Abstract

The literature emphasizes that interactions between biotic (the individual) and abiotic entities (the institutional environment) are central to entrepreneurial ecosystems. However, despite the importance of digital entrepreneurial ecosystem (DEE) elements, it might be questioned if all elements are equally necessary. Furthermore, different outputs might require different conditions. The same can happen with different levels of a given output. The answer to these questions is of particular concern from a policy perspective. By using necessary condition analysis (NCA) alongside with fuzzy-set qualitative comparative analysis (fs/QCA), this study advances understanding of the entrepreneurial ecosystems. While fs/QCA identifies only one necessary condition to produce digitally-enabled unicorns – market conditions – and none to unicorns and new business creation, NCA shows that all elements of DEE are necessary to produce digitally-enabled unicorns, and most of them are also necessary for producing unicorns. NCA also identifies formal institutions, regulations, and taxation and finance as necessary conditions for new business creation. Moreover, NCA shows that necessary conditions do not have the same degree of importance, and the necessity of a given condition does not automatically imply its highest level is required. For researchers, these results emphasize the importance of using NCA as a complement of fs/QCA. For practitioners, these findings can be used to optimize the allocation of policy resources, particularly targeting the elements that constitute bottlenecks.

Plain English Summary

Policymakers should target different levels of entrepreneurial ecosystem pillars performance to produce unicorns. Ambitious entrepreneurship is important for country competitiveness in the digital age. Digital entrepreneurial ecosystems can facilitate the rise of digitally-enabled unicorns, an extreme case of ambitious entrepreneurship. This study shows which conditions are necessary to produce this output; these conditions can be required at different levels. The comparison of country’s performance on each condition shows which of them constitute bottlenecks. Although all elements of digital entrepreneurial ecosystems are relevant for digitally-enabled unicorns, policymakers should target the ones that constrain the emergence of this output. This study identifies the levels that should be reached in each condition, not only for digitally-enabled unicorns, but also for unicorns in general. The results show relevant differences between the levels needed for these outputs. For example, knowledge creation and dissemination seem to be more important to boost digitally-enabled unicorns rather than unicorns in general. Thus, policymakers should consider specific levels of the conditions to optimize resource allocation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The “ecosystem” concept has become increasingly popular in the strategy field. An “ecosystem” corresponds to “the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize” (Adner 2017, p. 40). Ecosystems differ from other governance forms and emerge from modularity, thereby enabling the coordination of “multilateral dependences based on various types of complementarities” (Jacobides et al. 2018, p. 2255). In the entrepreneurship literature, several variations of this concept have emerged. Digital transformation put forward the importance of entrepreneurial ecosystems (Autio, Nambisan, et al., 2018). Entrepreneurial ecosystems include orchestrated communities of stakeholders and external resources that focus on opportunity identification, pursuit, and scale-up (Autio & Thomas, 2014).

Recently, to better conceptualize entrepreneurship in the digital age, Sussan and Acs (2017) introduced the term digital entrepreneurial ecosystem (DEE), which integrates two concepts: the digital ecosystem (Dini et al. 2011; Weil & Woerner, 2015) and the entrepreneurial ecosystem (Acs et al. 2014; Stam, 2015). Given its novelty, the definition of a DEE is not yet consolidated, in spite of some recent attempts to clarify this concept (see for example, Elia et al. 2020). In this study, following Du et al. (2018) definition, it is considered that a DEE represents a combination of elements, in a particular territory, backing the growth of start-ups aiming to pursue new opportunities that arise from digital technologies. There is an ongoing discussion on whether DEEs are “local, global, in between, or all of the above?” (Song, 2019, p. 583). In fact, the literature shows that the answer to this question is not consensual (e.g., Acs et al. 2018; Cavallo et al. 2019; Spigel, 2017; Stam, 2015). However, irrespective of this question, as any entrepreneurial ecosystem, a DEE always implies interactions between biotic (the individual) and abiotic entities (the institutional environment). But, despite the importance of DEE elements, it might be questioned if all elements are equally necessary.

Past studies suggested that the ecosystem’s performance is driven by the whole system (e.g., Stam & van de Ven, 2019; Isenberg, 2010), implying that all the elements are necessary. However, the necessity of the elements of a DEE has not been empirically tested. Furthermore, the level of necessity of each element is likely to differ and to be contingent to the outcome. Digitally-enabled unicorns can be the most suitable output of DEE performance, since they are likely to require both digital and entrepreneurial ecosystems. However, this study considers other outputs (unicorns — i.e., start-ups valued above $1 billion — and new business creation) to better understand the necessity of each DEE element. In doing so, an additional contribution can be made, since the literature has not reached a consensus on how to measure entrepreneurial ecosystems performance. Finding the necessity of each element is of special concern from a policy perspective because a necessary condition cannot be left out. A necessary condition must be present to achieve a desired outcome (Dul, 2016). Thus, identifying necessary conditions might provide actionable insights to guide policy design. This is important from a policy perspective, since policymakers are struggling to find the action points necessary to nurture and develop entrepreneurship (Jung et al., 2017). This study also responds to the call to further research to shed light on which elements operate as “true” bottlenecks (Acs et al., 2014). Finding the levels of necessity of each DEE element for specific levels of different outputs can provide useful guidance for policymakers. For example, it can show what matters most for producing digitally-enabled unicorns.

Inspired by Isenberg (2010) and following past research (Acs et al. 2014, 2018), this study considers the country as the unit of analysis and uses data from EIDES (Autio, Szerb, et al., 2018). It is asserted that a condition might be necessary, but not sufficient to obtain a given output. This especially applies to unicorns, which are considered to be a rare phenomenon (Acs et al. 2017). To analyze necessary conditions in kind and in degree, we resort to two complementary methods: fuzzy-set qualitative comparative analysis (fs/QCA) and necessary condition analysis (NCA). Fs/QCA analyzes relationships of necessity in kind (i.e., a condition is necessary or not for a given outcome), while NCA analyzes relationships of necessity both in kind and in degree, which allows to say that “a specific level of a condition is necessary or not for a specific level of the outcome” (Vis & Dul, 2018, p. 872).

This study makes the following contributions to the entrepreneurial ecosystems literature. First, the results show that all DEE elements are necessary to produce digitally-enabled unicorns, but for other outputs, only some DEE elements can be considered necessary. Second, the study identifies the bottlenecks for each level of a given output. This advances the literature and suggests that future research should take into account different levels of necessity. Furthermore, this insight provides actionable indications for policymakers, which can use the bottlenecks identified in this study to optimize policy resources allocation. Third, the results give empirical support to the notion that ambitious entrepreneurship is a more suitable measure of entrepreneurial ecosystems. The results show that digitally-enabled unicorns are a better measure of DEE performance rather than unicorns or new business creation. Finally, the results reinforce the argument that fs/QCA should be complemented with NCA when examining necessary conditions.

