Abstract

All families in Finland have the freedom to choose between subsidized home care, universal public childcare, and private childcare. We study the impact of the introduction of private childcare subsidies in Finland. Private childcare subsidies have causal effects on take-up but no impact on home care or employment among women with small children. Instead, private services seem to crowd out public childcare. Private services have a socioeconomic gradient by mother’s education that steepens when the subsidy increases. Families’ preferences between home care, public childcare, and private childcare do not explain the result.

Similar content being viewed by others

1 Introduction

Several European economies offer early childhood education and care (ECEC) services as both private and public provision. Governments fund private provision with either direct subsidies or vouchers to families or firms or with tax credits (Berlinski and Vera-Hernández 2019, Penn 2014).

Finland is an informative context to study with applications to other OECD countries. The public sector is required to supply ECEC to all children below school age, and it can offer publicly organized services or approve private service providers. In addition, cash-for-care subsidies for home care are available to all families with children under the age of three. Both public and private childcare are heavily subsidized, which allows parents to choose the care provider. There are no supply limits; instead, the out-of-pocket price differs, which we use to identify causal demand effects.

In this paper, we study if introducing private childcare subsidies in the Finnish universal childcare regime affects the take-up of private care (center-based and family day care), home care, and maternal employment as well as the implications for public childcare. We identify the causal effect of childcare subsidies conditional on identification assumptions.

While private childcare take-up was low at the beginning of the 2000s, we find that the subsidies increased demand substantially. During our research period (2000–2009), on average 2.7% of families with small children used private center-based day care and the corresponding share for private family day care was 1.9%. Depending on the age of the child, demand for center-based private day care increases by 17–20% for every €100 increase in the subsidy. Similarly, demand for private family day care increases by 10–26% for every €100 increase in the supplement.

Pilarz et al. (2019) found a socioeconomic gradient in childcare take-up by income. Similarly, studies on no-use subsidies identify a socioeconomic gradient between no-use subsidies and day care take-up by immigrant background, income, and education (Hardoy and Schøne 2010, Österbacka and Räsänen 2022). It is unclear how much childcare policy, selection or differences in preferences explain the observed socioeconomic gradients. We contribute to the discussion by showing that fixed-sum private day care subsidies have a socioeconomic gradient by mother’s education, which steepens as the subsidy increases. Families’ preferences between home care, public day care, and private childcare do not explain the result.

Previous research shows that public policies, such as subsidized childcare, have a positive effect on female employment and child development. However, subsidizing childcare does not necessarily increase female employment or generate more tax revenue than the alternatives, such as home care or informal care (Eckhoff Andresen and Havnes 2019, Glomm and Meier 2020, Lundin et al. 2008). Previous research in the Finnish context on the effects of private childcare subsidies finds no employment effects; however, the subsidies increase the demand for private services (Österbacka and Räsänen 2022, Viitanen 2011). In addition to previous literature, we are able to separate the effects of different private ECEC subsidies. We focus on private family day care and private center-based day care in the main results.Footnote 1 Private family day care subsidies show a weak positive impact on employment. If family day care is an intermediate step between parental care and care outside the home, then subsidizing private family day care could increase female employment. Overall, private ECEC subsidies have no employment effects.

Additionally, no-use subsidies, such as cash-for-care subsidies, prolong home care and reduce labor force participation among mothers (Giuliani and Duvander 2017, Hardoy and Schøne 2010, Kosonen 2014, Österbacka and Räsänen 2022). In addition to reduced employment, we find that cash-for-care subsidies crowd out not only public but also private childcare.

Our identification strategy uses variation in municipal-level subsidies. If increases in the subsidies are exogenous to the choices among families between public and private childcare, variation in the subsidies identifies the causal effect on private ECEC demand. If municipalities react to increased demand by increasing subsidies, then this could violate necessary identifying assumptions. However, municipalities have different reasons for offering subsidies, including providing residents with different alternatives, freedom to choose different early education providers, or, more pragmatically, cost reduction (Lahtinen and Svartsjö 2018, Ruutiainen et al. 2019). In addition, common trend assumption between the treatment group, i.e., municipalities that increase or adopt new subsidies, and control group must hold. We find support that common trend assumption holds for the main outcomes, including average take-up and heterogeneity in take-up. The identification strategy is presented in more detail in subsection Additional results.

This paper proceeds with a presentation of the institutional background and related literature in section Background. The data used and the empirical strategy are presented in section Empirical strategy, followed by the results in section Results and conclusions in section Conclusions.

2 Background

2.1 Institutional background

The Nordic countries have high female labor force participation, and therefore, high demand for ECEC services. The share of private provision in ECEC services has increased in recent years, but researchers and policy-makers know relatively little about ECEC markets and regulation in Europe. Commissioned by the European Commission, Penn (2014) provides a snapshot of the ECEC markets in Europe in the early 21st century. States subsidize private services for various reasons, and the proportion of children aged 0–6 attending private services varies by country. For instance, the proportion of children in private services in the Nordic countries varied from ~5% in Finland and Denmark to 18% in Sweden and 54% in Norway (Penn 2014).

The education and care of young children is resource intensive with high personnel costs. Proportional to GDP, Nordic countries spend more on public ECEC than Southern and Central European countries. In 2015, the total public expenditure on pre-primary education and day care in the Nordic countries varied from 1.1% of GDP in Finland to 1.6% in Sweden and 1.8% in Iceland. In terms of expenditure, many other European countries were below the OECD average of 0.7% of GDP. Informal care is nearly nonexistent in Denmark, Finland, and Sweden, while a few percent of the children in Norway and a higher proportion in Iceland use informal care (OECD 2019).

In comparison to the other Nordic countries, the enrolment rate in ECEC is lower in Finland. In the early 2000s, <60% of children between the ages of one and six participated in ECEC. The proportion increased to 62.3% in 2010. Few children attended private services at the beginning of the 1990s and 2000s. However, the number of children in private services increased after the introduction of a private day care allowance in 1997. In the 2000s, around 7–8% of all children in ECEC used private services. The proportion increased to over 17% in 2020 (Kela 2016, Säkkinen and Kuoppala 2021). The introduction of private day care allowance was followed by the first expansion of private ECEC services in the 2000s and accounted for the majority of private ECEC services in the 2000s.Footnote 2 A second expansion in the 2010s followed the introduction of private childcare vouchers (Ruutiainen et al. 2019).

Finland has universal family policies with subsidized public, private, and home care of small children. During the research period, the earnings-related parental leave period ended when the child was ~9 months old. After the parental leave, parents can choose between subsidized childcare and subsidized home care. Table 1 describes the available childcare options by age of the child and statutory allowances.

Home care is subsidized until the child turns three. Parents employed with a permanent contract before the leave period have job protection during home care leave. If the family chooses home care, they are entitled to a flat-rate home care allowance (cash-for-care) if their youngest child is under 3 years old and does not attend public day care or a publicly subsidized service. An additional allowance is paid if older siblings (3–5 years old) are cared for at home at the same time. In addition, some municipalities offer municipal supplements to the allowance. Both parents are eligible for cash-for-care but, usually, it is the mother who stays at home with the child for a shorter or longer period after the parental leave. Cash-for-care reduces employment of mothers and, as a consequence, children’s participation in ECEC (Kosonen 2014, Österbacka and Räsänen 2022). Municipalities are required to offer care for under-school-age children living in the municipality. If families choose private ECEC services approved by the municipality, the municipalities are required to pay a statutory private day care allowance. Some municipalities offer additional municipal supplements. The private day care fees vary by the age of the child.

