Abstract

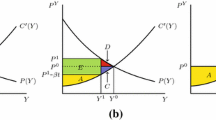

Technological improvements have proven essential in mitigating environmental problems such as climate change, depletion of the ozone layer and acid rain. While it is well-known that price- and quantity-based regulatory instruments provide different investment levels, the effects on the choice between different technologies have received scant attention. This paper expands on the prices versus quantities literature by investigating firms’ technology choice in the face of demand and supply side uncertainty. I show that the regulator can not design tradable emissions permits and an emissions tax such that the two regimes are equivalent, even in terms of expected values. Moreover, a tax encourages the most flexible abatement technology if and only if stochastic costs and the equilibrium permit price have sufficiently strong positive covariance, compared with the variance in consumer demand for the good produced. Finally, the firms’ technology choices are socially optimal under tradable emissions permits, but not under an emissions tax.

Similar content being viewed by others

Notes

That is, e.g., post-combustion flue-gas desulfurization and selective catalytic reduction, respectively.

See http://ec.europa.eu/clima/policies/ets/index_en.htm and Convery and Redmond (2007), and http://www.epa.gov/airmarkt/progsregs/arp/s02.html and Joskow et al. (1998), for more about the EU ETS and the US \(\hbox {SO}_{2}\) program, respectively. The \(\hbox {NO}_{x}\) programs are the Regional Clean Air Incentives Market (RECLAIM), the Ozone Transport Commission (OTC), \(\hbox {NO}_{x}\) Budget Program, and the \(\hbox {NO}_{x}\) State Implementation Plan (SIP). For details, see Burtraw et al. (2005).

Additive and multiplicative uncertainty applies to the intercept and the slope of marginal abatement costs, respectively.

Results by Convery and Redmond (2007) indicate that the EU emissions trading scheme is competitive.

As usual, \(\eta _{i}\sim \left( 0,\sigma _{\eta }^{2}\right) \) means that \(\eta _{i}\) is randomly distributed with expected value \(0\) and variance \(\sigma _{\eta }^{2}\).

The assumption of differentiability implies that the technology choice parameters \(({\varvec{\alpha }}_{i})\) are continuous, but in reality the choice of technology may be discrete. For example, a firm may choose the high capital cost investment (CCS) or the flexible option (fuel substitution), and options in-between may be limited. This is briefly discussed in the conclusion.

While quadratic approximations of the utility function have been frequently used in, e.g., portfolio optimization analysis, their limitations were early recognized and discussed (see, e.g., Levy and Markowitz 1979).

The assumption that \(\rho _{\eta }=E\left( \eta _{i}\eta _{i^{\prime }}\right) /\sigma _{\eta }^{2}\) is similar to Krysiak (2008), who assumes \(\rho _{\eta }\in \left[ 0,1\right] \).

As a notational convention, “\(x\)” may refer to variable/parameter \(x\) under either regulatory regime. If confusion is possible, I use “\(x_{\sigma }\)” and “\(x_{\tau }\)” to refer to \(x\) under tradable emissions permits and an emissions tax, respectively.

Open economy considerations are briefly discussed in Sect. 3.

The intuition here is slightly different under the general cost function \(\widetilde{c}(q_{i},a_{i},{\varvec{\alpha }}_{i},{\varvec{\eta }}_{i})\), because abatement and production levels under an emissions tax then affect each other through the cross derivative \(\widetilde{c}_{qa}(\cdot )\). Thus, the interpretation should be slightly revised. The mechanisms described above are then only present under tradable permits, while the effects through the cross derivatives are present under both regulatory regimes. Note, however, that Corollary 1 in Sect. 2.2 proves that the qualitative results explained in the text generalize to the general cost function \(\widetilde{c}(q_{i},a_{i},{\varvec{\alpha }}_{i},{\varvec{\eta }}_{i})\).

For example, Denicolo (1999, abstract at p.184) states: “If the government can adjust the level of taxes and permits after innovation has occurred, taxes and permits are fully equivalent.” Another prominent example is Requate and Unold (2003, p.142): “If the regulator, however, anticipates the new technology, we find that price-based instruments—in particular taxes and all the permit regimes—are equivalent and superior to standards...”.

Weitzman (1974) found that price-based instruments are advantageous when the marginal benefit schedule is relatively flat as compared to the marginal cost schedule, and vica versa.

Remember that \(g_{j}\left( Z\right) \) is the disutility of consumer \(j\) caused by aggregate emissions \(Z\) (in Eq. 2).

There are some other examples with \(Cov\left( G_{Z},\sum _{i\in N}\eta _{i}\right) =0\) in Eq. (17), e.g., when \(G(Z)\) is quadratic and \(\rho _{\eta }=-1/(n-1)\).

