Abstract

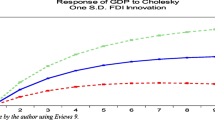

A better functioning industrial sector matters directly for growth and contributes indirectly to poverty alleviation, unemployment reduction, trade promotion, exchange of goods and services, increased per capital income, GDP growth etc. in developing and developed economies. Nonetheless, after global financial crisis and fall of Bretton wood system a new debate was generated to re-examine the issue after the implementation of financial liberalization policies in these economies. Therefore, the central theme of this study is to test the industrial development nexus in United States of America, European Union and China. With this background in mind the present research aims to ascertain whether financial liberalization in terms of capital account openness (CAO), trade openness (TO), equity openness (EO), Regulatory factors in terms of World Governance indicator, private sector investment, public sector investment and lastly whether macroeconomic factors in terms of exchange rate (ER) and foreign direct investment (FDI) have had any impact on industrial development. Augmented dicker fully test was applied to estimate stationarity of data, vector auto regression, impulse response function and variance decomposition were used to describe shocks, after effects and magnitudes and intra and inter dependence of the study variables. EO, TO and FDI were significant determinants in European Union. However, Governance, TO and CAO are significant predictors in China and Lastly Governance, ER, FDI, private investment and public investment were significant in United States of America.

Similar content being viewed by others

References

Abbott, A.: The impact of exchange rate volatility on UK exports to EU countries. Scott. J. Polit. Econ. 51(1), 62–81 (2004)

Aghion, P., Bacchetta, P., Ranciere, R., Rogoff, K.: Exchange rate volatility and productivity growth: the role of financial development. J. Monet. Econ. 56(4), 494–513 (2009)

Alfaro, L., Chanda, A., Kalemli-Ozcan, S., Sayek, S.: FDI and economic growth: the role of local financial markets. J. Int. Econ. 64(1), 89–112 (2004)

Amable, B.: International specialization and growth. Struct. Change Econ. Dyn. 11(4), 413–431 (2000)

Amavilah, V.H.S.: Domestic resources, governance, global links, and the economic performance of Sub-Saharan Africa. Reeps Working Paper No. 200808 (Main 1.03), pp. 1–29. https://mpra.ub.uni-muenchen.de/11193/ (2008)

Arestis, P.: 21 Financial liberalization and the relationship between finance and growth. In: A Handbook of Alternative Monetary Economics, Chap 21, p. 346. Edward Elgar Publishing (2007)

Arrow, K.J.: The economic implications of learning by doing. Rev. Econ. Stud. 29(3), 155–173 (1962)

Atiq, Z.: Essays on financial liberalisation, financial crises and economic growth. Thesis for Doctor of Philosophy in the Faculty of Humanities, University of Manchester, UK (2014)

Bekaert, G., Harvey, C.R., Lundblad, C.: Does financial liberalization spur growth? J. Financ. Econ. 77(1), 3–55 (2005)

Bekaert, G., Harvey, C.R., Lundblad, C.: Financial openness and productivity. World Dev. 39(1), 1–19 (2011)

Blackburn, K., Forgues-Puccio, G.F.: Financial liberalization, bureaucratic corruption and economic development. J. Int. Money Finance 29(7), 1321–1339 (2010)

Bleaney, M., Greenaway, D.: The impact of terms of trade and real exchange rate volatility on investment and growth in sub-Saharan Africa. J. Dev. Econ. 65(2), 491–500 (2001)

Blomström, M., Kokko, A.: The impact of foreign investment on host countries: a review of the empirical evidence. Policy Research Working Paper, 1745 (1996)

Blonigen, B.A.: Firm-specific assets and the link between exchange rates and foreign direct investment. Am. Econ. Rev 87, 447–465 (1997)

Campos, N.F., Nugent, J.B.: Development performance and the institutions of governance: evidence from East Asia and Latin America. World Dev. 27(3), 439–452 (1999)

Carlin, W., Mayer, C.: Finance, investment, and growth. J. Financ. Econ. 69(1), 191–226 (2003)

Caves, R.E.: Multinational firms, competition, and productivity in host-country markets. Economica 41(162), 176–193 (1974)

