Abstract

Ever since the COVID-19 pandemic hit the global economy, banks all over the world experienced significant reductions in loan growth and increases in distressed and non-performing assets. The persistent increase in non-performing loans, accompanied by low interest rates, led to a surge in banking risk, posing a solemn threat to banks’ stability. In this paper, we empirically assess the accounting- and market-based risks of banks during the COVID-19 pandemic. Using a quarterly panel of international banks over the period 2020:Q1 – 2021:Q1, we find that banks exhibit greater accounting risk and increased return volatility during the pandemic. In particular, we report that a 1% growth of total COVID cases reduces (increases) our sample banks’ z-score (standard deviation of quarterly return) by 0.756 (2.51%). Our results remain robust across alternative measures of the pandemic, z-score decomposition, and across daily and monthly stock returns. We obtain consistent results for both U.S. and non-U.S. banks, as well as for banks from both high- and low-income economies. We use a propensity score matching strategy to deal with endogeneity. Additional tests reveal that government responses such as economic support, stringency, and containment play important roles in banking risk and stability during the pandemic.

Similar content being viewed by others

1 Introduction

Beginning at the end of 2019, the COVID-19 outbreak, led by the novel coronavirus, turned into a global pandemic by the first quarter of 2020.Footnote 1 Since then, there have been more than 235 million confirmed cases of the disease, resulting in more than 4.8 million deaths globally.Footnote 2 The rapid spread of the pandemic led nations to impose tight restrictions on human movement, bringing global economy and business activities into a near standstill. The Global Economic Prospects, published in June 2020, forecasted a 5.2% contraction in global gross domestic product (GDP) by the end of 2020, warning of the worst global recession in decades. The crisis created by the pandemic becomes a combination of demand- and supply-side shocks, turning it into a long-standing economic crisis (IFC, 2021).

The large contraction in the world economy hit the global banking industry by further intensifying the ongoing banking challenges. Globally, banks have experienced significant reductions in loan growth and increases in distressed and non-performing assets (NPA, hereafter). According to McKinsey Global Banking Annual Review (June 2021), the nominal loan loss provisions (LLP, hereafter) surpassed USD 1,100 billion by the third quarter of 2020. Banks in many countries experienced a decline in their tier-2 capital ratios by more than 2%, finding it difficult to lend to parties other than the most creditworthy. The persistent increase in non-performing loans (NPL, hereafter), accompanied by low interest rates, led to a surge in banks’ riskiness, posing a solemn threat to banking stability.

Numerous studies have empirically investigated banking performance during the COVID-19 crisis and the effects of various internal and external factors on banks’ and financial markets’ reactions to the crisis. In particular, previous studies examine banks’ lending growth (Li et al, 2021; Ҫolak and Öztekin, 2021), stock market performance (Demirgüç-Kunt et al., 2021; Dadoukis et al., 2021), and banking stability (Elnahass et al., 2021) during the pandemic. Some studies focus on the influence of numerous bank characteristics (Ҫolak and Öztekin, 2021; Demir and Danisman, 2021), as well as the influence of different country-specific factors (Li et al., 2021; Danisman et al., 2021) on banks’ and financial markets’ resilience to the pandemic. Others examine the role of governmental policy measures in mitigating the detrimental impact of the pandemic on banking performance (Demirgüç-Kunt et al, 2021; Demir and Danisman, 2021).

The riskiness of banks during global epidemics is still an enduring concern and is subject to further empirical investigation. In this paper, we empirically assess the accounting- and market-based risks of global banks and their stability during the COVID-19 pandemic. Consistent with prior literature (Elnahass et al., 2021), we hypothesize that banks face greater risk and thereby reduced stability during the pandemic. We also examine the riskiness of banks across alternative measures of the pandemic and bank risk, and across banks from different geographic locations and economies. Further, following Demirgüç-Kunt et al. (2021) and Demir and Danisman (2021), we investigate whether government response programs play any significantly mediating roles in banking risk and return volatility during the economic crisis driven by the pandemic.

