Abstract

We present the results of an experimental investigation on incentives to adopt cleaner abatement technologies in the presence of imperfect compliance. We consider two emission control instruments—emission taxes and tradable permits—as well as different combinations of the inspection probability and fine for non-compliance, which can result in full or weak enforcement scenarios. We review and qualify existing theoretical predictions in several ways and find the main result is that allowing for weak enforcement causes tax evasion, reductions in permit prices and lower adoption rates of cleaner abatement technologies. As a result, there are increases in aggregate emissions. Finally, treatments with tradable permits under weak enforcement encounter insufficient trading.

Similar content being viewed by others

1 Introduction

We present an experimental investigation on firms’ incentives to adopt environmentally friendlier technologies with government policies that may result in imperfect compliance. Both pollution taxes and emission permit trading schemes are powerful policy instruments designed to curb emissions cost-effectively and induce polluters to adopt cleaner abatement technologies. Here, we question whether these powerful incentives for technology adoption are weakened through imperfect compliance of the policy in place. In the case of pollution taxes, imperfect compliance means declaring an amount of released pollution lower than allowed to save on tax bills. In the context of emission permits, imperfect compliance refers to holding a number of tradable permits lower than the amount of released pollution, thereby saving on permits purchases.

Imperfect compliance in environmental regulation is a key issue, especially in developing countries with weak institutions and low environmental compliance assurance, monitoring, and enforcement. Examples of unsuccessful policies derailed by imperfect compliance are discussed by the OECD (2004) when promoting a toolkit for building better environmental inspectorates in Eastern European countries, but whose guidelines and recommendations apply to developing nations. Palacios and Chávez (2005) also discuss how the Emission Compensation program in the capital city of Santiago, Chile, has been jeopardized by widespread violation of maximum emission-capacity permits. Lin (2013) studies plants’ incentives to self-report emission under different inspection rules in China. He proposes a model to analyze plants’ strategic reactions to pollution levy regulation to determine if plants’ true pollution levels might actually increase with inspections. The growing literature on this topic bears witness to the importance of addressing regulatory failures due to imperfect compliance.

Arguedas et al. (2010) and Villegas-Palacio and Coria (2010), in parallel work, have analyzed the theoretical dynamic properties of different environmental policy instruments under weak enforcement. They show that compliance issues under pollution taxes do not affect adoption incentives and released pollution; hence, the only (although important) effect of weak enforcement is tax evasion. However, adoption incentives can decrease, and aggregate emissions can increase under emission permits when widespread non-compliance reduces the permit price.

Our analysis sheds light on these theoretical studies by providing the first experimental insights on the adoption incentives under either pollution taxes or tradable emission permits when compliance is an issue. To this end, we conducted a series of experiments simulating different scenarios on the adoption of a low-pollution (or cleaner) technology. We consider that firms can face a pollution tax or be engaged in a system of tradable emission permits, while we also allow for alternative monitoring and enforcement represented by different inspection probabilities and fines for non-compliance. We present several scenarios linking compliance and adoption incentives. Regardless of firms choosing to comply or not, some experiments are designed to induce perfect compliance (optimal violation is zero) while others induce imperfect compliance (optimal violation is positive). In this latter case, a rational firm exceeds the regulation whenever the marginal benefits of non-compliance (in terms of tax bills or permit purchase savings) outweigh the marginal costs; that is, the probability of being caught times the marginal fine for non-compliance.

Our experimental design is as follows. For each policy scenario (tax versus permits, full versus weak enforcement), subjects (i.e., firms) are assigned their initial pollution abatement technologies. After this, they decide whether they adopt a costly new technology that reduces their marginal abatement cost (MAC). If a pollution tax is in place, firms then decide on the amount of released pollution and declared emissions (i.e., whether or not they abide by the law and to what extent). The case of emission permits is more complex because subjects can acquire permits in a permit auction. Once the auction is over, subjects decide on their released emissions. We follow the asymmetric model by Requate and Unold (2001), later adopted in Arguedas et al. (2010), by allocating different initial technologies to the firms, whereas the new technology is the same for all firms.

Our results concur with the theoretical predictions in general, but they qualify and deviate from them in several ways. For example, as studied by Gangadharan et al. (2013) in simpler settings, some subjects initially endowed with dirtier technologies under-adopt, while others with cleaner technologies over-adopt.

Moreover, in the case of pollution taxes, and contrary to what Arguedas et al. (2010) predict, we find that weak enforcement reduces the number of firms adopting new technology when the regulator implements a monitoring policy with a high inspection probability but low fines. In addition, emissions are significantly higher under weak enforcement, irrespective of inspection probability. Finally, weak enforcement results in significantly higher tax evasion regardless of inspection probability, as predicted by the theory.

In line with Arguedas et al. (2010), we find permit prices under weak enforcement are lower than under full enforcement. Consequently, there are fewer adoption incentives under weak enforcement, regardless of inspection probability. In addition, all treatments suffer from under-pricing and insufficient trading in the permit market.

By studying the issue of adoption incentives (i.e., dynamic efficiency) under weak enforcement, this study contributes to the literature by testing the theoretical predictions on this topic. Adoption incentives under full enforcement have been extensively studied by, among others, Requate and Unold (2001) and Requate and Unold (2003). Requate (2005) presents a survey on the incentives provided by different environmental policy instruments when adopting new technologies. Coria (2009) explores how the choice between taxes and permits affects the pattern of adoption of low-polluting technologies. As mentioned above, there is also some theoretical literature that analyzes the dynamic properties of environmental policy instruments under imperfect compliance (see Arguedas et al. (2010) and Villegas-Palacio and Coria (2010).

A crucial criterion for environmental policy design is cost-effectiveness. When accounting for both abatement and enforcement costs, regulators weigh whether it is more effective to set the legal cap at a certain level under perfect compliance or to set it at a lower level and allow for imperfect compliance. Stranlund (2007), Arguedas (2008), and Caffera and Chávez (2011) have found that (1) the differences in costs between the two alternatives depend on the fine structure, and (2) inducing perfect compliance minimizes the total expected costs.

Stranlund (2017) highlights important insights into the nature of sources’ compliance incentives and the effective and efficient design of enforcement strategies. However, he states that the enforcement challenges become more difficult because markets are developed to control greenhouse gas emissions. Coria and Zhang (2015) analyze the consequences of a pollution inspection framework in which regulators’ targeting is based on firms’ past compliance records and investing in cleaner technologies. They conclude that targeted state-dependent enforcement has a deterrent effect and can help reduce total enforcement costs. Lappi (2016) studies the welfare difference between emission taxes and emission trading under non-compliance. He finds that (1) an emission tax produces a higher level of welfare than emissions trading under non-compliance, and (2) for permits, there is a trade-off between the actual total emissions and the number of audited firms.

