Abstract

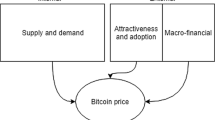

Bitcoin’s growing use as a financial asset and transaction instrument has economic and monetary effects. In this paper, we examine the short- and long-term interactions between Bitcoin prices and the money supply, consumer price index (CPI), and economic policy uncertainty (EPU) in the US. Using monthly data covering the period July 31, 2010 to August 31 2020, we employ continuous wavelet transforms, wavelet coherence, wavelet-based vector autoregressive Granger causality test, and nonlinear causality test. The results indicate that Bitcoin prices affect money supply and share dynamic inter-shock with CPI, EPU, and money supply. Specifically, the money supply and EPU negatively affect Bitcoin prices. CPI positively affects Bitcoin prices in the short-term, which supports the role of Bitcoin as a hedging asset. A bidirectional volatility transmission exists between Bitcoin prices and each of money supply, CPI, and EPU. Moreover, nonlinear causality test results show a bidirectional causality from Bitcoin price to money supply across all dimensions and a significant causality with CPI and EPU. The findings matter to investors seeking to refine their investment decisions while considering the effect of economic factors and to policymakers and central banks seeking to formulate policy tools using Bitcoin.

Similar content being viewed by others

Data Availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

A function x(t) is called a square integrable if \({\int }_{-\infty }^{\infty }x{\left(t\right)}^{2}dt<\infty \).

References

Aguiar-Conraria, L., Azevedo, N., & Soares, M. J. (2008). Using wavelets to decompose the time-frequency effects of monetary policy. Phys. A, 387(12), 2863–2878. https://doi.org/10.1016/j.physa.2008.01.063

Antonakakis, N., Tsangyao, C., Cunado, J., & Gupta, R. (2018). The relationship between commodity markets and commodity mutual funds: A wavelet-based analysis. Finance Res. Lett., 24, 1–9. https://doi.org/10.1016/j.frl.2017.03.005

Aslanidis, N., Bariviera, F., & A., & Perez-Laborda, A. (2021). Are cryptocurrencies becoming more interconnected? Economic Letters. https://doi.org/10.1016/j.econlet.2021.109725

Aysan, A. F., Demir, E., Gozgord, G., & MarcoLauc, C. K. (2019). Effects of the geopolitical risks on Bitcoin returns and volatility. Res. Int. Bus. Finance, 47(2019), 511–518. https://doi.org/10.1016/j.ribaf.2018.09.011

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring Economic Policy Uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024

Baur, D. G., & Dimpfl, T. (2021). The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empirical Economics. https://doi.org/10.1007/s00181-020-01990-5

Baur, D. G., Hong, K. H., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? J. Int. Financial Mark. Inst. Money, 54(2018), 177–189. https://doi.org/10.1016/j.intfin.2017.12.004

Best, R. d. (2021, January 02). Bitcoin trading volume on online exchanges in various countries worldwide in 2020. Retrieved from www.statista.com: https://www.statista.com/statistics/1195753/bitcoin-trading-selected-countries/

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspective, 29(2), 213–238. https://doi.org/10.1257/jep.29.2.213

Bordo, M. D., & Jonung, L. (1981). The Long Run behavior of the income velocity of money in five advanced countries, 1870–1975. An Institutional Approach. Econ. Inq., 19(1), 96–116. https://doi.org/10.1111/j.1465-7295.1981.tb00605.x

Bouri, E., Gkillas, K., Gupta, R., & Pierdzioch, C. (2020). Forecasting Realized Volatility of Bitcoin: The Role of the Trade War. Computational Economics. https://doi.org/10.1007/s10614-020-10022-4

Bouri, E., Gupta, R., Tiwari, A. K., & Roubaud, D. (2017). Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Res. Lett., 23(2017), 87–95. https://doi.org/10.1016/j.frl.2017.02.009

Branson, W. H. (1983). Macroeconomic Determinants of Real Exchange Rates. In R. J. Herring, Managing Foreign Exchange Risk. Cambridge: Cambridge University Press.

Brock, W. A., Dechert, W. D., Scheinkman, J. A., & LeBaron, B. (1996). A test for independence based on the correlation dimension. Econom. Rev., 15, 197–235.

