Abstract

In the presence of uninsurable idiosyncratic risk, the optimal credit contract allows for the possibility of default. In addition, the optimal contract incorporates a precautionary savings motive over and above what agents would otherwise save. When default is sufficiently high, credit markets may collapse. A regulatory requirement on the level of savings can increase risk sharing and improve welfare by increasing the gains to trade in credit exchange. Under the appropriate verifiability condition on the level of savings, an appropriate market structure, agents voluntarily increase their level of storage such that trade and welfare improve.

Similar content being viewed by others

Notes

In Sect. 6, we examine the case where agents do not know the distribution of endowments and elaborate on the way that regulatory requirements on precautionary savings can resolve the problems caused by unduly pessimistic expectations.

Geanakoplos and Zame (2002) and Geanakoplos (2003) introduce, in competitive general equilibrium, debt contracts defined not only on the interest rate, but also on the collateral requirement. Our storage requirement is, however, different from a collateral requirement, as the lender has no recourse to this storage in the event of default [(see Karine and Poitevin (2006) for a model where savings are pledged as collateral]. Their purpose is to restore optimistic expectations and not to protect creditors against losses in the event of default. We are interested in unsecured credit market, such as the interbank market, or in cases that collateral can prove to be of poor quality, as was the case for many assets banks were holding during the 2007 financial crisis, or cases were good collateral in scarce possible due to deflationary pressures (Goodhart et al. 2010a). We, thus, examine a different institutional mechanism, that of excess (liquid/cash) storage, and explore the role it plays in the functioning of unsecured credit markets.

This is true even controlling for the increase in the monetary base.

Given that the bond market is not secured by collateral, positive default penalties are needed to guarantee ex-post commitment to repay. There is a rich tradition in both the corporate finance and general equilibrium theory literature that assumes non-pecuniary default penalties, such as the seminal Shubik and Wilson (1977), Dubey et al. (2005), Diamond (1984), Zame (1993), Welch (1999), Tsomocos (2003) and Goodhart et al. (2006). Diamond allows for contracts with non-pecuniary penalties, which are penalties where the entrepreneur’s loss is not enjoyed by the lenders. He argues, as we do, that these penalties are best interpreted as bankruptcy penalties and cites examples including a manager’s time spent in bankruptcy proceedings, costly ‘explaining’ of poor results, search costs of a fired manager, and the manager’s loss of ‘reputation’ in bankruptcy. If one argues that the punishment for default reflects inability to access the market, one can consider an infinite horizon model where agents are prevented from accessing the market in subsequent periods if default occurs, such as in Alvarez and Jermann (2005) and Gertler and Kiyotaki (2009). In such a setting, equilibrium with asset trade can exist without explicit default penalties, as there are sufficient gains to trade in debtors honouring their promises. Empirical support for the non-pecuniary costs of bankruptcy have been forthcoming in recent years such as in Bris et al. (2006) which considers the US context and internationally in Djankov et al. (2008). Non-pecuniary penalties also signal the level of enforcement of contracts. Antunes et al. (2008) examine empirically the level of enforcement in various countries and find a direct effect on welfare. This paper explores the role that precautionary savings play in a situation where default penalties are not enough to guarantee trade of the optimal contract and show that in such a scenario a legislated amount of storage can stimulate trade in the asset market. We, thus, proceed with a Footnote 5 contiuned full parameterisation of equilibrium with respect to default penalties. In his 1984 paper, Douglas Diamond states that: “Projects which could not be undertaken at all without the penalties can be operated using the (default) penalties”. Here we extend his argument: Contracts that cannot be traded under such penalties, can be traded if agents increase their excess storage to the appropriate level.

Our results do not hinge on the pooling of debt contracts. We believe, the results are also easily be extended and made applicable to different and practical situations and economies.

For a discussion on pecuniary externalities see Shubik (1971)

Note that if \(\theta ^h=0\) in equilibrium, then agent \(h\) does not need to store \(\rho \). A formal representation would be to have \(\rho \mathbb I _{\theta ^h>0}\) in the budget sets.