Several experiments on permit trading have been conducted since Plott (1983) first experiments; however, only a few of them consider the adoption of low-pollution technologies when firms participate in emission permit markets.Footnote 1

In the experimental literature, few experiments on environmental policy instruments consider the adoption of low-pollution technologies. Cochard et al. (2005), who consider technology adoption incentives using emission taxes, and assume that emissions affect only the polluters themselves, but not other non-polluting agents. They show that an ambient tax does not result in social dilemmas because the group optimum is a Nash equilibrium, resulting in an efficient and reliable mechanism that improves welfare concerning the status quo. Ben-David et al. (1999) consider an emission permit market in which a firm’s adoption decision making is irreversible. They find that an increase in cost heterogeneity does not affect trade volume, although higher price variability leads to lower trade efficiency.

Camacho-Cuena et al. (2012) also study the incentives for adopting advanced abatement technologies under emissions trading, but unlike the present study, they only consider perfect compliance. They find that the observed adoption patterns are relatively close to the theoretical first-best and that initial technology mainly determines individual adoption decision making. Moreover, they conclude that auctioning and grandfathering are equivalent in their dynamic efficiency. Gangadharan et al. (2013) focus on an industry with asymmetric firms that differ in maximum emissions. As in our model, the effect of adopting a cleaner technology is asymmetric; that is, higher polluting firms gain more by adopting the technology. Taschini et al. (2014), in a laboratory setting, explore the timing of irreversible adoption decision making of abatement technology under a grandfathering allocation rule. They show that firms tend to adopt abatement technology faster when the regulator applies a strict enforcement mechanism. Cason and de Vries (2018) study the performance of permit markets on dynamic efficiency, with permits being auctioned or grandfathered. They show that auctioning permits usually provides stronger R&D incentives, leading to greater dynamic efficiency.

Murphy and Stranlund (2007) were the first to study compliance behavior of firms for both transferable permits and standards. Caffera and Chávez (2016), which is closer to our work, study the compliance behavior of firms for both transferable permits and standards. They evaluate whether a regulator can induce individual firms on a given level of emissions by using different combinations of the aggregate supply of tradable permits (or the emission standards) and the monitoring probability for both perfect and imperfect compliance scenarios. Unlike us, they find that a regulator that allows for non-compliance could induce a reduction in emissions and an increase in the market price of tradable permits, which is at odds with theoretical predictions. Our experiment extends their study by introducing the possibility of adoption of cleaner technology. Our research contributes to the above experimental literature by jointly studying, for the first time, the most important instruments—taxes and permits, imperfect compliance, and adoption incentives.

We organize the rest of the paper as follows. In the following section, we present the theoretical background on which our experiments are based. In Sect. 3, we describe our experimental design and process. In Sect. 4, we present our main results, and we conclude in Sect. 5. We also include an online Appendix with experiment instructions and complementary results.

2 Theoretical Model and Hypotheses

In this section, we present the underlying theoretical model for our experimental design, as well as the hypothesis we plan to test. As mentioned in the Introduction, we focus on the theoretical predictions obtained by Arguedas et al. (2010).

2.1 Model and Theoretical Results

Consider an industry with n polluting firms and T different initial technologies. Each firm \(i={1,\ldots ,n}\) is endowed with one of these initial technologies. In the absence of regulation firm i pollutes the amount \(e_i^{max}>0\). Each firm i can abate pollution by using its initial technology or by adopting a new abatement technology (a) at a fixed cost, \(I>0\).Footnote 2 A firm’s technology can be characterized by the respective abatement cost functions \(c^k_i(e_i)\), with \(k=1,\ldots ,T,a\). To pollute an emission level \(e < e_i^{max}\), firm i faces total abatement costs given by \(c^k_i(e) > 0\) and marginal costs denoted as \(c^{\prime k}_{i}(e) < 0\). The adoption of the new technology results in lower total and marginal abatement costs (in absolute value) than the installed technology but requires the up-front payment \(I > 0\).

An industry regulator aims to reduce a firm’s aggregate emissions. As policy instruments, the regulator can either set an emission tax, denoted as \(\tau\), or issue tradable permits on an aggregate quantity denoted as S.Footnote 3

Because actual pollution levels cannot be directly verified, the regulator, in addition to the policy instrument, chooses an inspection probability and a fine for non-compliance. The regulator audits firms with a homogeneous and exogenous probability \(\pi\) to verify compliance with the environmental policy. With non-compliance, firm i is sanctioned according to a function that increases with the violation level, \(v_i\), as follows:

Violation levels are determined differently depending on the policy instrument. In the case of pollution taxes, firm i reports emissions, denoted as \(r_i\), and pays taxes according to the reported level. If audited, actual pollution, \(e_i\), is compared with reported pollution, \(r_i\). A firm is compliant with the regulation if actual and reported emissions are equal (\(r_i=e_i\)); it is not if reported emissions are lower (\(r_i<e_i\)). The violation level reflects the difference between actual and reported emissions (i.e., \(v_i=e_i-r_i\)). In the case of emission permits, firm i chooses the pollution level as well as the permit holding, denoted as \(s_i\). If audited, actual pollution \(e_i\) is compared with the number of permits held, \(s_i\). The firm is in compliance if \(e_i = s_i\), but it is not if \(s_i < e_i\). The level of the violation in this case is \(v_i=e_i-s_i>0.\)

Firms are assumed to be risk-neutral. They choose whether or not to adopt the new technology, as well as the corresponding pollution and permit holding (reported levels) under permits (taxes) to minimize the sum of abatement costs, cost of permit holding (pollution taxes), expected fines, and adoption costs—in case they invest in the new technology. Formally, the decision problem is the following in the case of permits (the issue is analogous under taxes, simply substituting the price of permits p with the tax rate \(\tau\), and the permit holding \(s_i\) with the reported level \(r_i\)):

This problem is solved backward in two steps (see Arguedas et al. (2010) for details). In the first step, optimal pollution and permit holding (or reported level in the case of taxes) are found for a given technology. In the second step, the firm decides whether to adopt the new technology based on the minimum expected payoff under each possibility.

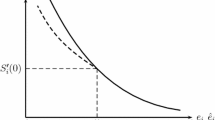

The results from step one are detailed in Arguedas et al. (2010), as well as in the earlier publications of Malik (1990), Keeler (1991), Stranlund and Dhanda (1999), and Stranlund (2007), among others. For a given technology, a firm’s optimal pollution can be derived by equating MAC to the price. In the case of emission permits, this condition can be written as follows (for taxes, substitute p with \(\tau\)):

Interestingly, a firm’s pollution decision is dependent on the permit price and the specific technology employed but is independent of the inspection probability or the fine for non-compliance. In other words, the decision is made independently of whether the enforcement strategy induces full or imperfect compliance.