The analysis presented in Krysiak (2008) has limited relevance in the case of pollution abatement because the product market influences the firms’ investment decisions. As the analysis in Krysiak (2008) does not feature a product market, his results are only valid for comparison of emissions trading and an emissions tax when the demand for the good produced is perfectly inelastic and non-stochastic (Krysiak 2008, addresses this point on page 1,282).

We see this from the variance in aggregate emissions under an emissions tax, which is given by \(nV_{\eta }\sigma _{\eta }^{2}/\beta ^{2}+nV_{2}^{2}V_{\varepsilon }\sigma _{\varepsilon }^{2}\) (cf. Table 2). This expression decreases in the technology parameter \(\beta \), given \(\rho _{\eta }>-1/(n-1)\).

For example, Parsons et al. (2009) states that a disruption in delivery of low-sulfur coal because of track failures in October 2005 created a bottleneck that reduced deliveries significantly. In addition, a pair of coalmines had extended outages. The price of low-sulfur coal trading in the Midwest peaked in December 2005 at a level triple the price a year earlier. The shortage in low-sulfur coal forced 11 power companies to shift to higher-sulfur coal with corresponding higher \(\hbox {SO}_{2}\) emissions.

A previous version of the paper shows that the firms’ technology choice is socially suboptimal under both price- and quantity-based regulation if there is a distortionary tax in the product market (and that the ranking become ambiguous).

However, if the social planner can affect the world market product price (in the derivation of the socially optimal technology), it is reasonable to conjecture that they will invest more (less) in technology than the competitive firms if the regulated area is a net importer (exporter), in order to decrease (increase) the product price.

References

Baldursson F, Von Der Fehr N-H (2012) Price volatility and risk exposure: on the interaction of quota and product markets. Environ Resour Econ 52:213–233

Burtraw D, Evans DA, Krupnick A, Palmer K, Toth R (2005) Economics of pollution trading for \(\text{ SO }_{2}\) and NOx. Ann Rev Environ Resour 30:253–289

Convery FJ, Redmond L (2007) Market and price developments in the European Union Emissions Trading Scheme. Rev Environ Econ Policy 1:88–111

Denicolo V (1999) Pollution-reducing innovations under taxes or permits. Oxf Econ Pap 51:184–199

Fowlie M (2010) Emissions trading, electricity restructuring, and investment in pollution abatement. Am Econ Rev 100:837–869

Griliches Z (1957) Hybrid corn: an exploration in the economics of technological change. Econometrica 25:501–522

Hoel M, Karp L (2001) Taxes and quotas for a stock pollutant with multiplicative uncertainty. J Public Econ 82:91–114

Hoel M, Karp L (2002) Taxes versus quotas for a stock pollutant. Resour Energy Econ 24:367–384

Hoel M, Schneider K (1997) Incentives to participate in an international environmental agreement. Environ Resour Econ 9:153–170

Jacoby HD, Ellerman AD (2004) The safety valve and climate policy. Energy Policy 32:481–491

Jaffe A, Newell R, Stavins R (2002) Environmental policy and technological change. Environ Resour Econ 22:41–70

Jaffe AB, Stavins RN (1995) Dynamic incentives of environmental regulations: The effects of alternative policy instruments on technology diffusion. J Environ Econ Manage 29:43–63

Joskow PL, Schmalensee R, Bailey EM (1998) The market for sulfur dioxide emissions. Am Econ Rev 88:669–685

Kaboski JP (2005) Factor price uncertainty, technology choice and investment delay. J Econ Dyn Control 29:509–527

Karp L, Zhang J (2006) Regulation with anticipated learning about environmental damages. J Environ Econ Manage 51:259–279

Kneese AV, Schultze CL (1975) Pollution, prices, and public policy. The Brookings Institution, Washington DC

Kon Y (1983) Capital input choice under price uncertainty: a putty-clay technology case. Inte Econ Rev 24:183–197

Krysiak FC (2008) Prices vs. quantities: the effects on technology choice. J Public Econ 92:1275–1287

Krysiak FC, Oberauner IM (2010) Environmental policy à la carte: letting firms choose their regulation. J Environ Econ Manage 60:221–232

Levy H, Markowitz HM (1979) Approximating expected utility by a function of mean and variance. Am Econ Rev 69:308–317

Lund D (1994) Can a small nation gain from a domestic carbon tax? The case with R &D externalities. Scand J Econ 96:365–379

Löschel A (2002) Technological change in economic models of environmental policy: a survey. Ecol Econ 43:105–126

Magat WA (1978) Pollution control and technological advance: a dynamic model of the firm. J Environ Econ Manage 5:1–25

Marschak T, Nelson R (1962) Flexibility, uncertainty, and economic theory. Metroeconomica 14:42–58

Mauzerall DL, Sultan B, Kim N, Bradford DF (2005) \(\text{ NO }_{X}\) emissions from large point sources: variability in ozone production, resulting health damages and economics costs. Atmos Environ 39 (16):2851–2866

