Abstract

The entry into force of the Solvency II regulatory regime is pushing insurance companies in engaging into market consistence evaluation of their balance sheet, mainly with reference to financial options and guarantees embedded in life with-profit funds. The robustness of these valuations is crucial for insurance companies in order to produce sound estimates and good risk management strategies, in particular, for liability-driven products such as with-profit saving and pension funds. This paper introduces a Monte Carlo simulation approach for evaluation of insurance assets and liabilities, which is more suitable for risk management of liability-driven products than common approaches generally adopted by insurance companies, in particular, with respect to the assessment of valuation risk.

Similar content being viewed by others

Notes

IFRS 17 is effective from 1 January 2021. A company can choose to apply IFRS 17 before that date, but only if it also applies IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts with Customers. The board will support the implementation of IFRS 17 over the next three and half years.

See definition (7) (Commission 2015), insurance and reinsurance undertakings’ valuation of the assets and liabilities using the market-consistent valuation methods prescribed in international accounting standards adopted by the Commission in accordance with Regulation (EC) No. 1606/2002, should follow a valuation hierarchy with quoted market prices in active markets for the same assets or liabilities being the default valuation method in order to ensure that assets and liabilities are valued at the amount for which they could be exchanged in the case of assets or transferred or settled in the case of liabilities between knowledgeable and willing parties in an arm’s length transaction. This approach should be applied by undertakings regardless of whether international or other valuation methods follow a different valuation hierarchy.

The estimates of future cash flows shall be current, explicit, unbiased and reflect all the information available to the entity without undue cost and effort about the amount, timing and uncertainty of those future cash flows. They should reflect the perspective of the entity, provided that the estimates of any relevant market variables are consistent with observable market prices [IFRS 17:33, Measurement].

See data on life insurance market at https://www.insuranceeurope.eu/insurancedata.

For a comprehensive introduction to ESGs and their applications to insurance and pension funds, see SOA (2016).

By and large, liability-driven investments are saving or pension products, like segregated fund, where the way assets performance affects liabilities is critical for the sustainability and success of the investment strategy.

For the definition of equivalent martingale measure and the fundamental theorem of asset pricing, see for example Bjork (2009).

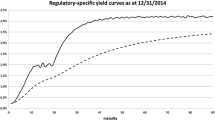

In market-consistent evaluations, liability cash flows are discounted using a risk-free curve derived from six months Euribor, which is constructed as prescribed by EIOPA. After the financial crisis in 2008, some European sovereign bond issuers (as Portugal, Italy, Greece and Spain) began to trade with a material spread over Euribor. Therefore, the assets of many insurance companies began to deteriorate while liabilities did not due to the basis or liquidity effect between market prices and discounting factors used to assess the economic value of technical provisions.

At the heart of the prudential Solvency II directive, the own risk and solvency assessment (ORSA) is defined as a set of processes constituting a tool for decision-making and strategic analysis. It aims to assess, in a continuous and prospective way, the overall solvency needs related to the specific risk profile of the insurance company.

With valuation risk, we mean correlation, basis, liquidity and model risks in accordance with the prudent person principle as stated in the article 132 of Solvency II Directive.

For an overview of insurance participating contracts, see Pitacco (2012).

See, for example, the hedging requirement under IFRS 9 financial instruments.

A stochastic time is a real positive and increasing right continuous process with left limits, for every \(t \ge 0\), \(\tau (t)\) is a stopping time, \(\tau (t)\) is finite almost surely, \(\tau (0) = 0\) and \(\lim \nolimits _{t \rightarrow \infty } \tau (t) = \infty \) (see Barndorff-Nielsen and Shiryaev 2010 for a complete discussion).

The relevance of the Italian traditional with-profit business as an example is explained in Gambaro et al. (2018). The same paper includes more information on the certainty equivalent and the market-consistent approach to insurance valuations.

