Abstract

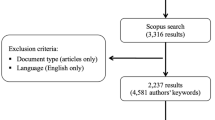

Developing and middle-income countries increasingly emphasize higher education and entrepreneurship in their long-term development strategy. Thus, our work focuses on the influence of higher education institutions (HEIs) on startup ecosystems in Brazil, an emerging economy. As traditional data to perform this type of study, such as surveys, are challenging to get, we propose an alternative approach. Given the growing capability of social media databases such as Crunchbase and LinkedIn to provide startup and individual-level data, we draw on computational methods to mine data for social network analysis. Our approach enables different types of analysis. First, we describe regional variability in entrepreneurial network characteristics. Second, we examine the influence of elite HEIs in economic hubs on entrepreneur networks. Third, we investigate the influence of the academic trajectories of startup founders, including their courses of study and HEIs of origin, on the fundraising capacity of startups. We find that HEI quality and the maturity of the ecosystem influence startup success. We also observe that elite HEIs have a powerful influence on local entrepreneur ecosystems. Surprisingly, while the most nationally prestigious HEIs in the South and Southeast have the longest geographical reach, their network influence remains local. This means that investments in entrepreneurship, in the Brazilian context, tend to remain concentrated in wealthier cities, and may actually reinforce or increase regional inequalities. We also find that the startup ecosystem in the wealthier South and Southeast is more diverse in terms of sectors, which is more advantageous to economic development. Our approach can be helpful, especially in countries with limited studies of the interaction between startups and institutional factors supporting them. In terms of policy recommendations, we would recommend more investment at the regional level in terms of cultivating entrepreneurship, given the limited spillover from wealthier regions.

Similar content being viewed by others

Availability of data and materials

The datasets generated and analyzed during the current study will be available in a public repository after review.

Code availability

Codes will be made available in a public repository after review.

Notes

Stanford and USP are absent from IGC rank. Yet, due to their academic excellence (Times Higher Education 2019), we regarded them as elite HEIs.

In Brazil, extension courses are certified programs that do not require a Bachelor’s degree, like continuing studies in the U.S.

Brazil is officially divided into five regions: Center-West, North, Northeast, South, and Southeast. More info at Duran (2013).

References

ABStartups (2018) O momento da startup Brasileira e o futuro do ecossistema de inovação. Abstartups and Accenture. http://abstartups.com.br/PDF/radiografia-startups-brasileiras.pdf

ABStartups (2021) Mapeamento de Startups. https://abstartups.com.br/mapeamento-de-comunidades/. Accessed 28 March 2021

AIEC (2019) Faculdade AIEC. https://www.aiec.br/. Accessed 14 April 2019

Alvarez SA, Barney JB (2007) Discovery and creation: alternative theories of entrepreneurial action. Strateg Entrep J 1(1–2):11–26

AmitaiEtzioni (1987) Entrepreneurship, adaptation and legitimation: a macro-behavioral perspective. J Econ Behav Org 8(2):175–189. https://doi.org/10.1016/0167-2681(87)90002-3

Audretsch DB, Keilbach MC, Lehmann EE et al (2006) Entrepreneurship and economic growth. Oxford University Press, Oxford

Avnimelech G, Feldman MP (2015) The stickiness of university spin-offs: a study of formal and informal spin-offs and their location from 124 us academic institutions. Int J Technol Manage 68(1–2):122–149

Balestra C, Llena-Nozal A, Murtin F et al (2018). Inequalities in emerging economies. https://doi.org/10.1787/6c0db7fb-en

Banerji D, Reimer T (2019) Startup founders and their LinkedIn connections: are well-connected entrepreneurs more successful? Comput Hum Behav 90:46–52. https://doi.org/10.1016/j.chb.2018.08.033

Bank W (2021) World development report 2021: Data for better lives. The World Bank

