Abstract

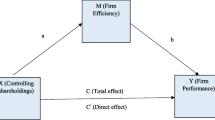

This paper investigates the effect of the largest controlling shareholders on firm productive efficiency. Using a sample of French listed firms, we employ parametric (linear regression), semi-parametric (Olley and Pakes) and non-parametric (Data Envelopment Analysis) approaches to estimate productive efficiency. We find a negative association between the excess control rights of dominant owners and firm productive efficiency, indicating that their private benefits of control prevent them from favoring productive projects. Our findings withstood several sensitivity and endogeneity tests. Additional analysis shows that multiple large shareholders, beyond the controlling owner, play a governance role that neutralizes the effect of excess control on productive efficiency.

Similar content being viewed by others

Notes

Throughout this article, we will use the terms “largest controlling shareholder” and “controlling owner” interchangeably.

Bebchuck et al. (2000, p 1) define a controlling minority structure as “an ownership structure in which a shareholder exercises control while retaining only a small fraction of the equity claims on a company’s cash flows”.

For instance, Palia and Lichtenberg (1999) find that the stock market rewards firms with higher productivity levels by increasing their values.

An interesting example of tunneling activities can be identified in reference to the Belgian company Barro (see, Johnson et al. (2000) for more details on this case of tunneling). As one of their accusations, Barro’s shareholders argued that Flambo (Barro’s controlling owner) had used Barro’s utilities without paying for them.

In this study, we focus on productive efficiency, which reflects how a firm employs inputs to produce output. To assess productive efficiency, we must adopt a measure of output per unit of total input. Therefore, we use Total Factor Productivity, which is a commonly used measure of producer efficiency. Palia and Lichtenberg (1999, p 327) point out: A good index of efficiency must account for, and give proper weight to, the services of all of the inputs employed by the firm. TFP is such an index; it is defined as output per unit of total input […].

The opreg code has been used by other researchers such as Hasan et al. (2016).

The economic significance is computed as the standard deviation of Excess Control, multiplied by its coefficient in Column (1) of Table 3, all divided by the average TFPOP, that is, 0.185 × (− 0.250)/0.479 = −0.096.

Despite the advantages of DEA, we would be remiss not to underscore some of its limitations (see, for example, Taylor and Harris 2004 and Vidal-García et al. 2018). For example, the method is sensitive to outliers and to errors in inputs and outputs. Moreover, DEA-efficient observations have the same score and do not show any differences between them. Another limitation relates to the absence of a theoretical maximum to which each observation is compared.

The results remain qualitatively the same when we consider two outputs, namely, total sales and sales growth.

To obtain fixed effects panel estimation, we use Stata’s command xtreg, with the fe option.

Please note that widely held firms are not included in any of the subsamples described in this section.

The results of this additional analysis remain qualitatively the same when TFPOLS or TFP obtained using DEA are used (unreported).

The results remain robust after dividing the sample into two groups based on the median VRRATIO (not reported).

References

Angulo-Meza, L., & Lins, M. P. E. (2002). Review of methods for increasing discrimination in Data Envelopment Analysis. Annals of Operations Research, 1, 225–242.

Attig, N., El Ghoul, S., & Guedhami, O. (2009). Do multiple large shareholders play a corporate governance role? Evidence from East Asia. Journal of Financial Research, 32, 395–422.

Attig, N., Guedhami, O., & Mishra, D. (2008). Multiple large shareholders, control contests, and implied cost of equity. Journal of Corporate Finance, 14, 721–737.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in Data Envelopment Analysis. Management Science, 30, 1078–1092.

Barbera, F., & Moores, K. (2013). Firm ownership and productivity: A study of family and non-family SMEs. Small Business Economics, 40, 953–976.

Barroso Casado, R., Burkert, M., Dávila, A., & Oyon, D. (2016). Shareholder protection: The role of multiple Large shareholders. Corporate Governance: An International Review, 24, 105–129.

Barth, E., Gulbrandsen, T., & Schønea, P. (2005). Family ownership and productivity: The role of owner-management. Journal of Corporate Finance, 11, 107–127.

Basso, A., & Funari, S. (2001). A Data Envelopment Analysis approach to measure the mutual fund performance. European Journal of Operational Research, 135, 477–492.

