Abstract

This paper measures the market response triggered by merger announcements in an environment without regulations and without a strong separation of ownership and control in Germany. Based on event study methods applied to daily data and regression analyses, I evaluate whether the merger paradox existed, and how firm size, the way of financing a merger, and industry factors influenced the success of acquirers. Hence, my study can shed some light on commonly believed explanations for the bad performance of mergers. The whole portfolio of acquirers exhibited positive cumulated abnormal returns, which indicates a rejection of the merger paradox—but market values of some companies declined. Particularly, acquiring banks lost shareholder value, although the majority of mergers occurred in the banking industry. Caused by the new exchange law, banks were in a merger wave. Therefore, alternative explanations like the minimax-regret principle might explain why banks merged in spite of lacking success.

Similar content being viewed by others

References

Andrade G, Mitchell M, Stafford E (2001) New evidence and perspectives on mergers. J Econ Perspect 15:103–120

Armitage S (1995) Event study methods and evidence on their performance. J Econ Surv 9:25–52

Banerjee A, Eckard EW (2001) Why regulate insider trading? Evidence from the first Great Merger Wave (1896–1903). Am Econ Rev 91:1329–1349

Binder J (1985) On the use of the multivariate regression model in event studies. J Accounting Res 23:370–383

Borg JR, Borg MO, Leeth JD (1989) The success of mergers in the 1920s: A stock market appraisal of the second merger wave. Int J Ind Organ 7:117–131

Borg JR, Leeth JD (1994) The impact of mergers on acquiring firm shareholder wealth: The 1905–1930 experience. Empirica 21:221–244

Borg JR, Leeth JD (2000) The impact of takeovers on shareholder wealth during the 1920s merger wave. J Financ Quant Anal 35:217–238

Boyer KD (2006) Mergers that harm competitors. Rev Ind Organ 7:191–202

Brown SJ, Warner JB (1980) Measuring security price performance. J Financ Econ 8:205–258

Brown SJ, Warner JB (1985) Using daily stock returns: The case of event studies. J Financ Econ 14:3–31

Bühner R (1991) The success of mergers in Germany. Int J Ind Organ 9:513–553

Eckbo B (1986) Mergers and the market for corporate control. Can J Economics 19:236–260

Eis C (1971) The 1919–1930 merger movement in American industry. Arno Press, New York

Eube S (1998) Der Aktienmarkt in Deutschland vor dem Ersten Weltkrieg. Eine Indexanalyse, Frankfurt

Fohlin C (2005) The history of corporate ownership and control in Germany. In: Morck R (ed) The history of corporate governance: The rise and sometimes fall of the world’s great mercantile families. NBER and University of Chicago Press

Fremdling R, Krengel J (1985) Kartelle und ihre volks- bzw. Einzelwirtschaftliche Bedeutung bis 1914. In: Kartelle und Kartellgesetzgebung, in: Praxis und Rechtsprechung vom 19. Jahrhundert bis zur Gegenwart, Pohl H (ed) Stuttgart

Gaudet G, Salant SW (1992) Towards a theory of horizontal mergers. In: Norman G, Manna La M (eds) The new industrial economics. Edward Elgar, Aldershot

Gömmel R (1985) Kartelle in the öffentlichen Meinung bis 1914. In: Kartelle und Kartellgesetzgebung in Praxis und Rechtsprechung vom 19. Jahrhundert bis zur Gegenwart, Pohl H (ed) Stuttgart

Hartzell JC, Ofek E, Yermack D (2004) What’s in it for me? CEOs whose firms are acquired. Rev Financ Stud 17:37–61

Jarrell G, Brickley J, Netter J (1988) The market for corporate control: the empirical evidence since 1980. J Econ Perspect 2:49–68

Jarrell GA, Poulsen AB (1989) The returns to acquiring firms in tender offers: evidence from three decades. Financ Manage 18:12–19

Jensen MC (1986) Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev 76:323–329

Jensen MC, Ruback RS (1983) The market for corporate control: the scientific evidence. J Financ Econ 11:5–50

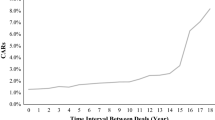

Kling G (2006) The long-term impact of mergers and the emergence of a merger wave in pre-World-War I Germany. Explorations in Economic History 43:667–688

Levin D (1990) Horizontal mergers: the 50-percent benchmark. Am Econ Rev 80:1238–1245

Masulis RW (1980) The effect of capital structure change on security prices. J Financ Econ 8:139–177

MacKinlay AC (1997) Event studies in economics and finance. J Econ Lit 35:13–39

Moeller T (2005) Let’s make a deal! How shareholder control impacts merger payoffs. J Financ Econ 76:167–190

Morse D (1984) An econometric analysis of the choice of daily versus monthly returns in tests of information content. Journal of Accounting Research 22:605–623

Nelson RL (1959) Merger movements in American Industry 1895–1956. Princeton University Press, Princeton, New Jersey

Rydqvist K (1996) Takeover bids and the relative prices of shares that differ in their voting rights. J␣Banking Finance 20:1407–1425

Salant SW, Switzer S, Reynolds R (1983) Losses from horizontal mergers: the effect of an exogenous change in industry structure on Cournot-Nash equilibrium. Quart J Economics 98:185–199

Schenk H (2001) Mergers and the economy: theory and policy implications, presented at the workshop entitled ‘European Integration, Financial Systems and Corporate Performance’, UN University, Institute for New Technologies Kasteel Vaeshartelt

Schwert GW (1996) Markup pricing in mergers & acquisitions. J Financ Econ 41:153–192

Shleifer A, Vishny RW (1988) Value maximization and the acquisition process. J Econ Perspect 2:7–20

Tilly R (1982) Mergers, external growth, and finance in the development of large-scale enterprise in Germany, 1880–1913. J Econ Hist 42:629–658

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kling, G. Does the merger paradox exist even without any regulations? Evidence from Germany in the pre-1914 period. Empirica 33, 315–328 (2006). https://doi.org/10.1007/s10663-006-9019-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-006-9019-7