Goodhart et al. (2010b) consider a separate banking sector that agents can use to hedge their idiosyncratic shocks. They show that the implementation of storage requirements through restrictions on dividends can restore trade in the interbank market and result in higher welfare for agents, though banking profits fall. Da-Rocha et al. (2012) show that, when a sovereign government cannot commit not to default and not to devalue, then consumers’ devaluation expectations imply a low safe level of government debt. Our result suggests that government debt would be higher if the sovereign could signal its credit worthiness by holding an asset that its value is independent of the decision t devalue, such as foreign reserves.

For an overview of the role of default and policy intervention in macro-models of financial stability see Goodhart and Tsomocos (2007).

Carvajal and Weretka (2012) study a model of trade in financial markets where individual investors recognise the fact that prices do depend on their trades. In our economy, agents do not understand their price impact, but rather choose among a menu of contracts at any given equilibrium. That is the reason we had to parameterize the contract space with respect to the storage requirement as well.

We only consider storage requirements that satisfy the conditions in Lemma 1. Thus, from the corollary we get that the additional storage is zero.

Acharya et al. (2011) provide empirical evidence for our equilibrium relation in the case of firms. In particular, they show that the correlation between firms’ cash holdings and spreads is robustly positive.

Quintin (2012) uses the framework of Dubey et al. (2005) to show that harsher default penalties may result in higher default rates if the composition of the pool of debtors changes. This adverse selection problem is discussed in Dubey et al. (2005) as well. The two dimensional contract in our framework may provide a way for higher quality debtors to separate themselves, though we do not examine such a situation herein.

de Castro and Chateauneuf (2011) show that more ambiguity aversion leads to less trade if the endowments are unambiguous. On the contrary, we discuss the case that markets freeze due to unduly pessimistic expectations about debtors’ endowments. This is related to the possibility of full default and not to ambiguity aversion or asymmetry of information about some fundamental value. See Ozsoylev and Werner (2011) for a model with asymmetric information where ambiguous information gives rise to an illiquid asset market.

References

Acharya, V.V., Davydenko, S.A., Strebulaev, I.A.: Cash holdings and credit risk. NBER Working Paper No. 16995 (2011)

Aiyagari, S.R.: Uninsured idiosyncratic risk and aggregate saving. Q. J. Econ. 109(3), 659–684 (1994)

Alvarez, F., Jermann, U.J.: Efficiency, equilibrium, and asset pricing with risk of default. Econometrica 68(4), 775–797 (2005)

Antunes, A., Cavalcanti, T., Villamil, A.: The effect of financial repression and enforcement on entrepreneurship and economic development. J. Monetary Econ. 55(2), 278–297 (2008)

Baumol, W.J.: The transactions demand for cash: an inventory theoretic approach. Q. J. Econ. 66(4), 545–556 (1952)

Bris, A., Welch, I., Zhu, N.: The costs of bankruptcy: chapter 7 liquidation versus chapter 11 reorganization. J. Finance 61, 1253–1303 (2006)

Carroll, C.D.: The buffer-stock theory of saving: some macroeconomic evidence. Brook. Pap. Econ. Activity 2, 61–156 (1992)

Carvajal, A., Weretka, M.: No-arbitrage, state proces and trade in thin financial markets. Econ. Theory 50(1), 223–268 (2012)

Challe, E., Ragot X.: Precautionary saving over the business cycle. Working paper (2011)

Da-Rocha, J.-M., Gimenez, E.-L., Lores, F.-X.: Self-fulfilling crises with default and devaluation. Econ. Theory. doi:10.1007/s00199-012-0702-6 (2012)

de Castro, L.I., Chateauneuf, A.: Ambiguity aversion and trade. Econ. Theory 48(2–3), 243–273 (2011)

Diamond, D.W.: Financial intermediation and delegated monitoring. Rev. Econ. Stud. 51, 393–414 (1984)

Diamond, D.W.: Monitoring and reputation: the choice between bank loans and directly placed debt. J. Polit. Econ. 99, 689–721 (1991)

Diamond, D.W., Dybvig, P.H.: Bank runs, deposit insurance, and liquidity. J. Polit. Econ. 91, 401–419 (1983)