After this introduction, the next section provides the conceptual framework. Thereafter, the sample and the methods are described. Then, the results are presented. In the subsequent section, the findings are discussed, and implications for policymakers and researchers are drawn. Finally, the main conclusions are highlighted.

2 Theoretical background

2.1 Digitalization and entrepreneurial ecosystems

Research on entrepreneurial ecosystems is still in its infancy, and that is even more so for digital entrepreneurial ecosystems (DEE). The literature that introduced the concept of entrepreneurial ecosystems goes back to Cohen (2006), Isenberg (2010), and Feld (2012). Since then, the concept gained momentum (for an overview on the evolution of the concept, see Cavallo et al. 2019). The concept of ecosystem translates a biological analogy. Therefore, interactions between biotic and abiotic entities characterize the ecosystem. The entrepreneurial ecosystem considers systemic conditions (the biotic) and framework conditions (the abiotic), and the systemic conditions (e.g., knowledge and support services, talent, finance, networks) are considered to be at the heart of the ecosystem (Stam & Spigel, 2016). The literature already proposed several frameworks to describe the elements of entrepreneurial ecosystems (e.g., Alvedalen & Boschma, 2017; Kuratko et al. 2017). However, only a few studies consider the influence of digitalization on entrepreneurial ecosystems (e.g., Sussan & Acs, 2017).

With the emergence of the digital age, the actors of entrepreneurial ecosystems have become more technological advanced. Startup Genome (2019) reported that, in 2018, 45% of the start-ups were related to deep tech (e.g., AI, advanced manufacturing, and robotics), versus 22.8% in 2010/2011, which reflects the importance of digital technologies and justifies the integration of the concept of digital ecosystem (Dini et al. 2011; Weil & Woerner, 2015) with the concept of entrepreneurial ecosystem (Acs et al. 2014; Stam, 2015), and brings about the concept of DEE that was introduced by Sussan and Acs (2017). DEEs combine different elements that support the growth of start-ups that pursue digital opportunities (Du et al. 2018). Sussan and Acs (2017) introduced a DEE framework, which was later refined by Song (2019). The reconfiguration of the DEE framework made by Song (2019) resulted in three concepts, as follows: (i) “digital user citizenship” that includes heterogeneous groups of users, who can be either consumers or producers; (ii) “digital technology entrepreneurship” comprehending all agents that develop complementary products and services linked to digital platforms; and (iii) “digital multisided platform” that enables and facilitates innovation and value creation activities. Furthermore, Song (2019) provides a number of conditions that are needed to warrant the sustainability of DEE, namely, the protection of user privacy, platform efficiency, market competition not being stifled by platforms, security of the digital infrastructure, and also digital finance.

Digital technologies have several implications for entrepreneurship. The boundaries of entrepreneurship outcomes and processes become increasingly more fluid (Nambisan, 2017). The digitalization of products and services offers greater flexibility (Yoo et al. 2010). Digitalization refers to “the sociotechnical process of applying digitising techniques to broader social and institutional contexts that render digital technologies infrastructural” (Tilson et al. 2010, p. 749). The term “digital affordances” has been coined to represent the potentialities of digitalization (Autio, Nambisan, et al., 2018). Digitalization provides new ways of collaborating and organizing resources and the design of novel solutions (Markus and Loebecke 2013). Digitalization simplifies access to new markets (Nambisan, 2017) and facilitates knowledge sharing (Thompson et al. 2018). Furthermore, digitalization reduces dependency on location-specific value chain assets and resources (Autio, Nambisan, et al., 2018). This raises the question about the optimal unit of analysis (Cavallo et al. 2019; Song, 2019). Past studies suggest that researchers should continue to investigate several units of analysis to better understand DEE (Sussan & Acs, 2017). This includes country comparisons. Thus, following past research (e.g., Acs et al. 2014, 2018), this study uses the country as the unit of analysis. Isenberg (2010) also recognizes the role of national governments in building environments that promote and help sustain entrepreneurship.

2.2 Elements of a digital entrepreneurial ecosystem: the EIDES index

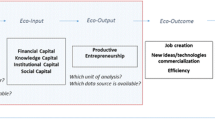

To assess DEEs in the 27 countries of the European Union and in the UK, which was a state member at the time of the report, Autio, Szerb, et al. (2018) developed an index: the European Index of Digital Entrepreneurship Systems (EIDES). Although several entrepreneurial ecosystem indexes have been developed, we are interested in DEEs, and the assessment made by the EIDES seems to be a proper and reliable match. Compared to other entrepreneurial indexes, such as the Global Entrepreneurship Index from the Global Entrepreneurship Monitor (GEM), EIDES integrates entrepreneurial ecosystems and digital ecosystem concepts by introducing the digital counterparts of entrepreneurship ecosystem conditions. To the best of our knowledge, EIDES is the first index that considers digitally-enabled entrepreneurial transformation and targets “modern” start-ups. More recently, the Global Entrepreneurship and Development Institute (GEDI) has developed the Digital Platform Economy Index (DPE), which could also be a proper data source. Whereas EIDES aims to reflect the use of digital technologies, DPE focuses on platforms. DPE considers more countries than EIDES, but it only presents the index scores, while EIDES discloses detailed data regarding the elements of the digital entrepreneurial ecosystem. This decomposition allows the analysis of the levels of necessity of each DEE component. EIDES is highly correlated with the Digital Economy and Society Index (DESI) (Autio, Szerb, et al., 2018, p. 45). DESI summarizes relevant indicators of EU member states digital competitiveness; this further ensures that the digital ecosystem is captured in EIDES. Furthermore, EIDES suggests that productive entrepreneurship is an output facilitated by general and systemic framework conditions. This is important for the analysis performed in the present study. Additionally, by focusing on EU member states (plus the UK, a former member state), EIDES isolates the aspects under study.

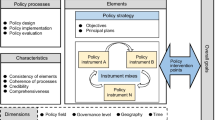

Literature on entrepreneurial ecosystem elements distinguishes institutional arrangements from resource endowments (Stam & van de Ven, 2019). In the same vein, the EIDES includes four general framework conditions, which relate to the market and to the institutional context, and four systemic framework conditions that are linked to the resource context. Figure 1 illustrates the conceptual framework of this study, including these pillars. EIDES was designed as a tool to better understand the extent of digitally-enabled entrepreneurial ecosystems (Autio, Szerb, et al., 2018). Therefore, the index takes into account associated digital counterparts of the aforementioned conditions.