Bates T (1997) Financing small business creation: the case of Chinese and Korean immigrant entrepreneurs. J Bus Ventur 12(2):109–124. https://doi.org/10.1016/S0883-9026(96)00054-7

Batjargal B (2003) Social capital and entrepreneurial performance in Russia: a longitudinal study. Organ Stud 24(4):535–556. https://doi.org/10.1177/017084060302400400

Bjørnskov C, Foss NJ (2016) Institutions, entrepreneurship, and economic growth: what do we know and what do we still need to know? Acad Manag Perspect 30(3):292–315. https://doi.org/10.5465/amp.2015.0135

Blei DM, Ng AY, Jordan MI (2003) Latent Dirichlet allocation. J Mach Learn Res 3(1):993–1022

Brandl J, Bullinger B (2009) Reflections on the societal conditions for the pervasiveness of entrepreneurial behavior in western societies. J Manag Inq 18(2):159–173

Burt RS (2000) The network structure of social capital. Res Org Behav 22:345–423. https://doi.org/10.1016/S0191-3085(00)22009-1

Coleman JS (1988) Social capital in the creation of human capital. Am J Sociol 94:S95–S120

Commission of the European Communities (2013) Entrepreneurship in Europe. http://ec.europa.eu/invest-in-research/pdf/download_en/entrepreneurship_europe.pdf

Conceição O, Faria AP, Fontes M (2017) Regional variation of academic spinoffs formation. J Technol Transf 42(3):654–675

Crescenzi R, Rodríguez-Pose A (2012) Infrastructure and regional growth in the European union. Pap Reg Sci 91(3):487–513

Crunchbase (2019) Main site. https://www.crunchbase.com/. Accessed 14 April 2019

Michael SD, Olav S (2009) The embedded entrepreneur. Eur Manag Rev 6(3):172–181. https://doi.org/10.1016/j.respol.2017.07.004

Michael SD, Olav S (2014) The who, why and how of spinoffs. Ind Corp Chang 23(3):661–688. https://doi.org/10.1093/icc/dtt032

Dalle JM, den Besten M, Menon C (2017). Using Crunchbase for economic and managerial research. https://doi.org/10.1787/6c418d60-en

Dasgupta P, David P (1994) Toward a new economics of science. Res Policy 23:487–521. https://doi.org/10.1016/0048-7333(94)01002-1

David B. Audretsch, Max Keilbach (2004) Entrepreneurship capital: determinants and impact. Discussion Papers on Entrepreneurship, Growth and Public Policy (ISSN 1613-8333)

Diánez-González JP, Camelo-Ordaz C (2019) The influence of the structure of social networks on academic spin-offs’ entrepreneurial orientation. Ind Mark Manag 80:84–98. https://doi.org/10.1016/j.indmarman.2017.12.009

Duran R (2013) Brazilian regions. The Brazil Business. https://thebrazilbusiness.com/article/brazilian-regions

Dvouletý O, Gordievskaya A, Procházka DA (2018) Investigating the relationship between entrepreneurship and regional development: case of developing countries. J Glob Entrepreneurship Res. https://doi.org/10.1186/s40497-018-0103-9

Economic Co-operation O, Development (2008) OECD factbook 2008. OECD publishing, Paris

Charles E, Yanbo W (2017) Social influence in career choice: evidence from a randomized field experiment on entrepreneurial mentorship. Res Policy 46(3):636–650. https://doi.org/10.1016/j.respol.2017.01.010

Etzkowitz H, Leydesdorff L (1998) A triple helix of university-industry-government relations: introduction. Ind High Educ 12(4):197–201

Etzkowitz H, Webster A, Gebhardt C et al (2000) The future of the university and the university of the future: evolution of ivory tower to entrepreneurial paradigm. Res Policy 29(2):313–330. https://doi.org/10.1016/S0048-7333(99)00069-4

Eugene LY, Yuan SD (2012) Where’s the Money? The social behavior of investors in Facebook’s small world. In: 2012 IEEE/ACM international conference on advances in social networks analysis and mining, pp 158–162, https://doi.org/10.1109/ASONAM.2012.36