Brock, W. A., Brock, W. A., Hsieh, D. A., & LeBaron, B. D. (1991). Nonlinear Dynamics, Chaos, and Instability: Statistical Theory and Economic Evidence. MIT Press.

Celeste, V., Corbet, S., & Gurdgiev, C. (2020). Fractal dynamics and wavelet analysis: Deep volatility and return properties of Bitcoin, Ethereum and Ripple. The Quarterly Review of Economics and Finance, 76(2020), 310–324. https://doi.org/10.1016/j.qref.2019.09.011

Chen, T.-H., Chen, M.-Y., & Du, G.-T. (2021). The Determinants of Bitcoin’s Price: Utilization of GARCH and Machine learning approaches. Computational Economics, 57, 267–280. https://doi.org/10.1007/s10614-020-10057-7

Chiou-Wei, S. Z., Chen, C.-F., & Zhu, Z. (2008). Economic growth and energy consumption revisited — Evidence from linear and nonlinear Granger causality. Energy Econ, 30(6), 3063–3076. https://doi.org/10.1016/j.eneco.2008.02.002

Ciaian, P., Rajcaniova, M., & Kancs, d. (2015). The economics of BitCoin price formation. Applied Economics, 48(19), 1799–1815. https://doi.org/10.1080/00036846.2015.1109038

Ciaian, P., Rajcaniova, M., & Kancs, d. (2016). The digital agenda of virtual currencies: Can BitCoin become a global currency? Info. Sys. Bus. Manag., 14(2016), 883–919. https://doi.org/10.1007/s10257-016-0304-0

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economic Letters, 165, 28–34. https://doi.org/10.1016/j.econlet.2018.01.004

Cuthbertson, A. (2020, September 02). Bitcoin now accepted by 100,000 merchants worldwide. Retrieved from International Business Times: https://www.ibtimes.co.uk/bitcoin-now-accepted-by-100000-merchants-worldwide-1486613

Bekiros, D., & S., & Diks, C. G. (2008a). The relationship between crude oil spot and futures prices: Cointegration, linear and nonlinear causality. Energy Econ., 30(5), 2673–2685. https://doi.org/10.1016/j.eneco.2008.03.006

Bekiros, D., & S., & Diks, C. G. (2008b). The nonlinear dynamic relationship of exchange rates: Parametric and nonparametric causality testing. Journal of Macroeconomics, 30(4), 1641–1650. https://doi.org/10.1016/j.jmacro.2008.04.001

Demir, E., Gozgora, G., MarcoLau, C. K., Vigne, A., & S. (2018). Does economic policy uncertainty predict the Bitcoin returns? An Empirical Investigation. Finance Res. Lett., 26(2018), 145–149. https://doi.org/10.1016/j.frl.2018.01.005

Dewandaru, G., Masih, R., & Masiha, M. (2017). Regional spillovers across transitioning emerging and frontier equity markets: A multi-time scale wavelet analysis. Economic Modelling, 65(2017), 30–40. https://doi.org/10.1016/j.econmod.2017.04.026

Diks, C., & Panchenko, V. (2006). A new statistic and practical guidelines for nonparametric Granger causality testing. Journal of Economic Dynamics & Control, 30(9–10), 1647–1669. https://doi.org/10.1016/j.jedc.2005.08.008

Dyhrberg, A. H. (2016). Bitcoin, gold and the dollar – A GARCH volatility analysis. Finance Res. Lett., 16(2016), 85–92. https://doi.org/10.1016/j.frl.2015.10.008

Fang, L., Bouri, E., Gupta, R., & Roubaud, D. (2019). Does global economic uncertainty matter for the volatility and hedging effectiveness of Bitcoin? International Review of Financial Analysis, 62(2019), 29–36. https://doi.org/10.1016/j.irfa.2018.12.010

Feng, W., Wang, Y., & Zhang, Z. (2018). Can cryptocurrencies be a safe haven: A tail risk perspective analysis. Applied Economics, 50(44), 4745–4762. https://doi.org/10.1080/00036846.2018.1466993

