Abstract

As tariffs have fallen, it is apparent that trade costs are a significant obstacle to international trade and that they vary from country to country. The gap between the cif and fob value of a trade flow is a useful measure of aggregate trade costs, but only if the measure is based on a consistent volume of trade; mirror statistics are unsuitable. Using high quality Australian import data disaggregated at the HS 6-digit level, we find large country-by-country variations in trade costs. Distance, weight and size account for part of the variation in trade costs. Indicators of institutional quality pick up some of the variation in trade costs, but the relationship is not uniform across mode of transport and commodities; exporting countries’ institutional quality is more strongly related to trade costs for air freight than sea freight, and the relationship is commodity-specific and strongest for manufactured goods. Country-specific characteristics influencing trade costs provide a link between institutions and economic development.

Similar content being viewed by others

Notes

Despite large reductions in tariffs and other barriers to trade since 1947, levels of international trade are less than would be expected from relative factor endowments (Trefler 1995). Even across frontiers as open as that between the USA and Canada, trade between a state and a province is less than between two US states or two Canadian provinces ceteris paribus.

Measurement is important for policy as well as for testing theories. Trade facilitation is included in the Doha Development Round of multilateral trade negotiations, and has featured increasingly prominently in regional trade agreements (Pomfret and Sourdin 2009). In 2001 Asia–Pacific Economic Cooperation (APEC) members adopted a goal of reducing trade costs by five percent over 5 years, and the commitment was repeated in 2006, although without an agreed measure of trade costs it is difficult to monitor progress towards such a goal.

Hummels (2007), reviewing the literature on trade costs, emphasises the difficulty of measuring costs of land transport (the mode used by over a fifth of international trade) and how they interact with costs of sea and air transport, which may be substitutes to varying degrees. For Australia the only substitution option is between sea and air transport.

Although bulk accounts for some commodity characteristics, we are unable to take account of other characteristics such as perishability or fashion which influence the choice of air or sea transport.

The time advantage of air is more pronounced over longer distances. To the extent that transport costs are related to weight rather than value, they are closer to a specific than an ad valorem charge, and hence trade costs are declining with respect to unit value; if the charge is by ton-kilometer, then for a given value the preference for air is likely to be increasing with distance. Hummels and Schaur (2009) argue that, when demand is volatile, air may be preferred because it permits a faster response to price changes.

A sector’s institutional dependence is measured by complexity, proxied by the Herfindahl index of intermediate input use.

With more than 5,000 HS 6-digit categories and over 200 trade partners, there are over a million potential trade flows, but the data set has just over 100,000 observations per year. Potential biases from the truncated sample could be addressed by a two-step sample selection model, but there is unlikely to be a consistent explanation of empty cells, e.g. some reflect high trade costs precluding goods without a pronounced comparative advantage whereas others are an artefact of size (one tiny Pacific island has four observations and over 5,000 empty cells).

There is a slight increase between 1999 and 2000 and a more substantial increase between 2003 and 2004, both of which may be related to oil price increases, but in every other year the average trade cost is constant or falling from the previous year. The decline in trade costs may be understated due to a composition effect; if air costs fell faster than sea costs, the lightest or most time-sensitive goods formerly shipped by sea may now be airfreighted, increasing average transport costs by both modes while providing more cost-effective transport for all.

Average tariff rates as reported on the WTO website www.wto.org. The Australian tariff profile on the same website reports a weighted average applied tariff in 2005 of 6.5 and 5.3% in 2008.

Between 1965 and 2004 the share of air in the total value of US imports increased from 8 to 32% and in US exports from 12 to 53%. Worldwide average revenue per ton-kilometre air-freighted (in constant 2000 US dollars) fell from $3.87 in 1955 to under $0.30 in 2004; the biggest decline was in 1955–1972 before rising oil prices led to a flattening of the decline during the 1970s, but since the late 1980s air transport costs by this measure more than halved (Hummels 2007).

The 51 exclude the island economies of Mauritius, Reunion and Seychelles. Four African countries sent no exports to Australia in 2007. Excluding the two extreme observations of zero for Libya and 51% for Morocco the African average was just over 6.5%, which is still about a third bigger than the average for the rest of the world.

Distances are taken from the Centre d'Etudes Prospectives et d'Informations Internationales database, available at www.cepii.fr/anglaisgraph/bdd/distances.htm. The correlations are similar irrespective of which of the four distance measures are used.