Chen, E.Y., Ng, R.: Economic restructuring of Hong Kong on the basis of innovation andtechnology. In: Industrial Restructuring in East Asia: Towards the 21st Century, vol. 25, p. 209 (2001)

Chinn, M.D., Ito, H.: What matters for financial development? Capital controls, institutions, and interactions. J. Dev. Econ. 81(1), 163–192 (2006)

Chit, M.M., Rizov, M., Willenbockel, D.: Exchange rate volatility and exports: new empirical evidence from the emerging East Asian economies. World Econ. 33(2), 239–263 (2010)

Coe, D.T., Helpman, E.: International R&D spillovers. Eur. Econ. Rev. 39(5), 859–887 (1995)

De Grauwe, P.: Exchange rate variability and the slowdown in growth of international trade. Staff Papers 35(1), 63–84 (1988)

Dickey, D.A., Fuller, W.A.: Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 49, 1057–1072 (1981)

Djankov, S., Hoekman, B.: Foreign investment and productivity growth in Czech enterprises. World Bank Econ. Rev. 14(1), 49–64 (2000)

Edison, H.J., Levine, R., Ricci, L., Sløk, T.: International financial integration and economic growth. J. Int. Money finance 21(6), 749–776 (2002)

Eichengreen, B., Gullapalli, R., Panizza, U.: Capital account liberalization, financial development and industry growth: a synthetic view. J. Int. Money Finance 30(6), 1090–1106 (2011)

Fagerberg, J.: Technology and international differences in growth rates. J. Econ. Lit. 32(3), 1147–1175 (1994)

Fischer, S.: Capital account liberalization and the role of the IMF. Princet. Essays Int. Finance 207, 1–10 (1998)

Globerman, S.: Foreign direct investment and spillover efficiency benefits in Canadian manufacturing industries. Can. J. Econ. 12, 42–56 (1979)

Greenberg, J.B.: A political ecology of structural-adjustment policies: the case of the Dominican Republic. Cult. Agric. Food Environ. 19(3), 85–93 (1997)

Grossman, G.M., Helpman, E.: Quality ladders in the theory of growth. Rev. Econ. Stud. 58(1), 43–61 (1991)

Haber, S.H., Musacchio, A.: Foreign Banks and the Mexican Economy, 1997–2004. Division of Research, Harvard Business School, Boston (2004)

Haddad, M., Harrison, A.: Are there positive spillovers from direct foreign investment? Evidence frompanel data for Morocco. J. Dev. Econ. 42, 51–74 (1993)

Jawad, M., Naz, M.: Pre and Post effect of Brexit polling on United Kingdom economy: an econometrics analysis of transactional change. Qual. Quant. (2018). https://doi.org/10.1007/s11135-018-0746-1

Jawad, M., et al.: Development dynamics: pre and Post Brexit analysis of United Kingdom. Qual. Quant. (2018). https://doi.org/10.1007/s11135-018-0789-3

Jones, D.R., Schonlau, M., Welch, W.J.: Efficient global optimization of expensive black-box functions. J. Glob. Optim. 13(4), 455–492 (1998)

Kabango, G.P., Paloni, A.: Financial liberalization and industrial development in Malawi Malawi. Business School-Economics, University of Glasgow, Working paper series No. 8. (2010). https://www.gla.ac.uk/media/media_145952_en.pdf

Khan, M.S., Reinhart, C.M.: Private investment and economic growth in developing countries. World Dev. 18(1), 19–27 (1990)

Klein, M.W., Olivei, G.P.: Capital account liberalization, financial depth, and economic growth. J. Int. Money Finance 27(6), 861–875 (2008)

Kose, M.A., Prasad, E., Rogoff, K., Wei, S.J.: Financial globalization: a reappraisal. IMF Staff Papers 56(1), 8–62 (2009)

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R.W.: Legal determinants of external finance. J. Finance 52(3), 1131–1150 (1997)

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R.W.: Law and finance. J. Polit. Econ. 106(6), 1113–1155 (1998)

Levine, R., Zervos, S.: Stock markets, banks, and economic growth. Am. Econ. Rev. 88, 537–558 (1998)

