Abstract

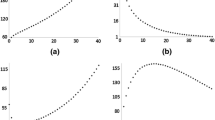

In this paper, we study the conditional, non-homogeneous and doubly stochastic compound Poisson process with stochastic discounted claims. We derive the moment generating functions of these risk processes and find their inverses, numerically or analytically, by using their corresponding characteristic functions. We then compare their distributions and some risk measures as the VaR and TVaR, and we examine the case where there is a possible dependence between the occurrence time and the severity of the claim.

Similar content being viewed by others

References

Albrecher H, Asmussen S (2006) Ruin probabilities and aggregate claims distributions for shot noise Cox processes. Scand Actuar J 2:86–110

Dassios A, Jang J (2008) The distribution of the interval between events of a Cox process with shot noise intensity, J Appl Math and Stoch An. Article ID 367170, 1-14

Gatto R (2010) A saddle point approximation of inhomogeneous discounted compound Poisson Processes, Methodol and Comput in Appl Probab 2: 533-551.

Gerber HU (1971) Der einfluss von zins auf ruinwahrscheinlichkeit. Mitteil Verein Schweiz Versich 71:63–70

Léveillé G, Adékambi F (2011) Covariance of discounted renewal sums with a stochastic interest rate. Scand Actuar J 2:138–153

Léveillé G, Garrido J (2001) Recursive moments of compound renewal sums with discounted claims. Scand Actuar J 2:98–110

Léveillé G, Garrido J, Wang YF (2010) Moment generating functions of compound renewal sums with discounted claims. Scand Actuar J 3:165–184

Léveillé G, Hamel E (2013) A compound renewal model for medical malpractice insurance. Eur Actuar J 3:471–490

Lu Y, Garrido J (2005) Doubly periodic Non-Homogeneous Poisson Models for Hurricane Data. Stat Methodol 2:17–35

Luciano E, Vigna E (2008) Mortality risk via affine stochastic intensities : calibration and empirical relevance. Belgian Actuar B : 1-16

Mikosch T (2009) Non-Life Insurance Mathematics: An Introduction with the Poisson Process, Springer. Universitext

Rolski T, Schmidli H, Schmidt V, Teugels J (1999) Stochastic Processes for Insurance and Finance, Wiley

Ross S (2014) Introduction to probability models, 11th Edn, Academic Press

Schmidt T (2014) Catastrophe Insurance Modeled by Shot-Noise Process. Risks 2:3–24

Shevchenko P (2010) Calculation of aggregate loss distributions. J of Oper Risk 5(2):3–40

Teugels J, Sundt B (eds.) (2004) Encyclopedia of Actuarial Science

Willmot G (1989) The total claims distribution under inflationary conditions. Scand Actuar J 1:1–12

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Léveillé, G., Hamel, E. Conditional, Non-Homogeneous and Doubly Stochastic Compound Poisson Processes with Stochastic Discounted Claims. Methodol Comput Appl Probab 20, 353–368 (2018). https://doi.org/10.1007/s11009-017-9555-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-017-9555-6

Keywords

- Aggregate discounted claims

- Compound Cox process

- Intensity function

- Joint and raw moments

- Non-homogeneous Poisson process

- Renewal process

- Stochastic interest rate