Both private and public childcare can be either center-based or family day care (FDC). The public alternatives are subject to a modest means-tested fee. The public childcare fee depends on the income and size of the family but not on the child’s age.

Municipal-level variation in the allowances enables us to make causal inferences if allowances vary independently of trends in the ECEC supply and demand or employment among women with young children. All municipalities offer at least a fixed-sum and means-tested private day care allowances for all eligible families. Optionally, municipalities may subsidize private services or home care by paying an additional supplement to residents, henceforth referred to as municipal supplements. During the research period, municipalities could subsidize three different private ECEC services and home care with municipal supplements. However, almost all of the municipalities offering one supplement offered supplements for all three types of private childcare: center-based care in private day care centers, private family day care, and a private childminderFootnote 3.

Municipalities accept and monitor private service providers, which are either firms, entrepreneurs, or private individuals in contracted employment with families. For-profit or non-profit firms typically arrange center-based private day care. Around 60% of all children in private services subsidized by the private day care allowance in 2009 were in private day care centers. At the same time, more than a quarter of families used a private family day care provider, and nearly 13% of children in private ECEC were cared for by a private childminder (Pohjola et al. 2013). Overall, the majority of children are cared for in day care centers, and the share of children in family day care has been decreasing since the turn of the century (Säkkinen and Kuoppala 2021).

With regard to the quality of ECEC, all service providers operate under the same ECEC jurisdiction in Finland. Among other things, the number of children per caregiver and their formal education requirements are legislated. At the beginning of the 2000s, the Ministry of Social Affairs and HealthFootnote 4 regulated ECEC. The group sizes are larger in center-based care, while family day care is usually carried out in the caregiver’s home with only few children. Municipalities are required to arrange ECEC services and, hence, approve and monitor the private service providers within their municipality. In theory, all ECEC care providers have the same minimum standard. However, municipalities acknowledged in a survey that the quality of private ECEC services varies, and that it is difficult to monitor the quality (Riitakorpi et al. 2017). With the current register data, it is difficult to reliably study whether quality differs between care providers.

As mentioned earlier, public expenditure on pre-primary education and day care is highest in the Nordic countries with public or universal childcare regimes. Real public expenditure on ECEC depends on the municipal tax rate, additional municipal supplements for home care and private day care, and the price of public day care. Home care and private day care are least expensive for the municipality, while the annual unit cost per child in municipal day care is considerably higher. Subsidized home care and private ECEC deliver cost savings for municipalities. In the six largest cities in Finland in 2010, the unit cost per child averaged €9449 per child in public center-based day care and €11,785 in public family day care, while the cost in private day care was €5353 per child (including statutory allowances and municipal supplements) (Heinonen 2011). At the same, the average costs of cash-for-care (including statutory allowances and municipal supplements) were €4958 per child for the municipality. However, comparing the direct cost of public, private, and home care for municipalities is challenging. For example, if the secondary earner returns to employment, the municipality gains additional tax revenues but the increased revenues may not offset the cost of public day care.Footnote 5

2.2 Related literature

This study and its institutional context relate to four different strands in literature on childcare subsidies. First, the topics of employment, price, and demand for childcare are widely studied in economics, but the results depend on the institutional context, such as private or public provision. More specifically, studies on public or universal childcare regimes are the most relevant to this study. Second, no-use subsidies, which have been studied especially in the Nordic context, affect the relative price and choice of childcare. Thirdly, while equity and segregation have been studied especially in education, there is little economic literature and few causal estimates for the early stages of education. Lastly, the net costs of the programs have been neglected in literature, with the exception of a few studies (Berlinski et al. 2020, Eckhoff Andresen and Havnes 2019). The present paper contributes to the first two strands of literature on employment, demand, and no-use subsidies. In addition, we suggest a need for future research and offer policy recommendations for the last two.

First, results on employment, price, and demand for childcare are mixed even within the universal childcare regime, highly subsidized regimes, or regimes where public provision is more common than private provision. Increased subsidies or lower childcare prices do not necessarily increase female labor force participation in highly subsidized Nordic or European childcare regimes (Akgunduz and Plantenga 2013, Lundin et al. 2008). Several studies report small employment gains from public or universal day care. Average gains from public day care or childcare subsidies may be small, but heterogeneous effects may be masked behind the average treatment effect (de Muizon 2020, Schuss and Azaouagh 2021).

Additionally, the reallocation of childcare slots or caregivers explains several null results or small employment and take-up gains from public or universal day care. Subsidies may cause families to reallocate to different caregivers (de Muizon 2020). In fact, public provision of or support for day care might not have a causal impact on female labor force participation; instead, publicly supported day care might crowd out informal care arrangements instead (Brewer et al. 2016, Havnes and Mogstad 2011, Viitanen 2011). Similarly, an increase in public provision may crowd out private provision (Bassok et al. 2014, Schuss and Azaouagh 2021). In this paper, we show that when universal subsidized public day care is available, private ECEC subsidies may cause reallocation of childcare slots; instead of reducing home care, private ECEC subsidies increase the use of private ECEC services while crowding out public day care.

Second, no-use subsidies such as cash-for-care, another relevant strand in the literature, generally increase the relative price of childcare and reduce demand for formal childcare and female labor supply (Glomm and Meier 2020, Kornstad and Thoresen 2007). Similarly, families with different backgrounds may react differently to changes in the relative price of day care. Unfortunately, the families that would benefit most from ECEC react the strongest to the no-use subsidies by reducing formal day care participation. Previous research has found that no-use subsidies reduce day care demand especially among non-western immigrant mothers and that mothers from low socioeconomic status (SES) families delay the labor market entry (Hardoy and Schøne 2010, Österbacka and Räsänen 2022). In addition to previous studies, we show that cash-for-care not only reduces public day care participation but also private center-based day care and family day care participation.

Third, several studies in education and social policy discuss equity and public policies in ECEC,Footnote 6 and few studies in economics discuss the equity and efficiency in ECEC (Wößmann 2008). However, there is some evidence that the subsidies or type of provision may affect equity and segregation either directly or indirectly. Firstly, policies or regulation that increase or decrease the relative price of formal childcare also indirectly affect which children attend the services and which children are in home care (Österbacka and Räsänen 2022). Secondly, some policies may have a direct effect on segregation. For instance, when private provision increases over public provision, new private services could concentrate in high-income neighborhoods (Noailly and Visser 2009). Overall, different types of childcare providers along with opportunity costs might cause sorting of children and, consequently, children would meet peers with family backgrounds similar to their own. Neidell and Waldfogel (2010) found in an early education context that in addition to family background and teachers, peers influence cognitive outcomes as well.

