Abstract

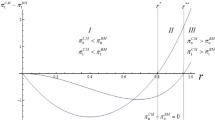

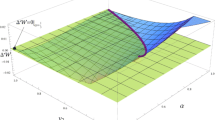

This paper offers a new theory that describes the influence of uncertainty on economic fundamentals. This theory posits that uncertainty can improve social welfare. We argue that in an economy, where spending of the customers for the differentiated good correlates with larger substitutability of its varieties, the equilibrium output decreases and the prices increase when uncertainty appears. Alternatively, if such spending and substitutability anti-correlate, the predictions for the price and output changes are reversed. The arguments are based on general equilibrium modeling with the monopolistic competition of firms which produce varieties of the differentiated good under limited information regarding the consumer demand. The impact of uncertainty on the equilibrium is assessed by using the relationship between the weighted elasticity of substitution between varieties, the elasticity of the consumer utility, and the income share spent on the differentiated good.

Similar content being viewed by others

Notes

More precisely, the mapping defined by (9) is concave on an appropriate class of the functions \(q(\cdot )\).

Strictly speaking, the mapping \(S_1\) returns a function that depends on the variety type. As we define a symmetric equilibrium, this is a constant-value function. For the sake of simplicity it is referred to as a number, and \({\hat{q}}_z\) is a function that depends only on z.

Q depends on L and \(L_a\), but q and \(q_a\) tend to 0 and L, and \(L_a\) tends to \(\infty\).

Shapoval and Goncharenko (2014) first explored equilibrium in this model without uncertainty.

\(u_1(q) = \frac{A}{A-1} q^{1-\frac{1}{A}} (2q+1)^{1+\frac{1}{2A}} F_1\left( 1, 2-\frac{1}{2A}, 2-\frac{1}{A}, -2q\right)\), if \(A > 1\), where \(F_1(a,b,c,z)\) is the standard notation used for hypergeometric functions (see Whittaker and Watson 1990 for a description of hypergeometric functions), and \(u_1(q)=2 \sqrt{2 q+1}+\log \frac{\sqrt{2 q+1}-1}{\sqrt{2 q+1}+1}\) if \(A = 1\).

\(u_2(q) = (2q)^{1-\frac{1}{2A}} \frac{A}{2A-1} F_1\left( 1, 2-\frac{2}{A}, 2-\frac{1}{A}, -\frac{q}{2}\right)\) and \(u_2(q) = \log \left( q+1+\sqrt{q^2+2q} \right)\) if \(A > 1\) and, respectively, \(A = 1\).

The statement also holds for more general forms of U, however the conditions are more complicated; instead of Assumption 4 we require the convexity of \(U(Nu(\cdot ))\) for any \(N \ge 1\) and the inequality \({\mathcal{E}}_{U(Nu(\cdot ))}(q)+ \frac{1}{\sigma _{U(Nu(\cdot ))}(q)}\le 1\), where q and N are the equilibrium individual demand and the number of firms, respectively, and the derivatives are with respect to q computed with the fixed N. The structure of the proof remains the same but details are ignored here.

References

Appelbaum A, Katz E (1986) Measures of risk aversion and comparative statics of industry equilibrium. Am Econ Rev 76:524–529

Appelbaum A, Lim C (1982) Monopoly versus competition under uncertainty. Can J Econ 15:355–363

Ball L, Mankiw G, Reis R (2005) Monetary policy for inattentive economies. J Monet Econ 52:703–725

Behrens K, Murata Y (2007) General equilibrium models of monopolistic competition: a new approach. J Econ Theory 136:776–787

Behrens K, Murata Y (2012) Trade, competition, and efficiency. J Int Econ 87(1):1–17

Behrens K, Mion G, Murata Y, Südekum J (2016) Distorted monopolistic competition. CEPR discussion paper no DP11642

Bertoletti P, Epifani G (2014) Monopolistic competition: CES redux? J Int Econ 93:227–238

Dana JD (1999) Equilibrium price dispersion under demand uncertainty: the roles of costly capacity and market structure. RAND J Econ 30:632–660

Di Comite F, Nocco A, Orefice G (2014) Tariff reductions, trade patterns and the wage gap in a monopolistic competition model with vertical linkages. Working papers 2014-02, CEPII research center

