Abstract

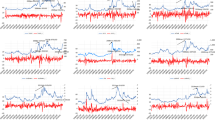

This research is focused on analyzing spillover effects from crude oil to agricultural commodities futures markets. Moreover, emphasis is placed on the “reverse” relationships between spot and futures markets with particular attention given to the interrelationships. The study is interesting for reasons of economics and finance as well as for taking into account geo-political considerations. This study lends insight into the empirical validity of reverse regressions hypothesizing that spot prices today contain information useful for predicting forward rates in the future. This paper considers the importance of the effects of temporal aggregation as well as alternative time series model specifications and assumptions on the distributions of residuals. In addition to the assumption of normality, the paper considers use of a fat-tailed distribution (multivariate t-distribution) to examine the robustness of results that are based on the normality assumption. Finally, models are compared in terms of ex post predictive validity.

Similar content being viewed by others

References

Affleck-Graves J, McDonald B (1989) Nonnormalities and tests of asset pricing theories. J Finance 44:889–908

Altay-Salih A, Pinar M, Leyffer S (2003) Constrained nonlinear programming for volatility estimation with GARCH models. SIAM Rev 45:485–503

Andersen TG, Bollerslev T (1998) Answering the skeptics: yes, standard volatility models do provide accurate forecasts, symposium on forecasting and empirical methods in macroeconomics and finance. Int Econ Rev 39:885–905

Baffes J (2007) Oil spills on other commodities. Resour Policy 32:126–134

Balcombe K (2010) The nature and determinants of volatility in agricultural prices: an empirical study from 1962–2008, 2–24, in Commodity Market Rev, 2009–2010. Food and Agriculture Organization of the United Nations. FAO, Rome

Bauwens L, Laurent S, Rombouts JVK (2006) Multivariate GARCH models: a survey. J Appl Econom 21:79–109

Beak J, Seo JY (2015) A study on unoberserved innovations of oil price: evidence from global stock, bond, foreign exchange, and energy markets. Rev Pac Basin Finance Mark Policies 18:1550004

Black S (1976) Rational response to shocks in a dynamic model of capital asset pricing. Am Econ Rev 66:767–779

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 307–327

Bollerslev T, Engle R, Nelson DB (1994) ARCH models. In: Engle RF, McFadden DL (eds) Handbook of econometrics, vol IV. Elsevier, New York

Bopp AE, Lady GM (1991) A comparison of petroleum futures versus spot prices as predictors of prices in the future. Energy Econ 13:274–282

Brown O (2008) From feast to famine: after seven good years what now for commodity producers in the developing world. In: International Institute for Sustainable Development (IISD) Manitoba, Canada

Campbell JY, Shiller RS (1987) Cointegration and tests of present value models. J Pol Econ 95:1062–1088

Campiche JL, Bryant HL, Richardson JW, Outlaw JL (2007) Examining the evolving correspondence between petroleum prices and agricultural commodity prices. Selected Paper prepared for presentation at the American Agricultural Economics Association annual meeting, Portland, Oregon, July 29–August 1, 2007

Cartwright P, Lee CF (1987) Time aggregation and the estimation of the market model: empirical evidence. J Econ Bus Stat 5:131–143

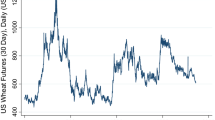

Cartwright PA, Riabko N (2015) Measuring the effect of oil prices on wheat futures prices. Res Int Bus Finance 33:355–369

Chang CL, McAleer M, Tansuchat R (2012) Modeling long term memory volatility in agricultural commodity futures returns. Unpublished manuscript. http://eprints.ucm.es/15093/1/1210.pdf. Accessed Feb 2014

Chen SW, Lin SM (2014) Non-linear dynamics in international resource markets: evidence from regime switching approach. Res Int Bus Finance 30:233–247

Chen Y, Rogoff K, Rossi B (2008) Can exchange rates forecast commodity prices? National Bureau Econ Res, Working Paper 13901

Chen S, Kuo H, Chen C (2010) Modeling the relationship between the oil price and global food prices. Appl Energy 87:2517–2525

Diaw A, Olivero B (2011) Empirical evidence of CAC 40 futures volatility under crisis. Int Res J Finance Econ 67:130–141

Doong SC, Yang SY, Chiang TC (2005) Response asymmetries in asian stock markets. Rev Pac Basin Finance Mark Policies 8:637–657

Drost FC, Nijman TE (1993) Temporal aggregation of GARCH processes. Econometrica 61:909–927

Dufour J, Khalaf L, Beaulieu M (2003) Exact Skewness–Kurtosis tests for multivariate normality and goodness-of-fit in multivariate regressions with application to asset pricing models. Oxf Bull Econ Stat 65:891–906

Engel C, West KD (2005) Exchange rates and fundamentals. J Pol Econ 113:485–517

Engle RF (1982) Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50:987–1007

Engle RF (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroscedasticity models. J Bus Econ Stat 20:339–350

Engle RF, Liu TC (1972) Effects of aggregation over time on dynamic characteristics of an econometric model. In: Hickman BG (ed) Econometric models of cyclical behaviour. Columbia University Press, New York, pp 673–728

Fama EF (1965) The Behavior of Stock Market Prices. J Bus 38:34–105

Cumby R, Figlewski, S, Hasbrouck J (1993) Forecasting volatility and correlations with EGARCH models. J Deriv Winter 51–63

Figlewski S (1997) Forecasting Volatility. Financ Mark Inst Instrum 6:1–88

Fildes R, Petropoulos F (2013) An evaluation of simple forecasting model selection rules. Lancaster University Management School, Working Paper 2013:2, Lancaster University Management School, Department of Management Science, Lancaster, UK