Our paper is different from the study of Elnahass et al. (2021) in several ways. First, contrary to previous studies, we consider a longer period of the pandemic (i.e., from 2020:Q1 until 2021:Q1) instead of only the first two quarters of it. This consequently provides us a more concrete picture of the evolution of the soundness of the banking system around the world, since there has been some delay of the impact of the pandemic on banks’ financial health. Second, in addition to quarterly frequencies, we exploit daily and monthly market-related banking data, which gives us a better insight of the pandemic’s impact on banks’ market risk. Third, we introduce continuous independent variables to measure the pandemic. Elnahass et al. (2021) measure the outbreak by a dummy variable that is equal to 1 if a sample bank is observed during the pandemic period (i.e., the first two quarters of 2020), 0 otherwise. We use the growth rate of total COVID cases (CVD) as our primary measure. In addition, we use the natural log of total COVID cases (LnCVD) and the growth rate of total deaths (DGR) from the disease as alternative measures of the pandemic. Fourth, we control for country-wise health care expenses to isolate the pandemic’s influence on global banking industries. Finally, we investigate the restraining role of government interventions in neutralizing the pandemic’s impact on global banks.

The remainder of the paper is organized as follows: Sect. 2 provides a brief review of the current literature. Section 3 describes the data, variables, and methodology. Section 4 presents and analyzes the main empirical findings. Finally, Sect. 5 concludes.

2 Literature review

Literature on banks’ performance during the COVID-19 outbreak covers a range of issues, such as, bank lending, profitability and stability during the pandemic, influence of various bank characteristics on banking performance and resilience throughout the crisis, how business diversification, competition from foreign banks, severity of financial regulations, and governmental policy initiatives affect banks’ performance in the pandemic, and so forth. For example, Li et al. (2021) empirically confirm that banks suffer from reduced loan growth and profitability during the pandemic. They also claim that diversification (i.e., investment on non-interest income sources) plays a moderating role by strengthening (reducing) banking performance (risk) during the crisis. According to Ҫolak and Öztekin (2021), banks experience a reduction in their lending growth during the pandemic and this effect is more pronounced for smaller banks with low profitability, and high credit risk and financial constraints. Based on a large sample of 14,163 banks from 125 countries and using a difference-in-difference (DiD) analysis and entropy balancing technique for endogeneity, their results suggest that bank lending during the COVID-19 crisis is strengthened in countries with stricter regulation and supervision, larger financial development, better institutional quality, and better healthcare policies, whereas bank credit supply is weakened in countries with higher competition from foreign banks and limited credit sources for corporations.

In a similar study, Danisman et al. (2021) empirically analyze the influence of banking market structure on financial market’s response to the pandemic. Using a sample of global banks from 66 countries, they claim that stock markets are stronger against the COVID-19 crisis in countries with larger number of foreign and Islamic banks, as well as with stricter regulations in regard to capital adequacy and liquidity requirements. They also find that security markets are less resilient to the pandemic in countries where banking sectors suffer from pre-existing high loan ratio, NPL, and LLP.

Demirgüç-Kunt et al. (2021) empirically assess the role of governmental policy announcements in moderating the adverse effects of the pandemic on global banking performance. Using a large sample of 896 commercial banks from 52 countries, they find that bank stocks, in general, underperform during the pandemic. Further, they document that stock markets react differently to various governmental policy measures. In particular, they report that bank stocks exhibit positive abnormal returns in response to borrower assistance (credit extended by the government to businesses and households) and liquidity support (short-term funds provided by the government to help banks remain liquid), whereas banks experience negative abnormal returns when governments take countercyclical prudential measures (lessening of regulation and supervision by the government). They find no decisive evidence of the role of monetary policy measures in minimizing the detrimental consequences of the pandemic.

Studying the performance of U.S. banks during the COVID-19 crisis, Dadoukis et al. (2021) argue that banks experience weaker market and accounting performance during the pandemic. However, their findings reveal that banks with high pre-COVID investments on information technology (IT) suffer less from the pandemic. In particular, they document that high IT investments in the pre-pandemic period led to smaller decline in abnormal and market-adjusted returns, higher value (measured by Tobin’s Q), and larger lending growth of their sample banks during the pandemic.

Demir and Danisman (2021) empirically explore the relationship between numerous bank characteristics and banking resilience to the pandemic. Studying a sample of 1,927 listed banks from 110 countries around the world, their results indicate that bank size, liquidity, capital ratio, non-interest income is positively associated with banking resilience, whereas banks’ corporate social responsibility (CSR) performance and NPL are negatively connected to banking resilience to the pandemic. Further, they find no evidence of banks’ environmental and governance performance affecting their reaction to the pandemic. Finally, they conclude that policy-related governmental responses, such as economic support and debt assistance, play favorable moderating roles in banking performance during the pandemic.