Dixit K, Stiglitz E (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Dhingra S, Morrow J (2019) Monopolistic competition and optimum product diversity under firm heterogeneity. J Polit Econ 127:196–232

Ireland NJ (1985) Product diversity and monopolistic competition under uncertainty. J Ind Econ 33:501–513

Ishii Y (1977) On the theory of the competitive firm under price uncertainty: note. Am Econ Rev 67:768–769

Ishii Y (1991) On the theory of monopolistic competition under demand uncertainty. J Econ 54:21–32

Kichko S, Kokovin S, Zhelobodko E (2014) Trade patterns and export pricing under non-CES preferences. J Int Econ 94:129–142

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99:483–499

Leland ES (1972) Theory of the firm facing uncertainty demand. Am Econ Rev 62:278–291

Mankiw G, Reis R (2007) Sticky information in general equilibrium. J Eur Econ Assoc 2:603–613

Melitz MJ, Redding SJ (2014) Heterogeneous firms and trade. In: Handbook of international economics, chapter 1, vol 4, pp 1–54

Mrázová M, Peter Neary J (2017) Not so demanding: demand structure and firm behavior. Am Econ Rev 107(12):3835–74

Osharin A, Verbus V (2018) Heterogeneity of consumer preferences and trade patterns in a monopolistically competitive setting. J Econ 125:211–247

Osharin P, Thisse J-F, Ushchev P, Verbus V (2014) Monopolistic competition and income dispersion. Econ Lett 122:348–352

Parenti M, Ushchev P, Thisse J-F (2017) Toward a theory of monopolistic competition. J Econ Theory 167:86–115

Samuelson PA (1965) Using full duality to show that simultaneously additive direct and indirect utilities implies unitary price elasticity of demand. Econometrica 33:781–796

Sandmo A (1971) On the theory of the competitive firm under price uncertainty. Am Econ Rev 61:65–73

Schmidt KD (2014) On inequalities for moments and the covariance of monotone functions. Insur Math Econ 55:91–95

Shapoval A, Goncharenko V (2014) Monopolistic competition under uncertainty. No. 14/02e. EERC Research Network, Russia and CIS

Sims CA (2003) Implications of rational inattention. J Monet Econ 50:665–690

Vives X (1999) Oligopoly pricing: old ideas and new tools. MIT Press, Cambridge

Whittaker ET, Watson GN (1990) A course in modern analysis. Cambridge University Press, Cambridge

Zhelobodko E, Kokovin S, Parenti M, Thisse J-F (2012) Monopolistic competition: beyond the constant elasticity of substitution. Econometrica 80:2765–2784

Acknowledgements

We are thankful to Professors M. Alexeev (Indiana University), R. Ericson (East Carolina University), and S. Weber (SMU and NES) for useful discussions; we are grateful to two anonymous reviewers whose comments and suggestions helped us improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

Let \(s<Q\). Then, according to (10), the profit \(\pi\) is an increasing function of p. We will prove that in the opposite case, \(s\ge Q\), the profit \(\pi\) is a decreasing function of p. Then the choice \(s=Q\) maximizes the profit \(\pi\).

Indeed, let \(s\ge Q\). Differentiating (11) we have

Substituting Eq. (14) into (46) we get \(\frac{\partial \pi }{\partial p}= Q\big (1-{\mathfrak{S}}(q,q_a)\big )\). Since \(\sigma >1\) it follows that \({\mathfrak{S}}>1\) and the profit \(\pi\) is a decreasing function of Q. \(\square\)

Proof of Proposition 2

The proof is split into Lemmas 1–7. Lemma 1 relates the average price to the weighted elasticity of the substitution found with a specific value of the random variable \(\zeta\).

Lemma 1

Assume that the optimal prices, which solve maximization problem (17) for any feasible value\(z\in Z\)of\(\zeta\), are continuous with respect toz. Then, first, there exists a value\(z^*\)of the random variable\(\zeta\)such that the mean\({\bar{p}}\)of the optimal prices is given by the equation

where\({\mathfrak{S}}^*={\mathfrak{S}}\big (q(z^*),q_a(z^*)\big )\), and the demands\(q(z^*)\)and\(q_a(z^*)\)satisfy equation

as well as (4), (6), (7), and (8) (with\(z=z^*\)). Second, Eqs. (27) and (28) hold.