The general framework conditions comprise: “cultural and informal institutions”; “formal institutions, regulation, and taxation”; “market conditions”; and “physical infrastructure”. Regarding “cultural and informal institutions”, the rationale is as follows. If the country’s cultural values and practices encourage entrepreneurship, becoming an entrepreneur might be more attractive for high-potential individuals (Autio, Szerb, et al., 2018). This might increase entrepreneurship quality. Informal institutions constitute the first level of the conceptual structure proposed by Williamson (2000) to the institutional framework, considering a four-level hierarchy. In EIDES, the basic use of the Internet by population and businesses is included in this pillar. The first two levels of the proposed conceptual framework are of most importance for entrepreneurship. Level two comprises formal institutions, which represent the “rules of the game” (North, 1990) and can impact both the quality and the quantity of national entrepreneurship (Autio & Fu, 2015). The level two institutions are especially important for entrepreneurship because they influence the portion of potential profits that entrepreneurs can claim (Acemoglu et al. 2005; Estrin et al. 2013). To include digitalization, the EIDES considers in the pillar “formal institutions, regulation, and taxation” the freedom of the Internet versus its security and e-government indicators. Williamson (2000) framework also considers governance (level three), which corresponds to the “play of the game” and resource allocation (level four). In the EIDES, “market conditions” are considered an important driver of entrepreneurship. This pillar includes not only the conditions and ease of entry in the local market, but also internationalization and use of the Internet for sales. The “physical infrastructure” regulates potential accessibility to markets. An adequate level of “physical infrastructure” might be a vital element because it allows economic interaction (Audretsch et al. 2015). Besides more traditional infrastructures, the EIDES considers digital infrastructure, access, cost, speed, and reliability.

The systemic framework conditions, that is, resource-related conditions, include: “human capital”; “knowledge creation and dissemination”; “finance”; and “networking and support”. “Human capital” is usually associated with entrepreneurship quality. High-talented individuals are more likely to spot and engage in high-quality opportunities for entrepreneurship (Davidsson & Honig, 2003). Knowledge creation can lead to better solutions (Stam & van de Ven, 2019) that can leverage firm growth. Finance, particularly the existence of adequate venture capital, is important to support start-ups; for instance, venture capital impacts high-tech entrepreneurial firms’ sales growth (Grilli & Murtinu, 2014). Regarding “networking and support”, it has been recognized that networks can be an important element for entrepreneurial ecosystems’ success (Spigel, 2017). Networks enable access to resources, which otherwise would not be useful (Spigel & Harrison, 2018), and they also facilitate access to knowledge, human capital, and funding (Malecki, 1997). In EIDES, this condition includes social media, among other digital networks.

Despite the importance of DEE elements, it might be questioned if all elements are equally necessary. Past studies suggest that ecosystem performance is driven by the whole system (e.g., Stam & van de Ven, 2019; Isenberg, 2010), which means that a “penalty for bottleneck” might occur. That is, if the system elements interact to produce system performance, then, bottlenecks might hinder the ecosystem performance (Acs et al. 2014). However, the necessity of each condition has not been empirically tested. Furthermore, the level of each condition that might constitute a bottleneck for a desired level of DEE performance has not been empirically addressed. In fact, the necessity of a condition might depend on the desired output. This study aims to shed light on these important issues.

2.3 Digital entrepreneurial ecosystem performance

There is some evidence of the impact of entrepreneurial ecosystems on entrepreneurship and value creation (e.g., Stam & van de Ven, 2019; Tsvetkova, 2015). Nevertheless, the measurement of entrepreneurial ecosystems performance remains an open question. Common output measures of entrepreneurship are the emergence of new self-employment or the creation of new businesses. These outputs are obtained through indicators based on surveys and are aggregated at the national level and normalized by the country population; these outputs constitute mainly density measures (Cavallo et al. 2019). However, these measures might be inadequate to address entrepreneurial ecosystems performance.

Spigel and Harrison (2018) suggested that the concept of entrepreneurial ecosystems might be different because of its focus on high-growth firms (HGFs). Entrepreneurial ecosystems are usually used to explain ambitious entrepreneurship (Alvedalen & Boschma, 2017). High-quality entrepreneurship has been the focus of many works (e.g., Coad et al. 2014; Davila et al. 2003; Georgallis & Durand, 2017). In the same vein, Bruns et al. (2017) note that the presence of unicorns might be a better measure than self-employment and new firm creation. The number of unicorns can constitute a proper output and a robust indicator of the strength of entrepreneurial ecosystems (Acs et al. 2017). However, because unicorns are rare, there is a risk of being a too narrow output (Cavallo et al. 2019).

Many unicorns are multisided platforms whose activity is conducted in the virtual space, helping two or more different groups to interact with each other (Evans and Schmakensee 2016). In doing so, unicorns often disrupt existing businesses (Sussan & Acs, 2017). Platform business models are highly scalable (Acs et al. 2017). Hence, it is sensible to expect digitally-enabled start-ups to reach high valuations in a very short timeframe. Multisided platform businesses have to acquire millions of customers to became unicorns. A well-functioning DEE might facilitate this task. Foundational multisided platforms, such as Google, can also be helpful to the rise of novel platform-based businesses, since they constitute a “platform of platforms” (Evans & Schmakensee, 2016).

Considering the previous arguments, if ambitious entrepreneurship can be a proper output of entrepreneurial ecosystems, it is even more so in the case of DEE. Unicorns constitute the “best in class” of HGFs, and they are an extreme case of high-growth. Furthermore, unicorns usually rely on digital technologies. Hence, they might be especially adequate to measure DEE performance. Digitally-enabled unicorns even more so, since these businesses rely on a well-functioning digital infrastructure. The present study aims to empirically test the suitability of three possible outputs as measures of DEE performance: (i) new business creation, which can be considered a traditional measure of entrepreneurship; (ii) unicorns which might be a measure of high-quality entrepreneurship; and (iii) digitally-enabled unicorns, which could be associated with multisided platform business models. By considering these outputs, this study may shed light on why HGFs are more prevalent in some countries, which has been considered an important research question (Krasniqi & Desai, 2016). Audretsch (2021) suggests that only a subset of entrepreneurial firms benefit from a model of entrepreneurship similar to the one of Silicon Valley and poses that the type of entrepreneurship that works depends on the context. In the same vein, this study aims to identify the different set of “true” bottlenecks that are linked to three aforementioned outputs.

Policymakers, researchers, and business leaders have shown increasing interested in HGFs because they constitute a highly desirable subset of firms (Krasniqi & Desai, 2016). Acs et al. (2014) suggest that the most important aspect of entrepreneurship from an economic perspective is not the quantity but the quality, and it has been noted that HGFs can produce disproportionate economic gains (Moreno & Coad, 2015). However, few start-ups become unicorns. Unicorns represent an extreme output. Even if all elements of the DEE are necessary to support this output, it is sensible to expect that their presence might not be sufficient to produce unicorns. Nevertheless, knowing the elements of DEE that matter the most for digitally-enabled unicorns can guide future policies aiming to enhance productive entrepreneurship in the digital age.

