Abstract

The exposure of sovereigns to climate risks is priced and can affect credit ratings and debt servicing costs. I argue that the climate risks to fiscal stability are not receiving adequate attention and discuss how to remedy the situation. After providing evidence of divergent climate risks to advanced economies, I describe the transmission channels from climate change to public finance. Then, I suggest how integrated assessment models (IAMs) can be linked with stochastic debt sustainability analysis (DSA) to inform our understanding of climate risks to sovereign debt dynamics and assess the available fiscal space to finance climate policies. I argue for adopting the narrative scenario architecture developed within the IPCC to bring structure and transparency to the analysis. The analysis is complicated by deep uncertainty —risks, ambiguity, and mis-specifications— of climate change. Using scenario trees, narrative scenarios, and ensembles of models, respectively, we can deal with these three challenges. I illustrate using two prominent IAMs to generate the debt dynamics of a high-debt country under climate risks to economic growth and find adverse effects from as early as 2030. I conclude with the policy implications for fiscal stability authorities.

Similar content being viewed by others

1 Introduction

The year 2020 tied as the warmest on record, but the COVID-19 pandemic overshadowed the risks from accelerating climate change. Nevertheless, the current decade is considered a make-or-break decade for climate action, and countries must act at a time when sovereign debt has reached levels not seen since World War II. The pandemic added $24 trillion to global debt, representing a surge of 35 percentage points as a proportion to global GDP, with government programmes accounting for half of the rise.Footnote 1 Unprecedented interventions by central banks have averted a debt crisis, but concerns are voiced that climate change will imperil the ability of countries to repay COVID-19 debts (Dibley et al. 2021), as mitigation and adaptation costs further strain public finance and climate change may suppress growth.Footnote 2

Public investments in climate policies require an assessment of the available fiscal space from an analysis of sovereign debt dynamics over long horizons. In this essay, I discuss how to perform such analysis. I look at the transmission channels from climate change to public finance and sovereign debt, discuss how fiscal authorities in developed economies deal with climate change, and identify a gap in assessing climate change risks to sovereign debt. This assessment is of the essence for institutions mandated with fiscal stability—budget management offices and national fiscal councils, International Monetary Fund, European Stability Mechanism, European Fiscal Board—and investors.

The analysis of climate risks to public finance is complicated by the deep uncertainty of climate change. There are risks for which the probabilities are known, there is ambiguity where outcomes may be known but their likelihood is not, and there are misspecifications with no consensus on data or models (Barnett et al. 2020). I argue that it is possible to deal with this complexity, even if not with high precision, and integrate climate risks into sovereign debt analysis.

First, projecting economic growth, government fiscal stance, interest rates, and inflation is a problem of risk. Risk management is already embedded in stochastic debt sustainability analysis (DSA) to assess whether countries can meet their debt obligations in the context of current debt levels and borrowing conditions. Such analysis is conducted regularly by the IMF, the European Commission or the European Central Bank. The recent work by the European Stability Mechanism (Zenios et al. 2021) takes a long-term view using scenario trees. This approach facilitates the integration of climate risks in stochastic DSA, accounting for the tragedy of the horizon (Carney 2015).

Second, climate policies imply different socio-economic paths and determine climatic conditions. This creates ambiguity: we might know what the world could look like if the global temperature rise stays below 2 °C, or if it does not, but we cannot assign probabilities. The Integrated Assessment Consortium-IAC, established in response to a call from the Intergovernmental Panel on Climate Change—IPCC, developed a narrative scenario architecture to deal with this ambiguity (Climatic Change 2014). This architecture combines representative concentration pathways (RCPs) of atmospheric greenhouse-gas (GHG), with narratives on shared socio-economic development pathways (SSPs). The scenario architecture provides states of the world for what-if analyses, even if we do not know their probabilities.

Finally, model misspecifications arise from the lack of consensus on the appropriate model, nonlinear climate sensitivities, and tipping points. Climate scientists have limited ability to “give fine-grained and concrete answers to an impatient public” (Weitzman 2011), in spite developments in integrated assessment models (IAMs). Such models advance our understanding of the effects of GHG on the climate, the interaction of climate with natural systems, and the macroeconomic impact of increasing global temperatures (Nordhaus 2018). They do so under different SSP-RCP combinations, providing key input variables for debt analysis under temperature increase ranging from 2 °C (RCP2.6) to 4.2 °C (RCP8.5) by 2100. However, there is presently large variability among model assumptions and predicted outcomes, and we need to utilize ensembles of models.

Methodological commonalities in the analysis of climate risks and debt sustainability enable their integration. Narrative scenarios are a cornerstone of climate analysis (Climatic Change 2014), and probabilistic scenarios are at the core of stochastic DSA (Blanchard 2022; Zenios et al. 2021). Also, DSA focuses on tail risk (Zenios et al. 2021), just like the economics of climate change deal with extreme events (Weitzman 2011). We bring together these strands of literature to integrate climate risks in DSA using IAM. The integration facilitates a holistic analysis of the climate risks to debt.

We start by highlighting divergent climate impacts even among developed economies (G20 and EU) and show that investors differentiate sovereign issuers by their climate risk exposures, albeit fiscal authorities do not seem to be paying much attention to the climate risks to public finance (Sect. 2). We then identify the transmission channels of climate risks to sovereign debt (Sect. 3) and suggest incorporating climate change in DSA using IAM and the narrative scenario architecture (Sect. 4). We use two prominent IAMs to construct an illustrative example and demonstrate the potential climate effects on debt dynamics. Section 5 concludes with policy implications.

2 Sovereign exposure to climate risks

A survey of twenty-one studies (Tol 2014) found that a 5 °C temperature rise by the end of the century could adversely impact the world economy by 3 to 15% of GDP compared to a scenario of no further warming. For 2.5 °C increase, the impact would be 2.5%. IMF (2020) reports 25% GDP losses under a 5 °C increase. Whereas global average losses may be modest under limited climate change in line with the Paris Agreement goals, the impact in some regions could be substantial. Tol puts losses at 15% for the worst-hit region (South America), with positive effects for some countries (Baltics). Kalkuhl and Wenz (2020) project losses 20% GDP for the tropics. Overall, the adverse effects of climate change on economic growth are not disputed, but their timing and magnitude are not precisely estimated (Dell et al. 2014).

