Abstract

We consider an optimal stochastic impulse control problem over an infinite time horizon motivated by a model of irreversible investment choices with fixed adjustment costs. By employing techniques of viscosity solutions and relying on semiconvexity arguments, we prove that the value function is a classical solution to the associated quasi-variational inequality. This enables us to characterize the structure of the continuation and action regions and construct an optimal control. Finally, we focus on the linear case, discussing, by a numerical analysis, the sensitivity of the solution with respect to the relevant parameters of the problem.

Similar content being viewed by others

Notes

The fact that only positive intervention, i.e. \(i_n>0\), is allowed is expressed in the economic literature of Real Options by saying that the investment is irreversible.

Other than in [63, Ch. 4, Sec. 5], irreversible and reversible investment problems with no fixed investment costs are largely treated in the mathematical economic literature, both over finite and infinite horizon. We mention, among others [1, 2, 4, 5, 10, 11, 23, 24, 30, 32, 33, 37, 39,40,41,42, 52, 55, 59, 64, 70].

The smooth-fit principle has also been established, when the diffusion is assumed to be transient, by techniques based on excessive function (see [66]).

Actually, we should consider \(b(x)=\nu x\) if \(x>0\) and \(b(x)=0\) otherwise and similarly for \(\sigma \), in order to fit Assumption 2.1. But this does not matter because our controlled process lies in \(\mathbb {R}_{++}\).

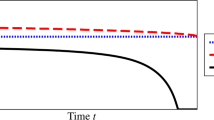

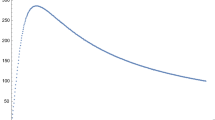

The simulations are done for negative values of \(\nu \), thinking of it as a depreciation factor. We omit, for the sake of brevity, to report the simulations that we have performed for positive values of \(\nu \), as the outputs show the same qualitative behaviour as in the case of negative \(\nu \).

In this case the optimal control consists in a reflection policy at a boundary; in other terms the interval [s, S] degenerates in a singleton \(\{s\}=\{S\}\).

References

Abel, A.B., Eberly, J.C.: Optimal investment with costly reversibility. Rev. Econ. Stud. 63, 581–593 (1996)

Aïd, R., Federico, S., Pham, H., Villeneuve, B.: Explicit investment rules with time-to-build and uncertainty. J. Econ. Dyn. Control 51, 240–256 (2015)

Alvarez, L.H.: A class of solvable impulse control problems. Appl. Math. Optim. 49, 265–295 (2004)

Alvarez, L.H.: Irreversible capital accumulation under interest rate uncertainty. Math. Methods Oper. Res. 72(2), 249–271 (2009)

Alvarez, L.H.: Optimal capital accumulation under price uncertainty and costly reversibility. J. Econ. Dyn. Control 35(10), 1769–1788 (2011)

Alvarez, L.H., Lempa, J.: On the optimal stochastic impulse control of linear diffusions. SIAM J. Control Optim. 47(2), 703–732 (2008)

Anderson, R.F.: Discounted replacement, maintenance, and repair problems in reliability. Math. Oper. Res. 19(4), 909–945 (1994)

Arrow, K.J., Harris, T., Marshak, J.: Optimal inventory policy. Econometrica 19(3), 250–272 (1951)

Avriel, M., Diewert, W.E., Schaible, S., Zang, I.: Generalized Concavity. Classics in Applied Mathematics, vol. 63. SIAM, Philadelphia (2010)

Baldursson, F.M., Karatzas, I.: Irreversible investment and industry equilibrium. Finance Stoch. 1(1), 69–89 (1997)

Bank, P.: Optimal control under a dynamic fuel constraint. SIAM J. Control Optim. 44(4), 1529–1541 (2005)

Bar-Ilan, A., Sulem, A.: Explicit solution of inventory problems with delivery lags. Math. Oper. Res. 20(3), 709–720 (1995)

Bar-Ilan, A., Sulem, A., Zanello, A.: Time-to-build and capacity choice. J. Econ. Dyn. Control 26, 69–98 (2002)

Bayraktar, E., Emmerling, T., Menaldi, J.L.: On the impulse control of jump diffusions. SIAM J. Control Optim. 51(3), 2612–2637 (2013)

Belak, C., Christensen, S., Seifred, F.T.: A general verification result for stochastic impulse control problems. SIAM J. Control Optim. 55(2), 627–649 (2017)

Bensoussan, A., Chevalier-Roignant, B.: Sequential capacity expansion options. Oper. Res. 67(1), 33–57

Bensoussan, A., Lions, J.L.: Impulse Control and Quasi-Variational Inequalities. Gauthier-Villars, Paris (1984)

Bensoussan, A., Liu, J., Yuan, J.: Singular control and impulse control: a common approach. Discrete Contin. Dyn. Syst. (Ser. B) 13(1), 27–57 (2010)