Mendelsohn R (1984) Endogenous technical change and environmental regulation. J Environ Econ Manage 11:202–207

Mills DE (1984) Demand fluctuations and endogenous firm flexibility. J Ind Econ 33:55–71

Morton IK, Schwartz NL (1968) Optimal ‘induced’ technical change. Econometrica 36:1–17

Newell RG, Pizer WA (2003) Regulating stock externalities under uncertainty. J Environ Econ Manage 45:416–432

Nordhaus WD (2007) To tax or not to tax: alternative approaches to slowing global warming. Rev Environ Econ Policy 1:26–44

Orr L (1976) Incentive for innovation as the basis for effluent charge strategy. Am Econ Rev 66:441–447

Parsons JE, Ellerman AD, Feilhauer S (2009) Designing a U.S. market for \(\text{ CO }_{2}\). J Appl Corporate Financ 21:79–86

Pizer WA (2002) Combining price and quantity controls to mitigate global climate change. J Public Econ 85:409–434

Requate T (2005) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54:175–195

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: Will the true ranking please stand up? Eur Econ Rev 47:125–146

Roberts MJ, Spence M (1976) Effluent charges and licenses under uncertainty. J Public Econ 5:193–208

Ruttan VW (2001) Technology, growth, and development: an induced innovation perspective. Oxford University Press, New York

Spulber DF (1985) Effluent regulation and long-run optimality. J Environ Econ Manage 12:103–116

Stigler G (1939) Production and distribution in the short run. J Polit Econ 47:305–327

Weitzman ML (1974) Prices vs. quantities. Rev Econ Stud 41:477–491

Weitzman ML (1978) Optimal rewards for economic regulation. Am Econ Rev 68:683–691

Zhao J (2003) Irreversible abatement investment under cost uncertainties: tradable emission permits and emissions charges. J Public Econ 87:2765–2789

Acknowledgments

I am grateful to Cathrine Hagem, Michael Hoel, Knut Einar Rosendahl and two anonymous referees for their valuable comments and suggestions. Financial support from the Renergi program of the Norwegian Research Council is acknowledged. While carrying out this research I have been associated with CREE—Oslo Centre for Research on Environmentally Friendly Energy.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1. I first prove that \(\rho _{\eta }\in \left[ -1/(n-1),1\right] \). A matrix is a valid covariance matrix if and only if it is positive semi-definite. With \(n^{\prime }\) identical firms and \(\rho _{\eta }=E\left( \eta _{i}\eta _{i^{\prime }}\right) /\sigma _{\eta }^{2}\) the covariance matrix is given by the following \(n^{\prime }\times n^{\prime }\) matrix:

The determinant of this matrix is given by \(\left( 1-\rho _{\eta }\right) ^{n^{\prime }-1}\left( 1+\rho _{\eta }\left( n^{\prime }-1\right) \right) \). It can then be shown that the principal minors of the \(n\times n\) covariance matrix satisfy the criteria necessary for positive semi-definiteness if and only if \(\rho _{\eta }\in \left[ -1/(n-1),1\right] \) (use the determinant criteria for positive semi-definiteness with the given formula for \(n^{\prime }=1,n^{\prime }=2,...,n^{\prime }=n\)). The proof that \(\rho _{\varepsilon }\in \left[ -1/(m-1),1\right] \) is similar.

Proof of Corollary 2 and derivation of Eqs. (11), (12) and (14) to (17): In the following, I solve the model under the general cost function \(\widetilde{c}(q_{i},a_{i},{\varvec{\alpha }}_{i},{\varvec{\eta }}_{i})\) in order to prove Corollary 2. The needed equations are derived on the way by inserting specification (1) in the general solutions. Firm \(i\in N\) solves:

The solution to inner maximization problem (with \({\varvec{\alpha }}_{i}\) given) yields the firm’s first order conditions in period 3:

Let \({\varvec{\alpha }}_{i}=\left( \alpha _{1i},\alpha _{2i},...,\alpha _{Vi}\right) \). By the envelope theorem, the first order conditions in period 2 of firm \(i\in N\) are:

In the particular case with \(\widetilde{c}(q_{i},a_{i},{\varvec{\alpha }}_{i},{\varvec{\eta }}_{i})=c(q_{i},a_{i})\) (see Eq. 1) and \(\widetilde{k}\left( \alpha _{i}\right) =k(\alpha _{i},\beta _{i})\), Eq. (18) yields:

which are the firms’ first order conditions (11) and (12) given in the text.