In contrast, a firm’s optimal degree of violation crucially depends on the regulator’s enforcement strategy (that is, probability of inspection and levels of sanction) as well as on the permit price (or tax rate). However, it is independent of the technology that a firm employs. For emission permits (for taxes, simply substitute p with \(\tau\)), we have:

In the permits case, the inspection probability and the fine for non-compliance are such that the expected marginal fine for the infinitesimal violation is higher than the permit price. This corresponds to a scenario of full enforcement that induces a firm to comply with the regulation (i.e., \(v_i^*=0\)). The second is a case of weak enforcement, where the expected marginal fine for the infinitesimal violation is less than the permit price. In this case, the optimal violation is positive and equal to the familiar condition requiring that the marginal expected fine equals the permit price.

Next, the solution to step two (adoption decisions) is specific to Arguedas et al. (2010) and Coria and Villegas-Palacio (2010). Combining two characteristics—the optimal pollution and violation levels—results in adoption incentives that depend on permit price, not on whether enforcement is full or weak. The first important result is the following:

Proposition 1

(Arguedas et al. (2010)): For a given supply of tradable permits, the equilibrium permit price under weak enforcement (imperfect compliance) is less than that under full enforcement (perfect compliance). Thus, adoption incentives under imperfect compliance are smaller than those under full enforcement.

This result establishes that, everything else being equal, under tradable permits, incentives to adopt are lower with weak enforcement. The reason is that weak enforcement lowers the demand for permits, which results in a lower equilibrium permit price and consequently in fewer incentives to adopt. An interesting corollary of this result is that weak enforcement does not change adoption incentives under emission taxes because, by definition, the tax rate (the price of pollution in this case) is exogenous.

The following result goes a step further in comparing alternative scenarios resulting in the same equilibrium price:

Proposition 2

(Arguedas et al. (2010)): Under emission permits, the incentives to adopt depend only on a firm’s technology and permit price. If two alternative enforcement scenarios (that is, monitoring policies) result in the same equilibrium permit price, then adoption incentives are the same.

This result, in particular, implies that two alternative enforcement strategies with the same expected marginal fine should provide the same adoption incentives. This should mean two alternative scenarios of full and weak enforcement resulting in the same permit price by appropriately adjusting the aggregate supply for permits.

2.2 Hypotheses

In our experiment, we test the main theoretical results in Arguedas et al. (2010) under tradable permits and emission taxes in case of weak enforcement. We also compare different enforcement strategies leading to the same equilibrium price. Based on this theoretical background, we formulate the following hypotheses concerning the influence of enforcement strategies on firms’ incentives to adopt new technology under tradable permits and emission taxes:

Hypothesis 1

For a given supply of permits, weak enforcement reduces firms’ adoption incentives as a consequence of a reduction in the equilibrium permit price.

Hypothesis 2

Different enforcement strategies leading to the same equilibrium permit price result in the same behavior of firms concerning technology adoption.

Hypothesis 3

For a given emission tax rate, firms’ adoption incentives are independent of enforcement strategies.

Arguedas et al. (2010), among others, also provide some results on firms’ decisions making related to emissions or degree of violation:

Hypothesis 4

A firm’s decision on emissions depends only on the firm’s technology and the permit price or the emission tax.

Eq. (2) derives the optimal decision concerning emissions, satisfying the simple condition that equals MAC to the permit price or the emission tax rate. Under this condition, a firm’s decision regarding emissions depends only on the production technology and the emission permit or the tax rate. Thus, we should observe the same emission levels under different enforcement strategies that result in the same permit price or emission tax.

However, this is not the case for the optimal degree of violation:

Hypothesis 5

The degree of violation depends only on the enforcement strategy applied by the regulator, and it is independent of the firm’s technology.

Equation (3) shows how the optimal degree of the violation depends on the enforcement strategy applied by the regulator and the permit price or the emission tax. In this case, a firm’s technology does not play a role.

3 Experimental Design and Procedure

Our experiment was conducted in the Laboratori d’Economia Experimental (LEE) at Universitat Jaume I using z-Tree software (Fischbacher (2007)). Subjects were volunteer undergraduate students in Economics, Finance and Accounting, or Business Administration. Firms’ earnings were designated in Experimental Currency Units (ECUs) and converted into Euros at the end of the experiments.

3.1 Parameters and Treatments

Our experimental design is close to Camacho-Cuena et al. (2012). We consider an industry consisting of 12 firms producing with one of five available technologies: \(T_j, j=1,\ldots ,5\) (see Table 1 for the initial distribution of technologies among firms). Each technology is characterized by a default emissions level. Firms’ technologies are represented by stepwise, downward sloping marginal abatement cost functions (see Table 2 for the specific marginal abatement costs associated with each type of technology). Note that technology \(T_1\) results in the highest maximum default emissions levels and technology \(T_5\) represents the lowest maximum default emissions chosen in the absence of regulation. The firms had a default profit of 1200 ECU from their production activity and could adopt the common advanced technology a by investing 580 ECU. The adoption of the advanced technology leads to lower default emissions and, therefore, lower MAC (the specific marginal abatement costs associated with the new technology are also shown in Table 2).

From the perspective of the regulator, we consider an emission tax of 53 ECU and a number of permits \(S=72\) to be auctioned off. These two policies are designed to be equivalent under full enforcement. That is, the resulting equilibrium permit price under full enforcement is 53 ECU.Footnote 4 Following Requate and Unold (2003), with these parameters, only firms with technologies \(T_1\) and \(T_2\) have incentives to adopt the new technology in equilibrium because the abatement cost of reducing emissions to 7 units (see Table 2) exceeds the investment cost of adopting the new technology (Table 3 presents the number of emissions to be abated and its associated total abatement cost, TAC).Footnote 5 This adoption decision corresponds to optimal behavior based on expected profits, which are the same across firms sharing the same technology, as presented in the next section.

Table 4 shows the experimental treatments and implemented parameters. We conducted two sessions for emission taxes and three sessions for tradable permits of each of the four different treatments varying the inspection probability (\(\pi\)) and the induced optimal violation level (\(v_{i}=v^*\)).Footnote 6

Regarding the inspection probability, in treatments FE&LM and WE&LM (in which \(\pi\)=0.35), firms face a low inspection probability (i.e., low monitoring); that is, there is a 35% probability the regulator will audit the firms. In treatments FE&HM and WE&HM (\(\pi\)=0.70), a firm faces a high inspection probability (i.e., high monitoring); that is, there is a 70% probability a firm will be inspected.

