Abstract

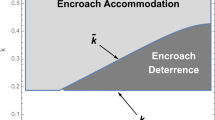

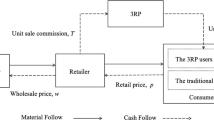

Big retailers that carry a large assortment of products rely on knowledgeable salespeople to provide purchase advice to customers and match customers with suitable products. Interestingly, big retailers vary in their policies regarding whether to allow their salespeople to receive manufacturer SPIFF (Sales Person Incentive Funding Formula) payments, which motivate salespeople advising at no cost of the retailer. In this study, we investigate a big retailer’s incentive to block manufacturer SPIFF programs, which has the consequence of demotivating salespeople from advising customers, from the perspective of vertical channel interactions. We scrutinize a big retailer’s decision to maximize its profit through managing its channel interactions with upstream manufacturers offering horizontally differentiated products, customers uncertain about true fits with competing products, and its salesperson who can match customers with suitable products through offering purchase advice. Our analysis shows that motivating the salesperson to advise customers is profitable for the retailer only if the such advising has moderate effectiveness in matching consumers and suitable products, and only in this case would the retailer collaborate on manufacturer SPIFF programs. Otherwise, salesperson advising hurts retailer profit and the big retailer benefits from blocking manufacturer SPIFF programs. Our study reveals the interesting theoretical insight that the incentives of a big retailer and upstream manufacturers to motivate sales advising reside in their incentives to battle for a more favorable channel status.

Similar content being viewed by others

Notes

http://www.journalpatriot.com. See Online Appendix 1 for a snapshot.

For instance, Samsung in its description for the “Power Cash Incentive Program” explicitly states that “the main target of this program is the sales representative of the reseller who can earn extra income from Samsung when selling Samsung products.” (http://www.samsung.com. See Online Appendix 2 for a snapshot.) And the furniture maker Highmark in the description for its SPIFF program indicates that “participants must be an authorized dealer sales representative for HighMark product.” (http://www.highmarkergo.com. See Online Appendix 3 for a snapshot.)

Modern technologies have made it easier for manufacturers to operate SPIFF programs. For instance, Lenovo operates an online system; all sales invoices reported by retailers are preloaded into an online claiming pool and salespeople only need to log in to claim their SPIFF rewards. (http://www.partnerinfo.lenovo.com. See Online Appendix 1 for a snapshot.)

A majority of the salesforce literature models the principal-agent relationship between a monopolistic seller and its sales representative with more information about aggregate market demand and examines how sales commissions should be devised to eliminate the moral hazard problem in such a relationship (see Coughlan and Sen 1989; Prendergast 1999 for reviews). For example, Basu et al. (1985) examines the optimal commission schedule when the sales outcome is a function of the sales agent’s effort and market uncertainty but the principal only observes the sales outcome, not the sales effort or market uncertainties. Lal and Staelin (1986) examines the optimal commission schedule when the sales outcome is a function of the sales agent’s effort and selling capability, but the principal only observes the sales outcome, not the sales effort or sales agent’s selling capability. Recently, the principal-agent model has been adopted in structural empirical analysis of sales force compensation. Misra and Nair (2011) examines dynamic effects of quota-compensation contracts on salesforce output with a Fortran 500 contact lens manufacturer. Chung et al. (2014) examines how different components of a sales compensation plan, including salary, commissions, and bonuses on achieving annual quotas, affect the sales outcome of the direct sales force with a Fortune 500 firm that sells office durable goods.

This assumption well captures the business reality in our research context. Big retailers typically maintain a stable customer base, which allows them to accumulate extensive operating experience in a sales territory. A survey conducted by Forester Research shows that across 12 industries, retailers inspire the most loyalty among customers, with 80% of respondents reported being reluctant to switch business away from favorite stores than from hotels or airlines (Korkki 2009). Moreover, big retailers commonly undertake technology and organizational efforts to improve CRM capabilities (Chu 2006), which allows them to obtain deep insights into customer needs and wants as well as keep track on key measurements on salesforce productivity such as sales per employee. For example, the office supply store Staples uses mystery shopping, third-party research, monthly customer surveys, and automated data analytics to study its customers’ purchasing behaviors.

https://www.consumer.ftc.gov/articles/0176-buyers-remorse-when-ftcs-cooling-rule-may-help(accessed November 2017).