Breiman, L.: Probability. Classics in Applied Mathematics. SIAM, Philadelphia (1992)

Cadellinas, A., Zapatero, F.: Classical and impulse stochastic control of the exchange rate using interest rates and reserves. Math. Finance 10(2), 141–156 (2000)

Cadenillas, A., Lakner, P., Pinedo, M.: Optimal control of a mean-reverting inventory. Oper. Res. 58(6), 1697–1710 (2010)

Chen, Y.-S.A., Guo, X.: Impulse control of multidimensional jump diffusions in finite time horizon. SIAM J. Control Optim. 51(3), 2638–2663 (2013)

Chiarolla, M.B., Ferrari, G.: Identifying the free boundary of a stochastic, irreversible investment problem via the Bank–El Karoui representation theorem. SIAM J. Control Optim. 52(2), 1048–1070 (2014)

Chiarolla, M.B., Haussman, U.G.: On a stochastic irreversible investment problem. SIAM J. Control Optim. 48(2), 438–462 (2009)

Christensen, S.: On the solution of general impulse control problems using superharmonic functions. Stoch. Process. Appl. 124(1), 709–729 (2014)

Christensen, S., Salminen, P.: Impulse control and expected suprema. Adv. Appl. Probab. 49(1), 238–257 (2017)

Constantidinies, G.M., Richard, S.F.: Existence of optimal simple policies for discounted-cost inventory and cash management in continuous time. Oper. Res. 26(4), 620–636 (1978)

Dai, J.G., Yao, D.: Brownian inventory models with convex holding cost, part 1: average-optimal controls. Stoch. Syst. 3(2), 442–499 (2013)

Dai, J.G., Yao, D.: Brownian inventory models with convex holding cost, part 2: discount-optimal controls. Stoch. Syst. 3(2), 500–573 (2013)

Davis, M.H., Dempster, M.A.H., Sethi, S.P., Vermes, D.: Optimal capacity expansion under uncertainty. Adv. Appl. Probab. 19, 156–176 (1987)

Davis, M., Guo, X., Wu, G.: Impulse control of multidimensional jump diffusions. SIAM J. Control Optim. 48, 5276–5293 (2010)

De Angelis, T., Ferrari, G.: A stochastic partially reversible investment problem on a finite time-horizon: free-boundary analysis. Stoch. Process. Appl. 124(3), 4080–4119 (2014)

De Angelis, T., Federico, S., Ferrari, G.: Optimal boundary surface for irreversible investment with stochastic costs. Math. Oper. Res. 42(4), 1135–1161 (2017)

Eastham, J.F., Hastings, K.J.: Optimal impulse control of portfolios. Math. Oper. Res. 13(4), 588–605 (1988)

Egami, M.: A direct solution method for stochastic impulse control problems of one-dimensional diffusions. SIAM J. Control Optim. 47(3), 1191–1218 (2008)

Evans, L.: Partial Differential Equations. Graduate Studies in Mathematics, vol. 19, Second edn. AMS, Providence (2010)

Federico, S., Pham, H.: Characterization of optimal boundaries in reversible investment problems. SIAM J. Control Optim. 52(4), 2180–2223 (2014)

Ferrari, G., Koch, T.: On a strategic model of pollution control. Ann. Oper. Res. (2018). https://doi.org/10.1007/s10479-018-2935-7

Ferrari, G.: On an integral equation for the free-boundary of stochastic, irreversible investment problems. Ann. Appl. Probab. 25(1), 150–176 (2015)

Ferrari, G., Salminen, P.: Irreversible investment under Lèvy uncertainty: an equation for the optimal boundary. Adv. Appl. Probab. 48(1), 298–314 (2016)

Gu, J.W., Steffensen, M., Zheng, H.: Optimal dividend strategies of two collaborating businesses in the diffusion approximation model. Math. Oper. Res. 43, 377–398 (2018)

Guo, X., Pham, H.: Optimal partially reversible investments with entry decision and general production function. Stoch. Process. Appl. 115(5), 705–736 (2005)

Guo, X., Wu, G.: Smooth fit principle for impulse control of multidimensional diffusion processes. SIAM J. Control Optim. 48(2), 594–617 (2009)

Harrison, J.M., Sellke, T.M., Taylor, A.J.: Impulse control of Brownian motion. Math. Oper. Res. 8(3), 454–466 (1983)

He, S., Yao, D., Zhang, H.: Optimal ordering policy for inventory systems with quantity-dependent setup costs. Math. Oper. Res. 42(4), 979–1006 (2017)

Helmes, K.L., Stockbridge, R.H., Zhu, C.: A measure approach for continuous inventory models: discounted cost criterion. SIAM J. Control Optim. 53(4), 2100–2140 (2015)