Regarding the optimal violation level, in treatments with full enforcement (i.e., FE&HM and FE&LM), the optimal behavior concerning reported emissions results in full compliance (i.e., v*=0). In treatments with weak enforcement (i.e., WE&HM and WE&LM), it is optimal for the firms to under-report emissions by two units (v*=2). We implement this by decreasing the fine through parameters \(f_1\) and \(f_2\), the linear and quadratic components defined in eq. (1). Under the assumption of expected profit maximization, the level of expected fines is the same in all implemented treatments.

Given its exogenous nature, the equilibrium tax rate remains constant across the different enforcement strategies, meaning under full and weak enforcement. By contrast, the equilibrium permit price is endogenous. The resulting equilibrium permit price in the full enforcement scenarios is 53 ECU; however, it lowers to 45 ECU under weak enforcement.Footnote 7

3.2 Experimental Procedure

A group of 12 subjects participated in each session, assuming the role of managers at firms operating in an industry subject to environmental regulation. In each session, subjects played 10 periods of a given treatment, and there was no time limit to make their decision.Footnote 8 We randomly assigned subjects to one of the computers. We distributed instructions to the subjects, and we answered their questions before they played a trial period.Footnote 9

3.2.1 Tradable Permits

In the treatments with tradable permits, each period consisted of the following four stages:

Stage 1: Technology assignment and adoption decision. Each subject is randomly assigned an initial technology \(T_1\),..., \(T_5\), following the distribution displayed in Table 1. Subjects are informed about the number of auctioned permits, the inspection probability, and the marginal (and total) fines they will face in case of non-compliance if audited. In this stage, subjects simultaneously decide whether to keep the initial technology or to adopt the new technology a, paying the corresponding price of 580 ECU.

Stage 2: Permit auctioning. Permits are allocated among firms using an ascending clock auction (permits are not transferable, and banking of permits is not allowed). In this process, the opening price is 5 ECU. Subjects have 3 minutes to submit their permit demand at the current price. If aggregate permit demand exceeds the permit supply set by the regulator (72 permits), the price increases by 10 ECU (so that the next price is 15 ECU, then 25 ECU, and so on). The auction continues until the quantity demanded by the firms is smaller or equal to the permit supply. When this happens, the auction closes, and each subject is allocated the quantity demanded at this latest price.

Stage 3: Real emissions. Subjects decide on their real emission levels \(e_i\). In this setting, the violation level \(v_i\) is equal to the difference between actual emission levels \(e_i\) and permits held \(s_i\). The abatement level results in the difference between maximum and actual emissions.

Stage 4: Inspection and profit. The regulator inspects subjects with probability \(\pi\) and imposes the corresponding fine \(F(v_i)\) if a positive violation \(v_i>0\) is discovered. We compute the firm profit in this period as:

where p denotes the corresponding permit market price and \(s_i\) is the number of permits acquired by firm i in the auction.

Subjects’ final payoff is the accumulated profit obtained in two periods randomly chosen at the end of the session. Each session lasted approximately 120 minutes, and the average payoff was around 18 ECU.

3.2.2 Emission Taxes

In the treatments with taxes, each period consisted of the following three stages:

Stage 1: Technology assignment and adoption decision. Each subject is randomly assigned an initial technology \(T_1\),..., \(T_5\), following the distribution displayed in Table 1. Subjects are informed about the unit tax, the inspection probability, and the marginal (and total) fines they will face in case the regulator detects non-compliance. Subjects decide whether to keep the initial technology or to adopt the advanced technology a by investing 580 ECU.

Stage 2: Emissions decision. Subjects decide on their actual emission levels \(e_i\) and the emission level they report to the regulator \(r_i\). Firms pay a tax of 53 ECU per reported emission unit. The abatement level results in the difference between maximum and emitted (actual) units.

Stage 3: Inspection and profit. After subjects submit their reported emissions, the regulator inspects them with probability \(\pi\). If a positive violation level \(v_i>0\) is detected, firms pay the corresponding fine \(F_i(v_i)\) (see equation (1)). Recall that the violation level \(v_i\) is equal to the difference between real \(e_i\) and reported \(r_i\) emissions levels. We compute the profit of firm i in this period as:

where \(c^{T}_i (e_i)\) and \(c^a_i (e_i)\) are the abatement cost functions corresponding to the \(j=1,...5\) conventional and new technologies, respectively. Note that in cases when firms go uninspected, or when \(v_i=0\), the fine term does not apply.

Again, the subjects’ final payoff is the accumulated profit obtained in two randomly chosen periods at the end of the session. Each session lasted approximately 90 minutes, and the average payoff was around 17 ECU.

Finally, for the treatments where the regulator implements tradable emission permits, we complemented our analysis to elicit some attitudinal characteristics of the subjects that might influence their behavior. In particular, we looked for the existence of risk aversion and ecological beliefs.Footnote 10

Risk attitude

At the beginning of each session, we test subjects for their attitudes on risk. To this end, we used the low-payoff menu of paired lotteries (Holt and Laury (2002)), which ranks risk attitudes on a scale from 1-4 (high degree of risk-loving) to 6-10 (high degree of risk-aversion). A measure of 5 indicates risk neutrality. Table A.1 in the online Appendix describes the menu.

Figure 1 shows the distribution of risk attitudes of our sample.Footnote 11 The figure shows that most subjects (80%) are risk-averse; 10% are risk neutral (that is, they switched to the risky alternative after five consecutive choices). The remaining 10% are risk-loving subjects.

New ecological paradigm scale

The revised 15-item NEP (New Ecological Paradigm) scale by Dunlap et al. (2000) captures ecological attitudes. At the end of each session, participants were asked to rate the level of their agreement for each statement on a 5-point Likert-like scale (Table A.2 in the online Appendix describes the questionnaire).

Figure 2 shows that the average NEP scale score is 51.79 on a range of 15–75, where 15–45 indicates anti-ecological attitudes, 46-60 indicates mid-ecological attitudes, and 61–75 indicates pro-ecological attitudes.Footnote 12 Subjects generally show positive attitudes towards the environment, with 64% having mid-ecological scores, 14% having pro-ecological scores, and 22% having anti-ecological scores.

4 Results

We test whether there are significant differences in performance under full and weak enforcement strategies. In this section, we compare the results on technology adoption, emissions, and violation level when the regulator implements an enforcement policy and in which perfect compliance is optimal for the firm (i.e., full enforcement strategy), compared when imperfect compliance becomes optimal (i.e., weak enforcement strategy). We then discuss whether experimental evidence allows for rejecting our hypothesis.