2.1 Divergence of advanced economies

Advanced economies differ significantly in their climate risk exposures. The index from the Notre Dame Global Adaptation Initiative (ND-GAIN, Appendix A) shows ratings from below 50 (India, Brazil, Argentina) up to 70 (Australia, UK, Germany), among forty-one G20 and EU countries. Burke et al. (2015) estimate striking divergence of GDP per capita under 4.2 °C warming; see Fig. 1. Likewise, Kahn et al. (2021) find significant adverse effects using a cross-country estimation of climate effects, with GDP per capita losses averaging 10% for the worst-hit countries and 2.5% for the least affected, under RCP8.5. Such differences in growth can create significant divergence in sovereign debts.

Potential divergence of advanced economies without climate policy action. Source: Burke et al. (2015); https://web.stanford.edu/%7Emburke/climate/map.php. The black line denotes the best estimate and the shaded area represents uncertainty

The two studies agree on the direction of travel, but differ on magnitudes. Such disagreements are not uncommon. Burke et al. use forward-looking simulations, while Kahn et al. use historical data. Extrapolation from the past can give more precise estimates, albeit about a future that may be very different from the past, while forward-looking projections hinge on assumptions about damage functions. That is why, it is important to have common narrative scenarios and use ensembles of models.

The economic divergence is not so severe under a 2 °C increase, but remains material. Kahn et al. find that the best-prepared countries, according to the ND-GAIN index, suffer average losses of 0.8% and the least prepared 1.1% GDP per capita by 2100 under RCP2.6.

We use the RICE50+ model of Gazzotti et al. (2021) under SSP2-RCP2.6 with the damage function from Kahn et al. (2021) to obtain GDP growth rates until the end of the century. We display in Fig. 2 the ratio of model-projected GDP growth rates of 2100 to 2020 (bars) and the trend line of ND-GAIN indices (bullets). Denmark and Finland see growth rates lowered by less than 0.20, whereas some countries see growth rates drop by more than 0.7 from their current levels. Italy is doing remarkably well under this model, compared to neighboring Greece, but under a more severe damage function (Burke et al. 2015), its growth rate is reduced to about 2/3rd of its current value like its neighbor. Again, we see agreement in the direction and differences in magnitudes, and a trend of less prepared countries suffering the most. Northern countries are above the trend while Southern and Central European countries are below.

2.2 An EU climate divide

Divergent climate effects are noticeable even within the geographically proximate European Union economies. EU countries are among the world’s best prepared and less vulnerable (Fig. 3), but with significant differences in their ratings. The ND-GAIN index ranges from 52 (Romania) to 73 (Denmark, Finland), with the bottom tercile averaging 57 and the top tercile 70. European countries are already experiencing climate disasters with estimated damages €446 billion between 1980 and 2019.Footnote 3 This is 3% of GDP over a 40-year period, which may seem distant and indirect. The effects can be nevertheless material: EU economic losses from extreme weather have amounted to about €12 billion annually in recent years and are projected to grow by at least €170 billion per year (1.4% GDP).Footnote 4 Kahn et al. (2021) estimate GDP losses of about 10% for the worst-hit EU countries and 2.5% for the least hit, under RCP8.5 by 2100. Under RCP2.6, the losses are milder, with average losses 0.5% for the top and 1.7% for the bottom terciles. Mitigation requires costly upgrading of infrastructure, and the transition to a low-carbon economy will cause asset revaluation, with Darvas and Wolff (2021) reporting investment requirements to meet EU climate goals up to 1% of GDP annually during this decade. These pressures on public finance come as EU countries can experience lower growth from climate change; Fig. 2.

Climate change could lead to increased political instability (Dell et al. 2014), and political science literature documents contagion effects, with political risk recognized as a risk factor of asset prices (Gala et al. 2020; Kelly et al. 2016). Europe’s neighbors in the Middle East and North Africa are more vulnerable and less prepared (Fig. 3), and political risks that have been quite low in the EU could change through spillovers. Spillovers hit harder the EU periphery countries creating another source of climate-induced tension within the Union.

Porter and van der Linde (1995) suggest that climate policies can trigger innovation and spur growth. Countries that use the European Green Deal to stimulate innovation will adapt to climate change, while those that fail to stimulate innovation will become laggards. This would aggravate existing imbalances and accelerate capital flight towards innovators. Central European countries could find themselves among the laggards if they fail to compensate for losses from their rich fossil-fuel resources.

Countries with greater exposure to climate risks have more precarious public debt positions, adding to the tension. The climate-vulnerable EU tercile has weighted average debt 133% of GDP, whereas the least vulnerable tercile averages 78%. The available fiscal space limits the implementation of mitigation and adaptation policies, further exacerbating the differences.

Whereas the climate shocks may be systemic, they have asymmetric effects on fiscal stability of EU member states. All the factors above, taken together, can create a ‘climate divide’ in EU, which is quite distinct from the usual North-South divide. This requires the Union to think how to react. Climate effects that are not distributed evenly have the potential to increase political risks that can arise not only from climate-vulnerable neighbors but also from inequalities within the bloc.

European institutions have a stake in these risks. The European Commission is tasked with ensuring robust management of public finances, and the European Fiscal Board with the national fiscal councils, and the European Stability Mechanism, have related objectives. Climate change presents a common threat to the fulfillment of their mandates, creating a need for coordination. COVID-19 prompted the EU towards community financing with the Next Generation EU recovery plan, and its focus on a resilient Europe is highly relevant during the current make-or-break decade for climate action.