Hodder, J.E., Triantis, A.: Valuing flexibility as a complex option. J. Finance 45, 549–565 (1990)

Jack, A., Zervos, M.: Impulse control of one-dimensional itô diffusions with an expected and a pathwise ergodic criterion. Appl. Math. Optim. 54, 71–93 (2006)

Jeanblanc-Picqué, M.: Impulse control method and exchange rate. Math. Finance 3(2), 161–177 (1993)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1991)

Korn, R.: Portfolio optimization with strictly positive transaction costs and impulse control. Finance Stoch. 2, 85–114 (1998)

Manne, A.S.: Capacity expansion and probabilistic growth. Econometrica 29(4), 632–649 (1961)

Mauer, D.C., Triantis, A.: Interactions of corporate financing and investment decisions: a dynamic framework. J. Finance 49, 1253–1277 (1994)

McDonald, R., Siegel, D.: The value of waiting to invest. Q. J. Econ. 101(4), 707–727 (1986)

Merhi, A., Zervos, M.: A model for reversible investment capacity expansion. SIAM J. Control Optim. 46(3), 839–876 (2007)

Mitchell, D., Feng, H., Muthuraman, K.: Impulse control of interest rates. Oper. Res. 62(3), 602–615 (2014)

Morton, J., Oksendal, B.: Optimal portfolio management with fixed costs of transactions. Math. Finance 5, 337–356 (1995)

Muthuraman, K., Seshadri, S., Wu, Q.: Inventory management with stochastic lead times. Math. Oper. Res. 40(2), 302–327 (2014)

Øksendal, A.: Irreversible investment problems. Finance Stoch. 4(2), 223–250 (2000)

Øksendal, B., Sulem, A.: Applied Stochastic Control of Jump-Diffusions. Springer, Berlin (2007)

Øksendal, B., Ubøe, J., Zhang, T.: Non-robustness of some impulse control problems with respect to intervention costs. Stoch. Anal. Appl. 20(5), 999–1026 (2002)

Ormeci, M., Dai, J.G., Vande Vate, J.: Impulse control of Brownian motion: the constrained average cost case. Math. Oper. Res. 56(3), 618–629 (2008)

Pham, H.: Continuous-Time Stochastic Control and Applications with Financial Applications. Stochastic Modelling and Applied Probability, vol. 61. Springer, Berlin (2009)

Riedel, F., Su, X.: On irreversible investment. Finance Stoch. 15(4), 607–633 (2011)

Rockafellar, R.T.: Convex Analysis. Princeton University Press, Princeton (1970)

Salminen, P., Ta, B.Q.: Differentiability of excessive functions of one-dimensional diffusions and the principle of smooth-fit. Adv. Math. Finance 104, 181–199 (2015)

Scarf, H.: The optimality of \((S,s)\) policies in the dynamic inventory problem. In: Karlin, S., Suppes, P. (eds.) Mathematical methods of social sciences 1959: proceedings of the first Stanford symposium, pp. 196–202. Stanford University Press (1960)

Sulem, A.: A solvable one-dimensional model of a diffusion inventory system. Math. Oper. Res. 11, 125–133 (1986)

Sulem, A.: Explicit solution of a two-dimensional deterministic inventory problem. Math. Oper. Res. 11(1), 134–146 (1986)

Wang, H.: Capacity expansion with exponential jump diffusion process. Stoch. Stoch. Rep. 75(4), 259–274 (2003)

Yamazaki, K.: Inventory control for spectrally positive Lévy demand processes. Math. Oper. Res. 42(1), 302–327 (2016)

Yong, J., Zhou, X.Y.: Stochastic Controls: Hamiltonian Systems and HJB equations. Springer, Berlin (1999)

Acknowledgements

The authors are sincerely grateful to the Associate Editor and to two anonymous Referees for their careful reading and very valuable comment that improved the final version of the paper. They also thank Giorgio Ferrari for his very valuable comments and suggestions. Mauro Rosestolato thanks the Department of Political Economics and Statistics of the University of Siena for the kind hospitality in March 2017 and the grant Young Investigator Training Program financed by Associazione di Fondazioni e Casse di Risparmio Spa supporting this visit. He also thanks the ERC 321111 Rofirm for the financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

A Appendix

A Appendix

Proposition A.1

Under Assumption 2.1 the boundaries 0 and \(+\infty \) are natural in the sense of Feller’s classification for the diffusion \(Z^{0,x}\).