Children benefit from the highest quality services produced with the available resources. Increasing the proportion of children in high quality childcare is an educational investment. High quality childcare improves both cognitive and non-cognitive skills, which facilitate later learning. Children from less affluent backgrounds are likely to be less endowed and benefit more from external support than children from more prosperous backgrounds (Cornelissen et al. 2018, Heckman, Stixrud and Urzua 2006, van Huizen and Plantenga 2018). High quality education and care early in life can equalize opportunities among children with different backgrounds, which contributes to more equal outcomes. In contrast, quality differences related to family background characteristics can aggravate differences (Datta Gupta and Simonsen 2010, Rege et al. 2018, van Huizen and Plantenga 2018). However, high quality ECEC is resource intensive. For these reasons, choosing an optimal subsidy scheme is vital for both efficiency and equity. ECEC policies can be both efficient and equitable if an optimal policy scheme is chosen (Wößmann 2008). In accordance with previous studies, we find that childcare subsidies have heterogeneous effects. Heterogeneous effects imply that the use of ECEC varies between families from different socioeconomic backgrounds.

Lastly, as seen in the previous section, home care, even when subsidized, increases public expenditure less than universal public day care. However, it is hard to evaluate efficiency, the direct net costs of public childcare, or welfare effects. On average, reducing the price of public childcare may increase the labor supply of families with small children. However, only a small portion of public childcare expenditure is offset by increased tax revenue when children are enrolled in formal childcare (Eckhoff Andresen and Havnes 2019). Furthermore, efficient subsidy schemes depend on the price of childcare and the amount of means testing. When compared to public childcare, non-means tested vouchers are relatively expensive, while means-tested or income-requirement vouchers are associated with the lowest public expenditure (Berlinski et al., 2020). In summary, private provision may be more cost-effective than public provision. On the other hand, public services can provide equitable access to childcare but at an increased public expenditure (Baker et al. 2008, Berlinski et al. 2020).

3 Empirical strategy

3.1 Data sources and descriptive statistics

Our sample includes households where the youngest child is between 9 months and 5 years old during the research period spanning from 2000 to 2009. The 60% sample is drawn from the administrative registers of the Social Insurance Institution of Finland (Kela) and it links to register data from Statistics Finland.Footnote 7 The main data set includes unit-level data on individuals and families, such as labor market information and disposable income of the household. Administrative register information guarantees the absence of measurement errors due to self-reporting or top coding. Similarly, municipality-specific policy data from administrative registers on available and paid subsidies guarantees that there are no measurement errors in the take-up or policy variables.

Families apply for a fixed-sum and means-tested private day care allowance from the national social security institution, the Social Insurance Institution of Finland. Municipalities can choose to either pay no additional municipal supplements, administer and pay the supplements locally out of the municipal budget, or automate the payment of the municipal supplement to the Social Insurance Institution. If municipalities choose to administer the supplement themselves, they can add more eligibility criteria. It is, however, less cost-effective than automation. Over half of the families in the sample live in a municipality that has automated the payment of the municipality-specific supplements. Around a third of the families live in a municipality not offering any supplement and around one out of six live in a municipality administering the supplements themselves. We have exact policy rules for the municipalities that automate the payment of municipal supplements. The policy data set includes available municipal supplements and eligibility criteria for different municipal private day care and cash-for-care supplements by the age of the youngest child and municipality of residence. For the municipalities administering the supplement themselves, the policy data set includes no information on the supplement level. Instead, we construct a dummy variable indicating that the municipality administers the supplement themselves (0 = no/1 = yes) in the analyses.Footnote 8

Table 2 shows the background variables for the sample used, presented separately for households with children in home care or public care (No use of private day care allowance), and in private care (Use of private day care allowance). Municipalities offer public center-based day care or family day care, which are options for all families. As private alternatives, we use information on private center-based day care and private family day care allowance, since both options are available in most municipalities as public day care. On average, mothers are around 33 years old and have ~1.4 children under the age of six and the youngest child being around 3 years old. Mothers using the private day care allowance are more likely to be highly educated and living in urban municipalities. Furthermore, if families receive private day care allowance, they are more likely to live in a municipality offering municipal supplements. Only 13% of families who use private day care allowance live in a municipality not offering any supplements.

Table 3 presents the average monthly prices of ECEC services for families with children at 2010 prices. The private day care fee is higher in private day care centers than among private family day care providers. The average level of total subsidies varies between €292 and €366 per child, and municipal supplements account for half of the total subsidies. The average out-of-pocket payment varies as well: It is higher in private day care centers and lower if the family uses private family day care. By comparison, the public day care fee varies with income and the number of children in the family. The descriptive statistics show that those who use private care alternatives have, on average, higher income and would have higher municipal day care fees than those who use municipal day care.

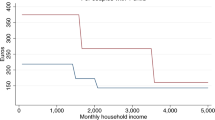

Compared to low-income families, high-income families buy relatively more expensive services. Furthermore, when comparing public day care fees and out-of-pocket costs in private day care, public childcare is less expensive for low-income families than for high-income families. Figure 1 represents the average monthly price in private childcare and compares it to public childcare fees. Both family day care and center-based care are included in public and private care. The top line represents the average price without any subsidies in private childcare (FDC or center-based care). The second line from the top represents the out-of-pocket cost after deducting statutory allowances (both means-tested and fixed-sum) from the price. Means testing reduces the average price for families in the first and second income quintiles. Lastly, the third line from the top represents the final out-of-pocket cost that families pay after all subsidies, including statutory allowances and municipal supplements, have been deducted. Overall, the price difference between private and public day care (represented by the lowest line in Fig. 1) is higher for low-income families than high-income families.

Prices and out-of-pocket costs of municipal and private childcare by income quintile in 2009 at 2010 prices. The sample includes prices for private center-based day care and private family day care for families using private services. The sample includes all households with children between 9 months and 5 years of age, none of whom are in home care. Families living in municipalities paying the supplement themselves are excluded. The figure presents the price of public day care as an alternative for the private services used. The public day care fees are estimated with a microsimulation model based on family size and income

3.2 Continuous difference-in-difference estimator

Kornstad and Thoresen (2007) point out that families decide on the labor market re-entry and childcare provider simultaneously. Families can choose between public and private care providers. The identification strategy for causal effects of private fixed-sum ECEC subsidies exploits regional variation in private day care allowances between 2000 and 2009. The regional variation arises from the voluntary supplements paid by municipalities. Between 2000 and 2009, the private day care allowance included most of the private ECEC services’ take-up, which provides a plausible, standardized policy setting to estimate causal effects of fixed-sum private ECEC subsidies. Several increases in supplement provision occurred over the research period, as municipalities either increased the existing supplements or introduced new ones. The first wave of increases occurred during 1999–2004 and the second during 2006–2009.Footnote 9

We identify the effects of subsidies on the demand for private ECEC services using difference-in-differences with a continuous treatment variable. We observe discrete choices made by families when choosing between private day care services, public day care, and home care. Choices between the public or private childcare providers and employment are likely simultaneous choices. However, to further simplify the multinomial choices, we model the discrete choices of family i with a binary response variable Yi.Footnote 10 We estimate the model

where the municipality-specific supplement Mmtj is converted to 2010 values and scaled by dividing by 100. The coefficient δj captures the effect of the continuous treatment variable. The variable Mmtj represents the level of private day care subsidy j (for private day care center or private family day care) provided in a municipality m during year t for children under the age of six. The continuous variable Hmt, scaled by dividing by €100, controls for municipality-specific cash-for-care subsidies at 2010 values. Variables Mmtj and Hmt depend on the age of the youngest child since some municipalities offer different subsidies depending on the child’s age. Additionally, the policy controls include a dummy variable Dmt = 1 for cases where the municipality pays the supplement itself.