2.3 The price of climate risks in sovereign bonds

There are today more than 40,000 securities globally issued by sovereigns, agencies, or supra-nationals, for a total nominal value of $74 trillion with $65tn for the G20. They comprise 68% of the bond markets.Footnote 5 Sovereign bonds are a significant component of the portfolios of institutional investors and constitute the lion’s share in the asset purchasing programs of central banks. Most outstanding issues mature within 10 years, but significant amounts run into the 2060s, and century bonds with 100-year maturity have been on the rise as borrowers lock-in record low interest rates. Bond investors start to be attuned to climate risks (Barnett et al. 2020).

Cevik and Tovar-Jalles (2020) analyze the bond yields of 98 economies since 1995 and find that climate vulnerability and readiness are determinants of governments’ cost of borrowing. A 1% increase in climate vulnerability increases the long-term government bond spreads of developing countries by about 3%. Battiston and Monasterolo (2020) use forward-looking simulations of transition risks to find yield increases from 0.1% (UK) to 2.5% (Australia, Norway), but also decreases for countries using renewable energy (Switzerland, Baltics).

Increasing borrowing costs due to climate change can be material for sovereign debt. Investors use credit ratings to assess the issuer’s ability to pay. Rating agencies anticipate that climate trends will affect ratings in coming decades (Moody’s 2019; S&P 2017). Klusak et al. (2021) develop a model linking climate-adjusted GDP estimates to sovereign ratings. They use machine learning to predict sovereign credit ratings and train it on the S&P ratings using natural disaster risk assessments and macroeconomic data. Then, they use Burke et al. (2015) and Kahn et al. (2021) to project climate-adjusted macroeconomic input data to the rating model and estimate ratings under different climate scenarios.

They find that fifty-five sovereigns face downgrades under a 2 °C temperature increase and eighty under 4.2 °C. Within the Paris Agreement targets, most G20 and EU countries would be down-rated marginally (up to 2 notches), but the down-ratings under 4.2°C are up to 6 notches. A majority of G20-EU countries are down-rated, with effects noticeable as early as 2030. Climate risks to ratings are not as distant as we might think. In a 2 °C scenario, the cost of debt servicing will increase by 0.1% GDP for Australia and China and about 0.5% for UK, USA, and Japan. Such increases can be material for countries with tight fiscal space. Increasing debt servicing costs will add to the fiscal costs incurred from damages and climate policies, as countries’ growth faces adverse climate effects. The compounded climate effects can become a first-order problem for sovereign debt.

2.4 Are countries fiscally prepared for climate risks?

The effects of climate risks on sovereign debt instruments are gradually coming into focus, with BlackRock launching recently a climate adjusted sovereign fund.Footnote 6 Australia, Canada, Japan, New Zealand, and the UK started connecting the dots between climate change and the fiscal position (Appendix B.1), and the EU financial sector supervisors perform climate stress tests to financial stability (ECB/ESRB 2021).

Albeit, the climate risks to fiscal stability are receiving much less attention. A 2019 survey by the EU network of the national fiscal councils found that none of their quantitative analyses covers climate risks. Only the UK Office for Budget Responsibility and the Irish Fiscal Advisory Council devote some space to the issue (Appendix B.2).

The lagging interest is broad. A Google trends search since the Paris Agreement has an average rating of 92 for “climate risks + financial” and 36 for “climate risks + fiscal”. Only users in Mexico, Brazil, Spain, and France have more interest in the latter. On Google Scholar, there are 1.94 million documents on the former topic and 0.3 million on the latter.

Studies assessing climate risks to sovereign debt are scant. Notable exceptions are Dafermos et al. (2018) and Lamperti et al. (2019), who look at the fiscal costs from financial instability, namely, reduction in tax revenues and bank bailouts. A more holistic view is needed to integrate multiple channels of climate effects on sovereign debt. The integration of climate risks into DSA provides such a view.

3 Climate risks to public finance

The climate risks to public finance can be acute from extreme weather events or chronic from long-term gradual changes. The costs from the physical risks are compounded by transition risks from mitigation and adaptation policies that introduce trade-offs to the analysis. Mitigation spending can put further pressure on public finance, while leading to more benign climate change. Adaptation spending burdens the public purse but cushions the impact of climate change. Both can spur growth per the Porter-van der Linde hypothesis.

Three main channels transmit climate risks — physical and transition — to public finance. First, we have damages, including social costs, and the fiscal cost of adaptation and mitigation. Second, we have the effects of climate change and of climate policies on growth and financial stability. Third, we have repricing of assets.

The physical risks from climate change are mediated by climate policies which are costly and create transition risks but can have positive climate effects. The effects of climate change on public finance are not independent from the effect of climate policies on both the climate and public finance. However, they are usually treated in isolation,Footnote 7 and I argue how to bring them together.

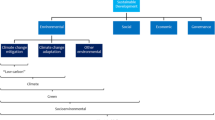

Figure 4 sketches the integration of climate change and climate policies into public finance. Climate modules (green) specify chronic and acute changes which create physical risks. Societies pursue mitigation and adaptation policies (yellow modules), which are costly but moderate the long-term impacts of climate change. Mitigation creates transition risks but can limit climate change. Adaptation reduces economic damages and improves resilience. Policies feed into the economic modules (blue) to estimate damages, growth effects, and asset repricing. Thus, physical and transition risks from climate change, with the costs and benefits of mitigation and adaptation, are transmitted to the fiscal module (brown).

The fiscal module generates the variables for DSA to estimate the sovereign’s gross financing needs and the debt-to-GDP ratio. The sovereign’s fiscal needs, adjusted for public investments in adaptation and the fiscal cost of mitigation, add to sovereign debt. Economic growth reduces the debt ratios. Financial variables determine the cost of debt financing. Inflation is used to arrive at nominal values, since debt is nominal. Asset valuation is a key component of a sovereign’s balance sheet that determines credit ratings and risk premia. Climate change then enters the debt variables through damages, economic growth, and sovereign wealth, and by affecting market conditions for debt financing.