Proof

Differentiating (17) by s we obtain

The derivative

can be found from (14) with \(Q=s\). Then the first order condition \(\partial {{\bar{\pi }}}/\partial s=0\) becomes

By the mean value theorem there exists a value \(z^*\) such that \({\mathfrak{S}}\big (q(z^*),q_a(z^*)\big )\) can be taken off the last integral

justifying (47). Substituting (47) into (17) and using free entry condition \({{\bar{\pi }}}=0\) we get (27). Then the substitution of (27) into (18) leads to (28). \(\square\)

Lemma 2

Letzbe a revealed value of the exponent\(\zeta\). Then the equilibrium prices, wages, and individual demands are given by Eqs.(29), (30), and (31) respectively.

Proof

Income (19) of the skilled workers consists of the wages and firm profits (or losses), whereas the income of the workers employed in the traditional sector consists only of their wages \(y_a=w_a=1\). Then the balance of money given by Eqs. (6) and (8) can be written as:

Multiplying (50) by L and (51) by \(L_a\) and summing up the results, we get

From (11) and (18) it follows that

so that

At last, from (27) and (28) we conclude that \(QN=\left( {\mathfrak{S}}^*-1\right) L/\left( m{\mathfrak{S}}^*\right)\) proving (29).

Taking the expected value of the both sides of (29) and evaluating \({\bar{p}}\) in the left-hand side with (47), we obtain (30).

Finally, from (50), (51), and (53) it follows that

Then (31) follows from linear system of Eq. (54) on q and \(q_a\) and the definition of aggregate demand (12). \(\square\)

Substituting formulas (29), (47), (30) and (31) for prices, average prices, wages and individual demands into (48), we get (32).

By this moment, we have proved that the optimal supply (together with \({\mathfrak{S}}^*\) which is yet unknown) satisfies the system of Eqs. (27) and (32). Now we intend to establish the existence and uniqueness of the optimal supply. The exclusion of \({\mathfrak{S}}^*\) from this system results in the equation

Lemma 3

We suppose that Assumption 1holds. Then Eq. (55) has a unique solution with respect tos.

Proof

The left hand side \(\mathrm{lhs}\) of (55) does not depend on s. We are going to prove that its right hand side as a monotonic function of s crosses once the level given by the left hand side. The right hand side \(\mathrm{rhs}(0)=\int _Z\frac{z}{1-z}\frac{f(z)}{\sigma (0)}dz= \frac{1}{\sigma (0)}{\mathbf{E}}\big (\frac{\zeta }{1-\zeta }\big )<\mathrm{lhs}\). However, as \(s\rightarrow \infty\),

If the function \(\sigma (\varkappa )\) is increasing, we continue

By the Lagrange formula, there is \(\kappa\) such that

If s is sufficiently large, then \(\sigma (0)/\big (\frac{ms}{\varphi }+1\big )<1/2\). By Assumption 1, we have \(\sigma '(\kappa )\frac{s}{\min \{L,L_a\}}<\frac{ms}{2\varphi }\). Eventually, we have \(\mathrm{lhs}(\infty )<\mathrm{rhs}(\infty )\). Regarding the monotonicity of the right hand side, we put

and establish that \(h'(s)<0\). The explicit computation yields that the inequality \(h'(s)<0\) is equivalent to

Initially, we are going to establish that

Case A\(ms/\varphi \le 1\). Then the inequality \(\sigma '(\varkappa )<\frac{m}{2\varphi }\sigma (\varkappa )\) followed from (23) and used with \(\varkappa =zs/L\) implies that

i. e. inequality (58) holds.

Case B\(ms/\varphi >1\). Then inequality \({\mathcal{E}}_{\sigma }(\varkappa )<1/2\) which is a part of (23) used with \(\varkappa =zs/L\) implies that

i. e. inequality (58) holds once again. The inequality

is proved in the same manner. Inequalities (58) and (59) result in (57).