François, & Benhmad. (2012). Modeling nonlinear Granger causality between the oil price and US dollar: A wavelet based approach. Economic Modelling, 29(4), 1505–1514. https://doi.org/10.1016/j.econmod.2012.01.003

Gandal, N., Hamrick, J., Moore, T., & Oberman, T. (2018). Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics, 95(2018), 86–96. https://doi.org/10.1016/j.jmoneco.2017.12.004

Giungato, P., Rana, R., Tarabella, A., & Tricase, C. (2017). Current trends in sustainability of bitcoins and related blockchain technology. Sustainability, 9(2214), 2214. https://doi.org/10.3390/su9122214

Gkillas, K., & Longin, F. (2019). Is bitcoin the new digital gold Evidence from extreme price movements in financial markets. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3245571

Gkillas, K., Gupta, R., & Pierdzioch, C. (2021). Forecasting realized volatility of bitcoin returns: Tail events and asymmetric loss. Eur. J. Finance. https://doi.org/10.1080/1351847X.2021.1906728

Goczek, Ł, & Skliarov, I. (2019). What drives the Bitcoin price? A factor augmented error correction mechanism investigation. Applied Economics, 51(59), 6393–6410. https://doi.org/10.1080/00036846.2019.1619021

Gozgor, G., Tiwari, A. K., Demir, E., & Akron, S. (2019). The relationship between Bitcoin returns and trade policy. Finance Res. Lett., 29(2019), 75–82. https://doi.org/10.1016/j.frl.2019.03.016

Granger, C. W. (1969). Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica, 37(3), 424–438. https://doi.org/10.2307/1912791

Hatemi-J, A., Hajji, M. A., Bouri, E., & Gupta, R. (2020). The Benefits of Diversification Between Bitcoin. Bonds, Equities and the US Dollar A Matter of Portfolio Construction: Asia Pac J Oper Res. https://doi.org/10.1142/S0217595920400242

Hazlett, P. K., & Luther, W. J. (2020). Is bitcoin money? And what that means. The Quarterly Review of Economics and Finance, 77(2020), 144–149. https://doi.org/10.1016/j.qref.2019.10.003

Kang, S. H., Yoon, S.-M., Bekiros, S., & Uddin, G. S. (2020). Bitcoin as Hedge or Safe Haven: Evidence from Stock, Currency. Bond and Derivatives Markets. Comput. Econ, 56(2020), 529–545. https://doi.org/10.1007/s10614-019-09935-6

Karfakis, C. (2002). Testing the quantity theory of money in Greece. Applied Economics, 34(5), 583–587. https://doi.org/10.1080/00036840110070014

Katsiampa, P., Gkillas, K., & Longin, F. (2018). Cryptocurrency market activity during extremely volatile periods. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3220781

Koutmos, D. (2019). Market risk and Bitcoin returns. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03255-6

Kristoufek, L. (2015). What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis: Plos ONE. https://doi.org/10.1371/journal.pone.0123923

Lu, X., Guo, K., Dong, Z., & Wang, X. (2016). Financial development and relationship evolvement among money supply, economic growth and inflation: A comparative study from the US and China. Applied Economics, 49(10), 1032–1045. https://doi.org/10.1080/00036846.2016.1210776

Matkovskyy, R., Jalan, A., & Dowling, M. (2020). Effects of economic policy uncertainty shocks on the interdependence between Bitcoin and traditional financial markets. The Quarterly Review of Economics and Finance, 77(2020), 150–155. https://doi.org/10.1016/j.qref.2020.02.004

Mokni, K., Ajmi, A. N., Bouri, E., & Vo, X. V. (2020). Economic policy uncertainty and the Bitcoin-US stock nexus. J. Multinatl. Financial Manag., 57, 100656. https://doi.org/10.1016/j.mulfin.2020.100656

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

Narayan, P. K., Narayan, S., Rahman, R. E., & Setiawan, I. (2019). Bitcoin price growth and Indonesia’s monetary system. Emerging Markets Review, 38(2019), 364–376. https://doi.org/10.1016/j.ememar.2018.11.005

Fasanya, O., & I., A. Oliyide, J., B. Adekoya, O., & Agbatogun, T. (2021). How does economic policy uncertainty connect with the dynamic spillovers between precious metals and bitcoin markets? Resources Policy, 72, 102077. https://doi.org/10.1016/j.resourpol.2021.102077