Our parsimonious approach to modeling reputation effect follows existing literature (e.g., Hauser and Wernerfect 1994; Kalra et al. 2003). For example, in Kalra et al. (2003), the firm’s profit function is specified as π = (p − c)x − s(x, y) + 𝜃y, where p is price, c is production cost, x is demand, s is compensation paid to the salesperson, and 𝜃y is future profit related to the stock of consumer satisfaction, which increases with the salesperson’s effort. Under this specification, a reduced salesperson effort (a smaller y) leads to a loss in firm profit, which is similar to the impact of reputation effect in our model (i.e., a reputation loss of r(1 − α) in firm profit when the salesperson does not advise customers). Conceptually, this approach to modeling the reputation effect as directly affecting a firm’s profit function views the reputation effect as related to the retailer’s future profit, and views a reputation loss as caused by dissatisfied customers who attribute the purchase of a misfit product to the lack of sales advising and spend less at the retailer in future shopping occasions. Indeed, abundant evidence has demonstrated the positive relationship between consumer satisfaction and outcome measures of interest to the firm, such as repurchase intentions, loyalty, and profitability (Anderson and Sullivan 1993; Boulding et al. 1993, 1999; Anderson et al. 1994).

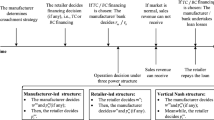

In determining the game sequence, we consider the strategic span of game players’ decisions in our research context and model a strategic decision with a longer time span as happening in an earlier stage of the game. In reality, retailers usually maintain policies regarding manufacturer SPIFF programs for a long time, evidenced in that Lowe’s change in SPIFF policy has caused big publicity; retailer SPIFF policy can thus be viewed as a strategy with the longest strategic span. Retailers’ sales commission policies usually remain unchanged for several years; and we focus on manufacturers’ SPIFF programs that last for multiple years; these strategies are viewed as mid-term. Lastly, manufacturers’ wholesale prices as well as the retailer’s retail prices may change from season to season and are thus viewed as short-term strategies.

This game sequence is determined based on the assumption that the retailer maintains a stable sales commission policy that applies to all products in the sale category invariant with individual manufacturers’ SPIFF rates. This specification well captures the business reality. Our conversations with business insiders suggest that commission on total category sales is the most commonly adopted contract type in the retailing industry because of its simplicity. In particular, a big retailer typically carries a large number of products in a category and routinely bring in new products. Renegotiating sales commission terms for each individual product can be costly and thus unrealistic. Moreover, retailers have incentive to maintain salesforce stability and a consistent sales compensation scheme helps in that regard.

All respondents had at least one year of experience as a retail salesperson and 87% of respondents reported more than three years of retail sales experience. On average, our respondents had sales experience with 5.73 categories among 13 product categories that we listed (home appliances, furniture and home improvement, home tools, women’s apparel, women’s shoes, men’s apparel, men’s shoes, kids’ apparel, kids’ shoes, kids’ toy, accessories, jewelry, and watch, home electronics, sports gears).

We also collected two additional measurements of sales advising effectiveness. First, in the survey on salespeople we asked the question “Do you feel the product return rate is higher in some product categories/departments than in others?” 35 (88%) of 40 respondents answered “yes” to this question and then evaluated the return rate across product categories on a 5-point Likert scale (1: very low, 5: very high). The result is presented in column (b) of Table 5. Our analysis shows a negative correlation between columns (a) and (b) of Table 5 (p = 0.07), supporting the notion that a higher level of sales advising effectiveness leads to a lower return rate. Second, we conducted a separate survey targeting consumers, and asked consumers to evaluate their perceived effectiveness of sales assistance across categories on a 5-point Likert scale (1: Not helpful at all, 5: extremely helpful). We collected 38 responses and present the result in column (c) of Table 5. Our analysis shows highly positive correlation between sales advising effectiveness evaluated by salespeople and by consumers (corr= 0.927, p < 0.001), which provides a strong support to the cross-category variation pattern in sales advising effectiveness observed in our data. Interestingly, we found that consumers’ evaluation of sales advising effectiveness is consistently lower than that of salespeople. In particular, across the 13 categories, the average level of sales advising effectiveness perceived by consumers is 2.88 (std 0.49) out of 5, which can be interpreted as “neither effective or ineffective.” And the average effectiveness perceived by salespeople is 4.99 (std 0.36) out of 7, which can be interpreted as “somewhat effective.” This result implies that salespeople tend to believe their effort in assisting customers is effective, whereas in reality customers do not perceive such effort as effective.