Djankov, S., Hart, O., McLiesh, C., Shleifer, A.: Debt enforcement around the world. J. Polit. Econ. 116(6), 1105–1149 (2008)

Dubey, P., Geanakoplos, J., Shubik, M.: Default and punishment in general equilibrium. Econometrica 73(1), 1–37 (2005)

Fostel, A., Geanakoplos, J.: Collateral restrictions and liquidity under-supply: a simple model. Econ. Theory 35(3), 441–467 (2008)

Freixas, X., Holthausen, C.: Interbank market integration under asymmetric information. Rev. Financ. Stud. 18(2), 459–490 (2005)

Geanakoplos, J.: Liquidity, default, and crashes: endogenous contracts in general equilibrium. In: In Advances in Economics and Econometrics: Theory and Applications, vol. 2 of Eighth World Conference, Econometric Society Monographs, pp. 170–205 (2003)

Geanakoplos, J., Zame, W.R.: Collateral and the enforcement of intertemporal contracts. Cowles Foundation Discussion Paper (2002)

Gertler, M., Kiyotaki, N.: Handbook of Monetary Economics. In: Friedman, B.M., Hahn, F.H. (eds.) Financial Intermediation and Credit Policy in Business Cycle Analysis, Elsevier, New York (2009)

Goodhart, C.A.E., Tsomocos, D.P.: Financial stability: theory and applications. Ann. Finance 3(1), 1–4 (2007)

Goodhart, C.A.E., Tsomocos, D.P., Vardoulakis, A.P.: Modeling a housing and mortgage crisis. In: Alfaro, R.A. (ed.) Financial Stability. Monetary Policy and Central Banking. Central Bank of Chile, Chile (2010a)

Goodhart, C.A.E., Peiris, M.U., Tsomocos, D.P., Vardoulakis, A.P.: On dividend restrictions and the collapse of the interbank market. Ann. Finance 6(4), 655–673 (2010b)

Goodhart, C.A.E., Sunirand, P., Tsomocos, D.P.: A model to analyse financial fragility. Econ. Theory 27, 107–142 (2006)

Gourinchas, P.-O., Parker, J.A.: The empirical importance of precautionary saving. Am. Econ. Rev. 91(2), 406–412 (2001)

Karine, G., Poitevin, M.: Non-commitment and savings in dynamic risk-sharing contracts. Econ. Theory 28(2), 357–372 (2006)

Kilenthong, W.: Collateral premia and risk sharing under limited commitment. Econ. Theory 46(3), 475–501 (2011)

Ozsoylev, H., Werner, J.: Liquidity and asset prices in rational expectations equilibria with ambiguous information. Econ. Theory 48(2–3), 469–491 (2011)

Parker, J.A., Preston, B.: Precautionary saving and consumption fluctuations. Am. Econ. Rev. 95(4), 1119–1143 (2005)

Quintin, E.: More punishment, less default? Ann. Finance. doi:10.1007/s10436-012-0203-4 (2012)

Selten, R.: Reexamination of the perfectness concept for equilibrium points in extensive games. Int. J. Game Theory 4(1), 25–55 (1975)

Shubik, M.: Pecuniary externalities: a game theoretic analysis. Am. Econ. Rev. 1(4), 713–718 (1971)

Shubik, M., Wilson, C.: The optimal bankruptcy rule in a trading economy using fiat money. J. Econ. 37(3–4), 337–354 (1977)

Tobin, J.: The interest-elasticity of transactions demand for cash. Rev. Econ. Stat. 38(3), 241–247 (1956)

Tsomocos, D.P.: Equilibrium analysis, banking and financial instability. J. Math. Econ. 39(5–6), 619–655 (2003)

Weil, P.: Equilibrium asset prices with undiversifiable labor income risk. J. Econ. Dyn. Control 16(3–4), 769–790 (1992)

Welch, I.: Two essays: 1. The underpricing in corporate bonds at issue; 2. From debtors’ prison to bankruptcy: the enforcement of optimal debt contracts, PhD thesis, University of Chicago, Illinois (1999)

Zame, W.: Efficiency and the role of default when security markets are incomplete. Am. Econ. Rev. 83, 1142–1164 (1993)