Peters, M. A., Green, B., & Yang, H. (2020). Cryptocurrencies, China’s sovereign digital currency (DCEP) and the US dollar system. Educational Philosophy and Theory. https://doi.org/10.1080/00131857.2020.1801146

Ramsay, J. B., & Lampart, C. (1998). Decomposition of economic relationships by timescale using wavelets. Macroeconomic Dynamics, 2(1), 49–71. https://doi.org/10.1017/S1365100598006038

Rogojanu, A., & Badea, L. (2014). The issue of competing currencies. Case study - Bitcoin. Theor. Appl. Econ., 21(1), 103–114. Retrieved from http://store.ectap.ro/articole/946.pdf

Schilling, L., & Uhlig, H. (2019). Some simple bitcoin economics. Journal of Monetary Economics, 106(2019), 16–26. https://doi.org/10.1016/j.jmoneco.2019.07.002

Scott, A. (2021, january 26). News. Retrieved from www.Bitcoin.com: https://news.bitcoin.com/worlds-top-10-bitcoin-friendly-countries/

Seetharaman, A., Saravanan, A. S., Patwa, N., & Mehta, J. (2017). Impact of bitcoin as a world currency. Account Finance Res., 6(2), 230. https://doi.org/10.5430/afr.v6n2p230

Shahzad, S. J., Bouri, E., Roubaud, D., & Kristoufek, L. (2020). Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling, 87, 212–224. https://doi.org/10.1016/j.econmod.2019.07.023

Shepherd, M. (2020, December 2016). How Many Businesses Accept Bitcoin? Full List. Retrieved from www.fundera.com: https://www.fundera.com/resources/how-many-businesses-accept-bitcoin#:~:text=15%2C174%20businesses%20worldwide%20accept%20bitcoin,2%2C300%20US%20businesses%20accept%20bitcoin.

Torrence, C., & Compo, G. P. (1998). A Practical Guide to Wavelet Analysis. Bulletin of the American Meteorological Society, 79(1), 61–78.

Torrence, C., & Webster, P. J. (1998). The annual cycle of persistence in the El Nño/Southern Oscillation. Quarterly Journal Royal Meteorological Society, 124(550), 1985–2004. https://doi.org/10.1002/qj.49712455010

Wang, G.-J., Xie, C., Wen, D., & Zhao, L. (2019). When Bitcoin meets economic policy uncertainty (EPU): Measuring risk spillover effect from EPU to Bitcoin. Finance Res. Lett. https://doi.org/10.1016/j.frl.2018.12.028

Yarmack, D. (2015). Is Bitcoin a Real Currency? An Economic Appraisal. In D. L. Chuen, Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data (pp. 31–43). Academic Press. doi: https://doi.org/10.3386/w19747

Yu, L., Li, J., Tang, L., & Wang, S. (2015). Linear and nonlinear Granger causality investigation between carbon market and crude oil market: A multi-scale approach. Energy Econ, 15, 300–311. https://doi.org/10.1016/j.eneco.2015.07.005

Zhang, Y.-J., Bouri, E., Gupta, R., & Ma, S.-J. (2021). Risk spillover between Bitcoin and conventional financial markets: An expectile-based approach. North Am. J. Econ. Finance. https://doi.org/10.1016/j.najef.2020.101296

Zhu, Y., Dickinson, D., & Li, J. (2017) Analysis on the influence factors of Bitcoin’s price based on VEC model. Financial Innovation https://doi.org/10.1186/s40854-017-0054-0

Acknowledgements

We are grateful to the reviewers for their valuable suggestions.

Funding

The research received no external funding.

Author information

Authors and Affiliations

Contributions

LW Visualization; Writing—original draft; PS Design; Methodology; Data curation; Writing—original draft; Revising, EB Supervision; Methodology; Writing—original draft; Revising, All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, L., Sarker, P.K. & Bouri, E. Short- and Long-Term Interactions Between Bitcoin and Economic Variables: Evidence from the US. Comput Econ 61, 1305–1330 (2023). https://doi.org/10.1007/s10614-022-10247-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-022-10247-5