Abstract

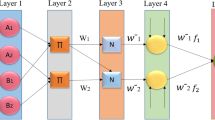

This paper presents a novel forecasting model for crude oil price which has the largest effect on economies and countries. The proposed method depends on improving the performance of the adaptive neuro-fuzzy inference system (ANFIS) using a modified salp swarm algorithm (SSA). The SSA simulates the behaviors of salp swarm in nature during searching for food, and it has been developed as a global optimization method. However, SSA still has some limitations such as getting trapped at a local point. Therefore, this paper uses the genetic algorithm to improve the behavior of SSA. The proposed model (GA-SSA-ANFIS) aims to determine the suitable parameters for the ANFIS by using the GA-SSA algorithm since these parameters are considered as the main factor influencing the ANFIS’s prediction process. The results of the GA-SSA-ANFIS are compared to other models, including the traditional ANFIS model, ANFIS based on GA (GA-ANFIS), ANFIS based on SSA (SSA-ANFIS) ANFIS based on particle swarm optimization (PSO-ANFIS), and ANFIS based on grey wolf optimization (GWO-ANFIS). The results show the superiority and high performances of the GA-SSA-ANFIS over the other models in predicting crude oil prices.

Similar content being viewed by others

References

Abbassi, R., Abbassi, A., Heidari, A. A., & Mirjalili, S. (2019). An efficient salp swarm-inspired algorithm for parameters identification of photovoltaic cell models. Energy Conversion and Management, 179, 362–372.

Agnolucci, P. (2009). Volatility in crude oil futures: A comparison of the predictive ability of garch and implied volatility models. Energy Economics, 31(2), 316–321.

Alameer, Z., Elaziz, M. A., Ewees, A. A., Ye, H., & Jianhua, Z. (2019a). Forecasting copper prices using hybrid adaptive neuro-fuzzy inference system and genetic algorithms. Natural Resources Research, 28(4), 1385–1401.

Alameer, Z., Elaziz, M. A., Ewees, A. A., Ye, H., & Jianhua, Z. (2019b). Forecasting gold price fluctuations using improved multilayer perceptron neural network and whale optimization algorithm. Resources Policy, 61, 250–260.

Allegret, J.-P., Mignon, V., & Sallenave, A. (2015). Oil price shocks and global imbalances: Lessons from a model with trade and financial interdependencies. Economic Modelling, 49, 232–247.

Aloui, C., & Jammazi, R. (2015). Dependence and risk assessment for oil prices and exchange rate portfolios: A wavelet based approach. Physica A: Statistical Mechanics and its Applications, 436, 62–86.

Aloui, R., Safouane Ben Aïssa, M., & Nguyen, D. K. (2013). Conditional dependence structure between oil prices and exchange rates: A copula-garch approach. Journal of International Money and Finance, 32, 719–738.

Baruník, J., & Malinska, B. (2016). Forecasting the term structure of crude oil futures prices with neural networks. Applied energy, 164, 366–379.

Bedoui, R., Braeik, S., Goutte, S., & Guesmi, K. (2018). On the study of conditional dependence structure between oil, gold and usd exchange rates. International Review of Financial Analysis, 59, 134–146.

Behmiri, N. B., & Manera, M. (2015). The role of outliers and oil price shocks on volatility of metal prices. Resources Policy, 46, 139–150.

Brigida, M. (2014). The switching relationship between natural gas and crude oil prices. Energy Economics, 43, 48–55.

Caporin, M., & Fontini, F. (2017). The long-run oil-natural gas price relationship and the shale gas revolution. Energy Economics, 64, 511–519.

Chai, J., Xing, L.-M., Zhou, X.-Y., Zhang, Z. G., & Li, J.-X. (2018). Forecasting the wti crude oil price by a hybrid-refined method. Energy Economics, 71, 114–127.

Cheng, F., Li, T., Wei, Y., & Fan, T. (2019). The vec-nar model for short-term forecasting of oil prices. Energy Economics, 78, 656–667.

Chen, F., & Linn, S. C. (2017). Investment and operating choice: Oil and natural gas futures prices and drilling activity. Energy Economics, 66, 54–68.