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to the seminar participants for their helpful comments at the 5th Cowles-CARESS conference, Yale University, at the IX SAET conference in Ischia, at Saïd Business School, Oxford University, at the Banque de France, and to Sudipto Bhattacharya, Régis Breton, John Geanakoplos, Charles Goodhart, Pete Kyle, Allan Morrison, Thomas Noe, Ken Okamura, Han Ozsoylev, Herakles Polemarchakis, Xavier Ragot, Jan Werner, an anonymous referee and especially Dimitrios Tsomocos and Anne Villamil. Finally, we thank and remember Tom Karkinsky. This work was completed while both authors were at the University of Oxford and Peiris at the University of Warwick. The paper has appeared previously as “Savings and the Pessimistic Market”. The views expressed in this paper are those of the authors and do not necessarily represent those of the Banque de France or the Eurosystem.

Appendix

Appendix

1.1 Proof of Proposition 1

Proof

Assume that the equilibrium for a certain region of \(\lambda \) is autarkic, that is, the bond is not traded and agents optimise only over storage, \(\sigma \).

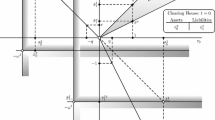

Under autarky, we obtain the following first-order condition (FOC): \(\sum _{s \in S}\mu _s -\mu _0^h=0\). Solving for storage we find \(\sigma = \frac{-1+\sqrt{17}}{8}\). In this equilibrium we need to check whether the bond should be traded or not.

The marginal utilities for this equilibrium are \(\mu _1=0.72\) and \(\mu _2=2.56\) in states 1 and 2 respectively. For \(\lambda <0.72\) the bond would definitely not be traded, since agents would default completely in both states. Thus, we consider \(\lambda >0.72\) for our analysis. The price offered by the on the verge seller here is \(\frac{\min [\frac{1}{2}\lambda ,\mu _1]+\min [\frac{1}{2}\lambda ,\mu _2]}{\mu _0}\). For \(1\le \lambda \) this price would be at least \(0.524\) and increasing on \(\lambda \). The price offered by the on the verge buyer would be \(\frac{K_1\mu _1+K_2\mu _2}{\mu _0}\). However, at \(1\le \lambda <4/3\), the seller would deliver fully in his good state as his marginal utility is strictly less than \(\frac{1}{2}\lambda \) and delivery nothing in the other state. Given that there are two agents, the delivery rate would be \(\frac{1}{2}\). In this range of \(\lambda \), the price offered by the buyer would be \(\frac{1}{2}\) which is less than that demanded by the buyer.

We leave it to the reader to show that an equilibrium, which involves trade in the bond and agents optimally choose not to save, that is, \(\sigma =0\), does not exist for this region of \(\lambda ^{\prime }s\). The proof starts with the assumption that agents trade the bond and considers two subcases: one where agents deliver partially and the other where they deliver fully. Under this assumption, the bond market fails when \(\lambda <1\), while full delivery occurs for \(\lambda \ge 4/3\). The last step of the proof is to calculate the intertemporal marginal utilities and show that for \(\lambda \ge 1\) there is excess demand for storage, which leads to a contradiction given the assumption that \(\sigma =0\).

Let us now consider the range \(0.72\le \lambda <1\) and conjecture that the equilibrium is autarkic. In this case, the price offered by an on the verge seller is \(\frac{\mu _1+\frac{1}{2}\lambda }{\mu _0}\), since \(\lambda >\mu _1\) as they would deliver fully in their good state and nothing in their bad state. Therefore, the price offered by an on the verge buyer is \(\frac{\frac{1}{2}\mu _1+\frac{1}{2}\mu _2}{\mu _0}>\frac{\mu _1+\frac{1}{2}\lambda }{\mu _0}\) indicating that agents have an excess demand for the bond in this region of \(\lambda \). Moreover, trade in the bond alone is not possible since the marginal disutility of delivering in the good state is 1 and the marginal disutility of default is less than 1 so agents would default completely in all states. The only other possible candidate equilibrium is one where both agents both trade the bond and save.

We now examine the equilibrium where agents optimise over the bond and \(\sigma \). We first look at the case that agents partially default on the bond and then on the case that they deliver fully.