Berthelon and Freund (2008) conclude from their disaggregated gravity model analysis that the importance of distance over time is related to the substitutability of goods, i.e. distance is more relevant to the cost of trading differentiated manufactured goods than to trade in homogeneous primary products.

The quantity data include measures by number, square meters and many commodity-specific units. For 556,468 observations they were in metric tons, kilograms, grams or metric carats.

Wilmsmeier et al. (2006) find that unbalanced trade (measured by the ratio of imports to exports in a country’s bilateral trade) is a significant determinant of freight costs in Latin America and they argue that their estimated coefficients are too low because the imbalances “need to be applied to broader trade routes” such as South America’s Pacific coast and North America. This is less relevant to Australia, where the only major non-Australian port for an empty ship to pick up cargo in the Southwest Pacific is Auckland. However, a potential complication from using Australia as the yardstick for measuring countries’ trade costs is the importance of bulk commodities in Australian exports. Although the trade costs of Australian exports are not the subject of this paper, there may be an indirect non-random impact on Australian import costs from the empty space in returning bulk carriers.

Hummels et al. (2009) show that one-sixth of importer/exporter pairs are served by a single liner service, and over half are served by three or less. They also present evidence of shipping companies charging higher rates on goods with inelastic demand, which is consistent with the exercise of market power. In contrast, the measures of market power in Clark et al. (2004) are not statistically significant. Geloso-Grosso (2008) and Piermartini and Rousova (2008) using a gravity model both find a robust positive relationship between liberalization and the volume of air traffic.

Their infrastructure index is based on kilometers of road, paved road and railway per square kilometer and telephone main lines per capita.

Their principal measure of port efficiency is survey data drawn from the Global Competitiveness Report published by the World Economic Forum. Wilson et al. (2003) and Wilmsmeier et al. (2006) use the same source, and Sanchez et al. (2003) use Latin American survey data. Bloningen and Wilson (2008) show that survey data overstate the importance of port efficiency because respondents include other country fixed effects. A problem with using the Global Competitiveness Report data or the Bloningen and Wilson econometric estimates of port costs is that the former only cover about fifty countries and the latter cover 100 ports in 42 countries.

The World Bank logistics perceptions index provides proxy measures for cross-country variations in logistic quality (http://info.worldbank.org/etools/tradesurvey/mode1a.asp).

Freund and Weinhold (2004) found that internet use had no impact on world trade in 1995 but after 1997 it had an increasing impact. Andrés et al. (2007), using data from the International Telecommunications Union database on the number of internet users, document for 199 countries the wide variations in internet diffusion and how this is influenced by policy decisions such as the degree of competition among providers. Unfortunately data on the quality of internet access, intensiveness of use or geographic concentration are not available for a large enough number of countries to use in cross-country analyses.

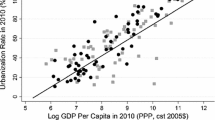

The Transparency International Corruption Perceptions Index is on a scale from 0 to 10, with a higher number indicating less corruption; 163 countries were covered in 2006 and 180 in 2007. The GDP data are the current dollars series from the Penn World Tables. Distance (the great circle distance between the largest city in each country and Sydney) and the landlocked dummy are from the CEPII database referred to in the previous section.

A dummy for landlocked countries had a negative sign and was statistically significant, which is difficult to explain as the literature strongly indicates that landlockedness is associated with higher trade costs (Arvis et al. 2007).

The coefficients are significant at the one percent level for both sea and air, with larger coefficients and bigger t-statistics for sea.

The range was determined by availability of all variables, notably the Transparency International Corruption Perceptions Index. Results with the borders (landlocked) dummy variable are not reported because the coefficient was not positive and significantly different from zero. The regressions underlying these and the results reported in the following paragraph are available from the authors on request.

The OECD dummy should capture differences in average ad valorem trade costs between OECD and non-OECD countries, but perhaps due to collinearity including both the OECD dummy and the interaction term renders both coefficients not statistically significant at any standard level of significance. The interaction term included in Tables 2 and 3 captures the differential impact of the TI index between developed and less-developed economies, and we therefore felt it better to report only the results with the interaction term. The coefficient on TI and other variables of interest are not materially different whether the OECD dummy variable is included or omitted.