Chen, Y.-C., Rogoff, K. S., & Rossi, B. (2010). Can exchange rates forecast commodity prices? The Quarterly Journal of Economics, 125(3), 1145–1194.

Chiroma, H., Abdul-Kareem, S., Abubakar, A., Zeki, A. M., & Usman, M. J. (2014). Orthogonal wavelet support vector machine for predicting crude oil prices. In Proceedings of the first international conference on advanced data and information engineering (DaEng-2013) (pp. 193–201). Springer: Berlin.

Ding, L., & Vo, M. (2012). Exchange rates and oil prices: A multivariate stochastic volatility analysis. The Quarterly Review of Economics and Finance, 52(1), 15–37.

Dooley, G., & Lenihan, H. (2005). An assessment of time series methods in metal price forecasting. Resources Policy, 30(3), 208–217.

Dutta, A., Bouri, E., & Roubaud, D. (2019). Nonlinear relationships amongst the implied volatilities of crude oil and precious metals. Resources Policy, 61, 473–478.

Ediger, V. Ş., & Akar, S. (2007). Arima forecasting of primary energy demand by fuel in turkey. Energy policy, 35(3), 1701–1708.

El Aziz, M. A., Hemdan, A. M., Ewees, A. A., Elhoseny, M., Shehab, A., Hassanien, A. E., & Xiong, S. (2017). Prediction of biochar yield using adaptive neuro-fuzzy inference system with particle swarm optimization. In PowerAfrica, 2017 IEEE PES (pp. 115–120). IEEE.

El-Fergany, A. A. (2018). Extracting optimal parameters of pem fuel cells using salp swarm optimizer. Renewable Energy, 119, 641–648.

Energy Minerals Division American Association of Petroleum Geologists. (2019). Unconventional energy resources: 2017 review. Natural Resources Research, 28(4), 1661–1751.

Guan, Q., & An, H. (2017). The exploration on the trade preferences of cooperation partners in four energy commodities’ international trade: Crude oil, coal, natural gas and photovoltaic. Applied Energy, 203, 154–163.

Haque, M. A., Topal, E., & Lilford, E. (2015). Relationship between the gold price and the australian dollar-us dollar exchange rate. Mineral Economics, 28(1–2), 65–78.

Henschke, N., Everett, J. D., Richardson, A. J., & Suthers, I. M. (2016). Rethinking the role of salps in the ocean. Trends in Ecology & Evolution, 31(9), 720–733.

He, Y., Wang, S., & Lai, K. K. (2010). Global economic activity and crude oil prices: A cointegration analysis. Energy Economics, 32(4), 868–876.

Ho, R. (2006). Handbook of univariate and multivariate data analysis and interpretation with SPSS. London: Chapman and Hall/CRC.

Holland, J. H., et al. (1992). Adaptation in natural and artificial systems: an introductory analysis with applications to biology, control, and artificial intelligence. Cambridge: MIT press.

Hou, A., & Suardi, S. (2012). A nonparametric garch model of crude oil price return volatility. Energy Economics, 34(2), 618–626.

Hung, N. T., & Thach, N. N. et al. (2018). Garch models in forecasting the volatility of the world’s oil prices. In International econometric conference of Vietnam (pp. 673–683). Springer.

Ibrahim, R. A., Ewees, A. A., Oliva, D., Elaziz, M. A., & Lu, S. (2018). Improved salp swarm algorithm based on particle swarm optimization for feature selection. Journal of Ambient Intelligence and Humanized Computing, 10(8), 3155–3169.

Jain, A., & Biswal, P. C. (2016). Dynamic linkages among oil price, gold price, exchange rate, and stock market in india. Resources Policy, 49, 179–185.

Jammazi, R., & Aloui, C. (2012). Crude oil price forecasting: Experimental evidence from wavelet decomposition and neural network modeling. Energy Economics, 34(3), 828–841.

Jang, J.-S. R. (1993). Anfis: Adaptive-network-based fuzzy inference system. IEEE Transactions on Systems, Man, and Cybernetics, 23(3), 665–685.

Kaufmann, R. K., & Hines, E. (2018). The effects of combined-cycle generation and hydraulic fracturing on the price for coal, oil, and natural gas: Implications for carbon taxes. Energy Policy, 118, 603–611.