Let the function \(\sigma (\varkappa )\) be decreasing. Then we have

and \(\mathrm{lhs}(\infty )<\mathrm{rhs}(\infty )\). The function h(s) decreases because the numerator in (56) decreases in s, whereas the denominator increases. Thus, the monotonically decreasing right hand side is larger than the left hand side at zero but smaller at infinity. Therefore, a unique solution of Eq. (55) exists. \(\square\)

Now we turn to the second order conditions. The proof is prefaced by the following technical lemma.

Lemma 4

For anyx, y, and\(\delta \ge 0\)such that\(1+\delta \le y\le x\le 2y\), the inequality

holds.

Proof

We fix an arbitrary \(y\ge 1+\delta\) and find the roots \(x_{\pm }\) of the left hand side (lhs) of Eq. (60) considered as a function of x:

The lhs, as a quadratic function with respect to x, is negative, if x is located between the roots: \(x_-<x<x_+\). The direct computation gives evidence that the lesser root \(x_{-}\) is less that y. The inequality \(2y\le x_{+}\) is equivalent to \(-3y^2+3(1+\delta )y\le 0\) and \(1+\delta \le y\). Therefore, from the inequality \(y<x<2y\) it follows that \(x_-<x<x_+\) and inequality (60) holds. \(\square\)

Lemma 5 exposes the second order condition for the firm optimization problem.

Lemma 5

We suppose that Eq. (17) defines the expected profits\({\bar{\pi }}\)and Assumptions 1and2hold. Then\(\partial ^2{\bar{\pi }}/\partial s^2<0\).

Proof

A direct computation of the partial derivatives of the profits (17) together with the equality \(s=Q\) leads to the equation

We are going to show that for any z the expression in the brackets of the last integral is negative:

The algebraic routine based on (49) gives

justifying that inequality (62) is equivalent to \(-\frac{{\mathfrak{S}}-1}{p}Q-\frac{Q}{{\mathfrak{S}}} \frac{\partial {\mathfrak{S}}}{\partial p}<0\). To find the derivative of \({\mathfrak{S}}=\left( qL\sigma (q)+q_aL_a\sigma (q_a)\right) /Q\) with respect to p we perform an auxiliary computation based on (4) and (7):

Then

Eventually, (62) is equivalent to the inequality

Writing \({\mathfrak{S}}\) and Q as the corresponding sums, we get

We have to prove that

This inequality coincides with (60) established in Lemma 4 and used with \(x=\max \{\sigma (q),\sigma (q_a)\}\) and \(y=\min \{\sigma (q),\sigma (q_a)\}\). If \(\sigma '<0\), Lemma 4 is applied with \(\delta =0\). If \(\sigma '>0\), Lemma 4 is applied with \(\delta =\max \{\sigma '(q)q,\sigma '(q_a)q_a\}\). The applicability of Lemma 4 is provided by Assumption 2. \(\square\)

In the next two Lemmas, we discuss the relation between Assumptions 2 and 2’.

Lemma 6

Assumption 2’implies that the individual demandsqand\(q_a\)satisfy the inequality

at the stationary point of the firm optimization problem.

Proof

From the condition (25) we obtain \(\frac{L_a}{L_a+2L}<1-z<\frac{2L_a}{2L_a+L}\). Therefore, \(\frac{L}{2L_a}<\frac{z}{1-z}<\frac{2L}{L_a}\) and \(\frac{1}{2}<\frac{zL_a}{(1-z)L}<2\). Then the statement of the Lemma follows from (31). \(\square\)

Lemma 7

Assumption 2’and the condition\(\sigma '(\varkappa ) < (\sigma (\varkappa )-1)/\varkappa\)of Assumption 1imply the double inequality (24) of Assumption 2.

Proof

Case A: \(\sigma (q)\) is increasing. Then (23) yields that the function \(\sigma (q)/q\) is decreasing. If, additionally, \(q\ge q_a\), inequality (64) implies

If \(q<q_a\), then \(1>\frac{\sigma (q)}{\sigma (q_a)}= \frac{\sigma (q)/q}{\sigma (q_a)/q_a}\cdot \frac{q}{q_a}>1/2\).