Facchini F, Jaeck L, Bouhaddioui C (2021) Culture and entrepreneurship in the United Arab Emirates. J Knowl Econ 12(3):1245–1269

Fischer BB, Schaeffer PR, Vonortas NS (2019) Evolution of university-industry collaboration in Brazil from a technology upgrading perspective. Technol Forecast Soc Chang 145:330–340

González-Pernía JL, Jung A, Peña I (2015) Innovation-driven entrepreneurship in developing economies. Entrepreneurship Region Dev 27(9–10):555–573

Hafer RW (2013) Entrepreneurship and state economic growth. J Entrepreneurship Public Policy 2(1):67–79. https://doi.org/10.1080/08985620802332723

Hartog C, Parker S, van Stel A et al (2010) The two-way relationship between entrepreneurship and economic performance. Sci Anal Entrepreneurship SMEs 17:1–45

Hayter CS (2015) Social networks and the success of university spin-offs: toward an agenda for regional growth. Econ Dev Q 29(1):3–13. https://doi.org/10.1177/0891242414566451

Hernández-Carrión C, Camarero-Izquierdo C, Gutiérrez-Cillán J (2020) The internal mechanisms of entrepreneurs’ social capital: a multi-network analysis. BRQ Bus Res Quart 23(1):2340944420901047. https://doi.org/10.1177/2340944420901047

Hornik K, Grün B (2011) topicmodels: an r package for fitting topic models. J Stat Softw 40(13):1–30

Hwang H (2006) Planning development: Globalization and the shifting locus of planning. World society and organizational change, Globalization and organization, pp 69–90

IBGE (2019) Sistema de contas regionais: Brasil 2017. IBGE, Rio de Janeiro

INEP (2019a) Censo da Educação Superior. http://inep.gov.br/educacao-superior. Accessed 14 April 2019

INEP (2019b) Indice Geral de Cursos (IGC). http://inep.gov.br/en/indice-geral-de-cursos-igc-. Accessed 14 April 2019

INEP (2019c) Instituto Nacional de Estudos e Pesquisas Educacionais Anísio Teixeira. http://portal.inep.gov.br/. Accessed 14 April 2019

INEP (2019d) Sistema do censo da educação superior (CENSUP). http://sistemascensosuperior.inep.gov.br/censosuperior_2018. Accessed 14 April 2019

IPEA, PNUD, Pinheiro FJ (2016) Desenvolvimento humano nas macrorregiões brasileiras: 2016. IPEA, Brasília

Ingrid V, Andre JVS (2007) Entrepreneurial diversity and economic growth. In: The entrepreneurial society: how to fill the gap between knowledge and innovation

Jaffe AB (1986) Technological opportunity and spillovers of R &D: evidence from firms’ patents, profits, and market Value. Am Econ Rev 76(5):984–1001. https://doi.org/10.3386/w1815

Julia G, Julia B, Fietkiewicz K et al (2018) Transitioning towards a knowledge society: Qatar as a case study. Springer. https://doi.org/10.1007/978-3-319-71195-9

Kacperczyk A (2013) Social influence and entrepreneurship: the effect of university peers on entrepreneurial entry. Organ Sci 24(3):664–683. https://doi.org/10.1287/orsc.1120.0773

Klyver K, Hindle K, Meyer D (2008) Influence of social network structure on entrepreneurship participation-A study of 20 national cultures, Springer International Publishing, Berlin, pp 331–347. https://doi.org/10.1007/s11365-007-0053-0

Kumar KB, van Welsum D (2013) Knowledge-based economies and basing economies on knowledge: Skills a missing link in GCC countries. RAND Corporation. https://www.rand.org/pubs/research_reports/RR188.html