3 Research design

3.1 Sample and data

Productive entrepreneurship is a proper output of entrepreneurial ecosystems (e.g., Stam & van de Ven, 2019; Stam, 2015). However, the adequate measure of DEE performance remains unclear. In this study, to shed light on this issue, three outputs were tested: the number of digitally-enabled unicorns and the number of unicorns and new business creation per 1000 people with ages ranging from 15 to 64. For new business creation, data from World Development Indicators, which is compiled by the World Bank from officially recognized international sources, regarding new business density (new registrations per 1000 people ages 15–64) was employed. The data refers to 2018, the last year available at the time this research was conducted.

Data about the number of companies that became unicorns, since 2018, in each country, was extracted from CB Insights (retrieved from https://www.cbinsights.com/research-unicorn-companies on the 30 of December 2020). The sample includes the current 27 EU member states, plus the UK (a former EU member state). Among the sixteen categories that are present in CB Insights report, the following eight categories were considered adequate to classify unicorns as digitally-enabled: (i) artificial intelligence; (ii) cybersecurity; (iii) data management and analytics; (iv) e-commerce and direct-to-consumer; (v) edtech; (vi) fintech; (vii) Internet software and services; and (viii) mobile and telecommunications. Considering this data source and criteria, the total number of companies that became unicorns since 2018 in the UE (including the UK) is 41, from which 25 are digitally-enabled unicorns. The sample is presented in Table 1.

Data regarding DEE elements comes from the EIDES (Autio, Szerb, et al., 2018), which was developed by JRC (the Joint Research Centre from the European Commission), in the context of project RISES — “Research on Innovation, Start-up Europe and Standardisation”. EIDES assesses the DEE of 28 EU member states (the scores were calculated before Brexit, so they also include the UK). In this study, the values of the eight elements of DEE in each country were used. These elements are consistent with the measurement of entrepreneurial ecosystems proposed by Stam (2015). As aforementioned in Subsection 2.3., they encompass four general framework conditions and four systemic conditions and include the respective digital counterparts.

3.2 Methods

3.2.1 Fs/QCA

Fs/QCA embraces causal complexity and considers configurations, allowing the conjunction of simple antecedent conditions and recognizing that different paths can bring about the same outcome or output (Furnari et al. 2020). If a configuration is a consistent superset of the outcome, it corresponds to a situation of necessity, while a configuration that is a consistent subset of the outcome corresponds to a situation consistent with sufficiency (Greckhamer et al. 2018). In fs/QCA, the analysis of necessary conditions usually precedes the sufficiency analysis (Rihoux & Ragin, 2009). Fs/QCA output quality is assessed using two key statistics: coverage and consistency, which vary between “0” and “1”. In the case of necessary conditions analysis, the consistency of the hypothesis “The antecedent X is necessary for the outcome Y” gauges how well the cases agree with the hypothesis, and it can be measured as (Ragin, 2008, p. 53):

where \({X}_{i}\) is the score of the i-th case in the antecedent X and \({Y}_{i}\) is the score of the i-th case in the consequent Y.

The coverage of the hypothesis is a measure of its empirical relevance, and it is calculated as (Ragin, 2008, p. 61):

To be considered necessary, a condition must show a very high consistency and a non-negligible coverage (Ragin, 2008). A consistency threshold of 0.90 is usually recommended for this analysis (e.g., Rihoux & Ragin, 2009).

This method uses fuzzy numbers, which represent degrees of membership, ranging from “0” to “1”. Through a calibration process, the degree of membership of each case to each condition should be assigned a priori (Muñoz & Dimov, 2015). This means that, in fs/QCA, the scores \({X}_{i}\) and \({Y}_{i}\) used in the previous expressions for calculating consistency and coverage are these degrees of membership. In this study, the outputs of interest are the presence of digitally-enabled unicorns, unicorns, and new business creation. To calibrate unicorns’ output, countries that exhibit more than 3 new unicorns during the considered period were coded as “fully in” (= 1) and countries with no unicorns were coded as “fully out” (= 0). The remaining countries were coded as “more in than out” (= 0.67) if the number of unicorns ranges from two to three and “more out than in” (= 0.33) if they have just one unicorn since 2018. There is no need to relativize the country size because “a large home base is neither a necessary nor sufficient condition for a highly productive ecosystem” (Acs et al. 2017 p. 7). Digitally-enabled unicorns are a subset of the unicorns sample; therefore, they follow the same calibration criteria. New business creation was calibrated in a similar way. More than 15 new firms per 1000 people ages 15–64 were coded as “fully in” (= 1). If the number is under 4.5, the country is considered as “fully out” (= 0). Over 8, but below 15, new business creation per 1000 people ages 15–64 was coded 0.67, and if the number of new business creation ranges from 4.5, to 8, the degree of membership 0.33 was used.

Regarding the general and systemic framework conditions, the EIDES index scores range from 0 to 100, and EIDES considers countries with a score above 70 to be “leaders”. The remaining countries are named “followers” if the score is over 45; “catchers-up” if the score is over 35; and “laggards” if the score is less than 35. These thresholds were used to define the four-value fuzzy-sets. Thus, scores above 70 were coded a “fully in” (degree of membership of 1), scores over 45 were coded as “more in than out” (degree of membership of 0.67), scores over 35 were coded as “more out than in” (degree of membership of 0.33), and scores under 35 were coded as “fully out” (degree of membership of 0).

3.2.2 NCA

Necessary condition analysis (NCA) is a novel method developed by Dul (2016). NCA allows the estimation of “the necessity effect size of a condition X for an outcome Y” (Dul et al. 2020, p. 385). This method can be used with both discrete and continuous conditions. While fs/QCA looks for sets of necessary and sufficient conditions, NCA allows a quantitative statement like “a specific level of X is necessary for a specific level of Y” (Vis & Dul, 2018, p. 879).

NCA draws a ceiling line on the top of the data in a XY scatter plot, and the empty space in the upper left corner suggests that high values of Y are not possible with low values of X (Dul et al. 2020). The area above this ceiling zone is a measure of the constraining effect of the identified necessary condition. The proportion of the potential area with observations that lies above the ceiling line is termed the effect size, d (Dul, 2016, p. 29):

where C is the size of the ceiling zone and S is the size of the potential area with observations, termed the scope.

Two techniques are generally used to draw the ceiling lines, the CE-FDH (Ceiling Envelopment – Free Disposal Hull), a step function, and CR-FDH (Ceiling Regression – Free Disposal Hull). The former is usually employed when using discrete data and a limited number of levels, and the latter is used both for discrete data with a large number of levels and for continuous data. In this study, we used four levels for each condition; hence, CE-FDH was used to draw the ceiling lines. The accuracy of a ceiling line corresponds to “the number of observations that are on or below the ceiling line divided by the total number of observations” (Dul, 2016, p. 28). For CR-FDH, the accuracy can be below 100%, but for CE-FDH, the accuracy must be 100%. Since we resort to CE-FDH, in this study, the accuracy is always 100%. The necessity effect size (d), which ranges from 0 to 1, corresponds to the size if the empty space above the ceiling line. Dul (2016) proposes the following criteria to evaluate necessary condition effect size: 0 < d < 0.1 = small effect; 0.1 < d < 0.3 = medium effect; 0.3 < d < 0.5 = large effect; and ≥ 0.5 = very large effect.