Case B: \(\sigma (q)\) is decreasing. Let \(q\ge q_a\). From Assumption 2’ it follows that

If \(q<q_a\), then \(1<\frac{\sigma (q)}{\sigma (q_a)}=\frac{\sigma (q)q}{\sigma (q_a)q_a}\cdot \frac{q_a}{q}<2\). \(\square\)

Concluding the Proof of Proposition 2, we note that the existence and uniqueness of the optimal supply is provided by Lemma 3. The equilibrium relationships are proved in Lemma 2. Finally, Lemma 5 yields the second order conditions. \(\square\)

To prove Proposition 3 we formulate three Lemmas. The first of them describes the sign of the covariance between two functions of a random variable X (see also Schmidt 2014).

Lemma 8

Letf(x) andg(x) be increasing functions that are differentiable on an interval [a, b]. Then for any random variableXdefined on [a, b] such that the expected values off(X) andg(X) exist, the inequality\(\mathbf{Cov}(f(X),g(X))>0\)holds. If one of these functions is decreasing and the other is increasing on [a, b], then\(\mathbf{Cov}(f(X),g(X))<0\).

Proof

Let the expected values of f(X) and g(X) be attained by the corresponding functions at points \(x_f\) and \(x_g\) respectively: \(f(x_f)={\mathbf{E}}(f(X))\), \(g(x_g)={\mathbf{E}}(g(X))\). Without loss of generality we assume that \(x_f\le x_g\). Then the product \((f(x)-f(x_f))(g(x)-g(x_g))\) is positive on \([a,b]\setminus [x_f,x_g]\) and negative on \((x_f,x_g)\). Let \({\tilde{x}}_g\in (a,x_f)\) be a point such that \(\int _{{\tilde{x}}_g}^{x_g} f(x)d\mu =f(x_f)\), where the measure \(d\mu (x)\) defines the random variable X. We put \(\varDelta f(x,x_f)=f(x)-f(x_f)\). Then, by monotonicity of g, we have:

We conclude that the integral \(\int (f(x)-f(x_f))(g(x)-g(x_g))d\mu\) is positive over the interval \([{\tilde{x}}_g,x_g]\). It is positive outside this interval because the integrated function is positive. In the same way we establish that if one of the functions is decreasing and the other function is increasing, then \(\mathbf{Cov}(f(X),g(X))<0\). \(\square\)

The following Lemma allows us to find the sign of the derivative of \({\mathfrak{S}}(q,q_a)\) considered as a function of \(v(\varkappa )\).

Lemma 9

Letq(z) and\(q_a(z)\)be the equilibrium demands of the skilled and unskilled workers for high-tech goods corresponding to a revealed valuezof the random variable\(\zeta\). Then for some\(\alpha \in [0,1]\)

Proof

In this Lemma and further on, we explore the weighted elasticity of substitution \({\mathfrak{S}}(q(z),q_a(z))\) as a function of z. It is still denoted by symbol \({\mathfrak{S}}\), now as \({\mathfrak{S}}(z)\).

Due to (31), the function \({\mathfrak{S}}(q(z),q_a(z))\) has the following form

Therefore,

With the definition of v, we re-write the obtained equation as

and (65) follows from the mean-value theorem. \(\square\)

The following Lemma relates the convexity of the function \(1/{\mathfrak{S}}(z)\), as a function of z, to the monotonicity of v.

Lemma 10

Let Assumptions 1–3be satisfied. If\(v(\varkappa )\)is a non-increasing function, then the function\(1/{\mathfrak{S}}(z)\)is convex. On the contrary, if\(v(\varkappa )\)is a non-decreasing function and, additionally, inequalities (36) and (38) hold, then the function\(1/{\mathfrak{S}}(z)\)is concave.

Proof

Clearly, \(\frac{d}{dz}\left( \frac{1}{{\mathfrak{S}}(z)} \right) = -{\mathfrak{S}}^{-2}(z){\mathfrak{S}}'(z)\) and \(\frac{d^2}{dz^2}\left( \frac{1}{{\mathfrak{S}}(z)} \right) = \frac{-{\mathfrak{S}}''{\mathfrak{S}}+2{\mathfrak{S}}'^2}{{\mathfrak{S}}^3}\), where all the primes are the derivatives with respect to z. Combining the last equation with \(\frac{d}{dz}\left( v(q) \right) = v'(q)\frac{dq}{dz}\) and (66), we have

If the function v is non-increasing then \(v' \le 0\) and the convexity of \(1/{\mathfrak{S}}(z)\) follows from (67).

