Abstract

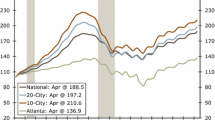

The causes of the housing bubble are investigated using Granger causality analysis and VAR modeling methods. The study employs the S&P/Case-Shiller aggregate 10 city monthly housing price index, available in the period 1987–2010/8, the 20 city monthly housing price index for 2000–2010/8, and the federal funds rate data for the period 1987–2010/8. The findings are consistent with the view that the interest rate policy of the Federal Reserve in the period 2001–2004 that pushed down the federal funds rate and kept it artificially low was a cause of the housing price bubble.

Similar content being viewed by others

Notes

The policy variables tested by Bernanke and Blinder (1992) included two measures of the money supply, the Treasury bill rate, and the 10-year Treasury bond rate. The macroeconomic variables included industrial production, capacity utilization, employment, unemployment rate, housing starts, personal income, retail sales, consumption, and durable-goods orders. Their tests consisted of forecasting each of these variables using six lags of the variable itself, the policy variable in question, and the consumer price index. The result that the federal funds rate Granger-causes housing starts suggests a similar result for housing prices.

See Mikhed and Zemcik (2009) for detailed tests for the presence of bubbles in U.S. metropolitan housing markets from 1978 to 2006 using data on price-rent ratios. Their results suggest the presence of housing price bubbles in the late 1980s, the early 1990s, and from the late 1990s to 2006. See Das et al. (2010) for time-series forecasting models of housing prices at the census division level. Several studies have used time-series methods to study housing permits and starts, the most recent of which is Vargas-Silva (2008).

References

Barth, J. (2009). The rise and fall of the U.S. mortgage and credit markets. Hoboken: Wiley.

Bernanke, B., & Blinder, A. (1992). The federal funds rate and the channels of monetary transmission. American Economic Review, 82, 901–921.

Box, G. E. P., Jenkins, G. M., & Reinsel, G. (2008). Time series analysis: Forecasting and control (4th ed.). Hoboken: Wiley.

Das, S., Gupta, R., & Kabundi, A. (2010). The blessing of dimensionality in forecasting real house price growth in the nine census divisions of the U.S. Journal of Housing Research, 19, 89–109.

Doan, T. (2010a). Rats user’s manual: Version 8.0. Evanston,: Estima.

Doan, T. (2010b). Rats reference manual: Version 8.0. Evanston: Estima.

Financial Crisis Inquiry Commission. (2011). The financial crisis inquiry report. New York: Public Affairs (Perseus Books).

Friedman, M. (1993). The “plucking model” of business fluctuations revisited. Economic Inquiry, 31, 171–177.

Friedman, M., & Schwartz, A. (1963). A monetary history of the United States. Princeton: Princeton University Press (for National Bureau of Economic Research).

Gorton, G. (2010). Slapped by the invisible hand. New York: Oxford University Press.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral models. Econometrica, 37, 424–438.

Greene, W. (2008). Econometric analysis (6th ed.). Upper Saddle River: Pearson/Prentice Hall.

Hendershott, P., Hendershott, R., & Shilling, J. (2010). The mortgage finance bubble: causes and corrections. Journal of Housing Research, 19, 1–16.

Krugman, P. (2009). The return of depression economics. New York: Norton.

Mikhed, V., & Zemcik, P. (2009). Testing for bubbles in housing markets: a panel data approach. Journal of Real Estate Finance and Economics, 38, 366–386.

Roubini, N., & Mihm, S. (2010). Crisis economics. New York: Penguin.

S&P/Case-Shiller Home Price Indices, http://www.standardpoors.com/indices/sp-case-shiller-home-price-indices/en/us/?indexId=spusa-cashpidff--p, accessed November, 2010.

Schwartz, A. (2009). Origins of the financial market crisis of 2008. Cato Journal, 29, 19–23.

Shiller, R. (2009). The subprime solution. Princeton: Princeton University Press.

Skousen, M. (2005). Vienna & Chicago: Friends or foes? Washington: Capital.

Stokes, H. H. (1991, 1997, third edition in electronic form 2011). Specifying and diagnostically testing econometric models. New York: Quorum Books.

Taylor, J. (2009). Getting off track: How government actions and interventions caused, prolonged, and worsened the financial crisis. Stanford: Hoover Institution Press.

Thornton, M. (2009). The economics of housing bubbles. In R. Holcombe & B. Powell (Eds.), Housing America: Building out of a crisis (pp. 237–262). New Brunswick: Transactions.

Vargas-Silva, C. (2008). The effect of monetary policy on housing: a factor-augmented vector autoregression (FAVAR) approach. Applied Economics Letters, 15, 749–752.

Woods, T. (2009). Meltdown. Washington: Regnery.

Zandi, M. (2009). Financial shock (updated edition). Upper Saddle River: FT Press.

Zellner, A., & Palm, F. (1974). Time series analysis and simultaneous equation econometric models. Journal of Econometrics, 2, 17–54.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

McDonald, J.F., Stokes, H.H. Monetary Policy and the Housing Bubble. J Real Estate Finan Econ 46, 437–451 (2013). https://doi.org/10.1007/s11146-011-9329-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9329-9