Labra R, Rock JA, Álvarez I (2016) Identifying the key factors of growth in natural resource-driven countries. A look from the knowledge-based economy. Ensayos sobre Política Económica 34(79):78–89. https://doi.org/10.1016/j.espe.2015.12.001

Larson A (1991) Partner networks: leveraging external ties to improve entrepreneurial performance. J Bus Ventur 6(3):173–188. https://doi.org/10.1016/0883-9026(91)90008-2

Johan PL, Karl W, Johan W, Mike W (2017) Location choices of graduate entrepreneurs. Res Policy 46(8):1490–1504. https://doi.org/10.1016/j.respol.2017.07.004

Lechner C, Dowling M (2003) Firm networks: external relationships as sources for the growth and competitiveness of entrepreneurial firms. Entrepreneurship Region Dev 15(1):1–26. https://doi.org/10.1080/08985620210159220

Lee SS, Mirza C (2021) Pursuing innovation as a strategy for improving quality of higher education: challenges and opportunities facing gcc countries. In: Higher education in the Gulf. Routledge, pp 16–31

Light I (1984) Immigrant and ethnic enterprise in North America. Ethn Racial Stud 7(2):195–216. https://doi.org/10.1080/01419870.1984.9993441

Light I, Dana LP (2013) Boundaries of social capital in entrepreneurship. Entrep Theory Pract 37(3):603–624

Lima A, Musolesi M (2012) Spatial dissemination metrics for location-based social networks. In: Proceedings of the 2012 ACM conference on ubiquitous computing, pp 972–979, https://doi.org/10.1145/2370216.2370429

Lyu L, Wu W, Hu H et al (2019) An evolving regional innovation network: collaboration among industry, university, and research institution in china’s first technology hub. J Technol Transf 44(3):659–680

Marvel MR, Davis JL, Sproul CR (2016) Human capital and entrepreneurship research: a critical review and future directions. Entrep Theory Pract 40(3):599–626

McCowan T (2007) Expansion without equity: an analysis of current policy on access to higher education in Brazil. High Educ 53:579–598. https://doi.org/10.1007/s10734-005-0097-4

Claudio and Olmo (2007) Why so many local entrepreneurs? Rev Econ Stat 89(4):615–633. https://doi.org/10.1162/rest.89.4.615

Minguillo D, Thelwall M (2015) Research excellence and university-industry collaboration in UK science parks. Res Eval 24(2):181–196

Mitra J, Formica P (1997) Innovation and economic development: University-enterprise partnerships in action. Oak Tree Press

Morris MH, Neumeyer X, Jang Y et al (2018) Distinguishing types of entrepreneurial ventures: an identity-based perspective. J Small Bus Manage 56(3):453–474

Msigwa FM (2016) Widening participation in higher education: a social justice analysis of student loans in Tanzania. High Educ 72(4):541–556. https://doi.org/10.1007/s10734-016-0037-5

Nahapiet J, Ghoshal S (1998) Social capital, intellectual capital, and the organizational advantage. Acad Manag Rev 23(2):242–266. https://doi.org/10.5465/amr.1998.533225

Nations Educational, Scientific and Cultural Organization (UNESCO) (2016) Education 2030: towards inclusive and equitable quality education and lifelong learning for all. UNESCO. https://unesdoc.unesco.org/ark:/48223/pf0000245656

Neumeyer X, Santos SC, Caetano A et al (2019) Entrepreneurship ecosystems and women entrepreneurs: a social capital and network approach. Small Bus Econ 53(2):475–489

Newman ME (2003) Mixing patterns in networks. Phys Rev E 67(2):026126. https://doi.org/10.1103/PhysRevE.67.026126

Newman M (2010) Networks: an introduction. Oxford University Press Inc, New York, NY. https://doi.org/10.1093/acprof:oso/9780199206650.001.0001