Damages

Economic damages are caused by the adverse effects of climate change on natural resources, physical capital, labor, and productivity. Damages can be assessed from past extreme events (see Australia and Canada, Appendix B.1 or the international disasters database EM-DATFootnote 8). However, extrapolating from historical datasets underestimates future damages as the number and severity of extreme events are increasing with time. For instance, EM-DAT reports an increase from 120 in 1985 to more than 250 per annum recently. Long-term damages can also be projected through IAM endowed with a damage function. The cost of damages from extreme weather events can be considered as contingent liabilities, as done by Australia, Japan, and New Zealand.

IAM could be employed to generate quantitative projections of damages for DSA under the IAC narrative scenarios. Presently, IAC collaborates with asset managers and central banks to generate scenarios for financial analysis. Similar interaction is warranted with sovereign debt issuers to generate scenarios for fiscal analysis. Damages from acute weather event can then be overlaid using historical data or as contingent liabilities.

Economic growth

Climate change affects growth through its impact on productivity, labor, and capital. On the other hand, investment and innovation in new technologies could raise productivity. Economic transition re-allocates resources, with employment and social impacts, and both direct and indirect non-discretionary fiscal impacts (European Commission 2019). Direct costs include social transfers to affected households and explicit contingent liabilities, such as insurance schemes backed by state guarantees or bank bailouts. Discretionary costs arise from policies such as public investments to infrastructure or public health or clean energy subsidies. Non-discretionary costs include reductions in tax revenues.

Significant expenditures are already foreseen on mitigation. The European Green Deal assumes an annual investment gap of €260 billion (1.86% of 2019 EU27 GDP) to reach the 2030 climate targets, and NGFS (2019) estimates that up to 4% of global GDP in 2030 will be needed for mitigation efforts to meet the Paris targets. Such liabilities will materialize on public balance sheets if private investments fall short.

Sovereign wealth

Climate change causes sovereign wealth to be repriced, affecting credit quality and debt financing rates. This is the case for carbon-intensive assets in public ownership, such as coal mines or energy utilities, which may become stranded assets due to rising carbon prices. Assets worth $12 trillion (3% of the capital stock) are estimated to be stranded by 2050 (Banque de France 2019).

Rents from natural resources are significant for some countries, and changes in extractive activity can affect their fiscal position. Furthermore, energy intensities with heavy reliance on fossil fuels create transition risks even for countries without asset repricing risks. For instance, among the EU countries, those with high energy intensity or high fossil-fuel extraction — Bulgaria, Czechia, Poland — are more exposed to transition risks. Countries with low energy intensity — Finland, France, Sweden — can more easily weather the transition.

Financial variables

The financial variables in DSA — the natural rate of interest r*, risk premia, and inflation — are also affected from climate change. The increase in the frequency and severity of supply shocks due to extreme weather makes it harder for central banks to forecast output gaps, and pricing policies for transition also need to be considered when evaluating inflationary pressures.Footnote 9 The Network for Greening the Financial System (NGFS 2019), which consists of central banks and financial supervisors, is studying the effects of climate change on financial variables. For instance, Bylund and Johnsson (2020) from the Central Bank of Sweden consider the effect of climate change to r*, and the monetary policy response to climate change should be factored into long-term DSA.

In conclusion, IAM can generate forward-looking scenarios of the climate effects on growth, fiscal costs, and sovereign wealth. However, these mechanisms are not perfectly understood, and models often rely on broad assumptions arriving at different estimates. Long-horizon projections give rise to ambiguity and misspecifications. These are the reasons I suggest using transparent narrative scenarios and ensembles of IAM.

4 Debt sustainability analysis with climate risks

Putting the pieces together suggests that climate risks could precipitate a destabilizing doom loop of sovereign debt. If climate costs to public finance raise concerns about the sovereign’s ability to repay, the sovereign is downrated and its financing rates go up increasing costs even further. The sovereign is caught in a debt trap from which it can be difficult to escape if climate change lowers GDP growth. Debt sustainability analysis with a climate module can assess the risk of been caught in such a debt trap.

DSA traces the debt stock (D) and flow (F) as a ratio to the country’s GDP (Y). Stock and flow depend on the amortization of pre-existing debt, government fiscal needs, and interest rates. Using the relations between these variables we incorporate climate risks in DSA by modeling the climate impact on each variable.

Under certainty, we have the following dynamic relations for debt:

i denotes debt financing interest rates, A denotes amortization of pre-existing debt, and B denotes fiscal primary balance. For sustainability, we look at the ratio of stock and flow to GDP to calculate debt ratios:

Debt is considered unsustainable if the stock ratio is increasing. If the flow ratio exceeds a threshold that markets can finance, then the sovereign faces a liquidity crisis. These are the sustainability conditions.

DSA by the international institutions uses experts’ projections of future GDP and government primary balance and market data on interest rates and inflation. The stochastic DSA of Zenios et al. (2021) uses scenario trees to model the uncertainty of these variables (see Appendix C). The debt stock and flow ratios are stochastic variables on the scenario tree, following paths (p) across time (t). Using a tail risk measure — conditional value-at-risk, or expected shortfall — we can assess if the dynamics of debt stock remain non-increasing with high probability (e.g., 0.75) to reach conclusions on debt sustainability with high confidence.

The model of Zenios et al. (2021) (Sects. 2 and 3) brings together all debt variables from (1) to (3) to optimize debt financing under the uncertainty of a scenario tree to achieve the minimum cost to the sovereign with acceptable risks to debt dynamics. Presently, DSA scenarios ignore climate risks and are meaningful over medium horizons when experts’ projections and market data are reliable. Beyond that, scenarios converge to long-term trends, such as the historical average growth rate or inflation target.

To integrate climate risk into DSA, we calibrate scenario trees using IAM-generated projections on damages or growth. Damages, to the extent they are carried by the public purse, add to B. Climate effects on growth suppress Y. Adaptation and mitigation investments can also affect r* that underlies refinancing rates i (Zenios et al. 2021; Sect. 4).