4.1 Technology Adoption

In equilibrium, it is optimal for those firms operating with technologies \(T_1\) and \(T_2\) (i.e., 5 out of 12 firms in the industry) to adopt the new technology a. Conversely, firms using technologies \(T_3\) thru \(T_5\) have no incentives to adopt the new technology.

Figure 3 shows the distribution of firms adopting the new technology as a function of the initial technology assigned for both tradable permits (top) and emission taxes (bottom).

A general feature common to all implemented treatments is that the majority of firms using initial technologies \(T_1\) and \(T_2\) adopt the new technology, and this proportion decreases for firms using technologies \(T_3\), \(T_4\) and \(T_5\) (i.e., those with initially lower baseline emissions and lower marginal abatement costs). Focusing first on enforcement, we find that adoption rates in the scenario in which full enforcement is optimal, \(v^*=0\), are similar to those reported by Camacho-Cuena et al. (2012); however, the number of firms adopting the new technology reduces under weak enforcement, \(v^*=2\).

4.1.1 Adoption Decision Making Under Tradable Permits

For tradable permits, the first step is to compare firms’ decision making on adoption to the behavior predicted by the equilibrium. Under full enforcement (i.e. in treatments FE&HM and FE&LM), statistically significant under-investment of firms using technologies \(T_1\) and \(T_2\) and over-investment of firms using technologies \(T_3\), \(T_4\) and \(T_5\) is observed.Footnote 13 Instead, under weak enforcement, we obtain similar results for technologies \(T_1\), \(T_2\), and \(T_3\), whereas the investment rate observed for firms using technologies \(T_4\) and \(T_5\) does not significantly differ from the equilibrium prediction.

Recall that Hypothesis 1 states that a reduction in the permit price under a weak enforcement strategy reduces a firm’s adoption incentives, compared to a situation in which a regulator applies a full enforcement strategy. To test this hypothesis, we first confirm that permit prices under weak enforcement are significantly lower than those under full enforcement.

4.1.2 The Permit Auction

We cannot use the optimal equilibrium price as a benchmark to evaluate the observed permit prices and volumes because that price corresponds to the theoretically optimal adoption pattern (i.e., only if firms of type \(T_1\) and \(T_2\) adopt the new technology, we expect the regulator to auction off 72 permits at an equilibrium permit price equal to 53 ECU under full enforcement and 45 ECU under weak enforcement). We have already seen that firms do not behave optimally concerning technology adoption. Therefore, we must calculate the theoretical equilibrium prices and volumes given the actual adoption decisions in each period.

Table 5 display the observed permit prices and volumes, as well as the (equilibrium) expected prices and volumes given the observed adoption decisions.Footnote 14

From Table 5, we see that the permit prices observed under weak enforcement are significantly lower than those under full enforcement. An interesting result is that in all scenarios, the observed prices are significantly lower than the expected (equilibrium) prices when we consider firms’ adoption decisions.

Permit holding is significantly lower than the number of permits issued by the regulator, on average, for all treatments (Wilcoxon signed-rank test p value 0.000). That is, there are spare permits in the auction. Moreover, under weak enforcement, permit holding is significantly lower than under full enforcement for both high and low monitoring treatments (Wilcoxon signed-rank test p value 0.000).

4.1.3 Firms’ Adoption Decisions

Given the differences between permit prices under full and weak enforcement, the lower permit prices observed under weak enforcement reduce adoption incentives compared to full enforcement. We analyze the differences (if any) in adoption decisions under full and weak enforcement.

Figure 3 shows the distribution of firms’ adoption rates per treatment: the lower permit price observed under weak enforcement reduces the number of firms adopting the new technology. A Kolmogorov Smirnov test (K–S) confirms that the number of firms adopting the new technology under weak enforcement is significantly lower than under full enforcement, regardless of the monitoring strategy and the initial technology. This is particularly true for high monitoring.Footnote 15 Hence, our results do not allow us to reject Hypothesis 1.

When we compare adoption decisions under different enforcement strategies resulting in the same equilibrium permit price, we should, according to Hypothesis 2, observe similar adoption decision making. Given that a regulator uses either full or weak enforcement, the K–S test comparing the distribution of adoption decisions under either high or low monitoring, shows that no significant difference is observed under full enforcement (K–S, p value = 0.968), whereas this is not the case under weak enforcement (K–S, p value = 0.003). We observe that the number of firms adopting the new technology is significantly lower under high monitoring.

We summarize our findings concerning prices and adoption decisions under tradable permits as follows:

Result 1

Observed permit prices and permit holding under weak enforcement are statistically lower than under full enforcement for both monitoring scenarios. This finding does not allow us to reject Hypothesis 1.

Result 2

Weak enforcement reduces the number of firms adopting the new technology. This finding does not allow us to reject Hypothesis 1.

Result 3

A given enforcement strategy affects firms’ adoption decisions under weak enforcement. Under high monitoring, this results in lower permit prices, reducing firms’ technology adoption. This finding allows us to reject Hypothesis 2.

4.1.4 Adoption Decision Making with Emission Taxes

We compare firms’ adoption decision making to the behavior predicted by the theory under emission taxes. From Figure 3 we observe under either full or weak enforcement there is statistically significant under-investment of firms using technologies \(T_1\) and \(T_2\) (expected to adopt the new technology in equilibrium) and over-investment of firms using technologies \(T_3\), \(T_4\) and \(T_5\) (not expected to adopt the new technology in equilibrium).Footnote 16

We now focus on the effect of weak enforcement on firms’ adoption decisions. According to Hypothesis 3, the incentives to adopt the new technology remain invariant under both full and weak enforcement strategies, provided the same tax rate is applied. Hence, we do not expect to observe differences in technology adoption under full or weak enforcement.

When we compare firms’ adoption decision making under full and weak enforcement, we cannot reject Hypothesis 3 for the low monitoring scenario. Relying on a Kolmogorov Smirnov test (K–S), we do not find statistically significant differences in the adoption rates in treatments FE&LM and WE&LM (K–S test, p value = 0.997). However, for the high monitoring treatments, we find statistically significant differences in the adoption rates comparing treatments FE&HM and WE&HM (K–S test, p value = 0.000). Therefore, we can reject Hypothesis 3. Enhancing previous experimental settings with weak enforcement when emission taxes are applied sheds light on adoption behavior with this unexpected result: the effect of weak enforcement depends on the monitoring strategy used, even if adoption incentives remain invariant.

We summarize our findings concerning firms’ adoption decision making under emission taxes as follows:

Result 4

The effect of weak enforcement under emission taxes on firms’ adoption decisions (although leaving firms’ adoption incentives invariant) depends on the monitoring strategy used by the regulator. Whereas no effect is observed under low monitoring, a significant reduction of the number of firms adopting the new technology is observed under high monitoring. Hence, we can reject Hypothesis 3.