A consequence of an higher turnover on the assets portfolio is the reduction of unrealised gains (or losses), which are used by insurance companies to steer the performance credited to and shared with the policyholder.

Abbreviations

- ALM:

-

Assets and liabilities management

- CDF:

-

Cumulative distribution function

- CDS:

-

Credit default swap

- CEQ:

-

Certainty equivalent

- CFO:

-

Chief financial officers

- CIR:

-

Cox Ingersoll Ross

- EIOPA:

-

European Insurance and Occupational Pension Authority

- ESG:

-

Economic scenario generator

- IASB:

-

International Accounting Standards Board

- IFRS:

-

International Financial Reporting Standard

- LGAAP:

-

Local generally accepted accounting principle

- MCEV:

-

Market Consistent Embedded Value

- ORSA:

-

Own risk and solvency assessment

- SCR:

-

Solvency capital requirement

- SDE:

-

Stochastic differential equation

- VOG:

-

Value of guarantee

- ZCB:

-

Zero coupon bond

References

Arvanitis, A., Gregory, J., Laurent, J.: Building models for credit spreads (1998). http://www.ressources-actuarielles.net/EXT/ISFA/1226.nsf/0/7c1d935203184237c1257a4f006b127a/$FILE/building_models_for_credit_spreads.pdf. Accessed 29 Sept 2016

Bacinello, A.: Fair pricing of life insurance partcipating policies with a minimum interest rate guaranteed. Astin Bull. 31, 275–297 (2001)

Bacinello, A.: Fair valuation of the surrender option embedded in a guaranteed life insurance participating policy. J. Risk Insur. 70(3), 461–487 (2003)

Barndorff-Nielsen, O., Shiryaev, A.: Change of Time and Change of Measure. World Scientific, Singapore (2010)

Baucells, M., Borgonovo, E.: Invariant probabilistic sensitivity analysis. Manag. Sci. 59(11), 2536–2549 (2013)

Bauer, D., Kiesel, R., Kling, A., Russ, J.: Risk-neutral valuation of participating life insurance contracts. Insur. Math. Econ. 39, 171–183 (2006)

Bianchetti, M.: Two curves, one price: pricing and hedging interest rate derivatives using different yield curves for discounting and forwarding (2012). arXiv:0905.2770

Bjork, T.: Arbitrage Theory in Continuous Time, 3rd edn. Oxford University Press, Oxford (2009)

Bremaud, P.: Point Processes and Queues: Martingale Dynamics. Springer, Berlin (1981)

Brigo, D., Mercurio, F.: Interest Rate Models: Theory and Practice, 2nd edn. Springer, Berlin (2006)

Briys, E., De-Varenne, F.: On the risk of life insurance liabilities: debunking some common pitfalls. J. Risk Insur. 64, 673–694 (1997)

Castellani, G., De Felice, M., Moriconi, F., Pacati, C.: Embedded value in life insurance (2005). https://ssrn.com/abstract=2761395 or https://doi.org/10.2139/ssrn.2761395

CFO-Forum: Market consistent embedded value basis for conclusions (2016a). http://www.cfoforum.nl/downloads/CFO-Forum_MCEV_Basis_for_Conclusions_April_2016.pdf. Accessed 25 Mar 2018

CFO-Forum: Market consistent embedded value principles-guidance (2016b). http://www.cfoforum.nl/downloads/CFO-Forum_MCEV_Principles_and_Guidance_April_2016.pdf. Accessed 25 Mar 2018

Commission, E.: Commission delegated regulation (EU) 2015/35 (2015). http://eur-lex.europa.eu. Accessed 25 Mar 2018

Cox, J., Ingersoll, J., Ross, S.: A theory of the term structure of interest rates. Econometrica 53(2), 385–407 (1985)

Efron, B., Tibshirani, R.: Bootstrap methods for standard errors, confidence intervals, and other measures of statistical accuracy. Stat. Sci. 1, 54–75 (1986)