Bebchuk, L., Kraakman, R., & Triantis, G. (2000). Stock pyramids, cross ownership, dual-class equity: The creation and agency costs of separating control from cash flow rights. In R. K. Morck (Ed.), Concentrated corporate ownership (pp. 295–318). Chicago: University of Chicago Press.

Benlemlih, M., & Bitar, M. (2018). Corporate social responsibility and investment efficiency. Journal of Business Ethics, 148, 647–671.

Ben-Nasr, H., Boubaker, S., & Rouatbi, W. (2015). Ownership structure, control contestability, and corporate debt maturity. Journal of Corporate Finance, 35, 265–285.

Bennedsen, M., & Wolfenzon, D. (2000). The balance of power in closely held corporations. Journal of Financial Economics, 58, 113–139.

Boateng, A., & Huang, W. (2017). Multiple large shareholders, excess leverage and tunneling: Evidence from an emerging market. Corporate Governance: An International Review, 25, 58–74.

Boubaker, S. (2007). Ownership-control discrepancy and firm value: Evidence from France. Multinational Finance Journal, 11, 211–252.

Boubaker, S., Cellier, A., & Rouatbi, W. (2014). The sources of shareholder wealth gains from going private transactions: The role of controlling shareholders. Journal of Banking and Finance, 43, 226–246.

Boubaker, S., Nguyen, P., & Rouatbi, W. (2016). Multiple large shareholders and corporate risk-taking: Evidence from French Family Firms. European Financial Management, 22, 697–745.

Boubaker, S., Rouatbi, W., & Saffar, W. (2017). The role of multiple large shareholders in the choice of debt source. Financial Management, 46, 241–274.

Cai, C. X., Hillier, D., & Wang, J. (2016). The cost of multiple large shareholders. Financial Management, 45, 401–430.

Castelli, L., Pesenti, R., & Ukovich, W. (2010). A classification of DEA models when the internal structure of the decision making unit is considered. Annals of Operations Research, 1, 207–235.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2, 429–444.

Claessens, S., Djankov, S., Fan, J. P., & Lang, L. H. (2002). Disentangling the incentive and entrenchment effects of large shareholdings. The Journal of Finance, 57, 2741–2771.

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58, 81–112.

Cronqvist, H., & Nilsson, M. (2003). Agency costs of controlling minority shareholders. Journal of Financial and Quantitative Analysis, 38, 695–719.

Cummins, J. D., Weiss, M. A., Xie, X., & Zi, H. (2010). Economies of scope in financial services: A DEA efficiency analysis of the US insurance industry. Journal of Banking and Finance, 34, 1525–1539.

Darrough, M., Kim, H., & Zur, E. (2018). The impact of corporate welfare policy on firm-level productivity: Evidence from unemployment insurance. Journal of Business Ethics. https://doi.org/10.1007/s10551-018-3817-2.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2008). The law and economics of self-dealing. Journal of Financial Economics, 88, 430–465.

Drake, L., Hall, M. J., & Simper, R. (2006). The impact of macroeconomic and regulatory factors on bank efficiency: A non-parametric analysis of Hong Kong’s banking system. Journal of Banking and Finance, 30, 1443–1466.

Durand, R., & Vargas, V. (2003). Ownership, organization, and private firms’ efficient use of resources. Strategic Management Journal, 24, 667–675.

Dyck, A., & Zingales, L. (2004). Private benefits of control: An international comparison. The Journal of Finance, 59, 537–600.

Edmans, A., & Manso, G. (2011). Governance through trading and intervention: A theory of multiple blockholders. The Review of Financial Studies, 24, 2395–2428.

El Ghoul, S., Guedhami, O., & Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48, 360–385.

Faccio, M. (2010). Differences between politically connected and nonconnected firms: A cross-country analysis. Financial Management, 39, 905–928.

Faccio, M., & Lang, L. H. (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics, 65, 365–395.

Faccio, M., Lang, L. H., & Young, L. (2001). Dividends and expropriation. American Economic Review, 91(1), 54–78.

Faccio, M., Marchica, M. T., & Mura, R. (2011). Large shareholder diversification and corporate risk-taking. The Review of Financial Studies, 24, 3601–3641.