Our theoretical insight can have more general implications. For example, our result suggests that a retailer may have incentive to allocate salespeople with different advising capacities to categories with different levels of difficulty in matching consumers with products.

Consumer acceptance of sales advice can be operationalized as a rational choice against a burdensome cognitive process of evaluating ex-post product values and foreseeing salesperson persuasion strategies, particularly when full refund is guaranteed with product returns. And our results hold as long as the market contains a sufficiently large segment of consumers whose product preferences can be affected by the salesperson.

References

Anderson, E.W., & Sullivan, M. (1993). The antecedents and consequence of customer satisfaction for firms. Marketing Science, 12(2), 125–143.

Anderson, E.W., Fornell, C., Lehmann, D.R. (1994). Customer satisfaction, market share and profitability: findings from Sweden. Journal of Marketing Research, 31(3), 53–66.

Arya, A., & Mittendorf, B. (2013). Managing strategic inventories via manufacturer-to-consumer rebates. Management Science, 59(4), 813–818.

Basu, A.K., Lal, R., Srinivasan, V., Staelin, R. (1985). Salesforce compensation plans: an agency theoretic perspective. Marketing Science, 4(4), 267–291.

Bhardwaj, P., Chen, Y., Godes, D. (2008). Buyer-initiated vs. seller-initiated information revelation. Management Science, 54(6), 1104–1114.

Boulding, W., Kalra, A., Staelin, R., Zeithaml, V.A. (1993). A dynamic process model of service quality: from expectation to behavioral intentions. Journal of Marketing Research, 30(1), 460–469.

Boulding, W., Kalra, A., Staelin, R. (1999). The quality double whammy: the rich get richer. Marketing Science, 18(4), 363–384.

Caldieraro, F., & Coughlan, A.T. (2007). Spiffed-up channels: the role of spiffs in hierarchical selling organizations. Marketing Science, 26(1), 31–51.

Chen, Y., & Xie, J. (2008). Online consumer review: word-of-mouth as a new element of marketing communication mix. Management Science, 54(3), 477–491.

Chen, X., Li, C.-L., Rhee, B.-D., Simchi-Levi, D. (2007). The impact of manufacturer rebates on supply chain profits. Naval Research Logistics, 54(6), 667–680.

Chu, J. (2006). What top performing retailers know about satisfying customers: experience is key. New York: IBM Institute for Business Value.

Chung, D.J., Steenburgh, T., Sudhir, K. (2014). Do bonuses enhance sales productivity? a dynamic structural analysis of bonus-based compensation plans. Marketing Science, 33(2), 165–187.

Coughlan, A.T., & Sen, S.K. (1989). Salesforce compensation: theory and managerial implications. Marketing Science, 8(4), 324–342.

Gerstner, E., & Hess, J.D. (1991a). A theory of channel price promotion. American Economic Review, 81(4), 872–886.

Gerstner, E., & Hess, J.D. (1991b). Who benefits from large rebates: manufacturer, retailer, or consumer Economics Letter, 36, 5–8.

Gu, Z.J., & Liu, Y. (2013). Consumer fit search, retailer shelf layout, and channel interaction. Marketing Science, 32(4), 652–668.

Gu, Z.J., & Xie, Y. (2013). Facilitating fit revelation in the competitive market. Management Science, 32(4), 652–668.

Hauser, S., & Wernerfect. (1994). Customer satisfaction incentives. Marketing Science, 13(4), 327–350.

