Abstract

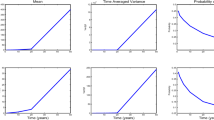

Multiple equilibria models are one of the major categories of theoretical models for stock market crashes. The main objective of this paper is to model multiple equilibria and demonstrate how market prices move from one regime into another in a continuous time framework. As a consequence of this, a multiple jump structure is obtained with both booms and crashes, which are defined as points of discontinuity of the stock price process. For the constructed model, we prove that the stock price is a càdlàg semimartingale process, find the conditional distributions for the time of the next jump, the type of the next jump and the size of the next jump, given the public information available to market participants, and conduct a number of numerical studies.

Similar content being viewed by others

References

Abreu, D., Brunnermeier, M.: Bubbles and crashes. Econometrica 71(1), 173–204 (2003)

Allen, F., Gale, D.: Understanding Financial Crises, Clarendon Lectures in Finance. Oxford University Press, Oxford (2009)

Angeletos, G., Werning, I.: Crises and prices: information aggregation, multiplicity, and volatility. Am. Econ. Rev. 96(5), 1720–1736 (2006)

Barlevy, G., Veronesi, P.: Information acquisition in financial markets. Rev. Econ. Stud. 67(1), 79–90 (2000)

Barlevy, G., Veronesi, P.: Information Acquisition in Financial Markets: a Correction, Working Paper. University of Chicago, Chicago (2008)

Barlevy, G., Veronesi, P.: Rational panics and stock market crashes. J. Econ. Theory 110(2), 234–263 (2003)

Bremaud, P.: Point Processes and Queues. Martingale Dynamics. Springer, New York (1981)

Brunnermeier, M.: Asset Pricing under Asymmetric Information: Bubbles, Crashes, Technical Analysis and Herding, Chapter 6, Oxford University Press (2001)

Brunnermeier, M.: Bubbles: Entry in New Palgrave Dictionary of Economics (2009)

Brunnermeier, M., Oehmke, M.: Bubbles, Financial Crises, and Systemic Risk. Handbook of the Economics of Finance, Amsterdam (2012)

Buonocore, A., Giorno, V., Nobile, A., Ricciardi, L.: On the two-boundary first-crossing-time problem for diffusion processes. J. Appl. Probab. 27(1), 102–114 (1990)

Buonocore, A., Nobile, A., Ricciardi, L.: A new integral equation for the evaluation of the first-passage-time probability densities. Adv. Appl. Probab. 19(4), 784–800 (1987)

Caplin, A., Leahy, J.: Business as usual, market crashes, and wisdom after the fact. Am. Econ. Rev. 84(3), 548–565 (1994)

Drazen, A.: Political Contagion in Currency Crises, NBER Working Paper 7211, University of Maryland (1999)

Friedman, D., Abraham, R.: Bubbles and crashes: gradient dynamics in financial markets. J. Econ. Dyn. Control 33(4), 922–937 (2009)

Ganguli, J., Yang, L.: Complementarities, multiplicity, and supply information. J. Eur. Econ. Assoc. 7(1), 90–115 (2009)

Gennotte, G., Leland, H.: Market liquidity, hedging, and crashes. Am. Econ. Rev. 80(5), 999–1021 (1990)

Grossman, S.: On the efficiency of competitive stock markets where trades have diverse information. J. Financ. 31(2), 573–585 (1976)

Hong, H., Stein, J.: Differences of opinion, short-sales constraints, and market crashes. Rev. Financ. Stud. 16(2), 487–525 (2003)

Huang, J., Wang, J.: Liquidity and market crashes. Rev. Financ. Stud. 22(7), 2607–2643 (2009)

Jacod, J., Shiryaev, A.: Limit Theorems for Stochastic Processes, vol. 288, 2nd edn. Springer (2003)

Karatzas, I., Shreve, S.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer (1991)

Kindleberger, C., Aliber, R.: Manias, Panics and Crashes. A History of Financial Crises, 6th edn. Palgrave Macmillan, Basingstoke (2011)

Krugman, P.: Balance sheets, the transfer problem, and financial crises. Int. Tax Public Financ. 6, 459–472 (1999)

Kyle, A., Obizhaeva, A.: Large Bets and Stock Market Crashes, Working Paper (2013)

Kyle, A., Obizhaeva, A.: Market Microstructure Invariants: Theory and Empirical Tests, Working Paper, University of Maryland (2013)