Fang, Y., Hu, M., & Yang, Q. (2018). Do executives benefit from shareholder disputes? Evidence from multiple large shareholders in Chinese listed firms. Journal of Corporate Finance, 51, 275–315.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, Series A, 120, 253–290.

Field, L. C., & Mkrtchyan, A. (2017). The effect of director experience on acquisition performance. Journal of Financial Economics, 123, 488–511.

Frésard, L., & Salva, C. (2010). The value of excess cash and corporate governance: Evidence from US cross-listings. Journal of Financial Economics, 98, 359–384.

Gaitán, S., Herrera-Echeverri, H., & Pablo, E. (2018). How corporate governance affects productivity in civil–law business environments: Evidence from Latin America. Global Finance Journal, 37, 173–185.

Gompers, P. A., Ishii, J., & Metrick, A. (2010). Extreme governance: An analysis of dual-class firms in the United States. The Review of Financial Studies, 23, 1051–1088.

Griliches, Z., & Mairesse, J. (1995). Production functions: The search for identification. In National Bureau of Economic Research working paper (No. w5067).

Guedhami, O., & Mishra, D. (2009). Excess control, corporate governance and implied cost of equity: International evidence. Financial Review, 44, 489–524.

Gujarati, D. (2004). Basic econometrics (forth ed.). Montréal: McGraw-Hill Publishers.

Hasan, I., Kobeissi, N., Liu, L., & Wang, H. (2016). Corporate social responsibility and firm financial performance: The mediating role of productivity. Journal of Business Ethics, 149, 671–688.

Havrylchyk, O. (2006). Efficiency of the Polish banking industry: Foreign versus domestic banks. Journal of Banking and Finance, 30, 1975–1996.

Hill, C. W., & Snell, S. A. (1989). Effects of ownership structure and control on corporate productivity. Academy of Management Journal, 32, 25–46.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305–360.

Jiang, F., Cai, W., Wang, X., & Zhu, B. (2018). Multiple large shareholders and corporate investment: Evidence from China. Journal of Corporate Finance, 50, 66–83.

Jiang, F., Kim, K. A., Ma, Y., Nofsinger, J. R., & Shi, B. (2017). Corporate culture and investment-cash flow sensitivity. Journal of Business Ethics, 154, 1–15.

John, K., Litov, L., & Yeung, B. (2008). Corporate governance and risk-taking. The Journal of Finance, 63, 1679–1728.

Johnson, S., LaPorta, R., López-de-Silanes, F., & Shleifer, A. (2000). Tunneling. American Economic Review, 90, 22–27.

Keller, W., & Yeaple, S. R. (2009). Multinational enterprises, international trade, and productivity growth: firm-level evidence from the United States. The Review of Economics and Statistics, 91, 821–831.

Köke, J., & Renneboog, L. (2005). Do corporate control and product market competition lead to stronger productivity growth? Evidence from market-oriented and blockholder-based governance regimes. The Journal of Law and Economics, 48, 475–516.

Krishnan, K., Nandy, D. K., & Puri, M. (2014). Does financing spur small business productivity? Evidence from a natural experiment. The Review of Financial Studies, 28, 1768–1809.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54, 471–517.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2002). Investor protection and corporate valuation. The Journal of Finance, 57, 1147–1170.

Laeven, L., & Levine, R. (2008). Complex ownership structures and corporate valuations. The Review of Financial Studies, 21, 579–604.

Lin, C., Ma, Y., Malatesta, P., & Xuan, Y. (2011). Ownership structure and the cost of corporate borrowing. Journal of Financial Economics, 100, 1–23.

Lin, C., Ma, Y., Malatesta, P., & Xuan, Y. (2013). Corporate ownership structure and the choice between bank debt and public debt. Journal of Financial Economics, 109, 517–534.

Liu, Q., Luo, T., & Tian, G. G. (2015). Family control and corporate cash holdings: Evidence from China. Journal of corporate finance, 31, 220–245.

López-Iturriaga, F. J., & Santana-Martín, D. J. (2015). Do shareholder coalitions modify the dominant owner’s control? The impact on dividend policy. Corporate Governance: An International Review, 23, 519–533.

Margaritis, D., & Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking and Finance, 34, 621–632.