4.1.5 Factors Determining Firms’ Adoption Decisions

To better explain the factors determining technology adoption behavior in the different treatments we estimate a pooled Probit model with robust standard errors clustered across sessions. We study the impact of the initial technology on the probability of adopting the cleaner technology. For explanatory variables, we include dummies for both the initial technologies assigned and the fine in the previous period, and also the period number. In the treatments with tradable permits, we also include the permit price in the previous period, the individual risk attitude measurement (from risk-loving to risk-averse) and the NEP measure (from anti-ecological to pro-ecological). These scales are defined above.

Because firms with dirtier technologies obtain higher gains from adopting new technology, we expect that the probability of adoption diminishes for firms with cleaner technologies. More specifically, we expect discrete jumps in adoption when moving across technologies (particularly between \(T_2\) and \(T_3\) representing the border between adoption and non-adoption at the social optimum). The results reported in Table 6 confirm this hypothesis for all implemented treatments.Footnote 17

Regarding additional results on the treatments using tradable permits, we find risk attitude is relevant only if the regulator induces full compliance using high monitoring (FE&HM). In this case, risk aversion increases the probability of adopting the new technology. Some factors significantly contribute to increasing adoption probability under weak enforcement and low monitoring (WE&LM). These are (1) observing higher permit prices in the past, (2) having a pro-ecological attitude (elicited using the NEP), or (3) being fined in the previous period.

4.2 Real Emissions

In this section, we discuss how weak enforcement affects firms’ emissions. Figure 4 displays average real emissions per firm technology for all implemented treatments under full and weak enforcement. Given our results on the effect of weak enforcement on technology adoption, we expect an increase in emissions under weak enforcement. We expect this result in particular when the regulator controls emissions using emission taxes under a high monitoring strategy because the effect of weak enforcement resulting in under-investment is stronger.

Contrary to Caffera and Chávez (2016), our results show that weak enforcement significantly increases firms’ real emissions for both high and low monitoring and control instruments.Footnote 18 Using a K-S test, we can reject the null hypothesis that the two samples are drawn from the same distribution comparing real emission under full and weak enforcement for the two monitoring strategies and both permits and taxes.

Recall that Hypothesis 4 states that under different enforcement strategies resulting in the same permit price or emission tax, we should observe the same emission levels. Instead, our results show that, although weak enforcement does not affect the emission tax, it significantly increases firms’ emissions compared to full enforcement. This allows us to reject Hypothesis 4 when emission taxes are applied. We also observe statistically higher emission levels under low monitoring strategies with full enforcement. However, under weak enforcement, this effect is reversed, leading to higher emissions under high monitoring strategies.

In the case of tradable permits, weak enforcement reduces the equilibrium price (from 53 ECU under full enforcement to 45 ECU under weak enforcement). Therefore, we expect an increase in emissions under weak enforcement, given the lower permit price. Our results confirm this conjecture. We do observe similar emission levels under high and low monitoring strategies with full enforcement. However, with weak enforcement, emission levels under low monitoring are statistically lower than those under high monitoring.

Hypothesis 4 states that the emission decision depends on a firm’s technology. Table 7 shows the result of a pooled panel estimation of the observed emissions to determine the effect of a firm’s technology decision on real emissions. For explanatory variables, we include dummies for the technologies used by firms when deciding on emissions, fines in the previous period, and the period number. In the treatments with tradable permits, we also include the permit price, the individual risk attitude measure (from risk-loving to risk-averse) and the NEP measure (from anti-ecological to pro-ecological).

Our results clearly show the influence of firm’s technology on its emissions decision making. We observe that in all enforcement and monitoring strategies for both tradable permits and emission taxes, the amount of emission units reduces as we move from firms using \(T_1\) (considered our baseline) to firms using cleaner technologies, especially in the case of those that adopted the new technology (technology \(T_a\)). For tradable permits, we observe the significant effect of (an increase in) the permit price in reducing emissions, under weak and full enforcement, and for the two monitoring strategies.

We summarize our findings as follows:

Result 5

Under tradable permits, emissions depend on the firm’s technology and permit price. Weak enforcement reduces permit prices, leading to an increase in emissions for both monitoring strategies. Hence, our results do not allow us to reject Hypothesis 4 for tradable permits.

Result 6

Under emission taxes, emissions depend on a firm’s technology. However, weak enforcement leads to significantly higher emissions for both monitoring strategies. Therefore, our results allow us to reject Hypothesis 4 for emission taxes.

4.3 Violation Behavior

Recall that firms decide on both their real emissions and those reported to the regulator in the form of permits held or tax payments. This means that firms keep a record of their compliance level (and its cost) under tradable permits, while they pay taxes proportionally to the number of their reported emissions under emission taxes. When deciding on the number of permits held or reported emissions, subjects should consider that the regulator will inspect them with probability \(\pi\) paying the corresponding fine \(F(v_i)\) if a positive violation level is discovered. Figure 5 shows the average observed violation level depending on the technology used by firms in all implemented treatments.

In Hypothesis 5, we observe higher violation rates under weak enforcement compared to the treatments with full enforcement, independent of the monitoring strategy and emission control instrument used by the regulator. However, when comparing violation rates under high and low monitoring, and using the K–S test, we show that with full enforcement, we reject the null hypothesis that the distribution of violation rates is the same under high and low monitoring (FE&HM vs. FE&LM). Along the same line, under weak enforcement, we observe significantly higher violation rates under high monitoring compared to low monitoring (the K–S test rejects the null hypothesis of equal distribution comparing treatments WE&HM and WE&LM).

Comparing high and low monitoring strategies related to emission taxes, we observe differences in decisions on violations. Under full enforcement, the violation levels observed are higher for low monitoring than for high monitoring. Conversely, under weak enforcement, violation levels are higher under high monitoring compared to low monitoring (i.e., the violation levels for WE&HM are higher than that for WE&LM).Footnote 19 These results are in line with Friesen (2012), who finds that increasing the severity of punishment is a more effective deterrent than an equivalent increase in the probability of punishment. In our experimental design, fines follow this order FE&LM>FE&HM>WE&LM>WE&HM.