Nuscheler D (2016) Regularly change a running system! An analysis of stage-specific criteria for attracting venture capital and changing the likelihood for getting funded. http://ifabs.org/assets/stores/1206/userfiles/3IFABS%20Best%20Poster%20Award%20-%20Daniela%20Nuscheler,%20TU%20Dortmund%20University,%20DE.pdf

OECD (2018) Rethinking quality assurance for higher education in Brazil. https://doi.org/10.1787/9789264309050-en

Owen-Smith J, Powell W (2004) Knowledge networks as channels and conduits: the effects of spillovers in the Boston biotechnology community. Org Sci 15:5–21. https://doi.org/10.1287/orsc.1030.0054

Perotti V, Yu Y (2015) Startup tribes: social network ties that support success in new firms. In: AMCIS 2015 proceedings. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.852.4582 &rep=rep1 &type=pdf

Porter K, Whittington KB, Powell WW (2005) The institutional embeddedness of high-tech regions: relational foundations of the Boston biotechnology community. Clust Netw Innov 261:296

Renzulli LA, Aldrich H (2005) Who can you turn to? Tie activation within core business discussion networks. Soc Forces 84(1):323–341. https://doi.org/10.1353/sof.2005.0122

Rosenberg N, Nelson R (1994) American universities and technical advance in industry. Res Policy 23(3):323–348. https://doi.org/10.1016/0048-7333(94)90042-6

Rubens N, Russell M, Perez R, et al (2011) Alumni network analysis. In: 2011 IEEE global engineering education conference (EDUCON), pp 606–611. https://doi.org/10.1109/EDUCON.2011.5773200

Martin R, Howard EA, Nancy MC (2003) The structure of founding teams: homophily, strong ties, and isolation among US entrepreneurs. Am Sociol Rev 68(2):195–222. https://doi.org/10.2307/1519766

Ruef M (2010) The entrepreneurial group: social identities, relations, and collective action. Princeton University Press, Princeton, Nova Jersey, USA

Sanderson T (2017) Education remains the catalyst for Brazil’s staggering inequality. https://brazilian.report/society/2017/11/06/education-brazil-staggering-inequality

Saxenian A (2018) Inside-out: regional networks and industrial adaptation in silicon valley and route 128. In: The sociology of economic life. Routledge, pp 357–374

Schaeffer PR, Fischer B, Queiroz S (2018) Beyond education: the role of research universities in innovation ecosystems. Foresight STI Gov 12(2):50–61

Simone Affonso da Silva (2017) Regional inequalities in Brazil: divergent readings on their origin and public policy design. EchoGeo. https://journals.openedition.org/echogeo/15060

Soetanto D, Van Geenhuizen M (2015) Getting the right balance: university networks’ influence on spin-offs’ attraction of funding for innovation. Technovation 36:26–38

Olav S (2018) Social networks and the geography of entrepreneurship. Small Bus Econ 51:527–537. https://doi.org/10.1007/s11187-018-0076-7

Sorenson O (2018) Social networks and the geography of entrepreneurship. Small Bus Econ 51(3):527–537

Toby ES, Waverly WD (2006) When do scientists become entrepreneurs? The social structural antecedents of commercial activity in the academic life sciences. Am J Sociol 112(1):97–144. https://doi.org/10.1086/502691

Tata A, Martinez DL, Garcia D et al (2017) The psycholinguistics of entrepreneurship. J Bus Ventur Insights 7:38–44. https://doi.org/10.1016/j.jbvi.2017.02.001

Tata A, Laureiro Martinez D, Brusoni S (2016) Don’t look back? The effect of attention to time and self on startup funding. Acad Manag Proc 2016(1):13,926. https://doi.org/10.5465/ambpp.2016.13926abstract

Thurik R, Wennekers S (2004) Entrepreneurship, small business and economic growth. J Small Bus Enterp Dev 11(1):140–149. https://doi.org/10.1108/14626000410519173