3 Data and methods

3.1 Data and sample

For our empirical analysis, we obtain data from numerous sources. We collect bank-level data from Thomson Reuters Eikon (Datastream). Eikon provides a wide-range of accounting- and market-related banking data for global banks and financial institutions. We collect, in particular, banks’ gross total assets (GTA, hereafter), book value of equity, total deposits, gross and total loans, NPL, return on assets (ROA, hereafter), LLP, and income before taxes and LLP. We also collect banks’ stock market performance-related data, in particular, daily, monthly, and quarterly stock returns, to analyze the pandemic’s impact on banks’ market risk.

Following Hu and Zhang (2021), we collect COVID-19 related data from the World Health Organization (WHO, hereafter). In particular, we extract data on total COVID cases and total number of deaths from the disease from WHO website. Hu and Zhang (2021) use the logarithm of cumulative and new cases to measure the pandemic, whereas we use the growth in total cases and deaths as the main explanatory variables in our analysis.

Our macroeconomic data is obtained from World Development Indicators (WDI, hereafter) on the World Bank website.Footnote 3 World Bank open database offers an extensive time-series data on country-wide poverty and inequality, people, environment, economy, states and markets, and global links. For our study, we obtain GDP growth and health care expenses for each country in our sample.

Finally, to account for governmental interventions during the crisis, we get policy responses comparison data from the COVID-19 Government Response Tracker of the Blavatnik School of Government at the University of Oxford.Footnote 4 The Oxford COVID-19 Government Response Tracker (OxCGRT) provides government response indicators such as containment and closure, financial support, health care policies, and vaccination. It also facilitates a number of government policy indices, i.e., economic support, health and containment, stringency, risk of openness, and overall government response index. After merging all these datasets, our final sample comes down to a total of 1,953 bank-quarter observations over the four quarters of 2020. We winsorize all variables at top and bottom 1%.

3.2 Methodology and variables

Our main research objective is to empirically assess the impact of COVID-19 pandemic on the accounting- and market-based riskiness and thus the stability of global banks. Our empirical model is based on the following equations:

where, Z-Scorei,t represents the accounting risk of bank i in quarter t. Following Tran et al. (2019), we define Z-Score as the ratio of banks’ buffer (capital ratio added to mean ROA) to standard deviation (SD, hereafter) of ROA (SD_ROA). This definition of bank Z-score is consistent with those in many other studies in the literature, including Elnahass et al. (2021). The SD_ROA is calculated on a 12-quarter rolling basis. A lower value of Z-score implies a lower value of (equity ratio + mean ROA) and/or a higher SD_ROA, indicating a higher level of risk for banks.

Following Ding et al. (2021), we use SD of banks’ quarterly returns (SD_QR) as our primary measure of market-related banking risk. SD_QRi,t measures the standard deviation of stock returns of bank i over quarter t. We also use the SD of daily and monthly bank stock returns (SD_DRi,t and SD_MRi,t, respectively) as alternative specifications of banks’ market risk.

To measure the COVID-19 pandemic, we use CVDj,t as our main independent variable, representing the growth rate of total COVID cases in country j (i.e., bank i’s country of origin) in quarter t. For robustness tests using SD_DR and SD_MR, we use growth in total cases on a daily and monthly basis, respectively. Further, as alternative measures of pandemic, we use LnCVD and DGR, representing the natural log of total cases and the growth rate of total deaths from the disease, respectively.

Our model includes a range of bank-specific and macroeconomic control variables. γi,t is a vector of bank controls, whereas δj,t represents the set of macroeconomic factors. We use Size (natural log of GTA), Capital (book value of equity over GTA), Asset_Quality (NPL as a ratio of GTA), Loans (total loans over GTA), Deposits (total deposits over GTA), Growth (loan growth over quarters), and Earnings (income before taxes and provisions recognized in income over GTA) as our bank-specific control variables. Our macroeconomic and country-level variables include Healthcare (natural log of the health care expenses per capita), and GDP (growth rate of GDP).

We also use Econ_Support (economic support), Stringency (financial stringency), Gov_Resp (overall governmental response), and Containment (governmental containment policy) to capture the moderating effects of these policy measures on banking risk and return volatility during the pandemic. Basically, these are scores (out of 100) assigned to countries by OxCGRT to evaluate each country’s performance in terms of economic support, stringency and containment policies, and overall governmental policy measures in response to the pandemic.