This approach combines probabilistic scenarios calibrated on experts’ opinions and market data, with IAM long-term projections on narrative scenarios. It uses risk information from the scenario trees and ambiguous information from climate scenario narratives. The narrative scenario architecture provides the framework to deal with ambiguity. To deal with misspecifications, we can use ensembles of models to avoid reliance on a single model and search for robust strategies when we do not know (or cannot agree) upon the appropriate model (Lempert et al. 2006).

Importantly, using DSA, we can assess what is fiscally feasible by answering two key questions: (1) how can a sovereign finance its (climate adjusted) debt, and (2) how much extra fiscal adjustment is needed to stabilize the debt. Conversely, if debt is stable or declining, we can estimate the available fiscal space to take on more debt to support climate policies.

In summary, IAM can inform DSA about the risks from climate change. Using the narrative scenario architecture ensures transparency and helps us deal with ambiguity, and ensembles of models deal with the problem of misspecification. IAMs are criticized (Pindyck 2017), but Nordhaus (2018), Bosetti (2021), and Weyant (2017) argue that these models provide a conceptual framework for developing insights about complex, dynamic, and uncertain systems. IAMs do not provide precision forecasts for DSA but allow for a structured dialogue on the complex questions of debt sustainability to facilitate “what if” analyses and provide policy insights (Obama 2017).

4.1 Climate narrative scenario architecture for sovereign debt

The analysis of climate risks is unlike anything we see in the analysis of financial risks. The latter are estimated from market data with known probabilities, whereas the former require projections over long horizons with limited guidance from history. Climate scientists postulate possible future states of the world, but probabilities cannot be pinned down. Future states depend on policy choices, and precise projections are not possible without knowing the status of policy implementation. This creates ambiguity.

The narrative scenario architecture allows a structured analysis of ambiguity. For combinations of SSP and RCP, existing IAM can provide forward-looking projections of mitigation and adaptation costs, damages, GDP growth, and so on, to integrate climate risks into DSA variables.

Table 1 illustrates the IAC scenario architecture. Green cells are in line with the Paris Agreement, yellow cells fall short, red are dysfunctional states of the world, and implausible cells are blank. Check marks indicate the cells for conducting meaningful DSA. For each cell, we can use the currently available IAM (numbers shown) to generate inputs to the debt variables. DSA for each cell addresses the problem of ambiguity, and using multiple IAMs addresses the problem of misspecification.

We can now re-calibrate the trees for each narrative scenario (s) and condition the equations of debt dynamics by s together with paths p on the tree. The climate-sensitive debt dynamics become

where \({CB}_t^s\)denotes additional climate-related fiscal adjustment to account for adaptation and mitigation policies or damages.

From these relations we can adjust the debt variables using scenario values derived from an IAM under scenario narratives. For instance:

-

1.

Primary balance \({B}_{t-1}^p\) is adjusted by additional fiscal costs \({CB}_t^s\). This can reflect the cost of damages to be borne by the public purse, as well as the cost of mitigation and adaptation policies. IAM can be used to project such costs, and \({CB}_t^s\) is a climate fiscal adjustment.

-

2.

GDP is given on the calibrate tree by \({Y}_t^p\), and a climate growth factor adjustment \({\boldsymbol{c}}_{\boldsymbol{t}}^{\boldsymbol{s}}\) adjusts the GDP according to projections by an IAM. The adjustment factor is computed as the ratio of t = 0 GDP to the time t projections by an IAM.

-

3.

The interest rate \({i}_t^{p,s}\) is also indexed by climate. The interest rate is determined by risk and term premia over and above the policy rate rft (Zenios et al. 2021, section 4) set by a central bank (e.g., using Taylor rule) and determined by the equilibrium rate r*, output gap, and inflation. Current research to understand how climate policies may affect r* (e.g., Bylund and Johnsson 2020) can feed climate effects into a Taylor rule to set the interest rates for DSA.

-

4.

The amortization schedule \({A}_t^{p,s}\) depends on p for contingent debt and can be adjusted for climate scenarios s if contingency provisions are climate dependent.

With these adjustments the stochastic debt, ratios become

They fit into the DSA model to integrate climate risks into debt analysis. See Zenios et al. (2021) (Sects. 2 and 3) for a detailed description of the climate-free stochastic DSA model or Appendix C for an outline.

4.2 A case study of Italy

We build an illustrative example linking the DSA model with two IAMs — WITCH (Emmerling et al. 2016) and RICE50+ (Gazzotti et al. 2021) — to obtain values for the input variables.

We use Italy as a case study. This is a high-debt country, so climate change could have a noticeable impact. It has intermediate climate rating (ND-GAIN index 60) between the worst-rated G20-EU country (India, 41) and the best rated (Finland, 73). Also, multiple IAMs give quite different projections allowing us to highlight the effects of misspecifications. Italy is a country for which DSA is published in the open literature providing a baseline (Zenios et al. 2021). We emphasize, however, that we are presenting an illustrative example of the effects of climate risk on GDP growth, to show what is possible. A complete analysis would include projected damages and bailout costs (this will worsen the fiscal position and increase upside risk), the impact of mitigation (this will worsen the fiscal position but could spur growth and create downside potential), and the effects of climate change on monetary policy. Stochastic DSA can incorporate such estimates.

We use the IAM to obtain GDP growth projections and run DSA to showcase the climate effects on debt dynamics and the challenge of misspecifications. We first perform a climate-free DSA. We use growth and primary balance projections from the IMF World Economic Outlook, extrapolated to their historical averages in the long term. For inflation, we use ECB short-term projections with expected inflation converging to the 2% target. Scenario trees are calibrated so that their mean values match the IMF and ECB expectations, with volatilities and correlations matching their historical values. The calibrated trees underlying the DSA without climate change are in Appendix D.

We display the dynamics of debt stock ratio as the pink-shaded fan charts of Fig. 5. The median is stabilized slightly below 150% of GDP after 2030, from its initial value of 170%, with significant upside risk. The uncertainty of the fan chart (25/75 percentiles) is due to the volatilities and correlations of GDP growth and output gap, inflation, primary balance, and the risk-free rates of the calibrated trees of Appendix D.