The ceiling lines also define the bottlenecks. The bottleneck is the level of an antecedent X that is necessary to achieve a given level of the outcome Y, and it can be defined as the y-coordinate of the ceiling line for the considered level of X. If, for a given level of X, the ceiling line lies above the potential area with observations, this means that the outcome is not constrained for that level of X.

Similar to other methods, NCA uses the p-value for statistical inference. This work follows the approach of Dul (2015) for estimating the p-value: a large number of random samples (10, 000) is created to obtain a distribution of effect sizes under the null hypothesis, and the obtained effect size is compared with this distribution to determine the p-value (Dul, 2015, p. 15).

Although both fs/QCA and NCA can be used to perform an analysis of necessary conditions, NCA is able to provide richer information than fs/QCA on this regard – in fact, fs/QCA is usually applied mostly to sufficient conditions analysis. When applied to the identification of necessary conditions, fs/QCA looks for conditions whose presence is necessary to achieve the outcome (in kind necessary conditions), whereas NCA looks for conditions that are required at a given level (in degree necessary conditions). Therefore, NCA provides a more general analysis of necessary conditions than fs/QCA. We can say that fs/QCA restricts the ceiling line to the bisectional diagonal through the theoretical scope, and therefore, it normally finds considerably less necessary conditions in data sets than NCA (Dul, 2016, p. 32). Fs/QCA and NCA can be seen as providing two different, complementary perspectives over the necessary conditions to achieve an outcome, so it is useful to use both together to reach more robust conclusions.

4 Results

Table 2 presents the results of the fs/QCA analysis of necessary conditions. The consistency scores become higher as we move from new business creation to unicorns and digitally-enabled unicorns. However, in spite of high consistency scores in unicorns and digitally-enabled unicorns, none of the conditions can be considered necessary for unicorns, and only one condition is over the 0.90 threshold in digitally-enabled unicorns. The fs/QCA just identifies market conditions as necessary for digitally-enabled unicorns.

The NCA analysis provides a different picture, as shown in Table 3. All conditions can be considered necessary for digitally-enabled unicorns. All effect sizes are large or very large. Regarding unicorns, most conditions are necessary with two exceptions: “formal institutions, regulations, and taxation” and “knowledge creation and dissemination”. For new business creation, only two conditions (“formal institutions, regulations, and taxation” and “finance”) are statistically significant, and the respective effect sizes are medium. It is interesting to note the changes not only in the statistical significance, but also in the effect sizes. For instance, the effect size of “cultural and informal institutions” changes from large to very large, when considering unicorns and digitally-enabled unicorns, respectively. The most notable change in the necessary conditions for these two outputs is shown in “knowledge creation and dissemination”, which was not significant in the case of unicorns, but becomes significant and shows a very large effect in the case of digitally-enabled unicorns. Besides the effect sizes, it is also important to understand to what extent they are necessary.

The bottleneck analysis presented in Table 4 indicates the minimum level of each condition that is required for each level of output. This adds new insights. For instance, to obtain high levels of new business creation (a “fully in” situation), the results suggest that only three DEE elements require a minimal level: the score in EIDES of “formal institutions, regulations, and taxation” should be higher than 45 (corresponding to a calibrated score of 0.67); the same for “finance”; and the score for “networking and support” should be higher than 35 (which is translated into a calibrated score of 0.33). The two DEE elements that should present scores higher than 45 correspond to the ones that were found to be statistically significant.

For a “fully in” situation regarding unicorns (i.e., the number of unicorns in the time period of the analysis exceeds 3), all conditions should be present EIDES scores above 45, except the following two, which can have scores over 35: “formal institutions, regulations, and taxation” and “human capital”. Digitally-enabled unicorns require higher scores than unicorns in many DEE elements. To obtain more than three digitally-enabled unicorns, the results suggest that a minimal score of 45 is required in three systemic framework conditions (“human capital”; “finance”; and “networking and support”) and one general framework condition (“physical infrastructure”). All other conditions should present a score over 70 in EIDES: three general framework conditions (“cultural and informal institutions”; “formal institutions, regulations, and taxation”; and “market conditions”) and one systemic framework condition (“knowledge creation and dissemination”).

It is interesting to note the changes in the levels of the bottlenecks for different outputs. Between unicorns and digitally-enabled unicorns, the most notable change is in “formal institutions, regulations, and taxation” that changes from a minimal score of 35 to 70 to produce more than three unicorns. The same change is required when moving from a “more in than out” situation to a “fully in” situation in digitally-enabled unicorns. Regarding “human capital”, a similar situation occurs, but the change is from a score of 35 to 45. It is also worth to highlight the change in “knowledge creation and dissemination”. For unicorns, only the “fully in” situation requires countries to be in the “followers” group in this condition (score over 45 and below or equal to 70). Digitally-enabled unicorns require the same level of this condition for the “more in than out” output and require a score that belongs to the “leaders” group (that is, over 70) for a “fully in” situation. Moreover, it is also salient that “finance”, a condition that is required for a high level of new business creation at a minimal level corresponding to a 45 score in EIDES, does not need to be higher for the highest levels of unicorns or digitally-enabled unicorns. Thus, when reaching this score in this specific condition, countries should pay attention to other bottlenecks. Furthermore, this level is enough irrespectively of the output that policymakers aim to promote.

The obtained results give empirical support to some notions outlined in the entrepreneurial ecosystem literature, but they present a different picture. In particular, they highlight different levels of necessity of DEE elements that provide new insights for research and policy, which are discussed in the next section.

5 Discussion

The main objective of this study is to examine the levels of necessity of DEE elements. For this purpose, three possible outputs were considered. A traditional output, the number of new business creation normalized by the country population size, and two extreme outputs, the number of new unicorns and the number of digitally-enabled unicorns. The results show that DEEs are indeed important for producing very high-quality outputs. But, for new business creation, DEE elements do not have the same importance. This study identified the necessary conditions for each output, the effect size of necessary conditions, and potential bottlenecks. The insights obtained in this study advance the literature on this important issue and might guide policy design.