Novikov, A., Frishling, V., Kordzakhia, N.: Approximations of boundary crossing probabilities for a Brownian motion. J. Appl. Probab. 36(4), 1019–1030 (1999)

Novikov, A., Frishling, V., Kordzakhia, N.: Time-dependent barrier options and boundary crossing probabilities. Georgian Math. J. 10(2), 325–334 (2003)

O’Hara, M.: Bubbles: some perspectives (and loose talk) from history. Rev. Financ. Stud. 21(1), 11–17 (2008)

Ozdenoren, E., Yuan, K.: Feedback effects and asset prices. J. Financ. 63(4), 1939–1975 (2008)

Peskir, G.: On integral equations arising in the first-passage problem for Brownian motion. J. Integral Equ. Appl. 14(4), 397–423 (2002)

Poetzelberger, K., Wang, L.: Boundary crossing probability for Brownian motion. J. Appl. Probab. 38(1), 152–164 (2001)

Protter, P.: Stochastic Integration and Differential Equations, 2nd edn. Version 2.1. Springer (2005)

Romer, D.: Rational asset-price movements without news. Am. Econ. Rev. 83(5), 1112–1130 (1993)

Scheinkman, J., Xiong, W.: Overconfidence and speculative bubbles. J. Political Econ. 111(6), 1183–1220 (2003)

Skorohod, A.: Random Processes with Independent Increments. Nauka, Moscow (1964)

Thomas, J.: Numerical Partial Differential Equations: Finite Difference Methods, Texts in Applied Mathematics 22. Springer, New York (1998)

Wang, L., Poetzelberger, K.: Boundary crossing probability for Brownian motion and general boundaries. J. Appl. Probab. 34(1), 54–65 (1997)

Wilmott, P., Howison, S., Dewynne, J.: The Mathematics of Financial Derivatives. Cambridge University Press, Cambridge (1995)

Yuan, K.: Asymmetric price movements and borrowing constraints: a rational expectations equilibrium model of crises, contagion, and confusion. J. Financ. 60(1), 379–411 (2005)

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs not contained in the main text

Appendix: Proofs not contained in the main text

Proof of Theorem 2.1

This theorem will be proved in several steps.

-

Step 1

First, it will be shown that there exist some \(\delta _1\in (0,T)\) and \(\Delta _1>0\) such that

$$\begin{aligned} h^h(t)-h^l(t)\ge \Delta _1, \quad \forall t\in (T-\delta _1,T). \end{aligned}$$$$\begin{aligned} A_1=\lim _{t\uparrow T}p_1(t)=\kappa -\sqrt{-2\sigma _{\kappa }^2\ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \sigma _{\kappa }^2}\right) } \end{aligned}$$and

$$\begin{aligned} A_2=\lim _{t\uparrow T}p_2(t)=\kappa +\sqrt{-2\sigma _{\kappa }^2\ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \sigma _{\kappa }^2}\right) }, \end{aligned}$$which means that \(A_1<A_2\). Then

$$\begin{aligned}&\lim _{t\uparrow T}\int \limits _{-\infty }^{\infty }\Phi \left( \frac{K e^{-r(T-t)}-p_1(t)}{\Sigma (t)}\right) \frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK\\&\quad =\int \limits _{-\infty }^{\infty }\Phi \left( \lim _{t\uparrow T}\frac{K e^{-r(T-t)}-p_1(t)}{\Sigma (t)}\right) \frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK\\&\quad =\int \limits _{A_1}^{\infty }\frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK \end{aligned}$$and

$$\begin{aligned}&\lim _{t\uparrow T}\int \limits _{-\infty }^{\infty }\Phi \left( \frac{K e^{-r(T-t)}-p_2(t)}{\Sigma (t)}\right) \frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK\\&\quad =\int \limits _{-\infty }^{\infty }\Phi \left( \lim _{t\uparrow T}\frac{K e^{-r(T-t)}-p_2(t)}{\Sigma (t)}\right) \frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK\\&\quad =\int \limits _{A_2}^{\infty }\frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK. \end{aligned}$$Hence,

