Abstract

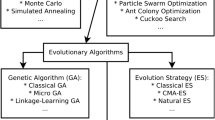

We introduce a Memetic system to solve the application problem of Financial Portfolio Optimization. This problem consists of selecting a number of assets from a market and their relative weights to form an investment strategy. These weights must be optimized against a utility function that considers the expected return of each asset, and their co-variance; which means that as the number of available assets increases, the search space increases exponentially. Our method introduces two new concepts that set it apart from previous evolutionary based approaches. The first is the Tree-based Genetic Algorithm (GA), a recursive representation for individuals which allows the genome to learn information regarding relationships between the assets, and the evaluation of intermediate nodes. The second is the hybridization with local search, which allows the system to fine-tune the weights of assets after the tree structure has been decided. These two innovations make our system superior than other representations used for multi-weight assignment of portfolios.

Similar content being viewed by others

References

Aranha C, Iba H (2007) Modelling cost into a genetic algorithm-based portfolio optimization system by seeding and objective sharing. In: Proc. of the conference on evolutionary computation, pp 196–203

Aranha C, Iba H (2008) A tree-based ga representation for the portfolio optimization problem. In: GECCO—genetic and evolutionary computation conference. ACM Press, New York, pp 873–880

Chen SP, Li C, Li SH, wei Wu X (2002) Portfolio optimization with transaction costs. Acta Math Appl Sin 18(2): 231–248

Fieldsend JE, Matatko J, Peng M (2004) Cardinality constrained portfolio optimisation. In: IDEAL, pp 788–793

Hart WE (1994) Adaptive global optimization with local search. Ph.D. Thesis, University of California at San Diego, La Jolla

Hassan G, Clack CD (2008) Multiobjective robustness for portfolio optimization in volatile environments. In: GECCO’08, Atlanta, Georgia, pp 1507–1514

Hochreiter R (2007) An evolutionary computation approach to scenario-based risk-return portfolio optimization for general risk measures. In: Giacobini M et al (ed) EvoWorkshops. LNCS, vol 4448. Springer, Heidelberg, pp 199–207

Jiang R, Szeto KY (2002) Discovering investment strategies in portfolio management: a genetic algorithm approach. In: Proceedings of the 9th international conference on neural information processing, vol 3, pp 1206–1210

Knowles J, Corne D (2004) Memetic algorithms for multiobjective optimization: issues, methods and prospects. Recent Adv Memetic Algorithms Ser Stud Fuzziness Soft Comput 166: 313–352

Lin CM, Gen M (2007) An effective decision-based genetic algorithm approach to multiobjective portfolio optimization problem. Appl Math Sci 1(5): 201–210

Lipinski P, Winczura K, Wojcik J (2007) Building risk-optimal portfolio using evolutionary strategies. In: Giacobini M et al (ed) EvoWorkshops. LNCS, vol 4448. Springer, Heidelberg, pp 208–217

Markowitz H (1987) Mean-Variance analysis in portfolio choice and capital market. Basil Blackwell, New York

Skolpadungket P, Dahal K, Harnpornchai N (2007) Portfolio optimization using multi-obj ective genetic algorithms. In: Evolutionary Computation. CEC 2007. IEEE Congress on, pp 516–523

Streichert F, Ulmer H, Zell A (2003) Evolutionary algorithms and the cardinality constrained portfolio optimization problem. In: Ahr D, Fahrion R, Oswald M, Reinelt G (eds) Operations research proceedings. Springer, Heidelberg

Streichert F, Ulmer H, Zell A (2004) Comparing discrete and coninuous genotypes on the constrained portfolio selection problem. In: Deb K et al (ed) Genetic and Evolutionary Computation-GECCO, vol 3103, pp 1239–1250

Subramanian H, Ramamoorthy S, Stone P, Kuipers BJ (2006) Designing safe, profitable automated stock trading agents using evolutionary algorithms. In: GECCO—Genetic and evolutionary computation conference. ACM Press, Seattle, pp 1777–1784

Tapia MGC, Coello CAC (2007) Application of multi-objective evolutionary algorihms in economics and finance: A survey. In: Proceedings of the conference on evolutionary computation, pp 532–539

Ullah B, Sarker R, Cornforth D, Lokan C (2007) An agent-based memetic algorithm (ama) for solving constrained optimization problems. In: IEEE Congress on evolutionary computation (CEC), Singapore, pp 999–1006

Veradajan G, Chan LC, Goldberg DE (1997) Investment portfolio optimization using genetic algorithms. In: JRKoza (ed) Late breaking papers at the genetic programming conference, pp 255–263

Werner JC, Fogarti TC (2002) Genetic control applied to asset managements. In: Foster J et al (ed) EuroGP. LNCS, pp 192–201

Yan W, Clack CD (2006) Behavioural gp diversity for dynamic environments: an application in hedge fund investment. In: GECCO—Genetic and Evolutionary Computation Conference. ACM Press, Seattle, pp 1817–1824

Yan W, Clack CD (2007) Evolving robust gp solutions for hedge fund stock selection in emerging markets. In: GECCO—Genetic and evolutionary computation conference, ACM Press, London

Yan W, Sewell M, Clack CD (2008) Learning to optimize profits beats predicting returns—comparing techniques for financial portfolio optimization. In: GECCO’08, Atlanta, Georgia, pp 1681–1688

Yan X, Zhang C, Zhang S (2005) Armga: Identifying interestin association rules with genetic algorithms. Appl Artif Intell 19(7): 677–689

Yan X, Zhang C, Zhang S (2009) Genetic-algorithm-based strategy for identifying association rules without specifying actual minimum-support. Expert Syst Appl 36: 3066–3076

Lyuu Y (2002) Financial Engineering and Computation. Cambridge Press, London

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Aranha, C., Iba, H. The Memetic Tree-based Genetic Algorithm and its application to Portfolio Optimization. Memetic Comp. 1, 139–151 (2009). https://doi.org/10.1007/s12293-009-0010-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12293-009-0010-2