Assume that \(v(\varkappa )\) is a non-decreasing function. By (67), the second derivative of \(1/{\mathfrak{S}}(z)\) is negative if and only if

or \(\left( v'(q)\frac{s}{L}+v'(q_a)\frac{s}{L_a}\right) \big ( z\sigma (q)+(1-z)\sigma (q_a) \big )> 2v'(\xi )(q-q_a)\big (v(q)-v(q_a)\big ),\) where \(\xi \in [q_a,q]\). As condition (36) guarantees that \(q>q_a\), it is enough to prove that

Since \(v'(\varkappa )\) is a non-increasing function it follows that \(v'(\varkappa )\ge v'(\xi )\). Then the last inequality follows from (38). \(\square\)

Proof of Proposition 3

We establish inequalities (37) for the decreasing function v(q). The first of them is equivalent to \(\frac{\varphi ({\mathfrak{S}}^*-1)}{m}< \frac{\varphi \big ({\mathfrak{S}}(z_0)-1\big )}{m}\) or to

The second inequality (37) is the direct consequence of the first one. Proving the third inequality, we combine (29) and (30) to obtain that

The latter is equivalent to (68). We are going to prove that for any decreasing function v(q) inequality (68) holds. From the definition (32) of \({\mathfrak{S}}^*\) it follows that (68) is equivalent to \({\mathbf{E}}\left( \frac{\zeta }{1-\zeta }\frac{1}{{\mathfrak{S}}(\zeta )} \right) {\mathfrak{S}}(z_0) > {\mathbf{E}}\left( \frac{\zeta }{1-\zeta }\right)\) and

We intend to establish that the covariance is positive in the last inequality. Introducing the functions \(\chi _1(z)=z/(1-z)\) and \(\chi _2(z)={\mathfrak{S}}^{-1}(z)\), we obtain that \(\chi _1'(z)>0\) and \(\chi _2'(z)=-{\mathfrak{S}}^{-2}(z){\mathfrak{S}}'(z)\). Equation (65) and the inequality \(q>q_a\) provided by (36) implies that \({\mathfrak{S}}'(z)<0\) and \(\chi _2'(z)>0\). Therefore, the derivatives of \(\chi _1\) and \(\chi _2\) have the same sign. According to Lemma 8, \(\mathbf{Cov}\displaystyle \left( \frac{\zeta }{1-\zeta },\frac{1}{{\mathfrak{S}}(\zeta )}\right) >0.\) Jensens’ inequality and the convexity of \(1/{\mathfrak{S}}(z)\) (proved in Lemma 10 for decreasing functions v) result in the inequality \({\mathbf{E}}\left( 1/{\mathfrak{S}}\left( \zeta \right) \right) > 1/{\mathfrak{S}}\left( {\mathbf{E}}(\zeta )\right)\). From the last two inequalities it follows that (69) holds. The case of an increasing function v(q) is considered in the same way. \(\square\)

We turn to the proof of Proposition 4, presenting three technical lemmas.

Lemma 11

Let Assumptions 1, 2 (or 2’), and 4hold. We put

and additionally assume that\(\nu ^*\)is positive and the function\(v(\varkappa )\)non-increases. Then the inequality

where\(D = \mathrm{Var}\zeta\)is the dispersion of the random variable\(\zeta\), holds if the upper and lower-tier utilities are related to each other by the equation\(U=u^{-1}\).

Proof

The direct calculations provide that the utilities \({\hat{\mathbf{U}}}\) and \({\hat{\mathbf{U}}}_a\) of skilled and unskilled workers are

Then

Put, \(F(\varkappa ,N)=\frac{Qu^{-1}(Nu(\varkappa ))}{L_a\varkappa }\), \(F=F(q,N)\), \(F_a=F(q_a,N)\), where q, \(q_a\), and N are the equilibrium values. Then substituting \(u^{-1}\) for U gives

Simplifying notation, the function \(h = W/L_a\) is used below instead of W. We are going to use Jensen’s inequality in a sharpened form \({\mathbf{E}}(h(\zeta )) \ge h(z_0) + \min _{z} h''(z)\mathrm{Var}\zeta / 2\). This approach requires an estimate of \(h''\) from below by a positive term. Computing the derivative of h with respect to z, we use the equilibrium variables \(q=Qz/L\) and \(q_a=Q(1-z)/L_a\) substituted for the first variable \(\varkappa\):