We include country-time and bank-fixed effects in all specifications. By controlling for these fixed effects, we condition out all time-varying and time-invariant country characteristics, such as differences in legal and political systems, policy reactions to the crisis, institutional and cultural norms, and other cross-country characteristics (Ding et al., 2021). With these fixed effects in all specifications, we can separate the effect of the pandemic on banks’ soundness as a function of banks’ financial strength, and other country-specific traits. We cluster robust standard errors at the country-level. Appendix Table 6 provides a list of definitions of our main variables.

4 Empirical results

4.1 Summary statistics

Appendix Table 7 presents the summary statistics of our empirical analysis. In Panel A, we provide the descriptive statistics of our main variables. Average bank Z-Score in our sample is 29.785, with a SD of 18.311 and minimum and maximum of 0.809 and 94.806, respectively. The natural log of mean Z-Score is 3.394, which is considerably higher than the mean log Z-Score of -0.001 in the first two quarters of 2020, as reported by Elnahass et al. (2021). Despite the difference between our sample and theirs, we can deduce that global banks somewhat recovered in terms of their risk-taking and stability in the second half of 2020. CVD ranges from 3.5% to 562.3%, whereas the mean CVD is 134.4% with a SD of 105.3%. Average Size in our sample is 9.153, with a minimum of 4.070 and a maximum of 14.471. On average, our sample banks have a capital ratio (Capital) of 10.5% with a SD of 6%. Average loan ratio (Loans) and average lending growth over a quarter (Growth) are 62.3% and 2.1%, respectively. Growth ranges from -15.9% to 30%, which appears to be considerably lower than that in normal times, indicating a decline in loan growth of our sample banks during the pandemic. Elnahass et al. (2021) reported a mean NPL/loans of 1.833% in the first half of 2020, whereas the average NPL ratio in our sample is 3.3% over the entire year of 2020.

On an average, deposits account for 76.8%, with a SD of 11.7%, of GTA, indicating a strong funding structure of our sample banks. This high deposit ratio is consistent with the reduced lending by the banks during the crisis. Average earnings ratio (Earnings) accounts for 1.6% of GTA, with a minimum and maximum of -2.1% and 9.8%, respectively. Mean log health care expenditure (Healthcare) of our sample countries is 7.79, whereas the minimum and maximum Healthcare are 3.758 and 9.271, respectively. On average, our sample countries have a GDP growth rate (GDP) of 1.83%, which is much lower than the average world GDP growth rate of 3.03% in the year of 2018.

In regard to economic support in response to the pandemic (Econ_Support), our sample countries exhibit an average score of 62.348 out of 100, ranging from a minimum score of 0 to a maximum score of 100. Average score in country-wide Stringency (Containment) index is 62.938 (60.502), with a minimum and maximum of 27.913 and 92.593 (30.234 and 84.444), respectively. Finally, average country-wide performance in overall governmental responses index (Gov_Resp) of our sample countries is 60.732, ranging between 26.457 and 84.829.

Overall, our sample banks exhibit an increased funding structure (i.e., increased deposit ratio), deteriorating asset quality (i.e., increased NPL ratio), reduced lending growth, and lower earnings ratio over the pandemic year of 2020. Countries demonstrate lower GDP growth rate and varying performance in the pandemic-related policy indices.

Panel B of Appendix Table 7 presents the correlation matrix, indicating the direction and magnitude of pair-wise correlations among our variables. The correlation between CVD and Z-Score is -0.116 with 1% significance, suggesting a considerable amount of negative correlation between the two variables. This provides a strong indication that increased growth in total COVID cases may lead to a higher level of accounting-based banking risk. As anticipated, with a correlation of -0.295, Asset_Quality is significantly and negatively correlated with Z-Score, suggesting that an increased NPL ratio may lead to an increased financial risk for banks. The correlation between Growth and CVD is -0.194 with 1% significance, suggesting a significantly negative association between the pandemic and bank lending, which is also prevalent in previous studies.

The pair-wise correlation between Healthcare and CVD is -0.147 with 1% significance, suggesting a decline in country-wise health care expenses when number of cases rise, which is somewhat puzzling. However, Healthcare is significantly and positively correlated with bank Z-Score (a correlation of 0.330 with 1% significance), indicating a plausible positive influence of country health care expenditures on accounting-based banking risk. GDP growth rate appears to be significantly and negatively (positively) correlated with bank Z-Score (accounting risk). As predicted, Econ_Support exhibits a positive (negative) correlation with bank Z-Score (accounting risk), although the coefficient is statistically insignificant. Both Stringency and Containment demonstrate significantly negative correlation with bank Z-Score, indicating a negative (positive) co-movement between country-wide stringency/containment policy initiatives and bank Z-Score (banking risk). Gov_Resp is negatively correlated with banking risk, however, the coefficient appears as statistically insignificant.