$$\begin{aligned}\lim _{t\uparrow T}(h^h(t)\!-\!h^l(t))&=\frac{1}{\gamma _3}\left( \!w^D\int \limits _{A_1}^{A_2}\frac{1}{\sqrt{2\pi \sigma _{\kappa }^2}}e^{-\frac{(K-\kappa )^2}{2\sigma _{\kappa }^2}}dK\!-\!2\gamma _1\sqrt{\!-2\sigma _{\kappa }^2\ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \sigma _{\kappa }^2}\right) }\right) \\&=\frac{2}{\gamma _3}\left( \gamma _1\sqrt{2\pi \sigma _{\kappa }^2}e^{\frac{z^2}{2}}\int \limits _{0}^{z}\frac{1}{\sqrt{2\pi }}e^{-\frac{y^2}{2}}dy-\gamma _1\sigma _{\kappa }z\right) \\&=:f(z), \end{aligned}$$where

$$\begin{aligned} z=\sqrt{-2\ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \sigma _{\kappa }^2}\right) }>0. \end{aligned}$$Since \(f(0)=0\) and \(f'(z)=\frac{2\gamma _1\sqrt{2\pi \sigma _{\kappa }^2} z e^{\frac{z^2}{2}}\int _{0}^{z}\frac{1}{\sqrt{2\pi }}e^{-\frac{y^2}{2}}dy}{\gamma _3}\) is positive for \(z>0\) and \(0\) for \(z=0\), we obtain that

$$\begin{aligned} \lim _{t\uparrow T}(h^h(t)-h^l(t))>0. \end{aligned}$$Finally, one can take, e.g., \(\Delta _1=\frac{1}{2}\lim _{t\uparrow T}(h^h(t)-h^l(t))\) and use the definition of the limit.

-

Step 2

Second, it will be proved that there exists some \(\Delta _2>0\) such that

$$\begin{aligned} h^h(t)-h^l(t)\ge \Delta _2, \quad \forall t\in [0,T-\delta _1]. \end{aligned}$$Assume that \(t\in [0,T-\delta _1]\). Then (2.5) and (2.6) imply that

$$\begin{aligned}p_2(t)-p_1(t)&= 2\sqrt{-2\left( \sigma _{\kappa }^2 e^{-r(T-t)}+\Sigma ^2(t)\right) \ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \left( \sigma _{\kappa }^2 e^{-2r(T-t)}+\Sigma ^2(t)\right) }\right) }\\&\ge 2\sqrt{-2\left( \sigma _{\kappa }^2 e^{-rT}+\alpha _1^2 \frac{1-e^{-2r\delta _1}}{2r}\right) \ln \left( \frac{\gamma _1}{w^D}\sqrt{2\pi \left( \frac{\alpha _1^2}{2r}+\left( \sigma _{\kappa }^2-\frac{\alpha _1^2}{2r}\right) e^{-2rT}\right) }\right) }\\&=: \delta _2>0, \end{aligned}$$which means that, for all \(y\in [-\frac{\delta _2}{2},\frac{\delta _2}{2}]\),

$$\begin{aligned} p_1(t)\le \kappa e^{-r(T-t)}+y\le p_2(t) \end{aligned}$$and, hence,

$$\begin{aligned} h^h(t)\ge h(t,\kappa e^{-r(T-t)}+y)\ge h^l(t). \end{aligned}$$(5.1)Furthermore,

$$\begin{aligned} h_x(t,\kappa e^{-r(T-t)}+y)&=\frac{1}{\gamma _3}\left( \gamma _1-\frac{w^D}{\sqrt{2\pi \left( \sigma _{\kappa }^2 e^{-2r(T-t)}+\Sigma ^2(t)\right) }}e^{-\frac{y^2}{2(\sigma _{\kappa }^2 e^{-r(T-t)}+\Sigma ^2(t))}}\right) \\&\le \frac{1}{\gamma _3}\left( \gamma _1-\frac{w^D}{\sqrt{2\pi \Bigl (\sigma _{\kappa }^2 e^{-2rT}+\Sigma ^2(0)\Bigr )}}e^{-\frac{y^2}{2\left( \sigma _{\kappa }^2 e^{-rT}+\alpha _1^2 \frac{1-e^{-2r\delta _1}}{2r}\right) }}\right) \end{aligned}$$Assumption 1 guarantees that there exists some positive \(\delta _3\le \frac{\delta _2}{2}\) such that