The objective is to estimate the right hand side of (72) from below by the first term:

To this end, we evaluate (72), transforming the terms marked by A to \(\ln F+{\mathcal{E}}_F\), and extracting the derivative of \((\ln F+{\mathcal{E}}_F)\) in the terms marked by B and \(B'\):

We intend to derive that

for any \(N > 1\) and, therefore, the function \(\ln F(\varkappa ,N) + {\mathcal{E}}_F(\varkappa ,N)\) is monotone increasing with respect to \(\varkappa\). Since \(q>q_a\) in the equilibrium, this monotonicity together with the monotonicity of F implies that the sum of the terms marked by A in (72) and (74) is non-negative. The positiveness of the terms marked by B and \(B'\) follows from (75) directly. Therefore, (75) yields (74) and (73).

We focus on the proof of (75). The dependence of N is omitted and the prime is used instead of the partial derivative with respect to \(\varkappa\) to simplify notation. With \(g(\varkappa ,N)=u^{-1}(Nu(\varkappa ))=F(\varkappa ,N)\varkappa L_a/Q\), we have \({\mathcal{E}}_F(\varkappa )={\mathcal{E}}_g(\varkappa )-1\). Therefore, (75) is transformed into

The straightforward computations of the derivative of g (omitted here), which involve the notation \(\eta =U(N u(\varkappa ))\), \(\eta '=Nu'(\varkappa )/u'(\eta )\), and \({\mathcal{E}}_g(\varkappa )= \frac{Nu'(\varkappa )\varkappa }{\eta u'(\eta )}\), result in

Since \(N>1\) and \({\mathcal{E}}_u\) is monotone non-increasing, Eq. (77) yields that \({\mathcal{E}}_g\ge 1\) and \({\mathcal{E}}_F \ge 0\). Further, the function \((\sigma (\cdot )-1)/\big (\sigma (\cdot ){\mathcal{E}}_u(\cdot )\big )\) is non-increasing (Assumption 4) and \(\eta \ge \varkappa\). Therefore, \({\mathcal{E}}_g'(\varkappa )\varkappa \ge 0\), and (77), (78) result in (76). The latter leads to (75) and, eventually, to (73).

The monotone increasing function F (with respect to \(\varkappa\)) attains its global minimum at zero (understood as the limit). In a positive neighborhood of zero, the utility \(u(\varkappa )\) is at most \(C\varkappa ^{\gamma }\) up to smaller terms, where \(\gamma\) is the Hölder exponent; \(\gamma = (\sigma (0) - 1) / \sigma (0)\). Therefore, \(\ln F \ge \sqrt{\nu ^*}\), where \(\nu ^*\) is defined in (70). Since \({\mathcal{E}}_F \ge 0\) and \(\nu ^*>0\), inequality (73) yields the estimate \(h''\ge F^z {\nu ^*} z\). With Jensen’s inequality,

We note that \(L_aF^{z}z \ge L_a\big ( F^{z}z + F_a^{z}(1-z)\big ) / 2 =\frac{W(z)}{2}\). The function W(z), as we have already proved, is convex. Applying Jensen’s inequality once again, we have \(\int W(z) (z-z_0)^2 f(z)\,dz \ge W(z_0) D\). The last three estimates lead to the inequality

which is equivalent to (71). \(\square\)

Lemma 12

From assumptions of Proposition 4it follows that the inequality

where\(B_3 = (2-{\mathcal{E}}_{\sigma '}(0))(\sigma (0)-1)\)and\(D = \mathrm{Var}\zeta\), holds.