Martikainen, M., Nikkinen, J., & Vähämaa, S. (2009). Production functions and productivity of family firms: Evidence from the S&P 500. The Quarterly Review of Economics and Finance, 49, 295–307.

Maury, B., & Pajuste, A. (2005). Multiple large shareholders and firm value. Journal of Banking and Finance, 29, 1813–1834.

Mishra, D. R. (2011). Multiple large shareholders and corporate risk taking: Evidence from East Asia. Corporate Governance: An International Review, 19, 507–528.

Morey, M. R., & Morey, R. C. (1999). Mutual fund performance appraisals: A multi-horizon perspective with endogenous benchmarking. Omega, 27, 241–258.

Murthi, B. P. S., Choi, Y. K., & Desai, P. (1997). Efficiency of mutual funds and portfolio performance measurement: A non-parametric approach. European Journal of Operational Research, 98, 408–418.

Neter, J., Wasserman, W., & Kunter, M. H. (1989). Applied linear regression models (2nd ed.). Homewood, IL: Irwin.

Nickell, S. J. (1996). Competition and corporate performance. Journal of Political Economy, 104, 724–746.

Olley, S., & Pakes, A. (1996). The dynamics of productivity in the telecommunication equipment industry. Econometrica, 64, 1263–1297.

Ortega-Argiles, R., Moreno, R., & Caralt, J. S. (2005). Ownership structure and innovation: Is there a real link? The Annals of Regional Science, 39, 637–662.

Pagano, M., & Röell, A. (1998). The choice of stock ownership structure: Agency costs, monitoring, and the decision to go public. The Quarterly Journal of Economics, 113, 187–225.

Palia, D., & Lichtenberg, F. (1999). Managerial ownership and firm performance: A re-examination using productivity measurement. Journal of Corporate Finance, 5, 323–339.

Paligorova, T. (2010). Corporate risk taking and ownership structure. In Bank of Canada Working Paper 2010, No. 3.

Pindado, J., Requejo, I., & De La Torre, C. (2011). Family control and investment-cash flow sensitivity: Empirical evidence from the Euro zone. Journal of Corporate Finance, 17, 1389–1409.

Psillaki, M., Tsolas, I. E., & Margaritis, D. (2010). Evaluation of credit risk based on firm performance. European Journal of Operational Research, 201, 873–881.

Ryan, T. P. (1997). Modern regression methods. New York: Wiley.

Sathye, M. (2001). X-efficiency in Australian banking: An empirical investigation. Journal of Banking and Finance, 25, 613–630.

Seiford, L. L., & Thrall, R. M. (1990). Recent developments in DEA: The mathematical programming approach to frontier analysis. Journal of Econometrics, 46, 7–38.

Sherman, H. D., & Gold, F. (1985). Bank branch operating efficiency: Evaluation with Data Envelopment Analysis. Journal of Banking and Finance, 9, 297–315.

Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94, 461–488.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52, 737–783.

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65, 557–586.

Taylor, B., & Harris, G. (2004). Relative efficiency among South African universities: A Data Envelopment Analysis. Higher Education, 47, 73–89.

Tian, G. Y., & Twite, G. (2011). Corporate governance, external market discipline and firm productivity. Journal of Corporate Finance, 17, 403–417.

Van Beveren, I. (2012). Total factor productivity estimation: A practical review. Journal of Economic Surveys, 26, 98–128.

Van Biesebroeck, J. (2007). Robustness of productivity estimates. The Journal of Industrial Economics, 55, 529–569.

Vidal-García, J., Vidal, M., Boubaker, S., & Hassan, M. (2018). The efficiency of mutual funds. Annals of Operations Research, 267, 555–584.

Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80, 385–417.

Yasar, M., Raciborski, R., & Poi, B. (2008). Production function estimation in Stata using the Olley And Pakes method. The Stata Journal, 8, 221–231.

Zhang, G. (1998). Ownership concentration, risk aversion and the effect of financial structure on investment decisions. European Economic Review, 42, 1751–1778.

Zwiebel, J. (1995). Block investment and partial benefits of corporate control. The Review of Economic Studies, 62, 161–185.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Boubaker, S., Manita, R. & Rouatbi, W. Large shareholders, control contestability and firm productive efficiency. Ann Oper Res 296, 591–614 (2021). https://doi.org/10.1007/s10479-019-03402-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03402-z