Overall, the pair-wise correlations suggest that the pandemic is expected to have a significantly adverse impact on banking stability, and this effect may be moderated by bank-specific characteristics such as increased lending, better asset quality, and higher funding liquidity, as well as by macro-specific factors such as increased health care expenditures and economic support, and flexible stringency and containment policies adopted by governments.

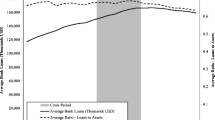

In Fig. 1, we illustrate the trends in total COVID cases and banks’ Z-scores throughout the four quarters of 2020. This gives us a better look at the change in banks’ financial risk, as compared with the change in the severity of the disease. Total COVID cases continue to increase over the entire year, reaching a total of about 13 million by the end of the fourth quarter. Banks experience a sharp decline in their Z-scores, i.e., an increased financial risk, in the first quarter of 2020. Similar trend is also visible in the fourth quarter, even though the Z-score exhibits an upward trend in the second and third quarters.

Banking risk and growth in total COVID cases over the sample period. In this figure, we show the trends in total COVID cases and banks’ Z-scores over the four quarter of 2020. The red line represents the trend in total COVID cases, whereas the blue line with circles indicates the trend in banks’ Z-score

4.2 Baseline analyses

Results from our baseline regressions are presented in Table 1. In Model 1, we regress bank Z-Score on CVD, while including all bank- and macro-level variables, as well as bank- and bank-quarter fixed effects. The estimated coefficient on CVD is -0.756 with significance at 1% level, indicating a significantly negative impact of increased COVID cases on bank Z-Score. In terms of economic impact, a 1% increase in total COVID cases leads to a decrease in bank Z-Score by 0.756, suggesting that the pandemic severely increases banks’ accounting risk. This detrimental impact of the pandemic on banking risk and stability is consistent with previous studies (e.g., Elnahass et al., 2021). In Model 2, we create a sub-sample excluding all American banks to check for robustness and consistency of our findings in Model 1. We do so as USA is represented by the majority and a substantially large number of our sample banks. The coefficient on CVD is still negative (-0.695) and highly significant at 1%, confirming the consistency of our previous findings in case of banks from all countries but USA. Economically, a 1% rise in total cases from the disease results in an increase in bank Z-score by 0.695 for all non-American banks.

In Models 3–5, we use alternative specifications of the pandemic and bank risk. In particular, in Models 3 and 4, we employ natural logarithm of CVD (LnCVD) and growth rate of total deaths from the disease (DGR) to obtain alternative measures of the pandemic. We report negative coefficients of -1.334 and -1.779 on LnCVD and DGR, respectively, with high statistical significance at 1%, claiming that our primary holds for alternative specifications of the pandemic. In Model 5, we use the log of bank Z-Score (Ln_ZS) and regress it on CVD, finding a coefficient of -0.022 with 1% significance and suggesting a significantly negative association between bank risk and growth in total COVID cases. This finding is consistent with Elnahass et al. (2021) who reported a coefficient of -0.753 with 1% significance, indicating a rapid decline (surge) in banks’ log Z-Score (risk) during the first two quarters of the pandemic.

Next, we empirically explore the effect of the pandemic on market-based banking risk. Models 6–8 present the results. In Model 6, we regress SD_QR on CVD and report an estimated coefficient of 2.507 with 1% significance, implying a significantly positive association between CVD and SD_QR. In terms of economic interpretation, a 1% increase in total number of COVID cases over a quarter leads to a 2.507% increase in the standard deviation (volatility) of quarterly returns of our sample banks. In Models 7 and 8, we use SD_DR and SD_MR, respectively, as alternative measures of return volatility. Consistent with our finding in Model 6, we obtain positive coefficients of 0.334 and 1.898, both being significant at 1% level, in Models 7 and 8, respectively, indicating a rapid increase in the SD of daily and monthly stock returns of banks. In particular, on average, a 1% increase in the growth rate of total COVID cases results in a 0.334% (1.898%) increase in volatility of daily (monthly) stock returns of global banks. These results reconfirm prior empirical findings (Demirgüç-Kunt et al., 2021; Dadoukis et al., 2021).