The sample includes families with at least one child over 9 months and under 6 years old. We estimate several central outcomes for all families and separately by the age of the youngest child. When relevant, we estimate the full model separately for families where the youngest child is at least 9 months but under 3 years old and families where the youngest child is 3–5 years old.

Our central outcomes are private family day care take-up, private center-based care take-up, cash-for-care take-up, female employment, and public day care take-up. Average mean take-up of private center-based care is 1.5% for families with children aged 9 months to 2 years and 4.2% for families with children aged 3–5. Mean take-up of private family day care is 1.9% for families with children aged 9 months to 2 years and 2% for families with children aged 3–5. In addition, we measure if subsidies for private day care can affect cash-for-care take-up or employment rate of women with small children. Cash-for-care take-up is relatively high, 53.7% for families with children between the ages of 9 months and 2 years. If a family receives the cash-for-care benefit, the mother is the caretaker in approximately nine out of ten cases. Additionally, we check if private day care subsidies affect female employment rate, which is 56.0% for women with children between the ages of 9 months and 5 years. Lastly, by following a method suggested by Eckhoff Andresen and Havnes (2019), we measure and estimate public ECEC participation rates.Footnote 11 The low work attendance rate reflects the low ECEC participation rate of young children. From the data, we approximate that the mean public day care take-up is 44.2% for families where the youngest child is under 3 years old and 92.6% for older children.

Controls Xit include family characteristics, and families form our observational units in the data. We aim to avoid endogenous variables by omitting all means-tested components from Mmtj and family income from the right-hand side of Equation (1). For example, if the supplement affects employment probability, it would affect family income and the variable Mmtj would be endogenous by construction. Instead, we control for the number of children (1, 2, 3, or more), mother’s native language (Finnish, Swedish, English, other), mother’s age, age squared, and marital status (cohabiting, married, single parent, or other), where the ’other’ group includes divorced and widowed but not remarried. We omit family income from the equation because available cash-for-care supplements make the variable endogenous. Instead, we control for mother’s education, which is a proxy for family socioeconomic status and mother’s earnings potential.

Municipalities usually pay all three of the different private day care allowance supplements. We omit other types of supplements except for the cash-for-care supplement from the estimation equation because near-extreme multicollinearity could bias the affected variables’ OLS estimates. However, including all possible supplements in Equation (1) allows us to test substitution between different services.Footnote 12

To be able to use family-level error terms (εi) and avoid aggregating the data to group level, we estimate fixed effects (FE) as multiple group fixed effects and two-way fixed effects by municipality and year (Cameron et al. 2011, Gaure 2013). The resulting robust standard errors are clustered by municipality and year. Municipal fixed effects (γm) remove the variation between municipalities, and year fixed effects (λt) control for time effects, such as employment shocks. Additionally, municipality fixed effects absorb municipality-specific childcare vouchers that slightly reduce the observed private day care allowance take-up in the data. Childcare vouchers became more common after our research period in the 2010s. After changes in legislation in 2009, it became easier for the municipalities to offer childcare vouchers. However, 18–25 municipalities offered childcare vouchers already during 2000–2009.

We use a two-way FE estimator and a continuous treatment variable to identify the average treatment effect for the treatment group (ATT) of a €100 increase in supplements (private center-based day care, private family day care, and cash-for-care). The binary two-way FE estimator equals ATT under additional assumptions (de Chaisemartin and D’Haultfœuille 2020, Goodman-Bacon 2021, Imai and Kim 2021). Our two-way FE estimator, based on continuous treatment variable, identifies the ATT under similar assumptions. However, non-parallel trends and differential treatment timing may cause bias to the two-way FE estimators (Goodman-Bacon 2021). Appendix Tables 8 and 9 show that there is large variation in the number of municipalities offering supplements as well as in the level of supplements. Some municipalities never implement any supplements, and others adopt private ECEC supplements early. However, some municipalities adopt the supplements relatively late. In other words, timing and level of the treatment vary over time. Recent literature discusses potential sources of bias that differential treatment timing in two-way FE estimators may cause (Goodman-Bacon 2021). The two-way FE estimator weights all potential estimates by group sizes (control and treatment group). As seen in Table 8, some municipalities adopt supplements relatively late, which causes them to spend less time in the treatment group and, thus, receive less weight.Footnote 13 In addition, if the treatment effect is heterogeneous over time, then differential treatment timing will most likely bias positive two-way FE estimates toward zero. Most likely, this will cause our two-way FE estimators to be conservative; we can interpret the estimated positive coefficients as lower bound for the treatment effect.

Lastly, families from different socioeconomic backgrounds have different opportunity costs and preferences regarding home care and formal childcare. Since the treatment effect is most likely heterogeneous to families, the average treatment effect for the treatment group from Eq (1) is uninformative for our purposes. After estimating the average effects, we estimate the heterogeneous effects by interacting subsidy Mmtj in Equation (1) with mother’s education and age of the youngest child. Since the earnings might be endogenous, we use mother’s education as a measure of the family’s socioeconomic status. We also remove the time-invariant family fixed effects when estimating the heterogeneous treatment effects by mother’s education. However, this solution has a few drawbacks; by including family fixed effects, we may also absorb variation from the treatment and control variables presented in Eq (1). For example, family fixed effects absorb mother’s education and other time-invariant family-level control variables. However, we are able to estimate coefficients for time-variant variables, such as number of children, mother’s single parent status and the level of municipal supplement. Appendix Tables 8 and 9 show that there is large variation in the level of supplements in the 2000s. Different families are exposed to different levels of treatment variable, and we are able to include year, municipal, and family fixed effect and not lose all of the variation. However, the resulting positive coefficients may be biased toward zero, or there may not be enough variation in the treatment variable. As such, we cannot rule out that families with low socioeconomic status are unaffected by higher supplements.

4 Results

Introducing or increasing private ECEC subsidies increases the use of private ECEC services, which has small to none employment effects and reduces the use of public day care. Additionally, we control for cash-for-care supplements that reduce both employment among women with small children and public and private day care take-up.

4.1 Demand for private ECEC services

The upper panel in Table 4 presents the average effect of an increase of €100 in the private day care center supplement. On average, the private day care center supplement increases take-up by 0.2 percentage points for every €100. Considering the average 2.7% take-up, a large portion of the take-up is explained by the private day care center supplement. Additionally, the employment rate of women with at least one child under the age of six is unaffected by the increase in the supplement. The number of families using home care is unaffected by the increase as well.

The lower panel in Table 4 presents the average effect of an increase of €100 in the private family day care supplement. The supplement for private family day care increases take-up by 0.5 percentage points for every €100. In comparison, the average take-up is around 1.9%. We observe a 0.4 percentage point increase in mother’s employment rate, which is quite low considering the average female employment rate of 56.0% in the data. The use of home care is unaffected.