Hubbard, J. (2012). Lowe’s gives incentives for leaving, Journal Patriot. February 10 2012.

Inderst, R., & Ottaviani, M. (2009). Misselling through agents. American Economic Review, 99(3), 883–908.

Inderst, R., & Ottaviani, M. (2012). Competition through commissions and kickbacks. American Economic Review, 102(2), 780–809.

Iyengar, S.S., & Lepper, M.R. (2000). When choice is demotivating: can one desire too much of a good thing? Journal of Personality and Social Psychology, 79 (6), 995–1006.

Iyer, G., & Miguel Villas-Boas, J. (2003). A bargaining theory of distribution channels. Journal of Marketing Research, 40(1), 80–100.

Jeuland, A.P., & Shugan, S.M. (1983). Managing channel profits. Marketing Science, 2(3), 239–272.

Kalra, A., Shi, M., Srinivasan, K. (2003). Salesforce compensation scheme and consumer inferences. Management Science, 49(5), 655–672.

Korkki, P. (2009). A look at those who’d rather stay than switch, New York times, May 30 2009.

Kuksov, D., & Miguel Villas-Boas, J. (2010). When more alternatives lead to less choice. Marketing Science, 29(3), 507–524.

Lal, R., & Staelin, R. (1986). Salesforce compensation plans in environments with asymmetric information. Marketing Science, 5(3), 179–198.

Misra, S., & Nair, H. (2011). A structural model of sales-force compensation dynamics: estimation and field implementation. Quantitative Marketing and Economics, 9(3), 211–257.

Prendergast, C. (1999). The provision of incentives in firms. Journal of Economic Literature, 37(1), 7–63.

Taylor, T. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Taylor, T., & Xiao, W. (2009). Incentives for retailer forecasting: rebates vs. returns. Management Science, 55(10), 1654–1669.

Wernerfelt, B. (1994). On the function of sales assistance. Marketing Science, 13(1), 68–82.

Acknowledgements

The authors acknowledge, with thanks, the insightful suggestions and constructive comments offered by the Co-editor and review team, which greatly enhanced the quality of this paper. The authors are also grateful to Anand Krishnamoorthy, Jeffrey Shulman, and Ashutosh Prasad for helpful comments and advice on earlier drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Appendix

Appendix

Proof of Lemma 1

The retailer has three options of pricing strategies: p1 < p2, p1 = p2, and p1 > p2. When p1 < p2, the retailer’s profit function is \(\pi _{R}^{N}(p_{1}<p_{2})=\alpha (p_{1}-w_{1})-(1-\alpha )r\). The retailer’s optimal prices can be solved as {p1 = V, p2 > V}, which leads to the maximized profit of \(\pi _{R}^{N\ast }(p_{1}<p_{2})=\alpha (V-w_{1})-(1-\alpha )r\). Similarly, we can solve the case when p1 > p2 . Lastly, when p1 = p2 = p, the retailer’s profit function is \(\pi _{R}^{N}(p_{1}=p_{2})=\frac {1}{2}\alpha (2p-w_{1}-w_{2})-(1-\alpha )r\). The retailer optimally charges p1 = p2 = V, which leads to the maximized profit of \(\pi _{R}^{N}(p_{1}=p_{2})=\frac {1}{2}\alpha (2V-w_{1}-w_{2})-(1-\alpha )r\). Comparing \(\pi _{R}^{N\ast }(p_{1}<p_{2})\), \( \pi _{R}^{N\ast }(p_{1}=p_{2})\), and \(\pi _{R}^{N\ast }(p_{1}>p_{2})\), we obtain Lemma 1. □

Proof of Lemma 3

The retailer has three options of pricing strategies: p1 < p2, p1 = p2, and p1 > p2. We discuss the three strategies respectively.