The social planner solves:

with

Differentiating wrt. \({\varvec{\alpha }}_{i}\), we get:

for all \(i\in N\) and \(v\in \left\{ 1,2,...,V\right\} \). Calculating \(\frac{dX}{d\alpha _{vi}}\) and rearranging yields:

where I used the firm’s first order conditions in period 3 given above and Eq. (6). The social planner’s first order conditions \(\frac{d\widetilde{W}}{d\alpha _{i}}=0\) then become:

for all \(i\in N\). Under emissions trading, aggregate emissions \(Z=S\) is exogenous to the technology choice parameter vector \({\varvec{\alpha }}_{i}\). Therefore, \(\frac{dZ}{d\alpha _{vi}}=0\) in Eq. (19). It follows that the first order conditions of the social planner (19) are equal to the first order conditions of the firms given in Eq. (18). The same is not true under an emissions tax, because emissions are endogenous and \(\frac{dZ}{d\alpha _{vi}}\ne 0\) in general. Corollary 2 follows.

In the particular case with \(\widetilde{c}(q_{i},a_{i},{\varvec{\alpha }}_{i},{\varvec{\eta }}_{i})=c(q_{i},a_{i})\) (see Eq. 1) and \(\widetilde{k}\left( {\varvec{\alpha }}_{i}\right) =k(\alpha _{i},\beta _{i})\), Eq. (19) becomes:

Under emissions trading we have \(\frac{dZ}{d\alpha }=\frac{dZ}{d\beta }=0\), while an emissions tax yields \(\frac{dZ}{d\alpha }=0\) and \(\frac{dZ}{d\beta }=\frac{-1}{\beta ^{2}}\sum _{i\in N}\eta _{i}\) (cf. Table 1). Hence, \(\frac{1}{n}E\left[ \left( \frac{dG}{dZ}-\tau \right) \frac{dZ}{d\beta }\right] =\frac{-1}{n\beta ^{2}}E\left[ \frac{dG}{dZ}\sum _{i\in N}\eta _{i}\right] =\frac{-1}{n\beta ^{2}}cov\left[ \frac{dG}{dZ},\sum _{i\in N}\eta _{i}\right] \). The Eqs. (14)–(17) follows (remember that \(E(a_{i}^{2})=var(a_{i})+(E(a_{i}))^{2}\)).

Proof of Proposition 1. I first derive the second order conditions to the maximization problem (10). The Hessian is given by:

where \(\frac{1}{2}\frac{dE(a^{2})}{d\alpha }=\frac{dE(a)}{d\beta }=-E(a)V_{3}\), cf. Table 2. The conditions for the Hessian to be negative semi-definite are \(\Pi _{\alpha \alpha }\le 0\) and \(\Pi _{\alpha \alpha }\Pi _{\beta \beta }-\Pi _{\alpha \beta }^{2}\ge 0\). I assume the last equation holds with strict inequality.

We observe from Eqs. (11), (12) and Table 2 that the regulatory regimes induce equal technology if and only if \(Var(a_{\sigma })=Var(a_{\tau })\) when \(S_{\sigma }=S_{\tau }\). Differentiating Eqs. (11) and (12) wrt. \(z\in \left\{ \sigma _{\eta },\sigma _{\varepsilon },\rho _{\eta },\rho _{\varepsilon }\right\} \), i.e., increasing \(Var(a)\) using exogenous parameters, we get:

Or, equivalently, using matrix notation and the definitions from the Hessian:

where I also used \(\frac{dE(a^{2})}{dz}=\frac{dVar(a)}{dz}\) (cf. Table 2). Solving for the changes in the technology parameters, we get:

It then follows from the second order conditions that \(\frac{d\alpha }{dz}\le (\ge )0\Leftrightarrow \Pi _{\alpha \beta }\ge (\le )0\) and that \(\frac{d\beta }{dz}<0\). Hence, \(\beta _{\sigma }\le \left( \ge \right) \beta _{\tau }\) if and only if \(Var(a_{\sigma })\ge \left( \le \right) Var(a_{\tau })\). This proves the proposition.

Proof of Corollary 1: Without loss of generality, specify \(\widetilde{c}(q_{i},a_{i},\alpha _{\mathbf{i}},\eta _{i})=\gamma \widehat{c}(q_{i},a_{i},\alpha _{\mathbf{i}},\eta _{i})\) \(+c(q_{i},a_{i})\), where \(\gamma \in \left[ 0,\infty \right) \) is a constant and \(c(q_{i},a_{i})\) is given by Eq. (1). The proof of Proposition 1 proves Corollary 1 in the particular case with \(\gamma =0\). The Corollary follows because ambiguity in the particular case with \(\gamma =0\) implies ambiguity in the general case \(\gamma \in \left[ 0,\infty \right) \).

Rights and permissions

About this article

Cite this article

Storrøsten, H.B. Prices Versus Quantities: Technology Choice, Uncertainty and Welfare. Environ Resource Econ 59, 275–293 (2014). https://doi.org/10.1007/s10640-013-9728-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9728-x