Hypothesis 5 states that a firm’s decision making on violation (or compliance) does not depend on the firm’s technology. Table 8 shows the result of a pooled panel estimation of the observed violation levels to determine the effect of a firm’s technology on decisions related to violation. For explanatory variables, we include dummies for the technologies used by a firm when deciding on emissions, the fine in the previous period, and the period number. In the treatments with tradable permits, we also include the permit price, the individual risk attitude measure (from risk-loving to risk-averse), and the NEP measure (from anti-ecological to pro-ecological). Our results clearly show the effect of a firm’s technology on its decisions on violation. We observe a significant effect of technology in all enforcement and monitoring strategies for both tradable permits and emission taxes. In fact, the level of violation reduces as we move from firms using \(T_1\) (considered our baseline) to firms using cleaner technologies, especially for those who adopted the new technology (technology \(T_a\)). With tradable permits, we observe a significant effect of risk aversion to reduce violation rates under high monitoring for both full and weak enforcement.

We summarize our findings in the following results:

Result 7

Weak enforcement increases a firm’s level of violation under tradable permits and emission taxes.

Result 8

Violation levels depend on the regulator’s enforcement strategy and the technology used by a firm under the two monitoring strategies. Therefore, our results allow us to reject Hypothesis 5.

5 Conclusions

An essential concern for policy-makers is designing effective policy instruments creating incentives for firms to adopt advanced pollution technologies. This paper investigates whether emission taxes and tradable permits in laboratory experiments provide efficient incentives for polluting firms to adopt cleaner technologies.

Comparing weak enforcement and its performance with full enforcement is an innovation of our experiment that allows new understandings of the design characteristics of emission taxes and tradable permit instruments to promote dynamic efficiency. To evaluate tradable permits, we consider different treatments under full and weak enforcement, where different compliance levels are induced in equilibrium. Additionally, we consider different monitoring strategies (high and low monitoring) to induce the same compliance level using different combinations of monitoring probabilities and fines.

Using Arguedas et al. (2010) as a theoretical benchmark, we find that a firm’s overall performance related to technology adoption is remarkably strong, although we observe some under-adoption by firms with dirtier technologies and some over-adoption by firms with cleaner technologies, in line with Gangadharan et al. (2013).

Regarding emission permits, the main result of our study is that weak enforcement reduces the number of firms adopting new technology, regardless of the monitoring strategy. This, in turn, significantly increases firms’ emissions and violation levels.

We find that permit prices are significantly lower than expected equilibrium prices. Further, as expected, and because of the existence of over-adoption for firms holding cleaner technologies and high levels of violation (i.e., both resulting in lower permits demands), there is excess supply pressure on permit prices, resulting in statistically significant lower prices, particularly under weak enforcement as compared to the prices under full enforcement. These results hold for both low and high monitoring. Finally, we find that permit holding is significantly lower under weak enforcement compared to full enforcement and lower than the expected volume. This result is expected because a firm’s marginal valuation of emissions (and abatement) drives the bidding for permits under auctioning.

Regarding emission taxes, contrary to what Arguedas et al. (2010) predict, the results of our experiment suggest that firms may behave significantly different when confronted with an exogenous emission tax and an inspection probability that induces full compliance; that is, under full enforcement as compared to firms facing weak enforcement. More specifically, weak enforcement reduces the number of firms adopting the new technology except when a regulator implements a monitoring policy with a high inspection probability. Therefore, weak enforcement significantly increases emissions significantly related to the full enforcement benchmark, independent of the regulator’s monitoring strategy. As predicted by existing theory, weak enforcement significantly increases tax evasion regardless of inspection probability.

Overall, these results reflect the complexity of managing environmental policy instruments, emission taxes, and tradable permits in a dynamic context that allows for technology adoption under weak enforcement. The likelihood of striking high efficiency at industry and social levels is hampered by the many choices each firm must make, particularly given the uncertainty about permit prices and monitoring (i.e., probability of inspection). Even with these many moving parts, a consistent result is that weak enforcement worsens policy efficiency because of lower adoption rates and higher violation levels. Our results, never explored in the literature, shed new light on the joint interaction among adoption incentives, government instruments, and compliance on environmental efficiency. These results should help improve the decision-making processes of regulators, firm managers, and general stakeholders.

Notes

For example, these policy instruments can enforce the implementation of the socially optimal aggregate emissions level \(E^*\); that is, the level that minimizes aggregate abatement costs and environmental damages. Following Requate and Unold (2003), when the fixed adoption cost is independent of the initial technology, only a subset of firms may find it optimal to adopt the advanced technology in equilibrium, particularly those with the highest abatement costs. Using AMAC(E, j) to denote the aggregate marginal abatement cost when the first j firms have adopted the advanced abatement technology and D(E) for environmental damages, with \(E=\sum _{i=1}^{n} e_i\), the optimal aggregate emission level \(E^*\) satisfies the condition \(AMAC(E^*, j)=D'(E^*)\).

For further information on the optimal instrument level, please check the online Appendix.

Adopting the new technology costs 580 ECU and results in a maximum of 7 emission units (see Table 2). A firm endowed with \(T_2\) (up to 18 emissions) prefers paying the adoption cost rather than the abatement cost leading to these 7 emission units (i.e., this requires abating 11=18-7 units at 660 ECU). Conversely, there is a disincentive to adopt as we move to cleaner technologies. For example, for \(T_3\) (up to 16 emissions), a firm prefers abating 9 units (16-7=9) for 450 ECU rather than adopting the new technology.

Given the higher degree of complexity in the permits treatments due to the endogenous nature of permit prices, we decided to run one more session.

Given the optimal adoption pattern, there is excess demand for emission permits at any price below 53 ECU under full enforcement and below 45 ECU under weak enforcement.

A total of 240 subjects were recruited, 144 for permits sessions (=12\(\times\)3\(\times\)4) and 96 for taxes (=12\(\times\)2\(\times\)4). Each subject participated in only one session. Consequently, there are 360 observations for each permits treatment (=12\(\times\)3\(\times\)10) and 240 for each tax treatment (=12\(\times\)2\(\times\)10).

This trial period was identical to the real periods but was excluded from the final payoff.

We decided to run these tests only for treatments with tradable permits because decision making is more complex due to the interactions determining the (endogenous) permit price, which, in turn, affects technology adoption decisions. Decision making under emission taxes is simpler because it is not influenced by strategic uncertainty. In addition, the process of active bidding for permits in auctions continuously elicits subjects’ willingness to pay, which may be influenced by their ecological attitudes.

We had to drop 40 observations from a total of 144 observations due to irrational behavior (multiple switching).

We had to drop 2 observations from a total of 144 observations due to irrational behavior.

A Wilcoxon signed test shows a significant difference between observed and expected investment rates in all treatments with full enforcement and initial technologies.

The figures in online Appendix A.6.1 show the dynamics of average observed and expected permit prices, as well as permit holding, in all implemented treatments.

K–S test comparing the distribution of adoption under weak and full enforcement, given high and low monitoring, p value 0.000.

A Wilcoxon signed test shows a statistically significant difference between observed and expected investment rates in all treatments with full or weak enforcement and initial technologies.