$$\begin{aligned} h_x(t,\kappa e^{-r(T-t)}-\delta _3)&=h_x(t,\kappa e^{-r(T-t)}+\delta _3)\\&\le \frac{1}{\gamma _3}\left( \gamma _1-\frac{w^D}{\sqrt{2\pi \Bigl (\sigma _{\kappa }^2 e^{-2rT}+\Sigma ^2(0)\Bigr )}}e^{-\frac{\delta _3^2}{2(\sigma _{\kappa }^2 e^{-rT}+\Sigma ^2(T-\delta _1))}}\right) \\&=:-\delta _4<0. \end{aligned}$$Moreover,

$$\begin{aligned} h_{xx}(t,x)=\frac{w^D(x-\kappa e^{-r(T-t)})}{\gamma _3\sqrt{2\pi (\sigma _{\kappa }^2 e^{-2r(T-t)}+\Sigma ^2(t))}(\sigma _{\kappa }^2 e^{-r(T-t)}+\Sigma ^2(t))}e^{-\frac{(\kappa e^{-r(T-t)}-x)^2}{2(\sigma _{\kappa }^2 e^{-r(T-t)}+\Sigma ^2(t))}}, \end{aligned}$$that is, function \(h_x(t,x)\) is a decreasing function of \(x\) for \(x\le \kappa e^{-r(T-t)}\) and an increasing function of \(x\) for \(x\ge \kappa e^{-r(T-t)}\). This means that, for \(x\in [\kappa e^{-r(T-t)}-\delta _3,\kappa e^{-r(T-t)}+\delta _3]\),

$$\begin{aligned} h_x(t,x)\le \max \Bigl (h_x(t,\kappa e^{-r(T-t)}-\delta _3),h_x(t,\kappa e^{-r(T-t)}+\delta _3)\Bigr )\le -\delta _4. \end{aligned}$$Thus, by the mean value theorem and in view of (5.1),

$$\begin{aligned} h^h(t)-h^l(t)\ge h(t,\kappa e^{-r(T-t)}-\delta _3)-h(t,\kappa e^{-r(T-t)}+\delta _3) \ge 2\delta _3\delta _4>0. \end{aligned}$$ -

Step 3

Finally, it will be shown that there exists some \(\Delta >0\) such that

$$\begin{aligned} h^h(t)-h^l(t)\ge \Delta ,\quad \forall t\in [0,T). \end{aligned}$$Indeed, one can take \(\Delta =\min (\Delta _1,\Delta _2)\), and the result follows.

\(\square \)

Proof of Theorem 3.3

The proof of this theorem will be done in several steps. Denote by \(\tau \) the remaining time to the first arrival after \(t\) in the sunspot process \(Z\). Recall that \(\tau \) is independent of \(\mathcal {F}^P_t\) and \(Z\) is a Poisson process with intensity \(\lambda _Z\). Hence, \(\tau \) has an exponential distribution with parameter \(\lambda _Z\). Let

-

Step 1

Calculation of the conditional probability on the set \([S_t=s_l]\): By the law of iterated expectations,

$$\begin{aligned}&\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right] \mid \mathcal {F}^P_t\right) \\&\quad =\mathbb {E}^{\mathbb {P}}\left( \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad =\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau \ge u\!-\!t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau _{N_t\!+\!1}\!<\!u, S_{\tau _{N_t\!+\!1}}\in C_1,J_{N_t\!+\!1}\!\in \! C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad \quad +\,\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau \!<\!u-t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau _{N_t+1}\!<\!t\!+\!\tau , S_{\tau _{N_t+1}}\in C_1,J_{N_t\!+\!1}\in C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad \quad +\,\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau <u\!-\!t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ B_{t+\tau }\le h_2(t\!+\!\tau ),t\right. \right. \right. \\&\quad ~\left. \left. \left. +\,\tau \le \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad \quad +\,\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau <u-t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ B_{t+\tau }>h_2(t+\tau ),t\right. \right. \right. \\&\quad ~\left. \left. \left. +\,\tau \le \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) . \end{aligned}$$The first term in this decomposition corresponds to the scenario that there are no shock arrivals on \([t,u)\) at all and, hence, Brownian motion hits the boundary \(h^h\) on \((t,u)\). The new state of the state process is equal to \(s_h\) and the jump size is \(J^u(\tau _{N_t+1})\). The second term corresponds to the scenario that the first shock arrival time is \(t+\tau <u\) and Brownian motion hits the boundary \(h^h\) on \((t,t+\tau )\). As in the first scenario, the process switches to \(s_h\), the jump size is equal to \(J^h(\tau _{N_t+1})\). According to the third scenario, the first shock arrival time is \(t+\tau <u\), the Brownian motion value stays smaller than the value of the boundary \(h^h\) on \((t,t+\tau )\) and at the time of the shock \(B_{t+\tau }\le h^l(t+\tau )\). As a consequence, there is no jump at time \(t+\tau \). The fourth scenario is the same as the third one with the only difference that \(B_{t+\tau }>h^l(t+\tau )\). Therefore, the price jumps at time \(t+\tau \). With probability \(p_{lh}\), the new state of the state process is \(s_h\) and the jump size is \(J^{lh}(t+\tau ,B_{t+\tau })\). With probability \(1-p_{lh}\), the new state of the state process is \(s_m\) and the jump size is \(J^{lm}(t+\tau ,B_{t+\tau })\). In view of the independence of \(\tau \) and \(\mathcal {F}^P_t\), the first and second terms are equal to