First, if the retailer charges p1 < p2, its profit function is

The retailer optimally charges the highest possible prices for the two products, that is,

This strategy leads to the retailer’s maximized profit of

Similarly, if the retailer charges p1 > p2, its maximized profit can be derived as

Lastly, when the retailer charges the same price for the two products, p1 = p2 = p, its profit function is

The retailer’s optimal pricing strategy can be derived as p1 = p2 = V, if \(\left \{\frac {m_{M1}+m_{M2}}{2}\right .\) \(\left .\geq \frac {e}{s\alpha (1-\alpha )V} \&w_{1},w_{2}\leq V\right \}\) or if \(\ \left \{\frac {m_{M1}+m_{M2}}{2}<\frac {e}{s\alpha (1-\alpha )V}\&w_{1},w_{2}<V-\frac {1-\alpha }{\alpha }r\right \}\), which renders the retailer profit of

Given the wholesale prices for the two products, w1 and w2, the retailer decides which pricing strategy to take (p1 < p2, p1 = p2 , or p1 > p2). We consider the following conditions.

-

(i) mM1 = mM2 = mM. In this case, the retailer’s optimal pricing strategy is similar as in subgame N. In particular, if wi < wj (i, j = 1,2,i ≠ j), the retailer optimally charges pi < pj:

$$ \left\{ \begin{array}{ccc} p_{i}^{A\ast }=V-\varepsilon ,\text{ }p_{j}^{A\ast }=V & if & m_{M}\geq \frac{e}{s\alpha (1-\alpha )V}\&w_{i}<w_{j}\leq V \\ p_{i}^{A\ast }=V,\text{ }p_{j}^{A\ast }>V & if & m_{M}\!<\!\frac{e}{s\alpha (1-\alpha )V}\&w_{i}\leq V-\frac{1-\alpha }{\alpha }r\&w_{i}<w_{j}. \end{array} \right. $$(23)And if wi = wj, the retailer optimally charges \(p_{i}^{A\ast }=p_{j}^{A\ast }=V\), if \(\{m_{M}\geq \frac {e}{s\alpha (1-\alpha )V}\) & wi = wj ≤ V } or if \(\ \left \{m_{M}<\frac {e}{s\alpha (1-\alpha )V}~\&~ w_{i}=w_{j}\leq V-\frac {1-\alpha }{\alpha }\right \}\).

-

(ii) mM1 < mM2. In this case, we consider the following conditions.

-

(ii.a) \(m_{M1}\geq \frac {e}{s\alpha (1-\alpha )V}\): The retailer optimally charges \(\{p_{i}^{A\ast }=V-\varepsilon ,\) \(p_{j}^{A\ast }=V\}\) if wi < wj ≤ V, and charges \(p_{i}^{A\ast }=\) \(p_{j}^{A\ast }=V\) if wi = wj ≤ V.

-

(ii.b) \(m_{M2}<\frac {e}{s\alpha (1-\alpha )V}\): The retailer optimally charges \(\{p_{i}^{A\ast }=V,\) \(p_{j}^{A\ast }>V\}\) if \(w_{i}\leq V-\frac { 1-\alpha }{\alpha }r\&w_{i}<w_{j}\), and charges \(p_{i}^{A\ast }=\) \( p_{j}^{A\ast }=V\) if \(w_{i}=w_{j}\leq V-\frac {1-\alpha }{\alpha }\).

-

(ii.c) \(m_{M1}<\frac {e}{s\alpha (1-\alpha )V}\leq m_{M2}\): The retailer has two strategic options. The retailer can charge \(\{p_{1}^{A\ast }=V-\varepsilon ,\) \(p_{2}^{A\ast }=V\}\) and obtain a profit of α(V − w1) + sα(1 − α)(V − w2); alternately, the retailer can charge \(\{p_{1}^{A\ast }>V,\) \(p_{2}^{A\ast }=V\}\) and obtain a profit of α(V − w2) − (1 − α)r. It can be proved that the former strategy is more profitable given w1,w2 ≤ V.

-

-

(iii) mM1 > mM2. This case is symmetric to case (ii) and the retailer’s optimal pricing strategies can be derived following a similar approach.

Summarizing the above discussion, we obtain Lemma 3.

□

Proof of Eq. 8

-

(i) We first consider the case when the two manufacturers offer the same SPIFF rate mM1 = mM2 = mM. We consider the following conditions.

