC are obtained as follows:

The theorem is proved.

Appendix 6: Proof of Theorem 4

The optimal GLs in Scenarios RT and RC are \(\theta _r^T = \frac{(a - b c_m) \beta \kappa }{2\Delta _2}\) and \(\theta _r^{C} = \frac{(a - b (c_m - \rho _0))(\beta + b \rho ) \kappa }{2\Delta _4}\), respectively; and those are equal if \(\lambda =\frac{((a - b c_m )\rho - \beta \rho _0)(\beta + b\rho ) \beta \kappa }{((a - b c_m) (\beta \gamma - b \rho (1 - \gamma )) - b (1 - \gamma ) (\beta + b\rho ) \rho _0)(4 \kappa -b M^2)}(=\lambda _2, say)\). Consequently, the difference between profits of CLSC members, return rate, CS and EI between Scenarios RT and RC are obtained as follows:

The theorem is proved.

Appendix 7: Proof of Theorem 5

The return rate of used products from the consumers in Scenarios MT and MC are \(\tau _m^T = \frac{b (a - b c_m) (1 - \gamma ) M \lambda }{\Delta _1}\) and \(\tau _m^C = \frac{(a - b (c_m + \rho _0))b M \lambda }{\Delta _3}\), respectively. Therefore, equality holds if \(\gamma = \frac{ b ((a - b c_m)\kappa \rho (2 \beta + b\rho ) + b (8 \kappa - b M^2) \lambda \rho _0 - \beta ^2 \kappa \rho _0)}{(a - b c_m \lambda \rho _0)\kappa (\beta + b\rho )^2 + b^2(8 \kappa - b M^2) \lambda \rho _0}(=\gamma _1, say)\). Consequently, the following differences are obtained:

The theorem is proved.

Appendix 8: Proof of Theorem 6

The collection rate of used products in Scenarios RT and RC will be uniform if \(\gamma = \frac{ b ((a - b c_m)\kappa \rho (2 \beta + b \rho ) + b (4 \kappa - b M^2) \lambda \rho _0 - \beta ^2 \kappa \rho _0)}{(a - b c_m \lambda \rho _0)\kappa (\beta + b\rho )^2 + b^2(4 \kappa - b M^2) \lambda \rho _0}(=\gamma _2, say)\). Consequently, the following differences are obtained:

The theorem is proved.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Saha, S., Nielsen, I.E. & Majumder, S. Dilemma in two game structures for a closed-loop supply chain under the influence of government incentives. J Ind Eng Int 15 (Suppl 1), 291–308 (2019). https://doi.org/10.1007/s40092-019-00333-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40092-019-00333-z