$$\begin{aligned} e^{-\lambda _Z (u-t)}\int \limits _{t}^{u}\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _1(y,t,B_t)dy \end{aligned}$$and

$$\begin{aligned} \int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\left[ \int \limits _{t}^{t+r}\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _1(y,t,B_t)dy\right] dr, \end{aligned}$$where

$$\begin{aligned} \phi _1(u,t,y)=-\frac{\partial {D_1(u,t,y)}}{\partial {u}}, \quad D_1(u,t,y)&=\mathbb {P}\Bigl (B_s<h^h(t+s)-y,\forall s\in [0,u-t]\Bigr ). \end{aligned}$$(5.2)The third term is equal to

$$\begin{aligned}&\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau <u-t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ B_{t+\tau }\le h^l(t+\tau ),t+\tau \le \tau _{N_t+1}\right. \right. \right. \\&\left. \left. \left. <u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right] \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad =\mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ \tau <u-t\right] \mathbb {E}^{\mathbb {P}}\left( \mathbb {E}^{\mathbb {P}}\left( \mathbb {I}\left[ B_{t+\tau }\le h^l(t+\tau ),(B_s<h^h(s),\forall s\in [t,t+\tau ))\right] \right. \right. \right. \\&\qquad \left. \left. \left. \quad \quad \quad \quad \quad \quad \mathbb {I}\left( \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\right) \mid \mathcal {F}^{P}_{t+\tau }\right) \mid \mathcal {F}^{P,\tau }_t\right) \mid \mathcal {F}^P_t\right) \\&\quad =\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [\tau <u-t\Bigr ]\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [B_{t+\tau }\le h^l(t+\tau ),(B_s<h^h(s),\forall s\in [t,t+\tau ))\Bigr ]\\&\quad \quad \quad \quad \quad \quad F_1(t+\tau ,B_{t+\tau },u,C_1,C_2)\mid \mathcal {F}^{P,\tau }_t\Bigr )\mid \mathcal {F}^P_t\Bigr )\\&\quad =\int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\left[ \int \limits _{-\infty }^{h^l(t+r)}q_1(x;r,t,B_t)F_1(t+r,x,u,C_1,C_2)dx\right] dr, \end{aligned}$$where \(q_1(x;r,t,y)\) is the density of \(B_r\) on the set \([B_s< h^h(t+s)-y,\forall s\in [0,r]]\), and the fourth term is equal to

$$\begin{aligned}&\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [\tau <u-t\Bigr ]\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [B_{t+\tau }>h^l(t+\tau ),t\\&\qquad +\tau \le \tau _{N_t+1}<u, S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\Bigr ]\mid \mathcal {F}^{P,\tau }_t\Bigr )\mid \mathcal {F}^P_t\Bigr )\\&\quad =\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [\tau <u-t\Bigr ]\mathbb {E}^{\mathbb {P}}\Bigl (\mathbb {I}\Bigl [B_{t+\tau }>h^l(t+\tau ),(B_s<h^h(s),\forall s\in [t,t+\tau ))\Bigr ]\\&\quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \mathbb {I}\Bigl (S_{\tau _{N_t+1}}\in C_1,J_{N_t+1}\in C_2\Bigr )\mid \mathcal {F}^{P,\tau }_t\Bigr )\mid \mathcal {F}^P_t\Bigr )\\&\quad =\int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\Bigl [\int \limits _{h^l(t+r)}^{h^h(t+r)}q_1(x;r,t,B_t)\Bigl ( p_{lh}\mathbb {I}(s_h\in C_1,J^{lh}(t+r,x)\in C_2)\\&\qquad +p_{lm}\mathbb {I}(s_m\in C_1,J^{lm}(t+r,x)\in C_2)\Bigr )dx\Bigr ]dr. \end{aligned}$$Combining all the terms, we get that