Ketabchi, H., & Ataie-Ashtiani, B. (2015). Evolutionary algorithms for the optimal management of coastal groundwater: A comparative study toward future challenges. Journal of Hydrology, 520, 193–213.

Khashei, M., & Bijari, M. (2010). An artificial neural network (p, d, q) model for timeseries forecasting. Expert Systems with Applications, 37(1), 479–489.

Khashei, M., & Bijari, M. (2011). A novel hybridization of artificial neural networks and arima models for time series forecasting. Applied Soft Computing, 11(2), 2664–2675.

Kriechbaumer, T., Angus, A., Parsons, D., & Casado, M. R. (2014). An improved wavelet–arima approach for forecasting metal prices. Resources Policy, 39, 32–41.

Lardic, S., & Mignon, V. (2008). Oil prices and economic activity: An asymmetric cointegration approach. Energy Economics, 30(3), 847–855.

Lean, Y., Zhang, X., Wang, S., et al. (2017). Assessing potentiality of support vector machine method in crude oil price forecasting. Eurasia Journal of Mathematics, Science and Technology Education, 13(12), 7893–7904.

Li, H., Chen, L., Wang, D., & Zhang, H. (2017a). Analysis of the price correlation between the international natural gas and coal. Energy Procedia, 142, 3141–3146.

Lineesh, M. C., Minu, K. K., & John, C. J. (2010). Analysis of nonstationary nonlinear economic time series of gold price: A comparative study. International Mathematical Forum, 5(34), 1673–1683.

Li, X., Shang, W., & Wang, S. (2018). Text-based crude oil price forecasting: A deep learning approach. International Journal of Forecasting, 35(4), 1548–1560.

Li, X.-P., Zhou, C.-Y., & Chong-Feng, W. (2017b). Jump spillover between oil prices and exchange rates. Physica A: Statistical Mechanics and its Applications, 486, 656–667.

Maghyereh, A. (2006). Oil price shocks and emerging stock markets: A generalized var approach. In Global stock markets and portfolio management (pp. 55–68). Springer.

Md-Khair, N. Q. N., & Samsudin, R. (2017). Forecasting crude oil prices using wavelet arima model approach. In International conference of reliable information and communication technology (pp. 535–544). Springer.

Mingming, T., & Jinliang, Z. (2012). A multiple adaptive wavelet recurrent neural network model to analyze crude oil prices. Journal of Economics and Business, 64(4), 275–286.

Mirjalili, S., Gandomi, A. H., Mirjalili, S. Z., Saremi, S., Faris, H., & Mirjalili, S. M. (2017). Salp swarm algorithm: A bio-inspired optimizer for engineering design problems. Advances in Engineering Software, 114, 163–191.

Mirmirani, S., & Cheng Li, H. (2004). A comparison of var and neural networks with genetic algorithm in forecasting price of oil. In Applications of artificial intelligence in finance and economics (pp. 203–223). Emerald Group Publishing Limited.

Mohammadi, H., & Lixian, S. (2010). International evidence on crude oil price dynamics: Applications of arima-garch models. Energy Economics, 32(5), 1001–1008.

Mo, B., Nie, H., & Jiang, Y. (2018). Dynamic linkages among the gold market, us dollar and crude oil market. Physica A: Statistical Mechanics and its Applications, 491, 984–994.

Mostafa, M. M., & El-Masry, A. A. (2016). Oil price forecasting using gene expression programming and artificial neural networks. Economic Modelling, 54, 40–53.

Parisi, A., Parisi, F., & Díaz, D. (2008). Forecasting gold price changes: Rolling and recursive neural network models. Journal of Multinational financial management, 18(5), 477–487.

Qin, J., Xinsheng, L., Zhou, Y., & Ling, Q. (2015). The effectiveness of china’s rmb exchange rate reforms: An insight from multifractal detrended fluctuation analysis. Physica A: Statistical Mechanics and its Applications, 421, 443–454.

Ramberg, D. J., Chen, Y. H. H., Paltsev, S., & Parsons, J. E. (2017). The economic viability of gas-to-liquids technology and the crude oil–natural gas price relationship. Energy Economics, 63, 13–21.