Debt stock dynamics of a high-debt country with climate impact on growth. Source: The author, using the model of Zenios et al. (2021) together with WITCH and RICE50+

We next introduce climate effects consistent with the Paris Agreement from the RCP2.6-SSP2 scenario matrix cell. We use WITCH, taking the growth for “Europe,” and RICE50+ with the impact function of Burke et al. (2015), to project climate adjustments to Italy’s GDP growth. Specifically, we look at the ratio of future growth rate until 2100 to the 2020 growth from each model (Appendix E, top figure). These are examples of adjustments due to climate change, with both models projecting downward adjustments. The impact is large after mid-century according to RICE50+, whereas changes are gradual and start earlier according to WITCH. We use these ratios to adjust downwards the GDP growth projections from the IMF World Economic Outlook and re-calibrate the trees. The denominator in (3) is adjusted downwards to account for the effects of climate change as per Eq. (6), and the resulting debt dynamics shift upwards. This approach combines expert knowledge about the country (Appendix D), with climate projections from IAM (Appendix E) to obtain climate-adjusted scenario trees for the DSA model.

We overlay the DSA results with climate adjustments onto the fan chart in Fig. 5. The blue lines are the median and 25/75 quantiles with WITCH, and the dashed line is the median with RICE50+. The debt dynamics worsen when accounting for climate change. With RICE50+, the climate risks kick in from about 2050, whereas with WITCH, the changes are pronounced from mid-2030s.Footnote 10 We note an accelerating increase of debt after mid-century. This is in part due to the increasing adverse effects on growth shown in Appendix E, but also in part due to the nonlinear increase in risk premia with increasing debt ratio (Zenios et al. 2021, section 4). This accelerating increase of debt stock dynamics are a manifestation of the destabilizing doom loop initiated by climate change.

This test illustrates how climate risks can impact sovereign debt dynamics. Most importantly, it highlights a potential role for linking IAM with DSA to provide climate-adjusted debt dynamics under narrative scenarios from the IAC architecture. It also illustrates differences among IAMs, highlighting the importance of using ensembles of models to reach robust conclusions.

We also tested climate policy effects. We ran WITCH with adaptation and add the fiscal cost (Appendix E, top figure, right axis) in the DSA, assuming that one third of this cost is borne by the public purse, with the rest carried by households and corporation. The primary balance in (1)-(2) is adjusted upwards to account for the cost of adaptation policies (variable CB in Eqs. 3 and 4). The increase in deficits, in the range 0.07 to 0.4% GDP until the end of the century, is counterbalanced by increases in the denominator as climate effects on growth become milder because of adaptation investments. Re-running the DSA model, we find that the debt dynamics marginally change from those of Fig. 5 (blue lines) and adaptation measures do not seem to offset the upside risks. Once more, our test shows what is possible by integrating IAM with DSA, but we need a more precise calibration with alternative models to draw robust conclusions.

4.3 Discussion of the case study

We compare our results with the scant literature on climate effects to sovereign debt instruments. The estimated upward shift of debt is in line with the sovereign down-ratings from Klusak et al. (2021). It is also consistent with the increasing bond yields in Battiston and Monasterolo (2020) under energy transition risks, although these authors find decreasing yields for countries with renewable sources of energy, and for Italy, they have predictions of opposite signs with different IAM. It is possible that Italy could see yield reduction by using renewable energy, as one model predicts, but our analysis shows consistent adverse effects on the country’s sovereign debt with two IAMs.

Our findings are in the same direction, but with smaller magnitude than the estimates of Lamperti et al. They estimate debt increase by a factor of two under an extreme climate scenario (SSP5 with 3 °C temperature increase). Likewise, Dafermos et al. document a larger increase of debt ratio from reduction in tax revenues due to lower economic activity with a 4 °C temperature increase.

What is the take from these studies and our own analysis? It is difficult to make precise comparisons, given that these studies test different climate conditions, look at different channels of climate effects on public debt, and use different IAMs. Using the narrative scenario architecture will facilitate comparisons using standardized and commonly accepted scenarios. Overall, however, we have agreement on adverse climate effects on debt dynamics with two different approaches — credit ratings of Klusak et al. and our stochastic DSA — using four different IAMs. The estimated magnitudes from these two studies are aligned, with their downrating estimates being consistent with our estimate of upward shift of debt trajectories. Both methodologies find noticeable climate effects from 2030 onwards.

4.4 Concluding remarks on DSA with climate risks

Some recent works on the fiscal effects of climate change (Dafermos et al. 2018; Lamperti et al. 2019) look at the problem through the finance channel. For instance, they show that ignoring bank bailouts leads to an underestimation of the climate costs. As I have argued, however, there are many channels from climate to fiscal, and Lamperti et al. acknowledge that their approach can lead to underestimation. A more holistic view is needed to reach conclusions on the climate effects on public finance. Integrating IAM into DSA identifies the climate effects on debt variables for a more complete analysis. Importantly, DSA can assess what is fiscally feasible instead of only estimating the cost of climate change. That is, we can estimating the fiscal space available to increase borrowing to debt finance climate policies, without violating the sustainability conditions.

Stochastic DSA is rich and flexible. First, it goes beyond estimating a single number of summarizing expectations (e.g., bond yields or credit ratings), and models instead the future debt dynamics. Second, starting from the fundamental debt relations allows us to incorporate a broad array of climate channels using narrative scenarios and IAMs. In addition to the growth effects and adaptation costs we illustrated above, the DSA scenarios can be adjusted for mitigation costs and damages, including social costs and bailouts, and transition effects. Some of these elements have been studied in isolation in the literature and can feed into the scenario analysis of DSA. Ensembles of IAM can give us a range of projections for each scenario narrative (see Appendix E, bottom figure) allowing us to reach conclusions that transcend any single model.

Our case study should not be construed as a complete analysis for a given country. The scope of this essay is to demonstrate what is possible when combining DSA with IAM and to argue that using the narrative scenario matrix architecture, we bring transparency to climate analysis.