Finally, in Models 9 and 10, we rerun our baseline test from Model 1 for high- and low-income economies, respectively. In this regard, we divide our entire sample into two sub-samples based on country-wise national income. For high-income (low-income) sample, the estimated coefficient on CVD is -0.702 (-0.669), which is close to our coefficient of -0.756 in Model 1. In both cases, the coefficients on CVD are highly significant at 1%, indicating a significantly adverse impact of the worsening of the pandemic on global banking risk and stability, confirming further robustness of our baseline findings.

Overall, results from our baseline tests conclude that globally, banks suffer from higher accounting-based risk and return volatility and thus reduced baking stability during the COVID-19 pandemic. This finding is consistent across alternative measurements of the pandemic and banking risk, as well as for different samples, such as U.S. and non-U.S. banks, and banks representing high- and low-income economies.

4.3 Z-Score decomposition

To identify the channels through which the COVID-19 pandemic affects bank risk and stability, we execute regressions based on Z-Score decomposition in Table 2. In particular, we assess the changes in banks’ ROA, Capital, and SD_ROA in response to worsening situation of the disease. In Model 1, we regress banks’ ROA on CVD, while controlling for the set of bank- and macro-level variables, as well as incorporating bank- and quarter-fixed effects. We do the same for Capital and SD_ROA in Models 2 and 3, respectively. We find that, both ROA and Capital are significantly negatively connected with CVD, whereas SD_ROA exhibits a strong positive association with CVD. In particular, the estimated coefficient on CVD in Model 1 (2) is -0.002 (-0.003) with significance at the 1% level. In terms of economic impact, a 1% increase in the growth rate of total cases causes a 0.2% (0.3%) decline in ROA (Capital) of our sample banks. These findings are similar to those in previous studies. For example, Hu and Zhang (2021) empirically find that firms experience significant decrease in their ROA during the COVID-19 pandemic. Other studies also confirm a detrimental effect of the pandemic on banks’ profitability (e.g., Li et al., 2021; Elnahass et al., 2021).

In Model 3, the coefficient on CVD is 0.735, which is highly significant at the 1% level. This implies that banks experience a significant increase in the volatility of their profitability (measured by ROA) during the COVID-19 crisis. Specifically, a 1% increase in the growth in total cases of the disease results in a 0.735% increase in the standard deviation of banks’ ROA. Again, our finding does not depart from Elnahass et al. (2021), who reported a coefficient of -0.098 (-1.160) for their variable ‘SDROA’ (‘ROA/SDROA’), suggesting a significantly negative impact of the pandemic on banks’ asset risk and thereby banking stability.

4.4 Quantile regressions

Table 3 illustrates the results from our quantile (quintile) regressions. We conduct these regressions to assess the robustness of our primary finding for banks with different pre-existing risk profiles. In particular, we divide our sample banks into five sub-samples based on quintiles based on bank Z-Score. Specifically, we obtain five different samples of banks having Z-Scores at the 10%, 25%, 50%, 75%, and 90% levels. For example, banks in the first sub-sample of Q(10) (in Model 1) are those having a Z-Score with the bottom 10% of Z-Score, whereas banks that fall under the sub-sample of Q(90) (in Model 5) are the banks having a Z-Score at 90% level or above.

In all five models, the estimated coefficients on CVD are negative, although statistically significant only in Models 1–3, suggesting that the impact of the pandemic on banking risk may be influenced by banks’ risk profiles. In Model 1, we report a coefficient of -0.710 on CVD, with statistical significance at the 5% level. This implies that a 1% increase in CVD leads to a fall (rise) in Z-Score (risk) by 0.710 for all banks belonging to the first quintile. Similarly, in Models 2 and 3, the regression-generated coefficients on CVD are -1.303 and -1.377 with statistical significance at 1% and 5% levels, respectively, indicating a significant reduction (surge) in Z-Score (risk) of banks belonging to the second and third quintiles over the year of 2020. We observe that the pandemic does not have much detrimental effect on the riskiness of banks with pre-existing high-risk levels. Overall, our results from the quantile regressions conclude that banks with low-risk profiles are subject to greater threat to banking risk and stability during the COVID-19 crisis.

4.5 Propensity scores matching

In general, the severity of the pandemic is assumed to be exogenous of bank characteristics. However, there might be strong association between country-specific factors and the intensity and degree of consequences of the pandemic. For example, countries with high levels of government and public awareness, stricter regulations, better (larger) health care systems (expenditures), improved biomedical engineering and technology, and smaller population may be subject to less severity and smaller impact of the pandemic. Therefore, our results may be influenced by one or many unobserved macro-specific factors, which affect the measurement and strength of the pandemic across our sample countries, leading to potential endogeneity in our empirical model.