For digitally-enabled unicorns, all conditions are necessary, and effect sizes are always large or very large. Two general framework conditions (“cultural and informal institutions” and “market conditions”) and two systemic framework conditions (“networking and support” and “knowledge creation and dissemination”) have very large effect sizes. Cultural and informal institutions can increase the quality of entrepreneurial activity. They correspond to the first level of Williamson (2000) institutional framework that is of utmost importance to entrepreneurship. Market conditions are also key. For instance, this condition is associated with agglomeration externalities, which facilitate opportunity recognition and exploitation (Autio, Szerb, et al., 2018). This positive effect is leveraged by digital technologies, which facilitate the growth of multisided platform businesses because they facilitate the business of matchmakers. This is further enhanced by urbanization, which is also taken into consideration in EIDES. In the index, “networking and support” is related with cluster development, business sophistication, and efficient logistics. The digital counterpart is linked with digital infrastructures and networking’ technologies. According to Autio, Szerb, et al. (2018), this DEE element can enhance efficiency, provide opportunities for innovation, and reduce barriers to entry. The “knowledge creation and dissemination” considers the access to knowledge-intensive human capital, R&D investment, and the existence of patents. Knowledge creation can leverage firm growth since it can lead to new solutions (Stam & van de Ven, 2019).

The results show that the necessity of “knowledge creation and dissemination” is not statistically significant for unicorns. Among other differences between the effect sizes of DEE elements for unicorns and digitally-enabled unicorns, this is likely to be most surprising. A possible justification relies on the use of digital technologies that distinguish digitally-enabled unicorns from the other unicorns. Digital technologies can facilitate absorbing knowledge and materializing knowledge spill-overs (Autio, Szerb, et al., 2018). Hence, “knowledge creation and dissemination” can be more important for digitally-enabled unicorns. Nevertheless, a certain level of this DEE element is also needed when the desired output is more than three unicorns (within the timeframe considered in this study): the score on this element should be higher than 45 for unicorns. Therefore, it is important to consider the bottlenecks for each level of output.

As reported on Table 4, different levels of each output require different levels of each DEE element. These results show a different picture, which provides action insights for policymakers. Different from previous research (e.g., Autio, Szerb, et al., 2018), we suggest that the allocation of policy resources should not just target the weakest pillar first, but rather focus on reaching the level in each DEE element that is required for a desired output. Doing this can improve the efficiency in the use of resources. For instance, in the case of digitally-enabled unicorns, the most demanding level of output just requires countries to be in followers’ group in four DEE elements. Since the EIDES reports the data sources that were used for determining each DEE element score, it is easier to find a benchmark and implement policies to reach a higher score in a given condition. Taking the case of the Netherlands as an example, we can see that the scores of “market conditions” and “networking and support” are below the threshold of 70 that is needed to increase the number of digitally-enabled unicorns (69.1 and 61.4, respectively). Using this information, the country should target the “networking and support” element. Hence, the policy could be design to improve logistics and cluster development, among other options.

It is not surprising that most of DEE elements are not necessary for high levels of new business creation. In fact, Autio, Szerb, et al. (2018), p. 26) state that they “expect EIDES to regulate the quality, rather than the quantity, of the entrepreneurial dynamic in the economy”. Nevertheless, the results of the NCA give an empirical support to this assumption. Furthermore, the results show that DEE elements become necessary and have a higher effect size when moving the output of the analysis from unicorns to digitally-enabled unicorns. These results give support to the notion that entrepreneurial ecosystems performance should be assessed by more ambitious outputs, such as unicorns, rather than less ambitious outputs, such as new business creation, as suggested in the related literature (e.g., Acs et al. 2017; Bruns et al. 2017). Furthermore, when considering digital entrepreneurial ecosystems, digitally-enabled unicorns constitute the most suitable output and an adequate measure of performance. Using this output would also be consistent with the increasing importance of the “digital platform economy”, which translates the rising of digitally-enabled activities in business, politics, and social interaction (Kenney & Zysman, 2016).

The results obtained in fs/QCA and in NCA present relevant differences. While fs/QCA only identifies one DEE element as necessary to achieve a high level of digitally-enabled unicorns (i.e., more than 3 in the time period of analysis), NCA shows that all elements are required for this level of output. The results obtained with fs/QCA can be compared with the results obtained by other studies that analyze entrepreneurial ecosystems using the same method. Schrijvers et al. (2021) analyze the conditions for high-performing and very high-performing ecosystems in Europe. The authors identify several different sufficient configurations for high levels of entrepreneurship, but no necessary conditions. In the case of very high entrepreneurial performance, the authors find just one sufficient configuration (with the presence of all the ten elements considered by them), and two necessary conditions: a strong presence of leadership and intermediate services. The authors also consider unicorns as an output, reaching four necessary conditions with a consistency larger than 0.9 – finance, leadership, talent and intermediate services – but with all of them having low coverage (smaller or equal to 0.21). Xie et al. (2021) analyze the antecedents of entrepreneurial quality and quantity using city-level data from China. Their sufficient condition analysis highlights the importance of Internet infrastructure and innovation capacity, but the authors find no necessary conditions for either quality or quantity entrepreneurship. Muñoz et al. (2020) are also unable to find necessary conditions for strong entrepreneurial activity in a study of Chilean local entrepreneurial ecosystems, although they find several sufficient configurations. These results are in line with the results of the present study, which shows a somewhat limited ability of fs/QCA for finding necessary conditions related to the performance of entrepreneurial ecosystems. The difference between the results of fs/QCA and NCA further emphasizes the importance of using NCA as a complement of fs/QCA.

5.1 Research implications

The findings provide support to the notion that DEEs are important to understand entrepreneurship in the digital age. However, the results show that this concept might be more useful to explain high-quality entrepreneurship, rather than new business creation. In line with past research (e.g., Acs et al. 2017; Bruns et al. 2017), our results show that unicorns might be an adequate measure of DEE performance. Previous literature argues that entrepreneurial ecosystems are fit to explain ambitious entrepreneurship (Alvedalen & Boschma, 2017). In a similar vein, we posit that DEE performance should be assessed using extreme outputs, such as unicorns. Furthermore, we suggest that an even better indicator of DEE performance would be digitally-enabled unicorns rather than unicorns.

The literature suggests that all elements of an entrepreneurial ecosystem are necessary to achieve high ecosystem performance (e.g., Stam and van de Ven 2019; Isenberg, 2010). In contrast, our results show that some elements might not be necessary. While DEEs can help explain why digitally-enabled unicorns are more prevalent is some countries, not all of its elements are required at the same level. This responds to Acs et al.’s (2014) call for further research to shed light on which pillars operate “true” bottlenecks. The obtained results show the elements that matter the most to produce digitally-enabled unicorns and present the levels of necessity for each output, which can inform future research.

This study also supports the notion that fs/QCA should be complemented with NCA to better understand the necessary conditions. The results show that the former identifies considerably less necessary conditions in data sets than NCA, as suggested by Dul (2016).