EIOPA: Technical documentation of the methodology to derive EIOPA’s risk-free interest rate term structures (2017). https://eiopa.europa.eu/regulation-supervision/insurance/solvency-ii-technical-information/risk-free-interest-rate-term-structures. Accessed 25 Mar 2018

Feller, W.: An Introduction to Probability Theory and Its Applications, vol. II, 2nd edn. Wiley, New York (1971)

Gambaro, A., Casalini, R., Fusai, G., Ghilarducci, A.: Quantitative assessment of common practice procedures in the fair evaluation of embedded options in insurance contracts. Insur. Math. Econ. 81, 117–129 (2018)

Hull, J., White, A.: Pricing interest-rate derivative securities. Rev. Financ. Stud. 3(4), 573–592 (1990)

IASB: IFRS 17 insurance contracts (2017). http://www.ifrs.org/projects/2017/insurance-contracts. Accessed 25 Mar 2018

Jarrow, R., Turnbull, S.: Pricing derivatives on financial securities subject to credit risk. J. Finance 50(1), 53–85 (1995)

Jørgensen, P.: On accounting standards and fair valuation of life insurance and pension liabilities. Scand. Actuar. J. 5, 372–394 (2004)

Kemp, M.: Market Consistency: Model Calibration in Imperfect Markets, 1st edn. Wiley, New York (2015)

Lando, D.: On Cox processes and credit risky securities. Rev. Deriv. Res. 2, 99–120 (1998)

Longstaff, F., Mithal, S., Neis, E.: Corporate yield spreads: default risk or liquidity? New evidence from the credit default swap market. J. Finance 60, 2213–2253 (2005)

Marena, M., Fusai, G., Materazzi, M.: Analysis of calibration risk for exotic options through a resampling technique. Working paper (2018)

Monfort, A., Renne, J.: Decomposing euro-area sovereign spreads: credit and liquidity risks. Rev. Finance 18(6), 2103–2151 (2014)

Moreni, N., Pallavicini, A.: Parsimonious HJM modelling for multiple yield-curve dynamics. Quant. Finance 14(2), 199–210 (2014)

Morini, M.: Solving the Puzzle in the Interest Rate Market. Interest Rate Modelling After the Financial Crisis, pp. 61–105. Risk Books, London (2013)

O’Kane, D., Turnbull, S.: Valuation of credit default swaps. Lehman Brothers, Fixed Income Quantitative Credit Research (2003)

Pearson, N., Sun, T.: Exploiting the conditional density in estimating the term structure: an application to the Cox, Ingersoll, and Ross Model. J. Finance 49(4), 1279–1304 (1994)

Pitacco, E.: From benefits to guarantees looking at life insurance products in a new framework (2012). http://ssrn.com/abstract=2200310. Accessed 29 Sept 2016

Schrager, D.: Affine stochastic mortality. Insur. Math. Econ. 38(1), 81–97 (2006)

SOA: Economic scenario generators: a practical guide (2016). https://www.soa.org/Files/Research/Projects/research-2016-economic-scenario-generators.pdf. Accessed 25 Mar 2018

Vedani, J., El Karoui, N., Loisel, S., Prigent, J.: Market inconsistencies of the market-consistent European life insurance economic valuation: pitfalls and practical solutions. Eur. Actuar. J. 7(1), 1–28 (2017)

Vigna, E., Luciano, E.: Mortality risk via affine stochastic intensities: calibration and empirical relevance. Belg. Actuar. Bull. 8, 5–16 (2008)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A Change of measure derivation

The dynamics of r(t) under the real-world \(\mathbb {P}\) measure follows a Vasicek dynamics as in Sect. 3.3 Eq. (14)

where \(W^{\mathbb {P}}\) is a Brownian motion under the measure \(\mathbb {P}\). We define the Radon–Nykodim derivatives from the real-world measure \(\mathbb {P}\) to the risk-neutral measure \(\mathbb {Q}\) as

where m(t) is the market price of interest rate risk, which has the following form

with \(\theta (t)\) a deterministic function of time.