5 Climate-proofing sovereign debt

I conclude with policy implications. Governments need to plan for the risks from climate change to sovereign debt. Linking DSA with IAM can assess the resilience of public finance and estimate the available fiscal space to finance mitigation and adaptation policies. NGFS is coordinating efforts on climate risks and financial stability, and complementary efforts are warranted from those responsible for fiscal stability. I suggest three steps to better deal with the climate risks to public finance: coordination, climate risk analysis, and disclosure.

Coordination

Climate challenges are global (or regional) and tackling them requires coordination between multiple agents. This is reflected in the establishment of the NGFS and the multi-agency efforts by New Zealand and the UK. Institutions mandated with fiscal stability should coordinate efforts to carry out assessments of climate change risks to sovereign debt. A network for climate-proofing public finance will bring together these institutions. The International Monetary Fund, the G20, or European institutions could play coordinating roles.

A coordinated effort using the scenario matrix architecture as a template will deliver transparency and ensure acceptability of scenarios. Each sovereign (and investors) can adapt their own local models, but the regional impact of climate change on sovereigns is best approached through a common understanding. The usual DSA relies on centralized expert methodologies (e.g., by IMF, ECB, ESM) with country teams contributing local knowledge. When it comes to climate change, the macro projections are regional. Coordination is needed to combine local country knowledge with climate scenarios generated centrally.

Climate risk analysis in public finance

Fiscal authorities should mainstream climate risk analysis in public finance. Budgetary plans should include damages and the costs of mitigation and adaptation, including potential social costs. Some of these costs can be immediate and direct, derived from national plans such as those related to the European Green Deal. Others will be long term, in response to adaptation needs derived from forward-looking plans. Still, others can be contingent, such as damages from acute weather events.

Planning for contingent liabilities requires databases of past extreme events to complement IAM projections. Databases such as EM-DATA provide useful information, as has also been shown by the experience in Australia and Canada.

The potential scale of weather-related contingent liabilities creates a need for risk-sharing. Climate risks are still mostly insurable, but in the long run, tapping the markets through contingent instruments can provide solutions. Catastrophe bonds, convertible debt, or GDP-linked bonds can provide fiscal space during weather shocks (Demertzis and Zenios 2019).

Disclosure

The climate risks to public debt should be transparent. Transparency makes economies more resilient, and the Task Force on Climate-related Financial Disclosures recommends disclosures relating to identification, assessment, and management of climate risks. Fiscal authorities should follow these guidelines. As we monitor the alignment of national expenditures with the climate goals of the Paris Agreement, we also need to monitor the effects of climate change on public finance. The resilience of a country’s debt to climate change is important, whether the country is contributing a lot or a little to climate change.

It is not up to any single country to mitigate climate change. But it is up to each fiscal authority to ensure that the fiscal position of its sovereign is resilient. Central banks are taking a leading role on monitoring the climate risks to financial stability. Fiscal stability institutions should play a corresponding role. In this essay, I suggested how to evaluate sovereign debt resilience in the presence of climate risks.

Data availability

The datasets generated during the current study are summarized in graphs. The data of Figs. 1 and 3 are generated by publicly available cited links, ND-GAIN index data of Fig. 2 are generated by the publicly available cited link, and the bars of Fig. 2 are readable from the figure and are available from the author. The data of Fig. 5 are not publicly available as they are generated in graph form by proprietary software that needs a commercial optimizer to run, but can be obtained from the corresponding author on reasonable request.

Notes

International Institute of Finance, https://www.reuters.com/article/us-global-debt-iif-idUSKBN2AH285

Estimates of global investments for sustainable infrastructure over the next 15 years reach $90 trillion, https://www.un.org/pga/71/wp-content/uploads/sites/40/2017/02/New-Climate-Economy-Report-2016-Executive-Summary.pdf.

PESETA IV project https://ec.europa.eu/jrc/en/peseta-iv/economic-impacts

Data from https://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/Secondary-Markets/bond-market- size/ and Bloomberg.

Financial Times, https://www.ft.com/content/112e536a-91db-426a-aef6-3106f0717972.

See comments by ECB executive board member Isabelle Schnabel, https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220108~0425a24eb7.en.html

Using RICE50+ with the Kahn et al. (2021) impact function produces lower impact of climate on GDP growth; the upward shift of debt persists but is smaller.

References

Banque de France (2019) Benchmarks for the financial sector in the face of climate risk: facts and recommendations, in Financial Stability Review 23, Banque de France, Paris

Barnett M, Brock W, Peter Hansen L (2020) Pricing uncertainty induced by climate change. Rev Financ Stud 33:1025–1066

Barrage L (2020) Optimal dynamic carbon taxes in a climate–economy model with distortionary fiscal policy. Rev Econ Stud 87:1–39

Batten S (2018) Climate change and the macro economy –a critical review, Staff Working Paper no. 706, Bank of England

Battiston S, Monasterolo I (2020) A climate risks assessment of sovereign bonds, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3376218

Blanchard O (2022) Fiscal policy under low interest rates. The MIT Press, Cambridge, MA

Bosetti V (2021) Integrated assessment models for climate change, Oxford Research Encyclopedia of Economics and Finance, available at https://oxfordre.com/economics/view/10.1093/acrefore/9780190625979.001.0001/acrefore-9780190625979-e-572

Burke M, Hsiang MS, Miguel E (2015) Global non-linear effect of temperature on economic production. Nature 527:235–239

Bylund E, Johnsson M (2020) How does climate change affect the long-run real interest rate? Economic Commentaries 11, Sveriges Riksbank, Stockholm

Carney M (2015) Breaking the tragedy of the horizon –climate change and financial stability, speech given at Lloyd’s of London

Cevik S and Tovar Jalles J (2020) This changes everything: climate shocks and sovereign bonds, IMF Working Paper 79/2020, International Monetary Fund, Washington DC