The first-order equation we get when agents optimise with respect to \(\sigma \) is

But \(D=2\sigma +2-\frac{2}{\lambda }\), thus \(\sigma =\frac{-4+\lambda +\sqrt{9\lambda ^2-24\lambda +32}}{4\lambda }\). Using the first-order equations of buying and selling the bond, we find that \(K=\frac{4\sigma \lambda +2\lambda -2}{2\sigma \lambda +\lambda }\). Under the assumption of partial delivery, we need \(K<0.5\), which yields \(\sigma \le \frac{4-3\lambda }{6\lambda }\) and \(\lambda <7/9\) using the equations above. Up to \(\lambda =\frac{7}{9}\) we get trade in both bonds and agents partially deliver on the bond in their good states while completely defaulting in their bad. After this \(\lambda \) we have to consider full delivery of the bond. Adjusting the above first-order conditions for saving and trading the bond, we get that agents both save and trade the bond, while they deliver fully in the good state, for \(7/9\le \lambda <0.92\). Autarky prevails for \(\lambda \ge 0.92\).\(\square \)

1.2 Proof of Proposition 2

Proof

Consider, first, that \(\lambda <0.72\). Under partial default the marginal utility for the good state will be \(\frac{1}{2}\lambda \) and for the bad \(\frac{1}{2}\frac{1}{1+2\rho ^*-\frac{1}{\lambda }}\). The delivery rate will be \(K=\frac{2\lambda }{\lambda +\frac{1}{1+2\rho ^*-\frac{1}{\lambda }}}\).

For this area of default penalties \(\rho ^*>\rho ^{**}\). Thus, agents have to hold at least \(\rho ^*\). In addition, both D and K have to be positive and \(K<1/2\). This is satisfied for \(0.66\le \lambda <0.72\). Obviously, for \(0<\lambda <0.66\) the equilibrium is autarkic.

For \(0.72\le \lambda <0.92\), \(\rho ^*\) is always less than \(\rho ^{**}\). Thus, agents have to hold at least \(\rho ^{**}\) to guarantee trade in the bond. Up to \(\lambda =\frac{7}{9}\) agents default partially and the delivery rate as well as the actual delivery are given by the formulas above. By holding more the required storage requirement agents can increase their delivery up to the point that they start delivering fully.

For \(\lambda >\frac{7}{9}\) agents deliver fully in their good states even if they are required to hold the minimum required, that is, \(\rho ^{**}\). Thus, the final delivery for the bond is given by:

As long as it yields a positive D under the relevant constraints, the equilibrium in which agents sell the bond and deliver fully in their good states exists. It turns out that the maximum level of \(\lambda \) for which the bond will be traded under storage requirements is 0.92.

Assume now that the default penalty is higher than 0.92. The bond should be traded, since agents would not default completely in their good states. Nevertheless, we showed in Propositions 1 that agents would not actually prefer to trade the bond and would rather save some of their initial wealth. As before the following two relations have to hold:

\(4\lambda \rho ^{**2}+4\lambda \rho ^{**}+2\lambda D-\lambda D^2+2D-2=0\) and \(8\rho ^{**2}+2D-D^2+2\rho ^{**}-2\ge 0\). The latter condition requires that there is no excess demand for storage. As long as these two relations yield positive D and \(\rho ^{**}\) equilibrium exist. Manipulating and adding them we get

Assume that \(\rho ^{**}>0\) and \(D>0\), then the last equation becomes

where K is a positive number. The above relation gives no real solution for \(D\) for \(\lambda \ge 0.92\), that is, a contradiction.