Proof

The definition (32) of the \({\mathfrak{S}}^*\) is written as

in the terms of expected values. Then the denominator is

where \(\rho\) is the correlation coefficient between the corresponding random variables. The expansion of \({\mathfrak{S}}^{-1}(z)\) into the Taylor series at \(z = z_0 = E\zeta\) leads to

where \({\hat{z}}\) is located between z and \(z_0\). The substitution of (81) into the expected value results in

Estimating the variance of \({\mathfrak{S}}^{-1}\) with the Taylor expansion given by (81), reduced to the first order term, we get

In the same manner, \(\mathrm{Var}\big ( (1-\zeta )^{-1} \big ) \le \max \big \{ (1-z)^{-2} \big \} D\). Substituting the derived variances into (80), we have

Then

Using (65), we estimate \(|(1/{\mathfrak{S}})'|\). By the assumption of Proposition 4, \(-v'({\tilde{q}}) \le -v'(0) = -\sigma '(0)(2-{\mathcal{E}}_{\sigma '}(0))\) for any \({\tilde{q}}\). Further, \(q - q_a \le q = \frac{Qz}{L} \le \frac{\varphi ({\mathfrak{S}}(z)-1) z}{mL}\). Since \({\mathfrak{S}}(z) = z\sigma (q_{z}) + (1-z)\sigma (q_{a,z}) \le \sigma (0)\) and \(z < 2L / (2L + L_a)\) it follows that

where \(B_3 = (2-{\mathcal{E}}_{\sigma '}(0))(\sigma (0)-1)\). Substituting just obtained estimates of \(v'(q)\) and \(v(q_a) - v(q)\) into (67) and using (44), we have:

Finally, the estimate \((1-z)^{-1} / E\big ( \zeta / (1-\zeta ) \big ) \le 2(L+L_a)/L\) is obtained by the substitution of \(2L / (2L+L_a)\) for z in the numerator and \(L / (L_a + L)\) in the denominator. Substituting the auxiliary estimates into (82), we get (79). \(\square\)

Lemma 13

Let condition (43) hold. We additionally assume that the functions\(v(\varkappa )\), \(-v'(\varkappa )\), \(\sigma (\varkappa )\), \(-\sigma '(\varkappa )\)are monotone non-increasing. Then

where\(B_1\)and\(B_2\)are defined in Assumption 5, and index 0 indicates that the corresponding variable is related to\({\mathfrak{S}}_0\).

Proof

The mean value theorem written with the elasticities yields the following equation:

where \({\hat{{\mathfrak{S}}}}\) is located between \({\mathfrak{S}}^*\) and \({\mathfrak{S}}_0\). We are going to estimate the right hand side of (84). Let \({\mathfrak{S}}\) be located between \({\mathfrak{S}}^*\) and \({\mathfrak{S}}_0\), and q is related to \({\mathfrak{S}}\) by Eq. (31); z is fixed. The direct computation of the derivatives leads to

The right hand side of (85) is monotone increasing (Assumption 4) and zero at \(q=0\) (u is Hölder continuous). By Proposition 3, under the assumptions of Proposition 4, \({\mathfrak{S}}^* \le {\mathfrak{S}}_0\). Therefore, \(Nu(q) \le N_0u(q_0)\). Returning to (84) and changing \({\hat{{\mathfrak{S}}}}\) to either \({\mathfrak{S}}^*\) or \({\mathfrak{S}}_0\) in an appropriate way, we have

Since the elasticity of the composition is the product of the elasticities, we continue:

Then (83) follows from (43). \(\square\)

Proof of Proposition 4

We estimate the bracket in the right hand side of (83) by using the elementary inequality \((1-x)^{-1} < 1 + 2x\), which holds if \(x < 1/2\). The latter follows from (44). Then (83) is re-written as

Using (79), we change the last inequality to \(U(N_0u(q_0)) \le U(N^*u(q^*)) ( 1 + \nu _2D )\), where

and the variables with stars are computed with \({\mathfrak{S}}^*\).

In the same way, \(U(N_0u(q_{a,0})) \le U(N^*u(q^*_a)) ( 1 + \nu _2 D)\). Taking into account that \(z > 1-z\), we estimate the welfare:

Combining the last inequality with (71), we have

Therefore, the inequality \(W_0(z_0) < W(z^*)\) follows from \(4z\nu _2 < \nu ^*\). With definitions (70) and (87) of \(\nu ^*\) and \(\nu _2\) the last inequality becomes

This inequality and the third inequality in (43) yields (44). \(\square\)

Rights and permissions

About this article

Cite this article

Shapoval, A., Goncharenko, V.M. Industry equilibrium and welfare in monopolistic competition under uncertainty. J Econ 130, 187–218 (2020). https://doi.org/10.1007/s00712-019-00687-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-019-00687-3