$$\begin{aligned} F_1(t,B_t,u,C_1,C_2)&= e^{-\lambda _Z (u-t)}\int \limits _{t}^{u}\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _1(y,t,B_t)dy\nonumber \\&+\int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\left[ \int \limits _{t}^{t+r}\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _1(y,t,B_t)dy\nonumber \right. \\&\left. +\int \limits _{-\infty }^{h^l(t+r)}q_1(x;r,t,B_t)F_1(t+r,x,u,C_1,C_2)dx\right. \nonumber \\&\left. +\int \limits _{h^l(t+r)}^{h^h(t+r)}q_1(x;r,t,B_t)\left( p_{lh}\mathbb {I}(s_h\in C_1,J^{lh}(t+r,x)\in C_2)\right. \right. \nonumber \\&+p_{lm}\left. \left. \mathbb {I}(s_m\in C_1,J^{lm}(t+r,x)\in C_2)\right. )dx\right. ]dr. \end{aligned}$$(5.3) -

Step 2

Calculation of conditional probability on the set \([S_t=s_m]\): According to the first scenario, there are no shock arrivals on \([t,u)\) at all and, hence, Brownian motion hits one of the two boundaries \(h^h\) or \(h^l\) on \((t,u)\). If it hits \(h^h\) earlier than \(h^l\), then the new state of the state process is \(s_h\) and the jump size is equal to \(J^h(t+\tau _{N_t+1})\). If it hits \(h^l\) earlier than \(h^h\), then the new state of the state process is \(s_l\) and the jump size is equal to \(J^l(t+\tau _{N_t+1})\). According to the second scenario, the first shock arrival time is \(t+\tau <u\) and Brownian motion hits one of the two boundaries \(h^h\) or \(h^l\) on \((t,t+\tau )\), then the new state of the state process and the jump size are determined by the same mechanism as in the first scenario. Finally, according to the third scenario, the first shock arrival time is \(t+\tau <u\) and Brownian motion stays between both boundaries \(h^h\) and \(h^l\) on \([t,t+\tau ]\). With probability \(p_{mh}\), the new state of the state process is \(s_h\) and the jump size is \(J^{mh}(t+\tau ,B_{t+\tau })\). With probability \(1-p_{mh}\), the new state of the state process is \(s_l\) and the jump size is \(J^{ml}(t+\tau ,B_{t+\tau })\). Taking this decomposition, we obtain the formula for \(F_2\):

$$\begin{aligned}&F_2(t,B_t,u,C_1,C_2)\nonumber \\&\quad =e^{-\lambda _Z (u-t)}\int \limits _{t}^{u}\Bigl [\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _{m,1}(y,t,B_t)\nonumber \\&\qquad +\mathbb {I}(s_l\in C_1,J^l(y)\in C_2)\phi _{m,2}(y,t,B_t)\Bigr ]dy\nonumber \\&\qquad +\int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\Bigl [\int \limits _{t}^{t+r}\Bigl [\mathbb {I}(s_h\in C_1,J^h(y)\in C_2)\phi _{m,1}(y,t,B_t)\nonumber \\&\qquad +\mathbb {I}(s_l\in C_1,J^l(y)\in C_2)\phi _{m,2}(y,t,B_t)\Bigr ]dy\nonumber \\&\qquad +\int \limits _{h^l(t+r)}^{h^h(t+r)}q^m(x;r,t,B_t)\Bigl (p_{mh}\mathbb {I}(s_h\in C_1,J^{mh}(t+r,x)\in C_2)\nonumber \\&\qquad +p_{ml}\mathbb {I}(s_l\in C_1,J^{ml}(t+r,x)\in C_2)\Bigr )dx\Bigr ]dr, \end{aligned}$$(5.4)where \(q^m(x;r,t,y)\) is the density of \(B_r\) on the set \([h^l(t+s)-y<B_s<h^h(t+s)-y,\forall s\in [0,r]]\) and