Levy-Yeyati, E., Sturzenegger, F.: To float or to fix: evidence on the impact of exchange rate regimes on growth. Am. Econ. Rev. 93(4), 1173–1193 (2003)

Lucas, R.E.: On the mechanics of economic development. Econom. Soc. Monogr. 29, 61–70 (1998)

McKinnon, R.I.: Money and Capital in Economic Development. Brookings Institution Press, Washington (1973)

Nazmi, N., Ramirez, M.D.: Public and private investment and economic growth in Mexico. Contemp. Econ. Policy 15(1), 65–75 (1997)

Obstfeld, M.: The global capital market: benefactor or menace? J. Econ. Perspect. 12(4), 9–30 (1998)

Obstfeld, M., Rogoff, K.: The Intertemporal Approach to the Current Account (No. w4893). National Bureau of Economic Research (1994)

Ou, K.A.: The effect of industrial development on economic growth (an empirical evidence in Nigeria 1973–2013). Eur. J. Bus. Soc. Sci. 4(02), 127–140 (2015)

Ozyurt, S.: Total factor productivity growth in Chinese industry: 1952–2005. Oxf. Dev. Stud. 37(1), 1–17 (2009a)

Ozyurt, S.: Total factor productivity growth in Chinese industry: 1952–2005. Oxf. Dev. Stud. 37(1), 1–17 (2009b)

Prasad, E., Rogoff, K., Wei, S.J., Kose, M.A. (eds.): Effects of financial globalization on developing countries: some empirical evidence. In: India’s and China’s Recent Experience with Reform and Growth, pp. 201–228. Palgrave Macmillan, Basingstoke (2005)

Rajan, R.G., Zingales, L.: Financial dependence and growth. Am. Econ. Rev. 88, 559–586 (1998)

Rajan, R.G., Zingales, L.: The great reversals: the politics of financial development in the 20th century. J. Financ. Econ. 69(1), 5–50 (2003)

Rodrik, D. (eds.): Who needs capital-account convertibility? In: Essays in International Finance, pp. 55–65. Harvard University Press (1998)

Romer, P.M.: Increasing returns and long-run growth. J. Polit. Econ. 94(5), 1002–1037 (1986)

Roy, P.K.: Socio-economic impact of industrialization on the Indian family: a case study in Ranchi, India. Anthropol. Forum 4(1), 97–109 (2010)

Shaw, E.: Financial Deepening in Economic Growth, vol. 19(73.21), pp. 1–278. Oxford University Press, Oxford (1973)

Siddharthan, N.S.: Industrial structure, non-price competition and industrial development. Econ. Polit. Wkl. 31, 1307–1310 (1984)

Singh, R.D.: Government-introduced price distortions and growth: evidence from twenty-nine developing countries. Public Choice 73(1), 83–99 (1992)

Solow, R.M.: A contribution to the theory of economic growth. Q. J. Econ. 70(1), 65–94 (1956)

Summers, L.H.: International financial crises: causes, prevention, and cures. Am. Econ. Rev. 90(2), 1–16 (2000)

Syrquin, M.: Productivity growth and factor reallocation. In: Chenery, H., Robinson, S., Syrquin, M. (eds.) Industrialization and Growth: A Comparative Study, pp. 229–262. Oxford University Press, Washington, DC (1986)

Team, E.G.F.S.: The supply effects of fiscal policy and economic development. Econ. Res. J. 9, 4–17 (2004)

Teubal, M.: A catalytic and evolutionary approach to horizontal technology policies (HTPs). Res. Policy 25(8), 1161–1188 (1997)

Vlachos, J., Waldenström, D.: International financial liberalization and industry growth. Int. J. Finance Econ. 10(3), 263–284 (2005)

Von Tunzelmann, G.N.: Technology and Industrial Progress: The Foundations of Economic Growth. Edward Elgar Publishing, Cheltenham (1995)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Jawad, M., Maroof, Z. & Naz, M. Industrial development factors: a comprehensive analysis of United States of America, European Union and China. Qual Quant 53, 1763–1821 (2019). https://doi.org/10.1007/s11135-019-00838-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-019-00838-0