Frino A, Jarnecic E, Zheng H (2010) Activity in futures: does underlying market size relate to futures trading volume. Rev Quant Finance Acc 34:313–325

Fung HG, Leung WK, Xu XE (2003) Information flows between the U.S. and China commodity futures trading. Rev Quant Finance Acc 21:267–285

Gilbert CL (2010a) How to understand high food prices. J Agric Econ 61:398–425

Gilbert CL (2010b) Food versus fuel: what do prices tell us? Energy Policy 38:445–451

Glosten LR, Jagannathan R, Runkle DE (1992) On the relation between the expected value and volatility and of the nominal excess returns on stock. J Finance 46:137–158

Goutte S (2013) Pricing and hedging in stochastic volatility regime switching models. J Math Finance 3:70–80

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Harrigan J (2014) The political economy of Arab food sovereignty. Palgrave Macmillan, London

Hotelling H (1931) The economics of exhaustible resources. J Pol Econ 39:137–175

International Grains Council (2013) Information services. http://www.igc.int. Accessed Nov 1 2013

Jorion P (1995) Predicting volatility in the foreign exchange market. J Finance 50:507–528

Judge GG, Griffith WE, Hill RC, Lütkepohl H, Lee TC (1985) The theory and practice of econometrics, 2nd edn. Wiley, New York

Knittel CR, Pindyck R (2013) The simple economics of commodity price speculation. MIT Center for Energy and Environmental Policy Research, CEEPR WP 2013-06

Lin CC, Chen SY, Huang DY (2003) An application of threshold co-integration to Taiwan Stock Index futures and spot markets. Rev Pac Basin Finance Mark Policies 6:291–304

Liu SM, Brorsen BW (1995) GARCH-stable as a model of futures price movements. Rev Quant Finance Acc 5:155–167

Mandelbrot B (1963) New methods in statistical economics. J Pol Econ 71:421–440

Marcellino M (1999) Some consequences of temporal aggregation in empirical analysis. J Bus Econ Stat 17:129–136

McAleer M (2005) Automated inference in learning in modeling financial volatility. Econom Theory 21:232–261

McAleer M, Chan F, Marinova D (2007) An econometric analysis of asymmetric volatility: theory and application to patents. J Econom 139:259–284

Merton RC (1976) An intertemporal capital asset pricing model. Econometrica 41:867–887

Muhammed A, Kebede E (2009) The emergence of an agro-energy sector: is agriculture importing instability from the oil sector? Choices 24:12–15

Nazlioglu S (2011) World oil and agricultural commodity prices: evidence from nonlinear causality. Energy Policy 39:2935–2943

Nelson DB (1990) Stationarity and persistence in the GARCH (1, 1) model. Econom Theory 6:318–334

Nelson D (1991) Conditional heteroscedasticity in asset returns: a new approach. Econometrica 59:347–370

Pindyck R (2001) Dynamics of commodity spot and futures markets: a primer. Energy J 22:1–29

Richardson M, Smith T (1993) A test for multivariate normality in stock returns. J Bus 66:295–321

Roberts MJ, Schlenker W (2013) Identifying supply and demand elasticties of agricultural commodities: implications for the US ethanol mandate. Am Econ Rev 103:2265–2295

Rowe R (1976) The effects of temporal aggregation over time on T-ratios and R2’s. Int Econ Rev 17:751–757

Saghaian SH (2010) The impact t of the oil sector on commodity prices: correlation or causation. J Agric Appl Econ 42:477–485

Shiller RK (1984) Stock prices and social dynamics. Brook Pap Econ Act 2:457–498

Silvestrini A, Veredas D (2005) Temporal aggregation of univariate linear time series models. Core Discussion Papers 2005059, Université catholique de Louvain, Center for Operations Research and Econometrics (CORE)

STATA (1985–2011) Time series, Release 12. Stata Press, College Station

Trujillo-Barrera A, Mallory M, Garcia P (2012) Volatility spillovers in U.S. crude oil, ethanol, and corn futures markets. J Agric Res Econ 37:247–262

Woertz E (2011) Arab food, water, and the big land grab that wasn’t. Brown J World Aff 2011:104–117

Yu TE, Bessler DA, Fuller S (2006) Cointegration and causality analysis of world vegetable oil and crude oil prices. In: Proceedings of the American Agricultural Economics Association annual meeting, Long Beach, CA, July 23–26

Zhang Q, Reed M (2008) Examining the impact of the world crude oil price on China’s agricultural commodity prices: the case of corn, soybean, and pork. In: Proceedings of the Southern Agricultural Economics Association annual meetings, Dallas, TX, February 2–5

Zheng Y, Kinnucan H, Thompson H (2008) News volatility of food prices. Appl Econ 40:1629–1635

Acknowledgments

The authors wish to thank James L. Smith, Southern Methodist University; C. F. Lee, Rutgers University and National Chiao Tung University; Octavio Escobar, ESG Management School; Ted Bos, University of Alabama-Birmingham; and Josse Roussel, Université Paris Dauphine and anonymous referees for helpful comments and criticisms. A part of this work was completed while the corresponding author was a visiting scholar at National Chiao Tung University. He extends thanks for support and helpful comments from faculty and students at NCTU.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cartwright, P.A., Riabko, N. Further evidence on the explanatory power of spot food and energy commodities market prices for futures prices. Rev Quant Finan Acc 47, 579–605 (2016). https://doi.org/10.1007/s11156-015-0513-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-015-0513-5