Proof

Clearly \(+\infty \) is not accessible, in the sense that \(Z^{0,x}\) does not explode in finite time. It remains to show that 0 is not accessible, that is

that both 0 and \(+\infty \) are not entrance, that is

To this end, we introduce the speed measure m of the diffusion \(Z^{0,x}\) transformed to natural scale (see [19, Prop. 16.81, Th. 16.83]). Up to a multiplicative constant, we have

Assumption 2.1 implies that for some \(C_0,C_1>0\) we have \(|b(\xi )|\le C_0 \xi \) and \(\sigma ^2(\xi )\le C_1\xi ^2\) for every \(\xi \in \mathbb {R}_+\). According to [19, Prop. 16.43] we compute \(\int _0^1 ym(dy) \). We have

Set \(F(y):=\int _1^y\frac{-2C_0\xi }{\sigma ^2(\xi )}d\xi \). We have

This shows, by [19, Prop. 16.43], that (A.1) holds, The fact that 0 is not-entrance, i.e. that the first limit in (A.2) holds, is then consequence of [19, Prop. 16.45(a)]. Let us show, finally, that also \(+\infty \) is not-entrance, i.e. that the second limit in (A.2) holds. In this case, according to [19, Prop. 16.45(b)] we consider \(\int _1^{+\infty } ym(dy)\) and see, with the same computations as above, that it is equal to \(+\infty \). By the aforementioned result we conclude that \(+\infty \) is not entrance. \(\square \)

Remark A.2

The property (A.1) can be generalized to the case of random initial data. Let \(\tau \) be a (possibly infinite) \(\mathbb {F}\)-stopping time and let \(\xi \) be an \(\mathscr {F}_\tau \)-measurable random variable, clearly we have the equality in law \( Z^{\tau ,\xi }_{t+\tau }= \left( Z^{0,x}_t \right) _{|_{x=\xi }}\). By (A.1), it then follows that

Lemma A.3

Let \(I\in \mathscr {I}\), \(x,y\in \mathbb {R}_{++}\).

-

(i)

We have

$$\begin{aligned} \mathbb {E} \left[ |X^{x,I}_s-X^{y,I}_s|^4 \right] \le |x-y|^4 e^{C_0 t}\quad \forall t \ge 0, \end{aligned}$$(A.4)where \(C_0 {:}{=}4L_b+6L_\sigma ^2.\)

-

(ii)

For each \(\lambda \in [0,1]\) and \(x,y\in \mathbb {R}_{++}\), define \(z_\lambda {:}{=}\lambda x+(1-\lambda )y\). Then

$$\begin{aligned} \mathbb {E} \left[ \left| X^{z_\lambda ,I}_t - \lambda X^{x,I}_t - (1- \lambda ) X^{y,I}_t\right| ^2 \right] \le A_0\lambda ^2(1-\lambda )^2 |x-y|^{4} e^{B_0t} \quad \forall \lambda \in [0,1], \ \forall t\ge 0, \end{aligned}$$(A.5)where \(A_0>0\) and \(B_0 {:}{=}2L_b+2L_\sigma ^2+\tilde{L}_b\).

Proof

(i) We apply Itô’s formula to \(|X^{x,I}-X^{y,I}|^4\) and then—after a standar localization procedure with stopping times to let the stochastic integral term be a martingale and all the other expectations be well defined and finite; see e.g. the proof of Proposition 3.2—we take the expectation. We get, also using Assumption 2.1,

The claim follows by Gronwall’s inequality.

(ii) Define \(\Sigma ^{\lambda ,x,y,I}{:}{=}\lambda X^{x,I} + (1- \lambda ) X^{y,I}\). We apply Itô’s formula to the process \((X^{z_\lambda ,I}-\Sigma ^{\lambda ,x,y,I})^2\) and then—after a standar localization procedure with stopping times to let the stochastic integral term be a martingale and all the other expectations are well defined and finite; see e.g. the proof of Proposition 3.2—take the expectation, obtaining, also using Assumption 2.1,

By doing the same computations as in [72, p. 188] in order to obtain [72, p. 188, formulae (4.22) and (4.23)], we have

where \(\tilde{L}_b, \tilde{L}_\sigma \) are as in Assumption 2.1. Then, by using (A.7) and (A.8) in (A.6), we get

Using the inequality

and (A.4) into (A.9), we obtain

where \(C_0\) is the constant of (A.4). We conclude by Gronwall’s inequality. \(\square \)

Rights and permissions

About this article

Cite this article

Federico, S., Rosestolato, M. & Tacconi, E. Irreversible investment with fixed adjustment costs: a stochastic impulse control approach. Math Finan Econ 13, 579–616 (2019). https://doi.org/10.1007/s11579-019-00238-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-019-00238-w

Keywords

- Impulse stochastic optimal control

- Quasi-variational inequality

- Viscosity solution

- Irreversible investment

- Fixed cost

AMS Subject Classification

- 93E20 (Optimal stochastic control)

- 35Q93 (PDEs in connecton woth control and optimization)

- 35D40 (Viscosity solution)

- 35B65 (Smoothness and regularity of solutions)