-

(i.a) \(m_{M}\geq \frac {e}{s\alpha (1-\alpha )V}\): Manufacturer i(i = 1,2)’s profit function is

$$ \pi_{Mi}^{A}=\left\{ \begin{array}{ccc} \alpha (w_{i}-m_{M}V) & if & w_{i}<w_{j}\leq V \\ \frac{1}{2}(\alpha +s\alpha (1-\alpha ))(w_{i}-m_{M}V) & if & w_{i}=w_{j}\leq V \\ s\alpha (1-\alpha )(w_{i}-m_{M}V) & if & w_{j}<w_{i}\leq V. \end{array} \right. $$(24)Each manufacturer can guarantee a demand of sα(1 − α) by charging the highest possible wholesale price of V. The manufacturer’s equilibrium profit is thus \(\pi _{Mi}^{A\ast }=s\alpha (1-\alpha )(1-m_{M})V\). By undercutting its rival’s wholesale price, a manufacturer can obtain a demand of α. Therefore, the lowest wholesale price \(\underline {w}\) a manufacturer is willing to charge satisfies \((\underline {w}-m_{M}V)\alpha = \) sα(1 − α)(1 − mM)V, that is, \(\underline {w}=s(1-\alpha )(1-m_{M})V+m_{M}V\). In equilibrium, each manufacturer i(i = 1,2) randomizes its wholesale price over \(w_{i}^{A\ast }\in \lbrack s(1-\alpha )V+m_{M}V,V+m_{M}V]\). The distribution function of \({w_{i}^{A}}\) can be derived from

$$\begin{array}{@{}rcl@{}} &&s\alpha (1-\alpha )(w_{i}-m_{M}V)+(1-F(w_{i}))(\alpha \!-s\alpha (1-\alpha ))(w_{i}-m_{M}V)\\&=&s(1-\alpha )(1-m_{M})V. \end{array} $$ -

(i.b) \(m_{M}<\frac {e}{s\alpha (1-\alpha )V}\): Manufacturer i’s profit function is

$$ \pi_{Mi}^{A}=\left\{ \begin{array}{ccc} \alpha (w_{i}-m_{M}V) & if & w_{i}<w_{j}\leq V-\frac{1-\alpha }{\alpha }r \\ \frac{1}{2}\alpha (w_{i}-m_{M}V) & if & w_{i}=w_{j}\leq V-\frac{1-\alpha }{ \alpha }r \\ 0 & if & w_{i}>w_{j}. \end{array} \right. $$(25)In this case, each manufacturer keeps undercutting its rival’s wholesale price until it is no more profitable to do so. Therefore, the optimal wholesale price is \(w_{i}^{A\ast }=m_{M}V\), which renders the manufacturer profit of \(\pi _{Mi}^{A\ast }= 0\).

-

-

(ii) We then consider the case when the two manufacturers offer different SPIFF rates mM1 < mM2. We consider the following conditions.

-

(ii.a) \(m_{M1}>\frac {e}{s\alpha (1-\alpha )V}\): Manufacturer i(i = 1,2)’s profit function is

$$ \pi_{Mi}^{A}=\left\{ \begin{array}{ccc} \alpha (w_{i}-m_{Mi}V) & if & w_{i}<w_{j}\leq V \\ \frac{1}{2}(\alpha +s\alpha (1-\alpha ))(w_{i}-m_{Mi}V) & if & w_{i}=w_{j}\leq V \\ s\alpha (1-\alpha )(w_{i}-m_{Mi}V) & if & w_{j}<w_{i}\leq V. \end{array} \right. $$(26)Each manufacturer can guarantee a demand of sα(1 − α) by charging the highest possible wholesale price of V. Manufacturer i’s equilibrium profit is thus \(\pi _{Mi}^{A\ast }=s\alpha (1-\alpha )(1-m_{Mi})V \) . By undercutting its rival’s wholesale price, a manufacturer can obtain a demand of α. Therefore, the lowest wholesale price \( \underline {w}_{i} \) a manufacturer is willing to charge satisfies \((\underline {w}-m_{Mi}V)\alpha =\) sα(1 − α)(1 − mMi)V, that is, \( \underline {w}_{i}=s(1-\alpha )(1-m_{Mi})V+m_{Mi}V\). Clearly, \(\underline {w}_{1}<\underline {w}_{2}\). Therefore, manufacturer 1 can charge a wholesale price slightly lower than \(\underline {w}_{2}\) and get the demand of α . The two manufacturers’ equilibrium profits are thus