$$\begin{aligned} \phi _{m,1}(u,t,y)&= \frac{\partial {D_{m,1}(u,t,y)}}{\partial {u}},\nonumber \\ D_{m,1}(u,t,y)&= \mathbb {P}\Bigl (\tau (t,y)\le u-t, B_{\tau (t,y)}=h^h(t+\tau (t,y))-y\Bigr ), \nonumber \\ \phi _{m,2}(u,t,y)&= \frac{\partial {D_{m,2}(u,t,y)}}{\partial {u}},\nonumber \\ D_{m,2}(u,t,y)&= \mathbb {P}\Bigl (\tau (t,y)\le u-t, B_{\tau (t,y)}=h^l(t+\tau (t,y))-y\Bigr ),\nonumber \\ \tau (t,y)&= \inf \{s\ge 0: B_s=h^l(t+s)-y \quad \text{ or }\quad B_{s}=h^h(t+s)-y\}. \end{aligned}$$(5.5) -

Step 3

Calculation of conditional probability on the set \([S_t=s_h]\): The conditional probability on the set \([S_t=s_h]\) satisfies

$$\begin{aligned} F_3(t,B_t,u,C_1,C_2)&= e^{-\lambda _Z (u-t)}\int \limits _{t}^{u}\mathbb {I}(s_l\in C_1,J^l(y)\in C_2)\phi _2(y,t,B_t)dy\nonumber \\&+\int \limits _0^{u-t}\lambda _Z e^{-\lambda _Z r}\Bigl [\int _{t}^{t+r}\mathbb {I}(s_l\in C_1,J^l(y)\in C_2)\phi _2(y,t,B_t)dy\nonumber \\&+\int \limits _{h^h(t+r)}^{\infty }q_2(x;r,t,B_t)F_3(t+r,x,u,C_1,C_2)dx\nonumber \\&+\int \limits _{h^l(t+r)}^{h^h(t+r)}q_2(x;r,t,B_t)\Bigl ( p_{hl}\mathbb {I}(s_l\in C_1,J^{hl}(t+r,x)\in C_2)\nonumber \\&+p_{hm}\mathbb {I}(s_m\in C_1,J^{hm}(t+r,x)\in C_2)\Bigr )dx\Bigr ]dr, \end{aligned}$$(5.6)where \(q_2(x;r,t,y)\) is the density of \(B_r\) on the set \(\Bigl [B_s>h^l(t+s)-y,\forall s\in [0,r]\Bigr ]\) and

$$\begin{aligned} \phi _2(u,t,y)=-\frac{\partial {D_2(u,t,y)}}{\partial {u}}, \quad D_2(u,t,y)&=\mathbb {P}\Bigl (B_s>h^l(t+s)-y,\forall s\in [0,u-t]\Bigr ). \end{aligned}$$(5.7)The calculation procedure is patterned after Step 2.

\(\square \)

Proof of Lemma3.1

Calculations pattern after Theorem 3.3 and yield the following:

In above representation, \(J^i\) and \(J^{ij}\) are as defined in (3.1) and \(\phi _{m,1}\) and \(\phi _{m,2}\) are as defined in (5.5). Recall that \(q^m(x;r,t,y)\) is the density of \(B_r\) on the set \([h^l(t+s)-y<B_s<h^h(t+s)-y,\forall s\in [0,r]]\). \(\square \)

Proof of Lemma3.2

Applying Leibniz’s rule for differentiating integrals to \(F_7\), \(F_8\) and \(F_9\), we obtain \(F_{10}(u,t,B_{t},C)\) satisfies

and \(F_{12}(u,t,B_{t},C)\) satisfies

In particular, for \(C=\mathbb {R}^2\), indicator functions in (5.9), (5.10), and (5.11) are equal to \(1\), and the result for \(g^{(i+1)}(u,\mathbb {R}^2)\) follows. \(\square \)

Rights and permissions

About this article

Cite this article

Çetin, U., Sheynzon, I. A simple model for market booms and crashes. Math Finan Econ 8, 291–319 (2014). https://doi.org/10.1007/s11579-014-0116-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-014-0116-2