Times Higher Education (2019) The World University Rankings. https://www.timeshighereducation.com/world-university-rankings/2019/world-ranking#!/page/0/length/25/sort_by/rank/sort_order/asc/cols/stats. Accessed 14 April 2019

Tolbert PS, David RJ, Sine WD (2011) Studying choice and change: the intersection of institutional theory and entrepreneurship research. Organ Sci 22(5):1332–1344

Nirnaya T, Pertti S, Ganesh B, Markku O, Kari L (2019) Insights into startup ecosystems through exploration of multi-vocal literature. Inf Softw Technol 105:56–77

Unger JM, Rauch A, Frese M et al (2011) Human capital and entrepreneurial success: a meta-analytical review. J Bus Ventur 26(3):341–358

Valliere D, Peterson R (2009) Entrepreneurship and economic growth: evidence from emerging and developed countries. Entrepreneurship Region Dev 21(5–6):459–480

Vivarelli M (2013) Is entrepreneurship necessarily good? Microeconomic evidence from developed and developing countries. Ind Corp Chang 22(6):1453–1495. https://doi.org/10.1093/icc/dtt005

Wennekers S, Van Wennekers A, Thurik R et al (2005) Nascent entrepreneurship and the level of economic development. Small Bus Econ 24(3):293–309. https://doi.org/10.1007/s11187-007-9066-x

Wennekers S, van Stel A, Carree M, et al (2010) The relationship between entrepreneurship and economic development: is it u-shaped? Foundations and trends ®in entrepreneurship 6(3):167–237. https://doi.org/10.1561/0300000023

Zimmer C, Aldrich H (1987) Resource mobilization through ethnic networks: Kinship and friendship ties of shopkeepers in England. Sociol Perspect 30(4):422–445. https://doi.org/10.2307/1389212

Funding

All stages of this study were financed in part by CAPES—Finance Code 001, project GoodWeb (Grant 2018/23011-1 from São Paulo Research Foundation - FAPESP), CNPq (grant 310998/2020-4), and by a Connaught Global Challenge Award.

Author information

Authors and Affiliations

Contributions

JN and YP ran the analysis and wrote the paper. MR, JN, TS, LO, and MV conceptualized the research, evaluated the results, and wrote the paper. MH, MV, LO, and TS revised the paper. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest/Competing interests (check journal-specific guidelines for which heading to use)

The authors declare that they have no competing interests.

Ethics approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable

Appendices

Appendix A: Full university names and abbreviations

-

Universidade de São Paulo (USP)

-

Universidade Anhembi Morumbi (UAM)

-

Unidervsidade Estadual Paulista (UNESP)

-

Universidade Presbiteriana Mackenzie (MACKENZIE)

-

Faculdade Milton Campos (FDMC)

-

Faculdade de Administração de Brasília (FAAB)

-

Fundação Getúlio Vargas de São Paulo (FGV/SP)

-

Instituto de Ensino e Pesquisa (INSPER)

-

Instituto Brasileiro de Mercado de Capitais (IBMEC)

-

Associação Internacional de Educação Continuada (AIEC)

-

Universidade Federal do Minas Gerais (UFMG)

-

Universidade Federal do Rio de Janeiro (UFRJ)

-

Universidade Federal do Santa Catarina (UFSC)

-

Universidade Federal do Grande do Sul (UFRGS)

-

Universidade Federal do Estado do Rio de Janeiro (UNIRIO)

-

Pontifícia Universidade Católica de Paraná (PUC/PR)

-

Pontifícia Universidade Católica de São Paulo (PUC/SP)

-

Pontifícia Universidade Católica de Minas Gerais (PUC/MG)

-

Pontifícia Universidade Católica de Rio Grande do Sul (PUC/RS)

Appendix B: Startup sectors by region

See Figs. 14, 15, 16, 17, and 18.

Appendix C: Summary of all ecosystems studied

See Table 5.

Appendix D: Classification and framework details

1.1 Classification

The classifications we used in this regard were to outline the startup ecosystems, the startups’ market segments, the classification of HEIs regarding teaching and research quality, and the classification of courses.