5.2 Policy implications

Necessary conditions cannot be left out; they must be present to achieve a desired outcome (Dul, 2016). Therefore, identifying necessary conditions has great value to policymakers. This study identifies the necessary elements of DEE for producing digitally-enabled unicorns and identifies bottlenecks for each level of the output. Furthermore, by considering different outputs, this study shows that some DEE elements can facilitate the rising of high levels of the three outputs considered in the analysis: digitally-enabled unicorns; unicorns; and new business creation. For instance, a score of 45 in EIDES in the “finance” element corresponds to a bottleneck to achieve the highest level in each output. This shows that improving this DEE element would be beneficial not only to produce extreme outputs, but also to boost new business creation. This also highlights that there is no need to surpass this level, even if the desired output is to produce a high number of digitally-enabled unicorns. New business creation was not an expected DEE output, but by including this output, it is shown that besides “finance”, a certain level of “formal institutions, regulations, and taxation” and “networking and support” can be necessary to facilitate high levels of new business creation. Since DEE introduces digital counterparts for each element, the digital aspect should also be considered. For instance, it is important to consider promoting digital finance (e.g., building a cashless society; promoting crowd funding activities).

The obtained values for the bottlenecks can guide policy design aiming to boost ambitious entrepreneurship. The bottleneck values can contribute to inform allocation of policy resources. Policymakers can target the DEE elements that are likely to have the highest effect, focusing on the weakest element, but they should consider the level of necessity of each condition to design more efficient policies.

5.3 Limitations and future research

As any empirical research, this study is not without limitations. The first one is related to the data used in the analysis. The sample includes only EU member states (plus UK), which has pros and cons. The countries have the same shared characteristics which may be useful to isolate the aspects under study, but extending the analysis to countries with wider cultural differences and different degrees of economic development might provide further insights. Furthermore, the data is limited in time, and few observations were used to test the necessity of DEE elements. This is justified by the novelty of DEE concept, but future research could explore the evolution of DEE elements and its effect on entrepreneurial outputs, as soon as more data becomes available. This might enable the examination of configurations that are sufficient to produce extreme entrepreneurial outputs, such as unicorns.

Second, to compute set membership thresholds, the distribution of values was considered. While the EIDES provides a rational for the setting the threshold for DEE elements, the threshold chosen regarding entrepreneurship outputs was set based on the distribution of values. This might provide a reference for future research, but different data might suggest different thresholds. Furthermore, future research might replicate this study with different outputs. Unicorns represent an interesting phenomenon, but they are relatively rare. Despite the conclusion that high-quality entrepreneurship is a better measure of DEE performance than more traditional measures, such as new business creation, future research might consider moderate HGFs as a DEE output.

Finally, this study contributes to entrepreneurial ecosystems’ performance measurement, suggesting that digitally-enabled unicorns are an adequate output for assessing DEE performance. However, it is recognized that other possible measures exist. This issue could be addressed in future research. For instance, Miller and Acs (2017) suggest that the performance can be evaluated considering how well an entrepreneurial ecosystem enables the exploration of knowledge frontiers.

6 Conclusion

Considering three possible outputs (digitally-enabled unicorns, unicorns, and new business creation), the main objective of this study is to examine the level necessity of each element of digital entrepreneurial ecosystems (DEEs). The findings emphasize that DEEs are important to produce digitally-enabled unicorns; all the elements are necessary for this output. However, each level of this output requires different levels of each DEE element. By outlining these bottlenecks, this study advances the literature on entrepreneurial ecosystems and provides some guidance for policymakers. To produce a high number of digitally-enabled unicorns, some conditions should be at its highest level, but for others, it is enough to reach a certain level. This insight advances the related literature that usually does not consider levels of necessity. It is also important from a policy perspective. Policymakers should be aware of these bottlenecks and adjust the allocation of policy resources taking them into consideration.

Furthermore, this study provides empirical support to the notion that DEE performance should be measured taking into consideration an ambitious output, such as unicorns. The results suggest that digitally-enabled unicorns are a better indicator of DEE performance. Additionally, this study reinforces the idea that fs/QCA should be complemented with NCA to better understand and identify necessary conditions.

References

Acemoglu, D., Johnson, S., & Robinson, J.A. (2005). Institutions as a fundamental cause of long-run growth. In: P.A., Durlauf, S.N. (Eds.), Handbook of Economic Growth, Vol. 1 (Part A), Chapter 6, Elsevier, pp. 385–472.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(1), 476–494.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics, 51(2), 501–514.

Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of entrepreneurial ecosystems approach. Small Business Economics, 49, 1–10.

Alvedalen, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies, 25(6), 887–903.

Audretsch, D. B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230.

Audretsch, D. B. (2021). Have we oversold the Silicon Valley model of entrepreneurship? Small Business Economics, 56(4), 849–856.

Autio, E., & Fu, K. (2015). Economic and political institutions and entry into formal and informal entrepreneurship. Asia Pacific Journal of Management, 32(1), 67–94.

Autio, E., & Thomas, L. D. W. (2014). Innovation ecosystems: Implications for innovation management. In The Oxford handbook of innovation management, M. Dodgson, N. Phillips, & D.M. Gann (Eds.), (pp. 204–228). Oxford, U.K.: Oxford University Press.

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018a). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12, 72–95.

Autio, E., Szerb, L., Komlósi, É., & Tiszberger, M. (2018b). The European index of digital entrepreneurship systems. JRC Technical Reports, EUR 29309 EN, JRC112439. Luxembourg: Publications Office of the European Union.

Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: A regional cross-section growth regression approach. Small Business Economics, 49(1), 31–54.

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal, 15, 1291–1321.

Coad, A., Daunfeldt, S.-O., Hölzi, W., Johansson, D., & Nightingale, P. (2014). High-growth firms: Introduction to the special section. Industrial and Corporate Change, 23(1), 91–112.

Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14.

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331.

Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Venturing, 18(6), 689–708.

Dini, P., Iqani, M., & Mansell, R. (2011). The (im)possibility of interdisciplinary lessons from constructing a theoretical framework for digital ecosystems. Culture, Theory and Critique, 52(1), 3–27.

Du, W., Pan, S. L., Zhou, N., & Ouyang, T. (2018). From a marketplace of electronics to a digital entrepreneurial ecosystem (DEE): The emergence of a meta-organization in Zhongguancun. China. Information Systems Journal, 28(6), 1158–1175.

Dul, J. (2015). Necessary condition analysis (NCA) with R (Version 3.0.3): A quick start guide. Revised June 11, 2020. Available at SSRN: https://ssrn.com/abstract=2624981 (accessed December, 29, 2020).

Dul, J. (2016). Necessary Condition Analysis (NCA): Logic and methodology of “necessary but not sufficient” causality. Organizational Research Methods, 19(1), 10–52.

Dul, J., van der Laan, E., & Kuik, R. (2020). A statistical significance test for necessary condition analysis. Organizational Research Methods, 23(2), 385–395.

Elia, G., Margherita, A., & Passiante, G. (2020). Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technological Forecasting & Social Change, 150, 179791

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2013). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28(4), 564–580.

Evans, D. S., & Schmalensee, R. (2016). Matchmakers: The new economics of multisided platforms. Harvard Business Review Press.

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. Wiley.