In addition to private day care supplements and socioeconomic controls, the models shown in Table 4 control for the cash-for-care supplement. The cash-for-care supplement reduces both female employment and take-up of private care. If the private family day care supplement increases female employment, then the result is offset by the cash-for-care supplement that reduces the employment rate. Additionally, the cash-for-care supplement increases the take-up of home care by 5.3 percentage points for every €100.

When compared to private family day care and private center-based day care take-up, hiring a private childminder is relatively rare. Mean take-up is ~0.5% when the youngest child in the family is between 9 months and 2 years old and 1.9% when the youngest child is 3–5 years old. Table 10 in the Appendix shows that an increase of €100 in the private childminder supplement increases take-up by 0.1–0.2 percentage points.

Socioeconomic variables show that the take-up of private care varies between families with different backgrounds. Table 5 shows the private care take-up by age of the child in center-based care and family day care. Three main conclusions can be drawn from the socioeconomic variables: First, a higher number of children decreases private care take-up. Second, the take-up of services increases by the age of the child in center-based care but decreases in family day care. Third, mother’s education is associated with the take-up; when compared to mothers with basic education, mothers with secondary or tertiary education use more private services.

The effects of the supplement levels may vary by the age of the child in relation to the type of supplement. Families with older children are more likely to respond to higher private day care center supplement levels, while the opposite holds for private family day care supplements. The effects are in the same range for municipalities administering the supplement themselves, where we use a dummy variable for indicating supply of the supplement. When estimating the effects of cash-for-care supplements for the subsamples, the only significant, and negative, effect is among toddlers’ private day care center take-up.

Average effects may mask heterogeneous responses to policies. Socioeconomic background variables mainly have similar magnitudes and coefficients when the youngest child is between 9 months and 2 years old or 3–5 years old. However, in addition to the impact of education, two-parent families with two children are more likely to use private day care centers. Correspondingly, highly educated married couples with one toddler are more likely to use private family day care. Coefficients for the age of the child and mother’s education differ. Next, we examine if the supplement affects families with younger or older children differently.

4.2 Heterogeneity in private care take-up

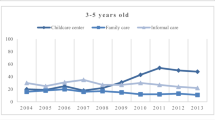

To scrutinize the dynamic effects further, we interact the age of the youngest child with the two supplements. Figure 2 shows the effect for private day care center and family day care take-up by age of the youngest child.

Age of the youngest child and private center-based care take-up in panel (a) and private family day care take-up in panel (b). Marginal effect of an increase of €100 in the supplement. Point-estimates represent the interaction effect between age of the child and private day care center supplement or private FDC supplement. Models include full controls, including age of the youngest child and municipal and year fixed effects. Shaded areas represent two times the standard errors. Mean take-up of center-based care is 1.5% for families with youngest child aged 9 months to 2 years and 4.2% for families with children aged 3–5. Mean take-up of FDC is 1.9% for children aged 9 months to 2 year and 2% for families with children aged 3–5

Take-up of private center-based care increases with the age of the child. The subsidy is highest for families with children under the age of three, but the subsidy has little effect when interacted with the younger age groups. However, for older children, the effect of the subsidy increases with the age of the child.

In contrast, the effects of private family day care supplements fade out as the youngest child grows. The supplement slightly increases the family day care take-up among families with children aged 2–3. However, the effect of the subsidy fades out with the age of the youngest child and becomes insignificant when the child turns four. Private family day care is more popular among families with younger children (compare Table 5 and Fig. 2), and, for some, it appears to be an intermediate step between home care and public or private center-based day care.

Previous results show that the response to the policy is heterogeneous in relation to the age of the child. In addition, take-up varies by the family’s socioeconomic background. However, some families might end up choosing private ECEC regardless of the price or, similarly, level of the subsidy. Different families have different preferences over how childcare should be arranged and respond to public policy differently. We control for unobservable time-invariant differences between families, such as preferences over public and private day care or home care, by including family fixed effects.

Results in Table 6 show that take-up without the supplement has a clear SES gradient. The largest difference in center-based take-up between different educational groups is when the child is over 3 years old. Furthermore, high SES families may react to supplements more strongly than low SES families. Private day care use increases by 0.2–0.3 percentage points for every €100 increase in the supplement for mothers with secondary and tertiary education. Translating coefficients to marginal effects shows that the effect increases with the family’s socioeconomic status. Demand for private family day care increases for families whose youngest child is between 9 months and 2 years old, but the coefficients are small and insignificant.

Differences in the response to the private day care allowance and its supplements are not explained by preferences for home care or for public or private ECEC, since the family fixed effects are controlled for. Different families respond to policies differently. However, by using family FE, the estimated coefficients are probably underestimated. Furthermore, the results provide an effective lower bound for how much the private day care allowance can affect private care demand and take-up. In summary, high SES families react more to the increases than low SES families.

4.3 Take-up of public day care

Table 4 shows that the number of families using home care is unaffected by the increase in either of the private day care supplements. The employment rate of women is unaffected by the increase in the private day care center supplement, while an increase of €100 in private family day care supplement increases the employment rate slightly by 0.4 percentage points. In addition, cash-for-care supplements increase home care but reduce both private care take-up and employment.

Even though family- and child-level information on public childcare attendance is unavailable from 2000 to 2009, we follow Eckhoff Andresen and Havnes (2019) and measure family-level childcare use by exploiting administrative registers for private day care allowance and cash-for-care recipients. Children of parents, who do not receive private day care allowance or cash-for-care, are assumed to be enrolled in public day care (center-based or family day care).

By inducing public day care take-up, Table 7 shows that the private day care supplements reduce public day care take-up. The estimated coefficients are larger for the family day care supplements than for the day care center supplements. The effect is also larger for older children. However, considering that the estimated public day care take-up is considerably larger among families with children aged three to five who are not eligible for cash-for-care, the relative effects are similar. Among children eligible for cash-for-care, an increase of €100 in cash-for-care supplement reduces the public day care take-up by almost 5 percentage points.

If there is excess demand for public care, subsidizing private center-based day care or family day care could increase female employment and ECEC participation. Anecdotal evidence suggests that if a family does not receive their desired childcare slot, mothers may postpone employment re-entry. In fact, both private and public care take-up and employment decrease among mothers who receive higher cash-for-care supplements. On the other hand, Table 4 shows a small increase in female employment when private FDC supplement is increased and the take-up of both forms of private care increases by the supplements. However, there does not seem to be any long-run employment effects of private day care supplements. (See additional robustness tests in Section 4.4).

In summary, any increase in the private day care supplements increase take-up in private care and reduce take-up in public care. Private day care supplements have no impact on home care, while the cash-for-care supplements reduce both private and public care take-up and female employment. Overall, the supplements crowd out public day care.