We, thus, get that for \(\lambda \ge 0.92\) the equilibrium is autarkic even under storage requirements \(\square \)

1.3 Proof of Proposition 3

Proof

The proof for trade, when \(0<\lambda <0.72\), is straightforward from Proposition 2. The marginal utility in the bad state (for the first agent state 2) is higher than the marginal utility in the good state, which is equal to \(\frac{\lambda }{2}\), since agent default completely. Thus, \(\mu _2>\mu _1\) and \(\frac{\partial w}{\partial \rho }<-\mu _0+2\mu _2(1+D\mu _2)\). But, \(D\mu _2=\frac{1+\rho -\frac{1}{\lambda }}{1+2\rho -\frac{1}{\lambda }}<1\). Consequently, \(\frac{\partial w}{\partial \rho }<-\mu _0+4\mu _2=-\frac{1}{1-\rho }+\frac{2}{1+2\rho -\frac{1}{\lambda }}.\) From Lemma 1, \(\rho (\epsilon )=\frac{1}{\lambda }-1+\epsilon ,\mathrm { \ }\epsilon >0\) for this are of default penalties. Thus,

As \(\epsilon \rightarrow 0\), \(\lim _{\epsilon \rightarrow 0}{-\frac{1}{2-\frac{1}{\lambda }-\epsilon }+\frac{2}{\frac{1}{\lambda }+2\epsilon -1}}<0\) and the first derivative of this expression with respect to \(\epsilon \) is negative. As a result, \(\frac{\partial w}{\partial \rho }<0\).

Consider, now, an equilibrium with partial default and some storage (optimised or not), that is, \(0.72\le \lambda <7/9\). The delivery is given by \(2(1+\rho - 1/\lambda )\) and the delivery rate by \(2 - \frac{2}{\lambda (1+2\rho )}\). The quantity traded is \(\phi = D/(2K) = \frac{1+\rho }{2}\frac{\lambda - \frac{1}{1+\rho }}{\lambda - \frac{1}{1+2\rho }}\). As agents are delivering partially, \(\lambda - \frac{1}{1+\rho }>0\). Differentiating, we find that the quantity of trade will increase with the storage requirement for \(\lambda <1\).

We now turn to the analysis of welfare. For this region of default penalties \(\rho (\epsilon )=\frac{\lambda -4+\sqrt{9\lambda ^2-24\lambda +32}}{4\lambda }+\epsilon \). For \(\epsilon \rightarrow 0\), it is easy to show that \(\lim _{\epsilon \rightarrow 0}{\frac{\partial w}{\partial \rho }}>0\). Also, \(\lim _{\epsilon \rightarrow \bar{\epsilon }}{\frac{\partial w}{\partial \rho }}>0\), where \(\rho (\bar{\epsilon })=\frac{4-3\lambda }{6\lambda }\), which is the level of storage at which agents deliver fully in their good states (see Proposition 2). Finally, \(\frac{\partial ^2 w}{\partial \rho ^2}=-\frac{1}{(1-x)^2}-\frac{4 \left(1+x-\frac{1}{\lambda }\right)}{\left(1+2 x-\frac{1}{\lambda }\right)^3}<0\), since \(1+x-\frac{1}{\lambda }>0\). Hence, \(\frac{\partial w}{\partial \rho }\) is monotonic and always positive in this region of default penalties.

Finally, under full delivery, that is, for \(7/9\le \lambda <0.92\), we can take the derivative of the on the verge for trading the bond which is

Solving for \(\frac{\partial D}{\partial \rho } = 2\frac{\mu _1^2 - \mu _2^2}{\mu _1^2 + \mu _2^2}\) we can see that the marginal utility in the state 1 is strictly less than that in state 2 and as the denominator is positive, then the delivery of agents is falling on \(\rho \). When there is full delivery, then the quantity of bonds sold will equal the delivery on the bonds, and hence, the trade in bonds falls on \(\rho \) for this region of \(\lambda \).

Turning to welfare analysis for this region of default penalties, observe that the consumption in the good state for each agent is now \(1+\rho - D/2\) and in the bad state \(\rho +D/2\). The delivery rate is given by \(K= \frac{\mu _1 + 1/2\lambda }{\mu _1+\mu _2} = 1/2\) where we take state 1 to be the good state and state 2 to be the bad state. Rearranging this expression we get \(\mu _1 + \lambda = \mu _2\). Now take the derivative of this equation with respect to \(\rho \) and we get that \(\frac{\partial D}{\partial \rho } = 2\frac{\mu _1^2 - \mu _2^2}{\mu _1^2 + \mu _2^2}\) which is negative as the marginal utility in the state 1 is strictly less than that in state 2.