To deal with this issue, we follow Tran et al. (2019) and conduct propensity score matching test developed by Rosenbaum and Rubin (1983) and subsequently extended by Heckman et al. (1997). We divide our sample into two sub-samples: banks from countries with above-median CVD and banks from countries with below-median CVD. Banks from countries with above-median (below-median) CVD are considered as our treated (controlled/untreated) sample. We use a logit model for these two subsamples to obtain the propensity/probability of a bank to be treated, i.e., being originated from a country that has a very high rate of CVD. In particular, we use a dummy variable (namely, CVD_Dummy) that is equal to 1 if a bank belongs to an above-median CVD country and 0 otherwise, as the predicted variable in our logit regression. We match each bank from the CVD_Dummy = 1 group with one or more banks with similar characteristics from the CVD_Dummy = 0 group. We apply one-to-one matching without replacement, allowing banks from the CVD_Dummy = 0 group to be used only once. Results from our PSM test are presented in Table 4.

The only model in Table 4 presents the regression estimates of the impact of the COVID-19 pandemic banks’ Z-Score. The estimated coefficient is -0.756 with significance at the 1% level, supporting the exogeneity of our model and confirming the consistency of our baseline findings.

5 Moderating role of government interventions

Motivated by earlier studies (e.g., Demirgüç-Kunt et al, 2021; Demir and Danisman, 2021), we hypothesize that country-wise policy-related government intervention may create important moderating effect on the adverse relationship between the pandemic and banking risk and stability. As mentioned in Sect. 3, we use performance (scores) of governments around the world on the policy indices of Oxford University’s COVID-19 government response tracker (OxCGRT). OxCGRT continuously monitors and compares the policy initiatives taken by governments around the world in response to the pandemic and assigns scores out of 100 to each country based on their evaluation of the government policy measures.

In their analysis, OxCGRT uses a total of five different policy indices to measure and compare government responses. In our study, we use four of them, except the ‘risk of openness’ index. ‘Economic support’ index (denoted by Econ_Support in our analysis) evaluates and compares governments based on income support and debt relief programs extended by them. ‘Stringency’ index (Stringency) measures country-wise strictness of lockdown, social-distancing and other similar policies, which may severely restrict human interaction and mobility and thus affect banking and financial activities. ‘Containment’ index (Containment) measures governmental performance based on testing policy and availability, health care expenditures, and vaccinations, in addition to their performance in lockdown restrictions. Finally, ‘overall government response index’ (Gov_Resp) tracks each government’s performance in all indicators over the course of the disease outbreak.

We interact each of these index scores with CVD and perform separate regressions for each of the interaction terms. In particular, we regress banks’ Z-Score on CVD and CVD*X (where, X represents each of the four indices at a time), while controlling for bank and country-level variables, as well as including bank- and quarter-fixed effects in each model. We run separate tests for each of the indices as they are highly correlated with each other. For example, as reported in Panel B of Appendix Table 7, the pair-wise correlation between Econ_Support and Gov_Resp is 0.930, whereas the correlation between Stringency and Containment is 0.999, both being statistically significant at the 1% level.

The results from these regressions are reported in Table 5. In Model 1, bank risk is regressed on the growth in total COVID cases and the interaction between growth in total COVID cases and government performance in the economic support index. The coefficient on CVD is -0.217, whereas the coefficient on CVD*Econ_Support is 0.015, both being significant at the 1% level. This implies that the pandemic has a significantly adverse impact on banking risk, however, increased economic support from the government significantly moderates this negative impact. Models 2 and 3 report the results for Stringency and Gov_Resp, respectively. The coefficient on CVD*Stringency in Model 2 is 0.019 with significance at the 1%, indicating that governmental stringency strongly moderates the impact of the pandemic on banking stability. The coefficient on the interaction term in Model 3 does not achieve statistical significance, Finally, in Model 4, we report the results for Containment. Surprisingly, CVD appears to exhibit a positive association between bank risk and the pandemic and the coefficient on CVD*Containment is negative and highly significant, indicating an adverse role of governmental containment policy on the effect of the pandemic.

6 Conclusion

Driven by the novel coronavirus, the COVID-19 pandemic not only created a world-wide health care catastrophe, but also gave rise to a severe crisis in the global economy. Being the major players in the world economy, banks became the worst sufferers from the aftermath/consequences of the pandemic. Globally, banks went through drastic decline in their loan growth, profitability, value, and stock market return. This paper empirically studies the impact of the COVID-19 pandemic on the riskiness and return volatility of global banks.