4.4 Additional results

Variation in the supplements identifies the causal effects if increases in the supplements are exogenous to the family choosing between public and private day care. Our identification strategy should satisfy four assumptions: First, the families in the control and treatment municipalities should have parallel trends in outcomes in the pre-treatment period. Second, the results are unaffected by policy endogeneity, i.e., the outcome does not determine the allocation of intervention. For example, municipalities should not increase the supplement in response to increased demand for private day care. Third, treatment in one municipality does not affect families in control municipalities. Fourth, the composition of the two groups should be stable over time. The third assumption is met, since the municipal supplements are for local residents only, and the possible gains from moving would not offset the moving costs. We deal with the last criterion by controlling for mothers’ individual and household characteristics as well as year shocks.Footnote 14

In the presence of common trends, the coefficients δb should be statistically insignificant before the increase. If the post-increase period of the treated differs from the counterfactual trend, δa should be statistically different from zero.

In the short run, municipalities can increase the demand for private services by increasing the supplements. Figure 3 shows that the effect of an increase in supplements is temporary but the magnitude is large. Average private center-based day care take-up is 3.1% before the increase, but an increase of €100 or more in the supplement increases the take-up by around 0.5 percentage points (18% increase in demand). Similarly, private family day care take-up increases by around 0.4 percentage points from 1.3% after an increase of €100 or more in the supplement (31% increase in demand). However, the effect diminishes 2–3 years after the increase.

Take-up and female employment 3 years before and 3 years after the increase in private center-based day care in panel (a) and family day care supplement in panel (b). Note: Shaded areas represent two times the standard errors. The female employment rate includes women with at least one child under the age of six. Mean values at t − 1 for private day care center supplement increase; the female employment rate is 0.561 and and for the private center-based care take-up is 0.0307. Mean values at t − 1 for private family day care supplement increase; the female employment rate is 0.491 and for the private family day care take-up is 0.0133

The event-study figures provide support that exogenous supplement increases identify average causal effects. Supplement effects are heterogeneous, but evidence on average effects does not necessarily translate to subgroup-specific evidence. Subgroup-specific regressions provide support that exogenous variation identifies the heterogeneous treatment effect by subgroup. The pre-trend analysis by subgroups shows that a higher subsidy for private center-based day care affects socioeconomic groups differently. Figures 4 and 5 in the Appendix include subgroup specific-regression by mother’s socioeconomic status. In families where mothers have completed tertiary education, demand for private day care centers increases after an increase of €100 or more in the subsidy. Demand for private family day care increases for families where mothers have completed secondary or tertiary education. In summary, families where mothers have higher earning potential and socioeconomic background increase their use of private services after an increase in the subsidy.

Demand for private services is unchanged before the increase in either supplement. In comparison, take-up increases immediately but employment is unaffected by the increase. Table 4 shows that employment increases slightly if the municipality provides a supplement for private family day care. However, according to the event-study figure, the female employment rate is unaffected. Furthermore, employment pre-trends in both figures support the claim that municipalities do not increase the supplement in response to increased demand. Overall, municipalities do not increase their supplements in response to increased demand for private services.

In summary, both event-study figures and robustness tests provide support for the causal interpretation that the effect of the increase is exogenous to the families choosing between public and private services. The declining pre-trend in employment 2–3 years before the increase shows that municipalities do not increase the private day care supplement in response to increases in the female employment rate. Policy endogeneity and reverse causality can be ruled out because increased demand for public and private day care does not explain the timing of the supplement increases. However, if the treatment effect is heterogeneous over time, the resulting positive two-way FE estimators are likely to be biased downwards.

5 Conclusions

Even though the use of private ECEC services at the beginning of the study period is low, demand for center-based private day care increased by 17 - 20% and demand for family day care increased up to 26% for every €100 increase in the subsidy. We find that the choice of care provider is dependent on socioeconomic background. Highly educated couples with two children are more likely to use private day care centers. Correspondingly, highly educated married couples with one toddler are more likely to use private family day care. Private ECEC take-up is higher among the highly educated both with and without municipal supplements, and the SES gradient aggravates with higher supplements. We find these effects even when controlling for family fixed effects, which exclude the impact of differences in preferences for care providers.

Kornstad and Thoresen (2007) point out that labor market re-entry and choice of care provider are simultaneous decisions. If families have more options when choosing care providers, this should affect employment among mothers. In contrast to theory, we find no effect of private day care allowance on labor force participation in the Finnish universal childcare regime. Instead, cash-for-care reduces employment. Our new and intuitive finding in this literature is that cash-for-care reduces both public and private day care take-up.

Families face different relative prices for available childcare options with different opportunity costs. Previous research shows that cash-for-care increases home care heterogeneously. Low SES families are most likely to take care of their children at home for longer periods. These mothers are less attached to the labor market. If mothers have no job to return to, they are likely to stay home longer with their children because their opportunity costs are lower (Österbacka and Räsänen 2022). High SES families, whose opportunity costs for home care are higher, are more likely to use private ECEC services, while middle-class families are likely to use public ECEC services. The price difference between public and private childcare is likely to be smaller among high SES families, while the price difference is larger among low SES families. The first general policy lesson, likely to apply for different types of regimes, is that relative prices matter in the choice of care provider.

In addition to the result that take-up varies by socioeconomic status, we found that families with small children are more inclined to prefer family day care, while families with older children are inclined to prefer center-based care. The majority of children in the Finnish context are cared for in day care centers, and the share of children in public family day care has reduced since the turn of the century (Säkkinen and Kuoppala 2021). Hence, the second general policy lesson: When supply and demand for specific public service alternatives are not met, private alternatives could fill the gap. Especially support for private family day care or private childminders could help answer unmet needs.

We find that public support for private ECEC services crowds out public ECEC. Policymakers in municipalities have different reasons for supporting or opposing private ECEC. Some policymakers seek cost-efficient solutions to fluctuating demands, others consider private provision as a complement to or a part of the public ECEC since the municipality both approves and supervises the private day care providers, and some seek to offer freedom to choose among ECEC alternatives (Ruutiainen et al. 2019). Le Grand (1984) points out that in addition to efficiency, equity belongs to the basic objectives of policy making. Indeed, ECEC policies can be both efficient and equitable. The essential feature of equity is that individuals have equal choices. However, the outcome depends on the chosen policy scheme (Wößmann 2008).

The third and last general policy lesson relates to equity and efficiency in policymaking and points out the need for future research. We found that support for both home care and private ECEC reduces public day care take-up. In addition, we found that public support to families causes differences in the use of ECEC services by SES. High SES families are more likely to use private care services, while low SES families are more inclined to home care. In the Finnish context, we know that home care and private services are less expensive to municipalities and, therefore, more cost-efficient alternatives. However, while home care is cost-efficient for municipalities, labor market re-entry among mothers is delayed (Österbacka and Räsänen 2022), which is likely to negatively affect women’s careers and their children’s access to early education. In the present study, we are unable to examine if inequality in use also implies inequality in access. To answer this question, a more extensive data set is required with center-level information and information on child outcomes. However, if possible, policymakers should monitor segregation between care alternatives.

International comparisons show that public providers have higher quality and generate more positive child outcomes than private providers (van Huizen and Plantenga 2018). However, all Finnish ECEC care providers use the same national curriculum guidelines and follow the same minimum quality standards, which implies that the international results do not necessarily apply to Finland. Existing Finnish evidence for differences in child outcomes between those in long-term home care and those in formal public childcare indicate that children in home care generally perform worse, at least in the short run (Hiilamo et al. 2018, Kosonen and Huttunen 2018). Our data contains no information on differences in quality between public and private ECEC or child outcomes.

