Abstract

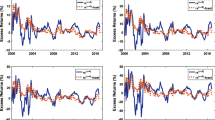

We assess the contribution of economic and financial factors in the determination of euro area corporate bond spreads over the period 2001–2015. The proposed multi-market, no-arbitrage affine term structure model is based on the methodology proposed by Dewachter et al. (J Bank Finance 50:308–325, 2015). We model jointly the ‘risk-free curve’, measured by overnight index swap (OIS) rates, and the corporate yield curves for two rating classes (A and BBB). The model includes four spanned and six unspanned factors. We find that, in general, both economic (real activity and inflation) and financial factors (proxying risk aversion, flight to liquidity and general financial market stress) play a significant role in the determination of the spanned factors and hence in the dynamics of the risk-free yield curve and corporate bond spreads. Across the risk-free OIS curve, macroeconomic and financial factors are each responsible on average for explaining 30 and 65% of yield variation, respectively. For A- and BBB-rated corporate debt, the selected financial variables explain on average 50% of the variation in corporate spreads during the last decade.

Similar content being viewed by others

Notes

There is also a vast literature that uses regression-based approaches to study the determinants of corporate bond spreads. See, for example, Collin-Dufresne et al. (2001).

The usual computational challenges faced by affine term structure models are well described by Duffee and Stanton (2008).

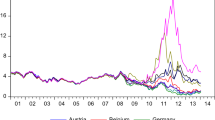

The CISS index also contains components related to stock market volatility. However, the VSTOXX and the CISS carry different information as evident from Fig. 1, and their correlation amounts to 0.62 (levels) and 0.35 (monthly changes), i.e. volatility and VIXX are not perfectly aligned.

The parameter estimates of the model are available upon request.

For every rating class, the risk premium is obtained under the condition of no default, i.e. it is assumed that the rating class considered does not default over the considered holding period.

References

Amato JD, Luisi M (2006) Macro factors in the term structure of credit spreads. BIS Working Papers 203, Bank for International Settlements

Ang A, Piazzesi M (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monet Econ 50(4):745–787

Bekaert G, Cho S, Moreno A (2010) New-Keynesian macroeconomics and the term structure. J Money Credit Bank 42:33–62

Collin-Dufresne P, Goldstein RS, Martin JS (2001) The determinants of credit spread changes. J Finance 56(6):2177–2207

Dai Q, Singleton KJ (2000) Specification analysis of affine term structure models. J Finance 55(5):1943–1978

Dewachter H, Iania L (2011) An extended macro-finance model with financial factors. J Financ Quant Anal 46:1893–1916

Dewachter H, Iania L, Lyrio M, Perea MdS (2015) A macro-financial analysis of the euro area sovereign bond market. J Bank Finance 50:308–325

Dewachter H, Lyrio M (2006) Macro factors and the term structure of interest rates. J Money Credit Bank 38(1):119–140

Duffee GR, Stanton RH (2008) Evidence on simulation inference for near unit-root processes with implications for term structure estimation. J Financ Econom 6(1):108–142

Duffie D, Kan R (1996) A yield-factor model of interest rates. Math Finance 6:379–406

Duffie D, Singleton KJ (1999) Modeling term structures of defaultable bonds. Rev Financ Stud 12(4):687–720

Gürkaynak RS, Wright JH (2012) Macroeconomics and the term structure. J Econ Lit 50(2):331–367

Holl D, Kremer M, Duca ML (2012) CISS—a composite indicator of systemic stress in the financial system. ECB Working Paper Series, European Central Bank

Hördahl P, Tristani O, Vestin D (2008) The yield curve and macroeconomic dynamics. Econ J 118(533):1937–1970

Joslin S, Priebsch M, Singleton KJ (2014) Risk premiums in dynamic term structure models with unspanned macro risks. J Finance 69(3):1197–1233

Joslin S, Singleton KJ, Zhu H (2011) A new perspective on Gaussian dynamic term structure models. Rev Financ Stud 24(3):926–970

Mueller P (2009) Credit spreads and real activity. Working Paper

Rudebusch GD, Wu T (2008) A macro-finance model of the term structure, monetary policy and the economy. Econ J 118:906–926

Wu L, Zhang FX (2008) A no-arbitrage analysis of macroeconomic determinants of the credit spread term structure. Manag Sci 54(6):1160–1175

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Marco Lyrio is grateful for financial support from CNPq-Brazil (Project No. 308310/2016-0).

The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank or the National Bank of Belgium. We thank the editor and a referee for useful comments. We also thank comments by seminar participants at the 2015 Auckland Finance Meeting, 6th International Research Meeting in Business and Management, 2016 International Finance and Banking Society Conference, and X Luso-Brazilian Finance Meeting. All remaining errors are our own.

Appendix A: Risk premium computation

Appendix A: Risk premium computation

This appendix shows the computations for the risk premium (rp) considering a 1-year (12 months) holding period.

1. Bond risk premium (expected excess holding period return)

Yields are affine in factors, and factors follow a VAR(1):

Log bond prices are likewise affine in factors:

The risk premium is the expected return from holding an m-month bond for 12 months in excess of the risk-free 1-year rate:

where

Expressing the risk premium in terms of factors:

2. Risk premium per rating

3. Risk premium differential

The risk premium differential is computed as the difference between the risk premium on a specific corporate bond (A and BBB) and the risk premium on the benchmark risk-free rate (OIS rate).

Rights and permissions

About this article

Cite this article

Dewachter, H., Iania, L., Lemke, W. et al. A macro–financial analysis of the corporate bond market. Empir Econ 57, 1911–1933 (2019). https://doi.org/10.1007/s00181-018-1530-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1530-8