$$\begin{array}{@{}rcl@{}} \pi_{M1}^{A\ast } \!&=&\!\alpha (\underline{w}_{2} - m_{M1}V) = \alpha (s(1 - \alpha )(1 - m_{M2})V + (m_{M2} - m_{M1})V)\text{, and}\\ \end{array} $$(27)$$\begin{array}{@{}rcl@{}} \pi_{M2}^{A\ast } &=&s\alpha (1-\alpha )(\underline{w}_{2}-m_{M2}V)=\alpha (s(1-\alpha )(1-m_{M2})V. \end{array} $$(28)That is, the manufacturer 2 that offers a higher SPIFF rate ends up with a lower profit.

In equilibrium, both manufacturers randomize their wholesale prices over [\( \underline {w}_{2},V\)]. The distribution function of manufacturer 1’s wholesale prices F1 can be derived from

$$\begin{array}{@{}rcl@{}} &&{}s\alpha{\kern-.5pt}(1\! -\!\alpha {\kern-.5pt}){\kern-.5pt}({\kern-.5pt}w_{2}\! -\! m_{M2}V{\kern-.5pt})\! +\! ({\kern-.5pt}1\! -\! F_{1}{\kern-.5pt}({\kern-.5pt}w_{2}{\kern-.5pt}){\kern-.5pt}){\kern-.5pt}({\kern-.5pt}\alpha - s\alpha {\kern-.5pt}({\kern-.5pt}1 - \alpha {\kern-.5pt}){\kern-.5pt}){\kern-.5pt}({\kern-.5pt}w_{2}\! -\! m_{M2}V{\kern-.5pt})\\ &=&s\alpha (1-\alpha )(\underline{w}_{2}-m_{M2}V). \end{array} $$The distribution function of manufacturer 2’s wholesale price F2 can be derived from

$$\begin{array}{@{}rcl@{}} &&s{\kern-.5pt}\alpha{\kern-.6pt}({\kern-.6pt}1\! -\! \alpha {\kern-.6pt}){\kern-.6pt}({\kern-.6pt}w_{1}\! -\! m_{M1}{\kern-.6pt}V{\kern-.6pt})\! +\! ({\kern-.6pt}1 \! -\! F_{2}{\kern-.6pt}({\kern-.6pt}w_{1}{\kern-.6pt}){\kern-.6pt}){\kern-.6pt}({\kern-.6pt}\alpha \! -\! s{\kern-.5pt}\alpha {\kern-.6pt}(1\! -\! \alpha{\kern-.6pt}){\kern-.6pt}){\kern-.6pt}({\kern-.6pt}w_{1}\! -\! m_{M1}{\kern-.6pt}V{\kern-.6pt})\\ &&=\alpha (\underline{w}_{2}-m_{M1}V). \end{array} $$ -

(ii.b) \(m_{M1}<\frac {e}{s\alpha (1-\alpha )V}<m_{M2}\): Manufacturer i(i = 1,2)’s profit function is