Ramyar, S., & Kianfar, F. (2019). Forecasting crude oil prices: A comparison between artificial neural networks and vector autoregressive models. Computational Economics, 53(2), 743–761.

Safari, A., & Davallou, M. (2018). Oil price forecasting using a hybrid model. Energy, 148, 49–58.

Salisu, A. A., & Oloko, T. F. (2015). Modeling oil price–us stock nexus: A varma–bekk–agarch approach. Energy Economics, 50, 1–12.

Shabri, A., & Samsudin, R. (2017). Hybridizing wavelet and multiple linear regression model for crude oil price forecasting. In Proceedings of the international conference on computing, mathematics and statistics (iCMS 2015) (pp. 157–164). Springer.

Šimáková, J. (2011). Analysis of the relationship between oil and gold prices. Journal of Finance, 51(1), 651–662.

Sun, S., Sun, Y., Wang, S., & Wei, Y. (2018). Interval decomposition ensemble approach for crude oil price forecasting. Energy Economics, 76, 274–287.

Sutherland, K. R., & Weihs, D. (2017). Hydrodynamic advantages of swimming by salp chains. Journal of The Royal Society Interface, 14(133), 20170298.

Teetranont, T., Chanaim, S., Yamaka, W., & Sriboonchitta, S. (2018). Investigating relationship between gold price and crude oil price using interval data with copula based garch. In International conference of the Thailand econometrics society (pp. 656–669). Springer.

Tiwari, A. K., Mukherjee, Z., Gupta, R., & Balcilar, M. (2019). A wavelet analysis of the relationship between oil and natural gas prices. Resources Policy, 60, 118–124.

Wang, J., Athanasopoulos, G., Hyndman, R. J., & Wang, S. (2018). Crude oil price forecasting based on internet concern using an extreme learning machine. International Journal of Forecasting, 34(4), 665–677.

Wu, Y.-X., Wu, Q.-B., & Zhu, J.-Q. (2019). Improved eemd-based crude oil price forecasting using lstm networks. Physica A: Statistical Mechanics and its Applications, 516, 114–124.

Xie, W., Yu, L., Xu, S., & Wang, S. (2006). A new method for crude oil price forecasting based on support vector machines. In International conference on computational science (pp. 444–451). Springer.

Yaojie Zhang, Y., Wei, Y. Z., & Jin, D. (2019a). Forecasting oil price volatility: Forecast combination versus shrinkage method. Energy Economics, 80, 423–433.

Yu, L., Zhao, Y., & Tang, L. (2014). A compressed sensing based ai learning paradigm for crude oil price forecasting. Energy Economics, 46, 236–245.

Zhang, Y.-J., & Wang, J.-L. (2019). Do high-frequency stock market data help forecast crude oil prices? Evidence from the midas models. Energy Economics, 78, 192–201.

Zhang, Y.-J., Yao, T., He, L.-Y., & Ripple, R. (2019b). Volatility forecasting of crude oil market: Can the regime switching garch model beat the single-regime garch models? International Review of Economics & Finance, 59, 302–317.

Zhao, C. L., & Wang, B. (2014). Forecasting crude oil price with an autoregressive integrated moving average (arima) model. In Fuzzy information & engineering and operations research & management (pp. 275–286). Springer.

Zhao, L.-T., Wang, Y., Guo, S.-Q., & Zeng, G.-R. (2018). A novel method based on numerical fitting for oil price trend forecasting. Applied Energy, 220, 154–163.

Zhou, Z., & Dong, X. (2012). Analysis about the seasonality of china’s crude oil import based on x–12-arima. Energy, 42(1), 281–288.

Zhu, J., Liu, J., Wu, P., Chen, H., & Zhou, L. (2019). A novel decomposition-ensemble approach to crude oil price forecasting with evolution clustering and combined model. International Journal of Machine Learning and Cybernetics, 10(12), 3349–3362.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abd Elaziz, M., Ewees, A.A. & Alameer, Z. Improving Adaptive Neuro-Fuzzy Inference System Based on a Modified Salp Swarm Algorithm Using Genetic Algorithm to Forecast Crude Oil Price. Nat Resour Res 29, 2671–2686 (2020). https://doi.org/10.1007/s11053-019-09587-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-019-09587-1