Child outcomes, segregation in care alternatives, and peer effects in early education are likely to appear in the research agenda as new data become available. Peers in ECEC influence children’s cognitive outcomes. However et al. (2010) found that the peer effects seem to fade out as the child grows older. Peer effects in ECEC can still be important, since achieved skills facilitate later learning. If children end up in different ECEC with varying peers based on their family background characteristics, the deviations in their path of development are aggravated further. We have shown that children with different family backgrounds may sort into different types of care providers. This is probably an unintended consequence of privatization and far from an optimal policy scheme. When supporting private childcare alternatives in addition to public alternatives, it is important to take into account not only cost-efficiency but also how different types of families are affected to avoid adverse equity effects.

Data availability

Not applicable. The unit-level research data is available for researchers, but requires an application for licence. Statistics Finland grants licenses to unit-level data and provides data access via remote data access for research organizations.

Change history

09 June 2023

A Correction to this paper has been published: https://doi.org/10.1007/s11150-023-09665-7

Notes

We present results for private childminder subsidies in the Appendix.

In 2000, 3.7% of all children aged 9 months to 6 years used private services subsidized by private day care allowance. In 2010, the proportion had increased to almost 5% (Kela, 2016).

A private childminder is a person with whom the family has made a contract of employment. See Tables 8 and 9 for the number of municipalities providing supplements and average supplements by age of the child. Additionally, municipalities may subsidize home care. See Österbacka and Räsänen (2022) for information on municipal supplements for home care.

Since year 2012, the pedagogy has been regulated by the Ministry of Education and Culture, which also provides curriculum guidelines.

If the secondary earner earns approximately at least 1.5 times the median income then the increased tax revenue offsets the additional cost of public day care relative to home care.

See Repo et al. (2020) for the most recent discussion.

The 60% simple random sample is drawn from all new maternity leave benefits between 1997 and 2009, but we have information on partners and all dependent children in the household.

Mothers living in municipalities that pay out the supplements through Kela are similar to mothers living in municipalities that pay out municipal supplements themselves. Selection and differences between the automated and self-administered sample may influence the results, which may threaten the external validity of the results. For example, municipalities that let Kela administer the supplement have a lower unemployment rate than municipalities that decide to administer it themselves. In addition, mothers are, on average, older in municipalities that automate the supplement, but the difference is not significant enough to be meaningful. In addition, we control for mother’s age and estimate municipal fixed effects, which control for these differences.

Individual-level information on public day care take-up is unavailable from 2000 to 2009. Instead, we follow Eckhoff Andresen and Havnes (2019) who measure individual childcare use by exploiting administrative registers for cash-for-care recipients and infer public day care use for all families and their children from administrative registers. All children not enrolled in subsidized public childcare and under 3 years old are eligible for cash-for-care benefit. We have information on cash-for-care recipients and children at the individual-level and knowledge on whether older siblings are cared for at home alongside the youngest child. Additionally, we improve the definition and include the private day care allowance register, which includes children in private ECEC during 2000–2009.

See Table 8 in the Appendix for the number of municipalities offering all three types of private day care supplements. When including all three of the supplements in the equation, we find that private family day care and private childminder might be substitutes for each other, but that all other coefficients that represent cross-substitution are uninformative. The results are presented in Tables 11 and 12 in the Appendix.

We have chosen a panel from 2000 to 2009 for two reasons. First, our administrative register data includes a majority of children and families using private ECEC services between 2000 and 2009. However, the coverage decreases in 2010s, since private childcare vouchers take-up is not registered in the national database. Second, increasing panel length to include years from 2010 to 2017 would potentially introduce new type of bias (multiple treatment bias), since families might be exposed to multiple treatments (for example reductions in public childcare fees in the 2010s, restriction of access to childcare for the unemployed in 2016–2019, and increasing number of municipalities offering private childcare vouchers in 2010–2017).

For the first two criteria, we test pre-trends with an event-study model where we include lags for the treatment as suggested by Angrist and Pischke (2008). Treatment municipalities in the analysis either increased the supplement by at least €100 or adopted a new supplement. We omit category t = −1 before an increase of at least €100 in the supplement or before the adoption of a new supplement and estimate.

References

Akgunduz, Y. E., & Plantenga, J. (2013). Comptetition for a better future? Effects of competition on child care quality. Technical Report 13–14, Utrecht: Utrecht University.

Angrist, J. D., & Pischke, J.-S. (2008). Mostly Harmless Econometrics: An Empiricist’s Companion. Princeton University Press, Princeton, NJ.

Baker, M., Gruber, J., & Milligan, K. (2008). Universal Child Care, Maternal Labor Supply, and Family Well-Being. Journal of Political Economy, 116(4), 709–745.

Bassok, D., Fitzpatrick, M., & Loeb, S. (2014). Does state preschool crowd-out private provision? The impact of universal preschool on the childcare sector in Oklahoma and Georgia. Journal of Urban Economic, 83, 18–33.

Berlinski, S., Ferreyra, M. M., Flabbi, L., & Martin, J. D. (2020). Child Care Markets, Parental Labor Supply, and Child Development. IZA Discussion Paper No. 12904.

Berlinski, S., & Vera-Hernández, M. (2019). The Economics of Early Interventions Aimed at Child Development. In Oxford Research Encyclopedia of Economics and Finance. https://doi.org/10.1093/acrefore/9780190625979.013.545.

Brewer, M., Cattan, S., Crawford, C., & Rabe, B. (2016). Free Childcare and Parents’ Labour Supply: Is More Better? IZA Discussion Paper No. 10415.

Cameron, A. C., Gelbach, J. B., & Miller, D. L. (2011). Robust Inference With Multiway Clustering. Journal of Business & Economic Statistics, 29(2), 238–249.

Cornelissen, T., Dustmann, C., Raute, A., & Schönberg, U. (2018). Who Benefits from Universal Child Care? Estimating Marginal Returns to Early Child Care Attendance. Journal of Political Economy, 126, 2356–2409.

Datta Gupta, N., & Simonsen, M. (2010). Non-cognitive child outcomes and universal high quality child care. Journal of Public Economics, 94(1), 30–43.

de Chaisemartin, C., & D’Haultfœuille, X. (2020). Two-Way Fixed Effects Estimators with Heterogeneous Treatment Effects. American Economic Review, 110(9), 2964–2996.

de Muizon, M. J. (2020). Subsidies for parental leave and formal childcare: be careful what you wish for. Review of Economics of the Household, 18(3), 735–772. https://doi.org/10.1007/s11150-020-09489-9.

Eckhoff Andresen, M., & Havnes, T. (2019). Child care, parental labor supply and tax revenue. Labour Economics, 61, 101762.

Gaure, S. (2013). OLS with multiple high dimensional category variables. Computational Statistics & Data Analysis, 66, 8–18.

Giuliani, G., & Duvander, A. Z. (2017). Cash-for-care policy in Sweden: An appraisal of its consequences on female employment. International Journal of Social Welfare, 26(1), 49–62.

Glomm, G., & Meier, V. (2020). Efficient child care subsidies: any need for cash for care?. Review of Economics of the Household, 18(3), 773–793. https://doi.org/10.1007/s11150-020-09488-w.