The results are available from the authors on request. Only HS 44 (wood and wood products), 63 (miscellaneous textiles) and 71 (pearls and precious stones) had coefficients significantly different from zero at the 1% level; the first two are heterogeneous and the third is not a major sea-freighted category. Case studies suggest that at some sea ports corruption is a major problem, e.g. in Durban and Maputo corrupt payments account for up to 600% of customs agents’ official income and queue jumping and avoidance of storage costs are important motives for illicit payments (Sequiera and Djankov, 2008). This suggests that corruption is most burdensome for traders to whom time matters. Such behaviour may lead to a tragedy of the anti-commons where over-competition for rents leads to less trade, and Australian imports from ports in which corruption is rife may be too small to influence our econometric results.

Leinbach and Bowen (2004), reporting on a survey of 126 electronics producers in Malaysia, the Philippines and Singapore, find that “Much of the variation in air cargo services usage is related to product characteristics that go beyond simply the value-to-weight ratio” (p. 316) and one of their “most significant findings… is the extent to which air cargo usage is associated with the degree to which a firm has internationalized, not only its production sites and final markets, but also its material procurement sites” (p. 317). They did not address national variations in institutions, but their case studies highlight the importance not only of flight times but also of associated services (electronic tracking, specialized plane-to-market logistical support, and so forth), which are unlikely to be compatible with inefficient institutions or widespread corruption.

Categories with few observations (n < 50) were omitted. There may be a selection bias due to the weight variable (i.e. goods whose quantity is measured by number, area, volume and so forth are excluded).

Hillberry and Hummels (2008), using US domestic trade data, find that distance and other frictions reduce trade primarily by reducing the number of commodities shipped and the number of establishments shipping. Our results point to high trade costs also discouraging shipment of some products, but the relationship is limited to a subset of commodities which a country is less likely to export if it has poor institutions (or more precisely if perceived corruption is high).

References

Amiti, M., & Konings, J. (2007). Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Anderson, J., & Marcouiller, D. (2002). Insecurity and the pattern of trade: An empirical investigation. Review of Economics and Statistics, 84(2), 342–352.

Anderson, J., & van Wincoop, E. (2003). Gravity with gravitas: A solution to the border puzzle. American Economic Review, 93(1), 170–192.

Anderson, J., & van Wincoop, E. (2004). Trade costs. Journal of Economic Literature, 42(3), 691–751.

Andrés, L., Cuberes, D., Astou Diouf, M., & Serebrisky, T. (2007). Diffusion of the internet: A cross-country analysis (World Bank Policy Research Working Paper WPS4420).

Arvis, J-F., Raballand G., & Marteau, J-F. (2007). The cost of being landlocked: Logistics costs and supply chain reliability (World Bank Policy Research Working Paper WPS4258).

Berthelon, M., & Freund, C. (2008). On the conservation of distance in international trade. Journal of International Economics, 75(2), 310–320.

Blonigen, B., & Wilson, W. (2008). Port efficiency and trade flows. Review of International Economics, 16(1), 21–36.

Centre d’Etudes Prospectives et d’Informations Internationales database (2010). Available at www.cepii.fr/anglaisgraph/bdd/distances.htm.

Clark, X., Dollar, D., & Micco, A. (2004). Port efficiency, maritime transport costs, and bilateral trade. Journal of Development Economics, 75(2), 417–450.

Devlin, J., & Yee, P. (2005). Trade logistics in developing countries: The case of the Middle East and North Africa. The World Economy, 28(3), 435–456.

Egger, P. (2008). On the role of distance for bilateral trade. The World Economy, 31(5), 653–662.

Evans, C., & Harrigan, J. (2005). Distance, time and specialization: Lean retailing in general equilibrium. American Economic Review, 95(1), 292–313.

Freund, C., & Weinhold, D. (2004). On the effect of the internet on international trade. Journal of International Economics, 62(1), 171–189.

Geloso-Grosso, M. (2008). Liberalizing air cargo services in APEC”, GEM (Groupe d’Economie Mondiale) (Working Paper available at http://gem.sciences-po.fr/content/publications/pdf/GelosoGrosso_Air%20cargo_122008.pdf. Accessed 2 December 2009).

Harrigan, J., & Deng H. (2008). China’s local comparative advantage (National Bureau of Economic Research Working Paper 13,963).

Hillberry, R., & Hummels, D. (2008). Trade responses to geographic frictions: A decomposition using micro-data. European Economic Review, 52(3), 527–550.

Hummels, D. (2001). Time as a trade barrier, http://www.mgmt.purdue.edu/faculty/hummelsd/research/time3b.pdf. Accessed 2 December 2009.

