Abstract

The frequent occurrence of crises in recent decades has triggered a debate between the proponents of Efficient market hypothesis and Fractal market hypothesis. While, the proponents of Efficient market hypothesis view crises as non-existent and highly improbable, the advocates of Fractal market hypothesis view crises as the dominance of certain investment horizons. We test whether the assertion of Fractal Market hypothesis regarding the dominance of certain frequencies during financial crises hold for the global stock markets. Following Kristoufek (Sci Rep 3:2857, 2013) the wavelet power spectra based on continuous wavelet framework are used to test the said hypothesis. It is shown that stock markets around the globe indicate the dominance of higher frequencies during the crises periods, hence, validate the assertions of Fractal market hypothesis. The results drawn are robust to the use of different countries as well as different crises.

Similar content being viewed by others

Notes

Frequency and time are inversely related. Therefore higher frequency is synonymous with the lower time scale.

Our choice of including more stock markets for this study was limited by the inclusion of 1987 stock market crisis and 1997 Asian currency crisis in the sample.

The number of countries was restricted to fourteen due to the availability of data. The exact date of samples is shown in Table 3 of appendix along with the ticker symbols of respective stock markets.

A time-series x(t), with wavelet coefficients for scale j, \( {\tilde{w}}_{j,t} \) and scaling coefficients Ṽ j,t , from a MODWT gives the energy decomposition as: \( {\displaystyle \sum_{t=1}^N{x}^2(t)={\displaystyle \sum_{j=1}^J{\displaystyle \sum_{t=1}^N{\tilde{w}}_{j,t}^2+{\displaystyle \sum_{t=1}^N{\tilde{V}}_{j,t}^2}}}} \). Here N refers to the total number of observations used in the calculation. In order to calculate the unbiased estimator of the energy only those coefficients unaffected by boundary are used. Hence N depends upon the number of scales used and basis and may not necessarily equal to T.

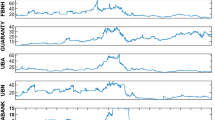

Here black line in bold indicates the significant wavelet power against red noise null. The observations at two ends of the time series are affected due to edge effects. Therefore, cone of influence is introduced to divide the wavelet power spectrum into two – a top part (above the curved line) where the results drawn are reliable and the area below the curved line (with fade colour) where the results are distorted hence should be interpreted with caution. The colours indicate the power or scale specific variance with deep red colour indicating highest variance and deep blue indicating lowest variance. Y-axis gives the scale and X-axis indicates time. Given the weekly data frequency, the scales shown on Y-axis are weekly.

Frequency and time are inversely related. A high frequency component (low) of time series is synonymous with the lower time scale (high).

Our results are also robust to the use of daily data. For the sake of brevity we have not shown the result, nevertheless can be produced on request.

References

Cella C, Ellul A, Mariassunta G (2013) Investors’ horizons and the amplification of market shocks. Financial markets group. Discussion Paper 717

Grinsted A, Moore J, Jevrejeva V (2004) Application of the corss wavelet transform and wavelet cohorence to geophysical time series. Nonlinear Process Geophys 11(1):561–566

Kristoufek L (2012) Fractal markets hypothesis and the global financial crisis: scaling, investment horizons and liquidity. Adv Compl Syst 15:1250065. doi:10.1142/S0219525912500658

Kristoufek L (2013) Fractal markets hypothesis and the global financial crisis: wavelet power evidence. Sci Rep 3:2857. doi:10.1038/srep02857

Peters E (1994) Fractal market analysis – applying chaos theory to investment and analysis. Wiley, New York

Rachev Z, Weron A, Weron R (1999) CED model for asset returns and fractal market hypothesis. Math Comput Model 29(1):23–36

Weron A, Weron R (2000) Fractal market hypothesis and two power-laws. Chaos Solitons Fractals 11(1):289–296

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dar, A.B., Bhanja, N. & Tiwari, A.K. Do global financial crises validate assertions of fractal market hypothesis?. Int Econ Econ Policy 14, 153–165 (2017). https://doi.org/10.1007/s10368-015-0332-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-015-0332-0