Goodman-Bacon, A. (2021). Difference-in-differences with variation in treatment timing. Journal of Econometrics, 225(2), 254–277.

Hardoy, I., & Schøne, P. (2010). Incentives to work? The impact of a ‘Cash-for-Care’ benefit for immigrant and native mothers labour market participation. Labour Economics, 17(6), 963–974.

Havnes, T., & Mogstad, M. (2011). Money for nothing? Universal child care and maternal employment. Journal of Public Economics, 95(11), 1455–1465.

Heckman, J., Stixrud, J., & Urzua, S. (2006). The Effects of Cognitive and Noncognitive Abilities on Labor Market Outcomes and Social Behavior. Journal of Labor Economics, 24(3), 411–482.

Heinonen, J. (2011). Suomen kuuden suurimman kaupungin lasten päivähoidon palvelujen ja kustannusten vertailu vuonna 2010. Technical Report 4, Helsinki:Kuusikko-työryhmä.

Hiilamo, H., Merikukka, M., & Haataja, A. (2018). Long-Term Educational Outcomes of Child Care Arrangements in Finland. SAGE Open, 8(2), 2158244018774823.

Imai, K., & Kim, I. S. (2021). On the Use of Two-Way Fixed Effects Regression Models for Causal Inference with Panel Data. Political Analysis, 29(3), 405–415. Publisher: Cambridge University Press.

Kela (2016). Statistical Yearbook of the Social Insurance Institution 2015. Official Statistics of Finland. Helsinki: Kela.

Kornstad, T., & Thoresen, T. O. (2007). A discrete choice model for labor supply and childcare. Journal of Population Economics, 20, 781–803.

Kosonen, T. (2014). To work or not to work? the effect of childcare subsidies on the labour supply of parents. The BE Journal of Economic Analysis & Policy, 14(3), 817–848.

Kosonen, T., & Huttunen, K. (2018). Kotihoidon tuen vaikutus lapsiin. Palkansaajien tutkimuslaitos, Tutkimuksia 115.

Lahtinen, J., & Svartsjö, M. (2018). Selvitys kotihoidontuen ja yksityisen hoidon tuen kuntalisistä ja niiden maksatusperusteista sekä palvelusetelistä. Kuntaliitto.

Le Grand, J. (1984). Equity as an Economic Objective. Journal of Applied Philosophy, 1(1), 39–51.

Lundin, D., Mörk, E., & Öckert, B. (2008). How far can reduced childcare prices push female labour supply? Labour Economics, 15(4), 647–659.

Neidell, M., & Waldfogel, J. (2010). Cognitive and Noncognitive Peer Effects in Early Education. The Review of Economics and Statistics, 92(3), 562–576.

Noailly, J. and Visser, S. (2009). The Impact of Market Forces on Child Care Provision: Insights from the 2005 Child Care Act in the Netherlands. Journal of Social Policy, 38:477–498. Num Pages: 22 Place: Cambridge, United Kingdom Publisher: Cambridge University Press.

OECD (2019). OECD Family Database. https://www.oecd.org/els/family/database.htm.

Penn, H. (2014). The business of childcare in Europe. European Early Childhood Education Research Journal, 22(4), 432–456.

Pilarz, A. R., Lin, Y.-C., & Magnuson, K. A. (2019). Do Parental Work Hours and Nonstandard Schedules Explain Income-Based Gaps in Center-Based Early Care and Education Participation? Social Service Review, 93(1), 55–95.

Pohjola, K., Haataja, A., & Juutilainen, V. (2013). Lasten yksityisen hoidon tuki osana päivähoitoa. Kela. http://hdl.handle.net/10138/39616.

Rege, M., Solli, I. F., Størksen, I., & Votruba, M. (2018). Variation in center quality in a universal publicly subsidized and regulated childcare system. Labour Economics, 55, 230–240.

Repo, K., Alasuutari, M., and Karila, K. (2020). The Policies of Childcare and Early Childhood Education: Does Equal Access Matter? Cheltenham, Gloucestershire: Edward Elgar Publishing.

Riitakorpi, J., Alila, K., and Kahiluoto, T. (2017). Varhaiskasvatuksen yksityiset palvelut. Valtakunnallinen selvitys 2015. Opetus- ja kulttuuriministeriön julkaisuja 2017:3. Helsinki:Opetus- ja kulttuuriminiesteriö.

Ruutiainen, V., Alasuutari, M., & Karila, K. (2019). Rationalising public support for private early childhood education and care: the case of Finland. British Journal of Sociology of Education, 0(0), 1–16.

Schuss, E., & Azaouagh, M. (2020). Combining parenthood and work: transmission channels and heterogeneous returns to early public childcare. Review of Economics of the Household, 19(3), 641–676. https://doi.org/10.1007/s11150-020-09530-x.

Säkkinen, S., & Kuoppala, T. (2021). Varhaiskasvatus 2020. Terveyden ja hyvinvoinninlaitos, Tilastoraportti 32. https://www.julkari.fi/handle/10024/143153.

Österbacka, E., & Räsänen, T. (2022). Back to work or stay at home? Family policies and maternal employment in Finland. Journal of Population Economics, 35(3), 1071–1101.

Thoresen, T. O., & Vattø, T. E. (2019). An up-to-date joint labor supply and child care choice model. European Economic Review, 112, 51–73.

van Huizen, T., & Plantenga, J. (2018). Do children benefit from universal early childhood education and care? A meta-analysis of evidence from natural experiments. Economics of Education Review, 66, 206–222.

Viitanen, T. K. (2011). Child care voucher and labour market behaviour: experimental evidence from Finland. Applied Economics, 43(23), 3203–3212.

Wößmann, L. (2008). Efficiency and equity of European education and training policies. International Tax and Public Finance, 15(2), 199–230.

Funding

Research was funded by the Strategic Research Council (SRC), FLUX consortium, decision numbers: 345130 and 345133. Open Access funding provided by Social Insurance Institution of Finland (KELA).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declares no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Tables 8, 9, 10, 11 and 12, Figs. 4, 5.

Take-up and female employment 3 years before and 3 years after the supplement increase by socioeconomic background. Private center-based day care. Shaded areas represent two times the standard errors. The female employment rate includes women with at least one child under the age of six. Mean values at t − 1 for female employment rate; Basic: 0.374, Secondary: 0.542, Tertiary: 0.635. Mean values at t − 1 for private center-based care take-up; Basic: 0.0194, Secondary: 0.02372, Tertiary: 0.0394

Take-up and female employment 3 years before and 3 years after the supplement increase by socioeconomic background. Private family day care. Note: Shaded areas represents two times the standard errors. Female employment rate includes women with at least one child under the age of siz. Mean values at t − 1 for female employment rate; Basic: 0.305, Secondary: 0.477, Tertiary: 0.559. Mean values at t − 1 for private center-based care take-up; Basic: 0.0102, Secondary: 0.00955, Tertiary: 0.0175

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Räsänen, T., Österbacka, E. Subsidizing private childcare in a universal regime. Rev Econ Household 22, 199–230 (2024). https://doi.org/10.1007/s11150-023-09657-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-023-09657-7