By Girsanow theorem, the short rate r(t) has the following dynamics under the risk-neutral \(\mathbb {Q}\) measure

where W(t) is a Brownian motion under \(\mathbb {Q}\). The previous process is an Hull–White process, and it can be written as in Eq. (1) for conveniently chosen functions \(\alpha (t)\) and \(\theta (t)\) (see, for instance, Brigo and Mercurio 2006, pp. 72–73).

As in Sect. 3 the default risk of sovereign issuers is modelled using an intensity model (also called Cox processes or doubling stochastic Poisson processes) with intensities modelled using correlated CIR processes, for \(i=1,2,\ldots ,I\),

where I is the number of sovereign bond issuers, \(\tau _i\) is the stochastic time of default of the ith issuer, \(\xi _i\) are i.i.d. unitary exponential random variables and \(Z^\mathbb {P}(t)\) ia a I-dimensional Brownian motions under \(\mathbb {P}\).

By Girsanov theorem for point processes (Bremaud 1981), defining the Radon–Nykodim derivatives as

with \(\psi _i(t)\) deterministic functions of time, we obtain that the credit risk intensity of the i-th issuer under the risk- neutral probability is

where \(y_i(t)\) follows the process in Eq. (5).

By similar reasoning, using the point process Girsanov theorem, the dynamics of the corporate credit risk intensity changes from the real-world process as in Eq. (15) to the risk- neutral measure process as in Eq. (12).

B Maximum likelihood for default probabilities

In this section, we detail the procedure used to calibrate the CIR parameters via maximum likelihood method for the historical series of corporate default probabilities. The same procedure is applied to historical series of sovereign probabilities bootstrapped from CDS spreads. Let \(\theta \) be the set of the model parameters. We define

and we assume that the function f is invertible with respect to \(\lambda = \lambda (t)\). Once we fix a maturity \(\tau \) and an initial rate i, then we can build the historical series of default probabilities \(\{\varPi _1,\ldots ,\varPi _N\}\) where \(\varPi _n = \varPi (t_n, t_n+\tau )_{iK}\). The likelihood function of the observed default probabilities is

where \(h_\varPi (x;\theta )\) is the conditional density function of the default probabilities (we assume that \(\varPi _1,\ldots ,\varPi _N\) are i.i.d.). The default probability density function \(h_\varPi \) can be obtained from the density function of \(\lambda \), which is a non-central Chi-squared distribution, using the monotonic transformation of random variables, as suggested in Pearson and Sun (1994), in the following way

where \(\lambda ^*_n = f^{-1}(\varPi _n,\theta )\). Hence, a maximum likelihood estimator of the parameters is

C Invariant probabilistic sensitivity analysis

Let y be a function of the model parameters (for instance, y can be the VOG)

with \(\theta \in D \subseteq \mathbb {R}^n\) and n is the number of the model parameters.

Let \(\varTheta \) be a random vector and \(\theta \) is realization, hence \(Y= y(\varTheta )\) is the corresponding random model output and \(F_Y\) is the CDF of Y.

We define the importance measure of \(\theta _i\) with respect to Y as

where \(0<d<1\) is a distance between the unconditional and the conditional CDF. We choose to use the Kuiper’s metric, then

In Table 5, we report the values of the importance measures \(\beta _i\). A value near to one of \(\beta _i\) signals an important difference between \(F_Y\) and \(F_{Y | \varTheta _i = \theta _i}\), i.e. the parameter \(\theta _i\) is a “critical” parameter of the model.

Rights and permissions

About this article

Cite this article

Gambaro, A.M., Casalini, R., Fusai, G. et al. A market-consistent framework for the fair evaluation of insurance contracts under Solvency II. Decisions Econ Finan 42, 157–187 (2019). https://doi.org/10.1007/s10203-019-00242-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-019-00242-1