Hummels, D. (2007). Transportation costs and international trade in the second era of globalization. Journal of Economic Perspectives, 21(3), 131–154.

Hummels, D., & Lugovskyy, V. (2006). Are matched partner trade statistics a usable measure of transport costs? Review of International Economics, 14(1), 69–86.

Hummels, D., & Schaur, G. (2009). Hedging price volatility using fast transport (National Bureau of Economic Research Working Paper 15,154).

Hummels, D., Lugovskyy, V., & Skiba, A. (2009). The trade reducing effects of market power in international shipping. Journal of Development Economics, 89(1), 84–97.

Kasahara, H., & Rodrigue, J. (2008). Does the use of imported intermediates increase productivity? Journal of Development Economics, 87(1), 106–118.

Korinek, J., & Sourdin, P. (2009). Clarifying trade costs: Maritime transport costs and its effect on agricultural trade (OECD Trade Policy Working Paper No. 92).

Leinbach, T. R., & Bowen, J. (2004). Air cargo services and the electronics industry in Southeast Asia. Journal of Economic Geography, 4(3), 299–321.

Levchenko, A. (2007). Institutional quality and international trade. Review of Economic Studies, 74(3), 791–819.

Limao, N., & Venables, A. (2001). Infrastructure, geographical disadvantage and transport costs. World Bank Economic Review, 15(3), 451–479.

Markusen, J., & Venables, A. (2007). Interacting factor endowments and trade costs: A multi-country, multi-good approach to trade theory. Journal of International Economics, 73(2), 333–354.

Moreira, M. M., Volpe, C., & Blyde, J. (2008). Unclogging the arteries: The impact of transport costs on Latin American and Caribbean Trade. Washington DC: Inter-American Development Bank.

Piermartini, R., & Rousova, L. (2008). Liberalization of air transport services and passenger traffic (World Trade Organization Staff Working Paper ERSD-2008-06—http://www.wto.org/english/res_e/reser_e/ersd200806_e.pdf. Accessed 2 December 2009).

Pomfret, R., & Sourdin, P. (2009). Have Asian trade agreements reduced trade costs? Journal of Asian Economics, 20(3), 255–268.

Sanchez, R., Hoffmann, J., Micco, A., Pizzolitto, G., Sgut, M., & Wilmsmeier, G. (2003). Port efficiency and international trade: Port efficiency as a determinant of maritime transport costs. Maritime Economics and Logistics, 5(2), 199–218.

Sequiera, S., & Djankov, S. (2008). On the waterfront: An empirical study of corruption in ports—http://www.doingbusiness.org/documents/Corruption_in_Ports.pdf . Accessed 2 December 2009.

Trefler, D. (1995). The case of the missing trade and other mysteries. American Economic Review, 85(6), 1029–1046.

Waugh, M. (2009). International trade and income differences. Federal Reserve Bank of Minneapolis Research Department Staff Report 435, available at http://www.minneapolisfed.org/research/sr/SR435.pdf. Accessed 2 December 2009.

Wilmsmeier, G., Hoffmann, J., & Sanchez, R. (2006). The impact of port characteristics on international maritime transport costs. In K. Cullinane & W. Talley (Eds.), Port economics: Research in transportation economics (Vol. 16, pp. 117–140). Oxford: JAI Press/Elsevier.

Wilson, J., Mann, C., & Otsuki, T. (2003). Trade facilitation and economic development: A new approach to quantifying the impact. World Bank Economic Review, 17(3), 367–389.

WTO (World Trade Organization) (2007). International trade statistics 2007, available at http://www.wto.org/english/res_e/statis_e/its2007_e/its07_toc_e.htm.

Acknowledgments

We have benefited from helpful comments on earlier versions of this paper by participants in seminars at Monash University, the University of South Australia and Flinders University, at the Empirical Investigations in Trade and Geography conference in Melbourne on 3–5 July 2009, and from Russell Hillberry and Ben Shepherd and a referee for this journal. We are grateful to the Australian Bureau of Statistics for assembling the trade data, and to the School of Economics at the University of Adelaide for paying for the data. A longer early version is available as Richard Pomfret and Patricia Sourdin: Why Do Trade Costs Vary? University of Adelaide School of Economics Working Paper 2008-08, at http://www.economics.adelaide.edu.au/research/papers/.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Pomfret, R., Sourdin, P. Why do trade costs vary?. Rev World Econ 146, 709–730 (2010). https://doi.org/10.1007/s10290-010-0072-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-010-0072-8