$$ \left\{\!\! \begin{array}{ccc} \pi_{M1}^{A}\! =\! \alpha ({\kern-.5pt}w_{1} - m_{M1}V{\kern-.5pt}){\kern-.5pt},{\kern-.5pt}\pi_{M2}^{A}=s\alpha {\kern-.5pt}({\kern-.5pt}1 - \alpha {\kern-.5pt}){\kern-.5pt}({\kern-.5pt}w_{2} - m_{M2}{\kern-.5pt}V{\kern-.5pt}) & if & w_{1},w_{2}\leq V \\ \pi_{M1}^{A}\! =\! \alpha ({\kern-.5pt}w_{1}\! -\! m_{M}V{\kern-.5pt}),\pi_{M2}^{A}\! =\! 0 & if & w_{1}\!{\kern-.5pt} <{\kern-.5pt}\! V\! -\! \frac{ (1-\alpha )r}{\alpha }\&w_{2}{\kern-.5pt}\! >\!{\kern-.5pt} V \\ \pi_{M2}^{A}\! =\! 0,\pi_{M1}^{A}\! =\! \alpha (w_{1}\! -\! m_{M}V) & if & w_{1}\! >\! V\&w_{2}\! <\! V\! -\! \frac{(1-\alpha )r}{\alpha } \\ \pi_{M1}^{A}\! =\! \pi_{M2}^{A}\! =\! 0 & if & w_{1},w_{2}>V. \end{array} \right. $$(29)No manufacturer has incentive to undercut its rival’s wholesale prices and in equilibrium, \(w_{1}^{A\ast }=w_{2}^{A\ast }=V\). The manufacturers’ equilibrium profits are thus \(\pi _{M1}^{A\ast }=\alpha (1-m_{M1})V\) and \( \pi _{M2}^{A\ast }=s\alpha (1-\alpha )(1-m_{M2})V\) respectively. Again, manufacturer 2 that offers a higher SPIFF rate ends up with a lower profit.

-

(ii.c) \(m_{M1}<\frac {e}{s\alpha (1-\alpha )V}\): Manufacturer i’s profit function is

$$ \pi_{Mi}^{A}=\left\{ \begin{array}{ccc} \alpha (w_{i}-m_{Mi}V) & if & w_{i}<w_{j}\leq V-\frac{(1-\alpha )r}{\alpha } \\ \frac{1}{2}\alpha (w_{i}-m_{Mi}V) & if & w_{i}=w_{j}\leq V-\frac{(1-\alpha )r }{\alpha } \\ 0 & if & w_{i}>w_{j}\text{ }. \end{array} \right. $$(30)Each manufacturer has incentive to undercut its rival’s wholesale price until it is not profitable to do so. The lowest wholesale price \(\underline {w }_{i}\) a manufacturer is willing to charge satisfies \(\underline {w}_{i}=m_{Mi}\). Clearly, \(\underline {w}_{1}<\underline {w}_{2}\). Therefore, manufacturer 1 can charge a wholesale price slightly lower than \(\underline {w }_{2}\) and get the demand of α. The two manufacturers’ equilibrium profits are thus \(\pi _{M1}^{A\ast }=\alpha (m_{M2}-m_{M1})V\) and \(\pi _{M2}^{A\ast }= 0\). Therefore, manufacturer 2 that offers a higher SPIFF rate ends up with a lower profit.

Summarizing the above discussion, we obtain Eq. 8.

-

□

Proof of Proposition 1

From Eq. 8, we obtain that the manufacturers have incentive to undercut each other’s SPIFF rate. This undercutting stops when \(m_{M1}^{A\ast }=m_{M2}^{A\ast }=\frac {e}{s\alpha (1-\alpha )V}\). The manufacturer’s equilibrium profit is thus \(\pi _{M1}^{A\ast }=\) \(\pi _{M2}^{A\ast }=s\alpha (1-\alpha )(1-\frac {e}{s\alpha (1-\alpha )V})V\). □

Proof of Proposition 2

The retailer’s maximized profit in subgame N when it does not allow SPIFF is given by \(\pi _{R}^{N\ast }=\alpha V-(1-\alpha )r\), and the retailer’s maximized profit in subgame A when it allows SPIFF is given by \(\pi _{R}^{A\ast }=(\alpha -s\alpha (1-\alpha ))(1-\frac {e}{s\alpha (1-\alpha )V} )V\). Comparing \(\pi _{R}^{N\ast }\) and \(\pi _{R}^{A\ast }\), it is easy to obtain that \(\pi _{R}^{N\ast }>\pi _{R}^{A\ast }\) if \(s<\underline {s}\) or \(s> \overline {s}\). □

Rights and permissions

About this article

Cite this article

Gu, Z.(., Liu, Y. Why would a big retailer refuse to collaborate on manufacturer SPIFF programs?. Quant Mark Econ 16, 441–472 (2018). https://doi.org/10.1007/s11129-018-9202-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-018-9202-8