Furnari, S., Crilly, D., Misangyi, V. F., Greckhamer, T., Fiss, P. C., & Aguilera, R. V. (2020). Capturing causal complexity: Heuristics for configurational theorizing. Academy of Management Review (in press). https://doi.org/10.5465/amr.2019.0298

Georgallis, P., & Durand, R. (2017). Achieving high growth in policy-dependent industries: Differences between start-ups and corporate-backed ventures. Long Range Planning, 50, 487–500.

Greckhamer, T., Furnari, S., Fiss, P. C., & Aguilera, R. V. (2018). Studying configurations with qualitative comparative analysis: Best practices in strategy and organization research. Strategic Organization, 16(4), 482–495.

Grilli, L., & Murtinu, S. (2014). Government, venture capital and the growth of European high-tech entrepreneurial firms. Research Policy, 43(9), 1523–1543.

Isenberg, D. (2010). The big idea: How to start an entrepreneurial revolution. Harvard Business Review, June, 1 https://hbr.org/2010/06/the-big-idea-how-to-start-an-entrepreneurialrevolution

Jacobides, M. G., Cennamo, C., & Gawer, A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(8), 2255–2276.

Jung, K., Eun, J. H., & Lee, S. H. (2017). Exploring competing perspectives on government-driven entrepreneurial ecosystems: Lessons from Centres for Creative Economy and Innovation (CCEI) of South Korea. European Planning Studies, 25(5), 827–847.

Kenney, M., & Zysman, J. (2016). The rise of the platform economy. Issues in science and technology, 32(3).

Krasniqi, B. A., & Desai, S. (2016). Institutional drivers of high-growth firms: Country-level evidence from 26 transition economies. Small Business Economics, 47, 1075–1094.

Kuratko, D. F., Fisher, G., Bloodgood, J. M., & Hornsby, J. S. (2017). The paradox of new venture legitimation within an entrepreneurial ecosystem. Small Business Economics, 49, 119–140.

Malecki, E. J. (1997). Entrepreneurs, networks, and economic development: A review of recent research. In J. A. Katz (Ed.), Advances in entrepreneurship, firm emergence, and growth (pp. 57–118). JAI Press.

Markus, M., & Loebbecke, C. (2013). Commoditized digital processes and business community platforms: new opportunities and challenges for digital business strategies. MIS Quarterly, 37(2), 649–653.

Miller, D., & Acs, Z. J. (2017). The campus as entrepreneurial ecosystem: The University of Chicago. Small Business Economics, 49(1), 75–95.

Moreno, F., & Coad, A. (2015). High-growth firms: Stylized facts and conflicting results. In Katz, J., & Corbertt, A. (Eds.), Entrepreneurship Growth: Individual, Firm, and Region, (pp. 87–230). Emerald Group Publishing Limited.

Muñoz, P., & Dimov, D. (2015). The call of the whole in understanding the development of sustainable ventures. Journal of Business Venturing, 30, 532–654.

Muñoz, P., Kibler, E., Mandakovic, V., & Amorós, J. E. (2020). Local entrepreneurial ecosystems as configural narratives: A new way of seeing and evaluating antecedents and outcomes. Research Policy (in press), https://doi.org/10.1016/j.respol.2020.104065

Nambisan, S. (2017). Digital entrepreneurship: Toward a digital technology per s pective of entrepreneurship. Entrepreneurship Theory and Practice, 41(6), 1029–1055.

Nambisan, S., Wright, M., & Feldman, M. (2019). The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Research Policy, 48(8), 103809.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

Ragin, C. C. (2008). Redesigning social inquiry: Fuzzy sets and beyond. University of Chicago Press.

Rihoux, B., & Ragin, C. (2009). Configurational comparative methods: Qualitative comparative analysis (QCA) and related techniques. Sage.

Schrijvers, M., Stam, E., & Bosma, N. (2021). Figuring it out: Configurations of high-performing entrepreneurial ecosystems in Europe. Utrecht University School of Economics – U. S. E. Working Paper Series nr: 21–05. Available at https://www.uu.nl/en/organisation/utrecht-university-school-of-economics-use/research/publications/working-papers/2021 (accessed May 1, 2021).

Song, A. K. (2019). The digital entrepreneurial ecosystem – A critique and reconfiguration. Small Business Economics, 53, 569–590.

Spigel, B., & Harrison, R. (2018). Toward a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168.

Spigel, E. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49–72.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769.

Stam, E., & van de Ven, A. (2019). Entrepreneurial ecosystem elements. Small Business Economics (in press). https://doi.org/10.1007/s11187-019-00270-6

Stam, F. C., & Spigel, B. (2016). Entrepreneurial ecosystems. USE Discussion paper series, 16(13).

Startup Genome (2019). Global startup ecosystem report. Retrieved on July 12, 2020 from https://startupgenome.com/report/gser2020

Sussan, F., & Acs, Z. J. (2017). The digital entrepreneurial ecosystem. Small Business Economics, 49(1), 55–73.

Thompson, T., Purdy, J., & Ventresca, M. J. (2018). How entrepreneurial ecosystems take form: Evidence from social impact initiatives in Seattle. Strategic Entrepreneurship Journal, 12(1), 96–116.

Tilson, D., Lyytinen, K., & Sørensen, C. (2010). Research commentary-digital infrastructures: the missing IS research agenda. Information Systems Research, 21(4), 748–759.

Tsvetkova, A. (2015). Innovation, entrepreneurship, and metropolitan economic performance: empirical test of recent theoretical propositions. Economic Development Quarterly, 29(4), 299–316.

Vis, B., & Dul, J. (2018). Analyzing relationships of necessaty not just in kind but also in degree: Complementing fsQCA with NCA. Sociological Methods & Research, 47(4), 872–899.

Weil, P., & Woerner, S. L. (2015). Thriving in an increasingly digital ecosystem. MIT Sloan Management Review, 56(4), 27–34.

Williamson, O. E. (2000). The new institutional economics: Taking stock, looking ahead. Journal of Economic Literature, 38(3), 595–613.

Xie, Z., Wang, X., Xie, L., & Duan, K. (2021). Entrepreneurial ecosystem and the quality and quantity of regional entrepreneurship: A configurational approach. Journal of Business Research, 128, 499–509.

Yoo, Y., Henfridsson, O., & Lyytinen, K. (2010). The new organizing logic of digital innovation: An agenda for information systems research. Information Systems Research, 21(4), 724–735.

Funding

This work has been funded by national funds through FCT – Fundação para a Ciência e a Tecnologia, I.P., Project UIDB/05037/2020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Torres, P., Godinho, P. Levels of necessity of entrepreneurial ecosystems elements. Small Bus Econ 59, 29–45 (2022). https://doi.org/10.1007/s11187-021-00515-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-021-00515-3

Keywords

- Digital entrepreneurial ecosystems

- Entrepreneurial ecosystem performance

- Unicorns

- Multisided platforms

- Fs/QCA

- NCA