The first concept is the startup ecosystem, a set of startups located in the same city. Ecosystems were classified as “mature” or “emerging,” depending on the number of startups. Mature ecosystems were those whose number of startups was more significant than the national average. It is important to note that mature ecosystems are found in the capitals of the South and Southeast states, Brazil’s wealthiest regions.

The startup industry was extracted from CrunchBase’s raw data and refined through a topic mining algorithm called LDA, which is part of the natural language processing (NLP) discipline.

The HEIs were classified as “elite or not” based on the IGC, which is the official index of the Ministry of Education to assess the quality of HEIs. They were also ranked in universities, colleges, and university centers. A more detailed description of the composition of the IGC is presented as follows:

CPC—An indicator that assesses the course of study on a scale from 1 to 5. For the calculation, the following are considered: Enade Concept (student performance in the Enade test—nationwide test); Difference Indicator between Observed and Expected Performance (IDD); faculty (information from the Higher Census on the percentage of masters, doctors, and work regime) and students’ perception of their training process (information from the Enade Student Questionnaire).

IGC—An indicator that evaluates the educational institution. The following are part of the IGC calculation: the average of the CPCs of the last three years of Enade (2016, 2017, and 2018) related to the evaluated courses of the institution; the average of the evaluation concepts of the master’s and doctoral programs awarded by the Coordination for the Improvement of Higher Education Personnel (Capes), in the last available triennial evaluation; and distribution of students among the different levels of education, undergraduate and graduate courses.

The classification of bachelor’s, master’s, Ph.D.’s, MBA, or extension courses was carried out according to the courses’ descriptions in the Linkedin profile.

1.2 Framework

The framework consists of acquiring public data available on the Web, and processing and calculating complex network metrics, among other metrics. The following items are the main steps of our framework:

-

1.

Load the raw data from Crunchbase.

-

2.

Loading of raw Linkedin data.

-

3.

Loading of raw IGC data.

-

4.

Extraction of categories of startups employing LDA.

-

5.

Extraction of courses from Linkedin profiles.

-

6.

Consolidation of clean data on a single basis.

-

7.

Enrichment of the base with georeferencing data from startups.

-

8.

Enrichment of the base with IGC from HEIs.

-

9.

Construction of networks.

-

10.

Calculation of centrality metrics.

-

11.

Calculation of startup fundraising.

-

12.

Data analysis and insights discussion.

Our framework was created from the combination of different elements identified in traditional models (Schaeffer et al 2018; Conceição et al 2017; Avnimelech and Feldman 2015), models based on analysis of social networks (Diánez-González and Camelo-Ordaz 2019; Hayter 2015; Soetanto and Van Geenhuizen 2015; Lyu et al 2019; Minguillo and Thelwall 2015; Porter et al 2005) and alumni networks (Rubens et al 2011) to create informal links between universities and startups, and investigation of the influence of HEIs in these network structures.

Appendix E: HEI quality and the maturity of the ecosystem

This is the algorithm used for the task studying the HEI quality and the maturity of ecosystems:

-

1.

For each startup, calculate the fundraising (k).

-

2.

For each ecosystem, tick “Elite HEI” if there is at least one HEI with maximum IGC (IGC = 5).

-

3.

Calculate startup fundraising CDFs and break them down into emerging ecosystems with or without elite HEIs, and mature ecosystems with or without elite HEIs.

-

4.

Plot the comparative CDFs between these four possibilities: mature ecosystem (with or without elite HEI) and emerging ecosystem (with or without elite HEI).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Reddy, M., Nardelli, J.C., Pereira, Y.L. et al. Higher education’s influence on social networks and entrepreneurship in Brazil. Soc. Netw. Anal. Min. 13, 2 (2023). https://doi.org/10.1007/s13278-022-01011-6

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13278-022-01011-6