We use a t-test to compare the coefficients for every technology between full and weak enforcement. When the policy instrument is an emission tax, we find that weak enforcement statistically decreases the probability of adopting the new technology when firms have initially been endowed with \(T_3\) only under low monitoring (FE&LM vs. WE&LM). On the other hand, in the case of tradable permits, weak enforcement statistically decreases the probability of adopting when firms have initially been endowed with \(T_4\) under a low monitoring scenario (FE&LM vs. WE&LM). Weak enforcement statistically increases the probability of adopting the new technology for firms using initial technology \(T_3\) under high monitoring (FE&HM vs. WE&HM).

Using a Mann Whitney test (M–W test), we can reject the null hypothesis that there is no difference between the average emissions under full and weak enforcement for the two inspection probabilities implemented under tradable permits and emission taxes.

Relying on the K–S test for full enforcement, we reject the null hypothesis that the two samples, FE&HM and FE&LM, are drawn from the same distribution. We also reject the null hypothesis of equal distribution comparing WE&HM and WE&LM under weak enforcement.

References

Arguedas C (2008) To comply or not to comply? Pollution standard setting under costly monitoring and sanctioning. Environ Resource Econ 41(2):155–168

Arguedas C, Camacho E, Zofío JL (2010) Environmental policy instruments: Technology adoption incentives with imperfect compliance. Environ Resource Econ 47(2):261–274

Ben-David S, Brookshire DS, Burness S, McKee M, Schmidt C (1999) Heterogeneity, irreversible production choices, and efficiency in emission permit markets. J Environ Econ Manag 38(2):176–194

Bohm P (2003) Experimental evaluations of policy instruments. In: Handbook of environmental economics, vol 1. Elsevier, pp. 437–460

Caffera M, Chávez C (2011) The cost-effective choice of policy instruments to cap aggregate emissions with costly enforcement. Environ Resource Econ 50(4):531–557

Caffera M, Chávez C (2016) The regulatory choice of noncompliance in the lab: Effect on quantities, prices, and implications for the design of a cost-effective policy. BE J Econ Anal Policy 16(2):727–753

Camacho-Cuena E, Requate T, Waichman I (2012) Investment incentives under emission trading: an experimental study. Environ Resource Econ 53(2):229–249

Cason TN, de Vries FP (2018) Dynamic efficiency in experimental emissions trading markets with investment uncertainty. Environ Resource Econ 1–31

Cochard F, Willinger M, Xepapadeas A (2005) Efficiency of nonpoint source pollution instruments: an experimental study. Environ Resource Econ 30(4):393–422

Coria J (2009) Taxes, permits, and the diffusion of a new technology. Resource Energy Econ 31(4):249–271

Coria J, Villegas-Palacio C (2010) Targeted enforcement and aggregate emissions with uniform emission taxes

Coria J, Zhang X-B (2015) State-dependent enforcement to foster the adoption of new technologies. Environ Resource Econ 62(2):359–381

Dunlap RE, Van Liere KD, Mertig AG, Jones RE (2000) New trends in measuring environmental attitudes: measuring endorsement of the new ecological paradigm: a revised nep scale. J Soc Issues 56(3):425–442

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Friesen L (2012) Certainty of punishment versus severity of punishment: an experimental investigation. South Econ J 79(2):399–421

Gangadharan L, Croson R, Farrell A, et al (2013) Investment decisions and emissions reductions: results from experiments in emissions trading. In: Handbook on experimental economics and the environment. Edward Elgar Publishing Ltd, pp 233–264

Holt CA, Laury SK (2002) Risk aversion and incentive effects. Am Econ Rev 92(5):1644–1655

Keeler AG (1991) Noncompliant firms in transferable discharge permit markets: Some extensions. J Environ Econ Manag 21(2):180–189

Lappi P (2016) The welfare ranking of prices and quantities under noncompliance. Int Tax Public Financ 23(2):269–288

Lin L (2013) Enforcement of pollution levies in China. J Public Econ 98:32–43

Malik AS (1990) Markets for pollution control when firms are noncompliant. J Environ Econ Manag 18(2):97–106

Muller RA, Mestelman S (1998) What have we learned from emissions trading experiments? Manag Decis Econ 225–238

Murphy JJ, Stranlund JK (2007) A laboratory investigation of compliance behavior under tradable emissions rights: implications for targeted enforcement. J Environ Econ Manag 53(2):196–212

OECD (2004) Assuring environmental compliance: A toolkit for building better environmental inspectorates in Eastern Europe, Caucasus, and Central Asia

Palacios M, Chávez C (2005) Determinants of compliance in the emissions compensation program in Santiago, Chile. Environ Development Econ 453–483

Plott CR (1983) Externalities and corrective policies in experimental markets. Econ J 93(369):106–127

Requate T (2005) Dynamic incentives by environmental policy instruments-a survey. Ecol Econ 54(2–3):175–195

Requate T, Unold W (2001) On the incentives created by policy instruments to adopt advanced abatement technology if firms are asymmetric. J Inst Theor Econ JITE 157(4):536–554

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: Will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Stranlund JK (2007) The regulatory choice of noncompliance in emissions trading programs. Environ Resource Econ 38(1):99–117

Stranlund JK (2017) The economics of enforcing emissions markets. Rev Environ Econ Policy 11(2):227–246

Stranlund JK, Dhanda KK (1999) Endogenous monitoring and enforcement of a transferable emissions permit system. J Environ Econ Manag 38(3):267–282

Taschini L, Chesney M, Wang M (2014) Experimental comparison between markets on dynamic permit trading and investment in irreversible abatement with and without non-regulated companies. J Regul Econ 46(1):23–50

Villegas-Palacio C, Coria J (2010) On the interaction between imperfect compliance and technology adoption: taxes versus tradable emissions permits. J Regul Econ 38(3):274–291

Acknowledgements

Eva Camacho-Cuena is grateful for funding from the Universitat Jaume I under grant UJI-B2018-77, the Spanish Ministry of Science and Technology under grant RTI2018-096927-B-100, and the Generalitat Valenciana for the financial support under grant AICO/2018/036 and Cátedra de Nueva Transición Verde 9100/2021. Carmen Arguedas acknowledges financial support from the Spanish Ministry of Economy under research grant ECO2017-82449-P, and José L. Zofío under grant EIN2020-112260/AEI/10.13039/501100011033.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Vidal-Meliá, L., Arguedas, C., Camacho-Cuena, E. et al. An Experimental Analysis of the Effects of Imperfect Compliance on Technology Adoption. Environ Resource Econ 81, 425–451 (2022). https://doi.org/10.1007/s10640-021-00634-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-021-00634-1