Using a large sample of listed banks over a period from 2020:Q1 to 2021:Q1, we observe reduced loan growth and asset quality, as well as lower earnings ratio of our sample banks in the pandemic year. Our baseline regressions suggest that globally, banks suffer from increased accounting- and market-based risks and thus reduced baking stability during the pandemic year. This finding is consistent across alternative specifications of the variables, as well as across numerous sub-samples, such as U.S. and non-U.S. banks, and banks from countries with high- and low-income profiles.

Further analyses suggest that banks face significant reductions in ROA and capital ratio, whereas their SD of ROA significantly increases over the pandemic year. Quantile regressions confirm our baseline finding for the first three quintiles and suggest that banks belonging to lower risk profiles suffer more during the pandemic, as compared with banks with preexisting high-risk levels. To address potential endogeneity issue stemming from country-wide unobservable that may influence the selection of our sample banks, we conduct PSM test and find consistency of our primary results. Finally, we test for potential moderating effects of government intervention on the negative impact of the pandemic on banks’ riskiness. We find that country-wide economic support and stringency policies play significant moderating roles in neutralizing the adverse impact of the pandemic. Providing new evidence on the impact of the COVID-19 pandemic on global banking risk and stability, this paper contributes to the current literature of bank riskiness during pandemics, offering directions and policy implications to researchers and practitioners for similar future events.

Notes

“On 31 December 2019, WHO was informed of cases of pneumonia of unknown cause in Wuhan City, China. A novel coronavirus was identified as the cause by Chinese authorities on 7 January 2020 and was temporarily named “2019-nCOV”…..On 11 March 2020, the rapid increase in the number of cases outside China led the WHO Director-General to announce that the outbreak could be characterized as a pandemic”.

Globally, as of 8:48 PM CEST, 6 October 2021, there have been 235,673,032 confirmed cases of coronavirus disease, leading to 4,814,651 deaths, reported to WHO. [Source: https://covid19.who.int/].

For more information, please visit: https://datatopics.worldbank.org/world-development-indicators/

For details, please visit: https://www.bsg.ox.ac.uk/research/research-projects/covid-19-government-response-tracker

References

Dadoukis A, Fiaschetti M, Fusi G (2021) IT adoption and bank performance during the COVID-19 pandemic. Econ Lett 204:109904

Danisman GO, Demir E, Zaremba A (2021) Financial resilience to the COVID-19 pandemic: The role of banking market structure. Appl Econ 53(39):4481–4504

Demir E, Danisman GO (2021) Banking sector reactions to COVID-19: The role of bank-specific factors and government policy responses. Res Int Bus Financ 58:101508

Demirgüç-Kunt A, Pedraza A, Ruiz-Ortega C (2021) Banking sector performance during the COVID-19 crisis. J Bank Finance 133:106305

Ding W, Levine R, Lin C, Xie W (2021) Corporate immunity to the COVID-19 pandemic. J Financ Econ 141(2):802–230

Elnahass M, Trinh VQ, Li T (2021) Global banking stability in the shadow of COVID-19 outbreak. J Int Finan Markets Inst Money 72:101322

Heckman JJ, Ichimura H, Todd PE (1997) Matching as an econometric evaluation estimator: Evidence from evaluating a job training program. Rev Econ Stud 64:605–654

Hu S, Zhang Y (2021) COVID-19 pandemic and firm performance: Cross-country evidence. Int Rev Econ Financ 74:365–372

Li X, Feng H, Zhao S, Carter DA (2021) The effect of revenue diversification on bank profitability and risk during the COVID-19 pandemic. Financ Res Lett 43:101957

Rosenbaum PR, Rubin DB (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70:41–55

Tran DV, Hassan MK, Houston R (2019) How does listing status affect bank risk? The effects of crisis, market discipline and regulatory pressure on listed and unlisted BHCs. N Am J Econ Financ 49:85–103

Ҫolak G, Öztekin Ö (2021) The impact of COVID-19 pandemic on bank lending around the world. J Bank Finance 133:106207

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tran, D.V., Hassan, M.K., Alam, A.W. et al. Banks’ financial soundness during the COVID-19 pandemic. J Econ Finan 46, 713–735 (2022). https://doi.org/10.1007/s12197-022-09591-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-022-09591-x