The welfare of this agent is given by

since \(\phi = D\). Taking the derivative of this expression with respect to \(\rho \) we get

We know that the last part of this expression is zero. The first part of the expression is zero when agents optimise over the bond and negative when they are forced to hold more liquidity than this. Under a storage requirements the whole expression is negative. Hence, when there is already full delivery, welfare is falling when the storage requirement is increasing. \(\square \)

1.4 Proof of Lemma 2

Proof

Suppose \((x,\sigma _v,\phi _v,\theta _v,\phi _v,D_v)\in B^h(q_v,K_v,\rho _v, \hat{\rho })\). Assume that \(\rho -\rho _v=\epsilon >0\). Since there is a continuum of contracts \(\exists \mathrm { \ }\epsilon \) such that \(\epsilon =\hat{\rho }\phi ^h_v\). Also assume that there is partial default in equilibrium. Then, \(q_v=\frac{\lambda }{\mu _0^v}\) and \(q=\frac{\lambda }{\mu _0}\), where \(\mu _0^v\) is then marginal utility of agent \(h\) at \(t=0\) in the equilibrium with variable storage requirements and \(\mu _0\) the marginal utility of agent \(h\) at \(t=0\) in the equilibrium with a flat storage requirement. Finally, \(\exists \phi ,\theta \mu _0>0\) such that \(\phi =\frac{\mu _0}{\mu _0^v}\phi _v\) and \(\theta =\frac{\mu _0}{\mu _0^v}\theta _v\), since \(\mu _0^v,\mu _0,\phi _v,\theta _v>0\).

The budget constraint for GE\((R,\lambda , \rho )\) at \(t=0\), under the conditions in Lemma 1 \(\tilde{\sigma }^h=\sigma ^h_v=0\), can be written as:

The budget constraint for GE\((R,\lambda , \rho )\) in state \(s\) that agent \(h\) chooses to partially deliver on his promise (an equivalent argument holds for the state that he chooses to default completely) can be written as:

Note the spans of GE\((R,\lambda , \rho _v, \hat{\rho })\) and GE\((R,\lambda , \rho )\) are the same, since \(D=D_v\) and \(\rho =\rho _v+\hat{\rho }\phi ^h_v\).

Thus, there exist \(\phi ^h,\theta ^h,D^h\) such that \((x^h,\phi ^h,\theta ^h,\phi ^h,D^h)\in B^h(q,K,\rho )\) and are optimal due to strictly concave utility functions.

The converse argument follows easily from the analysis above. \(\square \)

1.5 Proof of Proposition 5

Proof

Define by \(r\) the yield on the bond. Then, \(r=\frac{1}{q}-1\). As the risk-free interest rate in our economy is zero (agents have the option of costlessly storing wealth), a higher yield translates into a higher credit spread. Equivalently, a lower price translates into a higher credit spread. The price of the bond in equilibrium (from the first-order condition of the seller) is: \(q=\lambda (1-\rho )\). Differentiating the price with respect to the cash holdings we get \(\frac{\partial q}{\partial \rho }=-\lambda <0\).

To prove the second point we use the fact that, in equilibrium, agents will increase their cash holdings until they deliver fully in their good states or equivalently until \(K=\frac{1}{2}\)(from Sect. 5.1). Recall that the delivery rate is given by \(K=\frac{4\rho \lambda +2\lambda -2}{2\rho \lambda +\lambda }\). Thus, \(\rho =\frac{4-3\lambda }{6\lambda }\) for \(K=1/2\). Substituting the above expression for \(\rho \) into that for \(q\) and differentiating with respect to \(\lambda \) we get \(q=\lambda \left(1-\frac{4-3\lambda }{6\lambda }\right)\). Thus, \(\frac{\partial q}{\partial \lambda }=\frac{3}{2}>0\). A higher default penalty given the endowment of the agent in the state that he delivers on his promise is qualitatively the same as a higher endowment in that state given the level of punishment. The credit spread is a decreasing function of the future endowment as well. \(\square \)

Rights and permissions

About this article

Cite this article

Peiris, M.U., Vardoulakis, A.P. Savings and default. Econ Theory 54, 153–180 (2013). https://doi.org/10.1007/s00199-012-0722-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-012-0722-2