Climatic Change (2014) Special issue: a framework for the development of new socio-economic scenarios for climate change research. Clim Chang 122(3)

Dafermos Y, Nikolaidi M, Galanis G (2018) Climate change, financial stability and monetary policy. Ecol Econ 152:219–234

Darvas Z, Wolff G (2021) A green fiscal pact: climate investment in times of budget consolidation, Policy Contribution 18/2021. Bruegel, Brussels

Dell M, Jones B, Olken B (2014) What do we learn from the weather? The new climate-economy literature. J Econ Lit 52:740–798

Demertzis M, Zenios SA (2019) State contingent debt as insurance for euro area sovereigns. J Financ Regul 5(1):64–90

Dibley A, Wetzer T, Hepburn C (2021) National COVID debts: climate change imperils countries’ ability to repay. Nature 592:184–187

ECB/ESRB (2021) Climate-related risk and financial stability. European Central Bank, Frankfurt

Emmerling J, Drouet L, Aleluia Reis L, Bevione M, Berger L, Bosetti V … Havlik P (2016) The WITCH 2016 model - Documentation and implementation of the shared socioeconomic pathways, Working Papers 2016.42, Fondazione Eni Enrico Mattei, Milano

European Commission (2019) Debt sustainability monitor, Institutional Paper 120. Directorate-General for Economic and Financial Affairs, Brussels

Gala V, Pagliardi G and Zenios SA (2020) Global political risk and international stock returns, available at https://ssrn.com/abstract=3242300

Gazzotti P, Emmerling J, Marangoni G, Castelletti A, van der Wijst K, Hof A, Tavoni M (2021) Persistent inequality in economically optimal climate policies. Nat Commun 12:3421

IMF (2019) How to mitigate climate change. Fiscal Monitor, International Monetary Fund, Washington DC

IMF (2020) A long and difficult ascent. World Economic Outlook, International Monetary Fund, Washington DC

Kahn ME, Mohaddes K, Ng RNC, Pesaran MH, Raissi M, Yang J-C (2021) Long-term macroeconomic effects of climate change: a cross-country analysis. Energy Econ 104:1–13

Kalkuhl M, Wenz LL (2020) The impact of climate conditions on economic production. Evidence from a global panel of regions. J Environ Econ Manag 103

Kellner M and Runkel M (2021) Climate policy and optimal public debt, available at https://ssrn.com/abstract=3774673

Kelly B, Pastor L, Veronesi P (2016) The price of political uncertainty: theory and evidence from the option market. J Financ 71:2418–2480

Klusak P, Agarwal M, Burke M, Kraemer M and Mohaddes K (2021) Rising temperatures, falling ratings: the effect of climate change on sovereign creditworthiness, Bennet Institute Working Paper, University of Cambridge

Lamperti F, Bosetti V, Roventini A, Tavoni M (2019) The public costs of climate-induced financial instability. Nat Clim Chang 9:829–833

Lempert RJ, Groves DG, Popper SW, Bankes SC (2006) A general, analytic method for generating robust strategies and narrative scenarios. Manag Sci 52:514–528

Moody’s (2019) How Moody’s rates sovereigns and supranational entities, available at https://www.moodys.com/Pages/HowMoodysRatesSovereigns.aspx

NGFS (2019) Macroeconomic and financial stability –implications of climate change. Network for Greening the Financial System, Banque de France, Paris

Nordhaus, W. (2018) Climate change: the ultimate challenge for economics, The Nobel Prize Lecture.

Obama B (2017) The irreversible momentum of clean energy. Science 355:126–129

Pindyck R (2017) The use and misuse of models for climate policy. Rev Environ Econ Policy 11:100–114

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationshiP. J Econ Perspect 9:97–118

Rogelj J, Popp AA, Calvin KV, Luderer G, Emmerling J, Gernaat D et al (2018) Scenarios towards limiting global mean temperature increase below 1.5 °C. Nat Clim Chang 8:325–333

S&P (2017) Sovereign rating methodology. Ratings, Standard and Poors Global

Tol RSJ (2014) Correction and update: the economic effects of climate change. J Econ Perspect 28:221–226

Volz U, Beirne J, Ambrosio Preudhomme N, Fenton A, Mazzacurati E, Renzhi N and Stampa J (2020) Climate change and sovereign risk, SOAS University of London, available at https://eprints.soas.ac.uk/33524/

Weitzman ML (2011) Fat-tailed uncertainty in the economics of catastrophic climate change. Rev Environ Econ Policy 5:275–292

Weyant J (2017) Some contributions of integrated assessment models for global climate change. Rev Environ Econ Policy 11:115–137

Zenios SA, Consiglio A, Athanasopoulou M, Moshammer E, Gavilan A, Erce A (2021) Risk management for sustainable sovereign debt financing. Oper Res 69:755–773

Acknowledgements

Insightful comments from two anonymous referees led to significant improvements. Thanks for comments on an earlier draft are due to Roel Beetsma, Zsolt Darvas, Maria Demertzis, Demetris Georghiades, Barret Kupelian, Alexander Lehman, André Sapir, Lucrezia Reichlin, Rolf Strauch, Simone Tagliapietra, Guntram Wolff, Georg Zachman, Theodoros Zachariades and participants at the European Stability Mechanism Workshop on Debt Sustainability Analysis and the European Fiscal Board Fourth Annual Meeting on Public Finances and Climate Change. Andrea Consiglio and Vicenzo Martorana carried out the debt sustainability analysis tests and Johannes Emmerling generously provided access to WITCH and RICE50+. Research assistance by Klaas Lenaerts and Elena Papadiofantous is gratefully acknowledged.

Funding

The author has received research support from University of Cyprus, the Cyprus Academy of Sciences, Letters, and Arts, and Bruegel.

Author information

Authors and Affiliations

Contributions

The work was carried out by the author, with the support provided in the acknowledgements.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Zenios, S.A. The risks from climate change to sovereign debt. Climatic Change 172, 30 (2022). https://doi.org/10.1007/s10584-022-03373-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10584-022-03373-4